Get More Information on Hybrid Sealants and Adhesives Market - Request Sample Report

The Hybrid Sealants and Adhesives Market Size was valued at USD 8.10 billion in 2023 and is expected to reach USD 15.81 billion by 2032 and grow at a CAGR of 8.86% over the forecast period 2024-2032.

Hybrid Sealants & Hybrid Adhesives have gained popularity in recent years due to their ability to suit specific application performance criteria. Physical and chemical mixes of resins such as epoxy, acrylic, silyl-modified polyether, silyl-modified urethane, and urethanes make up these adhesives and sealants. They are chosen over traditional adhesives and sealants because of their superior adhesion and sealing abilities, remarkable mechanical and electrical insulating qualities, and chemical and heat tolerance.

The hybrid sealants and adhesives market is expanding significantly because there is a growing need for sophisticated bonding solutions with better performance attributes. The features of various chemistries, such as silicone, polyurethane, and acrylic, are combined to create hybrid sealants and adhesives, which have improved flexibility, durability, and resistance to environmental conditions.

Moreover, Ongoing research and development efforts are leading to the introduction of new and improved hybrid formulations. Innovations such as low-VOC and eco-friendly products are gaining traction, aligning with global sustainability trends.

For instance, in 2023, 3M Company introduced a new line of low-VOC hybrid adhesives designed for automotive and construction applications. This new line aligns with 3M's commitment to sustainability and innovation.

Furthermore, hybrid sealants and adhesives combine strength, flexibility, and resistance to chemicals and weathering and are appropriate for various demanding applications. Their attractiveness is increased in the aerospace, automotive, and construction sectors by their capacity to fuse disparate materials together. All these factors drive market growth.

Market Dynamics

Drivers

Enhanced longevity and durability drive the market growth.

In comparison to conventional sealants and adhesives, hybrid sealants and adhesives are intended to provide greater longevity and durability. Because of their longer lifespan, they require less maintenance and replacements over time, which saves money in the long run. These cutting-edge solutions especially help the construction and automobile industries, where long-lasting performance is critical.

The aggressive environmental elements that can break down conventional sealants and adhesives, such as UV rays, extremely high or low temperatures, and chemical exposure, are not tolerated by hybrid sealants and adhesives. The longevity of hybrid products is greatly increased as a result of their durability. In the building business, for instance, a hybrid sealant might last up to 20 years, minimizing maintenance costs and downtime, whereas a normal silicone sealant may need to be replaced every 5 to 10 years.

Under the Sikaflex® trademark, Sika AG, a pioneer in specialty chemicals worldwide, has created a variety of hybrid sealants and adhesives. These goods are made to last a long time and perform well over time. For instance, in 2023 Sika AG, reported, that their hybrid adhesives used in the automobile industry have helped their clients save up to 25% on maintenance expenses. This decrease is explained by the longer lifespan and lower failure rates of hybrid products in comparison to adhesives with a traditional composition.

Enhanced aesthetic and functional properties have driven the hybrid sealants and adhesives market.

Increasing demand for lightweight materials has driven the hybrid sealants and adhesives market.

Restrain

Technical challenges in application and formulation may hinder market growth.

It can be technically difficult to develop hybrid sealants and adhesives that satisfy particular performance requirements. Extensive research and development are needed to combine several chemistries to produce the desired qualities, which can be expensive and time-consuming. Moreover, adhesion strength, flexibility, curing time, and resistance to external influences are only a few of the attributes that hybrid goods must manage. It is technically difficult to achieve this equilibrium and calls for exact formulation methods. These formulas' complexity may result in lengthier development timeframes and increased production costs. This all may hamper the market growth.

By Resin

MS Polymer Hybrid resin segment held the largest market share around 38.76%in 2023. This segment is increase because of its low volatile organic compound emissions and excellent adhesion, flexibility, and durability. The market for MS Polymer hybrids is primarily being driven by the expansion of the construction industry, developments in the automobile sector, and an emphasis on sustainability. Leading businesses in this sector, including Sika AG, Henkel, and Bostik, are constantly inventing and diversifying their product lines to satisfy the changing demands of their clientele. The expansion of the construction industry, particularly in emerging markets, is driving the demand for MS Polymer hybrid sealants and adhesives. The need for durable and flexible bonding solutions in building and infrastructure projects is a significant growth driver.

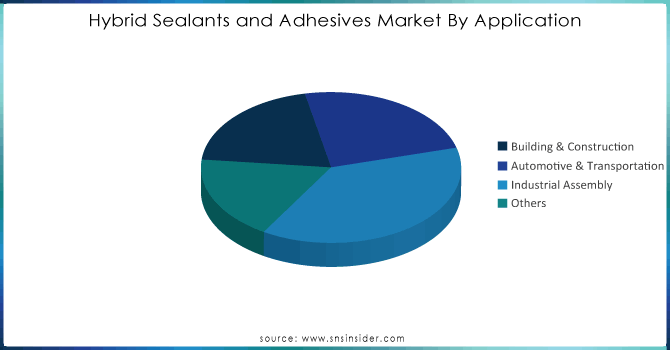

By Application

The Automotive & Transportation segment held the largest market share around 40.87% in the application segment in 2023. In the automotive sector, adhesive longevity is essential to guaranteeing the longevity and safety of automobiles. Applications for hybrid adhesives include joining trim pieces, sealing windshields, and bonding structural elements. According to a study conducted by the European Adhesive Bonding Association, bonded joints' lifespan can be up to 30% longer when hybrid adhesives are used in car assembly as opposed to regular adhesives. For automakers, this lifespan means fewer recalls and warranty claims in addition to higher consumer satisfaction.

Get Customized Report as per Your Business Requirement - Request For Customized Report

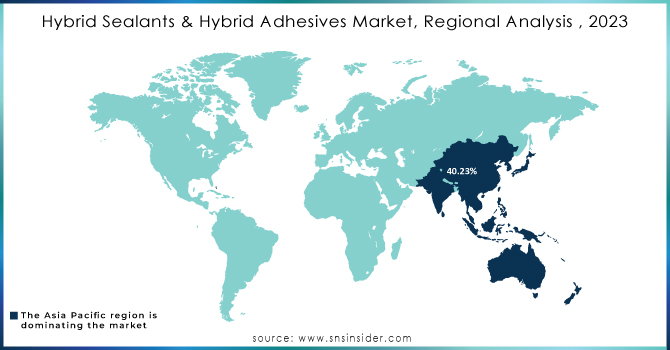

Regional Analysis

Asia Pacific dominated the market and held the largest market share approx. 40.23% in 2023. Due to increased industrialization and construction activity in the region, Asia-Pacific currently dominates the hybrid adhesive & sealant market and is expected to grow at the fastest rate during the forecast period. This might be ascribed to the increased usage of hybrid adhesives and sealants over silylated polymers for acoustic ceiling panels, window frames, decorative films, prefinished panels ceramic tile installation, and other applications due to their improved mechanical qualities and UV resistance. The region's prosperity is being supplemented by the rising hospitality sector, which includes the construction of hotels and healthcare centers. Furthermore, the expanding usage of technologically improved adhesives with greater durability and resistance in the growing automotive sectors, from structural bonding to assembly of electronic components, is a factor.

The company has been concentrating on growing its market share in the Asia-Pacific area, which is a significant area of growth for adhesives and hybrid sealants. To meet the growing demand in the area, For instance, Sika stated in 2023 that a new manufacturing site will open in China. Additionally, the business is putting sustainability first by creating environmentally friendly goods.

Bostik, Sika AG, Henkel AG & Co., KGaA, Illinois Tool Works Incorporation, Kisling AG, Soudal, H.B. Fuller, Wacker Chemie AG, Tremco illbruck GmbH & Co., 3M Company, and others.

Recent Development:

In 2023, Wacker Chemie AG the company introduced a new series of hybrid sealants designed for high-performance applications in the construction and automotive industries. Wacker Chemie is also investing in sustainable manufacturing practices.

In 2023, Henkel launched a new range of Loctite hybrid adhesives featuring advanced formulations that provide superior adhesion and flexibility. These products are designed for demanding applications in automotive and industrial settings.

In 2022, Henkel acquired a leading manufacturer of hybrid sealants, enhancing its product offerings and market reach. The company is also investing in R&D to develop next-generation hybrid adhesives with improved performance characteristics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.10 Billion |

| Market Size by 2032 | US$ 15.81Billion |

| CAGR | CAGR of 8.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin (MS Polymer Hybrid, Epoxy-Polyurethane Epoxy-cyanoacrylate, Others) • By Application (Building & Construction, Automotive & Transportation, Industrial Assembly, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bostik, Sika AG, Henkel AG & Co. KGaA, Illinois Tool Works Incorporation, Kisling AG, Soudal, H.B. Fuller, Wacker Chemie AG, Tremco illbruck GmbH & Co. KG, 3M Company, and others. |

| DRIVERS | • Enhanced aesthetic and functional properties have driven the hybrid sealants and adhesives market. • Increasing demand for lightweight materials has driven the hybrid sealants and adhesives market. |

| RESTRAINTS | •Technical challenges in application and formulation may hinder market growth. |

Ans: Manufacturers, Consultants, aftermarket players, associations, research institutes, private and universities libraries, suppliers, and distributors of the product.

Ans: Drivers, Restraints, Opportunity, Challenges.

Ans: Key Stakeholders Considered in the study:

Raw material vendors

Distributors/traders/wholesalers/suppliers

Regulatory authorities, including government agencies and NGO

Commercial research & development (R&D) institutions

Importers and exporters

Government organizations, research organizations, and consulting firms

Trade/Industrial associations

End-use industries are the stake holder of this report

Ans: Enhanced aesthetic and functional properties have driven the hybrid sealants and adhesives market.

Ans: The worldwide Hybrid Adhesives & Hybrid Sealants market is predicted to increase at a CAGR of 8.86% from 2024 to 2032

Ans: The worldwide Hybrid Adhesives & Hybrid Sealants market is from USD 8.10 billion in 2023 to USD 15.81 billion in 2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Hybrid Sealants and Adhesives Market Segmentation, by Resin

7.1 Introduction

7.2 MS Polymer Hybrid

7.3 Epoxy-Polyurethane

7.4 Epoxy-cyanoacrylate

7.5 Others

8. Hybrid Sealants and Adhesives Market Segmentation, by Application

8.1 Introduction

8.2 Building & Construction

8.3 Automotive & Transportation

8.4 Industrial Assembly

8.5 Others

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Hybrid Sealants and Adhesives Market by Country

9.2.3 North America Hybrid Sealants and Adhesives Market by Resin

9.2.4 North America Hybrid Sealants and Adhesives Market by Application

9.2.5 USA

9.2.5.1 USA Hybrid Sealants and Adhesives Market by Resin

9.2.5.2 USA Hybrid Sealants and Adhesives Market by Application

9.2.6 Canada

9.2.6.1 Canada Hybrid Sealants and Adhesives Market by Resin

9.2.6.2 Canada Hybrid Sealants and Adhesives Market by Application

9.2.7 Mexico

9.2.7.1 Mexico Hybrid Sealants and Adhesives Market by Resin

9.2.7.2 Mexico Hybrid Sealants and Adhesives Market by Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Hybrid Sealants and Adhesives Market by Country

9.3.2.2 Eastern Europe Hybrid Sealants and Adhesives Market by Resin

9.3.2.3 Eastern Europe Hybrid Sealants and Adhesives Market by Application

9.3.2.4 Poland

9.3.2.4.1 Poland Hybrid Sealants and Adhesives Market by Resin

9.3.2.4.2 Poland Hybrid Sealants and Adhesives Market by Application

9.3.2.5 Romania

9.3.2.5.1 Romania Hybrid Sealants and Adhesives Market by Resin

9.3.2.5.2 Romania Hybrid Sealants and Adhesives Market by Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Hybrid Sealants and Adhesives Market by Resin

9.3.2.6.2 Hungary Hybrid Sealants and Adhesives Market by Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Hybrid Sealants and Adhesives Market by Resin

9.3.2.7.2 Turkey Hybrid Sealants and Adhesives Market by Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Hybrid Sealants and Adhesives Market by Resin

9.3.2.8.2 Rest of Eastern Europe Hybrid Sealants and Adhesives Market by Application

9.3.3 Western Europe

9.3.3.1 Western Europe Hybrid Sealants and Adhesives Market by Country

9.3.3.2 Western Europe Hybrid Sealants and Adhesives Market by Resin

9.3.3.3 Western Europe Hybrid Sealants and Adhesives Market by Application

9.3.3.4 Germany

9.3.3.4.1 Germany Hybrid Sealants and Adhesives Market by Resin

9.3.3.4.2 Germany Hybrid Sealants and Adhesives Market by Application

9.3.3.5 France

9.3.3.5.1 France Hybrid Sealants and Adhesives Market by Resin

9.3.3.5.2 France Hybrid Sealants and Adhesives Market by Application

9.3.3.6 UK

9.3.3.6.1 UK Hybrid Sealants and Adhesives Market by Resin

9.3.3.6.2 UK Hybrid Sealants and Adhesives Market by Application

9.3.3.7 Italy

9.3.3.7.1 Italy Hybrid Sealants and Adhesives Market by Resin

9.3.3.7.2 Italy Hybrid Sealants and Adhesives Market by Application

9.3.3.8 Spain

9.3.3.8.1 Spain Hybrid Sealants and Adhesives Market by Resin

9.3.3.8.2 Spain Hybrid Sealants and Adhesives Market by Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Hybrid Sealants and Adhesives Market by Resin

9.3.3.9.2 Netherlands Hybrid Sealants and Adhesives Market by Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Hybrid Sealants and Adhesives Market by Resin

9.3.3.10.2 Switzerland Hybrid Sealants and Adhesives Market by Application

9.3.3.11 Austria

9.3.3.11.1 Austria Hybrid Sealants and Adhesives Market by Resin

9.3.3.11.2 Austria Hybrid Sealants and Adhesives Market by Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Hybrid Sealants and Adhesives Market by Resin

9.3.2.12.2 Rest of Western Europe Hybrid Sealants and Adhesives Market by Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Hybrid Sealants and Adhesives Market by Country

9.4.3 Asia Pacific Hybrid Sealants and Adhesives Market by Resin

9.4.4 Asia Pacific Hybrid Sealants and Adhesives Market by Application

9.4.5 China

9.4.5.1 China Hybrid Sealants and Adhesives Market by Resin

9.4.5.2 China Hybrid Sealants and Adhesives Market by Application

9.4.6 India

9.4.6.1 India Hybrid Sealants and Adhesives Market by Resin

9.4.6.2 India Hybrid Sealants and Adhesives Market by Application

9.4.7 Japan

9.4.7.1 Japan Hybrid Sealants and Adhesives Market by Resin

9.4.7.2 Japan Hybrid Sealants and Adhesives Market by Application

9.4.8 South Korea

9.4.8.1 South Korea Hybrid Sealants and Adhesives Market by Resin

9.4.8.2 South Korea Hybrid Sealants and Adhesives Market by Application

9.4.9 Vietnam

9.4.9.1 Vietnam Hybrid Sealants and Adhesives Market by Resin

9.4.9.2 Vietnam Hybrid Sealants and Adhesives Market by Application

9.4.10 Singapore

9.4.10.1 Singapore Hybrid Sealants and Adhesives Market by Resin

9.4.10.2 Singapore Hybrid Sealants and Adhesives Market by Application

9.4.11 Australia

9.4.11.1 Australia Hybrid Sealants and Adhesives Market by Resin

9.4.11.2 Australia Hybrid Sealants and Adhesives Market by Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Hybrid Sealants and Adhesives Market by Resin

9.4.12.2 Rest of Asia-Pacific Hybrid Sealants and Adhesives Market by Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Hybrid Sealants and Adhesives Market by Country

9.5.2.2 Middle East Hybrid Sealants and Adhesives Market by Resin

9.5.2.3 Middle East Hybrid Sealants and Adhesives Market by Application

9.5.2.4 UAE

9.5.2.4.1 UAE Hybrid Sealants and Adhesives Market by Resin

9.5.2.4.2 UAE Hybrid Sealants and Adhesives Market by Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Hybrid Sealants and Adhesives Market by Resin

9.5.2.5.2 Egypt Hybrid Sealants and Adhesives Market by Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Hybrid Sealants and Adhesives Market by Resin

9.5.2.6.2 Saudi Arabia Hybrid Sealants and Adhesives Market by Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Hybrid Sealants and Adhesives Market by Resin

9.5.2.7.2 Qatar Hybrid Sealants and Adhesives Market by Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Hybrid Sealants and Adhesives Market by Resin

9.5.2.8.2 Rest of Middle East Hybrid Sealants and Adhesives Market by Application

9.5.3 Africa

9.5.3.1 Africa Hybrid Sealants and Adhesives Market by Country

9.5.3.2 Africa Hybrid Sealants and Adhesives Market by Resin

9.5.3.3 Africa Hybrid Sealants and Adhesives Market by Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Hybrid Sealants and Adhesives Market by Resin

9.5.2.4.2 Nigeria Hybrid Sealants and Adhesives Market by Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Hybrid Sealants and Adhesives Market by Resin

9.5.2.5.2 South Africa Hybrid Sealants and Adhesives Market by Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Hybrid Sealants and Adhesives Market by Resin

9.5.2.6.2 Rest of Africa Hybrid Sealants and Adhesives Market by Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Hybrid Sealants and Adhesives Market by Country

9.6.3 Latin America Hybrid Sealants and Adhesives Market by Resin

9.6.4 Latin America Hybrid Sealants and Adhesives Market by Application

9.6.5 Brazil

9.6.5.1 Brazil Hybrid Sealants and Adhesives Market by Resin

9.6.5.2 Brazil Hybrid Sealants and Adhesives Market by Application

9.6.6 Argentina

9.6.6.1 Argentina Hybrid Sealants and Adhesives Market by Resin

9.6.6.2 Argentina Hybrid Sealants and Adhesives Market by Application

9.6.7 Colombia

9.6.7.1 Colombia Hybrid Sealants and Adhesives Market by Resin

9.6.7.2 Colombia Hybrid Sealants and Adhesives Market by Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Hybrid Sealants and Adhesives Market by Resin

9.6.8.2 Rest of Latin America Hybrid Sealants and Adhesives Market by Application

10. Company Profiles

10.1 Bostik

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Sika AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products / Services Offered

10.2.4 The SNS View

10.3 Henkel AG & Co. KGaA

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products / Services Offered

10.3.4 The SNS View

10.4 3M Company

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products / Services Offered

10.4.4 The SNS View

10.5 Tremco illbruck GmbH & Co. KG.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products / Services Offered

10.5.4 The SNS View

10.6 Illinois Tool Works Incorporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products / Services Offered

10.6.4 The SNS View

10.7 Kisling AG

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products / Services Offered

10.7.4 The SNS View

10.8 Soudal

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products / Services Offered

10.8.4 The SNS View

10.9 H.B. Fuller

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products / Services Offered

10.9.4 The SNS View

10.10 Wacker Chemie AG

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products / Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin

MS Polymer Hybrid

Epoxy-Polyurethane

Epoxy-cyanoacrylate

Others

By Application

Building & Construction

Automotive & Transportation

Industrial Assembly

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Recycled Textiles Market size was valued at USD 5.76 billion in 2023 and is expected to reach USD 8.69 billion by 2032, at a CAGR of 4.70% from 2024-2032.

The Ethanolamine Market Size was valued at USD 3.76 billion in 2023 and is expected to reach USD 5.82 billion by 2032 and grow at a CAGR of 5.70% over the forecast period 2024-2032.

The Polyurea Coatings Market Size was valued at USD 1.6 billion in 2023, and is expected to reach USD 4.7 billion by 2032, and grow at a CAGR of 12.5% over the forecast period 2024-2032.

The Medical Textile Industry Market Size was valued at USD 33.2 billion in 2023 and is expected to reach USD 48.49 billion by 2032 and grow at a CAGR of 4.30% over the forecast period 2024-2032.

The Bio-based Polycarbonate Market Size was valued at USD 70.16 Mn in 2023 and will reach USD 139.42 Mn by 2032 and grow at a CAGR of 9.11% by 2024-2032

The Industrial Wastewater Treatment Chemicals Market Size was valued at USD 15.28 billion in 2023, and is expected to reach USD 23.58 billion by 2032, and grow at a CAGR of 5.66% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone