Get More Information on HVAC Filters Market - Request Sample Report

The HVAC Filters Market size was valued at USD 3.90 billion in 2023 and is expected to reach USD 6.59 billion by 2032 and grow at a CAGR of 6.00% over the forecast period of 2024-2032. HVAC filters are an important part of any heating, ventilation, and air conditioning system because they remove foreign particles from the air. Indoor air quality (IAQ) is kept up by using these filters to filter out pollen, dust, and chemical pollutants in enclosed spaces. Few HVAC filters are very good at catching around 99.97% of particles up to 0.3 microns in size. Also, HVAC filters keep pollutants from getting into HVAC equipment, which makes it less likely that large foreign particles will damage the equipment.

Concerns about air quality getting worse, especially in cities, are also driving sales of HVAC filtration systems. Increased pollution from things like cars and factories has made the air quality worse overall, which is having a big effect on the health of a lot of people. High pollution levels usually cause short-term effects like nausea and dizziness. However, long-term exposure to pollutants can kill you by hurting your respiratory, nervous, and reproductive systems.

Moreover, the primary driver significantly affecting the demand for HVAC systems and filters is the construction industry's expansion, especially in emerging economies. In particular, rapidly urbanizing countries such as China, India, and Brazil are beginning construction of an increasingly large number of new residential, commercial, and industrial buildings and infrastructural elements.

For instance, in 2023, the China Department for Housing and Urban Development announced plans to begin investing heavily in new urban housing projects in the coming decade. As a part of these new investments, builders, and engineers will require advanced HVAC systems and filters to help the new urban development reach their modern energy efficiency standards. This trend is visible in the activities of the key industry players. In 2023, Daikin Industries announced plans to expand the production capacity of their HVAC component factor in India, which the company believes will help compensate for the drop in demand for automotive filters and also ensure uninterrupted delivery of HVAC systems and filters to the market.

Moreover, Honeywell International announced introducing a new line of eco-friendly HVAC filters in 2022 that are specially designed for use in the commercial building sector, which will help ensure air quality inside the buildings while reducing energy costs. Therefore, it seems that one of the key drivers of increasing demand for HVAC filters is the rapid expansion of the construction industry, especially in urbanizing countries.

Market Dynamics:

Drivers

One of the most significant drivers of market growth is the increasing demand for HVAC systems. It is a critical factor because the HVAC filters usually belong to HVAC systems. As urbanization continues developing and residents of most countries get the possibility to incur their living standards, the interest in premium indoor climate control environments in residential, commercial, and industrial buildings grows. The reasons for such a significant increase in demand can be identified as a growing interest in improving air quality, requirements related to energy-efficient buildings, and the fact that the construction sector has been developing significantly. When it comes to energy efficiency, filters can be discussed as a tool that can help in immense filtration in HVAC systems to contribute to the energy-saving process. Without these filters, the amounts of energy and time used for maintenance practices will have to increase. Moreover, the construction sector is also one of the leading consumers. As new buildings and existing ones are equipped with HVAC devices, the filters for these devices are also needed. Thus, the drivers are significant, and the market is growing because the need for the product is increasing significantly.In the United States, the Department of Energy reported that HVAC systems account for about 48% of the energy use in a typical U.S. home, making energy efficiency in HVAC systems a critical focus. This has led to increased adoption of energy-efficient HVAC systems and the need for advanced filters that support these systems.

Restrain

High initial costs associated with advanced HVAC filters can significantly hamper market growth. These filters, designed to offer superior air quality and energy efficiency, often come with a price tag that is considerably higher than standard filters. For businesses and homeowners, the upfront investment in these high-performance filters can be a deterrent, particularly in regions where cost considerations are a primary concern. This is especially true in emerging markets, where the focus may be on affordability rather than advanced features.

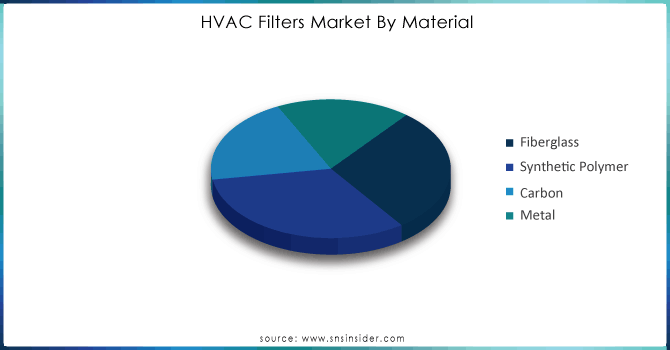

By Material

The synthetic polymer segment held the largest market share around 32.45% in 2023. Synthetic polymers, such as polyester and polypropylene, stand as the leading material in the HVAC filters market. The material is often favored for its versatility, durability, and affordability. Not only do these filters have high levels of filtration efficiency, but they are also light and easy to manufacture. The reactors typically take place over limited times, with the polymers cooling quickly. This allows for the particles to undergo a readily controlled crystallization process with aggregates that undertake variation above 140o. The high manufacturability rate, as such, also contributes to the low costs associated with this material. On top of that, many synthetic polymer filters are also reusable and washable, which appeals to commercial offices and homes alike. High expenditure associated with the maintenance of HVAC systems in commercial buildings is noted to be an issue, and as such, the lower replacement costs can provide value.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Technology

High-Efficiency Particulate Air filtration is leading among the technologies used in HVAC filters. HEPA filters are renowned for their exceptional ability to capture particles as small as 0.3 microns with an efficiency of 99.97%, making them the gold standard in air filtration. This technology is widely used in environments where air quality is critical, such as hospitals, laboratories, and cleanrooms, as well as in residential and commercial HVAC systems where reducing allergens, pollutants, and airborne pathogens is a priority.

By End-Use Industry

The building & construction industry held the largest market share in the HVAC filters market by end-use industry around 43.45% in 2023. This dominance is driven by the widespread application of HVAC systems in residential, commercial, and industrial buildings, where air quality and energy efficiency are critical. As urbanization accelerates, particularly in emerging economies, the demand for new buildings outfitted with advanced HVAC systems continues to grow, leading to increased consumption of HVAC filters. Additionally, regulations and standards related to indoor air quality and energy efficiency, such as those enforced by the U.S. Environmental Protection Agency (EPA) and the European Union's Energy Performance of Buildings Directive (EPBD), have made it mandatory for buildings to integrate high-efficiency filtration systems.

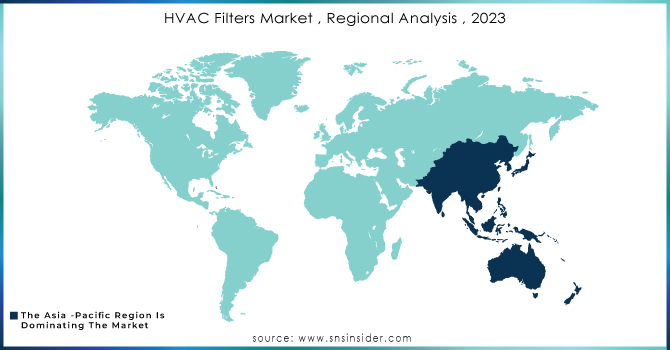

Regional Analysis

Asia Pacific held the largest market share with around 41.23% in 2023. The region's booming construction industry, particularly in countries like China, India, and Southeast Asian nations, is a major driver. For instance, China's government, under its 14th Five-Year Plan (2021-2025), is heavily investing in green and smart building projects, leading to a surge in demand for advanced HVAC systems and filters. Similarly, India's Smart Cities Mission, which aims to develop 100 smart cities, is driving the adoption of energy-efficient HVAC systems equipped with high-performance filters.

Moreover, government regulations focused on improving air quality are also propelling market growth. In 2020, the Chinese government introduced the "Blue Sky" initiative, which mandates stricter air pollution controls in urban areas, directly boosting the demand for high-efficiency HVAC filters. Additionally, Japan's focus on energy efficiency, supported by subsidies for green buildings, has further accelerated the adoption of advanced HVAC systems.

Key Players:

Filtration Group Corporation, Ahlstrom-Munksjö, 3M Company, Mann+Hummel, Parker-Hannifin Corporation, Sogefi Group, American Air Filter Company, Inc., Camfil AB, Donaldson Company, Inc., Freudenberg Group.

Recent Development:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.90 Billion |

| Market Size by 2032 | US$ 6.59 Billion |

| CAGR | CAGR of 6.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Fiberglass, Synthetic Polymer, Carbon, Metal) • By Technology (Electrostatic Precipitator, Activated Carbon, UV Filtration, HEPA Filtration, Ionic Filtration) • By End-Use Industry (Building & Construction, Pharmaceutical, Food & Beverage, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Filtration Group Corporation, Ahlstrom-Munksjö, 3M Company, Mann+Hummel, Parker-Hannifin Corporation, Sogefi Group, American Air Filter Company, Inc., Camfil AB, Donaldson Company, Inc., Freudenberg Group |

| DRIVERS | • Rising demand for the HVAC systems drives the market growth. • Indoor Air Quality Is Getting More Attention • Government rules and policies for filtering that works well |

| Restraints | • More worries about the environment |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Primary or secondary type of research done by this reports.

Ans: The most common way for COVID-19 to spread is from person to person. Social distance is an important way to stop the spread of COVID-19, but respiratory droplets can still infect other people through a building's HVAC system even if social distance is taken. In a recent survey by Air Conditioning, Heating and Refrigeration (ACHR) Magazine to find out how COVID-19 is affecting the industry, more than half of the people who answered said "business is slowing down" or "business has dropped off a lot."

Ans: More people want HVAC systems, Indoor Air Quality Is Getting More Attention and Government rules and policies for filtering that works well are the drivers for HVAC Filters Market.

Ans: HVAC Filters Market Size was valued at USD 3.90 billion in 2023, and expected to reach USD 6.59 billion by 2032, and grow at a CAGR of 6.00% over the forecast period 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. HVAC Filters Market Segmentation, by Material

7.1 Chapter Overview

7.2 Fiberglass

7.2.1 Fiberglass Market Trends Analysis (2020-2032)

7.2.2 Fiberglass Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Synthetic Polymer

7.3.1 Synthetic Polymer Market Trends Analysis (2020-2032)

7.3.2 Synthetic Polymer Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Carbon

7.4.1 Carbon Market Trends Analysis (2020-2032)

7.4.2 Carbon Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Metal

7.5.1 Metal Market Trends Analysis (2020-2032)

7.5.2 Metal Market Size Estimates and Forecasts to 2032 (USD Billion)

8. HVAC Filters Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Electrostatic Precipitator

8.2.1 Electrostatic Precipitator Market Trends Analysis (2020-2032)

8.2.2 Electrostatic Precipitator Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Activated Carbon

8.3.1 Activated Carbon Market Trends Analysis (2020-2032)

8.3.2 Activated Carbon Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 UV Filtration

8.4.1 UV Filtration Market Trends Analysis (2020-2032)

8.4.2 UV Filtration Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 HEPA Filtration

8.5.1 HEPA Filtration Market Trends Analysis (2020-2032)

8.5.2 HEPA Filtration Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Ionic Filtration

8.6.1 Ionic Filtration Market Trends Analysis (2020-2032)

8.6.2 Ionic Filtration Market Size Estimates and Forecasts to 2032 (USD Billion)

9. HVAC Filters Market Segmentation, by End-Use Industry

9.1 Chapter Overview

9.2 Building & Construction

9.2.1 Building & Construction Market Trends Analysis (2020-2032)

9.2.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Pharmaceutical

9.3.1 Pharmaceutical Market Trends Analysis (2020-2032)

9.3.2 Pharmaceutical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Food and Beverage

9.4.1 Food and Beverage Market Trends Analysis (2020-2032)

9.4.2 Food and Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Automotive

9.5.1 Automotive Market Trends Analysis (2020-2032)

9.5.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.4 North America HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.6.2 USA HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.7.2 Canada HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.8.2 Mexico HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.6.2 Poland HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.7.2 Romania HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.8.2 Hungary HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.9.2 Turkey HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.4 Western Europe HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.6.2 Germany HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.7.2 France HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.8.2 UK HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.9.2 Italy HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.10.2 Spain HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.13.2 Austria HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.4 Asia Pacific HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.6.2 China HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.7.2 India HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.8.2 Japan HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.9.2 South Korea HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.10.2 Vietnam HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.11.2 Singapore HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.12.2 Australia HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.4 Middle East HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.6.2 UAE HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.7.2 Egypt HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.9.2 Qatar HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.4 Africa HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.6.2 South Africa HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America HVAC Filters Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.4 Latin America HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.6.2 Brazil HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.7.2 Argentina HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.8.2 Colombia HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America HVAC Filters Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America HVAC Filters Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America HVAC Filters Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Filtration Group Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Ahlstrom-Munksjö

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 3M Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Mann+Hummel

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Parker-Hannifin Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Sogefi Group

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 American Air Filter Company, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Camfil AB

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Donaldson Company Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Freudenberg Group

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material

Fiberglass

Synthetic Polymer

Carbon

Metal

By Technology

Electrostatic Precipitator

UV Filtration

HEPA Filtration

Ionic Filtration

By End-Use Industry

Building & Construction

Pharmaceutical

Automotive

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Cosmetic Preservative Market Size was valued at USD 439.1 Million in 2023 and will hit USD 780.6 Million by 2032 & grow at a CAGR of 6.6% by 2024-2032.

The Low Dielectric Materials Market was USD 1.61 billion in 2023 and is expected to reach USD 2.81 Bn by 2032, growing at a CAGR of 6.44% by 2024-2032.

Water Treatment Chemicals Market was valued at USD 46.7 billion in 2023, and is expected to reach USD 94.2 billion by 2032, at a CAGR of 8.1% by 2024-2032.

The Plastic Films & Sheets market size was valued at USD 135 billion in 2023 and is expected to reach USD 212.3 billion by 2032 and grow at a CAGR of 5.20% over the forecast period 2024-2032.

The Nanofiber Market Size was valued at USD 904.9 million in 2023 and is expected to reach USD 5338.6 million by 2032 and grow at a CAGR of 21.8% over the forecast period 2024-2032.

The Construction Chemicals Market was worth USD 58.4 billion in 2023 and is expected to grow to USD 107.1 billion by 2032, with a CAGR of 7.0% in the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone