Immersive Display in Entertainment Market Size & Overview:

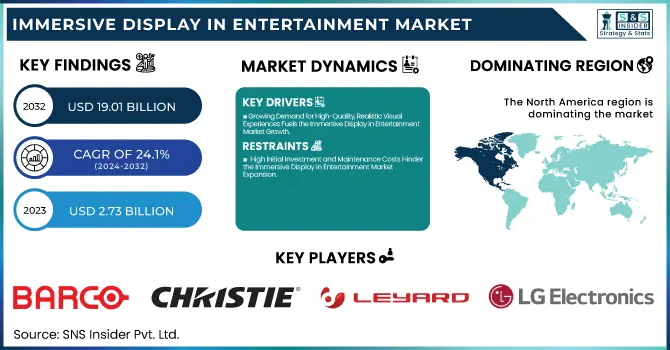

The Immersive Display in Entertainment Market Size was valued at USD 2.73 Billion in 2023 and is expected to reach USD 19.01 Billion by 2032 and grow at a CAGR of 24.1% over the forecast period 2024-2032. The Market is expanding rapidly due to the rising demand for high-quality visual experiences in cinemas, theme parks, and live events. Technologies like LED walls, OLED panels, projection mapping, and holographic displays are transforming audience engagement. Key players such as Barco, Christie Digital, Samsung, and Sony are innovating with 4K & 8K displays, AI-driven content, and interactive projections. The growing adoption of XR, AR, and VR in theme parks, exhibitions, and gaming is further driving growth. Advancements in microLED, OLED, and laser projection are making immersive experiences more accessible and cost-effective, fueling continued market expansion.

To Get more information on Immersive Display in Entertainment Market - Request Free Sample Report

Immersive Display in Entertainment Market Dynamics

Key Drivers:

-

Growing Demand for High-Quality, Realistic Visual Experiences Fuels the Immersive Display in Entertainment Market Growth

The increasing demand for high-quality, engaging visual experiences in cinemas, theme parks, live events, and exhibitions is a key driver of the immersive display in the entertainment market. Consumers seek realistic, multi-sensory experiences, pushing entertainment venues to adopt advanced LED walls, OLED panels, projection mapping, and holographic displays. The integration of 4K & 8K resolution, AI-driven content rendering, and interactive projection technologies has significantly enhanced audience engagement. Companies like Barco, Christie Digital, and Sony are investing in high-resolution, AI-powered immersive display solutions to cater to this growing demand.

Additionally, extended reality (XR), augmented reality (AR), and virtual reality (VR) are revolutionizing the industry, allowing entertainment providers to create highly interactive and lifelike experiences. As entertainment venues continue upgrading their display technologies to offer cinematic and immersive environments, the market is experiencing significant expansion, further driven by increasing consumer expectations for hyper-realistic visual content.

Restraint

-

High Initial Investment and Maintenance Costs Hinder the Immersive Display in Entertainment Market Expansion

The adoption of immersive display technologies in the entertainment industry is often hindered by the high initial investment and maintenance costs associated with advanced LED, OLED, and projection systems. Large-scale immersive setups require specialized hardware, software, and calibration, making them expensive for small and mid-sized entertainment businesses. Additionally, regular maintenance, content upgrades, and energy consumption further increase operational costs. Companies investing in microLED displays, laser projection, and AI-driven visual rendering must also allocate significant funds for customized installations, a skilled workforce, and continuous software updates.

While major players like Samsung, Panasonic, and LG Electronics are developing cost-efficient display solutions, the price barrier remains a challenge for widespread adoption. Moreover, upgrading older entertainment venues with state-of-the-art immersive displays requires substantial retrofitting, further adding to expenses. The high capital requirement often limits adoption to large cinema chains, theme parks, and major event organizers, slowing down market penetration.

Opportunity:

-

Rising Adoption of Extended Reality (XR) and AI-Driven Content Enhances Growth in the Immersive Display Market

The increasing adoption of Extended Reality (XR), Augmented Reality (AR), Virtual Reality (VR), and AI-driven content presents a major opportunity for the immersive display in the entertainment market. Entertainment providers are integrating XR-powered immersive displays to create highly interactive, lifelike experiences in theme parks, exhibitions, concerts, and gaming arenas. AI-driven real-time rendering and automated content enhancement are improving the efficiency of immersive displays, making them more engaging and cost-effective. Disguise Technologies and ROE Visual have launched AI-powered real-time rendering systems, enabling seamless virtual production in film studios and live events.

Additionally, the growing demand for immersive experiences in gaming, virtual concerts, and live sports broadcasts is accelerating the adoption of immersive display technologies. The expansion of cloud-based content delivery, 5G integration, and AI-enhanced display processing further enhances the market potential, enabling entertainment providers to offer next-generation immersive experiences to global audiences.

Challenge:

-

Content Creation and Compatibility Issues Limit the Widespread Adoption of Immersive Display Technologies

A major challenge in the immersive display in the entertainment market is the complexity of content creation and compatibility issues. Unlike traditional display solutions, immersive technologies require high-resolution, AI-optimized, and interactive content that must be specifically designed for LED walls, holographic displays, and projection mapping systems. The development of 4K, 8K, and real-time rendered content is resource-intensive and requires specialized software, hardware, and skilled professionals.

Additionally, ensuring compatibility between different immersive display systems remains a significant hurdle. Streaming platforms, virtual production studios, and content creators must adapt their workflows to support multiple display formats, refresh rates, and resolutions. Companies like Prysm Systems and Shenzhen INFiLED Electronics are working on standardized display solutions, but challenges in content optimization, latency, and seamless integration with AR/VR platforms persist. Without efficient content standardization, the adoption of immersive displays in widespread entertainment applications remains restricted.

Immersive Display in Entertainment Market Segments Analysis

By Technology

The LED segment led the immersive display in entertainment market with a 46% revenue share in 2023, driven by its superior brightness, energy efficiency, and scalability. LED walls, fine-pitch displays, and direct-view LED panels have become the preferred choice for theaters, concerts, theme parks, and live events, offering seamless, high-resolution visuals. Leyard’s fine-pitch LED displays have enhanced museum and exhibition setups, providing ultra-clear immersive experiences. The increasing adoption of XR, AI-enhanced content processing, and HDR-enabled LED panels is further accelerating market growth. With continued investments in microLED technology, the LED segment remains a dominant force in delivering high-quality, large-scale immersive entertainment experiences.

The OLED segment is projected to grow at the highest CAGR of 24.9% during the forecast period, driven by its superior contrast, flexibility, and true-to-life color accuracy. OLED displays are widely adopted in cinema halls, theme parks, and content creation studios due to their deep blacks, high dynamic range (HDR), and ultra-thin designs. LG's Transparent OLED Signage has revolutionized museum exhibitions and retail entertainment, offering interactive, see-through displays. Sony’s Crystal LED display system, based on OLED technology, has been widely used in virtual film production and high-end theaters. Panasonic’s OLED projection solutions have enhanced immersive experiences in exhibitions and entertainment venues. With the growing integration of OLED in XR applications, AI-powered content rendering, and foldable display technology.

By Resolution

The 4K resolution segment led the immersive display in the entertainment market in 2023, driven by its high visual clarity, superior color accuracy, and cost-effectiveness compared to higher resolutions. 4K displays have become the industry standard for cinemas, live concerts, theme parks, and virtual production studios, offering ultra-HD visuals that enhance audience engagement. Sony’s VPL-GTZ380 4K SXRD projector has gained popularity in theaters and large-scale entertainment venues due to its high brightness and immersive image quality. Barco introduced its 4K laser projectors for cinemas and museum exhibits, delivering sharper visuals with improved energy efficiency. Christie Digital expanded its 4K RGB pure laser projection lineup, providing high contrast and HDR support for theme parks and planetariums. As content creators and entertainment venues continue upgrading to 4K immersive displays, the segment remains dominant in shaping the future of high-definition, large-scale visual entertainment.

The 8K resolution segment is projected to grow at the highest CAGR during the forecast period, driven by its unmatched image sharpness, greater pixel density, and increasing adoption in next-generation immersive experiences. While 8K technology is still emerging, its demand is rising in premium cinemas, virtual reality (VR) applications, and high-end theme park attractions, where ultra-detailed visuals are essential for maximum engagement. Sharp launched its 120-inch 8K display panels, catering to exhibitions, esports arenas, and digital signage in entertainment venues. LG’s 8K OLED displays are being utilized in XR-based entertainment, live sports broadcasting, and virtual concert experiences. As content production in 8K increases, along with advancements in AI upscaling and high-speed data processing, the 8K segment is set to redefine ultra-immersive entertainment experiences.

By Application

The Theater & Cinema segment held the largest revenue share in 2023, driven by the widespread adoption of high-resolution projection systems, LED cinema screens, and laser-based immersive displays. As audiences demand ultra-realistic and engaging viewing experiences, 4K and 8K laser projection, HDR-enhanced visuals, and immersive sound integration have become industry standards. Leading companies such as Barco, Christie Digital, and Samsung have played a pivotal role in advancing immersive cinema technology. The rise of 3D, 5D, and interactive cinematic experiences further reinforces the segment’s dominance, as theaters invest in cutting-edge immersive display solutions to attract and retain audiences in the digital age.

The Content Creation Studios segment is projected to grow at the highest CAGR during the forecast period, driven by the rising demand for virtual production, extended reality (XR) environments, and high-resolution digital content creation. Film studios, gaming companies, and digital content producers are increasingly leveraging LED virtual production stages, AI-enhanced rendering, and volumetric capture technologies to create realistic and immersive visuals. ROE Visual’s high-pixel-density LED panels have powered major virtual production studios for creating lifelike environments in films, TV shows, and advertisements. As demand for virtual sets, real-time rendering, and immersive content production accelerates, the Content Creation Studios segment is set to redefine the entertainment landscape.

Immersive Display in Entertainment Market Regional Landscape

In 2023, North America dominated the immersive display in entertainment market, holding an estimated market share of over 42%. The region’s leadership is attributed to strong technological advancements, high consumer demand for premium entertainment experiences, and significant investments in immersive display technologies. The widespread adoption of 4K and 8K projection systems, LED cinema screens, and AR/VR-based entertainment solutions has fueled market expansion.

Additionally, the growth of virtual production techniques in Hollywood, combined with the increasing deployment of immersive dome theaters, interactive museum exhibits, and high-resolution LED displays in live concerts, has strengthened the region’s dominance. As consumer preferences shift toward highly engaging, real-time content, North America continues to lead in the adoption of cutting-edge immersive display technologies across various entertainment sectors.

The Asia-Pacific region is the fastest-growing market for immersive displays in entertainment, with an estimated CAGR of 25.8% during the forecast period. The region’s rapid growth is fueled by expanding entertainment infrastructure, increasing investments in high-tech amusement parks, and the rising popularity of digital entertainment experiences. The surge in e-sports tournaments, interactive museums, and AR/VR-based gaming arenas has further accelerated demand for high-resolution, large-format display solutions.

Additionally, government initiatives promoting smart city projects and digital entertainment hubs have boosted investments in advanced display technologies, including OLED, MicroLED, and holographic projection. As consumer preferences in Asia-Pacific shift toward personalized and interactive entertainment experiences, the region is poised to experience significant market expansion in immersive display applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Immersive Display in Entertainment Market are:

-

Barco N.V. (XDM-4K30 Projector, LED XT Series Video Walls)

-

Christie Digital Systems USA, Inc. (Christie MicroTiles LED, Christie Griffyn 4K50-RGB Projector)

-

Disguise Technologies Limited (Disguise vx 4+ Media Server, Disguise rx II Real-Time Render Engine)

-

Leyard (Leyard DirectLight Pro Series, Leyard CarbonLight LED Displays)

-

LG Electronics (LG MAGNIT MicroLED Display, LG UltraFine OLED Pro Monitor)

-

Panasonic Holdings Corporation (Panasonic PT-RQ50K 4K Laser Projector, Panasonic TH-55VF1H Video Wall)

-

Prysm Systems, Inc. (Prysm LPD 6K Display, Prysm Cloud Collaboration Platform)

-

ROE Visual (ROE Black Pearl BP2V2 LED Panels, ROE Vanish V8 Transparent LED)

-

Samsung Electronics Co., Ltd. (Samsung The Wall MicroLED, Samsung ONYX Cinema LED Screen)

-

Sharp Corporation (Sharp 8M-B120C 8K Display, Sharp PN-V701 Video Wall)

-

Shenzhen INFiLED Electronics Co., Ltd. (INFiLED DB Series LED Display, INFiLED AM Series for XR Studios)

-

Sony Corporation (Sony Crystal LED C-Series, Sony VPL-GTZ380 4K SXRD Projector)

Recent Trends

-

September 2024: Miraj Cinemas, a prominent Indian cinema chain, selected Barco as its preferred projection provider in collaboration with Qube, aiming to enhance the cinematic experience across its theaters.

-

November 2024: Christie Digital Systems' 4K10-HS laser projectors powered immersive visuals at a new 5D flying theatre in Hebei Province, China, delivering captivating experiences to audiences.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.73 Billion |

| Market Size by 2032 | USD 19.01 Billion |

| CAGR | CAGR of 24.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (LED, OLED, Others) • By Resolution (4K, 8K, Hybrid) • By Application (Theater & Cinema, Entertainment Venues, Museum & Exhibitions, Content Creation Studios, Theme Parks & Amusement Parks, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Barco N.V., Christie Digital Systems USA, Inc., Disguise Technologies Limited, Leyard, LG Electronics, Panasonic Holdings Corporation, Prysm Systems, Inc., ROE Visual, Samsung Electronics Co., Ltd., Sharp Corporation, Shenzhen INFiLED Electronics Co., Ltd., Sony Corporation. |