Humidity Sensors Market Report Scope & Overview:

The Humidity Sensors Market size was valued at USD 2.59 Billion in 2023 and is expected to grow to USD 4.86 Billion by 2032 and grow at a CAGR Of 7.25 % over the forecast period of 2024-2032.

Get more information on Humidity Sensors Market - Request Sample Report

The Humidity Sensor Market has seen significant growth, driven by the increasing need for precise humidity measurement in various industries. In the first two quarters of 2023, industrial humidity measurements reached 1,751 thousand metric tonnes, necessitating sophisticated monitoring solutions throughout the manufacturing process. Technological advancements have contributed to this growth, such as E+E Elektronik's HTS801 humidity sensor, launched in September 2023 for high humidity and chemical exposure applications, and Sensirion's SHT40I-Analog sensor, introduced in March 2023 for industrial environments with high noise levels. These innovations reflect the industry's response to the rising demand for reliable humidity control. The food and beverage sector has become a significant adopter, with companies like Wiliot introducing wireless humidity sensors for real-time monitoring throughout the supply chain, ensuring product safety and quality. the pharmaceutical industry has increased its use of relative humidity sensors to maintain the 40-60% humidity range mandated by the World Health Organization for optimal drug storage conditions. Similarly, the chemical industry's growth, particularly in China’s chemical API production, has further boosted demand for humidity sensors. These factors highlight the market’s expansion, with safety, quality control, and environmental conditions driving the adoption of advanced humidity sensor technologies across various sectors.

Market Dynamics

Drivers

-

Focus on Energy-Efficient and Sustainable Solutions Driving Humidity Sensor Adoption

The increasing global emphasis on sustainability and energy efficiency is driving the widespread adoption of humidity sensors across various industries. As environmental concerns and regulatory pressures mount, businesses are increasingly seeking solutions that not only optimize performance but also contribute to reducing energy consumption and minimizing environmental footprints. Humidity sensors play a crucial role in achieving these objectives by enabling more efficient use of energy in heating, ventilation, and air conditioning (HVAC) systems, industrial processes, and manufacturing operations. By accurately monitoring and regulating humidity levels, these sensors help maintain optimal conditions while reducing unnecessary energy consumption, ultimately leading to lower carbon emissions and energy costs. In the HVAC industry, for example, humidity sensors are integrated into smart systems to optimize airflow and temperature control, ensuring that energy is not wasted when humidity levels are within the desired range. Similarly, in the manufacturing sector, humidity sensors contribute to optimizing the performance of production processes, preventing equipment failures caused by extreme moisture levels and minimizing energy consumption. The growing push for sustainability, combined with advancements in sensor technology, has led to the development of more energy-efficient and eco-friendly humidity sensors. These sensors are designed with lower power consumption, reduced material use, and longer lifespans, aligning with global efforts to conserve resources and reduce environmental impact.

Restraints

-

The integration complexity of humidity sensors into existing systems, especially those relying on legacy equipment, poses a significant challenge for industries.

Many businesses are constrained by outdated infrastructure, which may not be compatible with the latest sensor technologies. This incompatibility often leads to difficulties in installation, requiring additional time and resources for system modifications. As a result, the integration process can be costly, which may deter some organizations, particularly small and medium-sized enterprises, from adopting advanced humidity sensing solutions. Moreover, industries such as pharmaceuticals, healthcare, and manufacturing, which must adhere to strict environmental control standards, may face increased operational downtime during system upgrades or recalibration. The need for specialized expertise to ensure proper integration further drives up costs and extends installation timelines. Furthermore, as businesses look to integrate humidity sensors, they must also contend with challenges related to data management, system interoperability, and the calibration of sensors to maintain accuracy over time. The rising demand for precise humidity control in areas like clean rooms, storage facilities, and healthcare settings only exacerbates the need for an efficient and cost-effective integration process. Additionally, as regulatory compliance grows more stringent, companies may find themselves spending more resources on overcoming these integration challenges to meet the required standards. The combination of high integration costs, complex installation procedures, and long-term maintenance needs represents a significant restraint for the widespread adoption of humidity sensors, despite their increasing importance across various industries.

Segment Analysis

By Type

The Absolute Humidity Sensor segment dominates the Humidity Sensors Market, accounting for approximately 71% of the market share in 2023. This segment is favored due to its accuracy and reliability in measuring the total water vapor present in the air, regardless of temperature. Absolute humidity sensors are widely used in various industries, including pharmaceuticals, automotive, and food processing, where precise and consistent humidity control is critical. These sensors provide real-time monitoring and contribute to maintaining optimal environmental conditions for manufacturing processes, storage, and transportation. Their ability to measure humidity without the need for temperature compensation makes them more efficient in settings where temperature fluctuations are common. As industries continue to prioritize environmental control, the demand for absolute humidity sensors is expected to remain high, further solidifying their dominance in the market.

The Relative Humidity (RH) Sensor segment is expected to be the fastest-growing in the Humidity Sensor Market over the forecast period from 2024 to 2032. RH sensors measure the amount of moisture in the air relative to the maximum amount of moisture the air can hold at a given temperature, making them crucial for a wide range of applications, including HVAC systems, agriculture, and electronics. Their ability to monitor and control indoor air quality, maintain optimal conditions in storage and manufacturing environments, and enhance comfort levels in buildings contributes to their increasing demand. As industries focus on energy efficiency, sustainable practices, and improved air quality, the adoption of RH sensors is set to accelerate, driving substantial growth in this segment.

By End Use

The automotive segment is dominating the Humidity Sensor Market by end-use, accounting for approximately 39% of the market share in 2023. Humidity sensors in vehicles are essential for optimizing air conditioning, defogging systems, and ensuring passenger comfort by monitoring moisture levels within the cabin. They are also critical in enhancing the efficiency of HVAC systems, activating ventilation processes only when necessary to save energy. Additionally, the growth in electric vehicles (EVs) and the increasing focus on vehicle safety systems and advanced driver assistance systems (ADAS) further amplify the demand for humidity sensors. These sensors help in monitoring environmental conditions that affect battery performance, preventing condensation-related issues. As the automotive industry invests in new technologies, the role of humidity sensors in vehicle design and functionality is expanding, boosting the segment's market dominance.

The environmental segment is the fastest-growing in the Humidity Sensor Market over the forecast period from 2024 to 2032. Rising concerns over climate change, air quality, and environmental monitoring are driving demand for accurate humidity sensors. These sensors are increasingly used in weather stations, agriculture, and industrial applications to monitor and control humidity levels, ensuring optimal conditions for crops, manufacturing processes, and pollution control. Additionally, government regulations regarding environmental standards and energy efficiency are fueling market growth. As industries and governments focus on sustainability and environmental conservation, humidity sensors are becoming essential tools for effective environmental management, contributing to the segment's rapid growth during the forecast period.

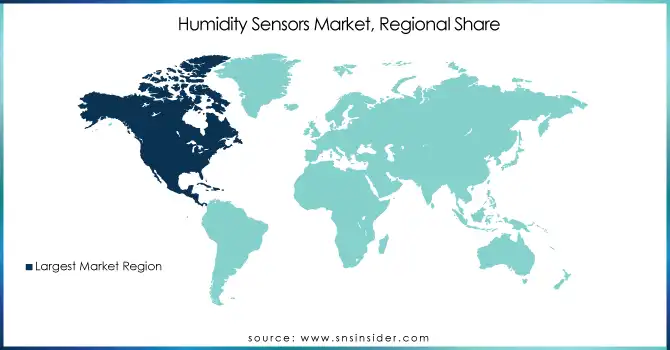

Regional Analysis

The Asia-Pacific region is dominating the Humidity Sensor Market, accounting for approximately 40% of the market share in 2023. This dominance is driven by rapid industrialization, urbanization, and significant advancements in manufacturing sectors across key countries like China, Japan, South Korea, and India. China, in particular, is a major contributor, with its robust automotive, electronics, and environmental sectors driving demand for humidity sensors. Additionally, the region’s growing focus on smart agriculture, climate control in buildings, and environmental monitoring is further propelling the adoption of humidity sensors. The expansion of healthcare and pharmaceutical industries, especially in India, is also contributing to market growth. With increasing investments in technological innovation and sustainability, Asia-Pacific is poised to maintain its leading position in the global humidity sensor market.

North America is the fastest-growing region in the Humidity Sensor Market over the forecast period from 2024 to 2032. This growth is driven by advancements in technology, particularly in industries such as automotive, healthcare, and environmental monitoring. The United States and Canada are seeing increased adoption of humidity sensors in electric vehicles, smart building systems, and HVAC (Heating, Ventilation, and Air Conditioning) applications, as energy efficiency and sustainability take center stage. Additionally, the region's growing emphasis on climate control solutions and air quality monitoring in response to rising health concerns is boosting the demand for precision humidity sensors. North America's robust infrastructure, along with regulatory standards requiring stringent environmental controls, particularly in pharmaceuticals and food safety, further accelerates the growth of humidity sensor technologies in this region.

Need any customization research on Humidity Sensors Market - Enquiry Now

Key Players

Some of the major key players in Humidity Sensors Market

-

Honeywell International Inc.(USA)

-

B+B Thermo-Technik GmbH (Germany)

-

E+E Elektronik Ges.m.b.H. (Austria)

-

IST AG (Switzerland)

-

Galltec Mess- und Regeltechnik GmbH (Germany)

-

TE Connectivity (USA)

-

Bosch Sensortec GmbH (Germany)

-

PCE Deutschland GmbH (Germany)

-

Infineon Technologies AG (Germany)

-

Amphenol Advanced Sensors (USA)

-

Panasonic Corporation (Japan)

-

Omega Engineering (USA)

-

Vaisala Oyj (Finland)

List of Suppliers in provide raw materials and components for the humidity sensor market:

-

Dow Inc.

-

BASF SE

-

3M

-

Texas Instruments

-

STMicroelectronics

-

Analog Devices

-

Infineon Technologies AG

-

Murata Manufacturing Co., Ltd.

-

NXP Semiconductors

-

Kemet Corporation

Recent Development

-

Jan 15, 2025 – Infineon Technologies has developed an integrated MEMS-based ultrasound transducer, offering a smaller footprint, improved performance, and higher functionality. This innovation enhances ultrasonic applications across consumer electronics, automotive, and medical industries, improving signal quality and reducing noise significantly

-

June 2024, Bosch Sensortec has introduced the BME690, a 4-in-1 MEMS air quality sensor that offers 50% power savings and is optimized for high-condensation environments. With AI-driven features, it monitors gases, humidity, temperature, and pressure, ensuring precise indoor air quality detection, perfect for battery-operated devices.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.59 Billion |

| Market Size by 2032 | USD 4.86 Billion |

| CAGR | CAGR of 7.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Absolute Humidity Sensor, Relative Humidity Sensor, Others) • By End Use(Automotive, Pharmaceutical & Healthcare, Industrial, Building Automation & Domestic Appliances, Food & Beverages, Environmental, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc. (USA), B+B Thermo-Technik GmbH (Germany), Sensirion AG (Switzerland), E+E Elektronik Ges.m.b.H. (Austria), IST AG (Switzerland), Galltec Mess- und Regeltechnik GmbH (Germany), TE Connectivity (USA), Bosch Sensortec GmbH (Germany), PCE Deutschland GmbH (Germany), Sensata Technologies, Inc. (USA), Infineon Technologies AG (Germany), Amphenol Advanced Sensors (USA), Panasonic Corporation (Japan), Omega Engineering (USA), Vaisala Oyj (Finland). |

| Key Drivers | • Focus on Energy-Efficient and Sustainable Solutions Driving Humidity Sensor Adoption |

| Restraints | • The integration complexity of humidity sensors into existing systems, especially those relying on legacy equipment, poses a significant challenge for industries. |