Get More Information on High-frequency Trading Server Market - Request Sample Report

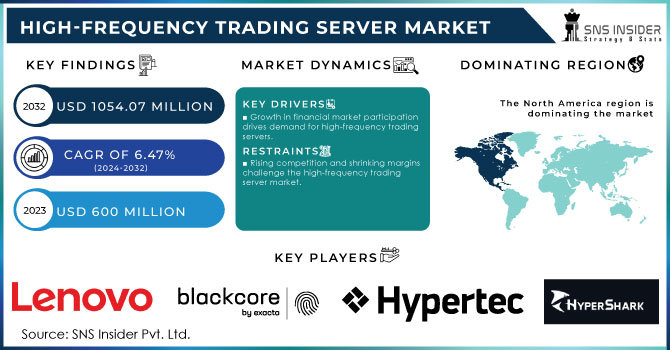

The High-frequency Trading Server Market Size was valued at USD 600 Million in 2023 and is expected to reach USD 1054.07 Million by 2032, growing at a CAGR of 6.47% over the forecast period 2024-2032.

The high-frequency trading (HFT) server market has emerged as a critical segment of the financial technology landscape, driven by the rapid evolution of trading strategies that leverage advanced algorithms and high-speed connectivity. Advanced server infrastructure is central to high-frequency trading, able to handle enormous amounts of data quickly. These servers are fitted with custom hardware like FPGAs and ASICs to enhance efficiency and shorten trading execution times. For instance, Bitmain Technologies, a prominent company in the cryptocurrency industry, is recognized for its specialized integrated circuits (ASICs). These specific chips greatly increase processing speed and efficiency, decreasing the time needed to carry out trades. Bitmain's ASICs offer a competitive advantage in high-frequency trading by quickly processing complex algorithms, which are essential due to the importance of speed in this market. The need for extremely fast solutions has resulted in the use of colocation services, where traders put their servers close to exchange data centers for a competitive advantage. This proximity enables HFT companies to respond to market changes quicker than rivals, increasing the demand for high-speed trading servers.

The growing number of trades conducted in worldwide financial markets is a major factor driving the high-frequency trading server market. Electronic trading has seen a large increase in the United States, with about 65% of the equity market now being conducted through electronic platforms by the beginning of 2024. This signals a major change towards trading solutions based on technology, driven by asset managers' increasing dependence. In a survey conducted in 2023, it was found that 75% of buy-side equity traders predominantly use electronic trading systems, while traditional high-touch sales trading remains prevalent. The increase in electronic trading platforms and the decrease in traditional brokerage models have heightened the demand for efficient, reliable, and quick trading systems. Institutions, hedge funds, and proprietary trading firms are making significant investments in HFT infrastructure to guarantee their ability to quickly and accurately handle large volumes of data. The increase in big data analytics and machine learning is also contributing to the adoption of trading strategies to improve decision-making processes.

Drivers

Growth in financial market participation drives demand for high-frequency trading servers.

The increase in involvement in financial markets has become a key factor in the growth of the High-Frequency Trading Server Market. Recently, an increasing number of people and organizations have joined the stock market due to the possibility of increased profits and the ease of use of trading systems. The rise in market engagement has boosted the need for cutting-edge trading technologies like high-frequency trading servers. Due to the increase in online brokerage platforms and trading apps, retail investors have played a significant part in this trend. these platforms offer convenient entry to financial markets and a plethora of educational materials, enabling individuals to trade on their own. As retail investors increase their involvement, they add to the total market volume and liquidity, which allows for high-frequency traders to find opportunities. Along with individual investors, large investment firms, hedge funds, and trading companies are also embracing high-frequency trading techniques to take advantage of market inefficiencies. With the increased competition among traders, there is a growing demand for advanced server infrastructure. Firms can take advantage of increasing market activity by using HFT servers with advanced algorithms and low-latency capabilities to execute trades faster than their competitors.

Rising demand for real-time data processing drives growth in the high-frequency trading server market.

The increased need for processing data in real-time is a major factor influencing the High-Frequency Trading Server Market. Accessing real-time data is essential for making well-informed trading decisions in today's fast-moving financial landscape. High-speed traders depend on immediate data feeds to assess market conditions, pinpoint trading chances, and carry out trades accurately. Real-time data processing allows HFT companies to keep track of numerous markets and instruments at the same time. by analyzing large volumes of data instantly, traders can react to changes in the market with greater efficiency and take advantage of brief opportunities. This functionality is crucial in high-frequency trading, as a delay of just one millisecond can lead to missed opportunities and decreased earnings.

Moreover, enhancements in data analysis and visualization software have simplified the process for traders to make sense of complicated data sets. Improved analytical features enable traders to create advanced trading algorithms that take into account a broader set of factors, enhancing the precision of their forecasts. Therefore, companies are investing more in high-performance servers that can manage large amounts of data and execute trades quickly. The increase in data sources, such as news feeds, social media sentiment, and economic indicators, has also led to a greater need for real-time data processing. Traders can use a variety of data points to create more well-rounded trading strategies. Advanced data processing-equipped servers for high-frequency trading play a crucial role in real-time integration and analysis of data streams.

Restraints

Rising competition and shrinking margins challenge the high-frequency trading server market.

Rising competition and shrinking margins are important limitations on the High-Frequency Trading Server Market. With the increase in high-frequency trading participants, firms are increasingly competing to secure profitable trading opportunities. The pressure from competition may cause a decrease in profit margins, which can make it difficult for HFT operations to remain sustainable. High-frequency traders depend on carrying out a substantial number of trades to make profits from minor price differences. Nonetheless, as additional companies begin using comparable trading tactics, the number of lucrative chances shrinks. The outcome is a fiercely competitive atmosphere in which companies are required to constantly create new and improve their trading tactics to sustain profitability. Margin compression may happen when companies participate in pricing battles to appeal to customers or vie for order volume. This trend is especially evident in high-frequency trading, as companies may reduce their prices to stand out from competitors. With the decrease in trading costs, firms are required to increase trading volumes to meet their financial goals as profit margins decrease. Additionally, depending on high-frequency trading strategies may result in a recurring cycle of competition and decreased margins. To take advantage of market inefficiencies, companies are increasing their trading activity, which can lead to quicker price corrections and reduce the effectiveness of traditional high-frequency trading strategies. This situation can result in competition to lower prices, as businesses focus on increasing sales instead of profits, worsening the reduction in profit margins.

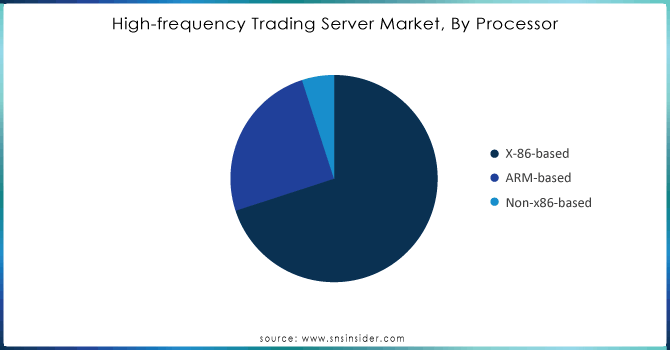

by Processor

X86-based processors held a 70% market share in 2023 and led the market because of their well-established structure, strong efficiency, and wide range of software options. These chips, mainly manufactured by Intel and AMD, provide fast clock speeds and multiple core functionalities, making them ideal for handling the intricate algorithms and minimal delay needs of HFT. Their ability to work well with various trading software and platforms cements their status as the top choice for trading companies. For example, companies such as Jane Street and Citadel use x86 servers to make trades quickly and stay competitive in fast trading.

ARM-based processors are experiencing rapid growth and are expected to have the fastest CAGR during 2024-2032, showcasing the highest growth rate because of their excellent energy efficiency, performance per watt, and scalability. The ARM architecture's reputation for lower power consumption allows companies to create high-performance trading systems without sacrificing energy efficiency. NVIDIA and Qualcomm are now focusing on improving ARM-based solutions for trading apps, boosting computational abilities for algorithmic trading strategies. Two Sigma is a well-known example that has investigated ARM-based systems for their quantitative trading models, demonstrating the possibility of changing the competitive nature of HFT.

Need any customization research on High-frequency Trading Server Market - Enquiry Now

by Form Factor

The 2U form factor led the market with a 40% market share in 2023. This setup achieves an equilibrium among size, efficiency, and heat release, which is perfect for the demanding needs of high-frequency trading. The 2U servers are equipped to accommodate numerous CPUs, sufficient RAM, and fast networking interfaces, essential for executing trades quickly and handling large amounts of market data. IBM and Dell Technologies have tailored their 2U server offerings for financial institutions, guaranteeing efficient performance and dependable reliability.

The 4U form factor is the fastest-growing segment which is expected to grow at a rapid CAGR during 2024-2032, mainly because it offers increased computational power and scalability. These servers can support numerous GPUs and high volumes of RAM, enabling enhanced data management and intricate algorithm processing. Due to improvements in parallel processing and machine learning, the need for 4U servers is increasing as companies aim to enhance trading strategies and boost performance. Hewlett Packard Enterprise (HPE) and Supermicro are at the forefront of offering strong 4U solutions designed specifically for trading applications.

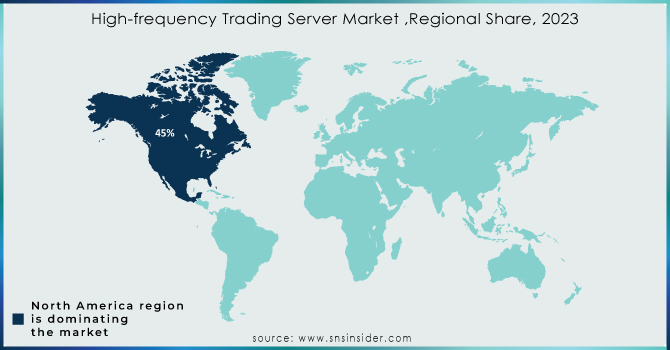

North America led the market in 2023 with a 45% market share, with major financial institutions, hedge funds, and proprietary trading firms driving its dominance in the region. The area features state-of-the-art technological infrastructure, guaranteeing quick response times and fast connections—important elements for efficiently carrying out high-frequency trades. New York City, where major stock exchanges are located, acts as a worldwide financial center, drawing substantial investments in trading technologies. Moreover, Citadel Securities and Jump Trading utilize advanced algorithms and state-of-the-art server technology to sustain their competitive edge in this rapidly changing setting.

Asia-Pacific is accounted to have the fastest CAGR during 2024-2032, due to increasing market liberalization, technological advancements, and growing interest in algorithmic trading are fueling rapid growth in the High-Frequency Trading Server Market in the Asia-Pacific (APAC) region. Nations such as Japan, China, and Australia are becoming important participants in the HFT scene, with stock markets upgrading their technological features to appeal to global traders. The increasing presence of fintech companies and online trading platforms in this area is also driving the need for high-frequency trading servers.

Key Players

The major key players in the High-frequency Trading Server Market are:

ASA Computers, Inc. (ASA SuperServer, ASA High-Performance Trading Workstation)

Blackcore Technologies (Blackcore HFT Server, Blackcore Ultra-Low Latency Platform)

Hypertec (Hypertec High-Performance Computing Server, Hypertec Ultra-Low Latency Solution)

Dell (Dell PowerEdge R940 Rack Server, Dell EMC PowerEdge C6420)

HP Enterprise Development LP (HPE ProLiant DL380 Gen10 Server, HPE Apollo 6000 System)

Hypershark Technologies (Hypershark HFT Optimized Server, Hypershark Low-Latency Trading Platform)

Lenovo (Lenovo ThinkSystem SR670, Lenovo System x3650)

Penguin Computing (Penguin Altus HFT Server, Penguin Computing Blade System)

Super Micro Computer, Inc. (Supermicro SuperServer 1029U, Supermicro Ultra SuperServer)

Tyrone Systems (Tyrone Ultra-Low Latency Server, Tyrone Trading Appliance)

XENON Systems Pty Ltd (XENON Performance Server, XENON Trading Node)

Intel Corporation (Intel Xeon Scalable Processors, Intel FPGA for HFT)

IBM (IBM Power System AC922, IBM z15)

Cisco Systems (Cisco Nexus 9000 Series, Cisco Unified Computing System)

AMD (AMD EPYC 7003 Series, AMD Ryzen Threadripper PRO)

Micron Technology (Micron DDR4 DRAM, Micron SSD for Low Latency)

Arista Networks (Arista 7500R Series, Arista 7280R Series)

Fujitsu (Fujitsu PRIMERGY RX2540 M5, Fujitsu SPARC M12)

Tyan Computer Corp. (Tyan Thunder HX FT77B-B7109, Tyan GT62B-B7117)

Hewlett Packard Enterprise (HPE) (HPE ProLiant DL325 Gen10, HPE Synergy)

Recent Development

In April 2024, IBM announced its introduction of the Watson Financial services platform, which incorporates AI-driven analytics created for high-frequency trading. The platform is used for the improvement of the decision-making process and trade execution time. High-frequency trading operates within a limited time frame, helping to generate profits in a timely manner. Modern algorithms are employed to make the trade more effective.

In June 2023, HPE announced a range of ProLiant Servers, which had been developed for financial services and focus on low-latency applications. This is another HPE-led solution, which remained developed for the company to contend in the HFT server market.

In September 2023, Cisco introduced new low-latency switches to run HFT. The switches are designed to operate by processing data at a rapid speed and high throughput. It aims at improving the trading system's performance by shortening the period to make trades.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 600 Million |

| Market Size by 2032 | USD 1054.07 Million |

| CAGR | CAGR of 6.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Processor (X-86-based, ARM-based, Non-x86-based) • By Form Factor (1U,2U, 4U, Others) • By Application (Equity Trading, Forex Markets, Commodity Markets, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ASA Computers, Inc., Blackcore Technologies, Hypertec, Dell, HP Enterprise Development LP, Hypershark Technologies, Lenovo, Penguin Computing, Super Micro Computer, Inc., Tyrone Systems, XENON Systems Pty Ltd, Intel Corporation, IBM, Cisco Systems, AMD, Micron Technology, Arista Networks, Fujitsu, Tyan Computer Corp., Hewlett Packard Enterprise (HPE) |

| Key Drivers | • Growth in financial market participation drives demand for high-frequency trading servers. • Rising demand for real-time data processing drives growth in the high-frequency trading server market. |

| RESTRAINTS | • Rising competition and shrinking margins challenge the high-frequency trading server market. |

Ans: The High-frequency Trading Server Market is expected to grow at a CAGR of 6.47% during 2024-2032.

Ans: The High-frequency Trading Server Market was USD 600 Million in 2023 and is expected to Reach USD 1054.07 Million by 2032.

Ans: Rising demand for real-time data processing drives growth in the high-frequency trading server market.

Ans: The 2U segment dominated the High-frequency Trading Server Market.

Ans: North America dominated the High-frequency Trading Server Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 High-frequency Trading Server Key Vendors and Feature Analysis, 2023

5.2 High-frequency Trading Server Performance Benchmarks, 2023

5.3 High-frequency Trading Server Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. High-frequency Trading Server Market Segmentation, by Processor

7.1 Chapter Overview

7.2 X-86-based

7.2.1 X-86-based Market Trends Analysis (2020-2032)

7.2.2 X-86-based Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 ARM-based

7.3.1 ARM-based Market Trends Analysis (2020-2032)

7.3.2 ARM-based Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Non-x86-based

7.4.1 Non-x86-based Market Trends Analysis (2020-2032)

7.4.2 Non-x86-based Market Size Estimates and Forecasts to 2032 (USD Million)

8. High-frequency Trading Server Market Segmentation, by Form Factor

8.1 Chapter Overview

8.2 1U

8.2.1 1U Market Trends Analysis (2020-2032)

8.2.2 1U Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 2U

8.3.1 2U Market Trends Analysis (2020-2032)

8.3.2 2U Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 4U

8.4.1 4U Market Trends Analysis (2020-2032)

8.4.2 4U Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. High-frequency Trading Server Market Segmentation, by Application

9.1 Chapter Overview

9.2 Equity Trading

9.2.1 Equity Trading Market Trends Analysis (2020-2032)

9.2.2 Equity Trading Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Forex Markets

9.3.1 Forex Markets Market Trends Analysis (2020-2032)

9.3.2 Forex Markets Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Commodity Markets

9.4.1 Commodity Markets Market Trends Analysis (2020-2032)

9.4.2 Commodity Markets Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.2.4 North America High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.2.5 North America High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.2.6.2 USA High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.2.6.3 USA High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.2.7.2 Canada High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.2.7.3 Canada High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.2.8.2 Mexico High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.2.8.3 Mexico High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.1.4 Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.1.5 Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.1.6.2 Poland High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.1.6.3 Poland High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.1.7.2 Romania High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.1.7.3 Romania High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.1.8.2 Hungary High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.1.8.3 Hungary High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.1.9.2 Turkey High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.1.9.3 Turkey High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.4 Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.5 Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.6.2 Germany High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.6.3 Germany High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.7.2 France High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.7.3 France High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.8.2 UK High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.8.3 UK High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.9.2 Italy High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.9.3 Italy High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.10.2 Spain High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.10.3 Spain High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.11.2 Netherlands High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.11.3 Netherlands High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.12.2 Switzerland High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.12.3 Switzerland High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.13.2 Austria High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.13.3 Austria High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.4 Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.5 Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.6.2 China High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.6.3 China High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.7.2 India High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.7.3 India High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.8.2 Japan High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.8.3 Japan High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.9.2 South Korea High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.9.3 South Korea High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.10.2 Vietnam High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.10.3 Vietnam High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.11.2 Singapore High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.11.3 Singapore High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.12.2 Australia High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.12.3 Australia High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.4.13.2 Rest of Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.4.13.3 Rest of Asia-Pacific High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.1.4 Middle East High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.1.5 Middle East High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.1.6.2 UAE High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.1.6.3 UAE High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.1.7.2 Egypt High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.1.7.3 Egypt High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.1.9.2 Qatar High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.1.9.3 Qatar High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.2.4 Africa High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.2.5 Africa High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.2.6.2 South Africa High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.2.6.3 South Africa High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.2.7.2 Nigeria High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.2.7.3 Nigeria High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America High-frequency Trading Server Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.6.4 Latin America High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.6.5 Latin America High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.6.6.2 Brazil High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.6.6.3 Brazil High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.6.7.2 Argentina High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.6.7.3 Argentina High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.6.8.2 Colombia High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.6.8.3 Colombia High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America High-frequency Trading Server Market Estimates and Forecasts, by Processor (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America High-frequency Trading Server Market Estimates and Forecasts, by Form Factor (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America High-frequency Trading Server Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11. Company Profiles

11.1 ASA Computers, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Blackcore Technologies

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Hypertec

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Dell

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 HP Enterprise Development LP

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Hypershark Technologies

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Lenovo

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Penguin Computing

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Super Micro Computer, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Tyrone Systems

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Processor

X-86-based

ARM-based

Non-x86-based

By Form Factor

1U

2U

4U

Others

By Application

Equity Trading

Forex Markets

Commodity Markets

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Liquid Crystal on Silicon (LCoS) Market size was valued at 1.94 Billion in 2023 and is projected to reach USD 3.42 Billion by 2032 with a growing CAGR of 6.49% Over the Forecast Period of 2024-2032.

The Thin Film Battery Market Size was valued at USD 0.45 Billion in 2023 and is expected to grow at a CAGR of 22.99% to reach USD 2.92 Billion by 2032.

The Baggage Handling System Market size was valued at USD 10.57billion in 2023 and is expected to grow to USD 18.92 billion by 2032 and grow at a CAGR of 6.68% over the forecast period of 2024-2032

The RF Test Equipment Market size was valued at USD 3.40 billion in 2023 and is expected to reach USD 6.18 billion by 2032 and grow at a CAGR of 6.93% over the forecast period 2024-2032.

The Lithium Titanate Oxide (LTO) Battery Market size was USD 4.46 billion in 2023 and is estimated to Reach USD 11.35 billion by 2032 and grow at a CAGR of 10.98% over the forecast period of 2024-2032.

The Leak Detection Market Size was valued at USD 4.58 billion in 2023 and is expected to grow at a CAGR of 5.31% to reach USD 7.26 billion by 2032.

Hi! Click one of our member below to chat on Phone