Get More Information on Hospital Services Market - Request Sample Report

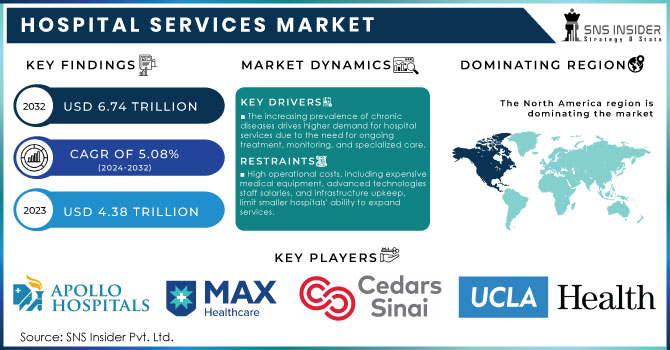

The Hospital Services Market size was estimated at USD 4.38 trillion in 2023 and is expected to reach USD 6.74 trillion by 2032 at a CAGR of 5.08% during the forecast period of 2024-2032.

The Hospital Services Market has grown significantly in recent years due to a wide range of factors. Some of the trends that have contributed to the growth of this service market include a growing prevalence of chronic disease which requires an increase in hospital visits and long-term management chronic diseases such as diabetes and cardiovascular disorders are becoming more and more prevalent. In addition, a growing aging population is pushing hospitals to improve their service provision in order to cater to the complex health needs of older citizens continually. In addition, some of the more current trends seem to be pushing towards more patient-centered care as more and more hospitals work on the improvement of patient experience and outcomes. One such trend is the use of telehealth services which has seen a significant growth even before the pandemic and has only accelerated their use with the need to keep patient loads in the hospitals to a minimum. The use of artificial intelligence and machine learning is often used in the hospital setting in order to facilitate operations and optimize diagnosis and treatment plans. The U.S. had approximately 6,093 hospitals with 920,531 licensed beds and an average occupancy rate of 66.4%, indicating that about two-thirds of beds were in use. The average length of stay for hospital patients was 4.6 days. In 2022, hospitals recorded 36.2 million inpatient admissions and over 880 million outpatient visits, highlighting the growing reliance on outpatient services. Hospital services represented 31% of total healthcare spending, amounting to USD 1.24 trillion. U.S. hospitals performed around 48 million surgical procedures annually and received 130 million emergency visits, with 16 million resulting in admissions. The healthcare workforce in hospitals comprises 5.4 million people, with over 2.9 million registered nurses. The adoption of telemedicine surged post-pandemic, with 76% of hospitals offering telehealth services by 2021, and telehealth accounting for 20% of outpatient visits in 2022.

Therefore, a wide variety of different value-based incentives are giving them incentives to invest in such programs and decrease the amount of money per patient that they have to spend. Furthermore, one should not forget about the trend of expanded health insurance coverage that is being experienced in many emerging and developing markets, which is allowing more and more hospital visits to occur. Finally, hospitals are expanding investment in the up-to-date infrastructure to house modern medical practices thus increasing their specialist services and outpatient facility options.

MARKET DYNAMICS

DRIVERS

The increasing prevalence of chronic diseases drives a higher demand for hospital services due to the need for ongoing treatment, monitoring, and specialized care.

The rising prevalence of chronic diseases is a significant driver of increased demand for hospital services. Conditions such as diabetes, cardiovascular diseases, cancer, and respiratory disorders require ongoing treatment, regular monitoring, and specialized care, often leading to frequent hospital visits. As chronic diseases typically persist over long periods, patients require continuous medical attention, including medication management, diagnostic tests, rehabilitation services, and surgical interventions. Hospitals play a critical role in delivering these services, making them essential for patients who require multidisciplinary care and advanced treatment options.

In addition to direct care, chronic disease patients often need specialized equipment and expertise for effective management. Cancer patients may need chemotherapy or radiation therapy, while individuals with cardiovascular conditions might require regular monitoring through specialized tests like ECGs and angiograms. These specialized services can only be provided in well-equipped hospitals, driving up the demand for hospital-based treatments.

Moreover, as chronic conditions are frequently linked to aging populations and unhealthy lifestyle habits, the global rise in life expectancy and sedentary lifestyles further accelerates this trend. Hospitals are increasingly being relied upon to provide comprehensive and long-term care solutions, from preventive measures to palliative care. Consequently, the growing prevalence of chronic diseases not only increases the number of patients seeking hospital services but also the complexity and frequency of their care needs, placing greater pressure on healthcare infrastructure and resources. This growing demand makes hospitals vital in managing the global chronic disease burden.

Technological advancements like telemedicine, AI diagnostics, and robotic surgeries enhance patient care and efficiency, boosting hospital service demand and market growth.

Technological advancements such as telemedicine, AI-driven diagnostics, and robotic surgeries are transforming the hospital services market by enhancing both patient care and operational efficiency. Telemedicine allows patients to receive remote consultations and treatments, reducing the need for physical hospital visits and expanding access to healthcare, especially in rural or underserved areas. AI diagnostics enable faster and more accurate disease detection, leading to improved treatment outcomes and better patient management. Additionally, robotic surgeries offer greater precision, shorter recovery times, and reduced risk of complications, increasing patient satisfaction and hospital efficiency. These innovations not only improve the quality of care but also help hospitals optimize resources, reduce operational costs, and handle larger patient volumes. As a result, the growing adoption of these technologies is driving increased demand for hospital services and contributing to the overall growth of the market, as hospitals seek to stay competitive and meet evolving patient expectations.

RESTRAIN

High operational costs, including expensive medical equipment, advanced technologies, staff salaries, and infrastructure upkeep, limit smaller hospitals' ability to expand services.

High operational costs pose a significant challenge for hospitals, particularly smaller ones, by constraining their ability to expand services. These expenses include the purchase and maintenance of costly medical equipment, such as MRI machines and robotic surgery systems, which are essential for offering advanced care. Additionally, hospitals must continually invest in cutting-edge technologies, like electronic health records (EHRs) and telemedicine platforms, to remain competitive and meet patient demands for efficient and modern healthcare services. Staff salaries also contribute significantly to operational costs, with hospitals needing to pay competitive wages to retain skilled doctors, nurses, and specialists. Furthermore, infrastructure maintenance, such as upgrading facilities to meet safety standards and accommodating growing patient volumes, adds to the financial burden. These combined costs make it difficult for smaller hospitals and healthcare centers, which often operate with tighter budgets, to expand their offerings, improve their services, or invest in the latest innovations.

By Type

The inpatient services segment dominated the market, accounting for the largest market share of 49.03% in 2023. The demand for this sector is anticipated to grow due to the increased requirement for around-the-clock extensive healthcare services offered through hospitalization, particularly for serious health conditions and surgical treatments. Furthermore, the rise in insurance availability in emerging nations is anticipated to drive up the number of patients staying in hospitals, leading to an increased demand for this sector on a global scale.

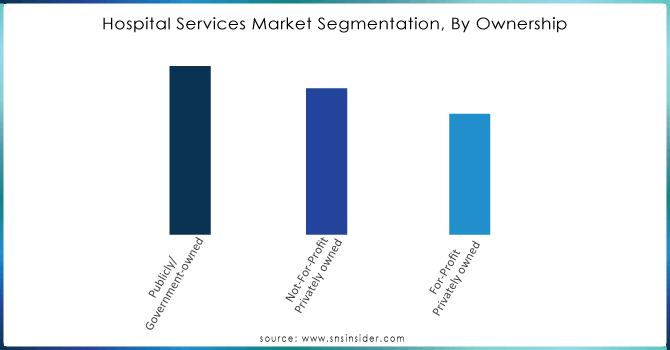

By Ownership

The publicly/government-owned segment held the largest revenue share of 42.58% in 2023 due to the large number of patients in these facilities as a result of lower prices or more affordable healthcare options when compared to private facilities. Moreover, nations are prioritizing the expansion of public hospitals in remote regions to offer top-notch healthcare to areas that lack access. Therefore, governments allocate resources to public health in order to improve workforce capabilities and quality of care.

Need any customization research on Hospital Services Market - Enquiry Now

REGIONAL ANALYSES

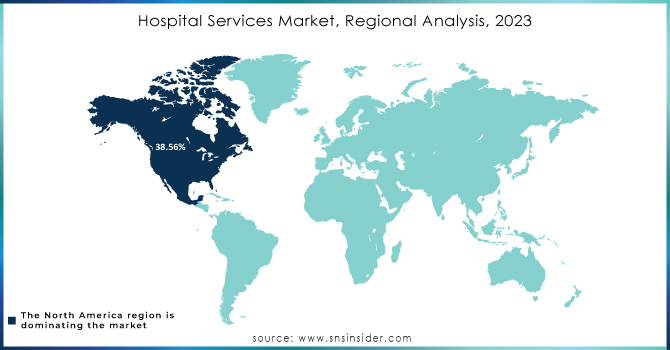

North America hospital services market dominated the market with a share of 38.56% in 2023. This can be attributed to the growing need for advanced services, the rising use of technologically advanced solutions in facilities, and significant investments in healthcare infrastructure and services by government and private sectors. The expansive hospital network and comprehensive care in the U.S. hospital services market are fueled by the rising use of advanced technologies and significant healthcare spending. Furthermore, changes in policies and expanded healthcare coverage through the Affordable Care Act have broadened access for a wider demographic. Furthermore, the movement towards consolidation, where hospitals combine to create larger systems, is anticipated to improve healthcare delivery and enhance patient outcomes, thus helping boost market expansion.

The Asia Pacific hospital services market is experiencing rapid growth due to the rapidly aging population, increasing prevalence of chronic diseases, and significant improvements in healthcare infrastructure. In addition, rising healthcare expenditures, growing health consciousness among the population, and government initiatives aimed at improving healthcare access and quality are expected to drive the growth of the market.

Some of the major key players of Hospital Services Market

Apollo Hospitals Enterprise Ltd.: (Specialty care services, Telemedicine, Health check-ups, Preventive health packages)

Max Healthcare: (Multi-specialty care, Cancer care, Cardiac services, Telemedicine solutions)

West Suffolk NHS Foundation Trust: (Emergency care services, Diagnostic services, Rehabilitation programs)

Royal Papworth Hospital NHS Foundation Trust: (Specialist heart and lung services, Cardiothoracic surgery, Transplant services)

Cedars-Sinai: (Cancer care, Neurology & neurosurgery, Cardiac care, medical research)

UCLA Medical Centers: (Multi-specialty care, Orthopedic surgery, Organ transplants, Neuroscience programs)

The Johns Hopkins Hospital: (Cancer treatment, Neurology & neurosurgery, Pediatrics, Cardiac care)

Mayo Clinic: (Cancer care, Cardiac care, Regenerative medicine, Advanced diagnostic tools)

Keio University (Medical Services): (Cardiovascular surgery, Oncology services, Neurology services)

The Royal Melbourne Hospital: (Acute medical care, Trauma and emergency services, Neurosurgery)

Burjeel Holdings: (Advanced surgical care, Cardiac services, Robotic surgery, Telemedicine)

Cleveland Clinic: (Cardiac surgery, Neurology, Cancer care, Wellness programs)

Massachusetts General Hospital: (Cancer care, Neurology, Cardiac care, Organ transplants)

Singapore General Hospital (SGH): (Acute care services, Specialist outpatient services, Cancer care)

Mount Sinai Health System: (Cardiac services, Cancer treatment, Neurosurgery, Robotic surgery)

Karolinska University Hospital: (Specialist care, Pediatric services, Transplantation surgery, Research services)

Tokyo Medical University Hospital: (Cancer care, Emergency medical care, Organ transplants, Advanced diagnostics)

Ramsay Health Care: (Private hospital services, Day surgery, Rehabilitation, Mental health care)

Fortis Healthcare: (Multi-specialty care, Cardiac care, Neurology services, Oncology services)

Columbia Asia Hospitals: (Inpatient and outpatient care, Cardiology, Orthopedics, Maternity services)

In June 2024: the University of Alabama at Birmingham (UAB) launched the first Tele-ICU expanded hospital in Alabama, U.S., by partnering with Whitefield Regional Hospital. This partnership is expected to improve the Tele-ICU capabilities of UAB, and to provide evidence-based care services to patients.

In July 2023: Nutex Health Inc. opened Covington Trace ER & Hospital, a new microhospital in Louisiana. The hospital includes eight private exam rooms, an emergency room, ten private inpatient beds, and an in-house pharmacy, laboratory, and imaging services.

In January 2023: the Government of India launched thefirst 100% carbon-neutral hospital in Bengaluru, India, with a capacity of 500 beds.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.38 Trillion |

| Market Size by 2032 | USD 6.74 Trillion |

| CAGR | CAGR of 5.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Inpatient, Outpatient) • By Ownership (Publicly/Government-Owned, Not-For-Profit Privately owned, For-Profit Privately Owned) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University, The Royal Melbourne Hospital, Burjeel Holdings, Cleveland Clinic, Massachusetts General Hospital, Singapore General Hospital (SGH), Mount Sinai Health System, Karolinska University Hospital, Tokyo Medical University Hospital,Ramsay Health Care, Fortis Healthcare, Columbia Asia Hospitals |

| Key Drivers | • The increasing prevalence of chronic diseases drives higher demand for hospital services due to the need for ongoing treatment, monitoring, and specialized care. • Technological advancements like telemedicine, AI diagnostics, and robotic surgeries enhance patient care and efficiency, boosting hospital service demand and market growth. |

| RESTRAINTS | • High operational costs, including expensive medical equipment, advanced technologies, staff salaries, and infrastructure upkeep, limit smaller hospitals' ability to expand services. |

Ans: The Hospital Services Market is expected to grow at a CAGR of 5.08%.

Ans: Hospital Services Market size was USD 4.38 trillion in 2023 and is expected to Reach USD 6.74 trillion by 2032.

Ans: Inpatient Services segmentation is the dominating segment by type in the Hospital Services Market.

Ans: The increasing prevalence of chronic diseases drives higher demand for hospital services due to the need for ongoing treatment, monitoring, and specialized care.

Ans: North America is the dominating region in the Hospital Services Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Patient Demographics (2023)

5.2 Service Utilization

5.3 Healthcare Spending, by region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hospital Services Market Segmentation, By Type

7.1 Chapter Overview

7.2 Inpatient Services

7.2.1 Inpatient Services Market Trends Analysis (2020-2032)

7.2.2 Inpatient Services Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.3 Cardiovascular Disorders

7.2.3 Cardiovascular Disorders Market Trends Analysis (2020-2032)

7.2.3 Cardiovascular Disorders Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.4 Cancer

7.2.4 Cancer Market Trends Analysis (2020-2032)

7.2.4 Cancer Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.5 Musculoskeletal Diseases

7.2.5 Musculoskeletal Diseases Market Trends Analysis (2020-2032)

7.2.5 Musculoskeletal Diseases Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.6 Emergency & Trauma

7.2.6 Emergency & Trauma Market Trends Analysis (2020-2032)

7.2.6 Emergency & Trauma Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.7 Respiratory Disorder

7.2.7 Respiratory Disorder Market Trends Analysis (2020-2032)

7.2.7 Respiratory Disorder Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.8 Gastroenterology

7.2.8 Gastroenterology Market Trends Analysis (2020-2032)

7.2.8 Gastroenterology Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.9 CNS Disorders

7.2.9 CNS Disorders Market Trends Analysis (2020-2032)

7.2.9 CNS Disorders Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.10 Pregnancy and Postpartum Care

7.2.10 Pregnancy and Postpartum Care Market Trends Analysis (2020-2032)

7.2.10 Pregnancy and Postpartum Care Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.11 Urology & Nephrology Disorders

7.2.11 Urology & Nephrology Disorders Market Trends Analysis (2020-2032)

7.2.11 Urology & Nephrology Disorders Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.12 Other Inpatient Services

7.2.12 Other Inpatient Services Market Trends Analysis (2020-2032)

7.2.12 Other Inpatient Services Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Outpatient Services

7.3.1 Outpatient Services Market Trends Analysis (2020-2032)

7.3.2 Outpatient Services Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Ancillary Services

7.4.1 Ancillary Services Market Trends Analysis (2020-2032)

7.4.2 Ancillary Services Market Size Estimates and Forecasts to 2032 (USD Million)

8. Hospital Services Market Segmentation, By Ownership

8.1 Chapter Overview

8.2 Publicly/Government-owned

8.2.1 Publicly/Government-owned Market Trends Analysis (2020-2032)

8.2.2 Publicly/Government-owned Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Not-For-Profit Privately owned

8.3.1 Not-For-Profit Privately owned Market Trends Analysis (2020-2032)

8.3.2 Not-For-Profit Privately owned Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 For-Profit Privately owned

8.4.1 For-Profit Privately owned Market Trends Analysis (2020-2032)

8.4.2 For-Profit Privately owned Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.4 North America Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.5.2 USA Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.6.2 Canada Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Mexico Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.6.2 France Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.7.2 UK Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia-Pacific Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.4 Asia-Pacific Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 China Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 India Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 Japan Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.6.2 South Korea Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.8.2 Singapore Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.9.2 Australia Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia-Pacific Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.4 Middle East Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.4 Africa Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Hospital Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.4 Latin America Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.5.2 Brazil Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.6.2 Argentina Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.7.2 Colombia Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Hospital Services Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Hospital Services Market Estimates and Forecasts, by Ownership (2020-2032) (USD Million)

11. Company Profiles

11.1 Apollo Hospitals Enterprise Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Max Healthcare

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 West Suffolk NHS Foundation Trust

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Cedars-Sinai

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 UCLA Medical Centers

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 The Johns Hopkins Hospital

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Mayo Clinic

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Keio University (Medical Services)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 THE ROYAL MELBOURNE HOSPITAL

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Burjeel Holdings

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

Inpatient Services

Cardiovascular Disorders

Cancer

Musculoskeletal Diseases

Emergency & Trauma

Respiratory Disorder

Gastroenterology

CNS Disorders

Pregnancy and Postpartum Care

Urology & Nephrology Disorders

Other Inpatient Services

Outpatient Services

Ancillary Services

By Ownership

Publicly/Government-owned

Not-For-Profit Privately owned

For-Profit Privately owned

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Genomic Services Market Size, valued at USD 6.3 billion in 2023, is projected to reach USD 17.5 billion by 2032, at a CAGR of 11.8%. by 2024-2032

Home Health Hub Market was valued at USD 0.80 billion in 2023, and is expected to reach USD 9.16 billion by 2032, growing at a CAGR of 31.29% from 2024-2032.

The Compression Therapy Market size was valued at USD 4.06 Billion in 2023 & is estimated to reach USD 7.86 Billion by 2032 with a growing CAGR of 7.63% over the forecast period of 2024-2032.

The Insulin Pump Market Size was valued at USD 6.70 Billion in 2023, and is expected to reach USD 13.37 Billion by 2032, and grow at a CAGR of 8.36%.

The Hepatitis E Diagnostic Tests Market, worth USD 59.43 million in 2023, is expected to reach USD 88.18 million by 2032 at a CAGR of 4.52% from 2024-2032.

The Diabetes Drug Market Size was valued at USD 79.4 billion in 2023 and is expected to reach USD 145.0 billion by 2032, growing at a CAGR of 6.9%.

Hi! Click one of our member below to chat on Phone