Get More Information on High-Performance Fibers Market - Request Sample Report

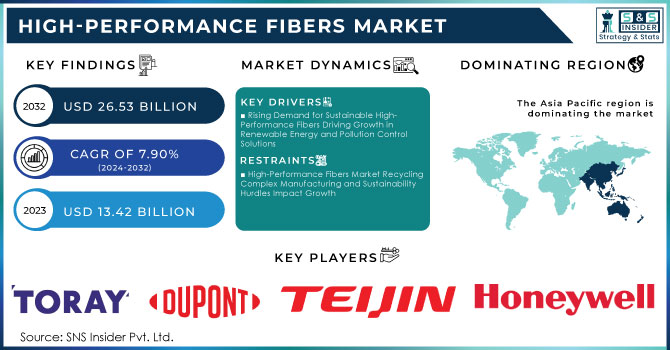

The High-Performance Fibers Market Size was valued at USD 13.42 Billion in 2023 and is expected to reach USD 26.53 Billion by 2032 and grow at a CAGR of 7.90% over the forecast period 2024-2032.

The high-performance fibers market is seeing growth as they are used by industries that need materials with high strength, durability, and lightweight attributes. The increasing usage of these fibers in the aerospace and defense industries is one of the main factors propelling this market, for high performance under extreme conditions and low weight is critical to maximizing fuel efficiency and operational performance. The Airbus A350 XWB uses 53% composite materials, primarily carbon fiber, reducing fuel consumption by 25% compared to older models. The F-35 Lightning II incorporates 35% composites, improving fuel efficiency and cutting maintenance costs. NASA’s James Webb Space Telescope (JWST) utilizes carbon fiber composites, reducing its weight by 30% while maintaining strength for extreme space conditions. Carbon fiber, aramid, and PBI fibers are some of the most heat, chemical, and mechanically stressed-resistant high-performance ones with wide applications. Also, the automotive sector is helping boost the market significantly as manufacturers want to develop improved efficiency and performance of vehicles by using such materials as lightweight structures which are fabricated from strong high-strength materials. Ford Motor Company uses carbon fiber-reinforced plastic in the Ford GT, reducing the vehicle weight by 40%. This lightweight material enhances acceleration, handling, and overall performance. The potential high-performance fiber in the energy sector is just growing especially in wind energy, where lighter and more durable turbine blades due to carbon fibers could help improve overall efficiency.

This helps not only in the efficient use of protective clothing but also home as well as industrial safety equipment which is accelerating demand from end-use industries such as law enforcement, military, and firefighting among others owing to heat resistance and durability combined with impact protection particularly provided by these types of fibers. Their lightweight and high-strength properties are contributing to the increasing demand for high-performance fibers in sporting goods and electronics.

KEY DRIVERS:

Rising Demand for Sustainable High-Performance Fibers Driving Growth in Renewable Energy and Pollution Control Solutions

A key factor fueling the growth of the high-performance fiber market is a rising demand for sustainability and attention to environmental performance from various industries. With an increasing trend of environmental awareness worldwide, industries are being impacted to decrease their carbon footprint and use more sustainable materials. This transition relies heavily on high-performance fibers, especially in renewable energy systems, such as solar and wind energy systems. This enables higher strength-to-weight ratios, which is advantageous in creating lighter and more effective renewable energy components like wind turbine blades and solar panels. Siemens Gamesa's Haliade-X 12 MW turbine uses carbon fiber in 107-meter-long blades, boosting energy efficiency by 20-25%. The University of Michigan has developed carbon fiber-based flexible solar panels, improving efficiency by 10%. These innovations reduce material wastage and enhance sustainability. They minimize the de facto aspects of material wastage through elevated efficiency, contributing towards an overall reduction in carbon footprint across these elements. Moreover, these high-performance fibers are increasingly used for the technology development of advanced filters to minimize industrial emissions and pollutants thereby providing a cleaner energy solution with environmentally friendly industrial processes.

Advancements in Material Science Fueling Demand for High-Performance Fibers in Electronics Medical and Robotics Applications

Another major category of the driver is the development in material science and technology, which have resulted in new high-performance fibers with greater performance characteristics. The exceptional physical and mechanical characteristics of these High-performance fibers are further enhanced by innovations in fiber technology such as nanofibers, and hybrid fibers, including bio-based high-performance fibers thereby extending the application areas. Incorporating carbon nanofibers (CNFs) into carbon fiber composites can boost strength by up to 50% and thermal conductivity by more than 30%, making them ideal for aerospace and defense applications. Similarly, hybrid composite materials used in automotive parts like door panels and body structures can reduce vehicle weight by 25-30% while improving structural integrity. These high-technology fibers possess superior mechanical properties, greater thermal stability, and chemical resistance, which may enable broader applications in next-generation products. These fibers are being used to produce lighter, more efficient, and more durable components in industries like electronics, medical devices, and robotics. Advanced high-performance fibers are utilized in applications like medical implants, surgical sutures, and tissue engineering that may require properties such as biocompatibility and strength. The demand for high-performance fibers across different industries will be spurred by the customization capacity of fiber properties that can be matched with newly developed technologies.

RESTRAIN:

High-Performance Fibers Market Recycling Complex Manufacturing and Sustainability Hurdles Impact Growth

One of the major restraints in the high-performance fibers-making market is the low recyclability of a few synthetic fibers and other environmental problems. For example, fibers such as carbon and aramid have higher strength and heat resistance but are challenging to recycle because of their complex chemical structures. As a result, these components become less reusable, which raises environmental concerns, especially in industries like aerospace and automotive where sustainability is at the forefront of discussions. This is a problem as industries are under pressure to move towards a circular economy if we do not have processes that can recycle these materials. This problem is evident in the wind energy sector, where carbon fiber-reinforced wind turbine blades possess longer life cycles but complex disposal avenues at the end of their lifecycle, resulting in a sustainability issue.

Advanced fibers also face another challenge, their manufacturing processes are relatively complex and time-consuming. For example, PBO can take up to 30 days from precursor to fiber form, a timeframe that hasn't changed in decades, says presenting author Robert S. Pack of the US Army Research Laboratory in Adelphi, Maryland. Due to the type of processes involved in their production, these fibers are hard to scale up for manufacturers. PBO (polybenzoxazole) is an exceptional material in terms of strength and thermal resistance, but its complex production steps present hurdles to widespread application. Such complexity also hampers the consistent/available material with relevance to industrial-scale applications delaying product development while limiting wider adoption by industries.

BY PRODUCT

The carbon fiber segment dominated the high-performance fibers market with over 21% share of global market revenue in 2023, as it offers unique properties like high tensile strength, low weight, and excellent chemical strain resistance. Carbon fibers have numerous applications in the aerospace, automotive, and sports equipment industries, where lightweight materials with superior strength are important for increasing fuel efficiency and decreasing emission levels while improving performance. For example, aerospace heavily employs carbon fibers for aircraft parts such as fuselages and wings, when the goal is lower weight with no loss of strength. Likewise, in the automotive industry, carbon fiber-reinforced composites are seeing usage in electric vehicles to improve battery efficiency by reducing vehicle weight.

The Polybenzimidazole (PBI) fibers segment is anticipated to witness the highest growth rate during 2024–2032, owing to its outstanding thermal stability and flame retardant. The superior protection from extreme heat and fire offered by PBI fibers is the reason they are being more widely used in specialized applications such as firefighting gear, aerospace, and military uniforms. For instance, PBI applies to firefighting suits and protects its users in very high-temperature conditions while maintaining flexibility and comfort levels. The demand for high-performance protective leather and the advancements in fiber technology are expected to drive PBI at a high speed during the forecast period. PBI fibers are anticipated to have a strong trajectory in the market as industries are moving more toward providing safety and durability in harsh environments

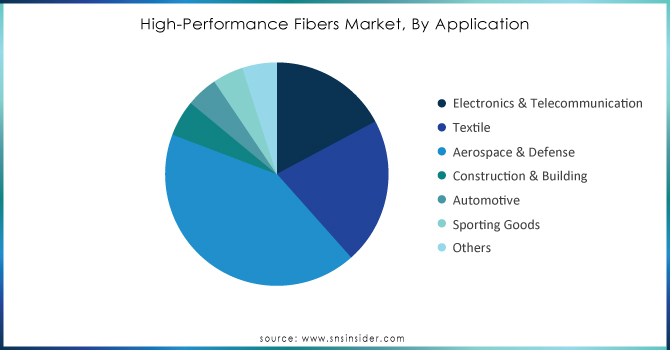

BY APPLICATION

The aerospace and defense application segment accounted for the largest revenue share of 42.34% globally in 2023 and held dominance in the high-performance fibers market owing to the demanding nature of this sector requiring lightweight but extremely strong materials. high-performance fibers like carbon fiber and aramid have been used in the aerospace sector for making fuselage, wings, and inner parts of an aircraft as they lead to lightweight components that help with fuel efficiency and flight range. Around 50-60% of the Boeing 787 Dreamliner's total weight is made from carbon fiber-reinforced composites, contributing to a 20% improvement in fuel efficiency compared to older aircraft models, showcasing how these materials have revolutionized the aerospace industry. These fibers are used in defense for protective gear as well as ballistic vests and helmets where strength to weight ratio is extremely high, thus offering great resistance from extreme heat. Modern military aircraft, such as JWST, utilize a high degree of carbon-fiber composites for structural components enabling fuel efficiencies and increased payload.

The automotive application segment is expected to experience a notable CAGR between 2024 and 2032 due to increasing emphasis on the light-weighting of vehicles for fuel efficiency enhancement along with decreasing stringent emission regulation. A range of high-performance fibers, notably carbon fiber and high-strength polyethylene, are more frequently employed in automobile parts —body panels, chassis, and/or interiors strengthening vehicles with reduced mass while increasing safety. Further pushing the market for lightweight materials that enhance battery life and overall vehicle efficiency are electric vehicles (EVs). Top auto OEMs like BMW and Tesla are already using carbon fiber reinforced composites in their new cycle vehicle designs as a part of performance and sustainability objectives. BMW’s i3 electric vehicle uses about 50% carbon fiber by weight in its body panels and chassis, reducing the vehicle's overall weight by 30-40%, which improves energy efficiency and extends its driving range. Combined with engineering breakthroughs aimed at producing high-performance fibers which can help in lowering manufacturing costs for mass production, this trend is anticipated to offer lucrative growth opportunities for the automotive segment over the forecast period.

Need Any Customization Research On High-Performance Fibers Market - Inquiry Now

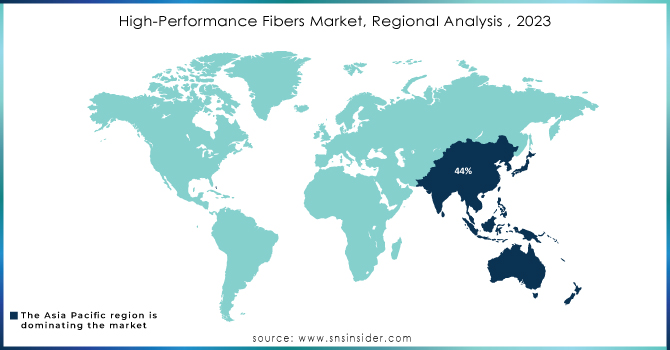

Asia Pacific was the largest high-performance fibers market in 2023, with a share of more than 44% of global revenue and it is expected to register the fastest CAGR over the forecast period 2024 to 2032. The reason behind this dominance includes factors like rapid industrialization and technological advancements along with the growing adoption of lightweight materials in key industries including automotive, aerospace, and electronics. Increasing manufacturing capabilities in the region (especially China, Japan, and South Korea) make this trend what it is today.) With China being the largest automotive market around the globe, they are exceptionally key in getting the successful transition to EVs within a prosperity cycle of the global automotive sector in particular. It set bold aims to see 20% of all new cars sold to be electric by 2025, a move expected to spur demand for the likes of carbon and high-strength polyethylene used in high-performance fibers. As an example, BYD which is one of the largest EV manufacturers uses its cars with Carbon Fiber Composite to decrease weight and ensure battery efficiency and longer mileage which assists in driving demand.

Japan and South Korea are investing heavily in what is claimed as advanced materials, too, particularly for aerospace. In practice, that means companies like Mitsubishi Heavy Industries and Korean Air are jointly developing technology to make composites such as carbon fiber directly into the body of airframes. Along with these industrial shifts, the technological innovation and sustainability focus of this region are poised to drive the Asia Pacific high-performance fiber market as the dominant fastest-growing region during the forecast period.

Some of the major players in the High-Performance Fibers Market are:

Toray Industries, Inc. (Torayca Carbon Fiber, T300 Carbon Fiber)

DuPont (Kevlar, Nomex)

Teijin Ltd. (Twaron, Technora)

Mitsubishi Chemical Corporation (MEC-Carbon, Dyneema)

Honeywell International Inc. (Spectra Fiber, Spectra Shield)

DSM (Dyneema, Spectra Shield)

Kolon Industries, Inc. (Twaron, Technora)

Kermel S.A. (Kermel Fiber, Kermel Aramid)

Corning Incorporated (Glass Fiber, Hybrid Composites)

PBI Performance Products (PBI Fiber, PBI Gold)

AGY (S2 Glass Fiber, Aerospace Fiber)

Zoltek Corporation (PX35 Carbon Fiber, Zoltek Carbon)

Yantai Tayho Advanced Materials Co. (Carbon Fiber, S-Glass Fiber)

SGL Carbon (Sigrafil Carbon Fiber, Sigraflex Graphite)

Solvay (Solef PVDF, Torlon Polyamide)

Owens Corning (Corning Glass Fiber, Aro-Vac)

Toho Tenax Co., Ltd. (Tenax Carbon Fiber, Tenax Standard Fiber)

Toyobo Co. Ltd. (Zylon Fiber, Polyphenylene Sulfide Fiber)

Mitsubishi Rayon Co. (Panex Carbon Fiber, MR Carbon Fiber)

China Jushi Group (Jushi Glass Fiber, Carbon Fiber Reinforced)

Some of the Raw Material Suppliers for High-Performance Fibers Companies:

Solvay

SABIC

Mitsubishi Chemical

Dow Chemical

Huntsman Corporation

Lanxess

BASF

Covestro

ExxonMobil

3M

In August 2024, HFCL unveiled a new range of high-performance cable solutions at ISE EXPO 2024 in Dallas, Texas. Among the highlights was the launch of high-density single-jacket, single-armor Intermittently Bonded Ribbon (IBR) cables, featuring 144-1728 fibers. This innovation earned the company an ISE Innovators Award.

In July 2024, China unveiled the world’s first carbon fiber-only passenger train, marking a significant breakthrough in high-speed rail technology and reinforcing its leadership in the sector, according to Interesting Engineering.

In July 2024, Technical Fibre Products (TFP), a division of James Cropper Advanced Materials, announced a breakthrough in battery technology with the launch of its high-performance carbon fiber nonwovens.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.42 Billion |

| Market Size by 2032 | USD 26.53 Billion |

| CAGR | CAGR of 7.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, polybenzoxazole (PBO), Glass Fiber, High Strength Polyethylene, Others), • By Application (Electronics & Telecommunication, Textile, Aerospace & Defense, Construction & Building, Automotive, Sporting Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toray Industries, Inc., DuPont, Teijin Ltd., Mitsubishi Chemical Corporation, Honeywell International Inc., DSM, Kolon Industries, Inc., Kermel S.A., Corning Incorporated, PBI Performance Products, AGY, Zoltek Corporation, Yantai Tayho Advanced Materials Co., SGL Carbon, Solvay, Owens Corning, Toho Tenax Co., Ltd., Toyobo Co. Ltd., Mitsubishi Rayon Co., China Jushi Group |

| Key Drivers | • Rising Demand for Sustainable High-Performance Fibers Driving Growth in Renewable Energy and Pollution Control Solutions • Advancements in Material Science Fueling Demand for High-Performance Fibers in Electronics Medical and Robotics Applications |

| RESTRAINTS | • High-Performance Fibers Market Recycling Complex Manufacturing and Sustainability Hurdles Impact Growth |

Ans: The High-Performance Fibers Market is expected to grow at a CAGR of 7.90% during 2024-2032.

Ans: High-Performance Fibers Market size was USD 13.42 billion in 2023 and is expected to Reach USD 26.53 billion by 2032.

Ans: The major growth factor of the High-Performance Fibers Market is the increasing demand for lightweight, durable materials across industries like aerospace, automotive, and defense to enhance performance and fuel efficiency.

Ans: The Carbon Fiber segment dominated the High-Performance Fibers Market in 2023.

Ans: Asia Pacific dominated the High-Performance Fibers Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 High-Performance Fibers Demand & Supply Metrics, by Region, (2020-2023)

5.2 High-Performance Fibers Innovation & Technology Metrics, by Region, (2020- 2023)

5.3 High-Performance Fibers Manufacturing Facilities, by Region

5.4 High-Performance Fibers Supply Chain Metrics, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. High-Performance Fibers Market Segmentation, By Product

7.1 Chapter Overview

7.2 Carbon Fiber

7.2.1 Carbon Fiber Market Trends Analysis (2020-2032)

7.2.2 Carbon Fiber Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Polybenzimidazole (PBI)

7.3.1 Polybenzimidazole (PBI) Market Trends Analysis (2020-2032)

7.3.2 Polybenzimidazole (PBI) Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Aramid Fiber

7.4.1 Aramid Fiber Market Trends Analysis (2020-2032)

7.4.2 Aramid Fiber Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 M5/PIPD

7.5.1 M5/PIPD Market Trends Analysis (2020-2032)

7.5.2 M5/PIPD Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Polybenzoxazole (PBO)

7.6.1 Polybenzoxazole (PBO) Market Trends Analysis (2020-2032)

7.6.2 Polybenzoxazole (PBO) Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Glass Fiber

7.7.1 Glass Fiber Market Trends Analysis (2020-2032)

7.7.2 Glass Fiber Market Size Estimates and Forecasts to 2032 (USD Million)

7.8 High Strength Polyethylene

7.8.1 High Strength Polyethylene Market Trends Analysis (2020-2032)

7.8.2 High Strength Polyethylene Market Size Estimates and Forecasts to 2032 (USD Million)

7.9 Others

7.9.1 Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. High-Performance Fibers Market Segmentation, by Application

8.1 Chapter Overview

8.2 Electronics & Telecommunication

8.2.1 Electronics & Telecommunication Market Trends Analysis (2020-2032)

8.2.2 Electronics & Telecommunication Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Textile

8.3.1 Textile Market Trends Analysis (2020-2032)

8.3.2 Textile Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Aerospace & Defense

8.4.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.4.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Construction & Building

8.5.1 Construction & Building Market Trends Analysis (2020-2032)

8.5.2 Construction & Building Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Automotive

8.6.1 Automotive Market Trends Analysis (2020-2032)

8.6.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Sporting Goods

8.7.1 Sporting Goods Market Trends Analysis (2020-2032)

8.7.2 Sporting Goods Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Other Market Trends Analysis (2020-2032)

8.8.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.2.4 North America High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.2.5.2 USA High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.2.6.2 Canada High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.2.7.2 Mexico High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.6.2 France High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.7.2 UK High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.5.2 China High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.5.2 India High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.5.2 Japan High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.6.2 South Korea High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.8.2 Singapore High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.9.2 Australia High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.1.4 Middle East High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.2.4 Africa High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America High-Performance Fibers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.6.4 Latin America High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.6.5.2 Brazil High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.6.6.2 Argentina High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.6.7.2 Colombia High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America High-Performance Fibers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America High-Performance Fibers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Toray Industries, Inc

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 DuPont

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Teijin Ltd.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Mitsubishi Chemical Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Honeywell International Inc

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 DSM

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Kolon Industries, Inc

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Kermel S.A

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Corning Incorporated

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 PBI Performance Products

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Product

Carbon Fiber

Polybenzimidazole (PBI)

Aramid Fiber, M5/PIPD

Polybenzoxazole (PBO)

Glass Fiber

High Strength Polyethylene

Others

By Application

Electronics & Telecommunication

Textile

Aerospace & Defense

Construction & Building

Automotive

Sporting Goods

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Chemical Tankers Market was estimated at USD 34.62 billion in 2023 and is expected to arrive at USD 50.75 billion by 2032, at a CAGR of 4.34% from 2024-2032.

The Recycled Textiles Market size was valued at USD 5.76 billion in 2023 and is expected to reach USD 8.69 billion by 2032, at a CAGR of 4.70% from 2024-2032.

The Resin Market size was valued at USD 560 Billion in 2023. It is expected to grow to USD 861.3 Billion by 2032 and grow at a CAGR of 4.9% over the forecast period of 2024-2032.

Structural Adhesive Tapes Market was valued at USD 10.71 Bn in 2023 and is expected to reach USD 16.32 Bn by 2032, growing at a CAGR of 4.80% from 2024-2032.

Green Building Materials Market was USD 371.25 billion in 2023 and is expected to Reach USD 1020.53 billion by 2032, growing at a CAGR of 11.89% by 2024-2032.

Insoluble Sulfur Market was valued at USD 1.13 Billion in 2023 and is expected to reach USD 1.91 Billion by 2032, growing at a CAGR of 6.00% from 2024-2032.

Hi! Click one of our member below to chat on Phone