To get more information on Hyperspectral Imaging Systems Market - Request Free Sample Report

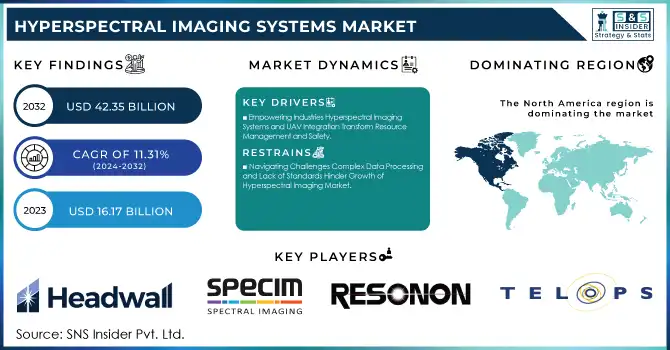

The Hyperspectral Imaging Systems Market Size was valued at USD 16.17 Billion in 2023 and is expected to reach USD 42.35 Billion by 2032 and grow at a CAGR of 11.31% over the forecast period 2024-2032.

The Hyperspectral Imaging Systems Market is experiencing significant growth due to its diverse applications across agriculture, environmental monitoring, healthcare, and defense. In agriculture, hyperspectral imaging enables precision farming by monitoring crop health, detecting diseases early, and optimizing yields with critical insights into plant physiology, supporting global food security and efficient resource use. Environmental monitoring benefits from its ability to detect pollution, assess water quality, and track climate change impacts through detailed spectral analysis. Healthcare applications are advancing diagnostics, particularly in oncology and dermatology, by facilitating early-stage disease detection at the molecular level. Defense and security sectors leverage hyperspectral imaging for enhanced surveillance, target detection, and threat assessment, with reported increases in accuracy and efficiency.

In 2023, notable advancements included a 95% success rate in detecting crop diseases, a 15% improvement in agricultural yields through early water stress detection, and NASA’s use of hyperspectral imaging to monitor harmful algal blooms across 50 U.S. sites. The technology also achieved high diagnostic accuracy in melanoma (85%) and prostate cancer (90% sensitivity and 85% specificity). Integration with artificial intelligence has further enhanced the technology's capabilities, enabling real-time analysis and reducing image processing time to minutes. These developments are driving the widespread adoption of hyperspectral imaging systems across industries, underscoring their critical role in delivering precise and actionable insights.

KEY DRIVERS:

Revolutionizing Industries Hyperspectral Imaging Systems Drive Precision Efficiency and Cost Savings Across Applications

HIS advances have made HIS compact, efficient, and much more versatile by allowing compact hyperspectral sensor systems with a variety of applications to be designed and delivered. With modern hyperspectral sensors that can acquire higher resolution and sensitivity, one can gain highly detailed spectral analysis over broader applications. Improvements in sensor designs made HIS units smaller and lighter. As such, they opened wider doors for usage scenarios. Presently, hyperspectral imaging now plays an increased role in industrial inspection, food safety, and pharmaceutical applications wherein an item's precise analysis with regard to its composition presents an important step. Additionally, it cuts the cost for an operation, and thereby such advantages enhance the chance of applying HIS in the field settings rather than inhibiting its usage within the confines of a laboratory. Hyperspectral imaging systems achieved resolutions of 2.5 nanometers in 2023 and showed above 95% accuracy for the detection of pesticide residues on food safety. Compact HIS were reported to cut inspection time and costs by 40% for industrial quality control applications. HIS was applied to pharmaceuticals with 98% precision in detecting active ingredients in tablets and can be applied to real-world settings rather than a laboratory.

Empowering Industries Hyperspectral Imaging Systems and UAV Integration Transform Resource Management and Safety

Integration of HIS with UAVs has further spurred expansion in the market because hyperspectral imaging systems mounted on drones simplify scanning huge areas, some of which would otherwise stay inaccessible or be too tedious and time-consuming to handle quickly and effectively. Change in sectors like forestry, mining, and oil and gas is being caused by its application as integration allows for immediate high-resolution images to follow resources, evaluate the kind of land composition, detect leaks, or dangers posed without risking human life. For example, in mining, HIS-outfitted drones can discern mineral compositions from the air without needing to conduct costly and invasive ground surveys. UAVs provide reduced costs, increased safety, and expanded scope, making HIS more accessible for field applications and increasing its value and adoption across industries. It is critically and primarily a mover in transforming the HIS landscape due to the convergence of innovation on sensors and UAV integration. The new avenues are further expanded in terms of application into remote and high-precision environments. In 2023, HIS-equipped UAVs scanned up to 100 square kilometers in less than an hour. In mining, the number of ground surveys reduced by more than 60%, and mineral compositions were identified. In oil and gas, the accuracy of leak detection rose to 95%, ensuring safety and reducing operational costs by 30%. The integration expanded HIS applications to inaccessible areas and high-precision environments.

RESTRAIN:

Navigating Challenges Complex Data Processing and Lack of Standards Hinder Growth of Hyperspectral Imaging Market

HIS creates massive amounts of spectral data, hence requiring complex algorithms and advanced computing capability to process them effectively. This demand for high-complexity capabilities of data processing becomes a problem in itself, particularly in real-time applications. Most end-users do not cope with the complexity and demands of controlling gigantic datasets because they lack the proper technical knowledge or infrastructure; hence, it lowers the access of technology. Another major problem has been that there exists no standard for hyperspectral imaging technologies and protocols. Differences in the sensor design, data formats, and methods of calibration constitute some areas where different manufacturers have designed their sensors; leading to a problem of interoperability, especially where it proves difficult to compare and amalgamate the data. This would hinder group efforts and probably slow up the overall industrial adoption process of HIS across industries. This sustainable development of the HIS market hence requires dealing with these problems by producing user-friendly and interoperable systems, as well as refining methods of processing data.

BY PRODUCT

Cameras dominated the HIS market with a largest share of 72% in 2023. The same is likely to gain the fastest growth in terms of CAGR between 2023 and 2032. This is quite simple - flexibility in cameras with ease of integration from agricultural to environmental monitoring applications, and most importantly, in the health care and defense domains. High-resolution spectral imaging over the range of wavelengths is thus achieved with cameras, specifically hyperspectral cameras, and can therefore be used to provide exact data in real-time conditions. The higher this technology is, the more compact, affordable, and available it is with compatibility towards existing systems. As with UAVs and other similar platforms, it's now more useful in harder and remote areas where getting real data is critical. And an increasing need for the most accurate spectral data through industrial applications confirms the role that the camera plays at the heart of HIS; because of this, this equipment will enjoy a larger percentage of the market as its growth will be even stronger in the following years.

BY TECHNOLOGY

Snapshot hyperspectral imaging technology has the largest share in HIS in 2023 with 48% market share and is expected to be the fastest-growing during the period between 2023 and 2032. The leading market position of snapshot technology can be explained by its capability of instantly capturing full-spectrum data, which helps provide immediate insights for applications that depend on real-time insights. Snapshot imaging captures spectral images in their entirety while at once, unlike other methods like line scanning, in which data is taken consecutively. This technology would thus be indispensable in various applications that require rapid analysis of a sample. This rapid acquisition capability has positioned snapshot technology at the top of various application fields, including remote sensing, agriculture, and medical diagnostics, where the first element of efficiency is a critical time. Furthermore, with the inventions occurring in the field of snapshot sensors, they have seemed compact and easy integration, increasing their adoption across diverse applications and supporting sustainable growth in the HIS market.

BY TECHNOLOGY

In the HIS market, military surveillance accounted for the highest market share in 2023 with 33%. That is evidence of its strong role in defense and security applications, increasing situational awareness through accurate target detection, object identification, and terrain mapping. HSI captures detailed spectral information that would help identify differences between various objects in relation to the unique signature that each carries, so this is why it proves extremely valuable to military intelligence and tactical operations. Capabilities of doing remote sensing across large regions have thereby cemented its position in defense surveillance and ensured the high market share for HIS.

The medical diagnostics segment is expected to register the fastest growth rate over the forecast period from 2024-2032. The adoption of this technology in the healthcare sector finds a thrust in its applicability toward non-invasive tissue analysis, early-stage disease diagnosis, and providing surgical guidance. Hyperspectral imaging can detect changes at the cellular level biochemical, allowing for earlier diagnostics, primarily in oncology and dermatology, supporting the demand for the system as an excellent diagnostic modality.

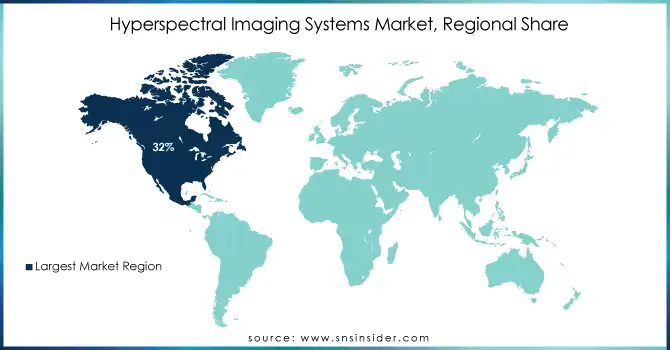

In 2023, North America captured 32% of the HIS market due to the widespread adoption of advanced technology and high investment in defense and healthcare sectors. For example, the U.S. military uses HIS for critical surveillance and reconnaissance missions where hyperspectral technology helps identify hidden threats and recognize materials based on their spectral characteristics. HIS is being adopted by North American healthcare facilities to detect diseases at the early stages and to improve surgical precision. The use of hyperspectral imaging in research projects that aim at detecting cancer in clinical trials is gaining popularity in North America. Such strong applications prove the firm foundation of North America in the HIS market.

Asia Pacific is projected to grow with the fastest cagr from 2024 and 2032. This is due to increased investment in agriculture and environmental monitoring. China and India are prime countries, where HIS is utilized in crop health monitoring to enhance yield. In addition, the Asia Pacific healthcare infrastructure is being expanded and adopting HIS for medical diagnostics, just like in the pilot projects conducted in Japan, where HIS is being explored for early-stage cancer diagnosis. Such real-world applications demonstrate how hyperspectral imaging is becoming an increasingly important tool for the region's critical sectors, supporting its expected rapid growth in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Hyperspectral Imaging Systems Market are:

Headwall Photonics (Hyperspec VNIR, Hyperspec SWIR)

Specim, Spectral Imaging Ltd. (Specim IQ, FX Series)

Resonon Inc. (Pika L, Pika XC2)

Corning Incorporated (MicroHSI 410 SHD, Hyperspec Explorer)

Telops Inc. (Hyper-Cam LW, Hyper-Cam MWE)

Norsk Elektro Optikk AS (HySpex VNIR-1800, HySpex SWIR-384)

Bayspec Inc. (OCI-F Hyperspectral Imager, Snapscan Hyperspectral Camera)

ChemImage Corporation (VivoSight OCT, HSI Examiner)

Applied Spectral Imaging (HiBand, HiSpectra)

XIMEA (xiSpec2, xiSpec)

Photon etc. (IR V-EOS, ZEPHIR Camera)

Surface Optics Corporation (SOC710-VP, SOC710-HS)

IMEC (SnapScan, On-Chip Filter)

Corescan (Core Imager, HighEye 4K)

Brimrose Corporation of America (HSC Imaging System, Lumos Hyperspectral Camera)

Cubert GmbH (FireflEYE, ULTRIS 20)

BaySpec Inc. (OCI-F, OCI-U Hyperspectral Cameras)

Telops (Hyper-Cam NB, Hyper-Cam LW)

Spectral Evolution (PSR+ Series, SR-6500)

GeoCue Group Inc. (True View, LIDAR Mapping Sensors)

Some of the Raw Material Suppliers

Dow Chemical Company

Corning Incorporated (for optical components)

Schott AG

Edmund Optics

Newport Corporation

Thorlabs Inc.

Hoya Corporation

Shin-Etsu Chemical Co., Ltd.

Heraeus Group

II-VI Incorporated

In June 2024, Specim introduced a new F4 macro lens for its FX10 hyperspectral camera, enabling enhanced focus on small objects and capturing detailed images in the visible and near-infrared spectrum.

In March 2024, UCLA researchers, led by Professors Mona Jarrahi and Aydogan Ozcan, have developed the first focal plane array for real-time, 3D multispectral terahertz (THz) video, achieving high-quality imaging with an impressive signal-to-noise ratio (SNR).

In June 2024, Metaspectral announced a partnership with Armada to integrate its spectral analysis computer vision technology into Armada's Edge AI Marketplace, enhancing edge computing solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.17 Billion |

| Market Size by 2032 | USD 42.35 Billion |

| CAGR | CAGR of 11.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Camera, Accessories) • by Technology (Snapshot, Push Broom, Others) • by Application (Military Surveillance, Remote Sensing, Medical Diagnostics, Machine Vision & Optical Sorting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Headwall Photonics, Specim, Spectral Imaging Ltd., Resonon Inc., Corning Incorporated, Telops Inc., Norsk Elektro Optikk AS, Bayspec Inc., ChemImage Corporation, Applied Spectral Imaging, XIMEA, Photon etc., Surface Optics Corporation, IMEC, Corescan, Brimrose Corporation of America, Cubert GmbH, BaySpec Inc., Telops, Spectral Evolution, GeoCue Group Inc. |

| Key Drivers | • Revolutionizing Industries Hyperspectral Imaging Systems Drive Precision Efficiency and Cost Savings Across Applications • Empowering Industries Hyperspectral Imaging Systems and UAV Integration Transform Resource Management and Safety |

| Restraints | • Navigating Challenges Complex Data Processing and Lack of Standards Hinder Growth of Hyperspectral Imaging Market |

Ans: The Hyperspectral Imaging Systems Market is expected to grow at a CAGR of 11.31% during 2024-2032.

Ans: Hyperspectral Imaging Systems Market size was USD 16.17 billion in 2023 and is expected to Reach USD 42.35 billion by 2032.

Ans: The major growth factor of the Hyperspectral Imaging Systems Market is the increasing demand for precise and detailed spectral data across various industries, including agriculture, healthcare, and defense.

Ans: The Snapshot segment dominated the Hyperspectral Imaging Systems Market in 2023.

Ans: North America dominated the Hyperspectral Imaging Systems Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Hyperspectral Imaging Systems Pricing Trends (2023)

5.2 Hyperspectral Imaging Systems Innovation Rate (2023)

5.3 Hyperspectral Imaging Systems Technology Adoption by Region (2023)

5.4 Hyperspectral Imaging Systems Sensor Performance Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hyperspectral Imaging Systems Market Segmentation, by Product

7.1 Chapter Overview

7.2 Camera

7.2.1 Camera Market Trends Analysis (2020-2032)

7.2.2 Camera Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Accessories

7.3.1 Accessories Market Trends Analysis (2020-2032)

7.3.2 Accessories Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Hyperspectral Imaging Systems Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Snapshot

8.2.1 Snapshot Market Trends Analysis (2020-2032)

8.2.2 Snapshot Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Push Broom

8.3.1 Push Broom Market Trends Analysis (2020-2032)

8.3.2 Push Broom Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Hyperspectral Imaging Systems Market Segmentation, by Application

9.1 Chapter Overview

9.2 Military Surveillance

9.2.1 Military Surveillance Market Trends Analysis (2020-2032)

9.2.2 Military Surveillance Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Remote Sensing

9.3.1 Remote Sensing Market Trends Analysis (2020-2032)

9.3.2 Remote Sensing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Medical Diagnostics

9.4.1 Medical Diagnostics Market Trends Analysis (2020-2032)

9.4.2 Medical Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Machine Vision & Optical Sorting

9.5.1 Machine Vision & Optical Sorting Market Trends Analysis (2020-2032)

9.5.2 Machine Vision & Optical Sorting Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Hyperspectral Imaging Systems Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Headwall Photonics

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Specim, Spectral Imaging Ltd.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Resonon Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Corning Incorporated

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Telops Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Norsk Elektro Optikk AS

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Bayspec Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 ChemImage Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Applied Spectral Imaging

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 XIMEA

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Camera

Accessories

By Technology

Snapshot

Push Broom

Others

By Application

Military Surveillance

Remote Sensing

Medical Diagnostics

Machine Vision & Optical Sorting

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Industrial Radiography Market Size was valued at USD 672.03 million in 2023 and is expected to reach USD 1262.4 million by 2031 and grow at a CAGR of 8.2% over the forecast period 2024-2031.

The Industrial Refrigeration Market size was valued at USD 21.46 Billion in 2023. It is estimated to reach USD 33.86 Billion by 2032 with a growing CAGR of 5.2% over the forecast period 2024-2032.

The Smart Retail Market Size was valued at USD 39.92 billion in 2023 and is expected to grow at a CAGR of 26.45% to reach USD 329.03 billion by 2032.

The High-speed Data Converter Market size was valued at USD 3.21 Billion in 2023 and expected to grow at a CAGR of 7.08% to reach USD 5.94 Billion by 2032.

The Silicon Carbide Market Size was valued at USD 3.34 Billion in 2023 and is expected to reach USD 7.64 Billion by 2032 and grow at a CAGR of 9.68% over the forecast period 2024-2032.

The Baggage Handling System Market size was valued at USD 10.57billion in 2023 and is expected to grow to USD 18.92 billion by 2032 and grow at a CAGR of 6.68% over the forecast period of 2024-2032

Hi! Click one of our member below to chat on Phone