Hybrid Composites Market Report Scope & Overview:

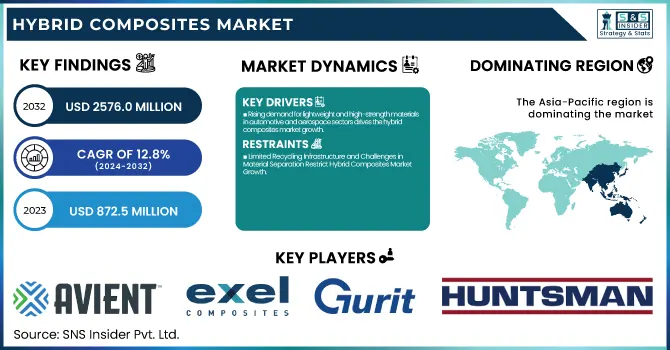

The Hybrid Composites Market Size was valued at USD 872.5 Million in 2023 and is expected to reach USD 2,576.0 Million by 2032, growing at a CAGR of 12.8% over the forecast period of 2024-2032.

To Get more information on Hybrid Composites Market - Request Free Sample Report

The hybrid composites market is growing due to increasing demand for lightweight, high-performance materials. This report covers supply chain analysis, highlighting key suppliers and production efficiencies, along with pricing analysis by cost trends. Investment and funding insights explore mergers and government support. The sustainability impact examines recyclability and regulations, while demand-supply gap analysis does its best to expose production challenges. There is also a performance comparison with other materials and a report on the customization trends in the aerospace and automotive industries.

Hybrid Composites Market Dynamics

Drivers

-

Rising demand for lightweight and high-strength materials in automotive and aerospace sectors drives the hybrid composites market growth

The increasing demand for fuel efficiency and improved performance in automotive and aerospace industries is a key factor driving the hybrid composites market. Owing to their better strength-to-weight ratios, hybrid composites are being widely adopted by manufacturers to minimize weight and improve fuel economy of vehicles which gives a reason for its market growth. Hybrid composites are used in structural components, fuselage sections and aircraft interiors to provide durability and keep them lightweight, and used in the aerospace sector. Moreover, stringent emission regulations coupled with the aforementioned benefits is paving the way for the automotive industry to move towards the use of hybrid composites in applications related to body panels, chassis, and interiors. Moreover, the market is being driven by the rising adoption rate of electric vehicles, with hybrid composites aiding not only in reducing costs for battery enclosures but also providing lightweight structural components that contribute to enhanced overall vehicle performance. As R&D progresses, hybrid composite materials innovate and broaden their uses, making such materials a practical choice for sustainable, cost-efficient performance enhancement manufacturers.

Restraints

-

Limited Recycling Infrastructure and Challenges in Material Separation Restrict Hybrid Composites Market Growth

Limited recycling facilities and material separation pose challenges for hybrid composites, however, and that needs to be addressed at a higher level. Hybrid composites have become increasingly popular in industries such as automotive and aerospace; however, their heterogeneous structure, combining multiple types of fibres and resin matrices, makes recycling a challenge when compared to conventional composites. Recycling methods vary greatly, leading to massive waste production that goes against the sustainability commitments of many sectors. Moreover, mechanical and thermal properties of hybrid composites can be diminished by the recycling process, resulting in a reduced performance when used in secondary applications. Moreover, the lack of recycling rules makes it more difficult for manufacturers to find affordable disposal solutions that align with the environment. In order to get around this limitation, new automotive composites need to achieve significant developments in optimising the recycling systems, such as mechanical and chemical processes to enable the separation of the fibre and resin fractions. Material scientists and manufacturers must work together to ensure innovative solutions to hybrid composite's recycling challenges, as circular economy initiatives will require more investment than it is bringing at the moment.

Opportunities

-

Rising adoption of hybrid composites in the sporting goods industry presents growth potential

The increasing popularity of hybrid composites in sporting goods provides the market players with new growth opportunities. With their lightweight and high strength, hybrid composites are increasingly being used for the manufacture of bicycles, golf clubs, tennis rackets, and other sporting goods. High-calibre sports equipment enhancing athletes' performance boosts high-investment activities of manufactures in advanced composite materials. Further, with better impact resistance and durability than conventional materials, hybrid composites provide excellent applications in extreme sports. The growing preference among consumers for durable and lightweight sports equipment provides added impetus for using hybrid composites. Sporting goods companies have joined forces with composite manufacturers for fresh product designs resulting in improved aerodynamic performance. The growing involvement of fitness and outdoor recreational activities is expected to be a key driver for hybrid composites in the sporting goods market in the forecast period.

Challenge

-

Fluctuating raw material availability and supply chain disruptions impact hybrid composites market stability

The hybrid composites market is facing challenges such as the availability of raw materials, as the supply of essential components such as carbon fibres, aramid fibres, and specialty resins tends to be influenced by geopolitical and economic aspects. Trade restrictions, labour shortages and transportation bottlenecks, among other things that can disrupt supply chains, will see material shortages and price volatility. The reliance on specific geographies for raw material sourcing compounds supply chain risk. To overcome these limitations, manufacturers are looking for alternative fibre and resin sources; however, improving uniformity in quality and performance is still a challenge in this area. To sustain growth in the hybrid composites market, the key driver is the creation of a more resilient supply chain that will ensure upturn and stabilization in demand through diversified sourcing strategies and production capabilities locally.

Hybrid Composites Market Segmental Analysis

By Fiber Type

In 2023, the Carbon/Glass Fiber segment dominated and accounted for the largest share of approximately 49% in the hybrid composites market. Carbon and glass fibers are widely used across important sectors such as automotive, aerospace, and renewable energy, resulting in this dominance. The lightweight and high-strength property of the carbon fibers makes excellent for decreasing weight in a variety of automotive and aerospace applications. The durability of glass fibers coupled with the low cost are other few factors of gaining preference in the market. Automobile manufacturers like Ford and BMW are using carbon/glass hybrid composites to improve fuel economy in their vehicles. According to the Global Wind Energy Council the introduction of carbon and glass fibers in the composite composition of wind turbine blades improved operational efficiency, reduced maintenance costs, and this has led to the widespread use of these materials in the development of renewable energy projects.

By Resin Type

The Thermoset Resin segment dominated and accounted for a market share of around 52% in the hybrid composites market in 2023 and is expected to maintain its dominance owing to their superior mechanical properties such as chemical resistance and temperature resistance. Thermosets are specifically designed for an industrial landscape requiring their hardware to endure challenging performance conditions in both static and dynamic mode of operation, like automotive, aerospace, and wind energy. Thermoset resins offer superior structural integrity and resistance to degradation in severe service environments. For instance, thermoset composites are used in the aerospace industry for aircraft structures, where the performance and safety are critical. However, the global composites materials market report highlights that these thermoset resins remain the most common type of composites in these applications given their proven reliability and history of use in these demanding applications. It strongly positions thermoset resins to meet the consistent demand for lightweight but durable materials in applications like energy-efficient vehicles and wind turbine blades.

By End-use

In 2023, Automotive & Transportation industry dominated the hybrid composites market with the highest share of 38%. This dominance is driven by the need for lightweight materials to achieve fuel efficiency, reduce emissions, and optimize overall vehicle performance. Hybrids, which add together the strengths of carbon and glass fiber with a variety of resins, are becoming more common in vehicle components like body panels, chassis, and interiors. For instance, Volkswagen and General Motors, both automotive giants, have implemented hybrid composite materials in various models of their electric vehicles to promote weight reduction and energy efficiency. As the automotive sector focuses more on electric vehicles, the International Energy Agency reports that the application of hybrid composites has been advancing. Increasing attention towards fuel economy and eco-friendliness in automotive segment is anticipated to continue driving the hybrid composites demand in transportation.

Hybrid Composites Market Regional Analysis

In 2023, the Asia Pacific region dominated the hybrid composites market with a market share of around 34%. The dominance is primarily due to flourishing manufacturing industries within the region, the automotive, aerospace, and construction sectors. Countries such as China and India are undergoing rapid development, with a rising demand for lightweight high strength materials, contributing very prominently to the growth of hybrid composites. China is focused on developing sustainable, energy-efficient forms of transport, and this drive has resulted in the uptake of hybrid composites in electric vehicles there. Companies in the Indian automotive industry have increasingly started adopting hybrid composites to improve fuel efficiency and decrease carbon emissions. The growing wind energy sector of the region especially due to regions such as China and Japan use hybrid composites for the manufacturing of lighter and effective wind turbine blades. Asia Pacific is also witnessing the development of novel; inexpensive manufacturing processes further widens the applicability of hybrid composites across industries. As a result, the regional market is likely to grow due to rising technological and infrastructure developments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Avient Corporation (Amodel PPA, Matrix Resin)

-

Exel Composites (Carbon Fiber Reinforced Tubes, Pultruded Profiles)

-

General Electric (Ultem Resin, Thermoplastic Composite Materials)

-

Gurit Services AG (Prepreg Laminates, Structural Core Materials)

-

Hexcel Corp. (HexWeb Honeycomb, HexPly Prepregs)

-

Huntsman International LLC (Araldite Epoxy Resins, Rilsan Nylon 11)

-

Innegra Technologies, LLC (Innegra S Fibers, Innegra HPP)

-

KINECO - KAMAN (Kinecoat Coatings, Kinefiber Reinforcements)

-

LANXESS (Tepex Composite Materials, Durethan Polyamides)

-

Mitsubishi Chemical Carbon Fiber and Composites, Inc. (T700 Carbon Fiber, Olin Carbon Fiber)

-

Owens Corning (Owens Corning™ Composites, Glass Fiber Reinforcements)

-

PlastiComp, Inc. (Long Fiber Reinforced Thermoplastics, Compounds)

-

Quantum Composites (QX5000, Carbon Fiber Prepregs)

-

RTP Company (Glass Fiber Reinforced Thermoplastics, Custom Compounds)

-

SABIC (Lexan Polycarbonate, ULTEM Polyetherimide)

-

SGL Carbon (Sigrafil Carbon Fibers, Sigraflex Prepregs)

-

Solvay S.A. (Cycom Prepregs, Ryton PPS)

-

Teijin Ltd. (Tenax Carbon Fiber, T-Core Composite Core Materials)

-

Toray Advanced Composites (Torayca Carbon Fiber, Prepreg Materials)

-

Textum OPCO, LLC (Textum Hybrid Composites, Prepreg Materials)

Recent Highlights

-

October 2024: Sustainable solutions from $10B Avient were showcased at Fakuma 2024, including thermoplastic elastomers with recycled-content and metallic-effect sulfone compounds. These advancements are designed to offer sustainable options for sectors such as the automotive and electronics industries.

-

June 2024: SABIC showcased its wide range of thermoplastic solutions at the Battery Show, Europe 2024, aimed at improving performance and durability in EV batteries while putting an emphasis on sustainability and lighter components in the automotive industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 872.5 Million |

| Market Size by 2032 | USD 2,576.0 Million |

| CAGR | CAGR of 12.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Fiber Type (Carbon/Glass, Aramid/Carbon, High Modulus Polypropylene (HMPP), Ultra-high Molecular Weight Polyethylene (UHMWPE), Others) •By Resin Type (Thermoset, Thermoplastic) •By End-use (Automotive & Transportation, Aerospace & Defense, Wind Energy, Marine, Sporting Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Teijin Ltd., DSM N.V., Hexcel Corp., Solvay S.A., Avient Corporation, Gurit Services AG, Mitsubishi Chemical Carbon Fiber and Composites, Inc., Owens Corning, SABIC, Toray Advanced Composites and other key players |