Hydrodesulfurization Catalysts Market Report Scope & Overview:

The Hydrodesulfurization Catalysts Market size was valued at USD 2.91 billion in 2023 and is expected to reach USD 4.20 billion by 2032 and grow at a CAGR of 4.20% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Hydrodesulfurization Catalysts Market - Request Sample Report

The Hydrodesulfurization (HDS) Catalysts Market has experienced consistent growth due to the increasing demand for clean fuel production driven by stringent environmental regulations. The growing emphasis on reducing sulfur content in fuels to meet global standards for air quality and health has significantly propelled the adoption of HDS technologies. The market is characterized by continuous technological advancements in catalyst formulations, with manufacturers investing heavily in developing more efficient and sustainable solutions. These advancements have led to the creation of next-generation catalysts, offering higher performance in sulfur removal with lower operating costs, thus attracting refiners seeking to improve operational efficiency. The rising adoption of cleaner fuels and the increasing demand for diesel, gasoline, and jet fuels with low sulfur content in emerging economies are also contributing factors to the market expansion.

In recent years, key players in the HDS catalysts market have made substantial strides toward enhancing product performance and developing new solutions. For instance, the introduction of advanced cobalt-molybdenum-based and nickel-molybdenum-based catalysts has significantly improved the desulfurization process, enabling refineries to meet the growing demand for ultra-low sulfur fuels. Some refiners have also turned to customized hydroprocessing catalysts, which help optimize fuel production based on specific regional or operational needs. For example, a well-known catalyst manufacturer has enhanced its product line to offer more robust catalysts designed to operate under harsher conditions, ensuring that refineries can continue their sulfur reduction efforts without compromising output quality. Moreover, companies are adopting novel approaches such as optimizing catalyst regeneration techniques and focusing on green and sustainable chemistry to minimize the environmental impact associated with the production and use of these catalysts. These initiatives are aligned with the global push for cleaner production processes, positioning the HDS catalysts market for sustained growth.

Hydrodesulfurization Catalysts Market Dynamics:

Drivers:

-

Rising Demand for Clean and Sustainable Fuel Alternatives in Transportation and Power Generation Sectors

The transportation and power generation sectors are undergoing substantial transitions towards more sustainable energy solutions. With the increasing demand for cleaner fuels to reduce carbon emissions, the necessity for hydrodesulfurization catalysts is more evident. Both diesel and gasoline require processing to meet global environmental standards, and these fuels are heavily used in transportation, including vehicles, ships, and industrial machinery, all of which require low sulfur content for optimal engine performance and lower emissions. As countries invest in sustainable energy solutions and cleaner transportation technologies, the demand for low-sulfur fuels continues to rise, thus directly driving the growth of the hydrodesulfurization catalysts market. Additionally, industries are adopting cleaner fuels to meet air quality regulations, supporting the long-term demand for HDS catalysts.

-

Growing Urbanization and Industrialization in Emerging Economies Boosting Fuel Consumption and Catalyst Demand

-

Stringent Environmental Regulations Increasing Demand for Low-Sulfur Fuels and Catalysts in Refining Industries

Restraint:

-

High Capital and Operational Costs Associated with Advanced Hydrodesulfurization Catalysts Limiting Adoption in Smaller Refineries

Smaller refineries and developing markets face significant obstacles due to the high capital and operational costs of advanced hydrodesulfurization catalysts. While larger refineries can afford state-of-the-art catalysts, smaller ones often struggle to cover the substantial upfront investment and ongoing maintenance costs. Refineries in regions with limited financial resources or lower refining capacities may also find it difficult to meet strict sulfur content regulations without compromising profitability. These financial constraints could impede the broader adoption of hydrodesulfurization catalysts, especially in less economically developed regions.

Opportunity:

-

Growing Focus on Green and Sustainable Chemistry in Catalyst Development Encouraging Environmentally Friendly Solutions

-

Expanding Refining Capacities in Emerging Economies Driving Demand for Advanced Hydrodesulfurization Solutions

As refining capacities expand in emerging economies to meet rising fuel consumption, there is a notable opportunity for the hydrodesulfurization catalysts market to grow. The increased demand for clean fuels in regions such as Asia-Pacific, the Middle East, and Latin America is pushing refiners to adopt advanced desulfurization technologies. These regions are focusing on enhancing refining infrastructure to meet global fuel quality standards, creating a fertile ground for the adoption of high-performance hydrodesulfurization catalysts. With the growing demand for ultra-low sulfur fuels in these regions, there is an opportunity for key players in the market to provide advanced catalysts that meet local regulatory and operational needs, ensuring the continued growth of the market in these emerging economies.

Challenge:

-

Difficulty in Meeting Demand for High-Performance Catalysts While Ensuring Cost-Effectiveness in the Competitive Market

A significant challenge faced by companies in the hydrodesulfurization catalysts market is the difficulty in balancing high-performance catalyst development with cost-effectiveness. While there is a growing demand for advanced catalysts that provide efficient sulfur removal, these high-performance catalysts often come with high production costs, which can make them less accessible to refineries, particularly smaller ones or those in developing regions. Refiners are constantly seeking ways to improve their refining processes while controlling costs, making it challenging for manufacturers to meet both performance and price expectations. This creates competitive pressure in the market, as companies strive to innovate and offer solutions that provide maximum efficiency without significantly increasing the financial burden on refineries.

Regulatory Influence on Technology Adoption in Hydrodesulfurization Catalysts Market

| Regulation | Region | Impact on Technology Adoption | Catalyst Response |

|---|---|---|---|

| Euro VI (EU) | Europe | Stricter sulfur emission limits for vehicles, pushing refiners to adopt advanced HDS catalysts for ultra-low sulfur diesel (ULSD) production. | Development of highly efficient catalysts like platinum-based and hybrid catalysts. |

| Tier 3 (U.S.) | United States | Enforces the reduction of sulfur in gasoline to 10 ppm, driving refiners to adopt advanced HDS technologies to meet fuel quality standards. | Adoption of next-generation catalysts with higher sulfur removal capabilities. |

| China National Standard V | China | Regulates the sulfur content in vehicle fuels, urging refiners to upgrade their technology to produce low-sulfur diesel. | Enhanced catalyst formulations and the introduction of more efficient regeneration techniques. |

| India BS-VI Standards | India | Mandates sulfur reduction in fuels to meet global environmental standards, prompting refineries to adopt cutting-edge HDS catalysts. | Increased adoption of molybdenum and nickel-based catalysts that offer higher sulfur removal at lower costs. |

| IMO 2020 Sulfur Cap | International | Limits sulfur content in marine fuels to 0.5%, requiring refineries and marine fuel producers to adopt advanced HDS catalysts for compliance. | Development of marine fuel-specific catalysts to meet stringent sulfur content regulations. |

Regulatory standards play a crucial role in driving the adoption of advanced hydrodesulfurization (HDS) technologies. Stringent sulfur content regulations like Euro VI in Europe, Tier 3 in the U.S., and BS-VI in India are compelling refiners to invest in advanced catalysts capable of reducing sulfur levels in fuels to meet emission standards. These regulations not only push for the development of more efficient catalyst formulations but also influence the market by prompting refiners to upgrade their technologies for compliance. For example, international regulations like the IMO 2020 sulfur cap have led to a significant increase in demand for specialized catalysts designed for marine fuel production, driving technological advancements in the catalyst industry. The combination of regulatory pressures and technological advancements is helping refine the global hydrodesulfurization landscape.

Hydrodesulfurization Catalysts Market Segments

By Type

The Cobalt molybdenum (CoMo) segment dominated the Hydrodesulfurization Catalysts Market in 2023, accounting for a market share of 42%. CoMo catalysts are highly effective in the removal of sulfur compounds from crude oil, particularly in diesel hydrotreating processes. They are favored for their robustness, stability, and excellent performance under the demanding conditions typical of refinery operations. The effectiveness of CoMo catalysts is further enhanced by their ability to operate efficiently at high temperatures and pressures, which are common in hydrodesulfurization units. Many large refineries in Europe and North America have adopted CoMo catalysts to comply with stringent environmental regulations aimed at reducing sulfur emissions in fuels. For instance, refineries in the U.S. have increasingly relied on CoMo catalysts to produce ultra-low sulfur diesel (ULSD) to meet Tier 3 fuel standards. Additionally, ongoing research and development efforts are focused on improving the efficiency and lifespan of CoMo catalysts, further solidifying their position as the preferred choice for many refiners in the evolving market landscape.

By Technology

The Fixed Bed segment dominated and held the largest market share in 2023, capturing 52% of the Hydrodesulfurization Catalysts Market. This technology is the most commonly used configuration in hydrodesulfurization processes, known for its simplicity, cost-effectiveness, and capacity to handle large-scale operations. Fixed bed reactors provide a continuous flow of feedstock, ensuring efficient processing while maintaining consistent catalyst activity. The fixed bed design allows for easy maintenance and replacement of catalysts, contributing to its popularity among refiners. It is particularly advantageous in petroleum refineries where substantial volumes of crude oil must be treated continuously to meet market demands for low-sulfur fuels. Fixed bed technology is extensively used in refineries across the Middle East and Asia-Pacific, where large refining capacities are prevalent. Additionally, fixed-bed reactors can be designed to optimize space and resource utilization, making them suitable for various operational environments. The reliability and established track record of fixed bed technology have reinforced its dominant position in the hydrodesulfurization market.

By Application

In 2023, the Petroleum Refining segment dominated the Hydrodesulfurization Catalysts Market with 63% of the overall revenue share. The escalating global demand for low-sulfur fuels, driven by stringent regulatory requirements and environmental concerns, has significantly boosted this segment. As refineries are tasked with producing fuels that meet increasingly stringent sulfur content limits, the need for effective hydrodesulfurization processes has grown. Petroleum refining applications encompass various stages, including diesel and gasoline hydrotreating, both of which require robust catalysts for efficient sulfur removal. For example, European refineries have implemented advanced hydrodesulfurization technologies to comply with Euro VI standards, which mandate a maximum sulfur content in fuels. Moreover, the focus on transitioning to cleaner energy sources has further intensified the need for low-sulfur fuels, positioning the petroleum refining segment as a key driver of growth in the hydrodesulfurization catalysts market. The ongoing efforts of refiners to enhance fuel quality and meet environmental regulations will continue to support the dominance of this application in the coming years.

By End-User

The Refineries segment dominated the Hydrodesulfurization Catalysts Market in 2023, holding a market share of 72%. Refineries are the primary consumers of hydrodesulfurization catalysts, driven by the increasing demand for ultra-low sulfur fuels and the necessity for compliance with stringent environmental regulations. The catalytic processes used in refining are critical for removing sulfur compounds from crude oil, particularly in diesel and gasoline production. As global fuel quality standards become more stringent, refineries are compelled to invest in advanced hydrodesulfurization technologies to achieve the required sulfur reduction. Significant investments have been made in catalyst technologies by refineries located in regions such as North America and the Middle East, where the refining capacity is substantial and regulations are rigorously enforced. For instance, U.S. refiners have adopted advanced catalysts to produce ultra-low sulfur diesel (ULSD) in compliance with Tier 3 fuel standards. The continuous push for cleaner fuels and environmental sustainability will further solidify the refineries segment's dominance in the hydrodesulfurization catalysts market, driving innovation and investment in this critical area.

Hydrodesulfurization Catalysts Market Regional Analysis

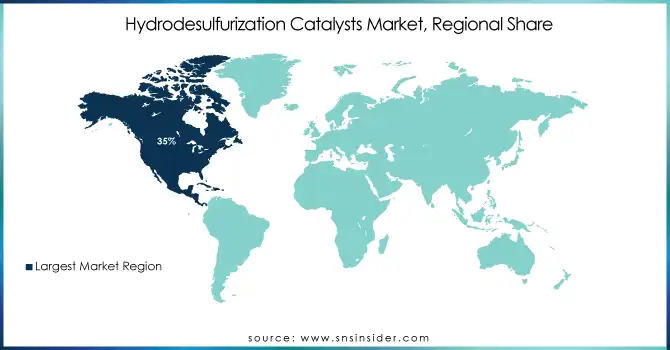

In 2023, North America dominated the Hydrodesulfurization Catalysts Market with a market share of 35%, largely due to stringent environmental regulations in the U.S. and Canada that necessitate the adoption of advanced hydrodesulfurization technologies for producing ultra-low sulfur diesel (ULSD) and gasoline. The U.S. has been a leader in implementing Tier 3 fuel standards, which impose strict sulfur content limits, thereby driving demand for effective catalysts. Refineries in the U.S. have heavily invested in state-of-the-art catalyst technologies to comply with these regulations, with significant upgrades across major facilities enhancing sulfur removal capabilities. Canada has also enacted similar regulations, bolstering the region's market leadership, while the presence of major catalyst manufacturers like Albemarle Corporation and Johnson Matthey further supports growth. The United States stands out as the leading country in this market, supported by its substantial refining capacity of approximately 18 million barrels per day, with refineries, particularly in the Gulf Coast and Midwest regions, rapidly adopting advanced technologies to meet environmental standards. Canada's regulatory framework and sizable refining industry contribute to North American dominance, while Mexico is increasingly focusing on refinery upgrades and the adoption of hydrodesulfurization catalysts to align with international low-sulfur fuel standards.

On the other hand, Asia-Pacific emerged as the fastest growing region in the Hydrodesulfurization Catalysts Market in 2023, with a CAGR of 6.5%. This growth is driven by the expanding refining capacity in countries like China, India, and Japan, along with the increasing demand for cleaner fuels to meet growing environmental regulations. China, the largest refiner in the region, is heavily investing in refining upgrades to produce low-sulfur fuels, in line with its commitment to reducing air pollution and greenhouse gas emissions. According to the China National Petroleum Corporation (CNPC), the country’s refining capacity surpassed 17 million barrels per day in 2023, leading to a substantial increase in demand for advanced hydrodesulfurization catalysts. Similarly, India, with its rapidly expanding refining sector and stringent sulfur content regulations, is witnessing robust growth in the hydrodesulfurization catalysts market. India’s refinery capacity, currently around 5.5 million barrels per day, is expected to grow significantly in the coming years, boosting the demand for sulfur removal technologies. Japan, though a smaller market compared to China and India, continues to invest in advanced catalysts for sulfur removal to meet domestic and international fuel standards. The increasing regulatory pressure in these countries, coupled with their large refining capacities, is expected to drive the continued growth of the hydrodesulfurization catalysts market in Asia-Pacific.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Albemarle Corporation (Octolig, K-Pure)

-

Axens (HySWEET, G.HDS)

-

China Petroleum & Chemical Corporation (Sichuan Refining Catalyst, HYDRODESULF)

-

Clariant AG (RDS Plus, SulfaTreat)

-

Dorf Ketal Chemicals (DorfKetal HDS Catalysts, DorfKetal Hydroprocessing Catalysts)

-

HaldorTopsoe (TK-325, TK-119)

-

Honeywell International Inc (UOP ISAL, UOP Naphtha Hydrodesulfurization Catalysts)

-

Johnson Matthey (Shincat, HDS-10)

-

JGC Catalysts and Chemicals Ltd (JGC-HDS, JGC-600)

-

Lubrizol Corporation (LZ-HDS, LZ-4200)

-

Mitsubishi Chemical Corporation (Mitsubishi HDS Catalyst, MSC-1000)

-

National Oilwell Varco (NOV Hydrodesulfurization Catalysts, NOV HDS-500)

-

Nippon Ketjen Co. Ltd (Ketjen HDS Catalyst, Ketjen UltraFine)

-

Oil & Gas Technology Ltd (OGT HDS, OGT-DS)

-

OXEA GmbH (OXEA Hydrotreating Catalysts, OXEA HDS 400)

-

PetroChina Company Limited (PC-Desulfurization Catalyst, PetroHDS)

-

Royal Dutch Shell PLC (Shell HDS Catalyst, Shell Hydrocracking Catalyst)

-

Saybolt LLC (Saybolt HDS, Saybolt Catalyst 100)

-

Sinopec Limited (Sinopec HDS Catalysts, HYDROKAT)

-

UNICAT Catalyst Technologies, LLC (UNICAT HDS, UNIDEC)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.91 Billion |

| Market Size by 2032 | US$ 4.20 Billion |

| CAGR | CAGR of 4.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Cobalt molybdenum (CoMo), Nickel based (NiMo), Palladium, Others) •By Technology (Fixed Bed, Moving Bed, Fluidized Bed) •By Application (Petroleum Refining, Diesel Hydrotreating, Gasoline Hydrotreating, Others) •By End-User (Refineries, Petrochemical Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HaldorTopsoe, Dorf Ketal Chemicals, Albemarle Corporation, China Petroleum & Chemical Corporation, Royal Dutch Shell PLC, Axens, Honeywell International Inc, Johnson Matthey, Clariant AG , UNICAT Catalyst Technologies, LLC, JGC Catalysts and Chemicals Ltd and other key players |

| Key Drivers | •Growing Urbanization and Industrialization in Emerging Economies Boosting Fuel Consumption and Catalyst Demand •Stringent Environmental Regulations Increasing Demand for Low-Sulfur Fuels and Catalysts in Refining Industries |

| Restraints | •High Capital and Operational Costs Associated with Advanced Hydrodesulfurization Catalysts Limiting Adoption in Smaller Refineries |