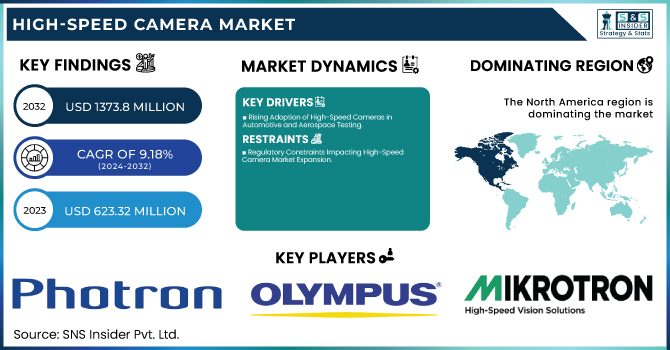

The High-speed Camera Market Size was valued at USD 623.32 Million in 2023 and is expected to reach USD 1373.8 Million by 2032, growing at a CAGR of 9.18% from 2024-2032. Growing need for high-speed imaging across sectors, including automotive testing, aerospace & defense, healthcare, and media is propelling the market growth. An increasing adoption of high-speed cameras across scientific research and in quality control and industrial automation also fuels market growth.

To Get more information on High-speed Camera Market - Request Free Sample Report

Advancements in sensor resolution and frame rates, as well as AI-based image processing, improve performance, while sustainability efforts give rise to energy-efficient camera systems. Also important are ongoing changes in consumer preferences, local shifts in markets, and continued investment in R&D that influence the trajectory of the industry, emphasizing drivers such as performance indicators, effect on the environment, regional adoption tendencies, and innovation-centric product exploration.

Drivers:

Rising Adoption of High-Speed Cameras in Automotive and Aerospace Testing

The increasing need for precise motion analysis in automotive and aerospace testing is driving the demand for high-speed cameras. These cameras play a crucial role in crash testing, aerodynamics research, and structural integrity assessments, capturing thousands to millions of frames per second to analyze impact forces, deformation, and material behavior. In the automotive sector, regulatory bodies like NHTSA and Euro NCAP mandate rigorous crash testing, where high-speed imaging helps engineers refine vehicle safety features. Similarly, in aerospace, high-speed cameras are used in wind tunnel experiments, jet engine testing, and missile trajectory analysis, ensuring optimal performance and safety. The continuous push for autonomous vehicles, electric aircraft, and advanced propulsion systems further accelerates market growth.

Restraints:

Regulatory Constraints Impacting High-Speed Camera Market Expansion

The high-speed camera market faces significant challenges due to stringent export Regulations High-speed cameras, especially in the defense and aerospace verticals are double use technology having military applications; for this reason, they are a subject of stringent export regulations by governments across the globe. Government-imposed licensing requirements lead to prolonged approvals, trade restrictions, and rising compliance costs, which restrict manufacturers' ability to expand globally. U.S. Bureau of Industry and Security (BIS) provides enforcement of the Export Administration Regulations (EAR), within which high-speed imaging systems are regulated. In February 2024, BIS imposed additional restrictions on international trade based on Export Control Classification Number (ECCN) 6A293 the provisions of which prevented the use of such products for military utilization without a proper license. These rules slow down transactions, dissuade foreign purchasers and complicate export processes. As global trade policies tighten, manufacturers struggle to access international markets, hindering commercialization, innovation, and overall market growth.

Opportunities:

AI-Driven Market Expansion Transforming Industries Through Strategic Investments

The rapid integration of artificial intelligence (AI) across industries is driving significant market expansion, particularly in manufacturing, healthcare, and infrastructure. Governments and major tech firms are investing heavily in AI infrastructure, aiming to enhance efficiency, reduce costs, and boost economic growth. AI Growth Zones are being established to streamline planning and accelerate technology adoption, with a strong focus on high-speed imaging for quality control in manufacturing. Leading corporations, such as Vantage Data Centres and Kyndryl, have committed £14 billion in AI-driven projects, creating over 13,250 jobs. Initiatives like increasing public compute capacity by twentyfold and developing National Data Libraries are further strengthening AI capabilities, positioning industries at the forefront of automation and digital transformation. These strategic advancements are reshaping global markets, paving the way for a future driven by AI-powered efficiency and technological breakthroughs.

Challenges:

Shortage of Skilled Professionals Impacting High-Speed Camera Market Expansion

The implementation of these types of high-speed cameras faced a critical challenge being the lack of qualified manpower for the operation, maintenance of the high-speed camera systems. Involving advanced optics, precise calibration, and specialized imaging software, this expertise is critical for key industries such as manufacturing, aerospace, and healthcare. But that has challenged deployment and operational costs due to limited training programs and an insufficient pool of resource personnel to undertake task of deploying. Companies must invest in extensive training or rely on third-party experts, further restraining market expansion. The growing demand for high-speed imaging in quality control, diagnostics, and research intensifies the need for skilled technicians. Addressing this skills gap through targeted training initiatives, academic collaborations, and industry-led certification programs will be critical to sustaining growth and ensuring the efficient use of high-speed camera technology.

By Component

In 2023, the Image Sensors Segment held the largest revenue share of approximately 40% in the high-speed camera market, driven by the growing demand for sophisticated imaging solutions in applications such as industrial automation, automotive testing and scientific research. Applications of High-Speed cameras: High-Speed camera uses advanced image sensors, mainly CMOS or CCD, to catch fast motion taking place at high resolution and accuracy. CMOS sensors, which have lower power consumption, higher frame rates, and greater sensitivity than other image sensors, have thus become the most widely adopted in the market, driving growth. As industries continue to emphasize automation and real-time analysis, the dominance of the image sensors segment is expected to persist, driving further market expansion.

The Memory segment is projected to be the fastest-growing in the high-speed camera market from 2024 to 2032, driven by the increasing need for efficient data storage and processing capabilities. High-speed cameras are able to record very high frame rates and as these are frequently be termed as data hungry this requires substantial memory to capture at real time, analyse or even stream. Improved data transfer speeds in DRAM and NAND flash memory are making high-resolution video capture seamless. Growth in such as automotive testing and aerospace feeding the demand for higher capacity memory for writing functions of high end imaging applications for commercial use. Additionally, advancements in edge computing and AI-driven analytics are further driving the adoption of high-speed memory solutions, positioning this segment for rapid expansion throughout the forecast period.

By Application

The aerospace and defense segment held around 35% of the high-speed camera market in 2023, driven by its essential use in tests for missiles, ballistics, and performance analysis for aircraft. These high-speed cameras are essential for recording ultra-fast events in a variety of defense research applications, weapons testing, and even space exploration, while providing high volumes of precise and accurate data. To enhance surveillance, target tracking, and flight diagnostics, military organizations and aerospace firms are spending heavily on advanced imaging technologies. Demand is also being driven due to the increasing need for rugged cameras with high-resolution and working in extreme conditions. As defense strategies evolve, the adoption of high-speed cameras for real-time monitoring and analysis continues to expand, reinforcing the segment's market dominance.

The healthcare segment is witnessing the fastest growth in the high-speed camera market over the forecast period 2024-2032, due to the rapid advancements in medical imaging, biomechanics research, and surgical analysis. In the field of motion analysis there is a growing role for high-speed cameras used for injury rehabilitation, gait analysis or cardiovascular system physiology, as they enable accurate evaluations of both human movements and their physiological functions. Their applications in surgery, for instance, include monitoring complex surgeries in real-time for better accuracy and reduced risk.. Additionally, biomedical research benefits from high-speed imaging in cell tracking and microfluidics studies, accelerating innovation in disease diagnosis and treatment.

By Spectrum

The 3D segment dominated the high-speed camera market, accounting for approximately 43% of total revenue in 2023. This dominance is driven by the rising penetration of 3D imaging across application segments demanding accurate motion detection, depth detection, and real-time object tracking. 3D high-speed cameras are used in industries like automotive, aerospace, health care, and manufacturing for applications such as quality control, crash testing, biomechanics studies, and machine vision. The ability to capture highly detailed spatial data makes these cameras indispensable in scientific research and industrial automation. Advancements in AI and machine learning further enhance 3D imaging capabilities, driving innovation in augmented reality (AR), robotics, and defense applications. The growing demand for enhanced visualization and accuracy in high-speed imaging solidifies the 3D segment’s leading position in the market.

The X-ray segment is projected to be the fastest-growing in the high-speed camera market from 2024 to 2032, due to its growing applications in medical imaging, industrial inspection, and scientific research. Tool for X-ray high-speed photography: high frame rate camera with soft X-ray Capability-P0571, where high-resolution images can be obtained in NDT, aerospace components and biomechanics applications. These cameras have begun to be used towards the latter category increasingly in the healthcare sector, such as in advanced diagnostics, cardiovascular studies, and bone fracture assessments.. Additionally, industries such as semiconductor manufacturing and material science rely on X-ray imaging for precision quality control. Technological advancements, such as enhanced sensor sensitivity and AI-driven image processing, further accelerate adoption. As demand for high-speed, high-precision imaging grows across multiple sectors, the X-ray segment is set to experience significant expansion.

By Frame

The 1,000–10,000 FPS segment dominated the high-speed camera market with approximately 40% of the revenue share in 2023. The demand for high-speed cameras can be seen in sectors like automobiles testing, aerospace, manufacturing, and scientific research, where accurately capturing high-velocity events is a must. With a balance of resolution, frame rate, and cost, cameras in this FPS range are perfect for applications across the crash testing, fluid dynamics, and component failure studies. The increasing need for quality control, predictive maintenance, and motion analysis in manufacturing augment the adoption in the industrial automation sector. Advancements in sensor technology and image processing have enhanced the performance of these cameras, increasing their efficiency in critical applications. With ongoing technological developments, the 1,000–10,000 FPS segment is expected to maintain its market dominance.

The 30,000 - 50,000 frames per second (FPS) segment is anticipated to be the fastest-growing in the high-speed camera market from 2024 to 2032. This growth can be attributed to the increasing demand for advanced imaging solutions in various other applications, including scientific research, industrial automation, and sports analysis. High-speed cameras working within this frames-per-second range allow scientists and engineers to document fast-paced phenomena with great precision and detail, yielding critical insights into kinematics and quality assurance. Moreover, improved sensor technology and processing capability are lowering the cost and availability of these cameras enabling their widespread adoption across all industry verticals. As the need for precise and high-resolution imaging continues to rise, this segment is poised for significant expansion during the forecast period.

In 2023, North America held the largest share of the high-speed camera market, accounting for approximately 40% of the total revenue. This dominance can be attributed to several factors, including the region's strong emphasis on research and development, particularly in sectors such as automotive, aerospace, and healthcare. The presence of leading technology companies and manufacturers further enhances innovation and competition in the market. Moreover, the high growth of the high-speed imaging systems for motion analysis, product test and sports broadcast is likely to push large amount in such segment. As industries continue to realize the benefit of high-speed cameras for accurately capturing fast events, the North America market share is set to improve with each passing year.

The Europe region is projected to be the fastest-growing market for high-speed cameras during the forecast period from 2024 to 2032. This growth is driven by the increasing adoption of the high-speed imaging technology in several sectors such as automotive, Defence and research industry. In particular, the automotive sector is putting money towards high-speed cameras for crash testing and for advanced driver-assistance systems (ADAS). Moreover, Europe has strong R&D offering as well, bolstered by both EU and government funding, driving innovation in the imaging technology sector. Scientific research and sports analysis are also boosting the region's rapid growth in the popularity of high-speed cameras. As industries prioritize precision and efficiency, Europe's high-speed camera market is expected to experience significant expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major Key Players in High-Speed Camera Market along with their product:

Photron Ltd. (Japan) – (FASTCAM Nova, FASTCAM SA-Z, FASTCAM Mini UX)

Olympus Corporation (Japan) – (i-SPEED 7 Series)

NAC Image Technology (Japan) – (MEMRECAM ACS Series, MEMRECAM Q Series)

Mikrotron GmbH (Germany) – (EoSens 4CXP, EoSens 25CXP+)

Excelitas Technologies Corp. (USA) – (pco.dimax CS4, pco.dimax HD)

Fastec Imaging (USA) – (TS5, IL5, HS Series)

Vision Research Inc. (USA) – (Phantom VEO, Phantom T-Series, Phantom TMX 7510)

Optronis GmbH (Germany) – (CamRecord CR, CL Series)

iX Cameras Inc. (Canada) – (i-SPEED 203, i-SPEED 5 Series)

AOS Technologies (Switzerland) – (S-Motion, L-Series)

Baumer (Switzerland) – (CX Series, LX Series)

Hypersen Technologies (China) – (HPS-HSC Series)

Mega Speed Corporation (Canada) – (MS100K, MS130K)

Shimadzu Corporation (Japan) – (HyperVision HPV-X2)

Ximea (Germany) – (xiB-64, xiC Series)

List of Suppliers who provide raw material and component in High-speed Camera Market:

Sony Semiconductor Solutions

ON Semiconductor

Teledyne e2v

Hamamatsu Photonics

STMicroelectronics

TSMC

Micron Technology

Samsung Electronics

Corning Inc.

Edmund Optics

Sept. 5, 2024 – Specialized Imaging launched the SIMX, an advanced ultra high-speed framing camera capable of capturing up to 1 billion fps with a 1320 x 1024 pixel sensor resolution. Featuring up to 16 intensified optical channels, 50lp/mm system resolution, and 10,000x gain adjustment, it supports applications in nanotechnology, medical research, particle analysis, and automotive testing.

November 10, 2024 – Aconity3D optimized PBLM process stability with Mikrotron high-speed CMOS cameras for real-time monitoring. This enhances precision in additive manufacturing for industries like automotive, medical, and aerospace.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 623.32 Million |

| Market Size by 2032 | USD 1373.8 Million |

| CAGR | CAGR of 9.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Image Sensors, Processors, Lens, Memory, Fans And Cooling, Others) • By Application(Automotive & Transportation, Consumer Electronics, Aerospace & Defense, Healthcare, Media & Entertainment, Others) • By Spectrum(3D, Infrared, X-ray, Visible RGB) • By Frame Rate (250 - 1000 FPS, 1000 - 10000 FPS, 10000 - 30000 FPS, 30000 - 50000 FPS, Above 50000 FPS) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Photron Ltd. (Japan), Olympus Corporation (Japan), NAC Image Technology (Japan), Mikrotron GmbH (Germany), Excelitas Technologies Corp. (USA), Fastec Imaging (USA), Vision Research Inc. (USA), Optronis GmbH (Germany), iX Cameras Inc. (Canada), AOS Technologies (Switzerland), Baumer (Switzerland), Hypersen Technologies (China), Mega Speed Corporation (Canada), Shimadzu Corporation (Japan), Ximea (Germany). |

Ans: The High-Speed Camera Market is expected to grow at a CAGR of 9.18% during 2024-2032.

Ans: The High-Speed Camera Market was USD 623.32 million in 2023 and is expected to Reach USD 1373.8 Million by 2032.

Ans: Key drivers of the high-speed camera market include increasing demand for advanced imaging solutions in research and development, growing applications in automotive testing and quality control, advancements in sensor technology, and rising interest in motion analysis across various industries.

Ans: The “Image Sensors” segment dominated the High-Speed Camera Market.

Ans: North America dominated the High-Speed Camera Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Performance & Technical Advancement Metrics

5.2 Environmental & Sustainability Impact

5.3 Regional & Consumer Behavior Insights

5.4 R&D & Innovation Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. High-speed Camera Market Segmentation, by Component

7.1 Chapter Overview

7.2 Image Sensors

7.2.1 Image Sensors Market Trends Analysis (2020-2032)

7.2.2 Image Sensors Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Processors

7.3.1 Processors Market Trends Analysis (2020-2032)

7.3.2 Processors Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Lens

7.4.1 Lens Market Trends Analysis (2020-2032)

7.4.2 Lens Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Memory

7.5.1 Memory Market Trends Analysis (2020-2032)

7.5.2 Memory Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Fans and Cooling

7.6.1 Fans and Cooling Market Trends Analysis (2020-2032)

7.6.2 Fans and Cooling Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. High-speed Camera Market Segmentation, by Application

8.1 Chapter Overview

8.2 Automotive & Transportation

8.2.1 Automotive & Transportation Market Trends Analysis (2020-2032)

8.2.2 Automotive & Transportation Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Consumer Electronics

8.3.1 Consumer Electronics Market Trends Analysis (2020-2032)

8.3.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Aerospace & Defense

8.4.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.4.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Healthcare

8.5.1 Healthcare Market Trends Analysis (2020-2032)

8.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Media & Entertainment

8.6.1 Media & Entertainment Market Trends Analysis (2020-2032)

8.6.2 Media & Entertainment Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. High-speed Camera Market Segmentation, by Spectrum

9.1 Chapter Overview

9.2 3D

9.2.1 3D Market Trends Analysis (2020-2032)

9.2.2 3D Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Infrared

9.3.1 Infrared Market Trends Analysis (2020-2032)

9.3.2 Infrared Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 X-ray

9.4.1 X-ray Market Trends Analysis (2020-2032)

9.4.2 X-ray Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Visible RGB

9.5.1 Visible RGB Market Trends Analysis (2020-2032)

9.5.2 Visible RGB Market Size Estimates and Forecasts to 2032 (USD Million)

10. High-speed Camera Market Segmentation, by Frame

10.1 Chapter Overview

10.2 250 - 1000 FPS

10.2.1 250 - 1000 FPS Market Trends Analysis (2020-2032)

10.2.2 250 - 1000 FPS Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 1000 - 10000 FPS

10.3.1 1000 - 10000 FPS Market Trends Analysis (2020-2032)

10.3.2 1000 - 10000 FPS Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 10000 - 30000 FPS

10.4.1 10000 - 30000 FPS Market Trends Analysis (2020-2032)

10.4.2 10000 - 30000 FPS Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 30000 - 50000 FPS

10.5.1 30000 - 50000 FPS Market Trends Analysis (2020-2032)

10.5.2 30000 - 50000 FPS Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Above 50000 FPS

10.6.1 Above 50000 FPS Market Trends Analysis (2020-2032)

10.6.2 Above 50000 FPS Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.4 North America High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.5 North America High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.2.6 North America High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.7.2 USA High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.7.3 USA High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.2.7.4 USA High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.8.2 Canada High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.8.3 Canada High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.2.8.4 Canada High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.9.2 Mexico High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.9.3 Mexico High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.2.9.4 Mexico High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.4 Eastern Europe High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.5 Eastern Europe High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.1.6 Eastern Europe High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.7.2 Poland High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.7.3 Poland High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.1.7.4 Poland High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.8.2 Romania High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.8.3 Romania High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.1.8.4 Romania High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.9.2 Hungary High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.9.3 Hungary High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.1.9.4 Hungary High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.10.2 Turkey High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.10.3 Turkey High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.1.10.4 Turkey High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.4 Western Europe High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.5 Western Europe High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.6 Western Europe High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.7.2 Germany High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.7.3 Germany High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.7.4 Germany High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.8.2 France High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.8.3 France High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.8.4 France High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.9.2 UK High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.9.3 UK High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.9.4 UK High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.10.2 Italy High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.10.3 Italy High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.10.4 Italy High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.11.2 Spain High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.11.3 Spain High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.11.4 Spain High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.12.2 Netherlands High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.12.3 Netherlands High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.12.4 Netherlands High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.13.2 Switzerland High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.13.3 Switzerland High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.13.4 Switzerland High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.14.2 Austria High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.14.3 Austria High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.14.4 Austria High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.4 Asia Pacific High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.5 Asia Pacific High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.6 Asia Pacific High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.7.2 China High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.7.3 China High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.7.4 China High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.8.2 India High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.8.3 India High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.8.4 India High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.9.2 Japan High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.9.3 Japan High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.9.4 Japan High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.10.2 South Korea High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.10.3 South Korea High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.10.4 South Korea High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.11.2 Vietnam High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.11.3 Vietnam High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.11.4 Vietnam High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.12.2 Singapore High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.12.3 Singapore High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.12.4 Singapore High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.13.2 Australia High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.13.3 Australia High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.13.4 Australia High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.4 Middle East High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.5 Middle East High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.1.6 Middle East High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.7.2 UAE High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.7.3 UAE High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.1.7.4 UAE High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.8.2 Egypt High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.8.3 Egypt High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.1.8.4 Egypt High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.10.2 Qatar High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.10.3 Qatar High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.1.10.4 Qatar High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.4 Africa High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.5 Africa High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.2.6 Africa High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.7.2 South Africa High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.7.3 South Africa High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.2.7.4 South Africa High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.8.2 Nigeria High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.8.3 Nigeria High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.2.8.4 Nigeria High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America High-speed Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.4 Latin America High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.5 Latin America High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.6.6 Latin America High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.7.2 Brazil High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.7.3 Brazil High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.6.7.4 Brazil High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.8.2 Argentina High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.8.3 Argentina High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.6.8.4 Argentina High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.9.2 Colombia High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.9.3 Colombia High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.6.9.4 Colombia High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America High-speed Camera Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America High-speed Camera Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America High-speed Camera Market Estimates and Forecasts, by Spectrum (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America High-speed Camera Market Estimates and Forecasts, by Frame (2020-2032) (USD Million)

12. Company Profiles

12.1 Photron Ltd

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Olympus Corporation

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 NAC Image Technology

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Mikrotron GmbH

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Excelitas Technologies Corp.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Fastec Imaging

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Vision Research Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Optronis GmbH

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 iX Cameras Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 AOS Technologies

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Image Sensors

Processors

Lens

Memory

Fans And Cooling

Others

By Application

Automotive & Transportation

Consumer Electronics

Aerospace & Defense

Healthcare

Media & Entertainment

Others

By Spectrum

3D

Infrared

X-ray

Visible RGB

By Frame Rate

250 - 1000 FPS

1000 - 10000 FPS

10000 - 30000 FPS

30000 - 50000 FPS

Above 50000 FPS

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Industrial Thermopile Sensors Market was valued at USD 1.38 Billion in 2023 and is projected to reach USD 2.43 Billion by 2032, growing at a CAGR of 6.5% during 2024-2032.

The RF Power Amplifier Market size was valued at USD 8.5 Billion in 2023. It is estimated to reach USD 25.3 Billion by 2032, growing at a CAGR of 12.9% during 2024-2032.

The Metal-Air Battery Market was valued at USD 555.9 Million in 2023 and is projected to reach USD 1793.5 Million by 2032, growing at a CAGR of 13.90% from 2024 to 2032.

Agriculture 4.0 Market was valued at USD 67.2 billion in 2023 and is expected to reach USD 175.54 billion by 2032, growing at a CAGR of 11.30% from 2024-2032.

The Spectrum Analyzer Market Size was valued at USD 1.66 Billion in 2023 and is expected to reach USD 3.17 Billion by 2032 and grow at a CAGR of 7.51% over the forecast period 2024-2032.

The Printed And Chipless RFID Market Size valued at USD 5.66 billion in 2023 and is expected to grow at 21.37% CAGR to reach USD 32.21 billion by 2032.

Hi! Click one of our member below to chat on Phone