Get More Information on Hydraulic Fracturing Market - Request Sample Report

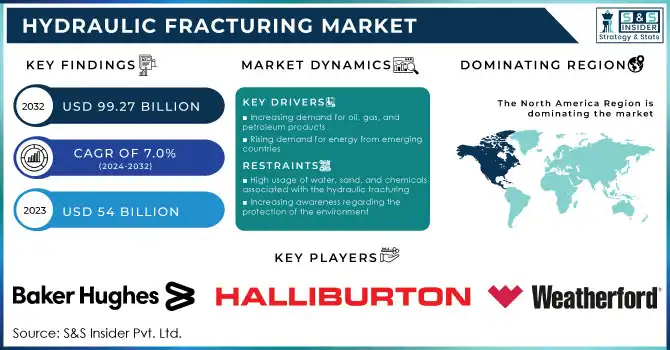

The Hydraulic Fracturing Market size was valued at USD 54 Billion in 2023 and is projected to reach USD 99.27 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2032.

Hydraulic fracturing, also known as fracking, is a process used to extract natural gas and oil from shale rock formations deep underground. This technique involves injecting a mixture of water, sand, and chemicals at high pressure into the rock, causing it to fracture and release the trapped gas or oil.

The Hydraulic Fracturing Market is a rapidly growing industry. Despite its potential benefits, hydraulic fracturing has been a controversial topic due to concerns about its environmental impact. Advancements in technology and regulations have made the process safer and more efficient. The chemicals used in the process can contaminate groundwater and air and the large amounts of water required can strain local water resources. However, it has the potential to increase domestic energy production, create jobs, and reduce dependence on foreign oil. The industry is heavily regulated and technological advancements have made the process safer and more efficient. The market for hydraulic fracturing is expected to continue to grow as the demand for natural gas and oil increases. This growth is driven by factors such as population growth, urbanization, and industrialization.

Drivers

Increasing demand for oil, gas, and petroleum products

Rising demand for energy from emerging countries

As the global population continues to expand, the demand for energy to power homes, businesses, and industries also increases. Hydraulic fracturing has emerged as a promising solution to meet this demand, as it enables the extraction of oil and gas from previously unreachable sources. This factor has propelled the growth of the hydraulic fracturing market. The benefits of hydraulic fracturing are numerous. It has reduced the dependence on foreign oil and gas, created jobs, and lowered energy costs for consumers. Additionally, it has enabled the United States to become a net exporter of energy, boosting the economy and enhancing national security.

Growing shale gas production and exploration activities

Restrain

High usage of water, sand, and chemicals associated with the hydraulic fracturing

Increasing awareness regarding the protection of the environment

Opportunities

Technological advancement made hydraulic fracturing more efficient and cost-effective

Growing demand for natural gas as a cleaner alternative to traditional fossil fuels

Challenges

Stringent rules and regulations imposed by the government to reduce the environmental impact

Potential Impact on the environment due to the hydraulic fracturing process

Hydraulic fracturing can contaminate groundwater and contribute to air pollution, among other issues. As a result, the hydraulic fracturing market is facing increasing scrutiny and regulation. As such, it is important for companies in the industry must adhere to strict environmental standards and invest in new technologies to minimize their impact on the environment. This has led to higher costs and decreased profitability for some companies.

The COVID-19 pandemic affected the hydraulic fracturing market negatively. The global economic slowdown, which was caused by the pandemic, has resulted in a decrease in the demand for oil and gas. This decline in demand has led to a reduction in hydraulic fracturing activity. In 2020, Europe experienced a 7% decline in the demand for oil and gas, while global natural gas consumption dropped by 4%. All regions have been affected, with mature markets across Europe, North America, Asia, and Eurasia accounting for approximately 75% of lost gas consumption in 2020. The impact of this decline in demand has been felt throughout the industry, with companies experiencing financial difficulties and job losses. The pandemic has also disrupted supply chains, causing delays in the delivery of equipment and materials needed for hydraulic fracturing operations. This has led to increased costs and further slowed down activity in the market.

The Russian invasion of Ukraine affected the oil industry, resulting in a surge in oil prices. This, in turn, has led to a decrease in the demand for hydraulic fracturing, making it less cost-effective. As a result, the number of hydraulic fracturing projects has decreased, causing a negative impact on the industry. According to the World Economic Forum, the conflict between Russia and Ukraine has caused oil prices to remain above $100/barrel. Moreover, this war has resulted in a significant decrease in the availability of equipment and supplies required for hydraulic fracturing. Many of the companies that supply equipment and supplies for hydraulic fracturing are based in Russia or Ukraine, and the conflict has disrupted their operations. This has led to delays in the delivery of equipment and supplies, further impacting the industry.

Impact of Recession

The recession has caused a decrease in demand for energy, which has had a significant impact on the hydraulic fracturing market. As a result, companies operating in this industry have experienced a decline in revenue. Additionally, the economic downturn has led to a decrease in investment in hydraulic fracturing. Many investors have become more risk-averse and are hesitant to invest in this industry due to the uncertain economic climate. More insights into the impact of the recession on the hydraulic fracturing market in comprised in the final report.

By Well Type

Horizontal Well

Vertical Well

By Technology

Sliding Sleeve

Plug & Perf

By Application

Onshore

Offshore

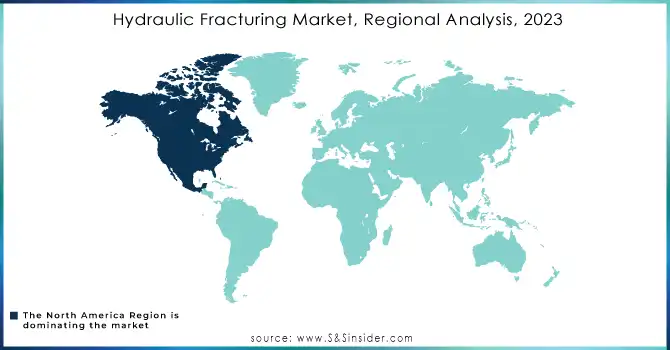

North America dominated the hydraulic fracturing market and is expected to grow with a significant CAGR during the forecast period. North America's dominance in the hydraulic fracturing market is attributed to the region's abundant shale reserves, advanced drilling technologies, and favorable regulatory environment. The United States contributes majorly to the growth of the North America region. The United States has an abundance of shale gas reserves, which are extracted using hydraulic fracturing with horizontal drilling techniques. This process is particularly effective for accessing ultra-hard shale deposits located deep underground throughout the country. In fact, natural gas production in the U.S. increased by 4% (4.9 billion cubic feet per day [Bcf/d]) in 2022, with an average of 119 Bcf/d. The Appalachian, Permian, and Haynesville regions were responsible for 60% of all U.S. production in 2022, a proportion similar to that of the previous year. These production and exploration activities are driving significant growth in the hydraulic fracturing market. Furthermore, the increasing demand for energy and the need for cost-effective extraction methods have also contributed to the growth of the hydraulic fracturing market in North America. As a result, the region has become a hub for hydraulic fracturing, attracting investors and companies from around the world.

Need any customization research on Hydraulic Fracturing Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The major players are Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, U.S. Well Services, Trican Well Services Ltd., Basic Energy Services, Propetro Holding Corp., RockPile Energy Services, FTS International, and other players

In April of 2023, Halliburton Company made an announcement regarding the implementation of their Auto Pumpdown™ service within their hydraulic fracturing business. This innovative service allows for wireline and pump automation during unconventional completion operations, revolutionizing the industry.

In September of 2022, Trican Well Service Ltd. announced its commitment to expanding its fleet of next-generation, low-emissions fracturing equipment. They plan to upgrade their fourth set of existing pumping equipment with CAT Tier 4 dynamic gas blending engines, further solidifying their position as a leader in the industry.

In December of 2022, ProPetro Holding Corp. announced a significant contract with a leading independent Permian operator for the use of their first electric-powered hydraulic fracturing fleet, known as the "e-fleet." This exciting development marks a major step forward in the industry's efforts to reduce emissions and promote sustainability. Under this agreement, ProPetro has committed to providing services for a period of three years after the delivery of the e-fleet.

| Report Attributes | Details |

| Market Size in 2023 | US$ 54.0 Bn |

| Market Size by 2032 | US$ 99.27 Bn |

| CAGR | CAGR of 7.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Well Type (Horizontal Well and Vertical Well) • By Technology (Sliding Sleeve and Plug & Perf) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, U.S. Well Services, Trican Well Services Ltd., Basic Energy Services, Propetro Holding Corp., RockPile Energy Services, FTS International |

| Key Drivers | • Increasing demand for oil, gas, and petroleum products • Rising demand for energy from emerging countries |

| Market Opportunities | • Technological advancement made hydraulic fracturing more efficient and cost-effective • Growing demand for natural gas as a cleaner alternative to traditional fossil fuels |

Ans: The expected CAGR of the global Hydraulic Fracturing Market during the forecast period is 7.0%.

Ans: The market size of the Hydraulic Fracturing Market is USD 54.0 billion in 2023.

Ans: The major key players in the Hydraulic Fracturing Market are Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, U.S. Well Services, Trican Well Services Ltd., Basic Energy Services, Propetro Holding Corp., RockPile Energy Services, FTS International.

Ans: North America region dominated the Hydraulic Fracturing Market.

Ans: Increasing demand for oil, gas, and petroleum products, rising demand for energy from developing economies, and growing shale gas production and exploration activities are the driving factors of the Hydraulic Fracturing Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Hydraulic Fracturing Market Segmentation, By Well Type

8.1 Horizontal Well

8.2 Vertical Well

9. Hydraulic Fracturing Market Segmentation, By Technology

9.1 Sliding Sleeve

9.2 Plug & Perf

10. Hydraulic Fracturing Market Segmentation, By Application

10.1 Onshore

10.2 Offshore

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Hydraulic Fracturing Market by Country

11.2.2North America Hydraulic Fracturing Market by Well Type

11.2.3 North America Hydraulic Fracturing Market by Technology

11.2.4 North America Hydraulic Fracturing Market by Application

11.2.5 USA

11.2.5.1 USA Hydraulic Fracturing Market by Well Type

11.2.5.2 USA Hydraulic Fracturing Market by Technology

11.2.5.3 USA Hydraulic Fracturing Market by Application

11.2.6 Canada

11.2.6.1 Canada Hydraulic Fracturing Market by Well Type

11.2.6.2 Canada Hydraulic Fracturing Market by Technology

11.2.6.3 Canada Hydraulic Fracturing Market by Application

11.2.7 Mexico

11.2.7.1 Mexico Hydraulic Fracturing Market by Well Type

11.2.7.2 Mexico Hydraulic Fracturing Market by Technology

11.2.7.3 Mexico Hydraulic Fracturing Market by Application

11.3 Europe

11.3.1 Europe Hydraulic Fracturing Market by Country

11.3.2 Europe Hydraulic Fracturing Market by Well Type

11.3.3 Europe Hydraulic Fracturing Market by Technology

11.3.4Europe Hydraulic Fracturing Market by Application

11.3.5Germany

11.3.5.1 Germany Hydraulic Fracturing Market by Well Type

11.3.5.2 Germany Hydraulic Fracturing Market by Technology

11.3.5.3 Germany Hydraulic Fracturing Market by Application

11.3.6 UK

11.3.6.1 UK Hydraulic Fracturing Market by Well Type

11.3.6.2 UK Hydraulic Fracturing Market by Technology

11.3.6.3 UK Hydraulic Fracturing Market by Application

11.3.7 France

11.3.7.1 France Hydraulic Fracturing Market by Well Type

11.3.7.2 France Hydraulic Fracturing Market by Technology

11.3.7.3 France Hydraulic Fracturing Market by Application

11.3.8 Italy

11.3.8.1 Italy Hydraulic Fracturing Market by Well Type

11.3.8.2 Italy Hydraulic Fracturing Market by Technology

11.3.8.3 Italy Hydraulic Fracturing Market by Application

11.3.9 Spain

11.3.9.1 Spain Hydraulic Fracturing Market by Well Type

11.3.9.2 Spain Hydraulic Fracturing Market by Technology

11.3.9.3 Spain Hydraulic Fracturing Market by Application

11.3.10 The Netherlands

11.3.10.1 Netherlands Hydraulic Fracturing Market by Well Type

11.3.10.2 Netherlands Hydraulic Fracturing Market by Technology

11.3.10.3 Netherlands Hydraulic Fracturing Market by Application

11.3.11 Rest of Europe

11.3.11.1 Rest of Europe Hydraulic Fracturing Market by Well Type

11.3.11.2 Rest of Europe Hydraulic Fracturing Market by Technology

11.3.11.3 Rest of Europe Hydraulic Fracturing Market by Application

11.4 Asia-Pacific

11.4.1 Asia Pacific Hydraulic Fracturing Market by Country

11.4.2Asia Pacific Hydraulic Fracturing Market by Well Type

11.4.3 Asia Pacific Hydraulic Fracturing Market by Technology

11.4.4 Asia Pacific Hydraulic Fracturing Market by Application

11.4.5 Japan

11.4.5.1 Japan Hydraulic Fracturing Market by Well Type

11.4.5. 2Japan Hydraulic Fracturing Market by Technology

11.4.5. 3Japan Hydraulic Fracturing Market by Application

11.4.6 South Korea

11.4.6.1 South Korea Hydraulic Fracturing Market by Well Type

11.4.6.2. South Korea Hydraulic Fracturing Market by Technology

11.4.6.3. South Korea Hydraulic Fracturing Market by Application

11.4.7China

11.4.7.1 China Hydraulic Fracturing Market by Well Type

11.4.7.2. China Hydraulic Fracturing Market by Technology

11.4.7.3. China Hydraulic Fracturing Market by Application

11.4.8 India

11.4.8.1 India Hydraulic Fracturing Market by Well Type

11.4.8.2. India Hydraulic Fracturing Market by Technology

11.4.8.3 India Hydraulic Fracturing Market by Application

11.4.9Australia

11.4.8.1 Australia Hydraulic Fracturing Market by Well Type

11.4.8.2. Australia Hydraulic Fracturing Market by Technology

11.4.8.3. Australia Hydraulic Fracturing Market by Application

11.4.10Rest of Asia-Pacific

11.4.10.1 APAC Hydraulic Fracturing Market by Well Type

11.4.10.2. APAC Hydraulic Fracturing Market by Technology

11.4.10.3. APAC Hydraulic Fracturing Market by Application

11.5 The Middle East & Africa

11.5.1 The Middle East & Africa Hydraulic Fracturing Market by Country

11.5.2 The Middle East & Africa Hydraulic Fracturing Market by Well Type

11.5.3The Middle East & Africa Hydraulic Fracturing Market by Technology

11.5.4The Middle East & Africa Hydraulic Fracturing Market by Application

11.5.5Israel

11.5.5.1 Israel Hydraulic Fracturing Market by Well Type

11.5.5.2 Israel Hydraulic Fracturing Market by Technology

11.5.5.3 Israel Hydraulic Fracturing Market by Application

11.5.6 UAE

11.5.6.1 UAE Hydraulic Fracturing Market by Well Type

11.5.6.2 Israel Hydraulic Fracturing Market by Technology

11.5.6.3 Israel Hydraulic Fracturing Market by Application

11.5.7South Africa

11.5.7.1 South Africa Hydraulic Fracturing Market by Well Type

11.5.7.2 South Africa Hydraulic Fracturing Market by Technology

11.5.7.3 South Africa Hydraulic Fracturing Market by Application

11.5.8 Rest of Middle East & Africa

11.5.8.1 Rest of Middle East & Asia Hydraulic Fracturing Market by Well Type

11.5.8.2 Rest of Middle East & Asia Hydraulic Fracturing Market by Technology

11.5.8.3 Rest of Middle East & Asia Hydraulic Fracturing Market by Application

11.6 Latin America

11.6.1 Latin America Hydraulic Fracturing Market by Country

11.6.2. Latin America Hydraulic Fracturing Market by Well Type

11.6.3 Latin America Hydraulic Fracturing Market by Technology

11.6.4 Latin America Hydraulic Fracturing Market by Application

11.6.5 Brazil

11.6.5.1 Brazil Hydraulic Fracturing Market by Well Type

11.6.5.2 Brazil Hydraulic Fracturing Market by Technology

11.6.5.3Brazil Hydraulic Fracturing Market by Application

11.6.6Argentina

11.6.6.1 Argentina Hydraulic Fracturing Market by Well Type

11.6.6.2 Argentina Hydraulic Fracturing Market by Technology

11.6.6.3 Argentina Hydraulic Fracturing Market by Application

11.6.7Rest of Latin America

11.6.7.1 Rest of Latin America Hydraulic Fracturing Market by Well Type

11.6.7.2 Rest of Latin America Hydraulic Fracturing Market by Technology

11.6.7.3Rest of Latin America Hydraulic Fracturing Market by Application

12. Company Profile

12.1 Baker Hughes Company

12.1.1 Market Overview

12.1.2 Financials

12.1.3 Product/Services/Offerings

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Halliburton

12.2.1 Market Overview

12.2.2 Financials

12.2.3 Product/Services/Offerings

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Schlumberger Limited

12.3.1 Market Overview

12.3.2 Financials

12.3.3 Product/Services/Offerings

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Weatherford

12.4.1 Market Overview

12.4.2 Financials

12.4.3 Product/Services/Offerings

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Superior Energy Services

12.5.1 Market Overview

12.5.2 Financials

12.5.3 Product/Services/Offerings

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 U.S. Well Services

12.6.1 Market Overview

12.6.2 Financials

12.6.3 Product/Services/Offerings

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Trican Well Services Ltd.

12.7.1 Market Overview

12.7.2 Financials

12.7.3 Product/Services/Offerings

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Basic Energy Services

12.8.1 Market Overview

12.8.2 Financials

12.8.3 Product/Services/Offerings

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 ProPetro Holding Corp

12.9.1 Market Overview

12.9.2 Financials

12.9.3 Product/Services/Offerings

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 RockPile Energy Services

12.10.1 Market Overview

12.10.2 Financials

12.10.3 Product/Services/Offerings

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 FTS International

12.11.1 Market Overview

12.11.2 Financials

12.11.3 Product/Services/Offerings

12.11.4 SWOT Analysis

12.11.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Oil Storage Market size was valued at 1649.6 MCM in 2022 and is expected to grow to 2435.3 MCM by 2030 and grow at a CAGR of 4.99 % over the forecast period of 2023-2030.

The Energy Harvesting System Market size was valued at USD 638.86 million in 2023 and is expected to grow to USD 1442.32 million by 2032 and grow at a CAGR of 9.47% over the forecast period of 2024-2032.

The Bioenergy Market size was valued at USD 124.32 billion in 2023 and is expected to grow to USD 228.41 billion by 2031 and grow at a CAGR of 7.9 % over the forecast period of 2024-2031.

The Hydrogen Storage Tanks and Transportation Market size was valued at USD 0.2 Billion in 2023 and is expected to grow to USD 6.0 Billion by 2031 with an emerging CAGR of 53% over the forecast period of 2024-2031.

The Recloser Market size was valued at USD 1.1 billion in 2022 and is expected to grow to USD 1.67 billion by 2030 and grow at a CAGR of 5.3% over the forecast period of 2023-2030.

The Distributed Control Systems Market size was valued at USD 19.45 Billion in 2023. It is expected to grow to USD 33.04 Billion by 2032 and grow at a CAGR of 6.07% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone