High Throughput Screening Market Size Analysis:

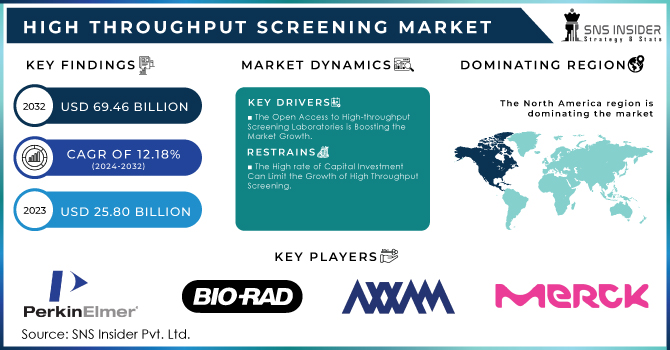

The High Throughput Screening Market size was valued at USD 25.80 billion in 2023 and expected to reach USD 69.46 Billion by 2032, growing at a CAGR of 12.18% over the forecast period 2024-2032.

Get more information on High Throughput Screening Market - Request Sample Report

The market for high-throughput screening (HTS) is buoyant because of a unique interplay between forces that are transforming the drug discovery landscape. Pharmaceutical and biotechnology industries are the frontrunners in this scenario where HTS plays a crucial role in quickly filtering libraries of potential drug candidates. This shortens the amount of time required to identify promising leads and thus drives forward new, patient-specific therapies. The market is further driven by the increasing spending on research and development (R&D). This influx of funding drives innovation which in turn results in HTS technologies with enhanced and improved automation, miniaturization, and data analysis abilities. These improvements mean shorter screening times, improved throughput, and better data accuracy - making HTS a more beneficial approach for drug discovery teams.

It also benefits from feedback loops and rapid technological increases. The ultimate advantage of using automation is that it makes your screening much faster and streamlined, reducing the answer to time lag lets then human mistakes. Emerging miniaturization approaches have enabled researchers to develop even smaller, more portable HTS instruments benefiting a large scope of research groups and at the same time decreasing some of the large space demands for fully functioning HTS facilities. Lastly, advancements in data analysis enable the rapid assessment and interpretation of extensive datasets resulting from HTS experiments to better inform key decisions while uncovering elusive trends that have so far gone unnoticed but may be relevant.

Government support can then serve as a catalyst, driving more research and development into new technologies and facilitating connections between academia with industry. This in turn also helps to increase the availability of HTS capabilities for academic institutions. These drivers working in conjunction help form a future for the high-throughput screening market, which is more fluid and brighter than ever before - possibly disrupting drug discovery as we know it and making new medical breakthroughs possible.

High Throughput Screening Market Dynamics:

KEY DRIVERS:

-

Increasing Usage of High Throughput Screening Solutions in Universities and Research Centers is responsible for Market Growth.

-

The Open Access to High-throughput Screening Laboratories is Boosting the Market Growth.

RESTRAINTS:

-

The Need for Extensive Automation Techniques is Hindering High Throughput Screening Market Growth.

-

The High rate of Capital Investment Can Limit the Growth of High Throughput Screening.

OPPORTUNITY:

-

Technological Advancements are Offering a Lucrative Growth Opportunity for High Throughput Screening Procedures.

-

Hefty R&D Investments are Responsible for the Market Growth During Upcoming Years.

High Throughput Screening Market Segmentation Analysis

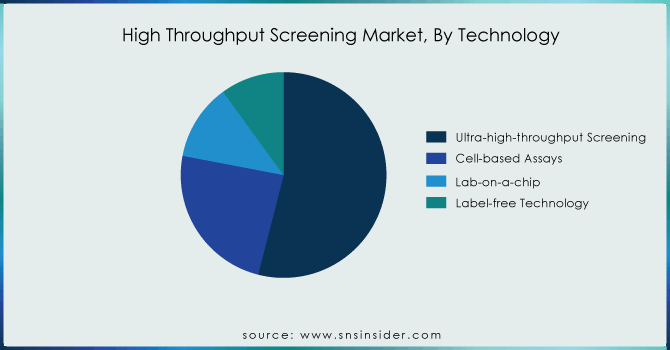

By Technology

In 2023, cell-based assays acquired over 45.0% of the overall revenue. Visible results by fluorometric imaging plate reader assays followed by cell-based assays along with the least volume for testing have outperformed other cell-based assays. Ultra-high throughput screening is the most recent technology development that is used for increased output in less time. Most of the companies are at an intermediate level where they use 3-D cells along with conventional cell culture techniques, this is because in itself 3-D cells provide less realistic properties to screen drugs in a natural environment and other cellular assays which used to help in drug designing and discovery.

Various such steps like the exploration of the capacity of chemical libraries for identifying chemical identity hits proactively while testing, hardware and software testing capacity and fully automated, increased funding from governments and research institutes to adopt newer technologies and faster data processing software are expected to boost the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-Use

Organizations of pharmaceutical and biotech firms accounted maximum share in the high-throughput screening market which is 41% in 2023. Furthermore, the increasing demand for quick and accurate screening for multi-target molecules at drug discovery stages has led to using automated high-throughput screening tools that screen large chemical libraries or biomarker libraries created during research activities.

In addition, a study released in June 2020 titled "Large-scale screening of fresh drugs" showed that fluorescence-based assays are effective for detecting biological responses to chemical substances under high-throughput conditions. Furthermore, a target molecule may be produced or depleted in fluorescence experiments to cause signals outgassing and quenching according to the same source. Post which, a boost in the utilization of high-throughput screening methods for drug discovery is foreseen to influence market expansion.

By Application

Primary screening dominated in 2023 with a share of 38%. The reason for this dominance seems to lie in the sheer volume of testing. The potential candidates for drugs in the thousands are separated by primary screening, and this volume work is best handled using reagents and kits that were meant to be used with automation. In contrast, the standardization of protocols and optimization of reagents within kits not only guarantees consistency but also reduces any variability - a requirement when analyzing thousands (or millions) of samples. Lastly, cost is a major factor during primary screening as this phase aims to find potential leads. The use of pre-formatted reagents and kits is more cost-effective than developing/sure-routing custom experiments that must be run for each candidate. Primary screening - which includes high-throughput approaches, standardization efforts, and cost-saving design over target identification or toxicology testing stands out in reagent/kit consumption relevant to drug discovery.

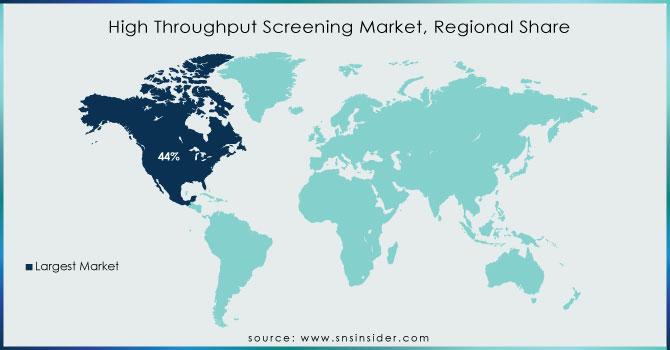

Regional Insights:

North America held 44% of market revenue in 2023. Factors attributing to North America's largest market share include the growing adoption of high-throughput screening, increases in research and development expenditure on pharmaceuticals by governments & NGOs worldwide leading to boosts in combinatorial chemistry as well as genomics advances, significant investments made towards automation miniaturization assay methodology for HTS technologies across their labs grow further.

This high spending of pharmaceutical companies and several government organizations on research & development (R&D) is expected to offer a good market outlook in the upcoming years. For example, Danaher Corporation spent USD 1.742 million on R&D at the fiscal year-end of 2021) versus (the fiscal year-end of 2020 which amounted toUSD3475million). Also, Bio-Rad Laboratories Inc. pumped USD 879.6 million into the market in 2021 versus USD 800.3 million of investments from years earlier Therefore, the massive investment by the pharmaceutical industry is likely to boost market growth over the coming few years.

High Throughput Screening Market Key Players

The key market players include PerkinElmer Inc., Bio-Rad Laboratories Inc., Axxam SpA, Beckman Coulter Inc., Merck KGaA, Tecan Group Ltd, Agilent Technologies Inc., Thermo Fisher Scientific Inc., GE Healthcare, Danaher Corporation & other players.

RECENT DEVELOPMENTS

-

Molbio Diagnostics introduced a novel test for differential diagnosis of HIV 1 and HIV 2 with viral loads in <60 min during August 2022.

-

Opera, a cell analyzer for rapid high-content analysis of drug action at even sub-cellular resolution was unveiled by Evotech Technologies in July 2022.

| Report Attributes | Details |

| Market Size in 2023 | US$ 25.80 Billion |

| Market Size by 2032 | US$ 69.46 Billion |

| CAGR | CAGR of 12.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Ultra-high-throughput Screening, Cell-based Assays, Lab-on-a-chip and Label-free Technology) •By Application (Target Identification, Primary Screening, and Toxicology) •By Products and Services (Instruments, Reagents, and Kits, and Services) •By End User (Pharmaceutical and Biotechnology Firms, Academia and Research Institutes and Contract Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PerkinElmer Inc., Bio-Rad Laboratories Inc., Axxam SpA, Beckman Coulter Inc., Merck KGaA, Tecan Group Ltd, Agilent Technologies Inc., Thermo Fisher Scientific Inc., GE Healthcare, Danaher Corporation & other players |

| Key Drivers | •Increasing Usage of High Throughput Screening Solutions in Universities and Research Centers is responsible for Market Growth. •The Open Access to High-throughput Screening Laboratories is Boosting the Market Growth. |

| RESTRAINTS | •The Need for Extensive Automation Techniques is Hindering High Throughput Screening Market Growth. •The High rate of Capital Investment Can Limit the Growth of High Throughput Screening. |