Get More Information on HVDC Capacitor Market - Request Sample Report

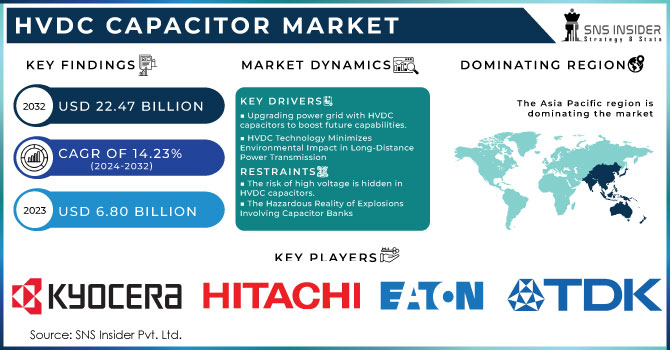

The HVDC Capacitor market size was $ 6.80 Billion in 2023 & expects a good growth by reaching USD 22.47 billion till end of year2032 at CAGR about 14.23 %during forecast period 2023-2032

HVDC capacitors are becoming more crucial in updating power grids. These capacitors enhance the security, dependability, and cost efficiency of transmission systems. They assist in detecting possible equipment weaknesses without interrupting operations, guaranteeing a steady and dependable electricity supply.

As the demand for electricity rises in conjunction with the use of solar and wind energy, upgrades are needed for our power grids. HVDC capacitors help power grids by aiding in the regulation of excess energy. An example of this scenario would be a large company revealing their initiative to improve the US power grid by connecting the east and west coasts with advanced HVDC technology.

Another key driver of the market is the positive impact on the environment from HVDC systems. In comparison to conventional AC systems, HVDC needs less transmission lines, decreasing their environmental footprint and space requirements. Furthermore, HVDC also offers greatly reduced transmission losses, which is essential for incorporating renewable energy sources that are frequently situated at a considerable distance from urban areas. Governments in countries such as the US, UK, and Germany are aiding in the widespread adoption of HVDC technology. This indicates that they are simplifying the use of specialized power lines capable of accommodating renewable energy sources such as solar and wind farms. In Europe and Asia, there is an effort to both upgrade aging power grids and incorporate clean energy sources.

Although HVDC capacitors face difficulties with high voltage, the market is projected to thrive as a result of progress in the energy industry and favorable government policies. This development will aid in creating a power grid that is more effective, trustworthy, and eco-friendly.

|

Report Attributes |

Details |

|---|---|

|

Key Segments |

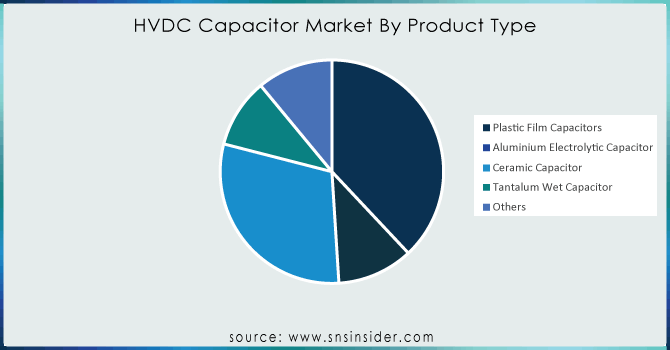

• By Product Type (Introduction, Plastic Film Capacitors, Aluminium Electrolytic Capacitor, Ceramic Capacitor, Tantalum Wet Capacitor, Others) |

|

Regional Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany), Sieyuan Electric Co., Ltd. (China), Kunshan GuoLi Electronic Technology Co., Ltd. (China), Condis (Switzerland), samwha Capacitor Group (South Korea), API Capacitors(UK) |

Drivers

Upgrading power grid with HVDC capacitors to boost future capabilities.

There is a growing demand for additional electricity to fuel various needs, leading to an increase in the popularity of solar and wind energy sources. These changes are putting pressure on obsolete electrical grids. Capacitors for HVDC systems are essential for the electricity infrastructure, functioning as superheroes within this critical network. Think of a crowded street filled with cars - that's basically how a congested power grid operates. HVDC capacitors act as traffic controllers, managing the flow of electricity and preventing overload situations. HVDC capacitors serve multiple purposes besides managing traffic; they also improve grid stability and efficiency, guaranteeing a reliable power source for data centers, electric vehicles, and other systems reliant on the grid. Think of them as invisible guardians of our power supply, ensuring a smooth transition to a renewable energy future.

HVDC technology reduces environmental impact when transmitting power over long distances by adopting sustainable practices.

Picture transmitting electricity over large distances without creating a significant impact. The attractiveness of HVDC transmission lines lies in the secret weapon of HVDC capacitors. HVDC, in contrast to traditional AC lines, is comparable to a nature lover because it needs less transmission lines, reducing environmental impact and land use. This revolutionizes the transportation of electricity from remote renewable energy sources such as solar farms in deserts or offshore wind power farms. The advantages do not end there. HVDC has much lower transmission losses, with reductions of up to 50%! This is particularly important for incorporating renewable sources that are frequently situated at a distance from urban areas. Reducing energy wastage results in a smaller environmental footprint.

Restraints

• The risk of high voltage is hidden in HVDC capacitors.

HVDC capacitors, the unsung heroes of transmitting power over long distances, pose a hidden danger of high voltage. These capacitors have voltages that can be fatal, presenting a major safety hazard throughout their entire lifespan. Stringent safety protocols and well-trained personnel are needed for installation, maintenance, and regular operation. This covers specific personal protective gear such as insulated suits, gloves, and face shields. Workspaces are carefully organized and secured to avoid unintentional contact. In addition, thorough training programs make sure that technicians grasp the possible risks and correct handling protocols.

• The Hazardous Reality of Explosions Involving Capacitor Banks

Capacitor banks in HVDC systems act as surge protectors to ensure smooth operation, but they also have the potential to cause harmful explosions. Determining the exact cause of a capacitor bank failure is just as difficult as pinpointing the reason for a flat tire. This difference could lead to voltage spikes exceeding the capacitors' limit, which may cause a destructive explosion. Properly implementing HVDC capacitor banks is crucial because of the emphasized danger. Through careful assembly of components and maintaining safe voltage levels, we can prevent these dangerous high-voltage devices from exploding.

By Product Type

By product Type, Plastic Film capacitors are holding the highest share market with 38% of market in HVDC Capacitors in 2023. Plastic film capacitors have a longer lifespan compared to traditional capacitors due to their ability to self-heal minor damage. This results in lower expenses for replacing and less time spent on maintenance. Minimal maintenance requirements are reduced by the self-healing feature, reducing the necessity for continual supervision and repairs. This results in reduced maintenance expenses and increased operational effectiveness. Outstanding Achievement in Challenging HVDC transmission applications entails harsh electrical conditions. Plastic film capacitors perform exceptionally well in these circumstances, guaranteeing dependable and uniform performance even when facing stress.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Installation Type

Open Racks hold the largest dominant segment in installation Type in hvdc capacitors market with 45 % share in 2023. Maintenance costs have gone up because of the effects of weather and wildlife, as well as the implementation of more rigorous safety measures for the high voltage parts. Despite being cheaper at first, these open installations could result in increased expenses and safety worries in the future, ultimately prompting individuals to switch to enclosed rack systems. Enclosed racks function similar to protective gear, requiring less upkeep and potentially easier safety protocols, though they come with a greater upfront price.

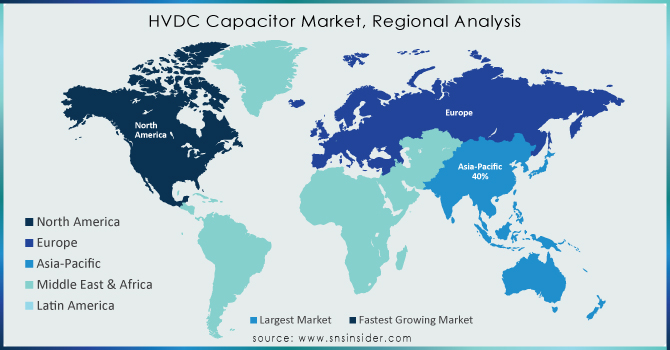

Asia Pacific is dominating in hvdc capacitor market with 40% of share in 2023. Asia is at the forefront in the use of specific devices (HVDC capacitors) to ensure a steady flow of electricity. This is happening due to the increasing demand for electricity in factories, homes, and businesses, particularly in countries experiencing population and economic growth. These capacitors act as overseers on a massive highway, guaranteeing electricity reaches its destination for cars, computers, solar panels, and wind farms. Currently, numerous Asian countries are focused on enhancing and enlarging their electricity networks to accommodate an increasing amount of power. These unique capacitors also assist in linking new sources of renewable energy from solar and wind to the electricity grid HVDC capacitors assist in managing increased loads by stabilizing and improving power transmission. Due to these factors, Asia-Pacific is set to continue dominating the HVDC capacitor market in the future. This emphasis on dependable and environmentally friendly power distribution sets the stage for a more promising future in the area.

In 2023 North America is leading the HVDC capacitor market with the highest growth rate, accounting for 35% of the market. Older electricity networks are having trouble keeping up with the needs of more people and moving towards using more wind and solar power. The key players are HVDC capacitors, facilitating grid improvements and growth to guarantee effective and dependable power delivery. The United States and Canada are effectively incorporating clean energy sources, with HVDC capacitors playing a crucial part in seamlessly linking them to the grid. Governments are playing a role by offering substantial assistance for renewable energy projects and updates to the grid, which frequently involve funding for HVDC technology, boosting the HVDC capacitor market. The increase in data centers and electric vehicle creates additional need for a constant supply of electricity.

Some of key players are listed in a HVDC Capacitor Market are Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany), Sieyuan Electric Co., Ltd. (China), Kunshan GuoLi Electronic Technology Co., Ltd. (China), Condis (Switzerland), samwha Capacitor Group (South Korea), API Capacitors(UK) and other players are listed in a final report.

In April 2023, Kyocera Corporation declared the development of a new capacitor (MLCC) with EIA 0201 dimensions (0.6 mm x 0.3 mm). As smartphones and wearable gadgets become more complex, electronic circuits require more MLCC devices with larger capacitance values.

In March 2023, GE Renewable Energy’s Grid Solutions business announced that it had been awarded three High-Voltage Direct Current (HVDC) contracts totaling roughly 6 billion euros as part of a specially formed consortium with Sembcorp Marine for TenneT’s innovative 2GW Program in the Netherlands.

In February 2023, Vishay Intertechnology, Inc. released a new series of low-impedance, Automotive Grade micro aluminum electrolytic capacitors that perform better in smaller case sizes than previous-generation alternatives.

In February 2023, TDK Corporation introduced its new EPCOS B43652 series of snap-in aluminum electrolytic capacitors with particularly small dimensions and strong ripple current carrying capacity. The DC link circuitry of onboard chargers in xEVs is a common application for these capacitors with high CV products.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 6.80 billion |

|

Market Size by 2032 |

US$ 22.47 billion |

|

CAGR |

CAGR of 14.23 % From 2024 to 2032 |

|

Base Year |

2022 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Upgrading power grid with HVDC capacitors to boost future capabilities. • HVDC technology reduces environmental impact when transmitting power over long distances by adopting sustainable practices. |

| RESTRAINTS | • The risk of high voltage is hidden in HVDC capacitors. • The Hazardous Reality of Explosions Involving Capacitor Banks |

Ans.Asia Pacific is expected to hold the largest market share in the HVDC Capacitors market during the forecast period.

Ans.The Open Rack Capacitor Banks Segment is leading in the market revenue share in 2023.

Ans.North America region is anticipated to record the Fastest Growing in the HVDC Capacitors market.

Ans.The HVDC Capacitor market size was $ 6.80 Billion in 2023 & expects a good growth by reaching USD 22.47 billion till end of year2032 at CAGR about 14.23 %during forecast period 2023-2032

Ans.Rising HVDC transmission systems and increasing renewable energy adoption drive the HVDC Capacitors market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. HVDC Capacitors market Segmentation, By Product Type

7.1 Introduction

7.2 Plastic Film Capacitors

7.3 Aluminium Electrolytic Capacitor

7.4 Ceramic Capacitor

7.5 Tantalum Wet Capacitor

7.6 Others

8. HVDC Capacitors market Segmentation, By Technology

8.1 Introduction

8.2 Line-Commutated Converter (LCC)

8.3 Voltage-Source Converter (VSC)

9. HVDC Capacitors market Segmentation, By Installation Type

9.1 Introduction

9.2 Open Rack Capacitor Banks

9.3 Enclosed Rack Capacitor Banks

9.4 Pole-Mounted Capacitor Banks

10. HVDC Capacitors market Segmentation, By Application

10.1 Introduction

10.2 Commercial

10.3 Industrial

10.4 Energy and Power

10.5Aerospace and Defense

10.6 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America HVDC Capacitors market by Country

11.2.3 North America HVDC Capacitors market By Product Type

11.2.4 North America HVDC Capacitors market By Technology

11.2.5 North America HVDC Capacitors market By Installation Type

11.2.6 North America HVDC Capacitors market By Application

11.2.7 USA

11.2.7.1 USA HVDC Capacitors market By Product Type

11.2.7.2 USA HVDC Capacitors market By Technology

11.2.7.3 USA HVDC Capacitors market By Installation Type

11.2.7.4 USA HVDC Capacitors market By Application

11.2.8 Canada

11.2.8.1 Canada HVDC Capacitors market By Product Type

11.2.8.2 Canada HVDC Capacitors market By Technology

11.2.8.3 Canada HVDC Capacitors market By Installation Type

11.2.8.4 Canada HVDC Capacitors market By Application

11.2.9 Mexico

11.2.9.1 Mexico HVDC Capacitors market By Product Type

11.2.9.2 Mexico HVDC Capacitors market By Technology

11.2.9.3 Mexico HVDC Capacitors market By Installation Type

11.2.9.4 Mexico HVDC Capacitors market By Application

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe HVDC Capacitors market by Country

11.3.2.2 Eastern Europe HVDC Capacitors market By Product Type

11.3.2.3 Eastern Europe HVDC Capacitors market By Technology

11.3.2.4 Eastern Europe HVDC Capacitors market By Installation Type

11.3.2.5 Eastern Europe HVDC Capacitors market By Application

11.3.2.6 Poland

11.3.2.6.1 Poland HVDC Capacitors market By Product Type

11.3.2.6.2 Poland HVDC Capacitors market By Technology

11.3.2.6.3 Poland HVDC Capacitors market By Installation Type

11.3.2.6.4 Poland HVDC Capacitors market By Application

11.3.2.7 Romania

11.3.2.7.1 Romania HVDC Capacitors market By Product Type

11.3.2.7.2 Romania HVDC Capacitors market By Technology

11.3.2.7.3 Romania HVDC Capacitors market By Installation Type

11.3.2.7.4 Romania HVDC Capacitors market By Application

11.3.2.8 Hungary

11.3.2.8.1 Hungary HVDC Capacitors market By Product Type

11.3.2.8.2 Hungary HVDC Capacitors market By Technology

11.3.2.8.3 Hungary HVDC Capacitors market By Installation Type

11.3.2.8.4 Hungary HVDC Capacitors market By Application

11.3.2.9 Turkey

11.3.2.9.1 Turkey HVDC Capacitors market By Product Type

11.3.2.9.2 Turkey HVDC Capacitors market By Technology

11.3.2.9.3 Turkey HVDC Capacitors market By Installation Type

11.3.2.9.4 Turkey HVDC Capacitors market By Application

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe HVDC Capacitors market By Product Type

11.3.2.10.2 Rest of Eastern Europe HVDC Capacitors market By Technology

11.3.2.10.3 Rest of Eastern Europe HVDC Capacitors market By Installation Type

11.3.2.10.4 Rest of Eastern Europe HVDC Capacitors market By Application

11.3.3 Western Europe

11.3.3.1 Western Europe HVDC Capacitors market by Country

11.3.3.2 Western Europe HVDC Capacitors market By Product Type

11.3.3.3 Western Europe HVDC Capacitors market By Technology

11.3.3.4 Western Europe HVDC Capacitors market By Installation Type

11.3.3.5 Western Europe HVDC Capacitors market By Application

11.3.3.6 Germany

11.3.3.6.1 Germany HVDC Capacitors market By Product Type

11.3.3.6.2 Germany HVDC Capacitors market By Technology

11.3.3.6.3 Germany HVDC Capacitors market By Installation Type

11.3.3.6.4 Germany HVDC Capacitors market By Application

11.3.3.7 France

11.3.3.7.1 France HVDC Capacitors market By Product Type

11.3.3.7.2 France HVDC Capacitors market By Technology

11.3.3.7.3 France HVDC Capacitors market By Installation Type

11.3.3.7.4 France HVDC Capacitors market By Application

11.3.3.8 UK

11.3.3.8.1 UK HVDC Capacitors market By Product Type

11.3.3.8.2 UK HVDC Capacitors market By Technology

11.3.3.8.3 UK HVDC Capacitors market By Installation Type

11.3.3.8.4 UK HVDC Capacitors market By Application

11.3.3.9 Italy

11.3.3.9.1 Italy HVDC Capacitors market By Product Type

11.3.3.9.2 Italy HVDC Capacitors market By Technology

11.3.3.9.3 Italy HVDC Capacitors market By Installation Type

11.3.3.9.4 Italy HVDC Capacitors market By Application

11.3.3.10 Spain

11.3.3.10.1 Spain HVDC Capacitors market By Product Type

11.3.3.10.2 Spain HVDC Capacitors market By Technology

11.3.3.10.3 Spain HVDC Capacitors market By Installation Type

11.3.3.10.4 Spain HVDC Capacitors market By Application

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands HVDC Capacitors market By Product Type

11.3.3.11.2 Netherlands HVDC Capacitors market By Technology

11.3.3.11.3 Netherlands HVDC Capacitors market By Installation Type

11.3.3.11.4 Netherlands HVDC Capacitors market By Application

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland HVDC Capacitors market By Product Type

11.3.3.12.2 Switzerland HVDC Capacitors market By Technology

11.3.3.12.3 Switzerland HVDC Capacitors market By Installation Type

11.3.3.12.4 Switzerland HVDC Capacitors market By Application

11.3.3.13 Austria

11.3.3.13.1 Austria HVDC Capacitors market By Product Type

11.3.3.13.2 Austria HVDC Capacitors market By Technology

11.3.3.13.3 Austria HVDC Capacitors market By Installation Type

11.3.3.13.4 Austria HVDC Capacitors market By Application

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe HVDC Capacitors market By Product Type

11.3.3.14.2 Rest of Western Europe HVDC Capacitors market By Technology

11.3.3.14.3 Rest of Western Europe HVDC Capacitors market By Installation Type

11.3.3.14.4 Rest of Western Europe HVDC Capacitors market By Application

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific HVDC Capacitors market by Country

11.4.3 Asia-Pacific HVDC Capacitors market By Product Type

11.4.4 Asia-Pacific HVDC Capacitors market By Technology

11.4.5 Asia-Pacific HVDC Capacitors market By Installation Type

11.4.6 Asia-Pacific HVDC Capacitors market By Application

11.4.7 China

11.4.7.1 China HVDC Capacitors market By Product Type

11.4.7.2 China HVDC Capacitors market By Technology

11.4.7.3 China HVDC Capacitors market By Installation Type

11.4.7.4 China HVDC Capacitors market By Application

11.4.8 India

11.4.8.1 India HVDC Capacitors market By Product Type

11.4.8.2 India HVDC Capacitors market By Technology

11.4.8.3 India HVDC Capacitors market By Installation Type

11.4.8.4 India HVDC Capacitors market By Application

11.4.9 Japan

11.4.9.1 Japan HVDC Capacitors market By Product Type

11.4.9.2 Japan HVDC Capacitors market By Technology

11.4.9.3 Japan HVDC Capacitors market By Installation Type

11.4.9.4 Japan HVDC Capacitors market By Application

11.4.10 South Korea

11.4.10.1 South Korea HVDC Capacitors market By Product Type

11.4.10.2 South Korea HVDC Capacitors market By Technology

11.4.10.3 South Korea HVDC Capacitors market By Installation Type

11.4.10.4 South Korea HVDC Capacitors market By Application

11.4.11 Vietnam

11.4.11.1 Vietnam HVDC Capacitors market By Product Type

11.4.11.2 Vietnam HVDC Capacitors market By Technology

11.4.11.3 Vietnam HVDC Capacitors market By Installation Type

11.4.11.4 Vietnam HVDC Capacitors market By Application

11.4.12 Singapore

11.4.12.1 Singapore HVDC Capacitors market By Product Type

11.4.12.2 Singapore HVDC Capacitors market By Technology

11.4.12.3 Singapore HVDC Capacitors market By Installation Type

11.4.12.4 Singapore HVDC Capacitors market By Application

11.4.13 Australia

11.4.13.1 Australia HVDC Capacitors market By Product Type

11.4.13.2 Australia HVDC Capacitors market By Technology

11.4.13.3 Australia HVDC Capacitors market By Installation Type

11.4.13.4 Australia HVDC Capacitors market By Application

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific HVDC Capacitors market By Product Type

11.4.14.2 Rest of Asia-Pacific HVDC Capacitors market By Technology

11.4.14.3 Rest of Asia-Pacific HVDC Capacitors market By Installation Type

11.4.14.4 Rest of Asia-Pacific HVDC Capacitors market By Application

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East HVDC Capacitors market by Country

11.5.2.2 Middle East HVDC Capacitors market By Product Type

11.5.2.3 Middle East HVDC Capacitors market By Technology

11.5.2.4 Middle East HVDC Capacitors market By Installation Type

11.5.2.5 Middle East HVDC Capacitors market By Application

11.5.2.6 UAE

11.5.2.6.1 UAE HVDC Capacitors market By Product Type

11.5.2.6.2 UAE HVDC Capacitors market By Technology

11.5.2.6.3 UAE HVDC Capacitors market By Installation Type

11.5.2.6.4 UAE HVDC Capacitors market By Application

11.5.2.7 Egypt

11.5.2.7.1 Egypt HVDC Capacitors market By Product Type

11.5.2.7.2 Egypt HVDC Capacitors market By Technology

11.5.2.7.3 Egypt HVDC Capacitors market By Installation Type

11.5.2.7.4 Egypt HVDC Capacitors market By Application

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia HVDC Capacitors market By Product Type

11.5.2.8.2 Saudi Arabia HVDC Capacitors market By Technology

11.5.2.8.3 Saudi Arabia HVDC Capacitors market By Installation Type

11.5.2.8.4 Saudi Arabia HVDC Capacitors market By Application

11.5.2.9 Qatar

11.5.2.9.1 Qatar HVDC Capacitors market By Product Type

11.5.2.9.2 Qatar HVDC Capacitors market By Technology

11.5.2.9.3 Qatar HVDC Capacitors market By Installation Type

11.5.2.9.4 Qatar HVDC Capacitors market By Application

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East HVDC Capacitors market By Product Type

11.5.2.10.2 Rest of Middle East HVDC Capacitors market By Technology

11.5.2.10.3 Rest of Middle East HVDC Capacitors market By Installation Type

11.5.2.10.4 Rest of Middle East HVDC Capacitors market By Application

11.5.3 Africa

11.5.3.1 Africa HVDC Capacitors market by Country

11.5.3.2 Africa HVDC Capacitors market By Product Type

11.5.3.3 Africa HVDC Capacitors market By Technology

11.5.3.4 Africa HVDC Capacitors market By Installation Type

11.5.3.5 Africa HVDC Capacitors market By Application

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria HVDC Capacitors market By Product Type

11.5.3.6.2 Nigeria HVDC Capacitors market By Technology

11.5.3.6.3 Nigeria HVDC Capacitors market By Installation Type

11.5.3.6.4 Nigeria HVDC Capacitors market By Application

11.5.3.7 South Africa

11.5.3.7.1 South Africa HVDC Capacitors market By Product Type

11.5.3.7.2 South Africa HVDC Capacitors market By Technology

11.5.3.7.3 South Africa HVDC Capacitors market By Installation Type

11.5.3.7.4 South Africa HVDC Capacitors market By Application

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa HVDC Capacitors market By Product Type

11.5.3.8.2 Rest of Africa HVDC Capacitors market By Technology

11.5.3.8.3 Rest of Africa HVDC Capacitors market By Installation Type

11.5.3.8.4 Rest of Africa HVDC Capacitors market By Application

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America HVDC Capacitors market by Country

11.6.3 Latin America HVDC Capacitors market By Product Type

11.6.4 Latin America HVDC Capacitors market By Technology

11.6.5 Latin America HVDC Capacitors market By Installation Type

11.6.6 Latin America HVDC Capacitors market By Application

11.6.7 Brazil

11.6.7.1 Brazil HVDC Capacitors market By Product Type

11.6.7.2 Brazil HVDC Capacitors market By Technology

11.6.7.3 Brazil HVDC Capacitors market By Installation Type

11.6.7.4 Brazil HVDC Capacitors market By Application

11.6.8 Argentina

11.6.8.1 Argentina HVDC Capacitors market By Product Type

11.6.8.2 Argentina HVDC Capacitors market By Technology

11.6.8.3 Argentina HVDC Capacitors market By Installation Type

11.6.8.4 Argentina HVDC Capacitors market By Application

11.6.9 Colombia

11.6.9.1 Colombia HVDC Capacitors market By Product Type

11.6.9.2 Colombia HVDC Capacitors market By Technology

11.6.9.3 Colombia HVDC Capacitors market By Installation Type

11.6.9.4 Colombia HVDC Capacitors market By Application

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America HVDC Capacitors market By Product Type

11.6.10.2 Rest of Latin America HVDC Capacitors market By Technology

11.6.10.3 Rest of Latin America HVDC Capacitors market By Installation Type

11.6.10.4 Rest of Latin America HVDC Capacitors market By Application

12. Company Profiles

12.1 Hitachi, Ltd.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 General Electric

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 TDK Corporation

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 Eaton

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 KYOCERA Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 YAGEO Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 Vishay Intertechnology, Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 General Atomics

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 International Capacitors, S.A.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 ELECTRONICON Kondensatoren GmbH

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

12.11 Sieyuan Electric Co., Ltd

12.11.1 Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 The SNS View

12.12 Kunshan GuoLi Electronic Technology Co., Ltd.

12.12.1 Company Overview

12.12.2 Financial

12.12.3 Products/ Services Offered

12.12.4 The SNS View

12.13 Condis

12.13.1 Company Overview

12.13.2 Financial

12.13.3 Products/ Services Offered

12.13.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Plastic Film Capacitors

Aluminium Electrolytic Capacitor

Ceramic Capacitor

Tantalum Wet Capacitor

Others

By Technology

Line-Commutated Converter (LCC)

Voltage-Source Converter (VSC)

By Installation Type

Open Rack Capacitor Banks

Enclosed Rack Capacitor Banks

Pole-Mounted Capacitor Banks

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Adaptive Optics Market was valued at USD 690.90 million in 2023 and is expected to reach USD 6632.27 million by 2032, growing at a CAGR of 28.61% over the forecast period 2024-2032.

The Embedded Security Market Size was valued at USD 7.07 Billion in 2023 and is expected to grow at 6.60% CAGR to reach USD 12.52 Billion by 2032.

LED Driver IC Market Size was valued at USD 3.79 Billion in 2023 and is expected to reach USD 16.05 Billion by 2032, at a CAGR of 17.46% During 2024-2032.

The Outsourced Semiconductor Assembly and Test Services Market Size was valued at USD 40.10 Billion in 2023 and is expected to reach USD 77.90 Billion by 2032, growing at a CAGR of 7.67% over the forecast period 2024-2032

The Micro-LED (Light-Emitting Diode) Market was valued at USD 1.91 billion in 2023 and is expected to reach USD 388.4 billion by 2032 and grow at a CAGR of 80.5% over the forecast period 2024-2032.

The Smart Home Security Market Size was valued at USD 72.42 billion in 2023 and is expected to grow at a CAGR of 9.96% to reach USD 169.63 billion by 2032.

Hi! Click one of our member below to chat on Phone