Industrial Display Market Key Insights:

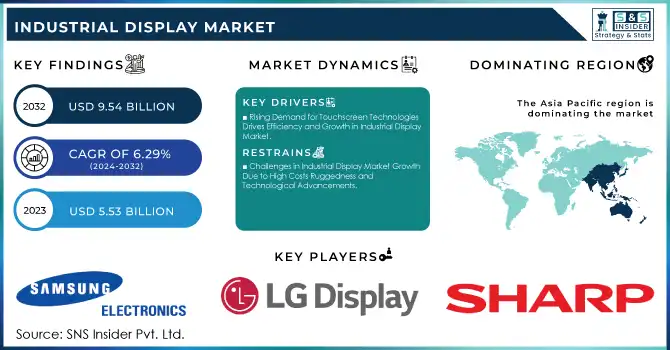

The Industrial Display Market Size was valued at USD 5.53 Billion in 2023 and is expected to reach USD 9.54 Billion by 2032 and grow at a CAGR of 6.29% over the forecast period 2024-2032.

The increase in operational efficiency and real-time decision-making has played a substantial role in edging up the Industrial Display Market. With the need for fast-paced yet simplified operations across industrial sectors, the demand for high-performance displays that perform various tasks and offer clear visibility is on the rise. Usage of industrial displays in control rooms, command centers, remote monitoring, and other applications are integrated due to the increasing digital transformation in many sectors such as automotive, aerospace, and logistics. In addition, an increase in the installation of automation systems and ongoing innovations in touch screen technologies get hold of a well-packed growth into the market as these displays become more interactive, intuitive, and integrated with new digital tools. Touchscreen technology adoption in 2023 grew 15% from the previous year, breaking the 50% of the market share threshold for the first time, and Industrial displays in Control Rooms & command centers grew 11%. Installation of automation systems with industrial displays increased by 13% and major demand increases of 10% were noted in rugged, weather-resistant displays, especially in mining, oil & gas, and power generation. Solutions such as smart display solutions for worker safety and productivity, which adapted 9%, while interactive displays for real-time decision-making went up by 12%.

To get more information on Industrial Display Market- Request Free Sample Report

Increasing focus on worker safety and productivity of the equipment

As manufacturers embrace the Industrial Internet of Things (IIoT) and the related network of Industry 4.0 technologies, they are implementing smart display to provide manufacturers with immediate access to relevant information to avoid equipment mishaps and minimize downtime. Vibration-proof displays have been witnessed during the Global pandemic, owing to various industries operating in harsh environments such as mining, oil & gas, and power generation. The mentioned factors coupled with the increasing efforts for sustainability, and energy-efficient display technologies, act as the catalysts for the growth of the industrial display market. The demand for vibration-proof industrial displays increased by 14%, particularly in mining, oil & gas, and power generation. Smart display systems incorporating IIoT and Industry 4.0 technologies increased by 16%, allowing for better and immediate access to data about equipment maintenance. For energy-efficient displays, usage was up 12%, as more organizations focused on sustainability, and smart displays for operational efficiency to improve worker safety and productivity rose 11%.

Industrial Display Market Dynamics

KEY DRIVERS:

-

Rising Demand for Touchscreen Technologies Drives Efficiency and Growth in Industrial Display Market

One of the major factors driving the growth of the Industrial Display Market is the increasing demand for touchscreen and interactive display technologies in industrial applications. User-friendly interfaces are facilitated by touchscreen displays as they enable operators to directly interact with machines and systems. Improving operational efficiency across systems, especially in sectors such as healthcare, automotive manufacturing, and logistics, where detailed inputs need to be processed at speed accurately and real-time monitoring data is crucial. Touchscreen technology continues to advance, leading to increasingly responsive, ruggedized displays that can withstand industrial operating conditions that involve dust, humidity, and/or extreme temperatures. The need for easy and simple interactions in industrial systems led to a rise of 20% in user-friendly touchscreen interface demands in 2023.

On the healthcare side, touchscreen displays for medical equipment and monitoring systems jumped 15%, and new data processing methods opened up real-time data processing capabilities. Vision to do on the automotive manufacturing part, where the touchscreen and interactive displays for the production line came to about 17% of precision and speed. Logistics saw a 13% increase in the use of interactive displays for warehouse automation, which improved inventory tracking and operational efficiency. Such trends reveal the increasing dependence on touchscreen technologies in the major industrial sectors. Interactive displays enable rapid access to key functions with minimal manual input, which is a major advantage in industrial workflow, so companies willing to modernize their control systems and maximize productivity can be drawn to such solution investment.

-

Sustainability Drives Growth in Industrial Display Market with Energy Efficient OLED and E Paper Technologies

The demand for advanced industrial displays is also being influenced by the transition to sustainable and energy-efficient solutions. Encouraged energy-efficient display technologies like OLED and e-paper are getting more popular getting more companies to want to reduce the energy consumption and cost of operation. Since these display types use less power than conventional LCD and LED displays, they can be ideal in any application where a display must be on in the background, or in remote locations. Moreover, the demand for eco-clean components and materials in industrial equipment is rising, resulting in displays that are less contributing to the environmental burden, in addition to efficient operating displays. These demands are coupled with wider industry plans for lowering carbon footprints and optimizing resource use, further underlining the position of energy-efficient displays in underpinning the industrial display market growth. Such an emphasis on sustainable tech is likely to encourage long-term investments in display technology advancements. The widespread interest in cutting down on energy consumption in complicated and sophisticated devices accelerated the adoption of energy-efficient OLED and e-paper displays by 18 % in 2023 which uses up to 40% less energy than a traditional LCD and LED displays, which makes them suitable for continuous or remote operation. Sales of eco-clean components, which help industrial facilities operate more sustainably, grew by 16%. Moreover, carbon footprint reduction industries have been increasingly integrated with energy-efficient displays, showing a 14% increase in this area, which reflects the trend of sustainability in the industrial display market.

RESTRAIN:

-

Challenges in Industrial Display Market Growth Due to High Costs Ruggedness and Technological Advancements

The high cost of various advanced display technologies, such as OLED, e-paper, etc. plays a vital role as a restraining factor for the Industrial Display Market, as the deployment of these technologies is extremely costly which limits their adoption, especially in the small and mid-sized enterprises segment. While offering perks like reduced energy usage and superb longevity, these displays also cost more than traditional LCDs and LEDs. However, the upfront cost is a major obstacle to low-budget companies putting these advanced techs to widespread use. One of the biggest challenges in the market is the longevity and reliability of displays in industrial temperature range (ITR) environments. Industrial displays deployed in industries like mining, oil, gas, and manufacturing are often subjected to very high temperatures, dust, vibration, moisture, etc. The display should still function in such conditions, and this scenario necessitates constant technological advancement in the display design & materials. The need for increased product ruggedness - over and above existing ruggedness levels - has resulted in continuous pressure on manufacturers to do more while keeping costs at a manageable level, which is a difficult proposition due to the technical challenges involved.

Industrial Display Market Segmentation Analysis

BY TYPE

The Industrial Display Market was led by Panel-Mount Monitors, which represented 30% of the market share in 2023, mainly due to their versatility and broad suitability with a variety of industrial applications. Industrial monitors are more rigid and can be embedded in any machine, control panel, and other industrial equipment and are often developed to offer a solid and stable unit. Essential in pressing environments with limited physical space, and where supervision must be stable (manufacturing plants, process control center), they deliver a clean, reliable interface for operators. Also, since panel-mount screens are frequently manufactured to endure tough surroundings, that is, exposure to dirt, moisture, and resonance, they are often preferred inside industries like manufacturing plants, energy, and shipping and delivery.

Open Frame Monitors is likely to grow with the fastest CAGR during the forecast period from 2024 to 2032, which can be attributed to its custom-tailored and flexible design. Open frame monitors are more flexible and allow manufacturers and industrial users greater versatility and more options to integrate them into their unique set-ups, housings, or equipment that require a specific display need than fully enclosed monitors do. This is especially advantageous for industries that provide bespoke machinery or those that need constant updates and changes in their equipment. Moreover, the need for open-frame monitors will grow rapidly in the upcoming years as different industries are adopting modular and flexible systems to keep pace with the technology.

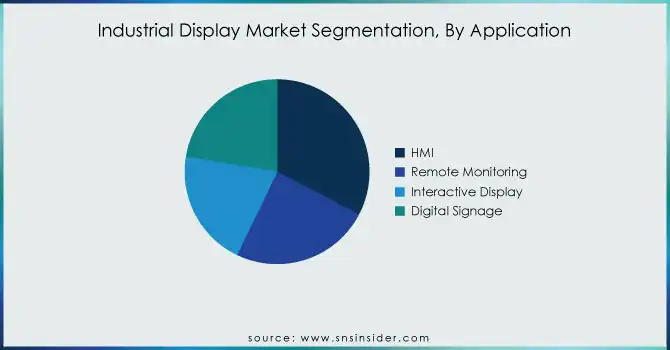

BY APPLICATION

The Industrial Display Market is dominated by Human-Machine Interface (HMI) with a share of 32% in 2023, as it plays an important role in modern industrial settings. HMI systems are crucial for operators to monitor, control, and interact with machinery and processes, ensuring efficiency and safety. With the advent of automation and digitalization, industries have benefitted from the intuitive, real-time information HMI displays provide to users dealing with the complexity of discrete and continuous processes that are prevalent in sectors like manufacturing, energy, and chemicals. Their capability of making machines talk simply, conduct more work, and be more controlled has led them to be adopted widely and ensure that they continued to lead in their market share.

The Interactive Displays will experience the fastest CAGR growth during the forecast period of 2024-2032. This will continue to grow due to the rising need for intuitive and user-friendly interfaces in industrial applications. Interactive touchscreen displays are effective at replacing traditional displays because they enable touch- and gesture-based control, providing operators with increased flexibility and engagement. With the movement of industries toward smart factories and IIoT-based working environments, intuitive information access and control is a top priority, and interactive displays have a big role to play in future success.

BY TECHNOLOGY

In 2023, LCD dominated the Industrial Display Market, with a share of 38%, primarily due to broad affordability, versatility, and reliability in the industrial sector. Thanks to its maturity, LCD technology provides decent display quality, durability, and price, making it a great option for budget-limited and large-scale display installations. In addition, LCDs are versatile and can be designed for an extensive variety of environments, including rough industries, where both industrial durability and industrial performance are essential. This has also made them more popular, ensuring that LCDs have become the top display technology in manufacturing, control rooms, and other industrial applications, due mainly to their good visibility even in high light conditions.

In contrast, E-Paper Displays are projected to register the fastest CAGR from 2024 to 2032, due to their unique energy-efficient properties and incorporation in certain industrial applications. E-paper displays draw very little power (note the second screenshot) compared to LCDs, which is useful and even necessary for applications that would be displayed continuously or where there is prohibitive access to mains power. E-paper, on the other hand, has high visibility indoors and outdoors due to reflectance that makes it suitable in very bright places, even if the light comes directly exactly to the displays 7. With the industries moving towards sustainable and low-power options, the market for e-paper displays is expected to be on the rise, driving their rapid growth over the forecast timeline.

BY END USE

In 2023, Manufacturing held the largest share 35% of the Industrial Display Market, as industrial displays are extensively adopted for monitoring, control, and automation of manufacturing facilities. Hence, these displays play an important role in HMI Applications, Process Control, and Real-Time data visualization, which in turn minimize the total amount of production time and ensure that the manufacturing industry runs smoothly. Manufacturing displays aid in visualizing the status of your machine, and metrics needed to manage production and facilitate decision-making to prevent any form of idle loss scenarios on the floor. Coming to their general application and demand in manufacturing, solutions such as these are always going to be in demand in manufacturing, as businesses aspire to enhance productivity and quality control as well as embrace Industry 4.0 philosophies.

The energy & Power segment is anticipated to be the fastest CAGR growing segment for the forecast period 2024 to 2032, owing to the growing requirement of the sector for reliable and durable display systems with energy-efficient displays. As the energy and power industry pivots to renewable energy sources, smart grids, and distributed power generation, it needs displays capable of enduring harsh environmental conditions and providing real-time monitoring for critical systems. This sector will also be interested in e-paper and such low-power display technologies to minimize energy as well as maintaining an outdoor and remote application where visibility is a critical aspect. Hence, the energy and power sector will account for a major chunk of the demand for advanced industrial displays, thereby propelling rapid growth.

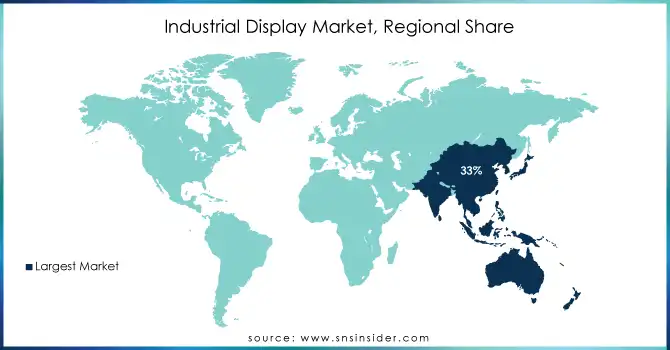

Industrial Display Market Regional Outlook

In 2023, Asia Pacific had the highest market share 33% in the Industrial Display Market due to further industrialization of various industries, including utilities and OEMs, in China, Japan, South Korea, and India. They turned into world manufacturing centers, with huge investments in electronics, automotive, and heavy machinery. Such as in the case, China has "Made in China 2025" and India has "Made in India" which mobilizes local industry towards digitalization and automation have increases industrial display demand. The regional consumer electronics and automotive manufacturing giants that enabled Japan and South Korea to dominate bitter battles over global economies (Toyota, Sony, Samsung) are all entirely dependent on the use of industrial displays to run their factories and their finessed production and monitoring processes. The expansion of smart factories and Industry 4.0 in this region is also fuelling demand for advanced display solutions.

North America is expected to grow at the fastest rate CAGR from 2024 to 2032, attributed to the growing transition toward automation and digitalization in a variety of industries such as energy, healthcare, and manufacturing. Smart manufacturing practices and investment in the Industrial Internet of Things (IIoT) in the United States are boosting the demand for displays that provide data visualization and visualizing real-time data. In the U.S., the energy sector is seeing major developments in smart grids and renewable energy projects, both of which depend on robust, energy-efficient displays that can perform monitoring functions. Furthermore, growing awareness regarding worker safety and operational proficiency, coupled with increasing adoption of advanced HMI systems, video walls, and interactive displays across various industries in North America is slated to accelerate market expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Industrial Display Market are:

-

Samsung Electronics (LCD Industrial Panels, OLED Displays)

-

LG Display (TFT-LCD Displays, IPS Monitors)

-

Sharp Corporation (Industrial TFT Displays, LCD Modules)

-

AU Optronics (AMOLED Displays, LCD Industrial Screens)

-

Panasonic Corporation (Rugged LCD Displays, Industrial Touch Screens)

-

BOE Technology Group (Ultra HD Displays, Flexible OLED Panels)

-

Mitsubishi Electric (TFT-LCD Modules, Industrial Touch Panels)

-

Advantech Co., Ltd. (Industrial Panel PCs, LCD Monitor Panels)

-

Planar Systems (Open-Frame Monitors, Industrial Video Walls)

-

Siemens AG (HMI Panels, Industrial Operator Interfaces)

-

Rockwell Automation (Graphic Terminals, Industrial Monitors)

-

Winmate Inc. (Rugged Displays, Industrial Panel PCs)

-

Kyocera Corporation (TFT-LCD Modules, Medical Displays)

-

Omron Corporation (Touchscreen HMIs, Industrial LCD Screens)

-

Eizo Corporation (Ruggedized Monitors, LCD Display Panels)

-

Crystal Display Systems (Custom LCD Displays, Rugged Monitors)

-

HannStar Display (TFT LCD Modules, Display Panels)

-

Phoenix Contact (HMI Display Solutions, Industrial Display Panels)

-

Innolux Corporation (Touch Display Modules, TFT-LCD Panels)

-

Schneider Electric (Industrial HMI, Operator Terminals)

Some of the Raw Material Suppliers for Industrial Display Companies:

-

3M

-

Corning Inc.

-

DuPont

-

Merck Group

-

BASF SE

-

Dow Inc.

-

Saint-Gobain

-

Asahi Glass Co. (AGC Inc.)

-

Nitto Denko Corporation

-

Toray Industries

RECENT TRENDS

-

Sony and Siemens will launch a VR headset by December 2024, tailored for Siemens' industrial metaverse focus. Currently integrated with Siemens' NX engineering platform, it will expand to other products, per a senior executive.

-

LG Display has unveiled its 27-inch 480Hz QHD Gaming OLED display, set to debut at CES 2024, marking a new era in ultra-high refresh rate OLED technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.53 Billion |

| Market Size by 2032 | USD 9.54 Billion |

| CAGR | CAGR of 6.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Rugged Displays, Open Frame Monitors, Panel-Mount Monitors, Marine Displays, Video Walls) • by Application (HMI, Remote Monitoring, Interactive Display, Digital Signage) • by Technology (LCD, LED, OLED, E-Paper Display) • by End Use (Manufacturing, Mining & Metals, Chemical, Oil, and Gas, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Display, Sharp Corporation, AU Optronics, Panasonic Corporation, BOE Technology Group, Mitsubishi Electric, Advantech Co., Ltd., Planar Systems, Siemens AG, Rockwell Automation, Winmate Inc., Kyocera Corporation, Omron Corporation, Eizo Corporation, Crystal Display Systems, HannStar Display, Phoenix Contact, Innolux Corporation, Schneider Electric. |

| Key Drivers | • Rising Demand for Touchscreen Technologies Drives Efficiency and Growth in Industrial Display Market • Sustainability Drives Growth in Industrial Display Market with Energy Efficient OLED and E Paper Technologies. |

| Restraints | • Challenges in Industrial Display Market Growth Due to High Costs Ruggedness and Technological Advancements. |