Industrial Dust Collector Market Report Scope & Overview:

To get more information on Industrial Dust Collector Market - Request Free Sample Report

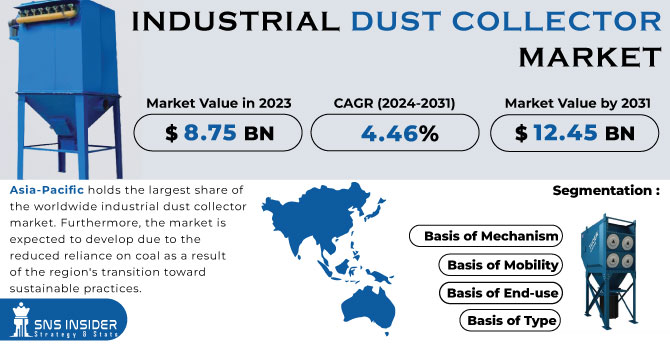

The Industrial Dust Collector Market Size was estimated at USD 8.13 billion in 2023 and is expected to arrive at USD 13.12 billion by 2032 with a growing CAGR of 5.46% over the forecast period 2024-2032. This report offers a comprehensive industry performance analysis by examining revenue and sales volume trends across key regions, alongside production capacity and utilization rates to assess operational efficiency. It uniquely highlights downtime and maintenance costs, providing insights into cost optimization strategies. The study also explores technological advancements and adoption rates, including smart filtration systems and IoT-enabled dust collectors. Additionally, it covers export and import trends to evaluate global trade dynamics. To enhance industry insights, the report includes regulatory compliance impact, supply chain disruptions, and sustainability initiatives, addressing the market's evolving landscape and competitive positioning.

Market Dynamics

Drivers

- Stringent environmental regulations by agencies like EPA and OSHA are driving the adoption of advanced industrial dust collectors to ensure air quality compliance and worker safety.

The Industrial Dust Collector Market is experiencing significant growth due to increasing stringent environmental regulations enforced by agencies like the EPA (Environmental Protection Agency) and OSHA (Occupational Safety and Health Administration). The countries have stringent air quality regulations, which ensure minimum emissions from industries, leading industries like cement, steel, drugs, and mining to use the most refined dust collector system. Moreover, increasing awareness of worker health and safety among employers is playing a key role in driving companies to adopt efficient air filtration technologies for decreasing workplace hazards. The major trends observed in the market include growing adoption of IoT enabled dust collectors for real-time monitoring, increasing demand for energy-efficient filtration systems, and extensive availability of sustainable solutions to meet sustainability goals. Rapid industrialization, especially in economies across Asia-Pacific and Latin America, is another factor that is supporting market demand. But challenges remain in terms of capital costs and operational energy consumption. Despite this, the market is set to grow steadily as industries prioritize compliance and efficiency.

Restraint

- The high initial investment and ongoing maintenance costs of industrial dust collectors make adoption challenging for SMEs due to capital constraints and operational expenses.

The high initial investment and maintenance costs associated with industrial dust collectors pose a significant barrier, particularly for small and medium enterprises (SMEs). A major investment of capital for equipment, ductwork, and systems integration is required for a dust collection system, making this a very expensive undertaking. Advanced filtration technologies like electrostatic precipitators and high-efficiency baghouse systems also drive upfront costs significantly higher. Used optimally installed, scheduled proper maintenance, and incurred the system proper charges for filters, repairs, loss, etc. Moreover, energy consumption may be a money concern, as large-scale dust collectors use considerable power to function, which drives the operating price for the long term. For SMEs already struggling with tight budgets, if the financial strain is punitive, SMEs would rather never use the technology and use a subpar method or wait before adoption. With more stringent regulations, businesses face the challenge of balancing the cost of compliance with operational efficiency, making affordability a major consideration in adopting advanced dust collection solutions.

Opportunities

- The development of energy-efficient and eco-friendly dust collection systems is driven by stringent environmental regulations, sustainability goals, and advancements in filtration technology

The development of sustainable and eco-friendly dust collection systems is gaining momentum as industries prioritize environmental responsibility and energy efficiency. The transition to greener solutions is a must, given that traditional dust collectors are typically energy-devouring and can generate secondary pollutants. With highly-efficient particle removal, low-energy electrostatic precipitators (ESPs), and regenerative thermal oxidizers (RTOs) offered by manufacturers, dust can now be removed more effectively without consuming too much power. Furthermore, by incorporating advanced smart sensors and Internet of Things (IoT) based monitoring systems, these filters help to optimize filter performance, decrease maintenance requirements, and prolong the life of equipment, promoting sustainability in the process. Owing to strict environmental laws, corporate sustainability initiatives, and rising awareness about the degradation of air quality on worker health, the demand for eco-friendly dust collectors is accelerating. Your training focuses on plans for reusable filter materials, energy recovery systems, and biodegradable filter coatings, making your company uniquely qualified to take advantage of the accelerating adoption of green industrial solutions.

Challenges

- Fluctuations in metal prices and supply chain disruptions increase production costs, delay deliveries, and impact market stability.

Disruptions in raw material supply chains pose a significant challenge to the industrial dust collector market. They are dependent on critical materials, including steel or aluminum and specialized filter media, which may be subject to price volatility from geopolitical tensions, trade restrictions or inflationary pressures. Supply Chain Bottlenecks Global crises, transportation delays, and labor shortages can cause supply chain bottlenecks that translate to longer lead times and higher production costs. Moreover, the fluctuations in raw material availability impact manufacturers' capacity to cater to demand, leading to project implementation and installation delays. This is especially true of smaller manufacturers, who cannot always absorb the jump in costs, which could be reflected in pricing to the end user. Recent (literal) shifts in the regulatory approach to mining and material extraction also create uncertainty around supply. To address these issues, businesses are turning to alternative materials, local sourcing and diversified supply chains. However, stability is an ongoing concern and will remain a hindrance in the growth and profitability of the market.

Segmentation Analysis

By Type

The Baghouse Dust Collector segment dominated with a market share of over 32% in 2023, owing to its ability to efficiently capture fine dust particles, making it a popular option in a wide range of industries. It features excellent filtration, which allows for high rates of dust collection, leading to better air quality and adherence to strict environmental regulations. Get a Price baghouse in the cement industry. With applications for cement, construction, agriculture, FM pollution control, pharmaceuticals, hazardous waste, ceramic, spices, and food industry, filter bags are strongly being used, and every industry that heavily produces dust is using baghouse collectors to keep the surrounding clean. The long-lasting repeatability and low price of these filters together with their capacity to trap high volumes of dust makes them the preferred solution over other filters. Advances in filter media technology also make them even more efficient, longer lasting, and have made them the preferred dust collection choice for the manufacturing floor.

By End Use

The Cement segment dominated with a market share of over 28% in 2023, as cement manufacturing generates a significant amount of dust during processes like crushing, grinding, and material handling. Stringent Environmental Rules Enforce the Use of Emerging Dust Collection Systems for the Control of Emission and Reduction in Air Pollution Moreover, dust exposure can lead to a number of health problems, prompting concern for worker safety and driving the need for effective dust suppression strategies. In cement plants, high production volumes and the requirement of round-the-clock operation makes it all the more critical for the dust collection system to be reliable. With sustainability and compliance with regulations gaining importance, cement manufacturers are increasingly investing on advanced filtration technologies for better air quality and operational efficiency.

By Mechanism

The Dry segment dominated with a market share of over 64% in 2023, due to its extensive use across industries such as manufacturing, pharmaceuticals, food & beverage, and cement, where efficient dust control is essential. Prevalently used baghouse filters, cartridge collectors and cyclone separators effectively capture fine particulate matter with commercial application. These systems provide higher filtration efficiency, lower operational costs, and less water consumption (when compared to wet alternatives) making them more economical and more environmentally sustainable. Furthermore, the need for dry dust collectors is fueled by strict environmental rules and workplace safety regulations. Due to their capacity to process vast quantities of dust without needing much upkeep, they are the go-to option for industries requiring trustworthy and economical air filtering systems.

By Mobility

The Fixed segment dominated with a market share of over 68% in 2023, due to its extensive use in large-scale industrial facilities, manufacturing plants, and heavy-duty applications. They are capable of running round the clock, effectively collecting and filtering dust, fumes, or other airborne threats in any setting with high particulate emissions. Fixed dust collectors are essential in industries including cement, metal processing, pharmaceuticals, and chemicals as they help ensure compliance with regulations, workplace safety, and enhanced air quality. Dust control systems can manage high dust volume with efficiently, which is especially suitable for industries seeking centralised control systems for long durations. Moreover, advanced filtration technology and automation are augmenting the efficiency and efficacy of fixed dust collectors.

Need any customization research on Industrial Dust Collector Market - Enquiry Now

Key Regional Analysis

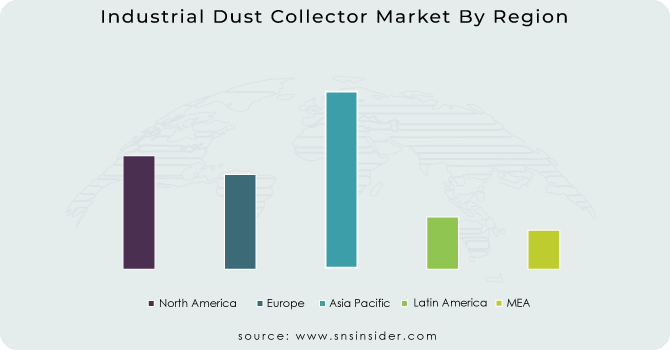

Asia-Pacific region dominated with a market share of over 38% in 2023, due to rapid industrialization, particularly in emerging economies like China and India. The region has large manufacturing, construction, and mining industries that produce high levels of industrial dust and require efficient dust collection systems. Moreover, governments are enforcing strict environmental regulations to regulate air pollution and enhance workplace safety, fueling the demand for sophisticated dust collectors. Increased investment in industrial infrastructure and an increase in focus on worker health and safety equipment also drives the Global Industrial Air Vents Market. Through filtering systems, countries like Japan and South Korea are also helping. Due to rapid economic growth, urbanization, and increasing concern over environmental issues, Asia-Pacific dominates the market and is the most powerful area for the industrial dust collector industry.

North America is the fastest-growing region in the Industrial Dust Collector Market, driven by strict environmental regulations and growing awareness of workplace safety. Stringent air quality and worker safety regulations imposed by government entities like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) have pushed industries to adopt efficient dust collection systems. Technology like smart dust collectors with real-time monitoring and energy-efficient filtration systems are also growing in popularity. This is encouraged by the growing industrial and manufacturing industries, especially in the U.S. and Canada. Increasing investments in industrial automation and rising environmental concern regarding air pollution is anticipated to boost a wide adoption of dust collectors in different industries in the region.

Some of the major key players in the Industrial Dust Collector Market

-

Donaldson Company, Inc. (Baghouse Dust Collectors, Cartridge Collectors)

-

Nederman Holding AB (Industrial Air Filtration, Wet Scrubbers)

-

Sumitomo Heavy Industries, Ltd. (Electrostatic Precipitators, Industrial Filters)

-

FLSmidth (ESP Systems, Fabric Filters)

-

Hamon(Electrostatic Precipitators, Gas Cleaning Systems)

-

Camfil AB (Cartridge Dust Collectors, Air Purification Systems)

-

Thermax Limited (Pulse Jet Bag Filters, Cyclone Separators)

-

KC Cottrell (ESP, Fabric Filters)

-

Babcock & Wilcox Enterprises (ESP, Particulate Control Equipment)

-

Kelin Environmental Protection Technology Co., Ltd. (Bag Filters, ESP)

-

AAF International (Dust Collectors, Air Filtration Units)

-

Parker Hannifin Corporation (Cartridge Filters, Portable Dust Collectors)

-

Alstom (ESP, Wet Scrubbers)

-

Clarcor Industrial Air (Dust Collectors, HEPA Filters)

-

CECO Environmental (Cyclone Separators, Wet Scrubbers)

-

Sly Inc. (Baghouse Collectors, Cartridge Collectors)

-

Airflow Systems Inc. (Portable & Central Dust Collection Systems)

-

Dynavac India Pvt Ltd (Cyclone Dust Collectors, Wet Scrubbers)

-

Imperial Systems Inc. (Cyclone Separators, Industrial Dust Collection)

-

Spänex GmbH (Compact Dust Collectors, Central Extraction Systems)

Suppliers for (Industrial air filtration and dust collection systems) on the Industrial Dust Collector Market

-

Airfilter

-

Axcent Air Flow Technologies

-

VATS Air Systems

-

AMS Cleanair Extractors

-

Donaldson Company, Inc.

-

Hako GmbH

-

Camfil APC

-

Nederman Holding AB

-

FLSmidth A/S

-

AAF International

Kelin Environmental Protection Technology Co., Ltd-Company Financial Analysis

Recent Development

In March 2024: Donaldson India Filtration Systems opened an experience center in Pune, featuring live demos and the iCue Connected Filtration Service for remote monitoring. The initiative aims to enhance productivity and reduce air pollution in Indian industries, reinforcing Donaldson's leadership in dust collection technology.

In December 2023: Camfil Air Pollution Control unveiled a new resource for battery manufacturers, emphasizing the importance of efficient dust collection for both worker and environmental safety.

| Report Attributes | Details |

| Market Size in 2023 | USD 8.13 Billion |

| Market Size by 2032 | USD 13.12 Billion |

| CAGR | CAGR of 5.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Baghouse Dust Collector [Woven, Non-woven], Cartridge Dust Collector, Wet Scrubbers, Inertial Separators, Electrostatic Precipitator (ESP), Others) • By End Use (Food & Beverage, Pharmaceutical, Energy & Power, Steel, Cement, Mining, Others) • By Mechanism (Dry, Wet) • By Mobility (Portable, Fixed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Donaldson Company, Inc., Nederman Holding AB, Sumitomo Heavy Industries, Ltd., FLSmidth, Hamon, Camfil AB, Thermax Limited, KC Cottrell, Babcock & Wilcox Enterprises, Kelin Environmental Protection Technology Co., Ltd., AAF International, Parker Hannifin Corporation, Alstom, Clarcor Industrial Air, CECO Environmental, Sly Inc., Airflow Systems Inc., Dynavac India Pvt Ltd, Imperial Systems Inc., Spänex GmbH. |