Ice Cream Packaging Market Report Scope & Overview:

Get More Information on Ice Cream Packaging Market - Request Sample Report

The Ice Cream Packaging Market Size was valued at USD 1.01 billion in 2023 and is projected to reach USD 1.46 billion by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

The growing popularity of ice cream around the world, fueled by exciting new flavors and varieties, is expected to drive demand for innovative packaging solutions. Industry experts predict the ice cream packaging market will expand significantly. This trend is further fueled by unique product launches like Amul's "Isabcool" ice cream in May 2022.

This innovative flavor, featuring cashew, figs, and the laxative Isabgol, reflects Amul's reputation for experimentation and caters to a specific health-conscious audience. Similar creative launches by leading ice cream and dairy brands are expected to keep the global ice cream packaging market churning.

As consumer preferences evolve rapidly, sustainability takes center stage. Manufacturers are scrambling to develop innovative packaging solutions that are both eye-catching and eco-friendly. This focus on meeting consumer needs and environmental concerns is expected to propel the global ice cream packaging market forward in the coming decade. With businesses seeking to enhance productivity and attract customer attention, this market surge is poised to be significant. Ice cream packaging offers a multitude of benefits, and its demand is steadily rising across both online and brick-and-mortar stores. Recognizing this trend, manufacturers are ramping up production capabilities to meet the growing need for innovative and functional packaging solutions. This ensures a steady supply to keep the ice cream industry thriving.

MARKET DYNAMICS

KEY DRIVERS:

Driving Demand Through Constant Industry Innovation

Ice cream makers are adding healthy ingredients to their products to make them more appealing as a healthy treat. This trend of functional foods with added benefits is expected to boost ice cream sales worldwide.

A surge in R&D spending is fueling a wave of digital transformation across industries.

RESTRAINTS:

Stringent government regulations on the types of materials allowed in ice cream packaging.

Governments around the world are implementing stricter regulations on the materials used in packaging, particularly regarding the use of certain chemicals and heavy metals. This can limit the options available to manufacturers and potentially increase costs to comply.

OPPORTUNITY:

Strong, flexible, and cold-resistant plastic packaging could be a key driver of future growth.

The ice cream market is poised for growth due to a surge in demand for plastic containers with lids. These containers offer the ideal combination of strength, flexibility, and resilience to cold temperatures, making them a perfect fit for storing and transporting ice cream.

The rise of eco-friendly ice cream packaging presents exciting opportunities for major players in the industry.

CHALLENGES:

Products with short shelf lives and high seasonality present unique challenges for businesses.

Ice cream's short shelf life due to spoilage and seasonal demand peaks in summer create a double whammy for the market. The high cost of maintaining proper storage adds another layer of challenge.

The absence of international uniformity in ice cream packaging regulations.

It creates challenges for manufacturers, as they need to adapt their packaging to meet the specific requirements of each region they operate in, hindering the streamlining of production processes.

IMPACT OF RUSSIA UKRAINE WAR

Russia might see a temporary boost in ice cream packaging due to production increases, the long-term outlook is uncertain due to sanctions. Ukraine, on the other hand, is likely to experience a decline in ice cream production and packaging demand due to the war's impact on its dairy industry. The ultimate impact depends on the duration and severity of the war. A prolonged conflict could significantly worsen the situation in Ukraine and potentially affect Russia's supply chain more severely. The effectiveness of sanctions and Russia's ability to find alternative suppliers will also play a role. The Russia-Ukraine war has a mixed impact on the ice cream packaging market. While there's a chance for short-term growth in Russia, the long-term outlook for both countries remains uncertain.

IMPACT OF ECONOMIC SLOWDOWN

The initial strong growth of 40% in the first half indicates a high demand for ice cream packaging. However, the slowdown led to a decrease in sales growth to 18-20% for the entire year. This directly translates to a reduced need for ice cream packaging. Economic downturns often lead companies to cut back on new product launches. In the ice cream industry, this could mean fewer unique ice cream flavors or portion sizes being introduced. These new products typically require new or modified packaging, so fewer launches lead to lower demand for innovative packaging solutions. As economic pressures tighten household budgets, consumers may cut back on non-essential purchases like ice cream. This puts pressure on ice cream manufacturers to reduce costs. One way they might achieve this is by opting for more basic or downsized packaging options.

KEY MARKET SEGMENTS

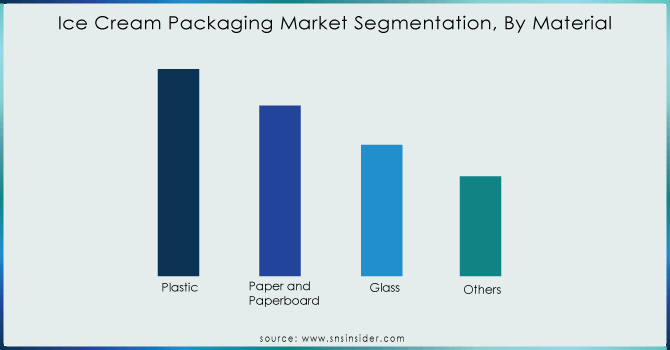

By Material

Plastic

Paper & Paperboard

Glass

Others

Plastic dominates in ice cream packaging, holding a 59% market share. Its strength, flexibility, and ability to handle cold temperatures are expected to drive further growth, creating a potential opportunity of US$209.9 million.

Get More Information on Ice Cream Packaging Market - Enquiry Now

By Packaging Type

Cup

Tub

Stick Pack

Folding Carton

Others

Ice cream cups are expected to be the most popular type of packaging in the world. The market for ice cream cups is expected to grow significantly by 2033. This is likely because people find ice cream cups to be convenient and easy to use.

By Sales Channel

Online

Offline

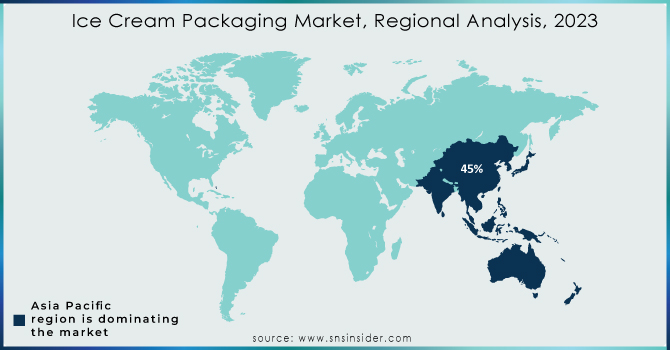

REGIONAL ANALYSIS

Asia Pacific dominated the ice cream packaging industry with market share of 45%. This dominance is attributed to rising living standards and surging ice cream consumption in China, India, Japan, and ASEAN countries. For example, China's ice cream packaging market witnessed a significant 14% growth in retail sales in 2022. Forecasts predict continued growth for the ice cream shop market in this region.

Asia Pacific is followed by North America and Europe in market share.The Ice Cream Alliance reports a strong rebound for ice cream packaging in the United States. This includes a rise in plastic packaging production. Additionally, the booming ice cream market suggests a continued demand for innovative packaging solutions in the coming years. Unique packaging is emerging from US startup ice cream stores, with a focus on meeting strict environmental regulations. A prime example is Sacred Serve, a Chicago-based producer known for their plant-based gelato. In August 2021, they debuted a new ice cream carton design made entirely from eco-friendly materials, 100% virgin, food-safe paperboard with a water-based, food-safe coating.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key players

Some of the major players in the Ice Cream Packaging Market are Amcor Plc, ITC Packaging, Huhtamaki Oyj, International Paper Company, Tetra Laval, Berry Global Group, Frapak Packaging b.v., Insta Polypack, Sonoco Products Company, INDEVCO GROUP, Stora Enso Oyj, Sirane Limited., Stanpac Inc. and Others Players.

RECENT DEVELOPMENTS

In January 2024, Tetra Laval unveiled a novel ice cream carton that caters to on-the-go consumers. The innovative design incorporates a built-in spoon, enhancing convenience and portability.

Eco-Products joins the sustainable scoop movement in December 2023 with plant-based, compostable ice cream cones.

Ben & Jerry's teams up with Amcor in November 2023 to create a recyclable ice cream tub made from recycled materials.

In October 2023, Huhtamaki targets eco-conscious ice cream makers with a new printable, moisture-resistant paper tub.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.01 Bn |

| Market Size by 2032 | US$ 1.46 Bn |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper & Paperboard, Glass, Others) • By Packaging Type (Cup,Tub, Stick Pack, Folding Carton, Others) • By Sales Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Plc, ITC Packaging, Huhtamaki Oyj, International Paper Company, Tetra Laval, Berry Global Group, Frapak Packaging b.v., Insta Polypack, Sonoco Products Company, INDEVCO GROUP, Stora Enso Oyj, Sirane Limited., Stanpac Inc |

| Key Drivers | • Driving Demand Through Constant Industry Innovation • A surge in R&D spending is fueling a wave of digital transformation across industries. |

| Key Restraints | • Stringent government regulations on the types of materials allowed in ice cream packaging. |

Ans: The Ice Cream Packaging Market is expected to grow at a CAGR of 4.2%.

Ans: Ice Cream Packaging Market size was USD 1.01 billion in 2023 and is expected to Reach USD 1.46 billion by 2032.

Ans: Driving Demand Through Constant Industry Innovation

Ans: Stringent government regulations on the types of materials allowed in ice cream packaging.

Ans: Asia Pacific holds the dominant position with market share of 45% .

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Ice Cream Packaging Market Segmentation, By Material

9.1 Introduction

9.2 Trend Analysis

9.3 Plastic

9.4 Paper & Paperboard

9.5 Glass

9.6 Others

10. Ice Cream Packaging Market Segmentation, By Packaging Type

10.1 Introduction

10.2 Trend Analysis

10.3Cup

10.4 Tub

10.5 Stick Pack

10.6 Folding Carton

10.7 Others

11. Ice Cream Packaging Market Segmentation, By Sales Channel

11.1 Introduction

11.2 Trend Analysis

11.3 Online

11.4 Offline

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Ice Cream Packaging Market by Country

12.2.3 North America Ice Cream Packaging Market By Material

12.2.4 North America Ice Cream Packaging Market By Packaging Type

12.2.5 North America Ice Cream Packaging Market By Sales Channel

12.2.6 USA

12.2.6.1 USA Ice Cream Packaging Market By Material

12.2.6.2 USA Ice Cream Packaging Market By Packaging Type

12.2.6.3 USA Ice Cream Packaging Market By Sales Channel

12.2.7 Canada

12.2.7.1 Canada Ice Cream Packaging Market By Material

12.2.7.2 Canada Ice Cream Packaging Market By Packaging Type

12.2.7.3 Canada Ice Cream Packaging Market By Sales Channel

12.2.8 Mexico

12.2.8.1 Mexico Ice Cream Packaging Market By Material

12.2.8.2 Mexico Ice Cream Packaging Market By Packaging Type

12.2.8.3 Mexico Ice Cream Packaging Market By Sales Channel

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Ice Cream Packaging Market by Country

12.3.2.2 Eastern Europe Ice Cream Packaging Market By Material

12.3.2.3 Eastern Europe Ice Cream Packaging Market By Packaging Type

12.3.2.4 Eastern Europe Ice Cream Packaging Market By Sales Channel

12.3.2.5 Poland

12.3.2.5.1 Poland Ice Cream Packaging Market By Material

12.3.2.5.2 Poland Ice Cream Packaging Market By Packaging Type

12.3.2.5.3 Poland Ice Cream Packaging Market By Sales Channel

12.3.2.6 Romania

12.3.2.6.1 Romania Ice Cream Packaging Market By Material

12.3.2.6.2 Romania Ice Cream Packaging Market By Packaging Type

12.3.2.6.4 Romania Ice Cream Packaging Market By Sales Channel

12.3.2.7 Hungary

12.3.2.7.1 Hungary Ice Cream Packaging Market By Material

12.3.2.7.2 Hungary Ice Cream Packaging Market By Packaging Type

12.3.2.7.3 Hungary Ice Cream Packaging Market By Sales Channel

12.3.2.8 Turkey

12.3.2.8.1 Turkey Ice Cream Packaging Market By Material

12.3.2.8.2 Turkey Ice Cream Packaging Market By Packaging Type

12.3.2.8.3 Turkey Ice Cream Packaging Market By Sales Channel

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Ice Cream Packaging Market By Material

12.3.2.9.2 Rest of Eastern Europe Ice Cream Packaging Market By Packaging Type

12.3.2.9.3 Rest of Eastern Europe Ice Cream Packaging Market By Sales Channel

12.3.3 Western Europe

12.3.3.1 Western Europe Ice Cream Packaging Market by Country

12.3.3.2 Western Europe Ice Cream Packaging Market By Material

12.3.3.3 Western Europe Ice Cream Packaging Market By Packaging Type

12.3.3.4 Western Europe Ice Cream Packaging Market By Sales Channel

12.3.3.5 Germany

12.3.3.5.1 Germany Ice Cream Packaging Market By Material

12.3.3.5.2 Germany Ice Cream Packaging Market By Packaging Type

12.3.3.5.3 Germany Ice Cream Packaging Market By Sales Channel

12.3.3.6 France

12.3.3.6.1 France Ice Cream Packaging Market By Material

12.3.3.6.2 France Ice Cream Packaging Market By Packaging Type

12.3.3.6.3 France Ice Cream Packaging Market By Sales Channel

12.3.3.7 UK

12.3.3.7.1 UK Ice Cream Packaging Market By Material

12.3.3.7.2 UK Ice Cream Packaging Market By Packaging Type

12.3.3.7.3 UK Ice Cream Packaging Market By Sales Channel

12.3.3.8 Italy

12.3.3.8.1 Italy Ice Cream Packaging Market By Material

12.3.3.8.2 Italy Ice Cream Packaging Market By Packaging Type

12.3.3.8.3 Italy Ice Cream Packaging Market By Sales Channel

12.3.3.9 Spain

12.3.3.9.1 Spain Ice Cream Packaging Market By Material

12.3.3.9.2 Spain Ice Cream Packaging Market By Packaging Type

12.3.3.9.3 Spain Ice Cream Packaging Market By Sales Channel

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Ice Cream Packaging Market By Material

12.3.3.10.2 Netherlands Ice Cream Packaging Market By Packaging Type

12.3.3.10.3 Netherlands Ice Cream Packaging Market By Sales Channel

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Ice Cream Packaging Market By Material

12.3.3.11.2 Switzerland Ice Cream Packaging Market By Packaging Type

12.3.3.11.3 Switzerland Ice Cream Packaging Market By Sales Channel

12.3.3.1.12 Austria

12.3.3.12.1 Austria Ice Cream Packaging Market By Material

12.3.3.12.2 Austria Ice Cream Packaging Market By Packaging Type

12.3.3.12.3 Austria Ice Cream Packaging Market By Sales Channel

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Ice Cream Packaging Market By Material

12.3.3.13.2 Rest of Western Europe Ice Cream Packaging Market By Packaging Type

12.3.3.13.3 Rest of Western Europe Ice Cream Packaging Market By Sales Channel

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Ice Cream Packaging Market by Country

12.4.3 Asia-Pacific Ice Cream Packaging Market By Material

12.4.4 Asia-Pacific Ice Cream Packaging Market By Packaging Type

12.4.5 Asia-Pacific Ice Cream Packaging Market By Sales Channel

12.4.6 China

12.4.6.1 China Ice Cream Packaging Market By Material

12.4.6.2 China Ice Cream Packaging Market By Packaging Type

12.4.6.3 China Ice Cream Packaging Market By Sales Channel

12.4.7 India

12.4.7.1 India Ice Cream Packaging Market By Material

12.4.7.2 India Ice Cream Packaging Market By Packaging Type

12.4.7.3 India Ice Cream Packaging Market By Sales Channel

12.4.8 Japan

12.4.8.1 Japan Ice Cream Packaging Market By Material

12.4.8.2 Japan Ice Cream Packaging Market By Packaging Type

12.4.8.3 Japan Ice Cream Packaging Market By Sales Channel

12.4.9 South Korea

12.4.9.1 South Korea Ice Cream Packaging Market By Material

12.4.9.2 South Korea Ice Cream Packaging Market By Packaging Type

12.4.9.3 South Korea Ice Cream Packaging Market By Sales Channel

12.4.10 Vietnam

12.4.10.1 Vietnam Ice Cream Packaging Market By Material

12.4.10.2 Vietnam Ice Cream Packaging Market By Packaging Type

12.4.10.3 Vietnam Ice Cream Packaging Market By Sales Channel

12.4.11 Singapore

12.4.11.1 Singapore Ice Cream Packaging Market By Material

12.4.11.2 Singapore Ice Cream Packaging Market By Packaging Type

12.4.11.3 Singapore Ice Cream Packaging Market By Sales Channel

12.4.12 Australia

12.4.12.1 Australia Ice Cream Packaging Market By Material

12.4.12.2 Australia Ice Cream Packaging Market By Packaging Type

12.4.12.3 Australia Ice Cream Packaging Market By Sales Channel

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Ice Cream Packaging Market By Material

12.4.13.2 Rest of Asia-Pacific Ice Cream Packaging Market By Packaging Type

12.4.13.3 Rest of Asia-Pacific Ice Cream Packaging Market By Sales Channel

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Ice Cream Packaging Market by Country

12.5.2.2 Middle East Ice Cream Packaging Market By Material

12.5.2.3 Middle East Ice Cream Packaging Market By Packaging Type

12.5.2.4 Middle East Ice Cream Packaging Market By Sales Channel

12.5.2.5 UAE

12.5.2.5.1 UAE Ice Cream Packaging Market By Material

12.5.2.5.2 UAE Ice Cream Packaging Market By Packaging Type

12.5.2.5.3 UAE Ice Cream Packaging Market By Sales Channel

12.5.2.6 Egypt

12.5.2.6.1 Egypt Ice Cream Packaging Market By Material

12.5.2.6.2 Egypt Ice Cream Packaging Market By Packaging Type

12.5.2.6.3 Egypt Ice Cream Packaging Market By Sales Channel

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Ice Cream Packaging Market By Material

12.5.2.7.2 Saudi Arabia Ice Cream Packaging Market By Packaging Type

12.5.2.7.3 Saudi Arabia Ice Cream Packaging Market By Sales Channel

12.5.2.8 Qatar

12.5.2.8.1 Qatar Ice Cream Packaging Market By Material

12.5.2.8.2 Qatar Ice Cream Packaging Market By Packaging Type

12.5.2.8.3 Qatar Ice Cream Packaging Market By Sales Channel

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Ice Cream Packaging Market By Material

12.5.2.9.2 Rest of Middle East Ice Cream Packaging Market By Packaging Type

12.5.2.9.3 Rest of Middle East Ice Cream Packaging Market By Sales Channel

12.5.3 Africa

12.5.3.1 Africa Ice Cream Packaging Market by Country

12.5.3.2 Africa Ice Cream Packaging Market By Material

12.5.3.3 Africa Ice Cream Packaging Market By Packaging Type

12.5.3.4 Africa Ice Cream Packaging Market By Sales Channel

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Ice Cream Packaging Market By Material

12.5.3.5.2 Nigeria Ice Cream Packaging Market By Packaging Type

12.5.3.5.3 Nigeria Ice Cream Packaging Market By Sales Channel

12.5.3.6 South Africa

12.5.3.6.1 South Africa Ice Cream Packaging Market By Material

12.5.3.6.2 South Africa Ice Cream Packaging Market By Packaging Type

12.5.3.6.3 South Africa Ice Cream Packaging Market By Sales Channel

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Ice Cream Packaging Market By Material

12.5.3.7.2 Rest of Africa Ice Cream Packaging Market By Packaging Type

12.5.3.7.3 Rest of Africa Ice Cream Packaging Market By Sales Channel

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Ice Cream Packaging Market by country

12.6.3 Latin America Ice Cream Packaging Market By Material

12.6.4 Latin America Ice Cream Packaging Market By Packaging Type

12.6.5 Latin America Ice Cream Packaging Market By Sales Channel

12.6.6 Brazil

12.6.6.1 Brazil Ice Cream Packaging Market By Material

12.6.6.2 Brazil Ice Cream Packaging Market By Packaging Type

12.6.6.3 Brazil Ice Cream Packaging Market By Sales Channel

12.6.7 Argentina

12.6.7.1 Argentina Ice Cream Packaging Market By Material

12.6.7.2 Argentina Ice Cream Packaging Market By Packaging Type

12.6.7.3 Argentina Ice Cream Packaging Market By Sales Channel

12.6.8 Colombia

12.6.8.1 Colombia Ice Cream Packaging Market By Material

12.6.8.2 Colombia Ice Cream Packaging Market By Packaging Type

12.6.8.3 Colombia Ice Cream Packaging Market By Sales Channel

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Ice Cream Packaging Market By Material

12.6.9.2 Rest of Latin America Ice Cream Packaging Market By Packaging Type

12.6.9.3 Rest of Latin America Ice Cream Packaging Market By Sales Channel

13. Company Profiles

13.1 Amcor Plc

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 ITC Packaging

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Huhtamaki Oyj

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 International Paper Company

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Tetra Laval

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Berry Global Group

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Frapak Packaging b.v.

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Insta Polypack

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Sonoco Products Company

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 INDEVCO GROUP

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Stora Enso Oyj

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Sirane Limited.

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 Stanpac Inc.

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Stick Packaging Market Size was valued at USD 909.805 million in 2023 and will reach $1378.80 million by 2032 and grow at a CAGR of 4.75% by 2024-2032.

The Freight Transport Market size was USD 35.61 billion in 2023 and is expected to Reach USD 96.4 billion by 2032 and grow at a CAGR of 11.7 % over the forecast period of 2024-2032.

The Transportation Management Systems (TMS) Market Size was valued at USD 13.5 billion in 2023 and is expected to reach USD 49.04 billion by 2031 and grow at a CAGR of 17.5% over the forecast period 2024-2031.

The Transit Packaging Market size was USD 78.06 billion in 2023 and is expected to Reach USD 213.45 billion by 2031 and grow at a CAGR of 13.4 % over the forecast period of 2024-2031.

Sugarcane Fiber Packaging Market Size, Share, and Industry Analysis by Type (Tableware, Food Packaging), By Application (Fresh Food, Dry and Frozen Food), By Region and Global Forecast, (2024-2032).

The Conical Top Bulk Bag Market was valued at USD 206.92 Billion in 2023 and expected to reach USD 376.51 Billion by 2031 and grow at a CAGR of 7.77% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone