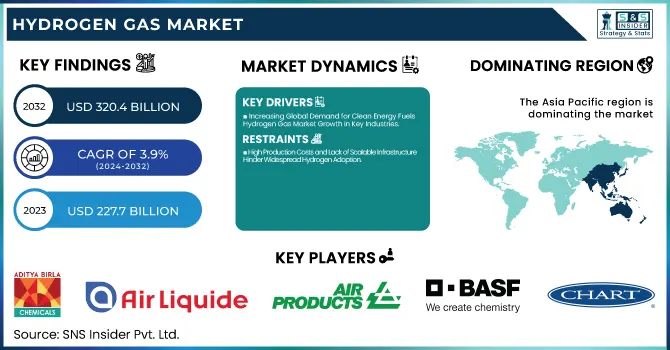

The Hydrogen Gas Market size was valued at USD 227.7 billion in 2023 and is expected to reach USD 320.4 billion by 2032, growing at a CAGR of 3.9% over the forecast period 2024-2032.

To Get more information on Hydrogen Gas Market - Request Free Sample Report

The hydrogen gas market is witnessing rapid growth, driven by its increasing adoption in various industrial applications, including refining, chemical manufacturing, and energy generation. The surge in demand is primarily fueled by the global energy transition towards renewable sources, as hydrogen is viewed as a clean and sustainable energy carrier. Industries are shifting from traditional grey hydrogen to low-carbon blue and green hydrogen, with numerous technological advancements shaping the market dynamics. For instance, in December 2024, Siemens Energy collaborated on an initiative to develop a 100% hydrogen-compatible HL gas turbine, highlighting the sector's move toward fully hydrogen-powered energy solutions. Similarly, a milestone was achieved in the same month with the launch of the first operational pure hydrogen gas turbine, demonstrating technological feasibility in reducing emissions in power generation. Such advancements reflect the increasing investment and innovation within the hydrogen ecosystem.

Several recent developments underscore the market's dynamic nature and alignment with sustainability goals. In September 2024, Microsoft partnered with ESB on a green hydrogen pilot project, aiming to integrate hydrogen into data center operations, showcasing the role of hydrogen in decarbonizing digital infrastructure. Additionally, in January 2025, SSAB announced its participation in a European Union initiative to promote hydrogen use in industrial applications, strengthening the decarbonization of steel manufacturing. Meanwhile, public awareness and global initiatives to combat climate change have further accelerated the deployment of hydrogen technologies. For example, in November 2024, new advancements were reported in producing low-carbon hydrogen, emphasizing the push towards cleaner alternatives. These developments illustrate the commitment of companies across industries to innovate and adopt hydrogen technologies, ensuring long-term environmental and economic sustainability.

Drivers

Increasing Global Demand for Clean Energy Fuels Hydrogen Gas Market Growth in Key Industries

Increasing Investment in Hydrogen Infrastructure and Distribution Networks Drives Market Growth

Government Regulations and Supportive Policies Stimulate Growth of Hydrogen Gas Market

Governments worldwide are adopting supportive policies and regulatory frameworks to boost the growth of the hydrogen gas market. Many countries have included hydrogen as a key part of their national energy strategies to meet climate change goals. For instance, the European Union’s Green Deal aims to reduce emissions and invest in hydrogen infrastructure. Similarly, the U.S. government has committed to funding hydrogen projects through the Department of Energy, with a focus on making hydrogen a competitive energy source. These policies often include grants, tax incentives, and subsidies for both production and end-use technologies. In Japan, the government has implemented a hydrogen roadmap, offering financial assistance for hydrogen fueling stations and fueling cell vehicles. These supportive measures create a favorable environment for both existing market players and new entrants to innovate and expand their presence in the hydrogen sector.

Restraints

High Production Costs and Lack of Scalable Infrastructure Hinder Widespread Hydrogen Adoption

Despite the growing interest and demand for hydrogen gas, the market faces significant hurdles in terms of high production costs and underdeveloped infrastructure. The current cost of producing hydrogen, especially green hydrogen, remains significantly higher than conventional energy sources. Green hydrogen production, using renewable energy sources like wind and solar through electrolysis, requires large amounts of electricity, leading to high operational costs. Moreover, there is a lack of a globally standardized infrastructure for hydrogen production, storage, and distribution. Without an established pipeline network and refueling stations, the transport and delivery of hydrogen become expensive and inefficient. As hydrogen technology becomes more cost-competitive, this challenge may be alleviated, but it remains a key restraint for the broader market adoption soon.

Opportunities

Expanding Hydrogen Applications in Industrial Processes Open New Growth Avenues

Hydrogen gas is increasingly being integrated into various industrial processes, providing a significant opportunity for market growth. Industries such as chemicals, steel manufacturing, and refining rely heavily on hydrogen as a key feedstock for their operations. In the steel industry, hydrogen is being used as a cleaner alternative to coke in the production of steel, significantly reducing CO2 emissions. Hydrogen is also playing an important role in ammonia production, which is critical for fertilizers. The growing demand for green and sustainable industrial processes creates opportunities for hydrogen adoption. Many countries are already investing in pilot projects aimed at using hydrogen in industrial decarbonization efforts. This trend is expected to create new demand for hydrogen as a critical raw material and energy source, fueling market expansion.

Hydrogen in Mobility Solutions Offers Attractive Market Opportunities

Expanding Hydrogen Export Markets Drive New Business Potential

Challenge

Lack of Global Standardization and Regulation Limits Hydrogen Market Growth

The hydrogen market faces a significant challenge due to the absence of uniform global standards and regulations regarding hydrogen production, storage, transport, and utilization. Different regions have adopted their own regulations and safety standards, creating barriers to international trade and technology transfer. Without a global regulatory framework, issues such as safety protocols, product quality, and certification requirements remain inconsistent, which could slow down the widespread adoption of hydrogen technologies. The lack of standardized hydrogen fueling infrastructure, for example, hinders cross-border trade of hydrogen-powered vehicles and infrastructure. To address this challenge, there is a need for global cooperation to establish consistent regulations, certifications, and safety standards, ensuring smooth market growth and increasing the efficiency of hydrogen usage across countries.

Harnessing Hydrogen: A Key Player in Energy Storage and Grid Management

| Technology/Aspect | Description |

|---|---|

|

Power-to-Gas (P2G) Technology |

Converts excess electricity into hydrogen through electrolysis, enabling energy storage for later use. |

|

Hydrogen as Seasonal Storage |

Hydrogen allows for long-term storage, balancing seasonal fluctuations in renewable energy supply. |

|

Fuel Cells for Grid Stability |

Hydrogen fuel cells can provide backup power to stabilize the grid during high demand or outages. |

|

Hydrogen for Peak Shaving |

Hydrogen can be used to produce electricity during peak demand periods, reducing reliance on fossil fuels. |

|

Hydrogen Blending in Natural Gas |

Hydrogen can be blended with natural gas for use in existing grid infrastructure, reducing carbon emissions. |

Hydrogen plays a crucial role in energy storage and grid management by providing a flexible and sustainable solution to address the intermittent nature of renewable energy sources. One significant application is Power-to-Gas (P2G) technology, which converts excess renewable electricity into hydrogen via electrolysis, allowing for energy to be stored and utilized when needed. Another key advantage is hydrogen as seasonal storage, enabling energy systems to store excess energy generated in one season for use in another, particularly during low renewable generation periods. Additionally, hydrogen fuel cells contribute to grid stability by offering reliable backup power during outages or high-demand situations. This aligns with the concept of peak shaving, where hydrogen-generated electricity can be utilized during periods of peak demand, reducing strain on the grid and dependence on fossil fuels. Lastly, hydrogen blending in natural gas infrastructure provides an effective way to reduce carbon emissions without significant changes to existing gas grid systems. Together, these hydrogen solutions are enhancing grid flexibility, reliability, and the integration of clean energy.

By Type

In 2023, Grey Hydrogen dominated the Hydrogen Gas market with a market share of 70%. Grey hydrogen is produced primarily through steam methane reforming (SMR), a process that extracts hydrogen from natural gas. This method is the most cost-effective and widely used for hydrogen production. It has been the go-to technology for industries requiring large volumes of hydrogen, such as oil refining, ammonia production, and chemical manufacturing. Despite its affordability, grey hydrogen production results in significant carbon emissions due to the lack of carbon capture mechanisms, making it less sustainable in the long run. However, grey hydrogen’s dominance can be attributed to its established infrastructure, ease of production, and lower cost compared to blue and green hydrogen. As industries continue to rely heavily on hydrogen for various applications, grey hydrogen remains the dominant segment. Although blue and green hydrogen, which are more environmentally friendly, are gaining attention due to their reduced carbon footprints, grey hydrogen still holds a significant share due to its affordability and large-scale availability.

By Distribution

In 2023, Pipelines dominated the distribution segment of the Hydrogen Gas market with a market share of 50%. The use of pipelines to distribute hydrogen is the most efficient and reliable method, especially for large-scale industries that require continuous and high-volume hydrogen supply. Pipelines offer significant advantages, such as low operational costs, safety, and a lower carbon footprint compared to other distribution methods like tube trailers or cylinders. They are also ideal for long-distance transportation, allowing hydrogen to be delivered from production facilities to industrial plants, refineries, and power plants. In regions with established hydrogen infrastructure, pipelines are the preferred distribution method due to their ability to handle large quantities of gas without the need for frequent refueling or handling. However, the installation and maintenance of pipelines require high initial investments, which can be a barrier in new markets. Still, as the hydrogen economy grows, pipeline distribution continues to dominate, especially in industrialized nations with a strong hydrogen infrastructure.

By Application

In 2023, the Fuel Cells application segment dominated the Hydrogen Gas market with a market share of 40%. Fuel cells utilize hydrogen to generate electricity through an electrochemical process, with water as the only byproduct, making them an environmentally friendly solution. The rise in demand for hydrogen fuel cells can be attributed to their growing use in transportation, especially in fuel cell electric vehicles (FCEVs), including buses, trucks, and trains. These vehicles are seen as an alternative to battery-electric vehicles (BEVs) due to their quick refueling time, long range, and zero emissions, offering a compelling solution to the transportation sector’s need for sustainable and clean alternatives. Additionally, fuel cells are increasingly being used for stationary power generation, providing backup power to industries, commercial buildings, and even residential areas. The global push towards decarbonization, along with government incentives for green technologies, has spurred interest in hydrogen fuel cells as a viable solution for reducing greenhouse gas emissions. This trend is expected to further solidify the dominance of the fuel cells segment in the coming years.

By End-Use Industry

In 2023, the Oil Refining industry dominated the Hydrogen Gas market with a market share of 35%. Hydrogen plays a critical role in the oil refining process, particularly in hydrocracking, desulfurization, and hydrogenation processes, which are essential for producing cleaner, high-quality fuels. The oil refining sector has long been the largest consumer of hydrogen, using it to remove impurities such as sulfur from crude oil and to produce lighter, more valuable products like gasoline, diesel, and jet fuel. As global environmental regulations become stricter, refiners are increasingly turning to hydrogen to meet low-sulfur fuel specifications and reduce the carbon content of their output. Despite the growing interest in renewable energy sources and the transition to cleaner technologies, hydrogen remains essential in refining operations. The demand for hydrogen in the oil refining industry is expected to remain strong, as refiners continue to invest in upgrading their facilities to comply with environmental standards. Additionally, the continued growth of hydrogen-powered technologies may further elevate the demand for hydrogen within the oil refining sector.

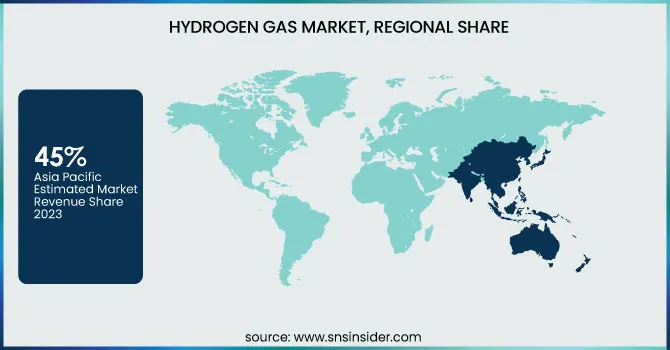

In 2023, the Asia Pacific region dominated the Hydrogen Gas market, holding a market share of around 45%. The region's leadership in the hydrogen market can be attributed to several factors, including the strong industrial base, government support for clean energy initiatives, and rapid advancements in hydrogen production and infrastructure. Countries like China, Japan, South Korea, and India have taken the lead in hydrogen adoption and infrastructure development. China has been a significant player, being the largest producer of hydrogen globally, largely through grey hydrogen, but with increasing investments in green hydrogen to meet decarbonization targets. In addition, Japan has been a pioneer in hydrogen fuel cell technology, investing heavily in hydrogen-powered transportation, including fuel cell electric vehicles (FCEVs) and hydrogen-powered trains, while also focusing on creating a hydrogen-based economy. South Korea has also made significant strides in hydrogen adoption, with a government-led initiative to promote hydrogen as a clean alternative to fossil fuels, including investments in hydrogen production, storage, and transportation. Furthermore, India is focusing on large-scale hydrogen production to meet its energy demands and reduce carbon emissions, with a focus on green hydrogen to decarbonize sectors such as transportation and power generation. With a rapidly growing demand for cleaner energy sources and the implementation of government policies encouraging the use of hydrogen, Asia Pacific remains the dominant region, and its hydrogen market is expected to continue expanding.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Aditya Birla Chemicals (Compressed Hydrogen, Liquid Hydrogen)

Air Liquide (Hydrogen Cylinder, Hydrogen Energy Solutions)

Air Products and Chemicals Inc. (Hydrogen Generators, On-Site Hydrogen Production)

BASF SE (Syngas Solutions, Hydrogen Catalysts)

Chart Industries (Hydrogen Storage Tanks, Hydrogen Trailers)

Cummins Inc. (Electrolyzers, Hydrogen Fuel Cells)

Equinor ASA (Blue Hydrogen, Green Hydrogen Projects)

Gulf Cryo (Industrial Hydrogen, Packaged Hydrogen Gas)

Gujarat Alkalies and Chemicals Limited (Compressed Hydrogen, Hydrogen Gas for Chemical Processes)

Iwatani Corporation (Hydrogen Refueling Stations, Liquid Hydrogen)

Linde PLC (Hydrogen Plants, Hydrogen Refueling Solutions)

Lords Chloro Alkali Limited (Industrial Hydrogen, Hydrogen for Chemical Manufacturing)

Matheson Tri-Gas Inc. (Hydrogen Cylinders, Specialty Hydrogen Gas Mixtures)

Messer SE & Co. KGaA (Bulk Hydrogen, Hydrogen for Energy Applications)

Nel ASA (Electrolyzers, Renewable Hydrogen Solutions)

PAO NOVATEK (Liquefied Hydrogen, Hydrogen for Energy Systems)

Plug Power Inc. (Hydrogen Fuel Cells, Electrolyzer Solutions)

Taiyo Nippon Sanso Corporation (Hydrogen Generators, Liquid Hydrogen Supply)

Universal Industrial Gases Inc. (Hydrogen for Industrial Applications, Custom Hydrogen Mixtures)

Xebec Adsorption Inc. (Hydrogen Purification Systems, On-Site Hydrogen Solutions)

Recent Development:

January 2024: Equinor and Linde agreed to develop the H2M Eemshaven low-carbon hydrogen project in the Netherlands.

November 2023: Air Products revealed plans for Europe’s largest blue hydrogen facility in Rotterdam, Netherlands, scheduled to commence operations by 2026, serving ExxonMobil’s (Esso) Rotterdam refinery and other clients.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 227.7 billion |

|

Market Size by 2032 |

US$ 320.4 billion |

|

CAGR |

CAGR of 3.9% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Grey Hydrogen, Blue Hydrogen, Green Hydrogen) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Air Liquide, Air Products and Chemicals Inc., BASF SE, Equinor ASA, Linde PLC, Messer SE & Co. KGaA, Matheson Tri-Gas Inc., Taiyo Nippon Sanso Corporation, PAO NOVATEK, Gulf Cryo and other key players |

|

Key Drivers |

•Increasing Global Demand for Clean Energy Fuels Hydrogen Gas Market Growth in Key Industries |

|

Restraints |

•High Production Costs and Lack of Scalable Infrastructure Hinder Widespread Hydrogen Adoption |

Ans: Asia Pacific dominated the Hydrogen Gas market with a 45% share, driven by strong industrial bases, government support, and advancements in hydrogen technologies, led by countries like China, Japan, South Korea, and India.

Ans: The hydrogen market's growth is hindered by inconsistent global standards and regulations for production, storage, transport, and utilization, limiting international trade and technology adoption.

Ans: The hydrogen gas market is advancing due to its growing role in industrial decarbonization, adoption in mobility solutions like fuel cell vehicles, and increasing exports from renewable energy-rich regions such as Australia and the Middle East.

Ans: The Hydrogen Gas Market size was valued at USD 227.7 billion in 2023 and is expected to reach USD 320.4 billion by 2032.

Ans: The Hydrogen Gas (CO2) Market is expected to grow at a CAGR of 3.9%

Table Of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, 2023

5.2 Investment Trends and Key Strategic Partnerships, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Sustainability and Environmental Impact,2023

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hydrogen Gas Market Segmentation, by Type

7.1 Chapter Overview

7.2 Grey Hydrogen

7.2.1 Grey Hydrogen Market Trends Analysis (2020-2032)

7.2.2 Grey Hydrogen Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Blue Hydrogen

7.3.1 Blue Hydrogen Market Trends Analysis (2020-2032)

7.3.2 Blue Hydrogen Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Green Hydrogen

7.4.1 Green Hydrogen Market Trends Analysis (2020-2032)

7.4.2 Green Hydrogen Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Hydrogen Gas Market Segmentation, by Distribution

8.1 Chapter Overview

8.2 Pipelines

8.2.1 Pipelines Market Trends Analysis (2020-2032)

8.2.2 Pipelines Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 High-pressure Tube Trailers

8.3.1 High-pressure Tube Trailers Market Trends Analysis (2020-2032)

8.3.2 High-pressure Tube Trailers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Cylinders

8.4.1 Cylinders Market Trends Analysis (2020-2032)

8.4.2 Cylinders Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Hydrogen Gas Market Segmentation, by Application

9.1 Chapter Overview

9.2 Fuel Cells

9.2.1 Fuel Cells Market Trends Analysis (2020-2032)

9.2.2 Fuel Cells Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Hydrogenation

9.3.1 Hydrogenation Market Trends Analysis (2020-2032)

9.3.2 Hydrogenation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Power Generation

9.4.1 Power Generation Market Trends Analysis (2020-2032)

9.4.2 Power Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Hydrogen Gas Market Segmentation, by End-Use Industry

10.1 Chapter Overview

10.2 Oil Refining

10.2.1 Oil Refining Market Trends Analysis (2020-2032)

10.2.2 Oil Refining Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Chemical Manufacturing

10.3.1 Chemical Manufacturing Market Trends Analysis (2020-2032)

10.3.2 Chemical Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Metal Processing

10.4.1 Metal Processing Market Trends Analysis (2020-2032)

10.4.2 Metal Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Power Generation

10.5.1 Power Generation Market Trends Analysis (2020-2032)

10.5.2 Power Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Transportation

10.6.1 Transportation Market Trends Analysis (2020-2032)

10.6.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

10.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.4 North America Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.2.5 North America Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.6 North America Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.7.2 USA Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.2.7.3 USA Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.4 USA Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.8.2 Canada Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.2.8.3 Canada Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.4 Canada Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.2.9.3 Mexico Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.1.7.3 Poland Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.1.8.3 Romania Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.5 Western Europe Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.7.3 Germany Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.8.2 France Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.8.3 France Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.4 France Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.9.3 UK Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.10.3 Italy Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.11.3 Spain Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.14.3 Austria Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.5 Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.7.2 China Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.7.3 China Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.4 China Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.8.2 India Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.8.3 India Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.4 India Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.9.2 Japan Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.9.3 Japan Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.4 Japan Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.10.3 South Korea Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.11.3 Vietnam Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.12.3 Singapore Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.13.2 Australia Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.13.3 Australia Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.4 Australia Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.1.5 Middle East Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.1.7.3 UAE Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.4 Africa Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.2.5 Africa Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.6 Africa Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Hydrogen Gas Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.4 Latin America Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.6.5 Latin America Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.6 Latin America Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.6.7.3 Brazil Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.6.8.3 Argentina Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.6.9.3 Colombia Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Hydrogen Gas Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Hydrogen Gas Market Estimates and Forecasts, by Distribution (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Hydrogen Gas Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Hydrogen Gas Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

12. Company Profiles

12.1 Air Liquide

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Air Products and Chemicals Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 BASF SE

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Equinor ASA

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Linde PLC

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Messer SE & Co. KGaA

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Matheson Tri-Gas Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Taiyo Nippon Sanso Corporation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 PAO NOVATEK

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Gulf Cryo

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Grey Hydrogen

Blue Hydrogen

Green Hydrogen

By Distribution

Pipelines

High-pressure Tube Trailers

Cylinders

By Application

Fuel Cells

Hydrogenation

Power Generation

Others

By End-Use Industry

Oil Refining

Chemical Manufacturing

Metal Processing

Power Generation

Transportation

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Waterborne Coatings Market Size was USD 72.3 billion in 2023 and will reach to USD 119.6 billion by 2032 and grow at a CAGR of 5.1% by 2024-2032.

Green Building Materials Market was USD 371.25 billion in 2023 and is expected to Reach USD 1020.53 billion by 2032, growing at a CAGR of 11.89% by 2024-2032.

Polypropylene Market size was USD 85.40 Billion in 2023 and is expected to reach USD 139.15 Billion by 2032, growing at a CAGR of 5.57% from 2024 to 2032.

The Wax Emulsion Market was valued at USD 1.95 Billion in 2023 and is expected to reach USD 2.93 Billion by 2032, growing at a CAGR of 4.66% from 2024-2032.

Explore the Isosorbide Market, focusing on bio-based polymers, resins, and pharmaceuticals. Learn about the rising demand for sustainable materials, applications in PET, polycarbonate, and how isosorbide is driving innovations in eco-friendly industries a

The Polybutylene Adipate Terephthalate Market Size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 3.2 Billion by 2032, growing at a CAGR of 8.8% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone