Get More Information on Hybrid Batteries Market - Request Sample Report

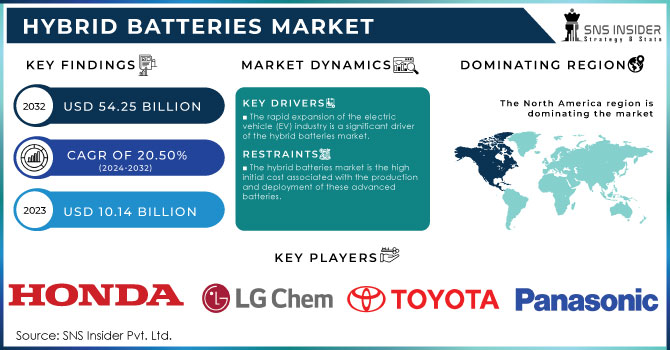

The Hybrid Batteries Market was valued at USD 10.14 Billion in 2023 and is expected to reach USD 54.25 Billion by 2032, growing at a CAGR of 20.50% over the forecast period 2024-2032.

The hybrid batteries market has emerged as a pivotal sector in the energy storage landscape, driven by the increasing demand for efficient and sustainable energy solutions. The rising demand for electric vehicles (EVs) is significantly boosting the need for hybrid batteries. In 2023, hybrid battery demand for lithium-ion reached approximately 140 kt, representing 85% of total lithium-ion demand and a 30% increase from 2022. In 2023, hybrid battery production in China, Europe, and the U.S. was 110 GWh and 70 GWh, producing 2.5 million and 1.2 million EVs, respectively. In August 2023, the global average hybrid battery capacity for passenger electric vehicles (EVs), including plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs), reached 38.6 kWh, marking a 9% increase compared to the previous year. PHEVs saw significant growth, boasting an average battery capacity of 21.8 kWh and a remarkable 27% year-over-year increase. HEVs experienced a modest rise to 1.3 kWh. Notably, over the first eight months of 2023, 413 GWh of new hybrid battery capacity was deployed globally, reflecting a 50% increase year-on-year, while total EV sales rose by 35%. PHEVs have gained traction, especially in China, where they account for 30% of the market, driven by models like the BYD Song Plus DM-i, which can travel over 1,000 kilometers on a single charge.

The global shift towards renewable energy sources such as solar and wind has created a significant need for efficient energy storage solutions. Hybrid batteries provide a reliable means to store excess energy generated during peak production times and discharge it during periods of high demand. The ability of hybrid batteries to rapidly respond to fluctuations in energy supply and demand enhances the integration of renewables into the energy grid, supporting efforts to transition to a more sustainable energy future. With the ongoing advancements in hybrid battery technology, including improvements in energy density, charging speed, and lifecycle, this market is poised for substantial growth in the coming years.

Drivers

The rapid expansion of the electric vehicle (EV) industry is a significant driver of the hybrid batteries market.

Many governments have imposed more stringent regulations on automotive emissions due to worldwide worries about climate change and the necessity to lessen carbon emissions. Consequently, the automotive sector has directed its attention to hybrid and fully electric cars. Sales of electric vehicles approached 14 million in 2023, with 95% of them being in China, Europe, and the United States. Hybrid vehicles, which use both internal combustion engines and electric power, depend significantly on advanced battery technologies, such as hybrid batteries. Hybrid vehicles rely heavily on hybrid batteries such as lithium-ion, nickel-metal hydride (NiMH), and solid-state batteries to power their electric components. These batteries improve both the fuel efficiency of vehicles and reduce emissions. The popularity of EVs, such as PHEVs and HEVs, is increasing in areas like Europe, North America, and some parts of Asia due to government incentives, subsidies, and green initiatives that prompt consumers to switch from traditional gasoline vehicles to greener options. Technological advancements in the hybrid battery market are driving growth in line with the automotive sector, speeding up expansion by boosting battery capacity, cutting charging times, and improving vehicle performance.

Stringent government regulations aimed at reducing carbon emissions are a key driver for the hybrid batteries market.

Governments globally are enacting measures to support the use of low-emission vehicles and renewable energy resources. In June 2024, the average atmospheric carbon dioxide (CO₂) levels hit a peak of 426.91 parts per million (ppm). This signifies a rise of around 20 percent when compared to the typical CO₂ levels measured in June 1990. By 2023, the global yearly average CO₂ levels hit a peak of 421 ppm. In numerous countries, car manufacturers must comply with particular emission regulations, leading to the advancement and acceptance of hybrid cars fitted with state-of-the-art battery technologies. Different governments provide tax breaks, subsidies, and financial aid to manufacturers and buyers of hybrid and electric cars. These monetary rewards lower the cost of hybrid vehicles, leading to increased demand for hybrid batteries. Furthermore, governmental backing for research and development in battery technologies has hastened advancements in the field, resulting in the creation of batteries that are both more efficient and cost-efficient. In Europe, the shift towards clean energy and low-emission transportation solutions, driven by initiatives like the Green Deal, is also boosting the hybrid batteries market. Likewise, nations in North America and the Asia-Pacific region are making significant investments in infrastructure for electric vehicle charging stations, a move that will strengthen the market for hybrid batteries in the near future.

Restraints

The hybrid batteries market is the high initial cost associated with the production and deployment of these advanced batteries.

Although hybrid battery technologies like lithium-ion and solid-state batteries provide better performance, their production procedures require intricate materials and advanced technologies, resulting in increased expenses. Despite government incentives, consumers may be discouraged by the higher price of hybrid vehicles when compared to traditional gasoline-powered vehicles. Likewise, the expense of setting up hybrid battery systems for storing renewable energy is quite high, posing a challenge to widespread acceptance, especially in less affluent areas with constrained financial means. Even though the cost of batteries has been decreasing in the past few years, it still poses a substantial financial burden for both producers and buyers.

By Type

Lithium-Ion batteries dominated the hybrid batteries market in 2023 with over 38% market share and it is expected to become the fastest-growing segment during 2024-2032, due to their high energy density, lightweight nature, and longer lifespan compared to other battery types. These batteries provide effective energy storage, making them well-suited for hybrid electric vehicles (HEVs) and storing renewable energy. The key advantage in hybrid applications is their capacity to manage frequent charging and discharging cycles. Large corporations such as Panasonic and LG Chem are using lithium-ion technology to improve the performance of electric and hybrid vehicle batteries, providing more advanced battery packs. The trend towards more environmentally friendly transportation options continues to drive the need for lithium-ion batteries in hybrid vehicles. Moreover, hybrid applications utilize lithium-ion technology for energy storage systems by companies such as Tesla and BYD in their hybrid and electric vehicle fleets. Continued progress in battery chemistry and manufacturing processes is key for developing hybrid battery solutions.

By Application

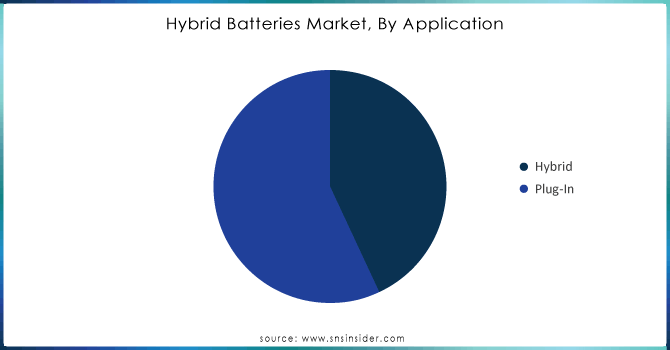

The plug-in segment dominated with a 58% market share in 2023, because of its exceptional range and performance. Plug-in Hybrid Electric Vehicles (PHEVs) possess batteries that are bigger compared to conventional hybrids, enabling them to cover greater distances solely on electric power before transitioning to a gasoline engine. Consumers are attracted to this flexibility because it offers the advantages of electric cars and traditional engines while avoiding concerns about driving distance. PHEVs such as the Chevrolet Volt and Mitsubishi Outlander PHEV represent this category well, providing a generous electric range and efficient hybrid capabilities. Numerous governments provide support for PHEVs by offering incentives and investing in charging infrastructure, which helps to increase their market presence.

The hybrid segment is anticipated to have a rapid CAGR during 2024-2032, due to the rising popularity of hybrid vehicles in the Hybrid segment. These batteries offer improved fuel efficiency and reduced emissions in comparison to conventional vehicles by balancing electric and internal combustion engines. Their capacity to replenish energy using regenerative braking also decreases dependence on fossil fuels. Governments globally have enforced strict emission rules and provided incentives for hybrid vehicles, increasing the demand for hybrid batteries. Major car manufacturers such as Toyota and Honda rely on these batteries to power their hybrid vehicles like the Prius and Accord Hybrid, respectively, guaranteeing continuous expansion in this sector.

Need Any Customization Research On Hybrid Batteries Market - Inquiry Now

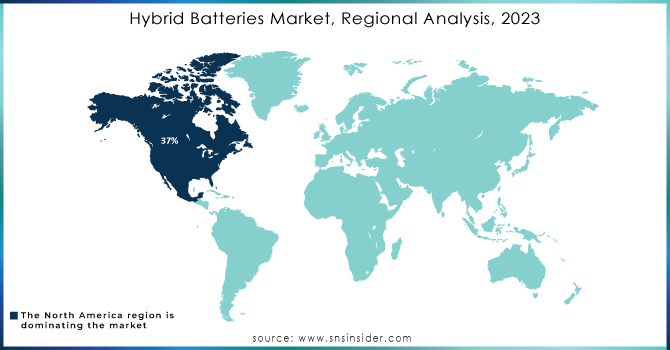

North America led the hybrid batteries market in 2023 with around 37% market share because of its strong automotive sector, which plays a major role in the adoption of hybrid and electric vehicles (EVs). The area's focus on cutting carbon emissions and government incentives promote the adoption of hybrid batteries. In addition, market growth is propelled by technological advancements and research and development investments by major players such as Tesla and General Motors. These companies use hybrid battery technology to enhance energy efficiency and decrease emissions. Moreover, the existing infrastructure in the region for electric vehicle charging and incorporating renewable energy also helps meet the need for hybrid batteries for different uses, like storing grid energy and powering electric buses.

Asia-Pacific is projected to have the fastest growth rate of 21% during 2024-2032, due to rising demand for electric vehicles and hybrid cars in China, Japan, and South Korea. These nations have enforced stringent emission standards, leading car makers to incorporate hybrid battery technology. Prominent companies BYD, Panasonic, and Toyota are making significant investments in hybrid battery production and research and development. The increasing urbanization and growing disposable incomes in the area are leading to greater adoption of hybrid vehicles. Moreover, the growth of the hybrid batteries market in APAC is driven by vast manufacturing facilities and supportive government policies, such as incentives for EV adoption.

The major key players in the Hybrid Batteries Market are:

Toyota Motor Corporation (Prius Hybrid Battery, Camry Hybrid Battery)

Panasonic Corporation (NCR18650, Li-ion Battery for Hybrid Vehicles)

LG Chem (Li-ion Pouch Battery, NCM Battery)

Samsung SDI (Prismatic Li-ion Battery, NCA Battery)

BYD Company Limited (Blade Battery, LiFePO4 Hybrid Battery)

General Motors (Chevrolet Volt Battery, Cadillac ELR Battery)

Ford Motor Company (Fusion Hybrid Battery, Escape Hybrid Battery)

Honda Motor Co., Ltd. (Insight Hybrid Battery, Accord Hybrid Battery)

Nissan Motor Co., Ltd. (Leaf Battery Pack, e-Power Hybrid Battery)

Tesla, Inc. (Model S Hybrid Battery, Model X Hybrid Battery)

A123 Systems LLC (Nanophosphate® Lithium Ion Battery, LFP Battery)

Contemporary Amperex Technology Co. Ltd. (CATL) (NCM Battery, Prismatic Battery for HEV)

SK Innovation Co., Ltd. (NCM811 Battery, Li-ion Polymer Battery)

Johnson Controls International (Absorbent Glass Mat (AGM) Battery, Li-ion 12V Hybrid Battery)

Hitachi Chemical Co., Ltd. (Automotive Li-ion Battery, Hybrid Nickel-Metal Hydride (NiMH) Battery)

GS Yuasa Corporation (ECO.R Hybrid Battery, S Series Hybrid Battery)

Saft Groupe S.A. (Li-ion Battery for HEV, NiMH Battery for Hybrid Applications)

EnerSys (Odyssey Performance Battery, Li-ion Hybrid Battery)

Mitsubishi Electric Corporation (EV-PHEV Battery, Li-ion Hybrid Battery)

Robert Bosch GmbH (Lithium-ion Battery Module, NiMH Battery Module)

Albemarle Corporation

BASF SE

Sumitomo Metal Mining Co., Ltd.

Umicore

American Manganese Inc.

Asahi Kasei Corporation

3M Company

POSCO

Glencore plc

Livent Corporation

May 2024: Lithium battery inverters compatible with solar power have been unveiled by the Korean brand, Daewoo. These are aimed for use by households and businesses. These are a type of hybrid inverters and are available in their rated power outputs of 0.5 kWP to 10 kWP, which cover a broad spectrum of power requirements.

February 2024: Maruti adopted a range extender or a serial hybrid system to establish its hybrid presence in the mass market space. The parallel system hybrid system, which was earlier tested with Toyota, did not guarantee cost-effectiveness.

September 2024: Honda's newly introduced two-motor hybrid system is a new-gen power system that promises high fuel efficiency, low emissions, simple packaging that is cost-effective, excellent performance, and high levels of comfort and luxury

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.14 Billion |

| Market Size by 2032 | USD 54.25 Billion |

| CAGR | CAGR of 20.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lead-Acid, Lithium-Ion, Nickel-Based, Others) • By Application (Hybrid, Plug-In) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota Motor Corporation, Panasonic Corporation, LG Chem, Samsung SDI, BYD Company Limited, General Motors, Ford Motor Company, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Tesla, Inc., A123 Systems LLC, Contemporary Amperex Technology Co. Ltd. (CATL), SK Innovation Co., Ltd., Johnson Controls International, Hitachi Chemical Co., Ltd., GS Yuasa Corporation, Saft Groupe S.A., EnerSys, Mitsubishi Electric Corporation, Robert Bosch GmbH |

| Key Drivers | • The rapid expansion of the electric vehicle (EV) industry is a significant driver of the hybrid batteries market. • Stringent government regulations aimed at reducing carbon emissions are a key driver for the hybrid batteries market. |

| RESTRAINTS | • The hybrid batteries market is the high initial cost associated with the production and deployment of these advanced batteries. |

Ans: The Hybrid Batteries Market is expected to grow at a CAGR of 20.50% during 2024-2032.

Ans: The Hybrid Batteries Market was USD 10.14 Billion in 2023 and is expected to Reach USD 54.25 Billion by 2032.

Ans: The rapid expansion of the electric vehicle (EV) industry is a significant driver of the hybrid batteries market.

Ans: The Lithium-Ion segment dominated the Hybrid Batteries Market.

Ans: North America dominated the Hybrid Batteries Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production and Capacity Utilization (2023)

5.2 Energy Density and Performance Metrics, (2023), by Region

5.3 Distribution Channel Analysis, by Region (2020-2032)

5.4 Adoption Rate

5.5 Supply Chain Analysis

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hybrid Batteries Market Segmentation, by Type

7.1 Chapter Overview

7.2 Lead-Acid

7.2.1 Lead-Acid Market Trends Analysis (2020-2032)

7.2.2 Lead-Acid Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Lithium-Ion

7.3.1 Lithium-Ion Market Trends Analysis (2020-2032)

7.3.2 Lithium-Ion Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Nickel-Based

7.3.1 Nickel-Based Market Trends Analysis (2020-2032)

7.3.2 Nickel-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Others

7.3.1 Others Market Trends Analysis (2020-2032)

7.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Hybrid Batteries Market Segmentation, by Application

8.1 Chapter Overview

8.2 Hybrid

8.2.1 Hybrid Market Trends Analysis (2020-2032)

8.2.2 Hybrid Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Plug-in

8.3.1 Plug-in Market Trends Analysis (2020-2032)

8.3.2 Plug-in Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Hybrid Batteries Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Hybrid Batteries Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Hybrid Batteries Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Toyota Motor Corporation

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Panasonic Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 LG Chem

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Samsung SDI

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 BYD Company Limited

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 General Motors

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Ford Motor Company

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Honda Motor Co., Ltd.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Nissan Motor Co., Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Tesla, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Lead-Acid

Lithium-Ion

Nickel-Based

Others

By Application

Hybrid

Plug-In

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The SiC Wafer Polishing Market size was valued at USD 0.46 Billion in 2023 and is expected to grow to USD 8.27 Billion by 2032 and grow at a CAGR of 37.86% over the forecast period of 2024-2032.

The Integrated Circuit Market Size will be valued at USD 1846.29 billion by 2032, and it accounted for USD 619.52 billion in 2023, and grow at a CAGR of 12.9% over the forecast period 2024-2032.

The Physical Security Market Size was valued at USD 122.92 Billion in 2023 and will reach USD 200.81 Billion by 2032 & grow at a CAGR of 5.65% by 2024-2032.

The 3D Metrology Market Size was valued at USD 10.88 Billion in 2023 and is expected to grow at a CAGR of 7.97% to reach USD 21.69 Billion by 2032.

Data Center Interconnect Market Size was valued at USD 11.45 billion in 2023 and is expected to reach USD 37.53 billion by 2032 and grow at a CAGR of 14.1% over the forecast period 2024-2032.

The Industrial Microscope Market Size was USD 2.90 billion in 2023 and will reach to USD 5.20 billion by 2032 and grow at a CAGR of 6.74% by 2024-2032.

Hi! Click one of our member below to chat on Phone