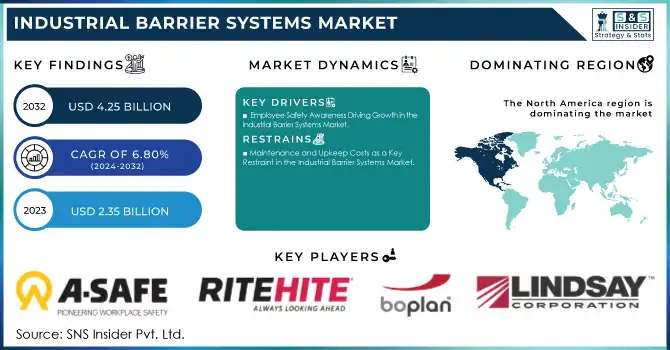

Industrial Barrier Systems Market Size & Overview:

The Industrial Barrier Systems Market Size was valued at USD 2.35 billion in 2023 and is projected to reach USD 4.25 billion by 2032, growing at a robust CAGR of 6.80% from 2024 to 2032.

The industrial barrier systems market is growing rapidly, driven by the increasing adoption of automation and digitalization across industries. A World Economic Forum report, in collaboration with Boston Consulting Group (BCG), highlights that 72% of manufacturers view advanced analytics as essential for growth, and 80% believe digitalization and data-driven insights can improve productivity through processes like predictive maintenance, which saves 8-12% over preventive maintenance and up to 40% over reactive maintenance.

Get More Information on Industrial Barrier Systems Market - Request Sample Report

Universal automation offers further transformative potential, enabling production systems to become self-configuring and self-healing. Over the next five years, the retail and consumer goods sector is expected to lead automation investments, with 23% of companies planning to spend more than $500 million, compared to 15% in food and beverage and 8% in automotive. The logistics and fulfillment sector will allocate over 30% of capital spending to automation, the highest share among industrial segments. However, 42% of companies report challenges in finding holistic end-to-end solutions across robotics and automation technologies. Additional barriers include the integration of robotics into existing systems, safety concerns, cybersecurity risks, and achieving return on investment (ROI).Despite these challenges, industries like automotive, electronics, logistics, and food processing are embracing automation. AI and IoT-enabled systems are reducing costs by up to 30%, improving operational efficiency, and driving demand for advanced safety systems such as smart barriers, proximity sensors, and contactless precision technologies. As industrial automation accelerates, the demand for robust and intelligent industrial barrier systems is poised for substantial growth, ensuring safety in increasingly automated environments.

Industrial Barrier Systems Market Dynamics

Drivers

-

Employee Safety Awareness Driving Growth in the Industrial Barrier Systems Market

The rising awareness of employee safety and accident prevention is a significant driver for the industrial barrier systems market. As businesses face increasingly dynamic and hazardous work environments, they are prioritizing the protection of their workforce. According to OSHA guidelines, workplace safety awareness is crucial in reducing injury risks, which compels organizations to invest in safety infrastructure such as industrial barriers. With over 2.3 million workplace accidents occurring globally each year, the need for effective containment and accident prevention measures is pressing. Modern industrial safety barriers are evolving to meet these challenges, incorporating advanced solutions such as impact-resistant barriers, modular systems, and energy-absorbing designs. Industries like manufacturing and logistics are major adopters, given the increased safety risks due to automation, high-speed operations, and the use of heavy machinery. Furthermore, effective safety barriers contribute to operational efficiency by clearly defining hazardous zones, thus reducing downtime caused by workplace incidents. The increased emphasis on employee well-being also aligns with stricter global safety standards, including ISO and ANSI regulations, which mandate the use of safety equipment to minimize workplace hazards. As sectors like e-commerce and logistics expand rapidly, there is a growing demand for high-performance barriers, particularly in warehouses, loading docks, and fulfillment centers. The economic impact of workplace injuries, which costs over USD 171 billion annually in the U.S. alone, further underscores the importance of these safety measures. As companies continue to focus on improving employee safety and complying with evolving regulations, the industrial barrier systems market is expected to experience substantial growth, driven by the need for durable, adaptable, and innovative solutions that reduce liability, enhance safety, and ensure compliance.

Restraints

-

Maintenance and Upkeep Costs as a Key Restraint in the Industrial Barrier Systems Market

Industrial barriers, particularly those subjected to harsh environments or high-impact conditions such as heavy machinery or extreme weather; necessitate consistent maintenance to remain functional and safe. The frequent need for inspections, repairs, and replacements adds to operational costs, creating a financial burden for businesses. For instance, barriers like bollards and gates in high-traffic areas or warehouses must be regularly assessed to ensure compliance with safety standards and maintain effectiveness barriers designed with advanced features such as energy absorption or impact resistance are more complex to maintain, further increasing the costs involved. Smaller organizations or those with limited budgets may struggle to allocate funds for ongoing maintenance, leading to delays in repairs or non-compliance with safety regulations. As the cost of maintaining and replacing these barriers adds up over time, many businesses may hesitate to invest in advanced barrier solutions, particularly if they lack dedicated maintenance resources. Poor maintenance can lead to barriers failing to provide adequate protection, escalating the risk of accidents and injuries. This, in turn, can influence operational efficiency and increase downtime, creating a cyclical problem. As companies strive for cost reduction and enhanced operational efficiency, the financial strain of maintaining these systems poses a significant challenge, slowing down the adoption of industrial barriers. This is especially true for businesses in emerging markets or those operating on tight budgets.

Industrial Barrier Systems Market Segment Outlook

By Function

In 2023, the Passive Barriers segment led the Industrial Barrier Systems market, holding around 68% of the market share. Passive barriers, such as guardrails, bollards, and walls, are designed to prevent accidents without active control, providing reliable physical protection. Their popularity stems from their simplicity, ease of installation, and low maintenance costs. They are widely used in industries like manufacturing, logistics, and warehousing, where they play a crucial role in separating workers from hazardous zones, ensuring compliance with safety regulations, and minimizing risks.

The Active Barriers segment is projected to experience the fastest growth from 2024 to 2032. These dynamic barriers, including automated gates and sensor-driven systems, offer real-time adjustments to changing conditions, driven by advances in automation and smart technologies. Their ability to improve safety while optimizing operational efficiency makes them highly sought after, particularly in manufacturing, logistics, and automotive industries, fueling their rapid market expansion.

By Material

In 2023, the Metal segment led the Industrial Barrier Systems market, holding about 64% of the total market share. Metal barriers, such as those made from steel, aluminum, and alloys, are preferred for their durability, strength, and ability to withstand wear and tear, making them ideal for high-impact environments like manufacturing plants, warehouses, and transportation hubs. Their long lifespan, minimal maintenance needs, and resistance to harsh weather conditions contribute to their widespread use. Moreover, metal barriers can be easily customized to meet specific safety standards and design needs, enhancing their appeal across various industries.

In contrast, the Non-Metal segment is expected to be the fastest growing from 2024 to 2032. Comprising materials like plastic, composites, and rubber, non-metal barriers offer lightweight, cost-effective, and corrosion-resistant solutions. Their growing adoption in sectors such as food processing, pharmaceuticals, and logistics is driven by the need for flexible, durable, and easy-to-maintain safety solutions.

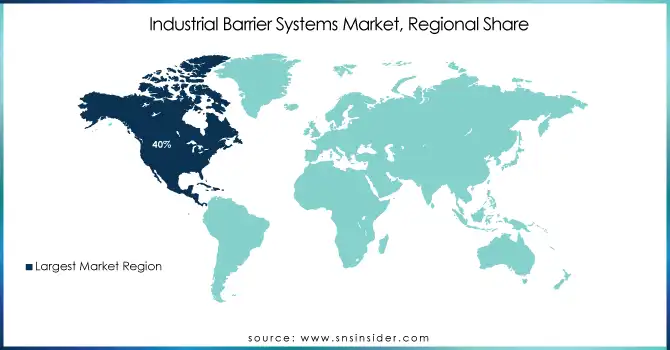

Industrial Barrier Systems Market Regional Analysis

In 2023, North America led the Industrial Barrier Systems Market with around 40% market share, driven by a strong focus on workplace safety, stringent regulations, and significant investments in industrial infrastructure. The demand for IBS is primarily driven by key industries such as manufacturing, logistics, and automotive in the U.S. and Canada. North America's adoption of advanced technologies like automation and robotics further boosts the need for both passive and active barriers, ensuring safety and operational efficiency. Regulatory compliance, along with the continued expansion of e-commerce and warehousing sectors, supports ongoing market growth.

The Asia-Pacific region is set to be the fastest-growing market for Industrial Barrier Systems Market from 2024 to 2032, fueled by rapid industrialization, urbanization, and significant investments in manufacturing and logistics, particularly in China, India, Japan, and South Korea. The integration of smart safety systems, automation, and robotics is also accelerating demand for advanced safety barriers in the region.

Need any customization research on Industrial Barrier Systems Market - Enquiry Now

Key Players

Some of the major key players in Industrial Barrier Systems Market along with their product:

-

A-Safe: (Polymer Safety Barriers)

-

BOPLAN: (Impact-Resistant Guardrails)

-

Rite-Hite: (Dock Barriers and Safety Systems)

-

Fabenco by Tractel: (Safety Gates)

-

Lindsay Corporation: (Crash Barriers)

-

Valmont Industries Inc.: (Steel Barriers and Fences)

-

Barrier1: (Vehicle Barriers)

-

Betafence: (Perimeter Security Fencing)

-

Gramm Barriers: (Noise Barriers)

-

Hill & Smith PLC: (Temporary Road Barriers)

-

CAI Safety Systems, Inc.: (Fall Protection Barriers)

-

Kirchdorfer Industries: (Concrete Barriers)

-

Tata Steel: (Steel Crash Barriers)

-

Arbus: (Pedestrian Safety Barriers)

-

Avon Barrier Corporation Ltd.: (Anti-Terror Vehicle Barriers)

-

Hörmann: (Industrial Dock Barriers)

-

Delta Scientific Corporation: (High-Security Vehicle Barriers)

-

Heras: (Access Control Fencing)

-

Stewart Safety Supplies: (Safety Bollards)

-

Jacksons Fencing: (Steel and Timber Fencing Systems)

List of raw material suppliers and component suppliers for Industrial Barrier Systems:

Raw Material Suppliers

-

ArcelorMittal: (Steel and metal alloys)

-

Tata Steel: (Crash barrier-grade steel, galvanized materials)

-

Nucor Corporation: (Steel plates and sheets)

-

Evonik Industries: (High-performance polymers)

-

Covestro AG: (Polycarbonate and polyurethane materials)

-

Dow Inc.: (Polymer coatings, adhesives, and resins)

-

BASF SE: (Thermoplastics and resins)

-

LyondellBasell Industries: (Polyethylene and polypropylene)

-

Saint-Gobain: (Concrete and composite materials)

-

Heidelberg Materials: (Concrete and aggregates)

-

SSAB: (High-strength steel for barriers)

-

Formosa Plastics Corporation: (PVC and polyethylene materials)

-

INEOS: (Specialty polymers and resins)

-

Alcoa Corporation: (Aluminum for lightweight barrier components)

Component Suppliers

-

3M Company: (Reflective tapes, adhesives, and safety coatings)

-

Toray Industries: (Fiber-reinforced plastics and composites)

-

Owens Corning: (Fiberglass and insulation materials for barrier structures)

-

AK Steel (Cleveland-Cliffs): (Carbon and stainless steel components)

-

SABIC: (Engineering thermoplastics for modular barrier systems)

Recent Development

-

July 2024: A-SAFE, the global leader in advanced polymer safety solutions, has won the Red Dot Award for Product Design 2024 for its Industry 4.0-ready RackEye, powered by the Conek IoT platform. This marks the company’s 40th anniversary, highlighting its ongoing innovation in safety technology.

-

October2024: Delta Scientific's MP100 portable barrier system has successfully passed the M30/P3 crash test, achieving the new ASTM F2656-23 standard with a total penetration of just 51 feet. This portable, foldable barrier offers easy setup and customization, with options for modular configurations and promotional advertising.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.35 Billion |

| Market Size by 2032 | USD 4.25 Billion |

| CAGR | CAGR of 6.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bollards, Safety Fences, Safety Gates, Guardrails, Barriers for Machinery, Others) • By Function (Active Barriers, Passive Barriers) • By Access Control Devices (Biometric Systems, Perimeter Security Systems & Alarms, Token & Reader Function, Turnstile, Others) • By Material (Metal, Non-metal) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | A-Safe, BOPLAN, Rite-Hite, Fabenco by Tractel, Lindsay Corporation, Valmont Industries Inc., Barrier1, Betafence, Gramm Barriers, Hill & Smith PLC, CAI Safety Systems, Inc., Kirchdorfer Industries, Tata Steel, Arbus, Avon Barrier Corporation Ltd., Hörmann, Delta Scientific Corporation, Heras, Stewart Safety Supplies, Jacksons Fencing. |

| Key Drivers | • Employee Safety Awareness Driving Growth in the Industrial Barrier Systems Market. |

| Restraints | • Maintenance and Upkeep Costs as a Key Restraint in the Industrial Barrier Systems Market. |