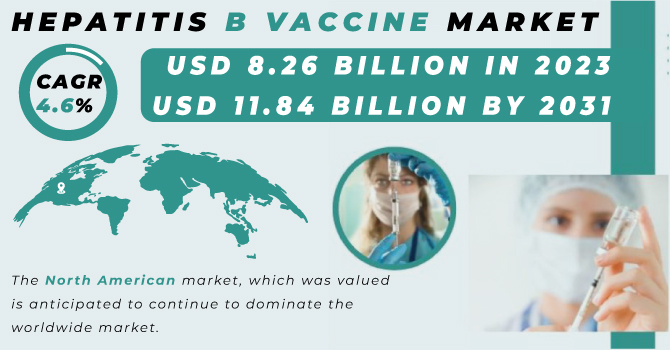

The Hepatitis B Vaccine market size was USD 8.27 billion in 2023 and is expected to reach USD 13.02 billion by 2032 and grow at a CAGR of 5.17% over the forecast period of 2024-2032. The report presents critical statistical insights and emerging trends shaping the industry. It covers healthcare facility loan distribution, highlighting how funding access influences vaccination programs and storage infrastructure across regions. The study includes technology adoption and equipment lifecycle data, detailing how modern cold chain systems impact vaccine efficacy and distribution efficiency. It further examines mergers and acquisitions in the medical financing sector, illustrating the strategic moves by companies to expand their market footprint. Additionally, it analyzes the rising demand for financing solutions, driven by increased government and private investments in immunization initiatives. The report also explores innovation and R&D by vaccine type in 2023, shedding light on advancements in recombinant DNA and combination vaccines. Collectively, these insights help stakeholders understand the financial, technological, and developmental dynamics influencing the Hepatitis B vaccine landscape.

Get More Information on Hepatitis B Vaccine Market - Request Sample Report

The United States held the largest market share in the hepatitis b vaccine market in 2023, primarily due to strong government-led immunization programs, advanced healthcare infrastructure, and a high level of public health awareness. With a market size of USD 2.43 billion in 2023 and projected growth to USD 3.93 billion by 2032 at a CAGR of 5.47%, the U.S. continues to lead due to its comprehensive vaccination coverage and stringent disease prevention policies enforced by agencies such as the CDC. The country's robust pharmaceutical industry, coupled with continuous investments in vaccine R&D and rapid adoption of next-generation recombinant and combination vaccines, further strengthens its market dominance. Additionally, a high prevalence of hepatitis B in certain high-risk populations and an aging demographic demanding increased immunization contribute to sustained demand across healthcare facilities nationwide.

Drivers

Rising global immunization initiatives and government vaccination programs propel the hepatitis b vaccine market growth.

The Hepatitis B Vaccine Market is experiencing significant growth due to extensive global immunization initiatives and aggressive national vaccination programs. Governments across both developed and developing countries are actively incorporating hepatitis B vaccination into their national immunization schedules, particularly for infants, healthcare workers, and high-risk populations. Organizations like WHO and UNICEF continue to support low- and middle-income countries with funding and vaccine procurement through alliances such as Gavi. For instance, the WHO’s Immunization Agenda 2030 aims to ensure equitable vaccine access worldwide, further boosting demand. Additionally, public health campaigns, increased awareness, and integration with maternal and child health programs have significantly improved vaccination coverage rates. These factors collectively enhance vaccine accessibility and uptake, leading to a robust and sustained expansion of the Hepatitis B Vaccine Market over the forecast period.

Restrain

High cost of advanced vaccines and cold chain logistics hampers the growth of the hepatitis b vaccine market.

Despite growing demand, the Hepatitis B Vaccine Market faces restraints primarily due to the high cost associated with advanced vaccine formulations and cold chain maintenance. Recombinant and combination hepatitis B vaccines, though more effective, are relatively expensive, which limits their affordability in low- and middle-income nations. Furthermore, the need for a reliable cold chain infrastructure from production to distribution adds to the overall logistics cost, especially in remote or underdeveloped regions with poor healthcare infrastructure. Breaks in cold storage can render vaccines ineffective, leading to wastage and increased operational costs. This creates financial challenges for governments and non-profit health organizations aiming to improve immunization rates. These economic and logistical burdens hinder universal access, thereby slowing down the full potential growth of the market, particularly in economically challenged regions across Africa and parts of Asia.

Opportunity

Development of innovative single-dose and combination vaccines presents lucrative opportunities in the hepatitis b vaccine market.

Emerging innovation in single-dose and combination vaccines is opening new avenues for growth in the Hepatitis B Vaccine Market. Manufacturers are increasingly investing in the development of vaccines that combine hepatitis B with other antigens (such as DTP or Hepatitis A), which not only reduce the number of required injections but also improve patient compliance and reduce costs. The introduction of thermostable and needle-free delivery systems further enhances the scope for widespread adoption, especially in remote areas with limited medical access. In 2023, several pharmaceutical companies advanced clinical trials for combination pediatric vaccines that could be game-changers in reducing immunization gaps. These innovations cater to the growing demand for simplified immunization schedules and can significantly enhance coverage rates in underserved regions, making them a vital opportunity for market players in the years ahead.

Challenge

Vaccine hesitancy and misinformation pose a significant challenge to the growth of the hepatitis b vaccine market.

One of the most pressing challenges facing the Hepatitis B Vaccine Market is vaccine hesitancy driven by misinformation and lack of awareness. Despite global scientific consensus on vaccine safety and efficacy, persistent myths and skepticism—especially circulating on social media—continue to deter sections of the population from receiving timely immunizations. This issue is particularly significant in high-income countries where individuals may delay or refuse vaccines due to personal beliefs or mistrust in pharmaceutical companies. Additionally, cultural stigma and low health literacy in certain regions contribute to the fear of side effects or doubt about vaccine necessity. The WHO has identified vaccine hesitancy as one of the top ten global health threats, underscoring its impact on public health initiatives. Overcoming this challenge requires coordinated education campaigns, healthcare professional training, and improved communication strategies to build public trust in vaccination.

By Type

Combination Vaccine held the largest market share around 61.23%, in 2023. It owing to their ability to provide treatment for multiple diseases with a single shot, leading to a markedly improved immunization efficiency and patient compliance. The use of these combined vaccines, including the hexavalent vaccine in particular, allows national immunization programs a simpler task and alleviates the logistic burden of giving multiple separate vaccines. Furthermore, combination vaccines save costs in the future by decreasing storage, distribution, and administration expenses, which is particularly important for government-funded programs and initiatives associated with organizations such as Gavi and WHO. In developed and in emerging countries their adoption has been especially high where there is a need to simplify vaccination schedules for infants and young children. Such advantages have led to their massive adoption and eventual monopoly over the market.

By End-User Industry

Hospital held the largest market share at around 47% in 2023. It is owing to the vital role of hospitals in administering vaccinations for Hepatitis B during birth and during postnatal care and regular medical services. Hospitals, as the first service contact point for newborns, routinely administer hepatitis B birth dose as part of national immunization programs especially in countries with very high birth rates and good institutional delivery coverage. Likewise, hospitals have the facilities and staff to store and administer vaccines and monitor for any post-vaccination adverse events--and must abide by safety protocols set by the government. Increased awareness about nosocomial infections and preventive health care, in addition to adults and healthcare workers now choosing to be vaccinated for hepatitis B during routine hospital visits or pre-employment screenings. This coupled with greater patient confidence for hospital-based care have cemented hospitals as the preferred center to the distribution and administration thereby capturing the leading market share.

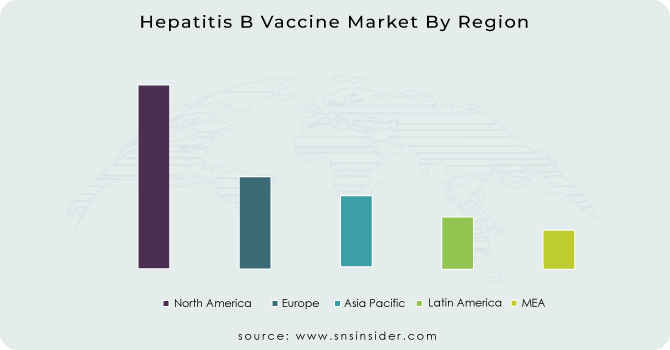

North America held the largest market share at around 37.74% in 2023. It is due to presence of established healthcare infrastructure, higher immunization awareness and presence of strong governmental led vaccination programs, the Hepatitis B Vaccine Market was acquired a major share in North America. In the U.S and Canada hepatitis B vaccination has been required for infants, health care workers, and high-risk individuals thus assuring a steady demand. Other reasons include strong funding support from public health agencies including the CDC and the Public Health Agency of Canada both of which are strong proponents of preventive vaccination vaccines to control the spread of disease. Also, the high per capita healthcare expenditure, presence of new vaccine technologies and collusion between major pharmaceutical companies facilitate wide availability and administration of hepatitis B vaccine. Additionally, increased political commitment to halt hepatitis B transmission and systematic adult immunization campaigns are further contributing to regional market leaders.

Asia Pacific held the significant market share. Its portfolio accounts for a larger population base and increasing birth rates and improved awareness regarding the need for immunization in emerging economies like China, India, and Southeast Asian countries. Mass vaccination campaign led by governments, especially within the national immunization programs has been a major resupplied on the demanded since the establishment of the demand. In countries such as China, vaccination against hepatitis B has been mandated for all newborns, and coverage has quickly become virtually complete. International health organizations, particularly WHO and Gavi, have been stepping up funding and technical assistance for the region. In addition to this, low-cost vaccine production centers, rising rural health reach, and a rapidly growing middle-class population supporting vaccine use trends are leading to peak vaccination rates in Asia Pacific and are translating as largest regional growth for the global hepatitis B vaccine market over the forecast period.

Get Customized Report as per Your Business Requirement - Request For Customized Report

GlaxoSmithKline (Engerix-B, Twinrix)

Gilead Science Inc. (Vemlidy, Viread)

Merck & Co., Inc. (Recombivax HB, Vaqta)

Shenzhen Kangtai Biological Products Co., Ltd. (HepBVac, KaiBiLi HepB)

Cyrus Poonawalla Group (Serum Institute of India Pvt.) (GeneVac-B, Hepavax-B)

Dynavax Technologies Corporation (HEPLISAV-B, SD-101)

Sanofi (Avaxim-HB, Shanvac-B)

VBI Vaccines Inc. (Sci-B-Vac, VBI-2601)

Meiji Group (KM Biologics) (Bimmugen, KM-B HepB)

LG Chem Ltd. (Euvax-B, HepB-12)

Indian Immunologicals Limited (Hepalert, Indivac-B)

Bharat Biotech (Revac-B, BioHep-B)

Zydus Lifesciences (Zyvac-B, Vax-B)

Panacea Biotec (EasyFour-HB, Enivac-HB)

Biological E. Limited (Bevac-B, ComBE Five)

Walvax Biotechnology (HepVax, WLV-B)

Sinovac Biotech (Healive, Sinovac-HepB)

Innovax Biotech (Innovax-HB, Reco-Hep)

Mitsubishi Tanabe Pharma (Tanabe-HepB, Entecavir Tanabe)

Crucell (Quinvaxem, HepB-Crucell)

In February 2024, Dynavax secured Marketing Authorization from the U.K.’s Medicines and Healthcare products Regulatory Agency (MHRA) for HEPLISAV B®, a two-dose hepatitis B vaccine for adults. This approval enables the active immunization of individuals aged 18 and above against hepatitis B virus infection.

In June 2023, VBI Vaccines strengthened its partnership with Brii Biosciences through expanded license and collaboration agreements valued at up to USD 437 million, along with potential royalty payments. The collaboration is focused on advancing both the prevention and treatment of hepatitis B.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD8.27 Billion |

| Market Size by 2032 | USD13.02 Billion |

| CAGR | CAGR of5.17 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single Antigen Vaccine, Combination Vaccine) • By End users (Hospital, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GlaxoSmithKline, Gilead Science Inc., Merck & Co., Inc., Shenzhen Kangtai Biological Products Co., Ltd., Cyrus Poonawalla Group (Serum Institute of India Pvt.), Dynavax Technologies Corporation, Sanofi, VBI Vaccines Inc., Meiji Group (KM Biologics), LG Chem Ltd., Indian Immunologicals Limited, Bharat Biotech, Zydus Lifesciences, Panacea Biotec, Biological E. Limited, Walvax Biotechnology, Sinovac Biotech, Innovax Biotech, Mitsubishi Tanabe Pharma, Crucell |

Ans: The Hepatitis B Vaccine Market was valued at USD 8.27 Billion in 2023.

Ans: The expected CAGR of the global Hepatitis B Vaccine Market during the forecast period is 5.17%

Ans: Combination Vaccine will grow rapidly in the Hepatitis B Vaccine Market from 2024 to 2032.

Ans: Rising global immunization initiatives and government vaccination programs propel the hepatitis b vaccine market growth.

Ans: North America led the Hepatitis B Vaccine Market in the region with the highest revenue share in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Healthcare Facility Loan Distribution

5.2 Technology Adoption & Equipment Lifecycle Data

5.3 Mergers & Acquisitions in Medical Financing Sector

5.4 Growth in Demand for Financing Solutions

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hepatitis B Vaccine Market Segmentation By Type

7.1 Chapter Overview

7.2 Single Antigen Vaccine

7.2.1 Single Antigen Vaccine Trends Analysis (2020-2032)

7.2.2 Single Antigen Vaccine Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Combination Vaccine

7.3.1 Combination Vaccine Market Trends Analysis (2020-2032)

7.3.2 Combination Vaccine Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Hepatitis B Vaccine Market Segmentation By End Use Industry

8.1 Chapter Overview

8.2 Hospital

8.2.1 Hospital Market Trends Analysis (2020-2032)

8.2.2 Hospital Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Clinics

8.3.1 Clinics Market Trends Analysis (2020-2032)

8.3.2 Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Hepatitis B Vaccine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Hepatitis B Vaccine Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Hepatitis B Vaccine Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 GlaxoSmithKline

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Gilead Science Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 Merck & Co., Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Biological Products Co., Ltd.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 Cyrus Poonawalla Group

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 Dynavax

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 Technologies Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Sanofi

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 VBI Vaccines Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 LG Chem Ltd.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Single Antigen Vaccine

Combination Vaccine

By End Use Industry

Hospital

Clinics

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Sleep Disorder Treatment Market was valued at $20.3 billion in 2023 and is expected to reach $40.0 billion by 2032 at a CAGR of 7.84% from 2024 to 2032.

The Smart Fertility Tracker Market was valued at USD 0.17 billion in 2023, and is expected to reach USD 0.42 billion by 2032, and grow at a CAGR of 10.59% over the forecast period 2024-2032.

The Healthcare CRM Market Size was valued at USD 16.84 billion in 2023 and is expected to reach USD 37.09 billion by 2032 and grow at a CAGR of 9.19%.

The Drug Eluting Stent Market size was estimated at USD 7.80 Billion in 2023 and is expected to reach USD 14.98 Billion by 2031 at a CAGR of 8.5% during the forecast period of 2024-2031.

Computational Biology Market was valued at USD 6.32 Billion in 2023, projected to reach USD 25.46 Billion by 2032, growing at a 16.80% CAGR from 2024-2032.

Steam Autoclaves Market Size was valued at USD 2.1 billion in 2023 and is expected to reach USD 4.46 billion by 2032, growing at a CAGR of 8.74% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone