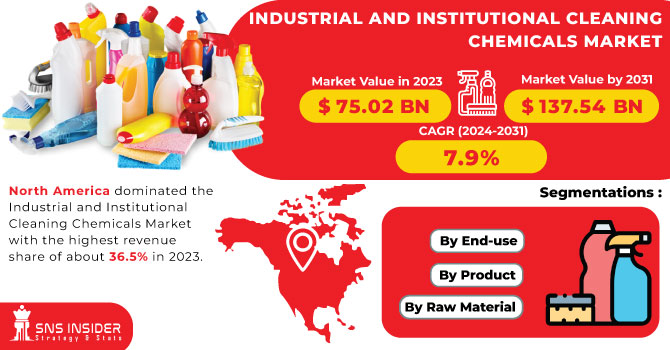

The Industrial and Institutional Cleaning Chemicals Market size was valued at USD 75.02 billion in 2023. It is estimated to hit USD 137.54 billion by 2031 and grow at a CAGR of 7.9% over the forecast period of 2024-2031.

The industrial and institutional cleaning chemicals market is driven by several factors. Firstly, the increasing awareness regarding the importance of cleanliness and hygiene has led to a surge in demand for effective cleaning solutions. Moreover, stringent regulations and guidelines imposed by regulatory bodies further propel the market growth, as businesses strive to comply with these standards. The market offers a wide array of cleaning chemicals, including disinfectants, sanitizers, degreasers, and detergents, each tailored to address specific cleaning requirements. These chemicals are formulated to effectively eliminate dirt, grime, bacteria, and other contaminants, ensuring a clean and safe environment.

Get E-PDF Sample Report on Industrial and Institutional Cleaning Chemicals Market - Request Sample Report

Furthermore, the market is witnessing a shift towards eco-friendly and sustainable cleaning chemicals. With growing environmental concerns, businesses are increasingly opting for products that minimize their ecological footprint. This trend has led to the development of innovative and environmentally friendly cleaning solutions, which not only provide effective cleaning but also align with sustainability goals.

Drivers

Increasing awareness of hygiene and cleanliness

The growing emphasis on maintaining cleanliness and hygiene in industrial and institutional settings is a significant driver for the cleaning chemicals market. This trend is driven by the need to prevent the spread of diseases and maintain a healthy environment.

Stringent regulations and standards

Governments and regulatory bodies are implementing stringent regulations and standards to ensure the safety and well-being of workers and the environment. Compliance with these regulations necessitates the use of effective cleaning chemicals, driving the demand for such products.

The outbreak of the COVID-19 pandemic

Restraint

Volatile raw material prices

Fluctuations in the prices of raw materials used in cleaning chemicals production can impact the market. The volatility of prices poses challenges for manufacturers in maintaining profitability and pricing stability.

Environmental concerns associated with these cleaning agents

The use of certain cleaning chemicals can have adverse effects on the environment. The increasing awareness of environmental issues and the demand for eco-friendly alternatives pose a restraint on the market. Manufacturers need to focus on developing sustainable and environmentally friendly cleaning solutions to overcome this challenge.

Opportunities

Increasing adoption of organic chemicals

The rising awareness of environmental sustainability and the demand for eco-friendly products create opportunities for manufacturers to develop and market green cleaning chemicals. This shift towards sustainability creates opportunities for green cleaning chemicals.

Challenges

Increasing demand for environmentally friendly cleaning products

With growing awareness about the harmful effects of traditional cleaning chemicals on human health and the environment, consumers are now seeking safer and more sustainable alternatives. This shift in consumer preferences poses a significant challenge for companies that have traditionally relied on conventional cleaning chemicals.

The Russia-Ukraine war has caused a disruption in the supply chain of cleaning chemicals, leading to a shortage in the market. This shortage has resulted in increased prices and limited availability of essential cleaning products. Industries and institutions heavily reliant on these chemicals have faced challenges in maintaining their cleanliness standards, which has had a detrimental effect on their operations. In addition to the supply chain disruption and lack of investment, the war has also impacted the demand for cleaning chemicals. With the ongoing conflict, many industries and institutions have experienced a decline in their activities, leading to reduced cleaning requirements. This decrease in demand has further exacerbated the challenges faced by manufacturers and suppliers in the market.

During a recession, businesses and consumers alike tend to tighten their belts, reducing their spending on non-essential goods and services. This shift in behavior directly affects the demand for industrial and institutional cleaning chemicals, as companies and institutions cut back on their cleaning budgets. Consequently, the market experiences a decline in sales and revenue, posing significant challenges for manufacturers and suppliers in this sector. Furthermore, the recession may also lead to a decrease in construction activities, as companies delay or cancel projects due to financial constraints. This, in turn, affects the demand for cleaning chemicals, as new buildings and facilities require a substantial amount of cleaning products. As a result, manufacturers and suppliers face a double blow, with reduced demand from existing customers and a decline in potential new customers.

By Product

Disinfectants And Sanitizers

General Purpose Cleaners

Laundry Care Products

Vehicle Wash Products

Ware washing

Others

By Raw Material

Surfactant

Chlor-alkali

Solvents

Biocides

Phosphates

Others

By End-use

Manufacturing

Commercial

Institutional & Government

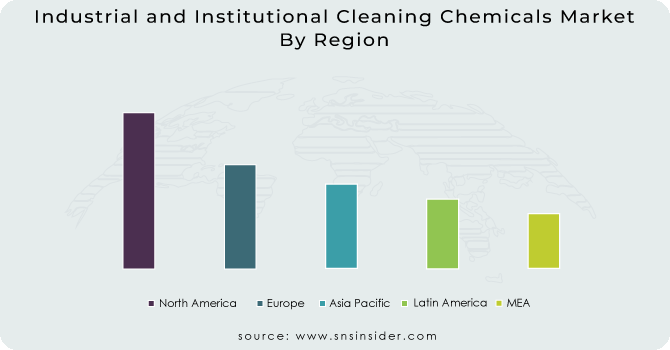

North America dominated the Industrial and Institutional Cleaning Chemicals Market with the highest revenue share of about 36.5% in 2023. This market encompasses a wide range of products used for cleaning and maintaining various commercial and industrial facilities. These chemicals play a crucial role in ensuring cleanliness, hygiene, and safety in workplaces, hospitals, schools, and other public spaces. One of the key reasons for North America's dominance in this market is its robust industrial sector. The region boasts a highly developed manufacturing industry, which generates a significant demand for cleaning chemicals. With numerous factories, warehouses, and production facilities operating across the continent, the need for effective cleaning solutions is paramount. Furthermore, North America's stringent regulations and standards regarding workplace safety and hygiene have also contributed to the market's growth.

Asia Pacific is expected to grow with the highest CAGR of about 8.3% during the forecast period. The Asia Pacific region, comprising countries such as China, India, Japan, and South Korea, is witnessing a significant surge in industrial and institutional activities. This can be attributed to the region's rapid economic development, urbanization, and increasing disposable income. As a result, there is a growing demand for cleaning chemicals in various sectors, including manufacturing, healthcare, hospitality, and commercial spaces. Furthermore, the Asia Pacific region is witnessing a shift towards stringent regulations and standards for cleanliness and hygiene. Governments and regulatory bodies are emphasizing the importance of maintaining high cleanliness standards in industries, institutions, and public spaces. This has led to an increased adoption of cleaning chemicals to ensure compliance with these regulations.

Moreover, the rising awareness among consumers regarding the importance of cleanliness and hygiene has further fueled the demand for industrial and institutional cleaning chemicals. With a growing middle-class population and changing lifestyles, individuals are becoming more conscious of maintaining clean and sanitized environments. This has resulted in increased usage of cleaning chemicals in households, offices, and public spaces. Additionally, the presence of a large number of manufacturing facilities and industrial complexes in the Asia Pacific region has contributed to the demand for cleaning chemicals. These facilities require effective cleaning solutions to maintain a safe and hygienic working environment, thereby driving market growth.

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are 3M, BASF SE, Clariant, Procter & Gamble, Dow, SOLVAY, Sasol, Reckitt Benckiser Group plc, Eastman Chemical Corporation, Kimberly-Clark Corporation, Huntsman International LLC, Croda International PLC, Clorox Company, Inc., and other key players mentioned in the final report.

In December 2022, Clariant AG announced its plans to expand its business by making new investments to enhance its ethoxylation plant in China. The company will invest a total of USD 86.7 million to increase the capacity for its existing products and introduce new products by the end of 2024.

In October 2022, BASF and Hannong Chemicals planned to establish a production joint venture called "BASF Hannong Chemicals Solutions Ltd." In this joint venture, BASF will hold a majority share of 51%, while Hannong Chemicals will hold a minority share of 49%.

In March 2022, Sasol Chemicals, a business unit of Sasol Ltd., and Holiferm Limited announced a partnership to collaborate on the development of new biosurfactants and facilitate the widespread commercialization of sophorolipids.'

| Report Attributes | Details |

| Market Size in 2023 | US$ 75.02 Bn |

| Market Size by 2031 | US$ 137.54 Bn |

| CAGR | CAGR of 7.9% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Disinfectants And Sanitizers, General Purpose Cleaners, Laundry Care Products, Vehicle Wash Products, Ware washing, and Others) • By Raw Material (Surfactant, Chlor-alkali, Solvents, Biocides, Phosphates, and Others) • By End-use (Manufacturing, Commercial, and Institutional & Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AK Scientific Inc., Alfa Aesar, MP Biomedicals, DPX Fine Chemicals, Virox, Thermo Fisher Scientific Inc., Parchem Fine & Specialty Chemicals, TCI America, Merck Millipore Corporation, Sigma-Aldrich Co. LLC |

| Key Drivers | • Increasing awareness of hygiene and cleanliness • Stringent regulations and standards • The outbreak of the COVID-19 pandemic |

| Key Restraints | • Volatile raw material prices • Environmental concerns associated with these cleaning agents |

Ans: The Industrial and Institutional Cleaning Chemicals Market was valued at USD 75.02 billion in 2023.

Ans: The expected CAGR of the global Industrial and Institutional Cleaning Chemicals Market during the forecast period is 7.9%.

Ans: The development of innovative cleaning chemicals and technologies has revolutionized the industry. These advancements offer improved cleaning efficiency, reduced environmental impact, and enhanced safety, thereby driving market growth.

Ans: The surfactant segment dominated the Industrial and Institutional Cleaning Chemicals Market with the highest revenue share of about 30% in 2023.

Ans: Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Ukraine- Russia War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Industrial and Institutional Cleaning Chemicals Market Segmentation, By Product

8.1 Disinfectants and Sanitizers

8.2 General Purpose Cleaners

8.3 Laundry Care Products

8.4 Vehicle Wash Products

8.5 Ware washing

8.6 Others

9. Industrial and Institutional Cleaning Chemicals Market Segmentation, By Raw Material

9.1 Surfactant

9.2 Chlor-alkali

9.3 Solvents

9.4 Biocides

9.5 Phosphates

9.6 Others

10. Industrial and Institutional Cleaning Chemicals Market Segmentation, By End-use

10.1 Manufacturing

10.2 Commercial

10.3 Institutional & Government

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Industrial and Institutional Cleaning Chemicals Market by Country

11.2.2North America Industrial and Institutional Cleaning Chemicals Market by Product

11.2.3 North America Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.2.4 North America Industrial and Institutional Cleaning Chemicals Market by End-use

11.2.5 USA

11.2.5.1 USA Industrial and Institutional Cleaning Chemicals Market by Product

11.2.5.2 USA Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.2.5.3 USA Industrial and Institutional Cleaning Chemicals Market by End-use

11.2.6 Canada

11.2.6.1 Canada Industrial and Institutional Cleaning Chemicals Market by Product

11.2.6.2 Canada Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.2.6.3 Canada Industrial and Institutional Cleaning Chemicals Market by End-use

11.2.7 Mexico

11.2.7.1 Mexico Industrial and Institutional Cleaning Chemicals Market by Product

11.2.7.2 Mexico Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.2.7.3 Mexico Industrial and Institutional Cleaning Chemicals Market by End-use

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Industrial and Institutional Cleaning Chemicals Market by country

11.3.1.2 Eastern Europe Industrial and Institutional Cleaning Chemicals Market by Product

11.3.1.3 Eastern Europe Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.1.4 Eastern Europe Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.1.5 Poland

11.3.1.5.1 Poland Industrial and Institutional Cleaning Chemicals Market by Product

11.3.1.5.2 Poland Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.1.5.3 Poland Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.1.6 Romania

11.3.1.6.1 Romania Industrial and Institutional Cleaning Chemicals Market by Product

11.3.1.6.2 Romania Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.1.6.4 Romania Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.1.7 Turkey

11.3.1.7.1 Turkey Industrial and Institutional Cleaning Chemicals Market by Product

11.3.1.7.2 Turkey Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.1.7.3 Turkey Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Industrial and Institutional Cleaning Chemicals Market by Product

11.3.1.8.2 Rest of Eastern Europe Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.1.8.3 Rest of Eastern Europe Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2 Western Europe

11.3.2.1 Western Europe Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.2 Western Europe Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.3 Western Europe Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.4 Germany

11.3.2.4.1 Germany Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.4.2 Germany Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.4.3 Germany Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.5 France

11.3.2.5.1 France Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.5.2 France Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.5.3 France Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.6 UK

11.3.2.6.1 UK Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.6.2 UK Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.6.3 UK Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.7 Italy

11.3.2.7.1 Italy Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.7.2 Italy Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.7.3 Italy Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.8 Spain

11.3.2.8.1 Spain Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.8.2 Spain Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.8.3 Spain Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.9.2 Netherlands Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.9.3 Netherlands Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.10.2 Switzerland Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.10.3 Switzerland Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.11.1 Austria

11.3.2.11.2 Austria Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.11.3 Austria Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.11.4 Austria Industrial and Institutional Cleaning Chemicals Market by End-use

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Industrial and Institutional Cleaning Chemicals Market by Product

11.3.2.12.2 Rest of Western Europe Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.3.2.12.3 Rest of Western Europe Industrial and Institutional Cleaning Chemicals Market by End-use

11.4 Asia-Pacific

11.4.1 Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by country

11.4.2 Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by Product

11.4.3 Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.4 Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.5 China

11.4.5.1 China Industrial and Institutional Cleaning Chemicals Market by Product

11.4.5.2 China Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.5.3 China Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.6 India

11.4.6.1 India Industrial and Institutional Cleaning Chemicals Market by Product

11.4.6.2 India Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.6.3 India Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.7 Japan

11.4.7.1 Japan Industrial and Institutional Cleaning Chemicals Market by Product

11.4.7.2 Japan Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.7.3 Japan Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.8 South Korea

11.4.8.1 South Korea Industrial and Institutional Cleaning Chemicals Market by Product

11.4.8.2 South Korea Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.8.3 South Korea Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.9 Vietnam

11.4.9.1 Vietnam Industrial and Institutional Cleaning Chemicals Market by Product

11.4.9.2 Vietnam Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.9.3 Vietnam Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.10 Singapore

11.4.10.1 Singapore Industrial and Institutional Cleaning Chemicals Market by Product

11.4.10.2 Singapore Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.10.3 Singapore Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.11 Australia

11.4.11.1 Australia Industrial and Institutional Cleaning Chemicals Market by Product

11.4.11.2 Australia Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.11.3 Australia Industrial and Institutional Cleaning Chemicals Market by End-use

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by Product

11.4.12.2 Rest of Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.4.12.3 Rest of Asia-Pacific Industrial and Institutional Cleaning Chemicals Market by End-use

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Industrial and Institutional Cleaning Chemicals Market by country

11.5.1.2 Middle East Industrial and Institutional Cleaning Chemicals Market by Product

11.5.1.3 Middle East Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.1.4 Middle East Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.1.5 UAE

11.5.1.5.1 UAE Industrial and Institutional Cleaning Chemicals Market by Product

11.5.1.5.2 UAE Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.1.5.3 UAE Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.1.6 Egypt

11.5.1.6.1 Egypt Industrial and Institutional Cleaning Chemicals Market by Product

11.5.1.6.2 Egypt Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.1.6.3 Egypt Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Industrial and Institutional Cleaning Chemicals Market by Product

11.5.1.7.2 Saudi Arabia Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.1.7.3 Saudi Arabia Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.1.8 Qatar

11.5.1.8.1 Qatar Industrial and Institutional Cleaning Chemicals Market by Product

11.5.1.8.2 Qatar Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.1.8.3 Qatar Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Industrial and Institutional Cleaning Chemicals Market by Product

11.5.1.9.2 Rest of Middle East Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.1.9.3 Rest of Middle East Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.2 Africa

11.5.2.1 Africa Industrial and Institutional Cleaning Chemicals Market by Country

11.5.2.2 Africa Industrial and Institutional Cleaning Chemicals Market by Product

11.5.2.3 Africa Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.2.4 Africa Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Industrial and Institutional Cleaning Chemicals Market by Product

11.5.2.5.2 Nigeria Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.2.5.3 Nigeria Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.2.6 South Africa

11.5.2.6.1 South Africa Industrial and Institutional Cleaning Chemicals Market by Product

11.5.2.6.2 South Africa Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.2.6.3 South Africa Industrial and Institutional Cleaning Chemicals Market by End-use

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Industrial and Institutional Cleaning Chemicals Market by Product

11.5.2.7.2 Rest of Africa Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.5.2.7.3 Rest of Africa Industrial and Institutional Cleaning Chemicals Market by End-use

11.6 Latin America

11.6.1 Latin America Industrial and Institutional Cleaning Chemicals Market by country

11.6.2 Latin America Industrial and Institutional Cleaning Chemicals Market by Product

11.6.3 Latin America Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.6.4 Latin America Industrial and Institutional Cleaning Chemicals Market by End-use

11.6.5 Brazil

11.6.5.1 Brazil Industrial and Institutional Cleaning Chemicals Market by Product

11.6.5.2 Brazil Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.6.5.3 Brazil Industrial and Institutional Cleaning Chemicals Market by End-use

11.6.6 Argentina

11.6.6.1 Argentina Industrial and Institutional Cleaning Chemicals Market by Product

11.6.6.2 Argentina Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.6.6.3 Argentina Industrial and Institutional Cleaning Chemicals Market by End-use

11.6.7 Colombia

11.6.7.1 Colombia Industrial and Institutional Cleaning Chemicals Market by Product

11.6.7.2 Colombia Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.6.7.3 Colombia Industrial and Institutional Cleaning Chemicals Market by End-use

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Industrial and Institutional Cleaning Chemicals Market by Product

11.6.8.2 Rest of Latin America Industrial and Institutional Cleaning Chemicals Market by Raw Material

11.6.8.3 Rest of Latin America Industrial and Institutional Cleaning Chemicals Market by End-use

12. Company profile

12.1 3M

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 BASF SE

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Clariant

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Procter & Gamble

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Dow

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 SOLVAY

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Sasol

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Reckitt Benckiser Group plc

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Eastman Chemical Corporation

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Kimberly-Clark Corporation

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Huntsman International LLC

12.11.1 Company Overview

12.11.2 Financials

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Croda International PLC

12.12.1 Company Overview

12.12.2 Financials

12.12.3 Products/ Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

12.13 Clorox Company, Inc

12.13.1 Company Overview

12.13.2 Financials

12.13.3 Products/ Services Offered

12.13.4 SWOT Analysis

12.13.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Organic Chemicals Market was valued at USD 12.75 billion in 2023 and is expected to reach USD 24.25 billion by 2032, growing at a CAGR of 7.40% from 2024-2032.

The Narrow Range Ethoxylates Market size was valued at USD 5545 thousand in 2023. It is expected to grow to USD 10280.30 thousand by 2032 and grow at a CAGR of 7.10% over the forecast period of 2024-2032.

The Antifreeze Market size was valued at USD 5.5 Billion in 2023. It is expected to grow to USD 9.9 Billion by 2032 & grow at a CAGR of 6.9% over the forecast period of 2024-2032.

Hollow Fiber Membranes Market was valued at USD 2.46 billion in 2023 and is expected to reach USD 8.52 billion by 2032, at a CAGR of 14.85% from 2024-2032.

Photocatalytic Coatings Market was valued at USD 0.91 Billion in 2023 and is expected to reach USD 2.05 Billion by 2032, at a CAGR of 9.53% from 2024-2032.

The Aliphatic Hydrocarbon Market size was USD 3.95 billion in 2023 and is expected to reach USD 6.02 billion by 2032 and grow at a CAGR of 4.81% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone