Human Insulin Market Size & Trends Analysis:

To Get More Information on Human Insulin Market - Request Sample Report

The Human Insulin Market size was valued at USD 18.1 billion in 2023 and is expected to reach USD 24.6 billion by 2032 and grow at a CAGR of 3.4% over the forecast period of 2024-2032.

Revolutionary growth in the market is experienced in human insulin, mainly due to the increase in the prevalence of diabetes and regulatory developments that make the treatment more accessible. According to IDF data, as many as 537 million people in the world are suffering from the disease, and by 2045, this number will increase to 643 million. This increase in diabetic patients, driven by sedentary lifestyles, is fueling the rising demand for insulin products that are vital in the treatment of diabetes. In developed countries, positive reimbursement scenarios also bolster the market.

One of the most crucial developments affecting the human insulin market is that the U.S., under the Inflation Reduction Act, has taken a major initiative to establish the Medicare Drug Price Negotiation Program. This bill empowers Medicare to negotiate directly with pharmaceutical companies over the open market price of prescription drugs, knocking a significant amount off the cost of insulin for millions of Americans. This reform models extant practices by other federal agencies, such as the U.S. Department of Veterans Affairs, and represents a landmark shift in health policy.

More importantly, the biosimilar insulins are entering the market. For instance, Eli Lilly and Company launched an interchangeable biosimilar of insulin glargine called Rezvoglar at a 78% lower price than Lantus. Accepted by the FDA in 2021 and approved as interchangeable in 2022, Rezvoglar will be another drug that will contribute to market competition and reduce the cost of treatment. Another one of its classes, Biocon Biologic's Semglee, approved in 2021, intensifies the competition even more. Semglee is substitutable, so pharmacists can substitute Lantus with this drug without the physician's prescription, which is a big success factor in increasing the availability of insulin.

The threats include: Insulin being expensive, and new diabetes drugs such as GLP-1 receptor agonists, that can threaten the present market. However, innovation will keep going on, and long-term growth is expected from biosimilars, where the company giant Eli Lilly, Novo Nordisk, and Sanofi will dominate market share.

| Company | Key Products | Product Type | Market Positioning | Recent Developments | |

|---|---|---|---|---|---|

| Novo Nordisk | - NovoLog (insulin aspart) | Rapid-acting insulin | Market leader with strong brand recognition | Launched generic versions of NovoLog | |

| - Levemir (insulin detemir) | Long-acting insulin | Focus on innovative insulin therapies | Increased availability in emerging markets | ||

| - Tresiba (insulin degludec) | Long-acting insulin | Targeting personalized diabetes management | |||

| Eli Lilly | - Humalog (insulin lispro) | Rapid-acting insulin | Pioneered rapid-acting insulin formulations | Launched Lyumjev, a new human insulin analog in China | |

| - Basaglar (insulin glargine) | Long-acting insulin | Focus on cost-effective alternatives | Strategic partnerships to enhance market presence | ||

| Sanofi | - Lantus (insulin glargine) | Long-acting insulin | Strong foothold in global markets | Launched a new formulation of Lantus in India | |

| - Admelog (insulin lispro) | Rapid-acting insulin | Focus on affordable options | Collaborations with healthcare providers | ||

| Boehringer Ingelheim | - biosimilar insulin products (e.g., Semglee) | Biosimilar insulin | Focus on biosimilars to enhance patient access | Expanding portfolio of biosimilar insulin products | |

| - Vials and pens for diabetes management | Various | Strengthening R&D capabilities for diabetes treatment | Increased investment in research initiatives | ||

| Biocon Biologics | - Insulin human (various formulations) | Human insulin | Affordable insulin solutions in emerging markets | Secured a $90 million contract with the Malaysian government | |

| - biosimilar insulins | Biosimilar insulin | Focus on expanding market access | Launching new products in various regions | ||

Human Insulin Market Dynamics

Drivers

-

A strong increase in the prevalence of diabetes is expected to foster market growth.

The rise in diabetes worldwide, primarily linked to obesity and sedentary lifestyles, is a significant driver of the growth of the human insulin market. World Health Organization declares that half a million people die each year due to the non-communicable disease NCD diabetes alone. Despite all the preventive measures, type 2 diabetes is considered to be among the biggest challenges for healthcare systems in all countries. According to data from the IDF Diabetes Atlas (2021), the number of patients with diabetes worldwide will increase to 643 million by 2030 and to 783 million by 2045. In addition, millions of people around the world suffer from type 1 diabetes and require insulin therapy to regulate glycemia. As per the European Association for the Study of Diabetes (EASD), over 9 million people worldwide currently suffer from type 1 diabetes. Moreover, the International Diabetes Federation estimates that about 10% of all diabetic patients are affected by type 1 diabetes. As this type of diabetes is increasingly growing, the high demand for human insulin globally will continue to support market growth throughout the forecast period.

-

Launch of Novel Insulin Products Drives Expansion

A rise in the launch of new insulin-based products also provides impetus to the human insulin market. Companies in the pharmaceutical industry have been surging in the development of new kinds of insulin solutions to maximize market shares, thus helping the market gain momentum. For instance, Sanofi introduced Soliqua, a long-acting insulin, into the Indian market after receiving the approval of the Central Drugs Standard Control Organization (CDSCO) in March 2023. Similarly, Eli Lilly and Company received approval for Mounjaro used in the treatment of type 2 diabetes in May 2022 while Lyumjev as rapid-acting insulin used in the treatment of both type 1 and 2 diabetes, got approval in June 2020. The launches of such products shall be raising the human insulin market by considerable margins.

More research and development is needed and will enhance the market for new products, such as oral insulin delivery technology that will eventually offer alternative options to insulin pens. An example of this is in the study of oral insulin using nano-carrier delivery technology. This could be the most significant shift in insulin administration to date, and further development is set to propel growth in the market in the coming years.

Restraints

-

Lack of Health Reimbursement and Low Diagnosis Rates in Emerging Markets Hinder Growth

Human Insulin Market Segmentation Overview

By Type

Analogue insulin dominated the market in 2023 with a 54.6% share due to its numerous advantages in comparison with traditional human insulin. Various studies and reports show that analog insulin has improved compliance with therapy and glycemic control with a reduced risk of hypoglycemia when compared with conventional insulin. According to Diabetes.co.uk, analog insulin is also a faster-acting and more consistent type of insulin, giving it an added impetus over the years.

More importantly, generic versions of products in the insulin category have further pushed up the growth in this segment. For instance, recently, the world's largest maker of insulin, Novo Nordisk A/S, said it would sell generic versions of NovoLog and NovoLog Mix, which are considerably cheaper than their branded counterparts.

This is because of low penetration in this segment. Compared to others, CAGR in the traditional human insulin segment will be slower due to this segment's lower adoption rate. With several traditional insulins including intermediate-acting insulin, there has been an increased trend wherein more healthcare providers prefer analogue insulin drugs because of higher effectiveness and better response from patients. This will further continue the dominance of analogue insulin in the market.

By Diabetes Type

In the year 2023, the type 1 diabetes segment grabbed the largest market share, which stood at 57.8% because of the increasing incidences of diabetes and the fact that patients suffering from type 1 diabetes need to rely on a daily dose of insulin shots to maintain blood glucose levels. As claimed by the IDF, for patients with type 1 diabetes, insulin is the most crucial medication.

In contrast, the type 2 diabetes segment is expected to grow at a lower CAGR than that for type 1; the primary reason is the existence of alternative treatments to manage type 2 diabetes. Patients having type 2 diabetes are prescribed human insulin only if other treatments fail. Nonetheless, the worldwide risk of developing type 2 diabetes is substantial. According to the IDF, 541 million adults suffer from IGT, a condition that predisposes them to type 2 diabetes. Therefore, though growth in the type 2 diabetes segment will be continuous, its rate will be slower compared with that of type 1 diabetes.

By Distribution Channel

The retail and online pharmacy segment stood at 59.2% of insulin revenues in 2023, mainly due to entrance by bigger players such as Amazon and Walmart. These entities have launched more affordable insulin options that have made insulin products more accessible. For instance, in June 2021, Walmart launched the brand ReliOn, an analog insulin available in vial and pen format. It costs between 58% to 75% cheaper than the alternative forms of branded insulin. In the same year, in November 2020 Amazon Pharmacy also began to sell and dispense insulin. More customers begin buying their insulin from the website due to the corporation.

The hospital pharmacy segment will see moderate CAGR, primarily fueled by global development in hospital infrastructure. Steady growth will be instead supported by increased availability of insulin in hospitals, though retail and online pharmacies are expected to continue dominating revenue markets.

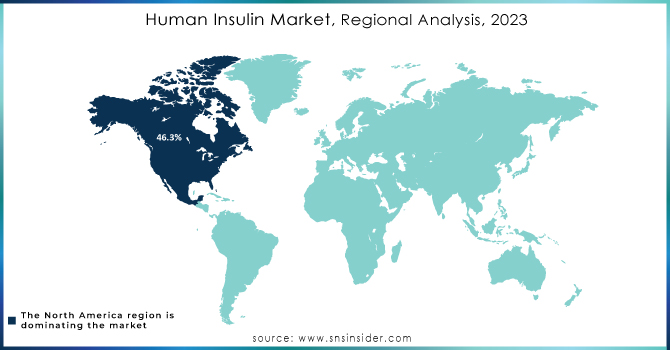

Regional Insights

North America generated a revenue share of 46.3% in the year 2023, thereby holding the largest share in the global market of human insulin. Contributive factors could be the strong presence of leading insulin manufacturers, healthy competition in the market, and the rising prevalence of type 1 diabetes in the region. According to the American Diabetes Association, 1.6 million Americans suffer from type 1 diabetes, including 187,000 children and adolescents. It is also worth mentioning that the increasing price of insulin in the U.S. during the last decade has enabled North America to gain a significant market share across the globe. According to the direct medical costs related to diabetes in the United States, the Centers for Disease Control and Prevention (CDC) consider that it reaches approximately USD 237 billion annually. Moreover, the "evergreening" of insulin products by major players in the market has enabled the firms to maintain substantial market share. For instance, the use of a CGM or an insulin pump reached about 30% penetration in the U.S. in 2021, according to Industry Dive.

Europe is expected to be the second-most lucrative market in terms of revenue, due to the growing availability of market leaders in the region. For instance, Sanofi began selling its next-generation basal insulin, Toujeo Solostar, to countries across the European Union in September 2021. Other growth in the latter half is also being aided by the formation of a more developed healthcare infrastructure and rising support for insulin therapies.

Asia Pacific is expected to grow at the highest compound annual growth rate (CAGR) during the forecast period. This is mainly due to the risk factors of diabetes development within the region, with its high risk among elderly populations in its respective locales. The Asian Diabetes Prevention Initiative states that lifestyle and dietary trends in Asia, such as smoking, poor diet, and physical inactivity, have a high risk of developing diabetes. This factor, with increasing healthcare awareness and widening access to insulin products, shall only fuel further growth in the Asian Pacific market.

Do You Need any Customization Research on Human Insulin Market - Enquire Now

Human Insulin Market Players

-

Sanofi

-

Oramed

-

Eli Lilly and Company

-

Biocon

-

Julphar

-

BIOTON S.A.

-

Pfizer Inc.

-

Gan & Lee Pharmaceuticals

-

Bristol-Myers Squibb Company

-

GlaxoSmithKline Plc

-

Wockhardt

-

Tonghua Dongbao Pharmaceutical Co., Ltd., and others.

Recent Development

Nov 2023: Biocon Biologics Secures USD 90 million Contract with the Government of Malaysia in the Human Insulin Business. Biocon Biologics biosimilars arm of Biocon- is setting a new benchmark in the Insulin business as it has bagged its largest contract with the Malaysian government to supply human insulin valued at USD 90 million. The five-year deal starting in 2024 is the largest that Biocon Biologics has signed for its insulin portfolio.

October 2023: Eli Lilly Launches New Rapid-Acting Human Insulin Analog in China. Eli Lilly and Company has launched Lyumjev, a rapid-acting human insulin analog for the treatment of diabetes, in China. Lyumjev is designed to start working much faster than other insulin products; it provides an effective solution for individuals suffering from diabetes who need to regulate blood sugar levels post-meal.

Sept. 2023: Novo Nordisk to Halve Prices of Human Insulin in Low- and Middle-Income Countries. The company said it will cut prices of its human insulin brands by as much as 50% in low- and middle-income countries, where three of four people with diabetes live.

August 2023: Sanofi Introduces Human Insulin Formulation in India. Sanofi recently unveiled a new formulation of its human insulin product in India. The company announced the new formulation of the human insulin product, Lantus, which provides better stability and easier administration to patients.

| Report Attributes | Details |

| Market Size in 2023 | US$ 18.1 billion |

| Market Size by 2032 | US$ 24.6 billion |

| CAGR | CAGR of 3.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analogue Insulin, Traditional Human Insulin) • By Diabetes Type (Diabetes Type 1, Diabetes Type 2) • By Distribution Channel (Hospital Pharmacies, Retail & Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sanofi, Oramed, Adocia, Merck & Co.Inc, Novo Nordisk A/S, Eli Lilly and Company, Biocon, Julphar, BIOTON S.A., Pfizer Inc., Gan & Lee Pharmaceuticals , Bristol-Myers Squibb Company, GlaxoSmithKline Plc, Wockhardt, Tonghua Dongbao Pharmaceutical Co., Ltd., and others. |

| Key Drivers | • A strong increase in the prevalence of diabetes is expected to foster market growth. • Launch of Novel Insulin Products Drives Expansion |

| Market Restraints | • Lack of Health Reimbursement and Low Diagnosis Rates in Emerging Markets Hinder Growth |