Hepatitis Testing Market Report Scope & Overview:

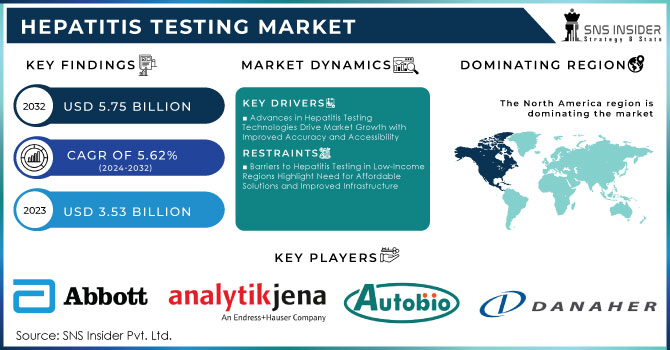

The Hepatitis Testing Market size was valued at USD 3.53 billion in 2023 and is expected to reach USD 5.75 billion by 2032, growing at a CAGR of 5.62% from 2024-2032.

Get More Information on Hepatitis Testing Market - Request Sample Report

There is a critical need to create better testing solutions managing the rising incidence of hepatitis infections, especially as by 2022, 254 million people live with hepatitis B, and 50 million live with hepatitis C worldwide. Hepatitis has become the second leading cause of death from communicable diseases after COVID-19. The number of estimated deaths arising from hepatitis cases in 2022 was 1.3 million. Of all these deaths, B-Type hepatitis accounted for 83%, whereas C-type hepatitis accounted for 17%. Such numbers make testing vital for catching infections in their earliest stages and relieving the burden imposed by liver-related diseases.

Testing and consequently correct diagnosis form the way into prevention and treatment services. Although the global burden is high, a significant proportion of individuals remain unaware of their status with hepatitis. Consequently, cases are diagnosed late in the stages, further contributing to the progression of the virus within communities. Advances in testing technologies, including rapid diagnostics and point-of-care testing, enable people to get a hepatitis test faster and more efficiently. It will only be through proactive governance that screening and vaccination of the vulnerable will take place, thereby preventing millions of infections and deaths in the next few decades. From 2022 to 2050, appropriate health measures may prevent hepatitis infections at 25.64 million and hepatitis B-related deaths at 8.63 million.

The economic benefits, too, are comparable. Expanding testing and treatment for hepatitis can bring important economic returns, as is concluded in the following paragraphs. Hepatitis infection and death prevention by 2050 are expected to save a net of USD 99.03 billion from a societal perspective. From this perspective, an incremental cost to achieve a Disability-Adjusted Life Year (DALY) averted of USD 2,934.55 marks hepatitis interventions as not only life-saving but also cost-effective. Opportunities for healthcare providers and manufacturers alike to contribute to the effort to combat viral hepatitis are expected in this market, which is certain to expand enormously as more and more people become aware of testing as a part of the recognition of their condition and as access to services improves.

Hepatitis Testing Market Dynamics

DRIVERS

-

Advances in Hepatitis Testing Technologies Drive Market Growth with Improved Accuracy and Accessibility

Advances in hepatitis testing technologies are providing better accessibility, efficiency, and accuracy, which can ensure growth for markets. Rapid diagnostics and point-of-care (POC) testing are allowing quicker results, contributing to broader adoption in underserved areas. A prototype example of a POC HCV assay that compared with the standard test in a laboratory showed 96.8% sensitivity and 99.4% specificity. 94% of the 203 participants received valid results. The new technologies, the wireless hepatitis B test kit developed by scientists at Chulalongkorn University, include the diagnosis of concurrent data collection for real-time epidemiological tracking. Continuation of more sensitive and specific serological test development will reduce false results. With more knowledge of hepatitis and preventive health care, demand for these high-tech solutions will increase. This is bound to drive further market growth.

-

Progress in Hepatitis Prevention and Screening Drives Market Growth and Access to Diagnostics

The growth of the hepatitis testing market is primarily driven by increasing awareness about hepatitis and targeted screening programs. Public health education campaigns are now making people aware of the danger of hepatitis infections, which in turn increases the test-seeking behavior of more people. Governments and healthcare establishments also launch wide-reaching screening programs to detect the unaware ones about their infection status. In FY 2023, the United States continued its strong progress on acute hepatitis B infections, which are on track to meet or exceed its 2025 target, and improved the vaccination rate for the hepatitis B "birth dose" as well as reduced hepatitis C-Related mortality. Early interventions are critical in preventing long-term complications from the disease. As a result, increasing awareness and better screening measures contribute to the increase in market growth and access to diagnostic products.

RESTRAINTS

-

Barriers to Hepatitis Testing in Low-Income Regions Highlight Need for Affordable Solutions and Improved Infrastructure

Low-income regions pose a big challenge in the hepatitis testing market mainly because of its high costs and limited access, thus presenting a major hindrance to growth. In this way, for instance, it is estimated that only 45% of newborns in the world received a dose of the hepatitis B vaccine within 24 hours, while in the Africa region alone, 63% of new cases of hepatitis B infections happen, with only 18% of babies receiving the birth dose vaccine. These lacunae in immunization contribute to the spread of the infection, making it more difficult to manage hepatitis. The cost of appropriate testing solutions still is out of reach for providers and patients alike and thus leaves people at a need to rely on less precise methods. Moreover, the lack of an adequate health infrastructure blocks the establishment of large screening programs, thereby making many people unaware of their status with regards to hepatitis. Low-cost diagnostic solutions, infrastructural enhancement in the healthcare system, and strategic partnerships will overcome the challenges of these hurdles to improve access to cheap testing and treatment.

Hepatitis Testing Market Segmentation Overview

BY TEST

Blood tests dominate the hepatitis testing market, accounting for about 54% of revenue in 2023, primarily due to their ability to identify hormonal imbalances causing acne. They can help uncover underlying causes such as PCOS or insulin resistance and will enable highly individualized treatment plans, intensely valued by both patients and providers.

Imaging tests, however, will increase at a healthy CAGR of 6.49% between 2024 and 2032 owing to advances in digital imaging, AI analysis, and non-invasive techniques. As these technologies advance, the sensitivity and accuracy of imaging tests increase and represent a painless adjunct to monitoring acne. Overall market growth therefore results from both blood tests and imaging tests.

BY TECHNOLOGY

The hepatitis testing market is expected to be dominated by the enzyme-linked immunosorbent assay which would be a trend followed in its effectiveness, much like the acne treatment market where the company stood at a revenue share of about 59% in 2023. The accuracy in detecting antibodies and antigens makes ELISA the most preferred technique for diagnosing hepatitis infections.

Rapid diagnostic tests will be the fastest-growing segment, in which growth is expected to happen at around 7.29% CAGR from 2024 to 2032. Rapid diagnostic tests are preferably utilized at point-of-care settings due to the ease of ease, faster turnaround times, and ease of application. Increased public health initiatives, owing to awareness and testing promotion, are likely to positively influence the demand for both ELISA and rapid diagnostic tests in hepatitis screening, thus upholding overall market growth.

BY END USER

Hospitals and diagnostic laboratories dominate the hepatitis testing market with 63% in revenue in 2023 due to their full testing capability. Advanced technologies are found there, ensuring accurate and efficient diagnostics. These units also offer prompt results so that patients can be treated on time, and patient management may be effectively done in cases of hepatitis infections.

Blood banks are expected to have the highest CAGR rate, around 5.71% between 2024 and 2032. Growth is primarily due to increasing pressures around blood safety and the growing necessity for routine hepatitis testing of blood donations. With increased awareness of the risks due to hepatitis, hospitals, and blood banks are now focusing on better patient screening and better results in treatment. These initiatives are said to contribute significantly to the sizeable expansion of the market.

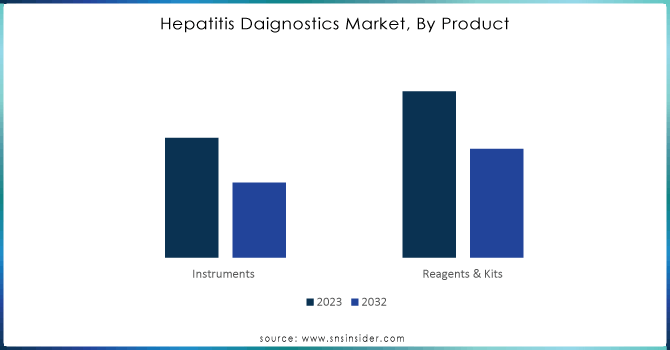

BY PRODUCT

Reagents and kits currently dominate the hepatitis testing market, holding a 60% market share. These tools are indispensable for proper and precise testing of hepatitis infections. They allow the multitude of test methodologies, used in elaborate laboratories and healthcare facilities, making them an integral part of a perfect diagnostic process for the attainment of up-to-date, sound results in patients and their healthcare providers.

Instruments are expected to generate the maximum compound annual growth rate (CAGR) of approximately 6.24% in the estimated period from 2024 to 2032. This growth is brought about due to the continuous enhancements in technology that enhance precision as well as speed in the testing of hepatitis. Together with the surging demand for reliable testing solutions, reagents, and instruments, both are expected to see maximum growth rates in the market, enhancing the capability for testing in healthcare settings. Such innovations will be in charge of the advanced step in early detection and treatment strategies for hepatitis infections.

Need Any Customization Research On Hepatitis Testing Market - Inquiry Now

Hepatitis Testing Market Regional Analysis

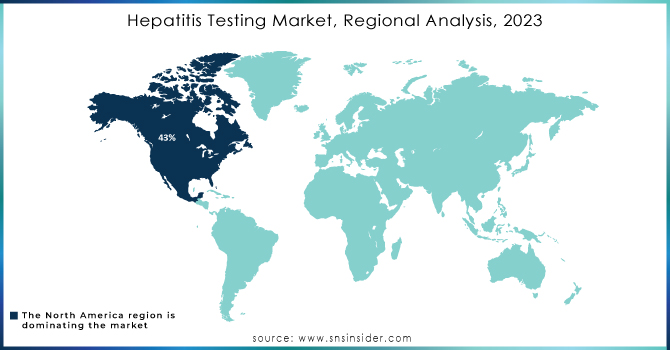

In 2023, North America would hold 43% of the hepatitis testing market owing to its very advanced healthcare system, adequate diagnostic technologies, and social awareness. The market will also be supported by government policies providing support for screening and treatment access. It is estimated that about 580,000 to 2.4 million individuals in the United States are living with HBV infection, thus giving an ever-rising demand for effective diagnostic solutions for hepatitis. These factors contribute to the region's dominance in the hepatitis testing market. Better infrastructure for health care further benefits this process.

Asia Pacific is estimated to continue registering the highest CAGR rate of about 6.40% during the forecast period of 2024 to 2032. The rise will be due to increasing awareness, improving healthcare infrastructure, and increased demand for advanced diagnostic solutions. Notably, 47% of hepatitis B-related deaths are reported in the WHO Western Pacific Region, meaning testing and treatment options in that region must be improved immediately. The factors will be the impetus toward marketing growth and an improvement in hepatitis care throughout the region.

LATEST NEWS-

-

F. Hoffmann-La Roche Ltd recently released two automated serology tests identifying the hepatitis E virus in November 2023. These newest advances focus on the diagnosis and treatment of the infection. Of course, another event revealed the high significance of the Elecsys Anti-HEV IgM and Elecsys Anti-HEV IgG immunoassays, as they are included in the World Health Organization's list of Essential Diagnostics.

-

At analytica 2024 in Munich, Analytik Jena will present three new products: the multi N/C x300 for TOC/TNb analysis, the qTOWER iris real-time PCR thermal cycler, and a fully automated sample preparation system for ICP-MS analysis.

KEY PLAYERS

-

Abbott Laboratories ( Architect Anti-HCV, Alinity HCV)

-

Analytik Jena (AdiSelect HCV, AdiSelect HCV Real-Time PCR Kit)

-

Autobio Diagnostics (HCV Antibody Test Kit, HEV Antibody Test Kit

-

Bio-Mérieux (VIDAS Anti-HCV, VIDAS HEV)

-

Danaher Corporation (Cepheid Xpert HCV, LumiraDx HCV Test)

-

DiaSorin (LIAISON HCV, LIAISON HCV)

-

Grifols SA (Procleix HCV Assay, Procleix HEV Assay)

-

Hologic Inc. (Aptima HCV Assay, Aptima HEV Assay)

-

MedMira Inc. (Reveal HCV Test, Reveal HEV Test)

-

Ortho-Clinical Diagnostics (Vitros Anti-HCV Test, Vitros HEV Test)

-

Qualpro Diagnostics (HCV Rapid Test, HEV Rapid Test)

-

Roche Molecular Diagnostics(Cobas HCV Test, Cobas HEV Test

-

Siemens Healthcare(ADVIA Centaur HCV , Dimension Vista HEV)

-

Sysmex Corporation(Sysmex HCV Test, Sysmex HCV Test)

-

Thermo Fisher Scientific( TaqMan HCV Test, HCV Viral Load Test)

-

PerkinElmer (HCV Viral Load Test, HEV Serology Test)

-

Qiagen (QIAstat-Dx Respiratory Panel, QIAamp Viral RNA Mini Kit)

-

Becton, Dickinson and Company (BD) (BD MAX HCV Test, BD Veritor System for HCV)

-

Myriad Genetics (Myriad RBM HCV Antibody Test, F. Hoffmann-La Roche LtD

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.53 Billion |

| Market Size by 2032 | USD 5.75 Billion |

| CAGR | CAGR of 5.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test (Blood Tests, Imaging Tests, Liver Biopsy) • By Technology (Enzyme-linked Immunosorbent Assay (ELISA), Rapid Diagnostic Test, Polymerase Chain Reaction (PCR), Isothermal Nucleic Acid Amplification Technology (INAAT), Others) • By End Use (Hospitals & Diagnostic Labs, Blood Banks, Others) • By Product (Instruments, Reagents & Kits) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Analytik Jena, Autobio Diagnostics, Bio-Mérieux, Danaher Corporation, DiaSorin, Grifols SA, Hologic Inc., MedMira Inc., Ortho-Clinical Diagnostics, Qualpro Diagnostics, Roche Molecular Diagnostics, Siemens Healthcare, Sysmex Corporation, Thermo Fisher Scientific, PerkinElmer |

| Key Drivers | • Advances in Hepatitis Testing Technologies Drive Market Growth with Improved Accuracy and Accessibility • Progress in Hepatitis Prevention and Screening Drives Market Growth and Access to Diagnostics |

| RESTRAINTS | • Barriers to Hepatitis Testing in Low-Income Regions Highlight Need for Affordable Solutions and Improved Infrastructure |