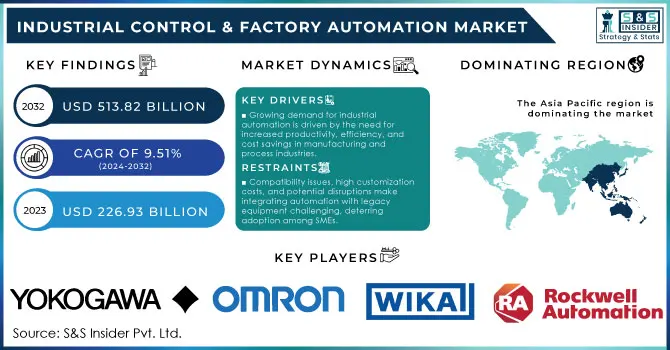

Industrial Control & Factory Automation Market Key Insights:

The Industrial Control & Factory Automation Market Size was valued at USD 226.93 Billion in 2023 and is now anticipated to grow to USD 513.82 Billion by 2032, displaying a compound annual growth rate (CAGR) of 9.51% during the forecast Period 2024-2032. The Industrial Control and Factory Automation Market is undergoing significant transformation, driven by rapid technological advancements and a growing emphasis on operational efficiency and sustainability. As of 2023, an estimated 75 billion devices are expected to be connected to the Internet of Things (IoT), profoundly impacting industrial operations. The integration of IoT technologies enables real-time data collection and analysis, allowing manufacturers to monitor performance, predict maintenance needs, and make informed decisions. This connectivity leads to smarter factories that can operate autonomously, enhancing operational efficiency by up to 30% and significantly reducing downtime.

To Get More Information on Industrial Control & Factory Automation Market - Request Sample Report

In addition to IoT, there is a strong focus on energy efficiency within industrial automation. The International Energy Agency (IEA) suggests that implementing automation solutions can result in energy savings of 20% to 30%, promoting sustainability and lowering operational costs. The adoption of artificial intelligence (AI) and machine learning (ML) technologies is also gaining momentum, with around 40% of companies planning to implement AI-driven solutions in their manufacturing processes within the next two years. These technologies facilitate predictive maintenance, potentially reducing maintenance costs by up to 25% and extending the lifespan of critical assets. Collaborative robots (cobots) are another vital aspect of this evolving landscape, projected to exceed USD 4 billion. Cobots are designed to work alongside human operators, improving efficiency in tasks that require both human dexterity and robotic precision.

| Type of Automation System | Description | Commercial Products |

|---|---|---|

| Programmable Logic Controllers (PLC) | Industrial computers used to control machinery and processes, enabling real-time control. | Siemens SIMATIC S7, Rockwell ControlLogix |

| Distributed Control System (DCS) | Systems that manage large processes across multiple control points in real-time. | ABB System 800xA, Honeywell Experion PKS |

| Supervisory Control and Data Acquisition (SCADA) | Systems for monitoring and controlling industrial processes remotely. | Schneider Electric EcoStruxure, GE iFIX |

| Human Machine Interface (HMI) | Interfaces that allow human operators to interact with the system for monitoring and control. | Allen-Bradley PanelView, Siemens WinCC |

| Industrial Internet of Things (IIoT) | Devices and sensors networked for data exchange, enabling predictive maintenance and analytics. | PTC ThingWorx, Bosch Rexroth IoT Gateway |

| Machine Vision Systems | Cameras and software used for automated inspection and quality control. | Cognex In-Sight, Keyence CV-X Series |

| Motion Control Systems | Systems for precise control of machinery movement, used in robotics and CNC machinery. | Siemens Sinamics, Mitsubishi MR-J4 |

| Robotics | Automated robots for handling, assembling, and packing in manufacturing processes. | Fanuc LR Mate, ABB IRB 6700 |

| Industrial Safety Systems | Safety mechanisms to protect workers and equipment, such as emergency shutdowns. | Honeywell Safety Manager, Rockwell GuardLogix |

| Process Automation | Technologies to automate manufacturing processes for efficiency and reduced human intervention. | Emerson DeltaV, Yokogawa CENTUM VP |

MARKET DYNAMICS

DRIVERS

- Growing demand for industrial automation is driven by the need for increased productivity, efficiency, and cost savings in manufacturing and process industries.

The demand for industrial automation has surged as industries strive for enhanced productivity, efficiency, and cost-effectiveness. Automation technologies, encompassing robotics, AI-driven systems, and IoT-enabled devices, enable industries to streamline processes, reduce human error, and improve product quality. Manufacturing and process sectors, in particular, have rapidly adopted these technologies to maintain competitiveness and meet rising consumer demands. In recent years, labor shortages and rising operational costs have further accelerated automation adoption, as automated systems can operate continuously, reducing dependency on human labor and cutting down costs associated with workforce management. In the manufacturing sector, automation can increase production speeds by up to 30% and reduce waste by up to 20% through precision and optimized resource usage. In addition, automated systems often bring a return on investment (ROI) within a few years, with studies showing up to 25% cost savings in operational expenses when integrated effectively. According to the research over 70% are investing in automation technologies to improve operational efficiencies and adapt to market changes. Industries ranging from automotive to pharmaceuticals are now deploying automation solutions for tasks that require precision and consistency, such as assembly, packaging, and quality inspection. This trend is not only enhancing productivity but also reducing the production cycle times by nearly 40% in certain sectors, enabling faster delivery and better scalability. As industries embrace automation to address production challenges, the demand for industrial automation systems continues to grow, shaping the future of manufacturing and process sectors globally.

- Integrating AI and IoT in automation enhances data analysis and predictive maintenance, driving smarter, digitally transformed industrial operations.

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into industrial automation systems has significantly transformed operational efficiency and intelligence. AI-powered analytics and IoT-connected devices allow for real-time data collection, monitoring, and analysis across manufacturing floors, which enhances both productivity and decision-making processes. Predictive maintenance, made possible by this integration, reduces unexpected equipment failures by analyzing data patterns and predicting potential malfunctions before they occur. IoT sensors can continuously monitor machinery performance and detect even subtle changes in vibration, temperature, or other critical metrics. This information, powered by AI algorithms, enables maintenance teams to intervene proactively, reducing downtime by up to 30%.

The adoption of IoT in industrial applications is already substantial, with over 80% of companies expected to incorporate IoT into their automation processes by 2025. Additionally, AI’s role in improving operational decision-making has led to the development of autonomous production lines, where machines can adjust parameters based on real-time data, reducing human error and optimizing resource usage. Studies indicate that smart factories utilizing AI and IoT can achieve up to a 40% increase in operational efficiency compared to traditional setups. As industries strive for digital transformation, these technologies are essential enablers, providing the connectivity and intelligence needed to meet growing demands for precision, speed, and sustainability in modern manufacturing.

RESTRAIN

- Integrating automation systems with legacy equipment poses significant challenges due to compatibility issues, high customization costs, and potential operational disruptions, which can deter adoption, particularly among small and medium-sized enterprises.

Integrating automation systems with existing legacy equipment presents significant challenges in the industrial control and factory automation market. Many factories and plants still operate using older machinery and outdated control systems that aren’t readily compatible with modern automation technologies. Connecting these legacy systems to advanced automation platforms, such as those incorporating the Industrial Internet of Things (IIoT) or AI-driven systems, requires extensive customization. This complexity increases implementation time and costs, as businesses often need specialized technicians and engineers to manage compatibility issues, adapt hardware interfaces, and configure software protocols for seamless operation. According to the research by IoT Analytics, around 53% of manufacturers cite compatibility with existing systems as a major hurdle in adopting IIoT and automation solutions.

Additionally, the integration process can disrupt ongoing operations, further adding to costs due to downtime or decreased productivity during the transition. According to research spending approximately 20% to 30% more on such integration projects than anticipated, reflecting unforeseen challenges and the need for custom solutions. These factors can deter especially small and medium-sized enterprises (SMEs) that lack the financial resources to undertake such capital-intensive modifications. Furthermore, the high cost of integration can delay a return on investment, reducing the overall appeal of adopting automation solutions. Consequently, this complexity often slows down the growth of the industrial control and factory automation market, as companies grapple with balancing the benefits of automation against the financial and logistical demands of integration with legacy equipment.

KEY SEGMENTATION ANALYSIS

By Solution

Distributed Control Systems (DCS) segment dominated the market share over 36.02% in 2023, due to the widespread adoption of Industrial IoT (IIoT) technologies. This large-scale adoption reflects industrialists’ growing preference for DCS in automated control systems, which provide centralized control with distributed data processing capabilities. DCS systems are vital for sectors like manufacturing and energy, where real-time data from sensors and actuators enables precise operational control and reduces downtime. The ongoing rollout of 5G further amplifies the benefits of IIoT and DCS, especially in high-demand sectors such as power. With the high-speed, low-latency advantages of 5G networks, IIoT integration with DCS has become even more efficient, enabling faster data transfer, enhanced connectivity, and improved operational efficiency.

By Industry

The discrete industry segment dominated the market share over 54.38% in 2023. This industry encompasses the production of tangible goods that are distinct and identifiable, such as nuts, bolts, brackets, assemblies, cables, automobiles, toys, furniture, and smartphones. These products are typically produced in units and can be easily counted or measured, making them crucial for various sectors. At the end of their life cycle, discrete products can often be disassembled and recycled, allowing for sustainable practices in manufacturing and waste management. This capability not only contributes to resource conservation but also enhances the industry's adaptability to changing consumer demands and environmental regulations.

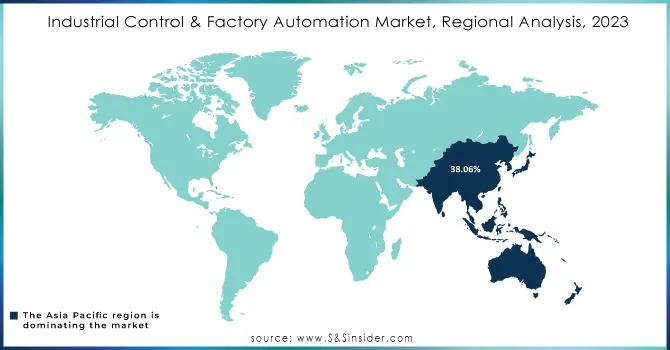

KEY REGIONAL ANALYSIS

The Asia Pacific region has dominated the market share over 38.06% in 2023. This growth can be attributed to the presence of numerous key market players and a surge in emerging companies across the region. Countries like India and China are witnessing an escalating demand for advanced solutions to optimize industrial plant management, which significantly boosts market growth. The transition from traditional to smart production facilities is becoming increasingly common, fostering greater acceptance of industrial automation technologies. China’s manufacturing sector has seen substantial investments in automation, driven by government initiatives aimed at enhancing productivity and efficiency. Furthermore, the emphasis on Industry 4.0 principles is steering industries toward digitization and connectivity, which collectively enhances the adoption of innovative automation solutions in the region.

North America is witnessing rapid growth in the Industrial Control & Factory Automation Market, primarily due to significant technological advances and the ongoing digital transformation across various sectors. The region's manufacturing units are increasingly adopting state-of-the-art automation technologies to enhance efficiency and streamline business processes. According to the research that 77% of manufacturers in North America believe that digital transformation is essential for staying competitive in the market. Additionally, 50% of manufacturing executives reported investing in advanced technologies like AI, IoT, and robotics to meet rising end-user demands and improve operational efficiency. This drive to embrace innovation is fueled by heightened competition, pushing companies to enhance productivity and reduce costs.

Do You Need any Customization Research on Industrial Control & Factory Automation Market - Inquire Now

KEY PLAYERS

Some of the major key players of Industrial Control & Factory Automation Market

-

Yokogawa Electric Corporation (Control Systems, Field Instruments)

-

Omron Corporation (Programmable Logic Controllers, Sensors)

-

WIKA (Pressure Transmitters, Level Sensors)

-

Mitsubishi Electric Corporation (Industrial Robots, Automation Control Systems)

-

Rockwell Automation (ControlLogix, FactoryTalk)

-

Yaskawa Electric Corporation (Servo Drives, Motion Controllers)

-

Toshiba Corporation (Programmable Logic Controllers, Industrial PCs)

-

Honeywell International Inc. (Distributed Control Systems, Safety Instrumented Systems)

-

Dwyer Instruments (Pressure Gauges, Flow Meters)

-

Stratasys (3D Printers, Additive Manufacturing Solutions)

-

Hitachi (Industrial Automation Solutions, Control Systems)

-

Siemens AG (SIMATIC PLCs, SINUMERIK CNC Systems)

-

Schneider Electric (EcoStruxure, Modicon PLCs)

-

ABB Ltd. (Industrial Robots, Control Systems)

-

GE Automation & Controls (iFIX, Proficy Software)

-

Emerson Electric Co. (DeltaV, Ovation)

-

KUKA AG (Industrial Robots, Automation Solutions)

-

FANUC Corporation (Robotic Automation, CNC Systems)

-

Panasonic Corporation (Automation Solutions, Industrial Robotics)

-

Advantech (Embedded Automation Computers, Industrial IoT Solutions)

Suppliers for Specializes in energy management and automation, offering EcoStruxure architecture and various control systems of Industrial Control & Factory Automation Market:

-

Siemens AG

-

Rockwell Automation, Inc.

-

ABB Ltd.

-

Schneider Electric

-

Mitsubishi Electric Corporation

-

Honeywell International Inc.

-

Emerson Electric Co.

-

Yokogawa Electric Corporation

-

Omron Corporation

-

GE Digital (General Electric)

RECENT DEVELOPMENTS

-

In July 2024: Mitsubishi Electric Corporation announced the signing of a Memorandum of Understanding (MOU) with Thailand's Forth EMS Public Company Limited to explore potential collaboration in co-manufacturing Mitsubishi Electric's Transmit/Receive Modules, intended for use in the Air Surveillance Radar Systems produced by Mitsubishi Electric.

-

In June 2024: ABB Robotics introduced OmniCore, an advanced automation platform designed to enhance speed, precision, and sustainability. This platform aims to empower businesses and prepare them for future challenges.

-

In March 2024: Rockwell Automation unveiled the Allen Bradley ArmorBlock 5000 IO-Link master blocks, a new control device that optimizes operations, shortens deployment times, and enhances functionality in demanding industrial environments. These improvements significantly boost the versatility, efficiency, and productivity of premier integrations, facilitating easier automation and maintenance.

-

In November 2023: NovaTech Automation finalized its acquisition of the product line from TestSwitch LLC. This moves enhanced NovaTech Automation's standing in the industry and broadened its product offerings to include TestSwitch's premier product, the W3TS Test Switch.

-

In November 2023: Huizenga Automation Group successfully acquired GSE Automation, which provides a diverse array of services such as process development, FEA analysis, and system design. This acquisition was intended to bolster Huizenga's presence in the industrial automation sector, leveraging GSE's extensive expertise to enhance their existing portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 226.93 Billion |

| Market Size by 2032 | USD 513.82 Billion |

| CAGR | CAGR of 9.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Industrial Robots, Collaborative Industrial Robots, Machine Vision, Control Valves, Field Instruments, Human–Machine Interface (HMI), Industrial PC, Sensors) • By Solution (SCADA, PLC, DCS, MES, Industrial Safety Solutions, PAM) • By Industry, Process Industry ( Oil & Gas, Chemical, Pulp & Paper, Pharmaceutical, Metals & Mining, Food & Beverages, Energy & Power) Discrete Industry (Automotive, Machine Manufacturing, Semiconductor & Electronics, Aerospace & Defense, Medical Device) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Yokogawa Electric Corporation, Omron Corporation, WIKA, Mitsubishi Electric Corporation, Rockwell Automation, Yaskawa Electric Corporation, Toshiba Corporation, Honeywell International Inc., Dwyer Instruments, Stratasys, Hitachi, Siemens AG, Schneider Electric, ABB Ltd., GE Automation & Controls, Emerson Electric Co., KUKA AG, FANUC Corporation, Panasonic Corporation, Advantech. |

| Key Drivers | • Growing demand for industrial automation is driven by the need for increased productivity, efficiency, and cost savings in manufacturing and process industries. • Integrating AI and IoT in automation enhances data analysis and predictive maintenance, driving smarter, digitally transformed industrial operations. |

| RESTRAINTS | • Integrating automation systems with legacy equipment poses significant challenges due to compatibility issues, high customization costs, and potential operational disruptions, which can deter adoption, particularly among small and medium-sized enterprises. |

Frequently Asked Questions

Ans: Asia-Pacific dominated the Industrial Control & Factory Automation Market in 2023.

Ans: The “Distributed Control Systems (DCS)” segment dominated the Industrial Control & Factory Automation Market.

Ans: Growing demand for industrial automation is driven by the need for increased productivity, efficiency, and cost savings in manufacturing and process industries.

Ans: The Industrial Control & Factory Automation Market was USD 226.93 Billion in 2023 and is expected to Reach USD 513.82 Billion by 2032.

Ans: The Industrial Control & Factory Automation Market is expected to grow at a CAGR of 9.51% during 2024-2032.