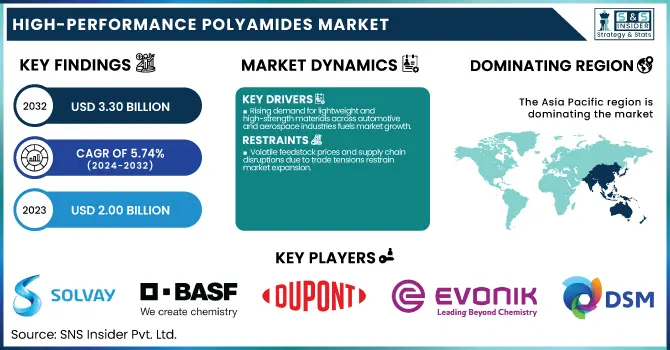

The High-Performance Polyamides Market size was USD 2.00 billion in 2023 and is expected to reach USD 3.30 billion by 2032 and grow at a CAGR of 5.74% over the forecast period of 2024-2032.

To Get more information on High-Performance Polyamides Market - Request Free Sample Report

The report offers comprehensive statistical insights and emerging trends that drive strategic decision-making. It includes data on global and regional production capacities and utilization rates by polymer type for 2023. The report examines feedstock price fluctuations and supply chain dynamics influencing cost structures. Regulatory impact assessments by region highlight how evolving standards affect manufacturing and distribution. Environmental metrics such as emissions data and waste management practices, are also analyzed, emphasizing industry sustainability efforts. Furthermore, the report explores innovation trends, focusing on R&D investments and the commercialization of bio-based and recyclable polyamides. These insights collectively provide a robust foundation for understanding market direction and identifying growth opportunities.

The U.S. tariff uncertainties have significantly impacted the high-performance polyamides market, particularly through disruptions in the nylon supply chain, a key component in automotive and industrial applications. “The imposition and fluctuation of tariffs on Chinese and other imported nylon materials have created volatility in raw material pricing and procurement, leading to cost pressures for U.S.-based manufacturers. This uncertainty has dampened investment confidence and slowed production planning, especially in downstream sectors like automotive, which rely heavily on high-performance nylons such as PA 6, PA 66, and PA 12 for lightweight components.” The reduced competitiveness of domestically produced nylon due to higher feedstock costs and limited access to affordable imports has, in turn, affected market growth. These trade tensions underscore the critical need for stable supply frameworks and policy clarity to support long-term expansion in the high-performance polyamides sector.

The United States held the largest share in the High-Performance Polyamides market in 2023, with a market size of USD 366 million, projected to reach USD 632 million by 2032, growing at a CAGR of 6.26% during 2024–2032. It is due to its strong presence of well-established automotive, aerospace, and electronics industries, which are key end-users of high-performance polyamides. The country benefits from advanced manufacturing infrastructure, significant R&D investments, and the presence of major players such as DuPont, Solvay, and Ascend Performance Materials, which continue to innovate and expand product portfolios to meet evolving performance demands. Furthermore, government initiatives promoting lightweight and fuel-efficient vehicles have increased the adoption of high-performance polyamides in under-the-hood and structural components. According to recent industry trends, the U.S. market also benefits from a relatively stable regulatory environment that encourages innovation in high-performance materials. The availability of high-quality feedstocks and integration of sustainable practices, including the use of bio-based polyamides, have further contributed to the country’s dominance in the global market.

Drivers

Rising demand for lightweight and high-strength materials across automotive and aerospace industries fuels market growth.

The growing focus on fuel efficiency, emissions reduction, and performance enhancement in the automotive and aerospace sectors is significantly boosting demand for high-performance polyamides. These materials offer superior mechanical strength, thermal resistance, and lightweight properties, making them ideal for components such as fuel lines, air intake manifolds, and structural elements. Automakers and aerospace manufacturers are increasingly replacing metal parts with high-performance polyamides to meet regulatory standards and consumer expectations for sustainability and efficiency. The integration of electric vehicles (EVs) and aircraft lightweighting programs further propels this trend. With the push for environmental compliance and energy efficiency, high-performance polyamides are becoming an essential material in advanced engineering applications, thereby driving market growth across developed and emerging economies.

Restrain

Volatile feedstock prices and supply chain disruptions due to trade tensions restrain market expansion.

The high-performance polyamides market faces challenges from the fluctuating prices of raw materials, especially petroleum-based feedstocks like caprolactam and adipic acid. These price volatilities are often exacerbated by geopolitical instability, trade disputes, and regional supply disruptions. In particular, U.S. tariff uncertainties on imported nylon materials have led to procurement delays and increased production costs for domestic manufacturers. Such supply chain instability limits manufacturers’ ability to offer cost-effective solutions, making it difficult to sustain long-term contracts with OEMs. Additionally, dependence on select global suppliers for specialty monomers further intensifies vulnerability to market shocks. These uncertainties not only affect pricing strategies but also hinder expansion plans, especially in sectors like automotive and electronics, where cost competitiveness is critical.

Opportunity

Expansion of bio-based and recyclable polyamides to offer sustainable growth opportunities for market players.

As industries increasingly emphasize sustainability, the development of bio-based and recyclable high-performance polyamides presents a promising opportunity for market players. Companies are investing in green chemistry to produce polyamides from renewable sources such as castor oil, which is used in PA 11 and PA 610. These eco-friendly alternatives offer comparable performance to petroleum-based counterparts while reducing carbon footprints and reliance on fossil fuels. Regulatory support and consumer preference for sustainable materials further accelerate this shift. Innovations in closed-loop recycling systems are also gaining traction, allowing for the reuse of high-performance polyamides without significant degradation in quality. These advancements open new revenue streams for manufacturers and enable industries like automotive, electronics, and consumer goods to meet circular economy goals.

Challenge

Intensive processing requirements and high production costs pose challenges for widespread industrial adoption.

Despite their superior properties, high-performance polyamides come with significant processing complexities and high manufacturing costs, limiting their adoption in cost-sensitive applications. These materials often require specialized equipment, high-temperature processing, and precise handling techniques, which increase overall production expenditure. Small and medium-scale manufacturers may find it difficult to invest in such infrastructure, narrowing the market to large-scale players. Additionally, the cost differential between standard engineering plastics and high-performance polyamides can deter usage in industries with thin profit margins. The challenge becomes more pronounced in developing regions, where affordability often takes precedence over performance. Overcoming these barriers requires continued innovation to simplify processing and reduce material costs without compromising performance, making these advanced polymers more accessible to broader markets.

By Type

The polyamide 12 (PA 12) segment held the largest market share at around 28% in 2023. It owing to their excellent combination of mechanical strength, flexibility, chemical resistance, and low moisture absorption, which makes them suitable for demanding applications. Because of its light weight and high strength characteristics, PA 12 is widely used in automotive fuel lines, brake systems, and electrical cable sheathing. Beyond this, its excellent high and low-temperature performance and resistance to fuel, oil, and grease make it one of the most used materials in aerospace and industrial applications as well. In addition, the growing market share of PA 12 is attributable to expanding usage of PA 12 in medical devices and 3D printing technologies, owing to its processability and biocompatibility. The investment in environmentally friendly and bio-based PA 12 solutions by various manufacturers will push PA 12 at the global high-performance polyamides landscape as a true and valued polymer.

By End-Use Industry

Automotive held the largest market share, around 38%, in 2023. It is owing to the ongoing industry trend toward lightweight, fuel-efficient, high-performance vehicles, automotive was the largest market for high-performance polyamides. They are high-performance polyamides that provide outstanding mechanical properties, high thermal stability, chemical resistance, etc., and can be used as substitutes for metals in automobile components, including air intake manifolds, fuel systems, engine covers, and electrical connectors. This has complemented the existing demand for high-temperature resistant and insulating materials for use in electric vehicles (EVs) and hybrid models, in which polyamides are critical. In addition to that, it is anticipated that strict environmental regulations regarding emission optimization to reduce the weight of the vehicle will also drive the demand for polymer because the automotive industry is looking towards lightweight alternatives. Such trends are anticipated to contribute to the fortified position of this segment within the global market, especially when coupled with the ongoing development of application-specific polyamide formulations for automobiles.

Asia Pacific held the largest market share, around 43%, in 2023. This is owing to a strong manufacturing base, expanding automotive and electronics industries, and rising need for advanced material for various end-user applications. Vehicle production and consumer electronics manufacturing in China, India, Japan, and South Korea, countries with relatively high-income manufacturing (including high-performance polyamide), have increased, with the plays of requisite high heat resistance, durability, and lightweight properties in components driving growth within these sectors. Additionally, supportive government policies for industrial growth and various initiatives to enhance infrastructure and foster technological innovations in the region have continued to grow the demand for performance polymers. Hence, the increasing presence of global and regional chemical producers setting up regional manufacturing sites in Asia Pacific to tap rising domestic and export demand has further enhanced competitive supply chain and cost advantages in the region and consolidated its market dominance.

North America held a significant market share. It is is driven by the well-established automotive, aerospace, and electronics industries and the critical performance of advanced-materials components used in these industries, which held a comparatively larger market share for the high-performance polyamides market in the North America high-performance polyamides market. In North America, the United States specifically stands as home to multiple leading automotive OEMs and aerospace companies that are becoming increasingly reliant on high-performance polyamides; materials that offer lightweight and durable properties as the automotive industry continues to battle strict fuel efficiency and emission standards. The increasing emphasis on R&D and innovation in the region coupled with the presence of leading manufacturers has led to a new level of polyamide formulations specifically designed for high-end applications. Also, the rising acceptance of electric cars and technology in North America is further increasing the consumption of heat- and chemical-resistant polymer. This high amount in conjunction with favorable trade as well as environmental policies will further prove the US supremacy in the global high-performance polyamides market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Solvay (Technyl, Amodel)

BASF (Ultramid, Ultramid Advanced)

DuPont (Zytel, Minlon)

Evonik Industries (VESTAMID, VESTAMID HTplus)

DSM (Stanyl, Akulon)

EMS-Chemie (Grilamid, Grilon)

PolyOne (Valox, Optima)

Ube Industries (Zytel, Tuffamide)

Mitsui Chemicals (Ailoy, Trevira)

Sumitomo Chemical (Sumika Super LCP, Sumika Nylons)

Toray Industries (TohoTenax, Toraynylon)

Royal DSM (Stanyl, Akulon)

Honeywell International (Solef, Aegis)

Saudi Basic Industries Corporation (SABIC) (Ultem, Noryl)

LG Chem (Zytel, LEXAN)

DowDuPont (Delrin, Zytel)

Nyloncraft (Polyamide 66, Polyamide 12)

BASF (Ultramid, Ultramid Advanced)

SABIC (Ultem, Lexan)

LANXESS (Durethan, Pocan)

In November 2024, Arkema collaborated with Authentic Material to develop innovative compounds that blend recycled leather with Rilsan polyamide 11 and Pebax TPE pellets. This partnership aims to target sectors including luxury goods, fashion, consumer electronics, automotive interiors, and sports equipment.

In October 2024, Evonik and BASF reached an agreement for the first delivery of biomass-balanced ammonia with a lower CO₂ footprint. Evonik intends to use this ammonia to manufacture sustainable products, such as VESTAMIN IPD eCO and VESTAMID eCO Polyamide 12.

In July 2024, BASF partnered with Ningbo Yaohua Electric Technology Co., Ltd. to design a concept switchgear cabinet that incorporates BASF’s high-performance materials, Ultramid polyamide and Ultradur polybutylene terephthalate, aimed at improving recyclability and energy efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.00 Billion |

| Market Size by 2032 | USD3.30 Billion |

| CAGR | CAGR of5.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyamide 6T (PA 6T), Polyarylamide (PARA), Polyamide 12 (PA 12), Polyamide 9T (PA 9T), Polyamide 11 (PA 11), Polyamide 46 (PA 46), Polyphthalamide (PPA)) • By End-Use Industry (Automotive, Electrical & Electronics, Consumer Goods, Medical & Healthcare, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Solvay, BASF, DuPont, Evonik Industries, DSM, EMS-Chemie, PolyOne, Ube Industries, Mitsui Chemicals, Sumitomo Chemical, Toray Industries, Royal DSM, Honeywell International, Saudi Basic Industries Corporation (SABIC), LG Chem, DowDuPont, Nyloncraft, LANXESS |

Ans: The High Performance Polyamides Market was valued at USD 2.00 billion in 2023.

Ans: The expected CAGR of the global High Performance Polyamides Market during the forecast period is 5.74%.

Ans: The polyamide 12 (PA 12) segment will grow rapidly in the High performance polyamides Market from 2024 to 2032.

Ans: Rising demand for lightweight and high-strength materials across automotive and aerospace industries fuels market growth.

Ans: Asia Pacific led the High Performance Polyamides Market in the region with the highest revenue share in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization by Country, By Type, 2023

5.2 Feedstock Prices by Country, and Type, 2023

5.3 Regulatory Impact by Country and By Type 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. High-Performance Polyamides Market Segmentation By Type

7.1 Chapter Overview

7.2 Polyamide 6T (PA 6T)

7.2.1 Polyamide 6T (PA 6T) Trend Analysis (2020-2032)

7.2.2 Polyamide 6T (PA 6T) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyarylamide (PARA)

7.3.1 Polyarylamide (PARA) Market Trends Analysis (2020-2032)

7.3.2 Polyarylamide (PARA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Polyamide 12 (PA 12)

7.4.1 Polyamide 12 (PA 12) Trend Analysis (2020-2032)

7.4.2 Polyamide 12 (PA 12) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyamide 9T (PA 9T)

7.5.1 Polyamide 9T (PA 9T) Market Trends Analysis (2020-2032)

7.5.2 Polyamide 9T (PA 9T) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Polyamide 11 (PA 11)

7.6.1 Polyamide 11 (PA 11) Market Trends Analysis (2020-2032)

7.6.2 Polyamide 11 (PA 11) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Polyamide 46 (PA 46)

7.7.1 Polyamide 46 (PA 46) Market Trends Analysis (2020-2032)

7.7.2 Polyamide 46 (PA 46) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Polyphthalamide (PPA)

7.8.1 Polyphthalamide (PPA) Market Trends Analysis (2020-2032)

7.8.2 Polyphthalamide (PPA) Market Size Estimates and Forecasts to 2032 (USD Billion)

8. High Performance Polyamides Market Segmentation By End-Use Industry

8.1 Chapter Overview

8.2 Automotive

8.2.1 Automotive Market Trends Analysis (2020-2032)

8.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Electrical & Electronics

8.3.1 Electrical & Electronics Market Trends Analysis (2020-2032)

8.3.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Consumer Goods

8.4.1 Consumer Goods Market Trends Analysis (2020-2032)

8.4.2 Consumer Goods Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Medical & Healthcare

8.5.1 Medical & Healthcare Market Trends Analysis (2020-2032)

8.5.2 Medical & Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Building & Construction

8.6.1 Building & Construction Market Trends Analysis (2020-2032)

8.6.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America High Performance Polyamides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America High Performance Polyamides Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America High Performance Polyamides Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 Solvay

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 BASF

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 DuPont

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Evonik Industries

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 DSM

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 EMS-Chemie

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 PolyOne

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Ube Industries

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 Mitsui Chemicals

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 Sumitomo Chemical

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

Polyamide 6T (PA 6T)

Polyarylamide (PARA)

Polyamide 12 (PA 12)

Polyamide 9T (PA 9T)

Polyamide 11 (PA 11)

Polyamide 46 (PA 46)

Polyphthalamide (PPA)

By End-Use Industry

Automotive

Electrical & Electronics

Consumer Goods

Medical & Healthcare

Building & Construction

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Textile Finishing Agents Market Size was valued at USD 2.7 Billion in 2023 and is expected to reach USD 4.1 Billion by 2032, growing at a CAGR of 5.1% over the forecast period of 2024-2032.

Explore the Hydroxyethyl Methyl Cellulose (HEMC) Market, covering key applications in construction, pharmaceuticals, and personal care. Learn about rising demand for HEMC in paints, coatings, and adhesives, and the trends driving growth in diverse industr

Thermal Spray Coatings Market was valued at USD 6.08 Billion in 2023 and is expected to reach USD 13.12 Billion by 2032, at a CAGR of 8.92% from 2024-2032.

Biocompatible Coatings Market was valued at USD 16.23 Billion in 2023 and is expected to reach USD 41.18 Billion by 2032, at a CAGR of 10.90% from 2024-2032.

Recycled Carbon Fiber Market was worth USD 163.3 million in 2023 and is expected to grow to USD 464.02 million by 2032, with a CAGR of 11.7% from 2024-2032.

The M-Toluic Acid Market Size was valued at USD 1.7 billion in 2023, and is expected to reach USD 4.2 billion by 2032, and grow at a CAGR of 10.8% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone