Humectants Chemical Market Report Scope & Overview:

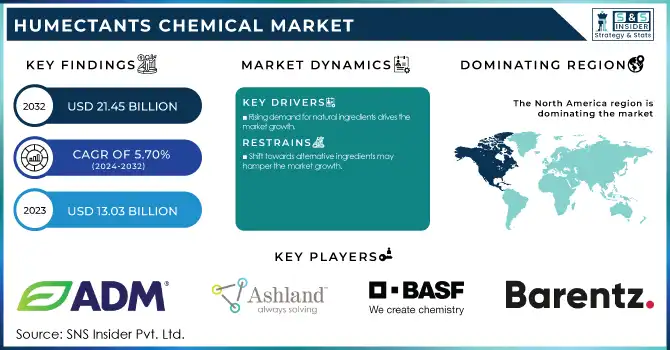

The Humectants Chemical Market was USD 13.03 Billion in 2023 and is expected to reach USD 21.45 Billion by 2032, growing at a CAGR of 5.70% over the forecast period of 2024-2032.

Get More Information on Humectants Chemical Market - Request Sample Report

The increasing awareness regarding personal care and cosmetic products has substantially increase the demand for humectants, especially in moisturizers, creams and lotions. A significant part of the products, humectants work by attracting the moisture to the skin as well as ensuring that the moisture is locked in as it works to keep the skin hydrated and improve the texture of the skin. In addition, with consumers chasing after products that add extra benefit including anti-aging, humidification, and skin nourishment, the growing demand for formulations with humectants such as glycerin, hyaluronic acid and propylene glycol is escalating. This increase in complex skincare habits, along with the consumer preference for organic & natural beauty products, is likely to drive the growth of humectants in cosmetic industry globally.

Advancement in formulations of chemicals has significantly increased the efficiency and functionalities of humectants, which can help the product hold moisture. Novel humectant compounds with high water retention ability are being developed by researchers and manufacturers to provide prolonged moisture retention in food, cosmetic and pharmaceutical formulations. By exporting bio-based and multifunctional humectants, not only do customers achieve improved functional benefits, but also include humectants that are increasingly in-demand for being sustainable and beneficial at the skin level. These developments address changing consumer demand, especially in personal care and food preservation applications, thereby expanding the market and product innovation.

For instance, The Indian Council of Agricultural Research (ICAR) discusses the utilization of waste and by-products from fisheries and fish processing activities, which can be converted into valuable biomolecules, including humectants, for use in foodstuffs, nutraceuticals, pharmaceuticals, and cosmetics.

Humectants Chemical Market Dynamics

Drivers

-

Rising demand for natural ingredients drives the market growth.

The surging demand for naturally sourced ingredient emerges as a prime growth contributor to humectants market, as customers preference are shifting towards ever so popular clean-label, organic and plant-based products. As the dangers of synthetic chemicals are gaining attention in the food and beverages, personal care, and pharmaceutical industries, major players are increasingly using naturally derived humectants such as glycerin, aloe vera extract, honey, and hyaluronic acid. With dermal appeal, the personal care segment is seeing brands creating skincare and haircare using plant-based humectants to align with increasing demand for sustainable and gentler ingredients. Likewise, in the food industry, if you keep your product less moist, but natural, the natural humectants can be utilized to have moisture-maintaining properties and smooth texture without any synthetic function. This trend is further complemented by government regulations in favor of sustainable and organic ingredients, which fuels the growth of bio-based humectants across different application areas. This has led to R&D investments made by manufacturers in developing novel high-performance natural humectants that support clean-label and sustainability trend, thereby creating lucrative opportunities for US natural humectant market.

Restraint

-

Shift towards alternative ingredients may hamper the market growth.

The use of alternative ingredients is a threat to the humectants market because consumers and industry are working on finding replacements for humectants that better meet their preferences and the changes in regulations as well. Because of rising worries about synthetic chemical substances, some producers are selecting non-synthetic hydration alternatives, together with botanical extracts, plant oils, waxes, and excessive bio-based polymer, which could exchange traditional humectants. Another driver in the food and beverage sector is the clean-label trend, which prefers naturally occurring moisture-retaining ingredients, such as fruits and vegetable extracts, compared with processed humectants. Some consumer habits are also changing as stricter regulatory controls regarding the use of some chemical-based humectants, especially in cosmetics and pharmaceuticals, which may hamper the market growth.

Humectants Chemical Market Segmentation

By Source

Natural source held the largest market share of around 64% in 2023. It is due to high demand for clean-label, plant-based, and sustainable ingredients, the humectants market is characterized by the largest share held by the natural segment. As consumers are becoming more aware of health and environmental-related concerns, the food and beverages, personal care and the pharmaceuticals sector are reverting towards using naturally derived humectants like glycerin, honey, aloe vera and hyaluronic acid. For personal care, natural humectants are increasingly used in skin and hair care formulations to provide successful hydration with non-synthetic chemicals. Likewise in the food industry, they are employed to retain moisture and improve texture without hindering product stability and functionality.

By Product

The sugar alcohol segment held the largest market share around 38% in 2023. The sugar alcohol segment held the largest market share in the humectants market due to the high usage in food and beverage, pharmaceutical, and personal care industries. Sugar alcohols have been used extensively as humectants because of their high humidity retentivity, low caloric value and ability to also provide sweetness which make them sugar-free and reduced-sugar food product suitable candidates. Sugar alcohols in the pharmaceutical sector are often added in oral syrups, chewable tablets and also in the mix of medicines to provide texture and stabilization. In the personal care industry, sugar alcohols serve as major components of skin and haircare formulations to ensure hydration and product stability.

By Application

Food & Beverage held the largest market share around 43% in 2023. Due to the product's role in providing moisture, texture, and longevity to a variety of food products, the food and beverage segment in the humectants market occupies the largest share of the market. Additionally, growing consumer preference for low-sugar and sugar-free products has propelled the use of humectants especially sugar alcohols in drinks, confections and functional foods.

Humectants Chemical Market Regional Analysis

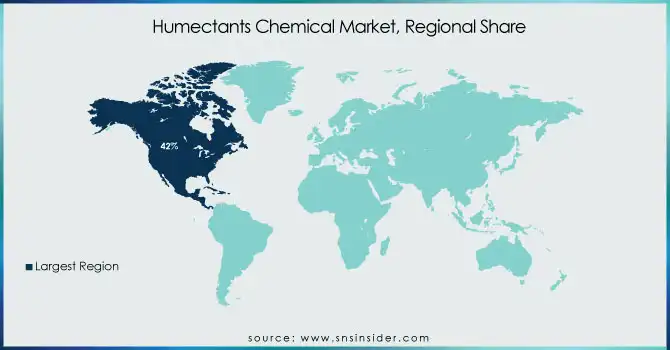

North America has the highest share of humectants chemical market of around 42% in 2023. It is due to the presence of key industries such as food and beverages, personal care, pharmaceuticals and animal feed in this region. Humectants chemical have been used extensively in the food industry in the region to increase the moisture retention, texture, and shelf life of bakery, confectionery, and processed food products. In addition, the rising demand for clean-label and sugar-free food products has resulted in the utilization of natural humectants and sugar alcohols. Moreover, the usage in personal care and cosmetics sector also accelerates the growth of the economy as plant-based humectants are incorporated into various skincare and haircare products by major brands to fulfill the demands of consumers towards the adoption of natural and recognized ingredients (natural and nature-identical). Additionally, the backing of agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada to ensure the safety and quality of products also contributes to market growth. North America is the largest humectants market due to continuous developments in product compositions along with growing consumption of consumers toward functional ingredients.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Archer Daniels Midland Company (Sorbitol, Glycerin)

-

Ashland Global Holdings Inc. (Harmoniance, N-DurHance)

-

BASF SE (Hydagen, Verdessence)

-

Barentz (Sorbitol, Xylitol)

-

Brenntag AG (Sorbitol, Propylene Glycol)

-

Cargill Incorporated (C☆Dry MD, Zerose Erythritol)

-

E.I. Du Pont De Nemours & Company (GENENCARE OSMS BA, GRINDSTED® Sorbitol)

-

Ingredion (NATIVACARE, SORBOGEM)

-

Roquette Frères (PEARLITOL, SweetPearl)

-

DOW Chemical Company (DOWSIL 2501, Methocel)

-

Evonik Industries (TEGOSOFT, SIPERNAT)

-

Solvay (Rheomer, Repel-O-Tex)

-

Lubrizol Corporation (Glucamate, Carbopol)

-

Croda International (Glycerox, Crodesta)

-

Merck Group (Sorbitol, Glycerin)

-

Eastman Chemical Company (Sustane, Optifilm)

-

Clariant (Genadvance Hydra, Plantasens)

-

Lonza Group (Carnipure, H2OBioEV)

-

Givaudan (Vetivyne, Cristalhyal)

-

Kao Corporation (Glyteer, Lipidure)

Recent Development:

-

In 2024, ADM diversified its bio-based product lineup by spending on sustainable, plant-based materials including glycerin as humectants and incorporating them into its personal care & food sectors.

-

In 2023, Ashland global holdings Inc. launched new product formulations, including its N-DurHance, a natural humectant for the personal care industry, to meet the increasing demand for clean-label, eco-friendly ingredients.

-

In 2023, BASF SE introduced new bio-based humectants as part of its commitment to sustainability. Its "Hydagen" range was upgraded to enhance moisture retention properties in both cosmetics and food applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.03 Billion |

| Market Size by 2032 | USD 21.45 Billion |

| CAGR | CAGR of 5.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Synthetic, Natural) • By Product (Sugar Alcohol, Alpha Hydroxy Acid, Glycols, Others) • By Application (Food & Beverage, Oral & Personal Care, Pharmaceutical, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Archer Daniels Midland Company, Ashland Global Holdings Inc., BASF SE, Barentz, Brenntag AG, Cargill Incorporated, E.I. Du Pont De Nemours & Company, Ingredion, Roquette Frères, DOW Chemical Company, Evonik Industries, Solvay, Lubrizol Corporation, Croda International, Merck Group, Eastman Chemical Company, Clariant, Lonza Group, Givaudan, Kao Corporation |

| Key Drivers | • Rising demand for natural ingredients drives the market growth. |

| Restraints | • Shift towards alternative ingredients may hamper the market growth. |