Image Sensor Market Report & Overview:

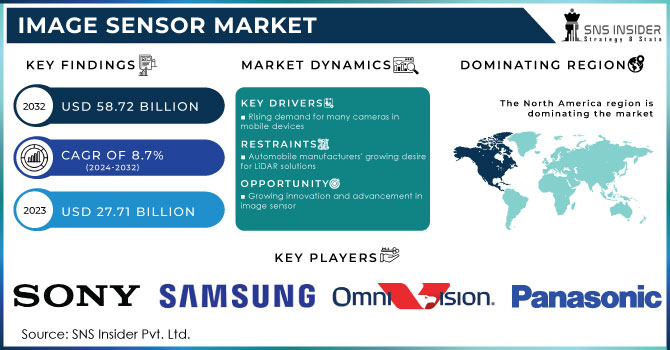

The Image Sensor Market size was valued at USD 25.12 billion in 2023 and is expected to grow to USD 50.77 billion by 2032 and grow at a CAGR of 8.13% over the forecast period of 2024-2032. CMOS technology advancements, the growing use of AI-enabled imaging systems, and the demand for high-resolution sensors in automotive, consumer electronics, healthcare, and security sectors stimulate the market growth. Moreover, innovations in stacked image sensors, 3D ToF technology, and higher quantum efficiency continue to drive growth in the market for advanced technology combined with superior imaging performance. It covers how the supply chain is changing with new investments in semiconductor fabrication, alliances between major players in the market, and a shift to fabless manufacturing models, which will help secure production capacity while keeping prices stable.

Get More Information on Image Sensor Market - Request Sample Report

Image Sensor Market Dynamics:

Drivers:

-

Revolutionizing Immersive Experiences: Image Sensors Fueling AR, VR, and the Metaverse

he growing use of augmented reality, virtual reality, and metaverse technology accelerates the growth of the image sensor market. With companies like Meta making big bets on AR and VR, the need for even higher-performance image sensors has never been greater. New developments like OmniVision’s release of the world’s smallest global shutter image sensor, designed for AR, VR, and mixed reality (MR), illustrate the industry’s drive toward improved image quality and real-time processing. Sony Semiconductor Solutions is also applying its state-of-the-art imaging technology to merge the real and the virtual. These advancements highlight the crucial importance of image sensors in driving growth in the market for next-generation immersive experiences.

Restraints:

-

Economic Barriers to Image Sensor Adoption in Emerging Markets

The high cost of advanced image sensors limits their adoption in emerging markets, especially in low- and middle-income countries (LMICs). Many consumers and industries find these technologies unaffordable, preventing their widespread use. Continuous glucose monitoring devices, which depend on advanced sensors, are out of reach for many patients due to their prohibitive costs. Similarly, sectors like industrial automation and security face challenges in deploying these sensors due to their high price. imec’s thin-film short-wave infrared image sensor with sub-2µm pixel pitch offers a more affordable alternative, but economic barriers and the need for further innovation remain obstacles.

Opportunities:

-

AI-Powered Image Sensors Unlocking Next-Gen Market Potential Across Industries

The inclusion of AI and ML with advanced driver-assistance systems (ADAS) and autonomous vehicles is disrupting the image sensor space. Equipped with 8.3MP resolution, high dynamic range, and flicker mitigation, Samsung’s ISOCELL auto sensors are helping make vehicles safer, with lane departure warnings, adaptive cruise control, and parking assistance. Matter of fact, outside of automotive applications AI-powered image sensors allow for real-time object recognition, and capabilities like low-light enhancement and predictive analytics, making them valuable for healthcare, security, and robotics.As industries rapidly adopt smart automation and AI-driven solutions, the demand for intelligent imaging technology is poised for exponential growth, making AI-powered image sensors a cornerstone of future innovation.

Challenges

-

Regulatory and Data Privacy Challenges in the Image Sensor Market

The image sensor market faces growing challenges due to strict data privacy regulations and compliance demands.With the increasing use of IoT devices such as image sensors, there are growing ethics, data privacy, threats, and security concerns. Companies must navigate various worldwide regulations including GDPR that require data minimization, explicit user consent, strong security, and respect for data subject rights. Handling large data volumes, securing devices with low processing resources, and dealing with complex data ecosystems are major challenges. Moreover, the rise of smart technologies in sectors like electric vehicles and smart cities amplifies data privacy risks, calling for comprehensive regulatory frameworks.

Image Sensor Market Segment Analysis:

By Type

The CMOS Image Sensors (CIS) segment dominated the image sensor market, of around 85% of the market share in 2023. Because CMOS sensors can offer distinct benefits, such as lower power consumption, higher integration, and potentially lower cost than alternative light-sensing devices such as the CCD. With the advent of increasingly demanding applications, such as smartphones, automotive cameras, security systems or industrial automation, CMOS sensors are becoming the preferred technology for their efficiency and scalability. Moreover, the growing investments in research and development for advancing CMOS technology, like increasing resolution and sensitivity, are supporting this trend as it is taking over the market in numerous application segments.

The CCD (Charge-Coupled Device) image sensor segment is expected to be the fastest- CCD (Charge-coupled device) image sensor segment. The demand for better image resolution led to the increased use of CCD sensors in high-end applications such as digital cameras, scientific imaging, and medical equipment thus fueling growth in this market. CCD sensors provide excellent light sensitivity and high compare image capture, which makes them ideal for working in situations where precision and detail matter. developments in charge-coupled device (CCD) technology continue to enhance sensor performance and lower power usage, which will continue to drive adoption in niche markets, especially those with high-resolution imaging needs.

By Processing Technology

The 3D image sensor segment dominated the image sensor market, capturing around 74% of the market share in 2023. This growth can be attributed to increasing demand for high-performance imaging solutions for applications such as augmented reality (AR), virtual reality (VR), autonomous vehicles, and robotics. This depth perception is vital in new-age technologies as 3D image sensors offer enhanced depth detection. Owing to advancements in 3D sensing technologies, in particular, time-of-flight (ToF) and structured light, led them to be widely adopted. The increasing need for precise, real-time data in complex environments is fueling the growth of the 3D image sensor market.

The 2D image sensor segment is expected to be the fastest-growing in the image sensor market during the forecast period from 2024 to 2032. That the 2D image sensor category would see the fastest growth in the global image sensor market and also propelled by the integration of 2D sensors into consumer devices such as smartphones, cameras and wearables. 2D sensors offer high resolution, fast processing speeds, and low power consumption, making them suitable for mass-market applications. Moreover, developments in 2D imaging technologies with advanced designs of pixels and better quality of image are also contributing for the growth of this segment. The continued demand for affordable, high-performance image capture in everyday devices is a key factor in the rapid expansion of the 2D image sensor market.

By Resolution

The "Above 16 MP" resolution segment dominated the image sensor market, accounting for around 39% of the market share in 2023. This segment's dominance by the growing requirement for high-resolution imaging in smartphones, digital cameras, and professional cameras. More megapixels lead to crisper, more detailed images — a must-have for media, entertainment, and security applications. With consumers and industries demanding better image quality, sensors with resolutions greater than 16 MP are becoming the standard across premium imager devices. Moreover, advancements in sensor technologies, such as improved light sensitivity and noise reduction, are making high-resolution sensors more accessible and desirable for a wide range of applications.

The "5 MP to 12 MP" resolution segment is the fastest-growing in the image sensor market over the forecast period 2024-2032. growing use of mid-range smartphones, security cameras, and automotive applications that prioritize image quality and cost efficiency with new computational technology demands. Sensors in this range can provide enough resolution for good imaging while still being affordable, making them suitable for consumers on a budget as well as industrial use. Furthermore, a rapid evolution in sensor technology, such as better low-light performance and AI-driven image processing, is increasing demand. The increasing use of these sensors in IoT devices and smart surveillance systems also contributes to their rapid market expansion.

By End Use

The consumer electronics segment dominated the image sensor market with a revenue share of around 40% in 2023, driven by the widespread adoption of smartphones, tablets, and digital cameras. The demand for high-resolution cameras, multi-sensor setups, and AI-powered imaging in smartphones has significantly contributed to this growth. Additionally, the integration of image sensors in wearables, smart home devices, and AR/VR applications has further fueled market expansion. Leading manufacturers are focusing on innovations such as compact sensor designs, improved low-light performance, and higher frame rates to enhance user experience. The increasing popularity of video content creation and social media engagement continues to drive advancements in this segment.

The healthcare & life sciences segment is the fastest-growing segment in the image sensor market over the forecast period 2024-2032, owing to the growth of medical imaging, diagnostics and minimally invasive procedures. The enhanced precision and efficiency of medical applications are being attributed to the increasing adoption of image sensors in endoscopy, robotic surgery, and digital pathology. CMOS and CCD sensors are enabling high-resolution X-ray imaging, ultrasound, and ophthalmology, changing how we care for our patients. Moreover, the growth is being further propelled by the popularity of wearables and AI-driven medical diagnostic tools. As telemedicine and remote diagnostics gain traction, the need for high-quality imaging solutions in healthcare continues to expand rapidly.

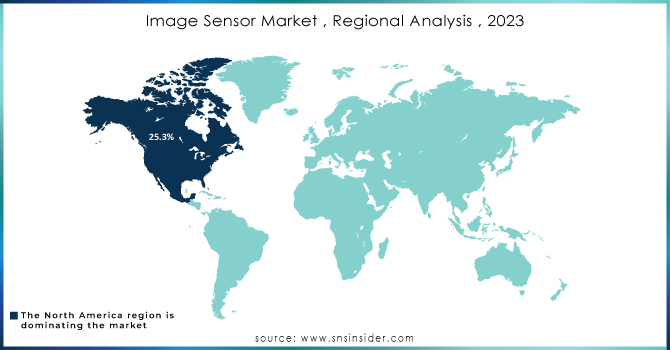

Image Sensor Market Regional Analysis:

The Asia-Pacific region dominated the image sensor market with a 46% revenue share in 2023, ueled by robust demand from consumer electronics, automotive, and industrial sectors. These are countries such as China, Japan, South Korea, and Taiwan, which are the main manufacturing centers of image sensors, given the active production of semiconductors and technological growth in the region. Market growth is driven by the swift growth of smartphones, security surveillance, and automotive safety systems. Moreover, government-backed AI, IoT, and smart city initiatives also contribute to the increasing need for advanced imaging solutions.With continuous investments in R&D and increasing adoption of high-resolution sensors, Asia-Pacific is expected to maintain its leadership position in the market.

North America is the fastest-growing region in the image sensor market over the forecast period 2024-2032, driven by advancements in autonomous vehicles, healthcare imaging, and security surveillance. Growing use of AI-enabled image processing across industries such as automotive, aerospace, and consumer electronics drives the demand. The region benefits from strong R&D investments from companies such as Sony, ON Semiconductor, and OmniVision, which are rapidly expanding their imaging technology portfolios.The increasing deployment of image sensors in applications, such as facial detection, augmented reality (AR), and industrial automation, further contributes to market growth. Regional growth is also aided by various government regulations that promote advanced driver-assistance systems (ADAS) and smart surveillance.

Need any customization research on Image Sensor Market - Enquiry Now

Image Sensor Market Key Players

Some of the major key players in Image Sensor Market along with their product:

-

ams OSRAM AG (Austria) (Image Sensors, Optical Components)

-

Canon Inc. (Japan) (CMOS Sensors, Imaging Solutions)

-

Continental AG (Germany) (Automotive Imaging Sensors, ADAS)

-

Denso Corp. (Japan) (Automotive Vision Systems, LiDAR)

-

GalaxyCore Shanghai Limited Corporation (China) (CMOS Image Sensors)

-

Gentex Corporation (USA) (Automotive Cameras, Smart Rearview Mirrors)

-

Hamamatsu Photonics K.K. (Japan) (Scientific & Industrial Image Sensors)

-

Himax Technologies, Inc. (Taiwan) (Display Imaging, AI Vision Sensors)

-

Infineon Technologies AG (Germany) (3D Time-of-Flight Sensors)

-

NXP Semiconductors (Netherlands) (Automotive & Industrial Imaging Sensors)

-

OMNIVISION (USA) (CMOS Image Sensors, AI Cameras)

-

STMicroelectronics N.V. (Switzerland) (CMOS Image Sensors, 3D Imaging Solutions)

-

SK HYNIX INC. (South Korea) (CMOS Sensors, Memory for Image Processing)

-

Panasonic Corporation (Japan) (CMOS Image Sensors, Industrial Cameras)

-

PixArt Imaging Inc. (Taiwan) (Optical Sensors, Gaming & Wearable Imaging)

-

Sony Group Corporation (Japan) (CMOS Sensors, Smartphone & Automotive Imaging)

-

ON Semiconductor Corporation (USA) (CMOS Image Sensors, ADAS Solutions)

-

Samsung Electronics Co. Ltd. (South Korea) (CMOS Image Sensors, Mobile & AI Imaging)

-

Teledyne Technologies (USA) (Scientific & Industrial Image Sensors)

-

PMD Technologies AG (Germany) (3D ToF Sensors, Depth Sensing Solutions)

-

Pixelplus (South Korea) (CMOS Image Sensors, Security & Automotive Imaging)

-

Sharp Corporation (Japan) (CMOS & CCD Image Sensors, Display Technology)

List of Suppliers in Image Sensor Market who provide raw material and component:

-

TSMC (Taiwan)

-

GlobalFoundries (USA)

-

UMC (Taiwan)

-

SMIC (China)

-

ASE Technology Holding Co., Ltd. (Taiwan)

-

Amkor Technology (USA)

-

Murata Manufacturing Co., Ltd. (Japan)

-

TDK Corporation (Japan)

-

Rohm Semiconductor (Japan)

-

Kyocera Corporation (Japan)

-

Shin-Etsu Chemical Co., Ltd. (Japan)

-

Sumco Corporation (Japan)

-

Soitec (France)

-

Dow Inc. (USA)

-

3M Company (USA)

-

BASF SE (Germany)

-

DuPont (USA)

-

Showa Denko K.K. (Japan)

-

Nichia Corporation (Japan)

-

Hitachi Metals, Ltd. (Japan)

Recent Development

-

November 19, 2024 – Sony Semiconductor Solutions announced IMX925 CMOS image sensor featuring global shutter technology and 394 fps high-speed processing for precise industrial inspection.

-

December 12, 2024 – The ams OSRAM and Valeo announced a partnership to integrate LEDs smart with the technology of image sensor, allowing the ambient lighting dynamic for the interactive interiors of the vehicle.

| Report Attributes | Details |

| Market Size in 2023 | USD 25.12 Billion |

| Market Size by 2032 | USD 50.77 Billion |

| CAGR | CAGR of 8.13 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (CCD Image Sensors, CMOS Image Sensors) • By Processing Technology (2D, 3D) • By Resolution (Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, Above 16 MP) • By End Use (Aerospace & Defense, Automotive, Consumer Electronics, Healthcare & Lifesciences, Industrial, Security & Surveillance, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ams OSRAM AG (Austria), Canon Inc. (Japan), Continental AG (Germany), Denso Corp. (Japan), GalaxyCore Shanghai Limited Corporation (China), Gentex Corporation (USA), Hamamatsu Photonics K.K. (Japan), Himax Technologies, Inc. (Taiwan), Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), OMNIVISION (USA), STMicroelectronics N.V. (Switzerland), SK HYNIX INC. (South Korea), Panasonic Corporation (Japan), PixArt Imaging Inc. (Taiwan), Sony Group Corporation (Japan), ON Semiconductor Corporation (USA), Samsung Electronics Co. Ltd. (South Korea), Teledyne Technologies (USA), PMD Technologies AG (Germany), Pixelplus (South Korea), Sharp Corporation (Japan). |