HVAC Linset Market Report Scope & Overview:

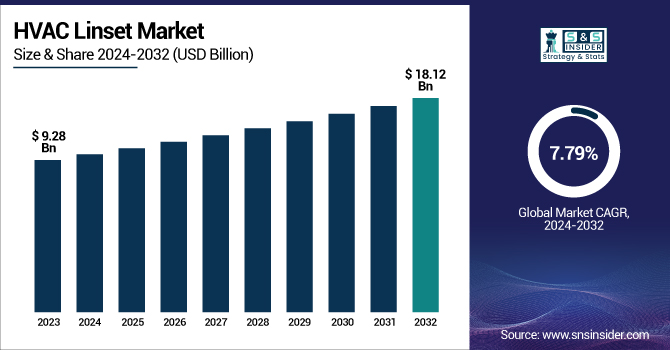

The HVAC Linset Market Size was valued at USD 9.28 Billion in 2023 and is expected to reach USD 18.12 Billion by 2032 and grow at a CAGR of 7.79% over the forecast period 2024-2032.

To Get more information on HVAC Linset Market - Request Free Sample Report

The HVAC Linset Market is also seeing great growth fuelled by the demand for more efficient energy-heating and cooling units in residential, commercial, and industrial segments. Growth drivers are improved technologies for refrigerant tubing materials, together with improving construction activity. Drivers for growth also come from trends toward sustainability, energy mandates of government, and fast-growing urbanization, especially in emerging nations. Improvements such as pre-charged and insulated Linsets are increasing.

The U.S. Industrial Boilers Market was USD 1.27 billion in 2023 and is expected to reach USD 2.79 billion by 2032, registering a CAGR of 9.22% during 2024 to 2032.The United States HVAC Linset Market is growing steadily, driven by growing demand for energy-efficient HVAC systems and government incentives for sustainable building solutions. The growth in residential construction, along with a robust retrofit market for old infrastructure, is generating strong demand for high-quality Linsets. Copper is still the leading material because of its strength and thermal conductivity, although alternatives such as low-carbon options are becoming increasingly popular. Technological innovations like pre-insulated and UV-resistant Linsets are gaining popularity.

HVAC Linset Market Dynamics

Key Drivers:

-

Increasing Demand for Energy-Efficient HVAC Systems in Residential and Commercial Applications Boosts HVAC Linset Market Growth.

The increasing focus on energy-efficient architecture in residential and commercial properties worldwide is heavily influencing the demand for sophisticated HVAC Linsets. With stringent building regulations and sustainable initiatives on the rise, advanced HVAC systems with better thermal characteristics and lower refrigerant leakage are emerging as a necessity. Linsets key elements of HVAC connection are being improved in terms of performance and efficiency. U.S. tax rebates and credits through energy initiatives like Energy Star and the Inflation Reduction Act are also accelerating market growth, particularly in retrofit markets. Such heightened emphasis on eco-friendliness is expediting product adoption.

Restrain

-

Raw Material Price Volatility and Copper Availability Disturb HVAC Linset Cost Structure.

One of the significant restraints affecting the HVAC Linset market is the volatile price of raw materials, specifically copper. Since copper is a key material in most Linsets because of its better conductivity and longer lifespan, price volatility greatly influences the cost of production. Geopolitical tensions, global supply chain issues, and price volatility in other markets like electronics and renewable energy cause prices to fluctuate. This volatility makes it challenging for producers to keep prices stable, which can deter customers in price-sensitive markets. The problem is also compounded by the scarcity of suitable replacement materials that can achieve copper's performance.

Opportunities

-

Increasing Construction of Green Buildings and Smart Homes Provides New Revenue Streams for HVAC Linset Market Players.

The increasing construction of green-certified buildings and smart homes is offering promising growth prospects for HVAC Linset producers. With developers seeking LEED and WELL certifications, energy-efficient low-leakage HVAC devices take center stage. Linsets with built-in insulation, corrosion resistance, and protection from UV light are much in demand in these buildings. Further, the implementation of IoT-based HVAC systems within smart homes demands sturdy and dependable Linsets that can provide a backstop to system operation. Government initiatives towards sustainable construction and growing consumer demand for environmental-friendly solutions are compelling HVAC developers to upgrade materials, leading to a profitable market for innovation in Linsets.

Challenge

-

Sophisticated Installation Needs and Shortage of Qualified HVAC Technicians Create Barriers to Global Widespread HVAC Linset Use in Emerging Markets.

One major challenge to the HVAC Linset market is that it requires sophisticated installation and has a shortage of qualified HVAC technicians, especially in emerging economies. Linset installation requires accuracy in size, bending, and insulation to avoid loss of performance and refrigerant leakage. Poor installation can cause system inefficiency or breakdown, raising long-term costs for consumers. With the increasing demand for HVAC systems in areas with fast urbanization, the shortage of skilled technicians constrains the scalability and dependability of installations. This is aggravated by restricted access to sophisticated equipment and training programs, which inhibits market penetration in high-growth potential markets.

HVAC Linset Market Segments Analysis

By Material

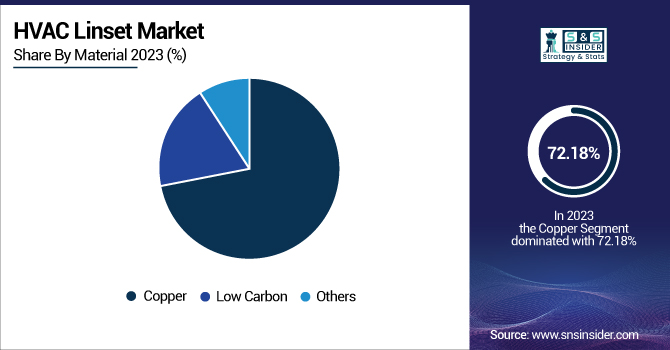

In 2023, the Copper segment maintained the leading revenue share of 72.18% in the HVAC Linset market because of its high thermal conductivity, corrosion resistance, and reliability in long-term HVAC applications. Leading manufacturers such as Mueller Industries and KME Group have strengthened their copper Linset portfolios with high-end insulation technologies and flexible designs for quicker installation. In 2023, Mueller launched its Streamline XHP series for high-pressure refrigerants to drive demand in residential and commercial HVAC. The segment remains the leader due to continuous product development, broad industry acceptance, and support from environmentally friendly refrigerants like R-410A and R-32.

The Low Carbon segment is expected to register the highest CAGR of 9.46% over the forecast period due to growing demand for cost-effective and sustainable low-carbon alternatives to copper. Daikin and Parker Hannifin are investing in low-carbon steel Linsets and marketing them for commercial and industrial HVAC applications. Daikin introduced a new series of steel-based insulated Linsets in 2024, which are targeted at large-scale HVAC installations in emerging economies. The expansion is in line with worldwide decarbonization and cost-conscious infrastructure construction. These Linsets provide adequate durability and thermal performance while lowering material costs and the environmental impact of HVAC systems.

By Implementation

The New Construction segment had the highest share of 56.48% in the HVAC Linset Market in 2023, propelled by increasing global construction activities, particularly in the residential and commercial sectors. New housing construction and mega-infrastructure projects are driving the need for high-performing HVAC solutions, where high-performing Linsets are highly consequential. Manufacturers such as Daikin and Trane have developed high-end HVAC solutions with pre-insulated and pre-flared Linset compatibility, making installation easier in new construction projects. Further, solutions such as Goodman's SmartCoil copper Linsets are designed for optimal use in new construction projects, maximizing energy efficiency and minimizing installation time.

The Retrofit segment is anticipated to record the highest CAGR of 8.27% during the forecast period due to increased efforts to upgrade aging HVAC infrastructure for better energy efficiency. This trend is pronounced in developed regions such as North America and Europe, where ageing buildings are being retrofitted with contemporary HVAC systems. Firms like Lennox and Carrier have introduced retrofit-friendly HVAC technologies meant to easily integrate into present structures, such as flexible and insulated Linsets. Technologies like Mueller Streamline's StreamShield Linsets increase retrofit feasibility by reducing refrigerant loss and allowing for faster, more consistent retrofitting in complicated settings.

By End-Use industry

The residential segment held the highest market share of 52.48% in the HVAC Linset Market in 2023 due to increasing demand for energy-efficient air conditioning units and increased residential construction in North America and Asia-Pacific. Greater usage of ductless mini-split systems, which significantly depend on high-performance Linsets, has spurred this dominance. In 2023, Daikin introduced miniaturized residential HVAC products with upgraded Linset compatibility, and Mitsubishi Electric introduced pre-insulated Linsets to facilitate faster installation. These innovations are falling in line with sustainability targets, affirming the key position of advanced Linsets in driving residential HVAC uptake.

The commercial segment is projected to grow at the highest CAGR of 8.69% during the forecast period, driven by surging HVAC installations in offices, retail complexes, and hospitality infrastructure. This growth correlates with rising investment in smart buildings and retrofitting projects emphasizing HVAC efficiency. In 2024, Carrier launched the "AquaEdge 19MV" chiller with enhanced Linset specifications for best-in-class performance in commercial systems, while Trane Technologies increased its Linset options for high-capacity rooftop units. These advancements indicate increasing complexity and performance requirements in commercial HVAC applications, significantly increasing demand for robust, efficient, and scalable Linset solutions.

HVAC Linset Market Regional Outlook

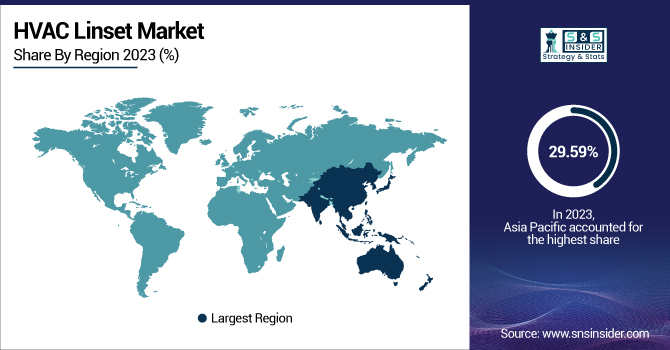

In 2023, Asia Pacific represented the highest revenue share of 29.59% in the HVAC Linset Market due to accelerated urbanization, surging residential construction, and growing use of energy-efficient HVAC systems. China, India, and Japan are among the countries that are experiencing huge demand for air conditioning equipment, fueling the use of copper and low-carbon Linsets. For instance, Daikin and Hitachi introduced new products to their splits through pre-insulated Linsets with optimized features for local climatic conditions. Moreover, LG introduced sophisticated HVAC solutions for the South Korean market in high-rise buildings, leading further to a rapid growth in the market based on product developments in this space.

North America is expected to advance at the highest CAGR of 9.51% over the forecast period, led by retrofitting demand, green building projects, and Inflation Reduction Act incentives. The U.S. market is emphasizing the reduction of HVAC system energy consumption, fueling demand for insulated and pre-charged Linsets. In 2023, Mueller Industries introduced next-generation Linsets with anti-corrosion coatings, while DiversiTech launched UV-resistant Linsets for harsh climate conditions. These innovations, combined with the increase in residential HVAC upgrades and smart home installs, are bolstering the region's pace and increasing prospects for HVAC Linset producers.

Get Customized Report as per Your Business Requirement - Enquiry Now

HVAC Linset Market Key Players are:

-

Klima Industries – (Copper Linsets, Pre-Insulated Linsets)

-

Icool USA, Inc. – (Pre-Flared Copper Linsets, Mini-Split Installation Kits)

-

Mandev Tubes – (HVAC Copper Tubes, Eco-Line Copper Pipes)

-

Halcor – (Talos Copper Tubes, Insulated Copper Linsets)

-

Cerro Flow Products LLC – (CerroTherm HVAC Tubing, CerroFlex Linsets)

-

KME SE – (KME HVAC Copper Tubing, KME Plus Linsets)

-

JMF Company – (ACR Copper Tubes, Insulated Linsets)

-

Hmax – (Mini-Split Linsets, Refrigerant Copper Tubing)

-

Kobelco & Materials Copper Tube Co., Ltd. – (Kobelco ACR Tubes, Pre-Insulated Copper Tubes)

-

Cambridge-Lee Industries LLC – (Linset Plus, Tube-Tuff ACR Tubing)

-

Linesets Inc. – (Insul-Lock Linsets, ArmorFlex Linsets)

-

Diversitech Corporation – (SpeediChannel Linset Covers, ArmorFlex Linsets)

-

Hydro – (Clad Tubing for HVAC, Aluminum Linset Solutions)

-

Daikin – (Factory-Charged Linsets, VRV-Compatible Copper Tubing Kits)

-

Foshan Shunde Lecong Hengxin Copper Tube Factory – (Refrigeration Copper Tubing, Air Conditioner Linsets)

-

Feinrohren S.P.A. – (Precision Copper Tubes for HVAC, ACR Linset Tubes)

Recent Trends

-

January 2025 – The EcoGuard Linset by Cambridge-Lee Industries LLC, introduced in January 2025, is engineered to address increasing concerns over corrosion in HVAC installations especially in coastal and industrial regions.

-

December 2024 – CerroSmart represents a major leap in HVAC Linset innovation by Cerro Flow Products LLC. This intelligent Linset integrates embedded smart sensors that monitor key operational parameters such as refrigerant pressure, temperature, and flow rate in real time. The sensor technology syncs with HVAC control systems and mobile diagnostics apps, enabling predictive maintenance and early fault detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.28 Billion |

| Market Size by 2032 | US$ 18.12 Billion |

| CAGR | CAGR of 7.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material – (Copper, Low carbon, Others) • By Implementation – (New Construction, Retrofit) • By End-use Industry – (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cambridge-Lee Industries LLC, Cerro Flow Products LLC, Daikin, Diversitech Corporation, Feinrohren S.P.A., Foshan Shunde Lecong Hengxin Copper Tube Factory, Halcor, Hmax, Hydro, Icool USA, Inc., JMF Company, Klima Industries, KME SE, Kobelco & Materials Copper Tube Co., Ltd., Linesets Inc., Mandev Tubes |