Home Care Testing Market Size Analysis:

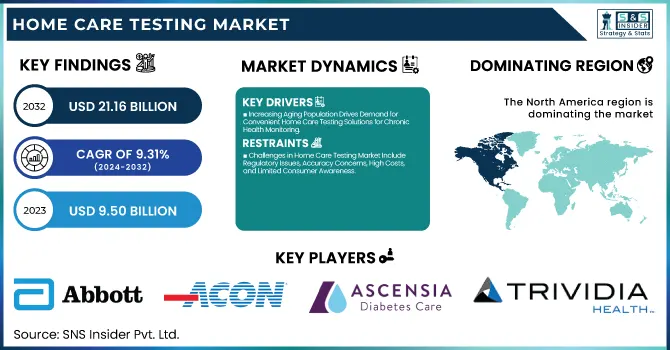

The Home Care Testing Market Size was valued at USD 9.50 billion in 2023 and is expected to reach USD 21.16 billion by 2032, growing at a CAGR of 9.31% from 2024-2032.

To Get more information on Home Care Testing Market - Request Free Sample Report

This report includes a comprehensive analysis of various factors influencing market growth, such as consumer trends and adoption patterns, insurance and reimbursement situations, and public health programs. The rise in chronic disease and condition prevalence and home healthcare solutions is boosting demand for home care testing. Government incentives in the form of policies supporting preventive healthcare and improved access to healthcare services further enhance market growth. Also, advancements in healthcare infrastructure and technology in diagnostic equipment are making home care testing more convenient and efficient. With increasing healthcare expenditures and patients demanding more convenient test options, the home care testing market is expected to grow substantially over the next few years.

U.S. Home Care Testing Market was valued at USD 2.75 billion in 2023 and is expected to reach USD 5.65 billion by 2032, growing at a CAGR of 8.32% from 2024-2032

The growth of the U.S. Home Care Testing Market can be attributed to several key factors. First, rising demand for affordable, convenient healthcare products is encouraging more individuals to use at-home diagnostic tests. Advances in medical devices have enhanced the ease of use and accuracy of home testing kits, further boosting market growth. Furthermore, increasing incidence of chronic diseases and conditions, as well as the rising population of older people, has led to greater demands for continuous monitoring. The move towards homecare and telemedicine also collaborates with the market's growth. Additionally, increasing awareness of preventive health and efforts towards decreasing hospitalizations drive the explosive growth of home testing solutions.

Home Care Testing Market Dynamics

Drivers

-

Increasing Aging Population Drives Demand for Convenient Home Care Testing Solutions for Chronic Health Monitoring.

As the global population ages, the need for regular and convenient health monitoring at home has significantly risen. Elderly people tend to have chronic conditions like diabetes, high blood pressure, and heart disease, necessitating frequent monitoring. Home care testing provides an easy solution by enabling elderly individuals to monitor their health without having to report to healthcare centers on a regular basis. This transition not only brings increased convenience but also improves patient outcomes through timely intervention. With a growing population of elderly individuals, there is increased need for user-friendly, consistent home care testing equipment that addresses the unique health concerns of the aging population, which makes it a critical driver of market growth.

Restraints

-

Challenges in Home Care Testing Market Include Regulatory Issues, Accuracy Concerns, High Costs, and Limited Consumer Awareness.

Unstable regulatory requirements across different geographies are major obstacles to the creation and approval of home care test devices. With no established guidelines, producers are unable to ensure compliance, causing delays and restricted market access. Concerns about accuracy and reliability also undermine consumer confidence since certain devices could return incorrect results, resulting in damaging health decisions. Low awareness regarding these devices and their appropriate application further inhibits adoption. Further, the excess initial expenditure of certain testing equipment restricts wider access, particularly for low-income consumers. Concerns about data privacy and security of confidential health details also prevail. Finally, the absence of medical assistance to users hinders people from determining test results correctly in the absence of professional expertise.

Opportunities

-

Integration with Telehealth, Technological Advancements, and Aging Population Create Key Growth Opportunities for Home Care Testing Market.

The merging of home care testing devices with telehealth platforms is creating opportunities for remote patient monitoring and consultation. The merging enables healthcare professionals to view real-time data, enhancing the treatment of chronic conditions and timely interventions. Moreover, the development of wearable devices and AI-based diagnostic tools provides more accurate and effective testing solutions, generating new market potential. The population aging also reflects a larger consumer segment, with older people increasingly needing convenient and dependable home-based health monitoring options. In addition, increased awareness of health demands self-testing instruments, which help individuals manage their own well-being. Government initiatives for home care and telemedicine provide a healthy environment for home care testing solutions to flourish.

Challenges

-

Data Privacy and Cybersecurity Risks Pose Significant Challenges for the Home Care Testing Market and Consumer Trust.

Privacy breach and cybersecurity risks are of major concern to home care testing devices that store sensitive health data. With growing numbers of individuals using these products to track their health, increasing amounts of medical and personal information are being put into circulation and thus become subjects of malicious intrusion. Lacking appropriate data protection measures, customers can be vulnerable to identity theft, fraud, or unauthorized use of their health data. Furthermore, since home care testing devices often use cloud storage and internet connectivity, the security of these devices is even more important. Ensuring strong security features and following data protection laws is crucial for building customer confidence and avoiding potential financial and legal consequences for manufacturers.

Home Care Testing Market Segment Analysis

By Test

The Infectious Diseases Tests segment dominated the Home Care Testing Market in 2023 with the highest revenue share of about 22%. This dominance is due to the increasing prevalence of infectious diseases and the rising demand for at-home diagnostic solutions. The convenience, affordability, and timely results provided by home care testing kits have contributed to their popularity. These factors, along with advancements in testing technology, have driven the segment's strong market position.

The Diabetes and Glucose Tests segment is expected to grow at the fastest CAGR of about 10.81% from 2024 to 2032. This rapid growth can be attributed to the rising global incidence of diabetes, along with increasing awareness about managing blood glucose levels. As individuals shift towards proactive health management and preventive care, the demand for convenient home testing solutions for diabetes monitoring continues to rise. Additionally, technological advancements in glucose monitoring devices have made them more user-friendly, fueling their adoption.

By Product

The Strip segment dominated the Home Care Testing Market in 2023 with the highest revenue share of about 35%. This dominance is driven by the affordability, ease of use, and accessibility of strip-based tests for various conditions, such as diabetes, pregnancy, and urinary tract infections. Strips offer quick, accurate results and are highly favored for their simplicity and convenience. The low cost and widespread availability of these testing strips further contribute to their leading market position.

The Cassette segment is expected to grow at the fastest CAGR of about 12.71% from 2024 to 2032. This growth is primarily fueled by the increasing demand for more advanced, accurate, and user-friendly testing solutions. Cassettes provide a higher level of precision compared to strips and are capable of detecting a broader range of conditions. As consumers seek reliable home diagnostic tools for infectious diseases, fertility, and other health monitoring, the cassette format's enhanced performance is driving its rapid adoption and market expansion.

By Sample

The Urine segment dominated the Home Care Testing Market in 2023 with the highest revenue share of about 41%. This dominance is attributed to the widespread use of urine-based tests for various conditions such as diabetes, urinary tract infections, and kidney health. Urine tests are cost-effective, non-invasive, and easy to use at home, making them a popular choice for consumers. The convenience of collecting urine samples and the accuracy of the results further enhance their market position.

The Blood segment is expected to grow at the fastest CAGR of about 10.15% from 2024 to 2032. This growth is driven by the increasing adoption of home blood testing kits for monitoring chronic conditions like diabetes, cholesterol levels, and heart disease. As consumers become more proactive about their health and prefer personalized healthcare solutions, the demand for blood tests that provide precise and reliable results continues to rise. Technological advancements in blood testing devices are also contributing to this rapid growth.

By Age Group

The Geriatric segment dominated the Home Care Testing Market in 2023 with the highest revenue share of about 40%. This dominance is driven by the aging population, who are more prone to chronic conditions like diabetes, hypertension, and heart disease. As elderly individuals prefer to manage their health from home, the demand for home care testing solutions continues to grow. The convenience, affordability, and ability to monitor health conditions without frequent hospital visits make these tests particularly appealing to the geriatric population.

The Pediatric segment is expected to grow at the fastest CAGR of about 10.12% from 2024 to 2032. This growth is largely driven by the increasing focus on early detection and management of health conditions in children. As parents seek more convenient and less invasive ways to monitor their children’s health at home, the demand for pediatric home care testing products is rising. Additionally, advancements in child-friendly, easy-to-use testing devices are fueling the segment’s rapid growth.

Home Care Testing Market Regional Insights

North America dominated the Home Care Testing Market in 2023 with the highest revenue share of about 38%. This dominance is driven by the region’s advanced healthcare infrastructure, high adoption of technology, and increasing awareness about home-based health monitoring solutions. Additionally, the rising prevalence of chronic diseases such as diabetes and cardiovascular conditions, along with the growing preference for convenience and cost-effective testing options, has contributed significantly to North America's leading market share.

Asia Pacific is expected to grow at the fastest CAGR of about 10.61% from 2024 to 2032. This growth is fueled by the region’s expanding population, increasing healthcare awareness, and rising disposable income, particularly in emerging economies. The demand for affordable, accessible, and efficient healthcare solutions is driving the adoption of home care testing products. Technological advancements, along with government initiatives to improve healthcare access, further support the rapid growth of this market in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Home Care Testing Market Key Players

-

Abbott Laboratories (Freestyle Libre Blood Glucose Monitoring System, Panbio COVID-19 Antigen Self-Test)

-

ACON Laboratories, Inc. (On Call Express Blood Glucose Meter, Flowflex COVID-19 Antigen Home Test)

-

Ascensia Diabetes Care Holdings AG (Contour Next Blood Glucose Monitoring System, Contour Plus One)

-

Becton, Dickinson and Company (BD) (BD Veritor At-Home COVID-19 Test, BD Diabetes Care Pen Needles)

-

bioLytical Laboratories Inc. (Insti HIV Self Test, Insti COVID-19 Antibody Test)

-

bioMerieux SA (Vidas ToRC IgG Test, BioFire SpotFire Respiratory Panel) (Limited home-use options, mostly lab-based.)

-

BioSure Global Limited (BioSure HIV Self Test, BioSure COVID-19 Antigen Test)

-

Chembio Diagnostics, Inc. (Sure Check HIV Self Test, DPP HIV-Syphilis Test)

-

EKF Diagnostics Holdings plc (Quo-Test A1c Analyzer, DiaSpect Hemoglobin Meter) (Some models can be home-use, but mostly point-of-care.)

-

F. Hoffmann-La Roche Ltd. (Accu-Chek Guide Blood Glucose Meter, Accu-Chek Instant)

-

iHealth Labs Inc. (iHealth COVID-19 Antigen Rapid Test, iHealth Smart Blood Pressure Monitor)

-

MP Biomedicals LLC (MP Rapid HIV Test, MP Rapid Syphilis Test)

-

Nova Biomedical (StatStrip Glucose Meter, StatStrip Xpress)

-

OraSure Technologies, Inc. (OraQuick HIV Self-Test, InteliSwab COVID-19 Rapid Test)

-

QuidelOrtho Corporation (QuickVue At-Home COVID-19 Test, QuickVue At-Home OTC Flu Test)

-

Randox Laboratories Ltd. (Randox COVID-19 Rapid Test, Randox Home Cholesterol Test)

-

SA Scientific Ltd. (OneStep Pregnancy Test, SA Scientific COVID-19 Rapid Test)

-

Sekisui Diagnostics, LLC (Osom Strep A Test, Osom Trichomonas Test)

-

Siemens Healthcare GmbH (Clinitest Rapid COVID-19 Antigen Test, DCA Vantage Analyzer)

-

Trividia Health, Inc. (True Metrix Blood Glucose Meter, True Track Blood Glucose Test Strips)

Recent Developments in the Home Care Testing Market

-

In November 2024, Abbott's FreeStyle Libre 2 and 3 systems became the only continuous glucose monitoring (CGM) sensors approved for MRI imaging. This breakthrough expands the convenience of managing diabetes, ensuring users can undergo MRI scans without removing the device.

-

In 2024, ACON Laboratories received FDA emergency use authorization for its Flowflex Plus COVID-19 and Flu A/B Home Test. This advancement in home testing enhances convenience and accuracy for consumers managing health at home.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.50 Billion |

| Market Size by 2032 | USD 21.16 Billion |

| CAGR | CAGR of 9.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test (HIV Test Kit, Diabetes and Glucose Tests, Cholesterol and Triglycerides Tests, Pregnancy Tests, Infectious Diseases Tests, Urinary Tract Infection Tests, Others) • By Product (Strip, Cassette, Test Panel, Midstream, Dip Card, Others) • By Sample (Urine, Saliva, Blood, Others) • By Age Group (Pediatric, Adult, Geriatric) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, ACON Laboratories, Inc., Ascensia Diabetes Care Holdings AG, Becton, Dickinson and Company (BD), bioLytical Laboratories Inc., bioMerieux SA, BioSure Global Limited, Chembio Diagnostics, Inc., EKF Diagnostics Holdings plc, F. Hoffmann-La Roche Ltd., iHealth Labs Inc., MP Biomedicals LLC, Nova Biomedical, OraSure Technologies, Inc., QuidelOrtho Corporation, Randox Laboratories Ltd., SA Scientific Ltd., Sekisui Diagnostics, LLC, Siemens Healthcare GmbH, Trividia Health, Inc. |