Get More Information on Hydrogen Fluoride Gas Detection Market - Request Sample Report

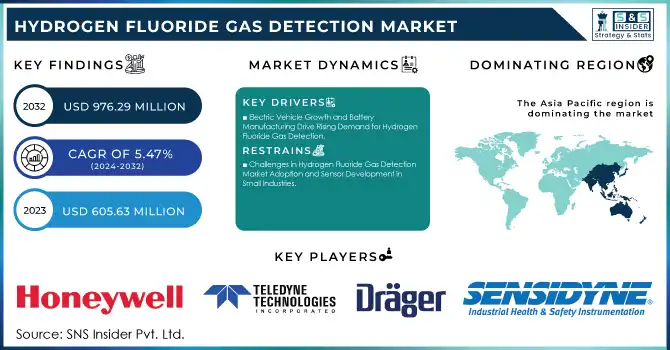

The Hydrogen Fluoride Gas Detection Market Size was valued at USD 605.63 Million in 2023 and is expected to reach USD 976.29 Million by 2032, growing at a CAGR of 5.47% over the forecast period 2024-2032.

The Hydrogen Fluoride Gas Detection Market is experiencing a boom primarily due to the growing requirement for safety and environmental regulations in the industries that use hydrogen fluoride. Hydrogen fluoride is a toxic and corrosive gas, so, its concentration must be monitored in an industrial setting. With the increasing expansion of industries such as mining, metallurgy, chemical manufacturing, and pharmaceuticals, the demand for systems that detect gas has grown to prevent exposure and fulfill regulatory requirements. With governments worldwide enforcing strict workplace safety regulations, the hydrogen fluoride gas detection system market is gaining traction in multiple sectors. Furthermore, increasing environmental awareness about emissions of toxic gases students to the market growth. In 2023, hydrogen fluoride gas detection system demand from chemical manufacturing and pharmaceuticals accounted for more than 30% of market adoption, as stringent regulations pushed hydrogen fluoride into the spotlight. Adoption in the mining and metallurgical industries increased 20-25% from 2022-2023. Due to their higher sensitivity, advanced detection technologies such as Non-Dispersive Infrared systems now represent 50% of new installations. Industry 4.0 itself will witness a 27% growth for the segment of Digital and remote monitoring solutions between 2023-2024. In areas such as the U.S. and Germany, 70% of HF detection systems were installed due to tougher safety regulations, though in Europe actually, between 10-15% of industrial plants have installed HF detectors just to meet the requirements of new environmental standards.

The development of sensor technology and the increasing demand for stationary and portable gas detection instruments are driving the market

Move towards smart sensors providing instantaneous detection and directly connecting to cloud-based systems are revolutionizing the detection abilities and making it more cost-effective and convenient than ever before. The rise in demand from industries where mobility and portability are crucial such as on-site operations or in remote areas is driving the growth of portable gas detectors. Stricter regulations, advances in HF gas technology, and the increasing focus on safety and environmental responsibility are driving the hydrogen fluoride gas detection market growth. 25% increase in adoption of WIRELESS & IoT-enabled gas detection systems owing to the need for real-time monitoring & remote analysis. In terms of sectors, the use of portable gas detectors is rising at a CAGR of 15-20%, primarily driven by demand from mining, oil & gas, and chemicals sectors. At the same time, MEMS-based sensors and infrared spectroscopy technology are expected to improve detection correctness and decrease false alarms by 20%. Cloud-based platforms for preventive maintenance are expected to share a 10-15% increase as well.

Key Drivers:

Electric Vehicle Growth and Battery Manufacturing Drive Rising Demand for Hydrogen Fluoride Gas Detection

The growing electric vehicle and battery manufacturing industry is one of the principal market drivers for the Hydrogen Fluoride Gas Detection Market. Hydrogen fluoride is crucial for the manufacture of lithium-ion batteries, which are widely used in electric cars. The world is rapidly moving to sustainable energy and electric vehicles and the demand for gas detection systems that are more efficient and reliable is growing. Battery manufacturing plants where HF-based chemicals such as hydrofluoric acid are processed during production need stringent monitoring systems to make sure that workers are safe and to keep industry safety standards. There has also been a marked increase in this activity in Europe, North America, and some areas of Asia-Pacific, where investments in renewable energy and electric vehicle infrastructure are common, which contribute to the higher growth of hydrogen fluoride gas detection market. Worldwide battery manufacturing capacity jumped to 2.5 TWh in 2023, a 25% year-on-year increase in 2022. Already, 70% of worldwide battery production capacity is spoken for by 2030. As a result, the company is witnessing a 25% rise in the adoption of hydrogen fluoride gas detectors in lithium-ion battery production plants owing to increased demand for the safety of personnel when handling these gases.

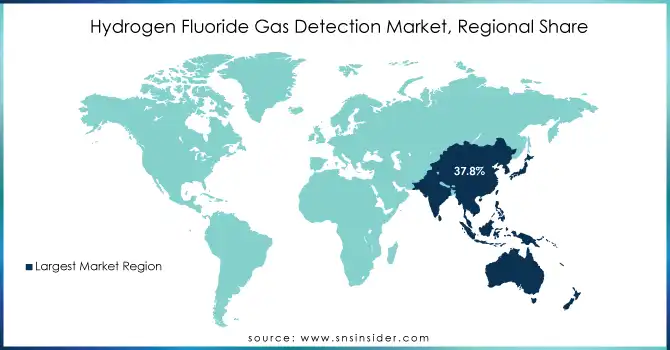

Industrial Growth in Asia Pacific and Latin America Drives Demand for Hydrogen Fluoride Gas Detection

Another important factor contributing to it is the increasing industrialization in developing countries, particularly in Asia-Pacific and Latin America. With the rapid industrialization of countries such as China and India, the chemical manufacturing, glass etching, and mining sectors are growing quickly. Hydrogen fluoride is identified in different production stages and often works with it, and hence these industries have the potential to spill it facilitating gas leaks and gas exposure. Hence, there is an increasing need for gas detection solutions for worker and environmental safety purposes. In these regions, industrial growth along with growing knowledge of environmental regulations and occupational safety are factors that will spur demand for gas detection equipment. This trend is expected to last long due to the modernization of industrial infrastructure in these emerging markets along with synchronization with global safety standards will further drive the market growth of hydrogen fluoride gas detection solutions. The chemical manufacturing and mining sectors in the Asia-Pacific region are buzzing with an 10% growth per year, while for the major industries in Latin America, including mining and chemicals has been 8%. The industrial expansion, reinforced by stricter safety and environment regulations, has driven 15-20% demand for hydrogen fluoride gas detection systems in high-risk industries like glass etching, chemical production, and mining.

Restrain:

Challenges in Hydrogen Fluoride Gas Detection Market Adoption and Sensor Development in Small Industries

One of the most important restraints of the Hydrogen Fluoride Gas Detection Market is the limited adoption in smaller industries due to a lack of awareness and fewer availabilities. Although gas detection systems are now being made available for larger industries, small-scale firms, especially in developing markets may not be able to afford these safety technologies as their budgets are lower or they may not be aware of the risks linked with hydrogen fluoride exposure. That failure to penetrate smaller-scale operations can stifle the overall growth of the market as a whole. Further, another major drawback is the technical challenges in sensor development. It uses hydrogen fluoride which is highly corrosive and highly reactive, eventually degrading the sensor over time. Technological difficulties exist in creating sensors that are both robust and reliable in the extreme environments found where HF is known to occur. As a result, market innovation providing ultra-competent reliable long-term detection devices capable of 24/7 performance at industry-critical Intrinsic Zone-level-aged conditions has lagged on the market.

By Forms

Gas Hydrogen Fluoride accounted for the largest share of the market with 64% in the year 2023 and is expected to register the fastest CAGR from 2024-2032. Hydrogen fluoride in gaseous form is widely used in chemical manufacturing, mining, glass etching, pharmaceuticals, and accounts for a large share of the market. Much as hydrogen fluoride in the vapor state is more widely dealt with in various industrial processes, gas detection systems are important to ensure employee safety as well as environmental safety. Also, a gas is more difficult to contain, making detection technologies even more necessary in real-time to avoid unsafe leaks or unintentional exposure, which drives gas detection technologies adoption. This growth is leading to additional advancements in sensor technology, enabling an ever-more robust, accurate, and efficient detection of gas hydrogen fluoride. This new age of sensor models additionally consists of clever sensors with now not only fashionable features of thousands and thousands of kinds of gases, explosive, and chemical kind gas but additionally include characteristics like wireless ability, actual time monitoring, statistics analytics, phenomenon examination, which admit primary Gas levels with remote focal point monitoring and integration onto higher stage protection programs. Such improved functionality aids industries in adhering to the rigorous safety and environmental regulations that are enforced today. In addition, increasing awareness about the hazardous nature of hydrogen fluoride gas and the threat it poses to human health and safety, particularly in closed-environment or uncontrolled surroundings, has led many industries to implement detection systems. The surge in efforts taken worldwide in the workplace safety sector coupled with the growing compliance standards will drive the gas hydrogen fluoride detection market growth over the upcoming years.

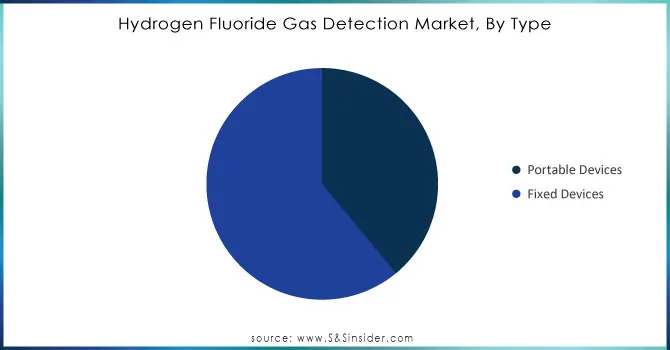

By Type

The fixed Device segment accounted for the highest market share of 56.1% in 2023, owing to extensive usage in large-scale industrial applications where real-time hydrogen fluoride gas detection is required for continuous monitoring in hazardous environments. These devices are used in stationary locations inside factories, chemical plants, and other buildings that use hydrogen fluoride gas in large, dangerous amounts. Non-portable or fixed devices stand for dependability, permanence, and continuous monitoring, thus, are recommended for industries that focus on enduring safety and long-run compliance. This is a factor that additionally contributes to their share of the market, as their ability to cover large spots and it can detect gas leaks throughout the facility.

Portable Devices are anticipated to register the fastest Compound Annual Growth Rate during the forecast period (2024-2032) due to increasing demand for flexibility and mobility in the hazardous environment. These portable detection devices enable workers to conduct localized monitoring where the fixed system may not be suitable during inspections and maintenance which makes sense either in prepared areas or in remote places. With industries moving toward dynamic operation spaces, portable devices provide user-friendliness, real-time readings, and rapid response against potential threats in different locations. Ongoing technological developments in sensor accuracy, battery life, and wireless connectivity are further augmenting the demand for portable gas detectors due to their high portability.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By End Use

In 2023, the Mining and Metallurgical sectors dominated the market with a share of 34% as hydrogen fluoride finds large applications in mineral processing, refining, and extraction of metal from ores. Hydrogen fluoride is a toxic and corrosive compound that requires constant monitoring, especially in the mining and metallurgical industries, where it is employed in the extraction of metals and minerals at various production cycles. Hydrogen fluoride detection systems are in high demand in these specific sectors due to the nature of operations, where strict safety regulations are working to ensure no exposure to any hazardous gases. This need for the safety of the workers in such an adverse environment has made the mining and metallurgical vertical the largest revenue-generating segment of the market.

The Chemical industry is projected to witness the fastest CAGR during 2024-2032, due to the growing use of hydrogen fluoride for various chemical products, including refrigerants, pharmaceuticals, and polymers. Hydrogen fluoride is also utilized by the chemical industry for the synthesis of different chemical compounds, and the ubiquitous presence of toxic HF gas requires rigorous detection and control systems for large-scale chemical processes. The chemical industry is generally expanding over the globe, and so also in rising development economic systems, gas discovery systems demand expansion swiftly. Environmental regulations, safety standards, and worker protection are increasingly becoming prominent drivers, which are propelling the chemical sector towards advanced hydrogen fluoride gas detection technologies contributing to fastest fastest-growing segment in the market.

Asia Pacific accounted for the largest share of the hydrogen fluoride gas detection market at 37.8% in 2023. As major industrial sectors like chemical manufacturing, mining, and electronics have grown rapidly in China, the demand for hydrogen fluoride gas detection systems has increased. To illustrate, one of the biggest oil and gas companies, China National Petroleum Corporation (CNPC) works in the atmosphere of hydrogen fluoride applied in refining processes and places an increasing need for gas detection. Furthermore, India's massive chemical production and mineral processing sectors add significantly to this market too, with firms like Reliance Industries pouring money into sophisticated safety technologies to satisfy strict worker safety & environmental regulations.

North America is forecast to maintain the fastest CAGR during the period from 2024-2032 due to the increasing use of hydrogen fluoride gas detection systems in manufacturing sectors such as chemical production, pharmaceuticals, and energy. A leading clamoring for American help especially in territories like semiconductor assembling and lithium-particle battery creation, in which hydrogen fluoride is a base substance used for numerous compound cycles. Sectors such as Intel and Tesla are quite active in these and quite a few others, where they have the technology of gas detection to keep their employees safe and also deal with regulation issues. The demand for hydrogen fluoride gas detection systems is also boosted by the rapid development of the electric vehicle (EV) market, especially in the U.S., where hydrogen fluoride is used in many of the processes related to battery production, particularly etching and refining.

Some of the major players in the Hydrogen Fluoride Gas Detection Market are:

Honeywell International (Portable Gas Detectors, Fixed Gas Detection Systems)

Teledyne Technologies (Multi-Gas Detectors, Personal Gas Monitors)

Drägerwerk (Toxic Gas Detectors, Personal Safety Monitors)

MSA Safety Incorporated (Portable Gas Detectors, Fixed Gas Detection Systems)

GfG Instrumentation (Gas Detection Tubes, Portable Gas Detectors)

Sensidyne (Fixed Gas Detectors, Gas Detection Tubes)

Crowcon Detection Instruments (Multi-Gas Monitors, Portable Gas Detectors)

Analytical Technology (Fixed Gas Monitors, Portable Gas Detectors)

RKI Instruments (Personal Gas Monitors, Fixed Detection Systems)

R.C. Systems (Industrial Gas Monitors, Area Gas Detection Systems)

Industrial Scientific Corporation (Portable Gas Detectors, Fixed Gas Detection Systems)

Bruel & Kjaer (Handheld Vibration Meters, Acoustic Analyzers)

Inficon (Handheld Leak Detectors, Stationary Gas Detectors)

Jerome Instruments (Gold Film Gas Detectors, Mercury Vapor Analyzers)

Gas Sensing Solutions (Infrared Gas Sensors, Portable Gas Detectors)

Emerson Electric (Fixed Gas Detectors, Portable Gas Detection Monitors)

OPSIS System (Continuous Emission Monitoring Systems, Process Control Instruments)

Alphasense Ltd (Electrochemical Sensors, Optical Particle Counters)

City Technology (Gas Detection Sensors, Electrochemical Cells)

LDetek (Online Trace Gas Analyzers, Industrial Gas Detectors)

Some of the Raw Material Suppliers for Hydrogen Fluoride Gas Detection companies:

Air Liquide

Linde PLC

Mitsui Chemicals

Honeywell Performance Materials

Daikin Industries

Sumitomo Chemical

Asahi Glass Co. (AGC Inc.)

Solvay

Shandong Dongyue Chemical Co., Ltd.

Fujian Yongjing Technology Co., Ltd.

In September 2023, Teledyne launched the enhanced GS700-Hydrogen detector, capable of detecting both hydrogen and natural gas in one device, supporting key hydrogen transition projects like SGN’s H100 Fife in Scotland.

In August 2023, MSA Safety's ALTAIR io 4 portable gas detector Frost & Sullivan New Product Innovation Award, recognizing its excellence in technological innovation and strategic product development in the global gas detection industry.

In November 2024, Sensidyne launched the SensAlert IR, a fixed-point infrared gas detector with advanced dual-wavelength NDIR technology, offering precise and reliable gas detection in harsh industrial environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 605.63 Million |

| Market Size by 2032 | USD 976.29 Million |

| CAGR | CAGR of 5.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Forms (Liquid Hydrogen Fluoride, Gas Hydrogen Fluoride) • By Type (Fixed Devices, Portable Devices) • By End Use (Mining and Metallurgical, Chemical, Glass Etching, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin Industries Ltd., Mitsubishi Corporation, Huntsman Corporation, Arxada, SABIC, Asahi Kasei Corporation, Topas Advanced Polymers, Zeon Corporation, Chemours Company LLC, DIC Corporation, Arkema, Showa Denko Materials Co. Ltd., Shin-Etsu Chemical Co. Ltd., Dow, Olin Corporation, Celanese Corporation, Solvay, Sumitomo Chemical Co. Ltd., Nippon Steel & Sumitomo Metal Corporation, JSR Corporation. |

| Key Drivers | • Electric Vehicle Growth and Battery Manufacturing Drive Rising Demand for Hydrogen Fluoride Gas Detection • Industrial Growth in Asia Pacific and Latin America Drives Demand for Hydrogen Fluoride Gas Detection |

| RESTRAINTS | • Challenges in Hydrogen Fluoride Gas Detection Market Adoption and Sensor Development in Small Industries |

Ans: Hydrogen Fluoride Gas Detection Market size was USD 605.63 Million in 2023 and is expected to Reach USD 976.29 Million by 2032.

The outbreak and spread of the COVID-19 epidemic have had a devastating effect on the hydrogen fluoride gas market, leading to a decline in the supply of hydrogen fluoride gas discovery equipment. This led to a decline in revenue leading to lower market growth in the first half of 2020.

The key players in the Hydrogen Fluoride Gas Detection Market are Honeywell International, Dragerwerk AG, MSA Safety Incorporated, Sensidyne, LP, Analytical Technology, R.C. Systems, Teledyne Technologies Incorporated, KGaA, GfG Instrumentation, Crowcon Detection Instruments, RKI Instruments and other.

Yes, and they are Raw material vendors, Distributors/traders/wholesalers/suppliers, Regulatory authorities, including government agencies and NGO, Commercial research & development (R&D) institutions, Importers and exporters, Government organizations, research organizations, and consulting firms, Trade/Industrial associations, End-use industries.

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Hydrogen Fluoride Gas Detection Technology and Product Metrics (2023)

5.2 Hydrogen Fluoride Gas Detection Competitive Pricing Analysis (2023)

5.3 Hydrogen Fluoride Gas Detection Emissions Control Metrics

5.4 Hydrogen Fluoride Gas Detection Sensor Accuracy and Sensitivity

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hydrogen Fluoride Gas Detection Market Segmentation, By Forms

7.1 Chapter Overview

7.2 Liquid Hydrogen Fluoride

7.2.1 Liquid Hydrogen Fluoride Market Trends Analysis (2020-2032)

7.2.2 Liquid Hydrogen Fluoride Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Gas Hydrogen Fluoride

7.3.1 Gas Hydrogen Fluoride Market Trends Analysis (2020-2032)

7.3.2 Gas Hydrogen Fluoride Market Size Estimates and Forecasts to 2032 (USD Million)

8. Hydrogen Fluoride Gas Detection Market Segmentation, By Type

8.1 Chapter Overview

8.2 Fixed Devices

8.2.1 Fixed Devices Market Trends Analysis (2020-2032)

8.2.2 Fixed Devices Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Portable Devices

8.3.1 Portable Devices Market Trends Analysis (2020-2032)

8.3.2 Portable Devices Market Size Estimates and Forecasts to 2032 (USD Million)

9. Hydrogen Fluoride Gas Detection Market Segmentation, By End Use

9.1 Chapter Overview

9.2 Mining and Metallurgical

9.2.1 Mining and Metallurgical Market Trends Analysis (2020-2032)

9.2.2 Mining and Metallurgical Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Chemical

9.3.1 Chemical Market Trends Analysis (2020-2032)

9.3.2 Chemical Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Glass Etching

9.4.1 Glass Etching Market Trends Analysis (2020-2032)

9.4.2 Glass Etching Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Pharmaceutical

9.5.1 Pharmaceutical Market Trends Analysis (2020-2032)

9.5.2 Pharmaceutical Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Other

9.6.1 Other Market Trends Analysis (2020-2032)

9.6.2 Other Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.2.4 North America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.2.5 North America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.2.6.2 USA Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.2.6.3 USA Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.2.7.2 Canada Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.2.7.3 Canada Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.2.8.2 Mexico Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.2.8.3 Mexico Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.1.6.2 Poland Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.1.7.2 Romania Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.1.8.2 Hungary Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.1.9.2 Turkey Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.4 Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.6.2 Germany Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.7.2 France Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.7.3 France Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.8.2 UK Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.8.3 UK Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.9.2 Italy Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.10.2 Spain Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.13.2 Austria Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.4 Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.6.2 China Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.6.3 China Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.7.2 India Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.7.3 India Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.8.2 Japan Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.8.3 Japan Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.9.2 South Korea Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.9.3 South Korea Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.10.2 Vietnam Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.11.2 Singapore Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.11.3 Singapore Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.12.2 Australia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.12.3 Australia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.1.4 Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.1.5 Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.1.6.2 UAE Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.1.7.2 Egypt Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.1.9.2 Qatar Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.2.4 Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.2.5 Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.2.6.2 South Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.6.4 Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.6.5 Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.6.6.2 Brazil Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.6.6.3 Brazil Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.6.7.2 Argentina Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.6.7.3 Argentina Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.6.8.2 Colombia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.6.8.3 Colombia Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Forms (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Hydrogen Fluoride Gas Detection Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

11. Company Profiles

11.1 Honeywell Analytics

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Teledyne Technologies

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Drägerwerk

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 MSA Safety Incorporated

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 GfG Instrumentation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Sensidyne

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Crowcon Detection Instruments

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Analytical Technology

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 RKI Instruments

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 R.C. Systems

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Forms

Liquid Hydrogen Fluoride

Gas Hydrogen Fluoride

By Type

Fixed Devices

Portable Devices

By End Use

Mining and Metallurgical

Chemical

Glass Etching

Pharmaceutical

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Antimicrobial Plastics Market was valued at USD 44.01 billion in 2023 and is expected to reach USD 85.06 billion by 2032, at a CAGR of 7.63% from 2024-2032.

The Chemical as a Service Market Size was valued at USD 9.07 billion in 2023 and will reach $13.50 billion by 2032 and grow at a CAGR of 7.96% by 2024-2032

The Adipic Acid Market size was valued at USD 5.20 billion in 2023. It is estimated to hit USD 7.46 billion by 2032 and grow at a CAGR of 4.09% over the forecast period of 2024-2032.

The Polyurethane Adhesives Market Size was valued at USD 9.35 Billion in 2023 and is expected to reach USD 15.57 Billion by 2032, growing at a CAGR of 5.83% over the forecast period of 2024-2032.

Gelcoat Market was valued at USD 1,390.34 Million in 2023 and is expected to reach USD 4,237.75 Million by 2032, growing at a CAGR of 4.70% from 2024-2032.

Oleochemicals Market was valued at USD 24.0 billion in 2023 and is expected to reach USD 43.3 billion by 2032, growing at a CAGR of 6.8% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone