To get more information on Horizontal Directional Drilling Market - Request Free Sample Report

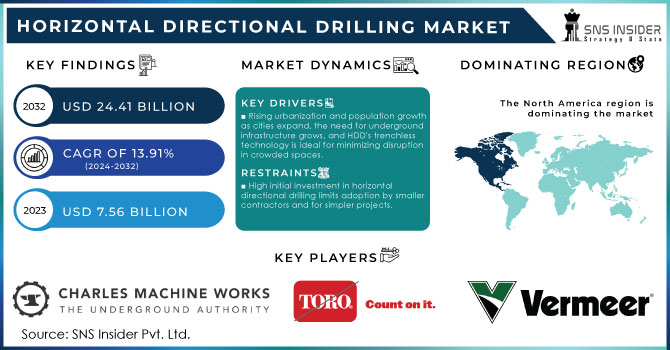

The Horizontal directional drilling Market size was valued at USD 7.56 Bn in 2023. It is anticipated to be valued at USD 24.41 Bn by the year 2032 and shows a growth rate of 13.91% CAGR during the forecasting period 2024-2032.

Tunneling creates the main passage, while HDD would likely be used to lay cables and pipelines alongside it. Asia's tunnel boom caters to large-scale projects like the massive 14.15 km Zojila tunnel, creating highways, railways, and water channels. In contrast, horizontal directional drilling (HDD) tackles smaller tasks, installing utilities and telecom lines typically ranging from centimeters to a few meters. Both sectors benefit from the region's infrastructure push. China alone is expected to invest $31-$38 billion annually between 2025-2028. Tunnelling addresses large-scale transportation needs, while HDD ensures these projects have the underground utility and communication networks they rely on. The North-South Commuter Railway-Metro Manila Subway tunnel exemplifies this.

The horizontal directional drilling market is also challenged in various ways. Some of these ways include the incurring of high costs, especially in the acquisition of HDD equipment. Other additional costs incurred may include permits and licenses which are quite costly since it is a form of regulation. Although horizontal directional drilling is less invasive than other approaches, there are still environmental risks involved, as it could accidentally spill drilling fluid or contaminate groundwater. Key drivers of the horizontal directional drilling market include increasing urban sprawl and the need for sustainable solution-based infrastructure. Developed countries are rapidly aging, and much of their Infrastructure is due for replacement or updates, resulting in a high need for this solution. Sliding technical enhancements in horizontal directional drilling technology due to technological achievements boost the need for such solutions and solutions. Finally, the elevated need for infrastructure and connectivity initiatives across the globe boosts the require for horizontal directional drilling.

In January 2024: SLB committed in association with Nabors Industries to provide its clients with automated drilling solutions across Opulence oil & gas operators and their contracting driller.

The commitment was designed to make it simpler for customers whose drilling automation application driller presently employs Nabors to access SLB’s vast array of automated drilling solutions or to contemplate integrating their current and remaining drilling automation technologies based on rig operating system restrictions.

MARKET DYNAMICS:

Drivers

Rising urbanization and population growth as cities expand, the need for underground infrastructure grows, and HDD's trenchless technology is ideal for minimizing disruption in crowded spaces.

The expanding urban areas and growing population, the demand for today’s efficient infrastructure solutions, which are minimally disruptive, increases constantly. Traditional methods of installing underground utilities such as pipelines, conduits, and cables usually entail significant earthworks that cause traffic jams and a cacophony of noise as well as pollutes the environment. In densely populated cities, these interruptions may seriously affect ordinary people's lives and local commerce. Horizontal directional drilling (HDD) has ranched less qualities that reduce the degree of surface damage. It involves drilling a pilot hole along a chronologically planned route and then widening this so as to take what are basically Conduits in drilling mud or slurry Bentonite, or other stabilizing solutions that do not pollute the environment below ground level as drilling ground-water recirculated well can. This method is especially suitable for the intricate city landscape where open-cut troughing would be either impractical or impossible. By minimizing the extent of earthworks, Horizontal directional drilling maintains the integrity of the city environment and existing infrastructure, which makes it a highly desirable choice for municipal planners and construction projects of future intent when looking to expand or upgrade the subterranean utility networks that lie beneath our feet. Moreover, its precision and efficiency ensure that this project can be done more quickly and at less cost than before, addressing the urban infrastructure requirements that are proliferating with mainstream methods.

Growing Demand for Efficient Utility Distribution to HDD supports efficient electricity, water, and gas transmission by facilitating the laying of cables and pipelines, driven by rising energy demands in urban and industrial areas.

Demand for efficient utility distribution systems in urban, and industrial areas is growing in concert with the increased use of energy. As cities grow and as industries develop, facilities for electricity transmission, water and gas all have to expand. Laying underground cables and pipelines, Horizontal directional drilling is pivotal for meeting this need. Horizontal directional drilling technology allows utilities to be installed underneath surfaces with minimal disruption to those surfaces. This is particularly important in densely-populated or developed areas where traditional trenching methods would cause considerable inconvenience and expense. Making it possible to add new utility lines to existing infrastructure in a smooth and seamless manner, Horizontal directional drilling bears that much more significance. This capability is crucial as cities seek to enhance their energy efficiency and assure a stable supply of indispensable services to their expanding populations. The literature review was performed on the Utility of Horizontal directional drilling in Meeting the Distribution of Urban and Industrial Energy Demand.

Restrain

High initial investment costs in horizontal directional drilling equipment and project setup can be expensive, limiting adoption by smaller contractors or for less complex projects.

Horizontal drilling (HDD) has a great deal of uses than traditional methods but requires large initial investment levels that may impede adoption. The equipment necessary for horizontal directional drilling, drilling rigs, drill pipes and fluid systems entail large economic input from anyone wishing to move into this field. In addition, horizontal directional drilling project layout requires special planning to bridge the gap between theory and reality, and it also calls for skilled workers and advanced technology which contribute a further amount to total costs. Smaller contractors or companies that perform simplified projects may think this is too costly a new approach for them, so will not be able to make use of it. The high up-front expense has been known to drive customers away even from horizontal directional drilling a technology which can be justified in tests by such things as its lower ground crater volume and quicker completion times. However, for any organization with limited funds and working on a project in which these benefits are not a matter of life or death, investing in horizontal directional drilling technology would be impossible. This kind of barrier to entry slows the uptake of horizontal directional drilling across a wide area and particularly in places lacking development resources as well as small emerging markets. When the technology continues to improve and hopefully lower in cost, those high initial costs may one day be reduced.

Limited application in hard rock land horizontal directional drilling is less effective in very hard rock formations, where traditional drilling methods might be better suited.

Horizontal directional drilling is known for handling a range of geologic conditions with success. But when it comes to hard rock formations, Horizontal directional drilling confronts significant challenges. The technology's effectiveness in such terrains is reduced because the standard horizontal directional drilling equipment for easily penetrating hard rock is less capable than of cutting through softer soils or mixed ground conditions. Traditional drilling methods such as rotary or percussion drilling are often better suited for these severe terrains because they can take more force and are abrasion-resistant during the grinding process in hard rock. Horizontal directional drilling thus requires special drill bits and improved drilling fluid systems to cope with its significantly increased rate of wear--which in turn only increases expense and complexity. Furthermore, the slower pace of expensive hard rock drilling can extend project schedules while at the same time causing labor costs to surge upward. All of these limitations serve to make Horizontal directional drilling less attractive for predominantly hard rock projects, where traditional drilling methods might offer a more practical and cost-effective solution. In spite of these hurdles, breakthroughs in Horizontal directional drilling technology are gradually improving the performance of this technology in hard rock conditions. But as long as such developments remain the preserve of a few and hence very costly, their application to such terrains will remain limited.

By Technique

Conventional

Rotary Steerable System

The Rotary Steerable Systems (RSS) segment held the largest share of about 64% in 2023. With real-time steering capabilities provided by RSS, drilling contractors can accurately follow a designated borehole passage even under challenging conditions. As a result, problems encountered by hitting objects or running over time and budget can be avoided entirely in many instances. This means that drilling companies have lower operating costs and higher profits.

Conventional is the easier to manage and do not require as skilfully crew. So, they are attractive to those less professional crews. They are also cheaper to purchase than RSS rigs, making them a more attractive option for small projects and budget-conscious operators. However, using conventional methods of drilling increases the risk of getting off-course from the planned path, which could potentially impact nearby infrastructure.

By Parts

Rigs

Pipes

Bits

Reamers

The rigs segment accounted for the largest share of approx. 34% in 2023 owing to the application of underground utility installation to install pipelines, cables, and conduits without disturbing the surface in industries like construction and telecommunication for infrastructural development.

Reamers came in at the second place in the part types section mainly because of the extensive usage of reamers in horizontal drilling. Reamers are often used in HDD operations in the oil and gas industry.

By Machine

By Application

On-shore

Off-shore

In 2023, the offshore segment had the largest proportion approx. to 69.5%. This occurs largely as a result of more offshore hydrocarbon exploration and production projects is driving demand for the use of horizontal directional drilling in the future.

It is anticipated that the second important field for horizontal directional drilling machines in oil and gas exploration & production will be the drilling of onshore fields, because there are more E&P activities being carried out in onshore parties than off parties.

By Machine Type

This is found in utility vibratory plow, utility tractor, and pile driver as well as in foundation machines boring machines and others. In 2023, the utility vibratory plow segment accounted for about 32% of the HDD market, largest Toshiba. This machine is mainly used for creating pipelines and installing cable conduits underground.

Pile drivers are pulled through this conduit to form a pipeline. These machines are used in the telecommunication industry for laying fiber cable and in the petroleum sector. The prospects for growth in these industries are expected to help demand for utility vibrator plough horizontal directional drilling machine over the next few years. In the telecommunication and oil/gas sectors, the pile driver takes second largest share of the market because pipeline and cable installations are in demand. STARKE and others are engaged in producing pile drivers that offer tremendous strength, automatic anchoring and so forth.

By Tooling

Transition Rods

HDD Drill Rods

HDD Paddle Bits

HDD Drive Collars, Chucks, and Subs

HDD Swivels & Pulling Equipment

Others

By End User

Oil and Gas Excavation

Utility

Telecommunication

Others

In 2023, the oil and gas extraction segment accounted dominating share of the market, with approximately 36% of global revenues coming through that channel. The well-developed infrastructure creates a large demand for drilling rigs, contributing to the oil and gas extraction segment's fine market share. Furthermore, the segment's dominance is likely to be enhanced by the need to address escalating oil exploration and production costs on new sites.

The telecommunication segment is expected to grow at a significant CAGR. With the increasing demand for higher-speed broadband, telecom operators are choosing to make greater use of new and more reliable drilling services like horizontal directional drilling in order to extend fiber optic networks.

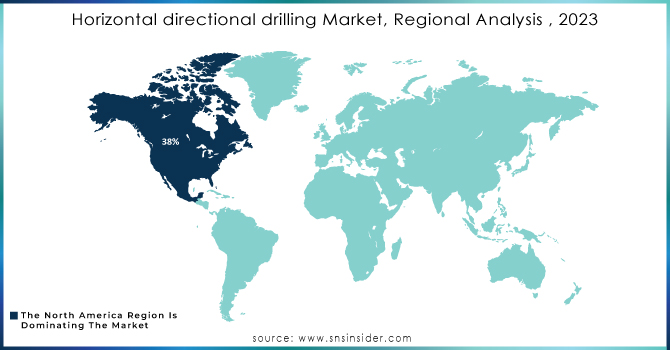

REGIONAL ANALYSIS:

North America is a dominant region in the horizontal directional drilling market with around 38% market share. The U.S. Energy Information Administration pointed to extensive liquid fuel utilization, underscoring the requirement of reliable drilling technologies (US EIA). Growing count of infrastructure and utility projects across North America is further supporting the demand for HDD equipment & services.

The Asia-Pacific region is expected to experience rapid growth, with China making its national energy infrastructure revolve around renewable sources of energy. The area is sprawling in terms of investments in telecommunications the market for 4G and 5G networks is increasing rapidly, this implies that demanding opportunities might be on the rise as far as employing better drilling equipment is concerned.

Need any customization research on Horizontal Directional Drilling Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The Major Players are Charles Machines Works, Inc. (Ditch Witch), Barbco, Inc., Toro Company, Vermeer Corporation, Vmt Gmbh Gesellschaft Für Vermessungstechnik, Laney Directional Drilling Co., Inrock Drilling Systems Ellingson Companies, Laney Directional Drilling Co., Mclaughlin Group, Inc., American Augers, Inc., Schlumberger Limited and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.56 Billion |

| Market Size by 2032 | US$ 24.41 Billion |

| CAGR | CAGR of 13.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Conventional, Rotary Steerable System) • By Machine Type (Utility vibratory plow, Utility tractor, Pile driver, Foundation machines, Boring machines, Others) • By Application (Onshore, Offshore) • By Machine (Mini, Midi, maxi) • By Parts Type (Rigs, Pipes, Bits, Reamers) • By Tooling (Transition Rods, HDD Drill Rods, HDD Paddle Bits, HDD Drive Collars, Chucks, and Subs, HDD Swivels & Pulling Equipment, Others) • By End-use (Oil & Gas Extraction, Utility, Telecommunication, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | American Augers, Inc., Ditch Witch, Ellingson Companies, Vermeer Corporation, The Toro Company, Baker Hughes Incorporate, Halliburton Company, Schlumberger Limited, Weatherford International National Oilwell Varco, Inc., Nabors Industries, Ltd. |

| Key Drivers | • Rising urbanization and population growth as cities expand, the need for underground infrastructure grows, and HDD's trenchless technology is ideal for minimizing disruption in crowded spaces. • Growing Demand for Efficient Utility Distribution to HDD supports efficient electricity, water, and gas transmission by facilitating the laying of cables and pipelines, driven by rising energy demands in urban and industrial areas. |

| RESTRAINTS | • High initial investment costs in horizontal directional drilling equipment and project setup can be expensive, limiting adoption by smaller contractors or for less complex projects. • Limited application in hard rock land horizontal directional drilling is less effective in very hard rock formations, where traditional drilling methods might be better suited. |

Ans: - The Horizontal directional drilling Market is expected to grow at a CAGR of 13.91%.

Ans: Horizontal directional drilling Market size was USD 7.56 billion in 2023 and is expected to Reach USD 24.41 billion by 2032.

Ans: - Rotary Steerable System is the dominating segment by system type in the Horizontal directional drilling Market.

Ans: - Growing Demand for Efficient Utility Distribution to Horizontal directional drilling supports efficient electricity, water, and gas transmission by facilitating the laying of cables and pipelines, driven by rising energy demands in urban and industrial areas.

Ans: -North America is the dominating region in the Horizontal directional drilling Market

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Horizontal directional drilling Market Segmentation, By Technology

7.1 Introduction

7.2 Magnetic Resonance Charging

7.3 Conventional

7.4 Rotary Steerable System

8. Horizontal directional drilling Market Segmentation, By Machine Type

8.1 Introduction

8.2 Utility vibratory plow

8.3 Utility tractor

8.4 Pile driver

8.5 Foundation machines

8.6 Boring machines

8.7 Others

9. Horizontal directional drilling Market Segmentation, By Application

9.1 Introduction

9.2 Onshore

9.3 Offshore

10. Horizontal directional drilling Market, By Machine

10.1 Introduction

10.2 Mini

10.3 Midi

10.4 Maxi

11. Horizontal directional drilling Market, By Parts Type

11.1 Introduction

11.2 Rigs

11.3 Pipes

11..4 Bits

11.5 Reamers

12. Horizontal directional drilling Market, By Tooling

12.1 Introduction

12.2 Transition Rods

12.3 HDD Drill Rods

12.4 HDD Paddle Bits

12.5 HDD Drive Collars, Chucks, and Subs

12.6 HDD Swivels & Pulling Equipment

12.7 Others

13. Horizontal directional drilling Market, By End-User

13.1 Introduction

13.2 Oil & Gas Extraction

13.3 Utility

13.4 Telecommunication

13.5 Others

14. Regional Analysis

14.1 Introduction

14.2 North America

14.2.1 Trend Analysis

14.2.2 North America Horizontal directional drilling Market, By Country

14.2.3 North America Horizontal directional drilling Market, By Technology

14.2.4 North America Horizontal directional drilling Market, By Machine Type

14.2.5 North America Horizontal directional drilling Market, By Application

14.2.6 North America Horizontal directional drilling Market, By Machine

14.2.7 North America Horizontal directional drilling Market, By Parts Type

14.2.8 North America Horizontal directional drilling Market, By Tooling

14.2.9 North America Horizontal directional drilling Market, By End-User

14.2.10 USA

14.2.10.1 USA Horizontal directional drilling Market, By Technology

14.2.10.2 USA Horizontal directional drilling Market, By Machine Type

14.2.10.3 USA Horizontal directional drilling Market, By Application

14.2.10.4 USA Horizontal directional drilling Market, By Machine

14.2.10.5 USA Horizontal directional drilling Market, By Parts Type

14.2.10.6 USA Horizontal directional drilling Market, By Tooling

14.2.10.7 USA Horizontal directional drilling Market, By End-User

14.2.11 Canada

14.2.11.1 Canada Horizontal directional drilling Market, By Technology

14.2.11.2 Canada Horizontal directional drilling Market, By Machine Type

14.2.11.3 Canada Horizontal directional drilling Market, By Application

14.2.11.4 Canada Horizontal directional drilling Market, By Machine

14.2.11.5 Canada Horizontal directional drilling Market, By Parts Type

14.2.11.6 Canada Horizontal directional drilling Market, By Tooling

14.2.11.7 Canada Horizontal directional drilling Market, By End-User

14.2.12 Mexico

14.2.12.1 Mexico Horizontal directional drilling Market, By Technology

14.2.12.2 Mexico Horizontal directional drilling Market, By Machine Type

14.2.12.3 Mexico Horizontal directional drilling Market, By Application

14.2.12.4 Mexico Horizontal directional drilling Market, By Machine

14.2.12.5 Mexico Horizontal directional drilling Market, By Parts Type

14.2.12.6 Mexico Horizontal directional drilling Market, By Tooling

14.2.12.7 Mexico Horizontal directional drilling Market, By End-User

14.3 Europe

14.3.1 Trend Analysis

14.3.2 Eastern Europe

14.3.2.1 Eastern Europe Horizontal directional drilling Market, By Country

14.3.2.2 Eastern Europe Horizontal directional drilling Market, By Technology

14.3.2.3 Eastern Europe Horizontal directional drilling Market, By Machine Type

14.3.2.4 Eastern Europe Horizontal directional drilling Market, By Application

14.3.2.5 Eastern Europe Horizontal directional drilling Market, By Machine

14.3.2.6 Eastern Europe Horizontal directional drilling Market, By Parts Type

14.3.2.7 Eastern Europe Horizontal directional drilling Market, By Tooling

14.3.2.8 Eastern Europe Horizontal directional drilling Market, By End-User

14.3.2.9 Poland

14.3.2.9.1 Poland Horizontal directional drilling Market, By Technology

14.3.2.9.2 Poland Horizontal directional drilling Market, By Machine Type

14.3.2.9.3 Poland Horizontal directional drilling Market, By Application

14.3.2.9.4 Poland Horizontal directional drilling Market, By Machine

14.3.2.9.5 Poland Horizontal directional drilling Market, By Parts Type

14.3.2.9.6 Poland Horizontal directional drilling Market, By Tooling

14.3.2.9.7 Poland Horizontal directional drilling Market, By End-User

14.3.2.10 Romania

14.3.2.10.1 Romania Horizontal directional drilling Market, By Technology

14.3.2.10.2 Romania Horizontal directional drilling Market, By Machine Type

14.3.2.10.3 Romania Horizontal directional drilling Market, By Application

14.3.2.10.4 Romania Horizontal directional drilling Market, By Machine

14.3.2.10.5 Romania Horizontal directional drilling Market, By Parts Type

14.3.2.10.6 Romania Horizontal directional drilling Market, By Tooling

14.3.2.10.7 Romania Horizontal directional drilling Market, By End-User

14.3.2.11 Hungary

14.3.2.11.1 Hungary Horizontal directional drilling Market, By Technology

14.3.2.11.2 Hungary Horizontal directional drilling Market, By Machine Type

14.3.2.11.3 Hungary Horizontal directional drilling Market, By Application

14.3.2.11.4 Hungary Horizontal directional drilling Market, By Machine

14.3.2.11.5 Hungary Horizontal directional drilling Market, By Parts Type

14.3.2.11.6 Hungary Horizontal directional drilling Market, By Tooling

14.3.2.11.7 Hungary Horizontal directional drilling Market, By End-User

14.3.2.12 Turkey

14.3.2.12.1 Turkey Horizontal directional drilling Market, By Technology

14.3.2.12.2 Turkey Horizontal directional drilling Market, By Machine Type

14.3.2.12.3 Turkey Horizontal directional drilling Market, By Application

14.3.2.12.4 Turkey Horizontal directional drilling Market, By Machine

14.3.2.12.5 Turkey Horizontal directional drilling Market, By Parts Type

14.3.2.12.6 Turkey Horizontal directional drilling Market, By Tooling

14.3.2.12.7 Turkey Horizontal directional drilling Market, By End-User

14.3.2.13 Rest of Eastern Europe

14.3.2.13.1 Rest of Eastern Europe Horizontal directional drilling Market, By Technology

14.3.2.13.2 Rest of Eastern Europe Horizontal directional drilling Market, By Machine Type

14.3.2.13.3 Rest of Eastern Europe Horizontal directional drilling Market, By Application

14.3.2.13.4 Rest of Eastern Europe Horizontal directional drilling Market, By Machine

14.3.2.13.5 Rest of Eastern Europe Horizontal directional drilling Market, By Parts Type

14.3.2.13.6 Rest of Eastern Europe Horizontal directional drilling Market, By Tooling

14.3.2.13.7 Rest of Eastern Europe Horizontal directional drilling Market, By End-User

14.3.3 Western Europe

14.3.3.1 Western Europe Horizontal directional drilling Market, By Country

14.3.3.2 Western Europe Horizontal directional drilling Market, By Technology

14.3.3.3 Western Europe Horizontal directional drilling Market, By Machine Type

14.3.3.4 Western Europe Horizontal directional drilling Market, By Application

14.3.3.5 Western Europe Horizontal directional drilling Market, By Machine

14.3.3.6 Western Europe Horizontal directional drilling Market, By Parts Type

14.3.3.7 Western Europe Horizontal directional drilling Market, By Tooling

14.3.3.8 Western Europe Horizontal directional drilling Market, By End-User

14.3.3.9 Germany

14.3.3.9.1 Germany Horizontal directional drilling Market, By Technology

14.3.3.9.2 Germany Horizontal directional drilling Market, By Machine Type

14.3.3.9.3 Germany Horizontal directional drilling Market, By Application

14.3.3.9.4 Germany Horizontal directional drilling Market, By Machine

14.3.3.9.5 Germany Horizontal directional drilling Market, By Parts Type

14.3.3.9.6 Germany Horizontal directional drilling Market, By Tooling

14.3.3.9.7 Germany Horizontal directional drilling Market, By End-User

14.3.3.10 France

14.3.3.10.1 France Horizontal directional drilling Market, By Technology

14.3.3.10.2 France Horizontal directional drilling Market, By Machine Type

14.3.3.10.3 France Horizontal directional drilling Market, By Application

14.3.3.10.4 France Horizontal directional drilling Market, By Machine

14.3.3.10.5 France Horizontal directional drilling Market, By Parts Type

14.3.3.10.6 France Horizontal directional drilling Market, By Tooling

14.3.3.10.7 France Horizontal directional drilling Market, By End-User

14.3.3.11 UK

14.3.3.11.1 UK Horizontal directional drilling Market, By Technology

14.3.3.11.2 UK Horizontal directional drilling Market, By Machine Type

14.3.3.11.3 UK Horizontal directional drilling Market, By Application

14.3.3.11.4 UK Horizontal directional drilling Market, By Machine

14.3.3.11.5 UK Horizontal directional drilling Market, By Parts Type

14.3.3.11.6 UK Horizontal directional drilling Market, By Tooling

14.3.3.11.7 UK Horizontal directional drilling Market, By End-User

14.3.3.12 Italy

14.3.3.12.1 Italy Horizontal directional drilling Market, By Technology

14.3.3.12.2 Italy Horizontal directional drilling Market, By Machine Type

14.3.3.12.3 Italy Horizontal directional drilling Market, By Application

14.3.3.12.4 Italy Horizontal directional drilling Market, By Machine

14.3.3.12.5 Italy Horizontal directional drilling Market, By Parts Type

14.3.3.12.6 Italy Horizontal directional drilling Market, By Tooling

14.3.3.12.7 Italy Horizontal directional drilling Market, By End-User

14.3.3.13 Spain

14.3.3.13.1 Spain Horizontal directional drilling Market, By Technology

14.3.3.13.2 Spain Horizontal directional drilling Market, By Machine Type

14.3.3.13.3 Spain Horizontal directional drilling Market, By Application

14.3.3.13.3 Spain Horizontal directional drilling Market, By Machine

14.3.3.13.4 Spain Horizontal directional drilling Market, By Parts Type

14.3.3.13.6 Spain Horizontal directional drilling Market, By Tooling

14.3.3.13.7 Spain Horizontal directional drilling Market, By End-User

14.3.3.14 Netherlands

14.3.3.14.1 Netherlands Horizontal directional drilling Market, By Technology

14.3.3.14.2 Netherlands Horizontal directional drilling Market, By Machine Type

14.3.3.14.3 Netherlands Horizontal directional drilling Market, By Application

14.3.3.14.3 Netherlands Horizontal directional drilling Market, By Machine

14.3.3.14.4 Netherlands Horizontal directional drilling Market, By Parts Type

14.3.3.14.6 Netherlands Horizontal directional drilling Market, By Tooling

14.3.3.14.7 Netherlands Horizontal directional drilling Market, By End-User

14.3.3.15 Switzerland

14.3.3.15.1 Switzerland Horizontal directional drilling Market, By Technology

14.3.3.15.2 Switzerland Horizontal directional drilling Market, By Machine Type

14.3.3.15.3 Switzerland Horizontal directional drilling Market, By Application

14.3.3.15.4 Switzerland Horizontal directional drilling Market, By Machine

14.3.3.15.5 Switzerland Horizontal directional drilling Market, By Parts Type

14.3.3.15.6 Switzerland Horizontal directional drilling Market, By Tooling

14.3.3.15.7 Switzerland Horizontal directional drilling Market, By End-User

14.3.3.16 Austria

14.3.3.16.1 Austria Horizontal directional drilling Market, By Technology

14.3.3.16.2 Austria Horizontal directional drilling Market, By Machine Type

14.3.3.16.3 Austria Horizontal directional drilling Market, By Application

14.3.3.16.4 Austria Horizontal directional drilling Market, By Machine

14.3.3.16.5 Austria Horizontal directional drilling Market, By Parts Type

14.3.3.16.6 Austria Horizontal directional drilling Market, By Tooling

14.3.3.16.7 Austria Horizontal directional drilling Market, By End-User

14.3.3.17 Rest of Western Europe

14.3.3.17.1 Rest of Western Europe Horizontal directional drilling Market, By Technology

14.3.3.17.2 Rest of Western Europe Horizontal directional drilling Market, By Machine Type

14.3.3.17.3 Rest of Western Europe Horizontal directional drilling Market, By Application

14.3.3.17.4 Rest of Western Europe Horizontal directional drilling Market, By Machine

14.3.3.17.5 Rest of Western Europe Horizontal directional drilling Market, By Parts Type

14.3.3.17.6 Rest of Western Europe Horizontal directional drilling Market, By Tooling

14.3.3.17.7 Rest of Western Europe Horizontal directional drilling Market, By End-User

14.4 Asia-Pacific

14.4.1 Trend Analysis

14.4.2 Asia-Pacific Horizontal directional drilling Market, By Country

14.4.3 Asia-Pacific Horizontal directional drilling Market, By Technology

14.4.4 Asia-Pacific Horizontal directional drilling Market, By Machine Type

14.4.5 Asia-Pacific Horizontal directional drilling Market, By Application

14.4.6 Asia-Pacific Horizontal directional drilling Market, By Machine

14.4.7 Asia-Pacific Horizontal directional drilling Market, By Parts Type

14.3.8 Asia-Pacific Horizontal directional drilling Market, By Tooling

14.3.9 Asia-Pacific Horizontal directional drilling Market, By End-User

14.4.10 China

14.4.10.1 China Horizontal directional drilling Market, By Technology

14.4.10.2 China Horizontal directional drilling Market, By Machine Type

14.4.10.3 China Horizontal directional drilling Market, By Application

14.4.10.4 China Horizontal directional drilling Market, By Machine

14.4.10.5 China Horizontal directional drilling Market, By Parts Type

14.4.10.6 China Horizontal directional drilling Market, By Tooling

14.4.10.7 China Horizontal directional drilling Market, By End-User

14.4.11 India

14.4.11.1 India Horizontal directional drilling Market, By Technology

14.4.11.2 India Horizontal directional drilling Market, By Machine Type

14.4.11.3 India Horizontal directional drilling Market, By Application

14.4.11.4 India Horizontal directional drilling Market, By Machine

14.4.11.5 India Horizontal directional drilling Market, By Parts Type

14.4.11.6 India Horizontal directional drilling Market, By Tooling

14.4.11.7 India Horizontal directional drilling Market, By End-User

14.4.12 Japan

14.4.12.1 Japan Horizontal directional drilling Market, By Technology

14.4.12.2 Japan Horizontal directional drilling Market, By Machine Type

14.4.12.3 Japan Horizontal directional drilling Market, By Application

14.4.12.4 Japan Horizontal directional drilling Market, By Machine

14.4.12.5 Japan Horizontal directional drilling Market, By Parts Type

14.4.12.6 Japan Horizontal directional drilling Market, By Tooling

14.4.12.7 Japan Horizontal directional drilling Market, By End-User

14.4.13 South Korea

14.4.13.1 South Korea Horizontal directional drilling Market, By Technology

14.4.13.2 South Korea Horizontal directional drilling Market, By Machine Type

14.4.13.3 South Korea Horizontal directional drilling Market, By Application

14.4.13.4 South Korea Horizontal directional drilling Market, By Machine

14.4.13.5 South Korea Horizontal directional drilling Market, By Parts Type

14.4.13.6 South Korea Horizontal directional drilling Market, By Tooling

14.4.13.7 South Korea Horizontal directional drilling Market, By End-User

14.4.14 Vietnam

14.4.14.1 Vietnam Horizontal directional drilling Market, By Technology

14.4.14.2 Vietnam Horizontal directional drilling Market, By Machine Type

14.4.14.3 Vietnam Horizontal directional drilling Market, By Application

14.4.14.4 Vietnam Horizontal directional drilling Market, By Machine

14.4.14.5 Vietnam Horizontal directional drilling Market, By Parts Type

14.4.14.6 Vietnam Horizontal directional drilling Market, By Tooling

14.4.14.7 Vietnam Horizontal directional drilling Market, By End-User

14.4.15 Singapore

14.4.15.1 Singapore Horizontal directional drilling Market, By Technology

14.4.15.2 Singapore Horizontal directional drilling Market, By Machine Type

14.4.15.3 Singapore Horizontal directional drilling Market, By Application

14.4.15.4 Singapore Horizontal directional drilling Market, By Machine

14.4.15.5 Singapore Horizontal directional drilling Market, By Parts Type

14.4.15.6 Singapore Horizontal directional drilling Market, By Tooling

14.4.15.7 Singapore Horizontal directional drilling Market, By End-User

14.4.16 Australia

14.4.16.1 Australia Horizontal directional drilling Market, By Technology

14.4.16.2 Australia Horizontal directional drilling Market, By Machine Type

14.4.16.3 Australia Horizontal directional drilling Market, By Application

14.4.16.4 Australia Horizontal directional drilling Market, By Machine

14.4.16.5 Australia Horizontal directional drilling Market, By Parts Type

14.4.16.6 Australia Horizontal directional drilling Market, By Tooling

14.4.16.7 Australia Horizontal directional drilling Market, By End-User

14.4.17 Rest of Asia-Pacific

14.4.17.1 Rest of Asia-Pacific Horizontal directional drilling Market, By Technology

14.4.17.2 Rest of Asia-Pacific Horizontal directional drilling Market, By Machine Type

14.4.17.3 Rest of Asia-Pacific Horizontal directional drilling Market, By Application

14.4.17.4 Rest of Asia-Pacific Horizontal directional drilling Market, By Machine

14.4.17.5 Rest of Asia-Pacific Horizontal directional drilling Market, By Parts Type

14.4.17.6 Rest of Asia-Pacific Horizontal directional drilling Market, By Tooling

14.4.17.7 Rest of Asia-Pacific Horizontal directional drilling Market, By End-User

14.5 Middle East & Africa

14.5.1 Trend Analysis

14.5.2 Middle East

14.5.2.1 Middle East Horizontal directional drilling Market, By Country

14.5.2.2 Middle East Horizontal directional drilling Market, By Technology

14.5.2.3 Middle East Horizontal directional drilling Market, By Machine Type

14.5.2.4 Middle East Horizontal directional drilling Market, By Application

14.5.2.5 Middle East Horizontal directional drilling Market, By Machine

14.5.2.6 Middle East Horizontal directional drilling Market, By Parts Type

14.4.2.7 Middle East Horizontal directional drilling Market, By Tooling

14.4.2.8 S Middle East ales Intelligence Market Segmentation, By Application

14.5.2.9 UAE

14.5.2.9.1 UAE Horizontal directional drilling Market, By Technology

14.5.2.9.2 UAE Horizontal directional drilling Market, By Machine Type

14.5.2.9.3 UAE Horizontal directional drilling Market, By Application

14.5.2.9.4 UAE Horizontal directional drilling Market, By Machine

14.5.2.9.5 UAE Horizontal directional drilling Market, By Parts Type

14.4.2.9.6 UAE Horizontal directional drilling Market, By Tooling

14.4.2.9.7 UAE Horizontal directional drilling Market, By End-User

14.5.2.10 Egypt

14.5.2.10.1 Egypt Horizontal directional drilling Market, By Technology

14.5.2.10.2 Egypt Horizontal directional drilling Market, By Machine Type

14.5.2.10.3 Egypt Horizontal directional drilling Market, By Application

14.5.2.10.4 Egypt Horizontal directional drilling Market, By Machine

14.5.2.10.5 Egypt Horizontal directional drilling Market, By Parts Type

14.4.2.10.6 Egypt Horizontal directional drilling Market, By Tooling

14.4.2.10.7 Egypt Horizontal directional drilling Market, By End-User

14.5.2.11 Saudi Arabia

14.5.2.11.1 Saudi Arabia Horizontal directional drilling Market, By Technology

14.5.2.11.2 Saudi Arabia Horizontal directional drilling Market, By Machine Type

14.5.2.11.3 Saudi Arabia Horizontal directional drilling Market, By Application

14.5.2.11.4 Saudi Arabia Horizontal directional drilling Market, By Machine

14.5.2.11.5 Saudi Arabia Horizontal directional drilling Market, By Parts Type

14.4.2.11.6 Saudi Arabia Horizontal directional drilling Market, By Tooling

14.4.2.11.7 Saudi Arabia Horizontal directional drilling Market, By End-User

14.5.2.12 Qatar

14.5.2.12.1 Qatar Horizontal directional drilling Market, By Technology

14.5.2.12.2 Qatar Horizontal directional drilling Market, By Machine Type

14.5.2.12.3 Qatar Horizontal directional drilling Market, By Application

14.5.2.12.4 Qatar Horizontal directional drilling Market, By Machine

14.5.2.12.5 Qatar Horizontal directional drilling Market, By Parts Type

14.4.2.12.6 Qatar Horizontal directional drilling Market, By Tooling

14.4.2.12.7 Qatar Horizontal directional drilling Market, By End-User

14.5.2.13 Rest of Middle East

14.5.2.13.1 Rest of Middle East Horizontal directional drilling Market, By Technology

14.5.2.13.2 Rest of Middle East Horizontal directional drilling Market, By Machine Type

14.5.2.13.3 Rest of Middle East Horizontal directional drilling Market, By Application

14.5.2.13.4 Rest of Middle East Horizontal directional drilling Market, By Machine

14.5.2.13.5 Rest of Middle East Horizontal directional drilling Market, By Parts Type

14.4.2.13.6 Rest of Middle East Horizontal directional drilling Market, By Tooling

14.4.2.13.7 Rest of Middle East Horizontal directional drilling Market, By End-User

14.5.3 Africa

14.5.3.1 Africa Horizontal directional drilling Market, By Country

14.5.3.2 Africa Horizontal directional drilling Market, By Technology

14.5.3.3 Africa Horizontal directional drilling Market, By Machine Type

14.5.3.4 Africa Horizontal directional drilling Market, By Application

14.5.3.5 Africa Horizontal directional drilling Market, By Machine

14.5.3.6 Africa Horizontal directional drilling Market, By Parts Type

14.5.3.7 Africa Horizontal directional drilling Market, By Tooling

14.5.3.8 Africa Horizontal directional drilling Market, By End-User

14.5.3.9 Nigeria

14.5.3.9.1 Nigeria Horizontal directional drilling Market, By Technology

14.5.3.9.2 Nigeria Horizontal directional drilling Market, By Machine Type

14.5.3.9.3 Nigeria Horizontal directional drilling Market, By Application

14.5.3.9.4 Nigeria Horizontal directional drilling Market, By Machine

14.5.3.9.5 Nigeria Horizontal directional drilling Market, By Parts Type

14.5.3.9.6 Nigeria Horizontal directional drilling Market, By Tooling

14.5.3.9.7 Nigeria Horizontal directional drilling Market, By End-User

14.5.3.10 South Africa

14.5.3.10.1 South Africa Horizontal directional drilling Market, By Technology

14.5.3.10.2 South Africa Horizontal directional drilling Market, By Machine Type

14.5.3.10.3 South Africa Horizontal directional drilling Market, By Application

14.5.3.10.4 South Africa Horizontal directional drilling Market, By Machine

14.5.3.10.5 South Africa Horizontal directional drilling Market, By Parts Type

14.5.3.10.6 South Africa Horizontal directional drilling Market, By Tooling

14.5.3.10.7 South Africa Horizontal directional drilling Market, By End-User

14.5.3.11 Rest of Africa

14.5.3.11.1 Rest of Africa Horizontal directional drilling Market, By Technology

14.5.3.11.2 Rest of Africa Horizontal directional drilling Market, By Machine Type

14.5.3.11.3 Rest of Africa Horizontal directional drilling Market, By Application

14.5.3.11.4 Rest of Africa Horizontal directional drilling Market, By Machine

14.5.3.11.5 Rest of Africa Horizontal directional drilling Market, By Parts Type

14.5.3.11.6 Rest of Africa Horizontal directional drilling Market, By Tooling

14.5.3.11.7 Rest of Africa Horizontal directional drilling Market, By End-User

14.6 Latin America

14.6.1 Trend Analysis

14.6.2 Latin America Horizontal directional drilling Market, By Country

14.6.3 Latin America Horizontal directional drilling Market, By Technology

14.6.4 Latin America Horizontal directional drilling Market, By Machine Type

14.6.5 Latin America Horizontal directional drilling Market, By Application

14.6.6 Latin America Horizontal directional drilling Market, By Machine

14.6.7 Latin America Horizontal directional drilling Market, By Parts Type

14.6.8 Latin America Horizontal directional drilling Market, By Tooling

14.6.9 Latin America Horizontal directional drilling Market, By End-User

14.6.10 Brazil

14.6.10.1 Brazil Horizontal directional drilling Market, By Technology

14.6.10.2 Brazil Horizontal directional drilling Market, By Machine Type

14.6.10.3 Brazil Horizontal directional drilling Market, By Application

14.6.10.4 Brazil Horizontal directional drilling Market, By Machine

14.6.10.5 Brazil Horizontal directional drilling Market, By Parts Type

14.6.10.6 Brazil Horizontal directional drilling Market, By Tooling

14.6.10.7 Brazil Horizontal directional drilling Market, By End-User

14.6.11 Argentina

14.6.11.1 Argentina Horizontal directional drilling Market, By Technology

14.6.11.2 Argentina Horizontal directional drilling Market, By Machine Type

14.6.11.3 Argentina Horizontal directional drilling Market, By Application

14.6.11.3 Argentina Horizontal directional drilling Market, By Machine

14.6.11.4 Argentina Horizontal directional drilling Market, By Parts Type

14.6.11.6 Argentina Horizontal directional drilling Market, By Tooling

14.6.11.7 Argentina Horizontal directional drilling Market, By End-User

14.6.12 Colombia

14.6.12.1 Colombia Horizontal directional drilling Market, By Technology

14.6.12.2 Colombia Horizontal directional drilling Market, By Machine Type

14.6.12.3 Colombia Horizontal directional drilling Market, By Application

14.6.12.3 Colombia Horizontal directional drilling Market, By Machine

14.6.12.4 Colombia Horizontal directional drilling Market, By Parts Type

14.6.12.6 Colombia Horizontal directional drilling Market, By Tooling

14.6.12.7 Colombia Horizontal directional drilling Market, By End-User

14.6.13 Rest of Latin America

14.6.13.1 Rest of Latin America Horizontal directional drilling Market, By Technology

14.6.13.2 Rest of Latin America Horizontal directional drilling Market, By Machine Type

14.6.13.3 Rest of Latin America Horizontal directional drilling Market, By Application

14.6.13.3 Rest of Latin America Horizontal directional drilling Market, By Machine

14.6.13.4 Rest of Latin America Horizontal directional drilling Market, By Parts Type

14.6.13.6 Rest of Latin America Horizontal directional drilling Market, By Tooling

14.6.13.7 Rest of Latin America Horizontal directional drilling Market, By End-User

15. Company Profiles

15.1 Charles Machines Works, Inc.

15.1.1 Company Overview

15.1.2 Financial

15.1.3 Products/ Services Offered

15.1.4 The SNS View

15.2 Barbco, Inc.

15.2.1 Company Overview

15.2.2 Financial

15.2.3 Products/ Services Offered

15.2.4 The SNS View

15.3 Toro Company

15.3.1 Company Overview

15.3.2 Financial

15.3.3 Products/ Services Offered

15.3.4 The SNS View

15.4 Vermeer Corporation

15.4.1 Company Overview

15.4.2 Financial

15.4.3 Products/ Services Offered

15.4.4 The SNS View

15.5 Vmt Gmbh Gesellschaft Für Vermessungstechnik,

15.5.1 Company Overview

15.5.2 Financial

15.5.3 Products/ Services Offered

15.5.4 The SNS View

15.6 Laney Directional Drilling Co.

15.6.1 Company Overview

15.6.2 Financial

15.6.3 Products/ Services Offered

15.6.4 The SNS View

15.7 Inrock Drilling Systems

15.7.1 Company Overview

15.7.2 Financial

15.7.3 Products/ Services Offered

15.7.4 The SNS View

15.8 Ellingson Companies

15.8.1 Company Overview

15.8.2 Financial

15.8.3 Products/ Services Offered

15.8.4 The SNS View

15.9 Laney Directional Drilling Co.

15.9.1 Company Overview

15.9.2 Financial

15.9.3 Products/ Services Offered

15.9.4 The SNS View

15.10 Mclaughlin Group, Inc.

15.10.1 Company Overview

15.10.2 Financial

15.10.3 Products/ Services Offered

15.10.4 The SNS View

16. Competitive Landscape

16.1 Competitive Benchmarking

16.2 Market Share Analysis

16.3 Recent Developments

16.3.1 Industry News

16.3.2 Company News

16.3.3 Mergers & Acquisitions

17. Use Case and Best Practices

18. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Telematics in Construction Equipment Market was estimated at $ 1.30 Bn in 2023 and is expected to reach $ 3.73 Bn by 2032 at a CAGR of 12.43% from 2024-2032.

Autonomous Construction Equipment Market was valued at $ 12.72 Bn in 2023 and is expected to reach $ 27.61 Bn by 2032 and at a CAGR of 8.99% from 2024 to 2032.

Industrial Cooling System Market was estimated at USD 21.07 Bn in 2023 and is expected to arrive at USD 34.15 Bn by 2032, at a CAGR of 5.51% from 2024-2032.

The Oil Country Tubular Goods Market size was valued at USD 42.66 Billion in 2023. It is expected to grow to USD 79.21 Billion by 2032 and grow at a CAGR of 7.12% over the forecast period of 2024-2032.

The Sanding Pads Market Size was valued at USD 2.98 Billion in 2023 and is estimated to reach USD 4.48 Billion by 2032, at a CAGR of 4.63% from 2024-2032.

The Ball Bearing Market Size was estimated at USD 10.66 billion in 2023 and is expected to arrive at USD 19.01 billion by 2032 with a growing CAGR of 6.64% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone