Get More Information on Industrial Batteries Market - Request Sample Report

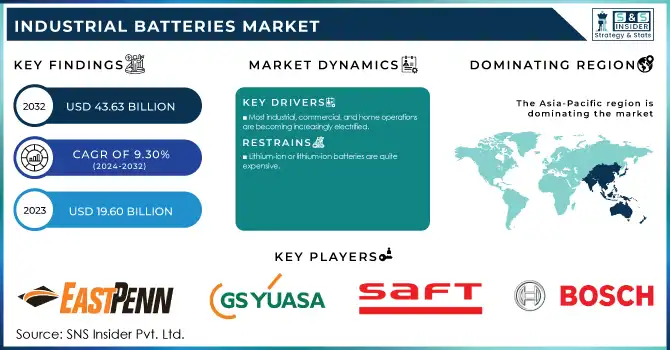

The Industrial Batteries Market was valued at USD 20.12 billion in 2023 and is expected to reach USD 46.15 Billion by 2032, growing at a CAGR of 9.69 % over the forecast period 2024-2032.

The rise of the renewable energy industry with the growing adoption of electric vehicles (EVs) is driving exceptional growth within the Industrial Batteries Market. Industrial batteries are now critical for maintaining grid stability, easing the transition to renewable energy, and storing irreplaceable and intermittent energy from wind and solar sources as the world moves toward cleaner sources of energy. Moreover, improvements in battery chemistry, especially lithium-ion batteries, have also increased the energy density, lowered the cost, and increased the cycle life making them more suitable for large-scale applications. Moreover, many governments around the globe are incentivizing, introducing new regulations, and encouraging energy solutions that focus on sustainability, which in turn is driving the growth of global adoption of industrial batteries. Across the globe, new renewable energy capacity additions grew by 13.9% to reach 473 GW in 2023, with renewables contributing 86% share to global power additions. BEV (battery electric vehicle) sales are expected to reach 17 million units in 2024, surpassing 20% of the global car market. Since the year 2010, the cost of lithium-ion batteries has decreased by 89%, from USD 1,100 per kWh to USD 137 per kWh in 2023. Furthermore, global-wide policies in more than 30 countries encouraging electric vehicles and renewable energy uptake will also benefit electrical batteries during the phase of the industrial output.

The expansion of telecom and data communication networks is another major growth factor for the market. As the world leans more on digital connectivity and data centers continue to grow, the need for reliable backup power solutions (like uninterruptible power supplies (UPS)) has never been greater. Likewise, industrial batteries have emerged as a preferred option for healthcare, manufacturing, and transportation sectors that require uninterrupted power supply. Increasing urbanization and the resilience demand of energy infrastructure will see grid storage & energy management systems become key applications of growth for the market in the coming years. Telecom infrastructure and data centers made up 1.5% of global energy consumption in 2023 and this is expected to grow alongside the digital economy. Due to a heightened dependence on critical infrastructure, healthcare-related uninterruptible power systems (UPS) demand is projected to grow by 8% annually. With urbanization and resilient energy systems pulling the strings, the global grid energy storage market is projected to grow by 20% YoY between 2024-2030. As of 2023, the global urbanization rate is at 57%, with forecasts estimating it will rise to 68% by 2050, and the increasing requirement for backup power solutions can be attributed to this.

KEY DRIVERS:

Rapid Growth in Automation and Industry 4.0 Drives Surge in Industrial Batteries Demand Worldwide

High growth in end-use industries, such as power, automotive, renewable energy, etc., is the major factor driving the growth of the Industrial Batteries Market across the globe. Automation of high-throughput plants like manufacturing, mining, construction, logistics, etc. are being deployed at a very fast rate, as they help in increasing production production yields along with work efficiency. They usually need a strong backup of power, along with reliable energy storage systems for continuous operations especially at remote or off-grid areas. Nickel-based and lead-based batteries are used widely in industrial applications, such as powering heavy machinery and forklifts, as well as automated guided vehicles (AGVs). Industry 4.0, with its promise of intelligent factories and connected systems, increases the requirement for dependable battery technologies to power energy-dependent processes. The year 2023 witnessed global automated guided vehicle (AGV) market expansion by 15% as industries such as manufacturing, logistics and construction, have triggered the adoption of AGVs. Automation systems account 7% of global industrial energy, primarily in mining and manufacturing. 40% of the global forklift fleet powered by lead-based and nickel-based batteries and growth of 35% in EV adoption in industrial sectors More than half of manufacturers worldwide are projected to adopt Industry 4.0 technologies IHS Markit estimates that the majority of these will be enabled by energy storage technologies by 2024.

Rising Carbon Reduction Initiatives and Renewable Energy Adoption Fuel Growth in Industrial Batteries Market

The rise in initiatives towards reducing carbon emissions across sectors mainly industrial and commercial activities also drives market growth significantly. To meet the global sustainability goals, companies across various industries are converting to efficient technologies and incorporate renewables systems. This transition cannot take place without the presence of industrial batteries, which are the necessary storage systems that must exist in order for renewable energies to be used effectively in industrial facilities. Companies providing grid-scale energy storage systems for supply/demand balancing via advanced batteries, which displace fossil fuels in many cases, are but one such example. The increased use of microgrid installations for localized energy generation and storage also drives the growth of the market for industrial batteries. With the growing importance of environmental responsibility and cost-effectiveness to business, batteries are playing a more significant role in decarbonization strategies, and the market is certainly not standing still. In the U.S. alone, added 89% battery storage capacity, topping 30 GW by the end of 2024. The need for localized and on-demand energy solutions fueled a 12% increase in global microgrid installations. More than 60% of Fortune 500 companies have begun to act on decarbonization strategies (2023), based on industrial batteries that provide storage of renewable energy. Driven by increasing share of global energy from renewables, which climbed to 28% in 2023 (up from 26.2% in 2022), demand for industrial batteries further increase.

RESTRAIN:

Environmental and Supply Chain Challenges Impacting Growth of Industrial Batteries Market Worldwide

Environmental issues and reclamation of used batteries pose challenges to the Industrial Batteries Market. However, with the increasing adoption of batteries such as lead based ones, or even, nickel-based ones, an improper disposal of such items will pose certain threats to the environment as well as human health via releasing certain toxic materials. Strict battery disposal and recycling regulations add another layer of compliance for manufacturers and end-users alike. Efficient and environmental recycling technology therefore remains a big challenge. However, the short supply of raw materials necessary for battery production including lithium, cobalt and nickel is another hurdle. Extraction Processing The domains are location-specific with the infrastructure enabling mining and metallurgy only able to be found in a select few countries leading to single point failures in the supply chain and monopolies on a resource. Geopolitical tensions and resource limitations are also another cause of this supply chain and production time disruption. Increased global battery demand further stimulates these challenges, requiring manufacturers to seek out alternative materials and diversify supply sources as supply remains fragile at best.

BY TYPE

Lithium-ion batteries gained a market share of 43.8% in 2023 within industrial batteries and are expected to continue leading the growth during the forecast period owing to their superior performance characteristics and versatile applications. Compared to other battery types, lithium-ion batteries have high energy density, the longest duration, and low self-discharge rates which makes them the most common kind of battery used in electronics. Being lightweight and capable of withstanding numerous charge-discharge cycles, they are popular in the respite of contemporary employments like renewable energy storage, electric vehicles (EVs), or portable industrial equipment. Further driving the growth trajectory for lithium-ion batteries is ongoing technical improvements to drive greater efficiency and safety. Current research is also helping to lower dependence on rare elements such as cobalt making them better for the environment and cheaper. Moreover, the worldwide transition towards clean energy and decarbonization has stimulated the supply of lithium-ion batteries for grid storage and renewable energy systems where high-efficiency and reliable energy storage are essential. Moreover, favorable regulations backing electrification across the industries, along with government incentives to assimilate energy-efficient technologies also play an essential role in enhancing their market growth. These aspects taken together explain their present market top and projected high growth rate over the next couple of years.

BY APPLICATION

In 2023, the industrial batteries market was dominated by the Uninterruptible Power Supply (UPS) segment with a 32.7% market share owing to its significance in providing reliable & uninterrupted power to critical loads across different sectors. UPS systems are widely used across several industries, including healthcare, data centers, IT, and telecommunications to minimize the disruption caused by power outages or fluctuations. The increasing digitization of enterprises, expansion of cloud computing as well as the growth of data centers have exponentially surged the need for reliable backup power solutions. Furthermore, the increasing adoption of automation and IoT technologies across industries has made the continuous availability of power indispensable, hence reinforcing UPS systems as a major application for industrial batteries.

The Grid Storage segment is estimated to be the fastest-growing application from 2024 to 2032, benefitting from the international move towards renewables. The intermittent nature of green energy sources like solar and wind necessitates grid storage systems to manage their output. They allow utilities to collect extra energy when production peaks and release the energy when demand is up, or supply decreases. The development of more efficient, scalable, and cost-effective battery technologies especially lithium-ion has paved the way for grid storage systems to take off from a technical and economic perspective. Furthermore, supportive government policies for clean energy integration and investments in smart grids are propelling a faster adoption of grid storage solutions which will support the grid storage segment to maintain the speed of growth in the future.

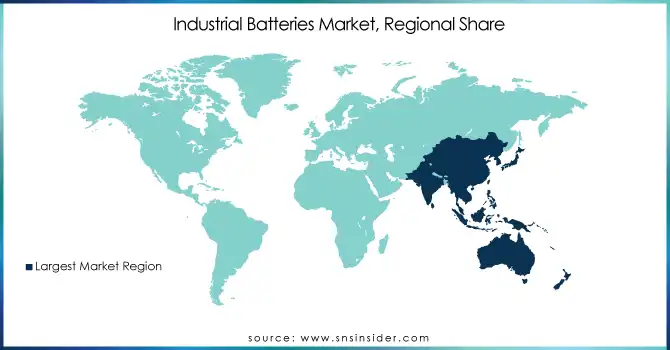

The industrial batteries market was led by the Asia Pacific in 2023 which held the 40.4% market share and is poised to be the fastest growing region from 2024 to 2032 on account of high industrial and urban growth coupled with energy drive. This growth potential is driven primarily by countries such as China, India, and Japan. As an example, the world leader in lithium-ion battery production (which has a strong supply chain and government policy promoting renewables and EVs) is China. Market leaders, such as CATL and BYD, drive the cutting-edge of battery technology to meet the growing needs of the EV market and utility-scale ESS. As India speeds up solar and wind energy installations, industrial batteries can help store renewable power and stabilize the grid. Demand is further driven through initiatives such as the National Electric Mobility Mission Plan (NEMMP) along with investments in smart grid infrastructure. Japan, where industry pioneers such as Panasonic are targeting next-generation energy storage systems for residential and commercial use. Furthermore, Industrial batteries are being sold in the Southeast Asian regions to aid telecom infrastructure along with industrial automation and this coverage shows the growth in dynamic markets.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major players in the Industrial Batteries Market are:

East Penn Manufacturing Co. (Deka Industrial Batteries, Lynx Industrial Batteries)

Tesla, Inc. (Tesla Powerpack, Tesla Megapack)

Clarios, LLC (VARTA Industrial Batteries, OPTIMA Industrial Batteries)

SK Battery America, Inc. (SK Innovation Industrial Batteries, SK On Industrial Batteries)

Stryten Energy (Element Industrial Batteries, PowerLine Industrial Batteries)

Ultium Cells, LLC (Ultium Industrial Batteries, GM Ultium Batteries)

A123 Systems, LLC (A123 Industrial Lithium-ion Batteries, Nanophosphate® Lithium Iron Phosphate Batteries)

EnerSys, Inc. (PowerSafe Industrial Batteries, DataSafe Industrial Batteries)

GS Yuasa Corporation (Yuasa Industrial Batteries, GS Industrial Batteries)

Exide Industries Limited (Exide Industrial Batteries, Chloride Industrial Batteries)

BYD Company Limited (BYD Iron-Phosphate Batteries, BYD Lithium Iron Batteries)

LG Chem (LG Chem Industrial Lithium-ion Batteries, LG Chem ESS Batteries)

Panasonic Corporation (Panasonic Industrial Lithium Batteries, Panasonic Valve-Regulated Lead-Acid Batteries)

Contemporary Amperex Technology Co. Limited (CATL) (CATL Lithium Iron Phosphate Batteries, CATL NCM Batteries)

Saft Groupe S.A. (Saft Ni-Cd Industrial Batteries, Saft Li-ion Industrial Batteries)

Samsung SDI Co., Ltd. (Samsung SDI Lithium-ion Batteries, Samsung SDI ESS Batteries)

Hitachi Chemical Company, Ltd. (Hitachi Industrial Lithium-ion Batteries, Hitachi Valve-Regulated Lead-Acid Batteries)

Toshiba Corporation (Toshiba SCiB™ Batteries, Toshiba Industrial Lithium-ion Batteries)

Johnson Controls International plc (HOPPECKE Industrial Batteries, VARTA Industrial Batteries)

C&D Technologies, Inc. (C&D Industrial Lead-Acid Batteries, C&D Industrial Lithium Batteries)

Some of the Raw Material Suppliers for Industrial Batteries companies:

Targray

Access World

Oxford Export Services Limited

Umicore

Asahi Kasei Corporation

Johnson Matthey

Sumitomo Chemical Co., Ltd.

Mitsubishi Chemical Corporation

Zhejiang Huayou Cobalt

Redwood Materials

In October 2024, Tesla plans to launch four new battery versions by 2026, including one for its upcoming robotaxi. This move aims to reduce reliance on external suppliers and enhance EV performance.

In October 2024, Clarios invested in Altris to accelerate the development of software-enhanced low-voltage sodium-ion batteries for vehicles. The collaboration aims to commercialize these sustainable batteries by 2026.

In October 2024, Exide Industries invested ₹100 crore in a new lithium-ion battery manufacturing plant in Bengaluru, aimed at supporting electric vehicle and energy storage applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.12 Billion |

| Market Size by 2032 | USD 46.15 Billion |

| CAGR | CAGR of 9.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lithium-Ion Battery, Lithium Cobalt Oxide, Nickel-based, Lead-based), • By Application (Telecom & Data Communication, Uninterruptible Power Supply (UPS), Energy, Equipment, Grid Storage, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | East Penn Manufacturing Co., Tesla, Inc., Clarios, LLC, SK Battery America, Inc., Stryten Energy, Ultium Cells, LLC, A123 Systems, LLC, EnerSys, Inc., GS Yuasa Corporation, Exide Industries Limited, BYD Company Limited, LG Chem, Panasonic Corporation, Contemporary Amperex Technology Co. Limited, Saft Groupe S.A., Samsung SDI Co., Ltd., Hitachi Chemical Company, Ltd., Toshiba Corporation, Johnson Controls International plc, C&D Technologies, Inc. |

Ans: The Industrial Batteries Market is expected to grow at a CAGR of 9.69% during 2024-2032.

Ans: Industrial Batteries Market size was USD 20.12 Billion in 2023 and is expected to Reach USD 46.15 Billion by 2032.

Ans: The major growth factor of the Industrial Batteries market is the increasing demand for energy storage solutions driven by the adoption of renewable energy and electric vehicles

Ans: The Lithium-Ion Battery segment dominated the Industrial battery market in 2023.

Ans: Asia Pacific dominated the Industrial Batteries Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Industrial Batteries Price Trends (2023)

5.2 Industrial Batteries Battery Efficiency Metrics (2023)

5.3 Industrial Batteries Battery Adoption Rates

5.4 Industrial Batteries Supply Chain Analysis

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Industrial Batteries Market Segmentation, By Type

7.1 Chapter Overview

7.2 Lithium-Ion Battery

7.2.1 Lithium-Ion Battery Market Trends Analysis (2020-2032)

7.2.2 Lithium-Ion Battery Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.3 Lithium Cobalt Oxide

7.3.1 Lithium Cobalt Oxide Market Trends Analysis (2020-2032)

7.3.2 Lithium Cobalt Oxide Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.4 Nickel-based

7.4.1 Nickel-based Market Trends Analysis (2020-2032)

7.4.2 Nickel-based Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.5 Lead-based

7.5.1 Lead-based Market Trends Analysis (2020-2032)

7.5.2 Lead-based Market Size Estimates and Forecasts to 2032 (USD BILLION)

8. Industrial Batteries Market Segmentation, By Application

8.1 Chapter Overview

8.2 Telecom & Data Communication

8.2.1 Telecom & Data Communication Market Trends Analysis (2020-2032)

8.2.2 Telecom & Data Communication Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.3 Uninterruptible Power Supply (UPS)

8.3.1 Uninterruptible Power Supply (UPS) Market Trends Analysis (2020-2032)

8.3.2 Uninterruptible Power Supply (UPS) Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.4 Energy

8.4.1 Energy Market Trends Analysis (2020-2032)

8.4.2 Energy Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.5 Equipment

8.5.1 Equipment Market Trends Analysis (2020-2032)

8.5.2 Equipment Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.6 Grid Storage

8.6.1 Grid Storage Market Trends Analysis (2020-2032)

8.6.2 Grid Storage Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.7 Hydraulic Fluids

8.7.1 Hydraulic Fluids Market Trends Analysis (2020-2032)

8.7.2 Hydraulic Fluids Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.8 Other

8.8.1 Other Market Trends Analysis (2020-2032)

8.8.2 Other Market Size Estimates and Forecasts to 2032 (USD BILLION)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.2.3 North America Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.2.4 North America Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.2.5 USA

9.2.5.1 USA Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.2.5.2 USA Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.2.6 Canada

9.2.6.1 Canada Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.2.6.2 Canada Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.2.7 Mexico

9.2.7.1 Mexico Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.2.7.2 Mexico Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.3.1.3 Eastern Europe Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.1.4 Eastern Europe Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.1.5 Poland

9.3.1.5.1 Poland Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.1.5.2 Poland Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.1.6 Romania

9.3.1.6.1 Romania Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.1.6.2 Romania Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.1.7.2 Hungary Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.1.8 turkey

9.3.1.8.1 Turkey Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.1.8.2 Turkey Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.1.9.2 Rest of Eastern Europe Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.3.2.3 Western Europe Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.4 Western Europe Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.5 Germany

9.3.2.5.1 Germany Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.5.2 Germany Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.6 France

9.3.2.6.1 France Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.6.2 France Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.7 UK

9.3.2.7.1 UK Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.7.2 UK Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.8 Italy

9.3.2.8.1 Italy Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.8.2 Italy Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.9 Spain

9.3.2.9.1 Spain Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.9.2 Spain Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.10.2 Netherlands Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.11.2 Switzerland Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.12 Austria

9.3.2.12.1 Austria Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.12.2 Austria Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.3.2.13.2 Rest of Western Europe Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.4.3 Asia Pacific Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.4 Asia Pacific Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.5 China

9.4.5.1 China Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.5.2 China Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.6 India

9.4.5.1 India Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.5.2 India Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.5 japan

9.4.5.1 Japan Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.5.2 Japan Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.6 South Korea

9.4.6.1 South Korea Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.6.2 South Korea Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.7 Vietnam

9.4.7.1 Vietnam Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.2.7.2 Vietnam Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.8 Singapore

9.4.8.1 Singapore Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.8.2 Singapore Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.9 Australia

9.4.9.1 Australia Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.9.2 Australia Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.4.10.2 Rest of Asia Pacific Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.5.1.3 Middle East Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.1.4 Middle East Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.1.5 UAE

9.5.1.5.1 UAE Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.1.5.2 UAE Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.1.6.2 Egypt Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.1.7.2 Saudi Arabia Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.1.8.2 Qatar Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.1.9.2 Rest of Middle East Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.5.2.3 Africa Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.2.4 Africa Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.2.5.2 South Africa Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.2.6.2 Nigeria Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.5.2.7.2 Rest of Africa Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Industrial Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.6.3 Latin America Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.6.4 Latin America Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.6.5 brazil

9.6.5.1 Brazil Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.6.5.2 Brazil Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.6.6 Argentina

9.6.6.1 Argentina Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.6.6.2 Argentina Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.6.7 Colombia

9.6.7.1 Colombia Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.6.7.2 Colombia Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Industrial Batteries Market Estimates and Forecasts, By Type (2020-2032) (USD BILLION)

9.6.8.2 Rest of Latin America Industrial Batteries Market Estimates and Forecasts, By Application (2020-2032) (USD BILLION)

10. Company Profiles

10.1 East Penn Manufacturing Co.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Tesla, Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Clarios, LLC

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 SK Battery America, Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Stryten Energy

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Ultium Cells, LLC

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 A123 Systems, LLC

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 EnerSys, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 GS Yuasa Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Exide Industries Limited

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Lithium-Ion Battery

Lithium Cobalt Oxide

Nickel-based

Lead-based

By Application

Telecom & Data Communication

Uninterruptible Power Supply (UPS)

Energy

Equipment

Grid Storage

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Geofoam Market Size was valued at USD 764.9 million in 2023 and is expected to reach USD 1466.6 million by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

Explore the Natural Extracts Market, covering trends in food, cosmetics, and pharmaceuticals. Learn about the rising demand for plant-based, eco-friendly ingredients and how natural extracts are driving innovation in flavoring, skincare, and health supple

Industrial Salt Market size was USD 15.2 Billion in 2023 and is expected to reach USD 21.1 Billion by 2032 and grow at a CAGR of 3.6 % from 2024 to 2032.

The Industrial Cleaning Chemical Market Size was valued at USD 42.89 Billion in 2023 and is expected to reach USD 65.37 Billion by 2032, growing at a CAGR of 4.80% over the forecast period of 2024-2032.

The Metal Powder Market size was USD 6.9 billion in 2023 and is expected to reach USD 12.3 billion by 2032 and grow at a CAGR of 6.7% over the forecast period of 2024-2032.

Coating Additives Market was valued at USD 8.94 Billion in 2023 and is expected to reach USD 13.09 Billion by 2032, growing at a CAGR of 4.33% from 2024-2032.

Hi! Click one of our member below to chat on Phone