Hematology Diagnostics Market Size Analysis

The Hematology Diagnostics Market Size was valued at USD 3.85 billion in 2023 and is expected to reach USD 6.86 billion by 2032 and grow at a CAGR of 6.64% over the forecast period 2024-2032. This report emphasizes the increasing rate of incidence and prevalence of hematological disorders, which is boosting the demand for sophisticated diagnostic solutions. The research analyzes changing regulatory trends and compliance needs, influencing market dynamics and product approvals. Moreover, it analyzes changes in hematology diagnostics technology, including automation, AI integration, and point-of-care testing, improving efficiency and accuracy. The report also analyzes healthcare expenditure on hematology diagnostics in various regions, such as government, commercial, private, and out-of-pocket spending, which affects market growth and accessibility.

To Get more information on Hematology Diagnostics Market - Request Free Sample Report

U.S. Hematology Diagnostics Market Trends

The U.S. Hematology Diagnostics Market Size was valued at USD 1.15 billion in 2023 and is expected to reach USD 1.83 billion by 2032 and grow at a CAGR of 5.31% over the forecast period 2024-2032. In the United States, elevated healthcare expenditure, sophisticated research efforts, and positive reimbursement policies are fueling market growth, with ongoing investments in new diagnostic technologies further enhancing its position as a global leader in the hematology diagnostics market.

Hematology Diagnostics Market Dynamics

Drivers

-

The rising prevalence of blood disorders such as anemia, leukemia, and hemophilia, increasing the demand for early and accurate diagnostic testing.

Based on the World Health Organization (WHO), anemia is prevalent among more than 1.92 billion individuals worldwide, and thus blood count tests are a standard diagnostic process. Moreover, hematology analyzers with AI-driven automated blood analyzers and flow cytometry systems are enhancing the accuracy and efficiency of diagnostics. The increasing number of aging populations is another significant factor, as older people are more prone to hematological disorders and thus need regular blood tests. Growing healthcare expenditure and government programs for preventive healthcare have contributed to the growth of diagnostic laboratories and point-of-care testing centers. The growing use of point-of-care hematology diagnostics, particularly in emergency and outpatient departments, is further driving market growth. In addition, partnerships among diagnostic firms and research organizations are driving innovation in hematology testing solutions, thereby improving disease management. The increasing demand for companion diagnostics and personalized medicine, especially for oncology-associated hematology tests, is also driving market growth. The greater usage of automated hematology analyzers by diagnostic laboratories and hospitals due to their efficiency in high test volumes supports market growth.

Restraints

-

The hematology diagnostics market faces restraints, primarily due to the high costs of advanced diagnostic instruments and maintenance requirements.

Automated hematology analyzers and flow cytometers are costly, restricting their implementation in low-resource healthcare facilities and small diagnostic laboratories. The complexity of obtaining regulatory approvals for hematology diagnostic equipment also presents challenges to manufacturers, extending the time required to bring products to market. Robust validation processes for new diagnostic technologies involve substantial investment and time, deterring market entry for small players. Another significant constraint is the lack of skilled laboratory personnel, which hinders the effective use of advanced hematology diagnostic equipment. This is especially so in rural and underserved regions, where trained personnel are not readily available. Reagent dependence and supply chain issues also present problems, as hematology testing is highly dependent on reagents, which can be subject to price volatility and shortages. In addition, the absence of reimbursement policies for some of the hematology diagnostic tests, particularly in developing economies, poses a challenge to accessing sophisticated diagnostic services by patients. Data security issues and interfacing difficulties with electronic medical records (EMRs) in sophisticated automated hematology systems also limit market growth.

Opportunities

-

The hematology diagnostics market presents significant opportunities, particularly in the development of next-generation hematology analyzers with AI and machine learning capabilities.

The convergence of big data analytics and digital pathology in hematology diagnosis provides better prediction and diagnosis of diseases, thus making precision medicine more viable. The emerging market of point-of-care testing (POCT) and portable hematology analyzers is a driving force for decentralized diagnostic solutions, particularly in rural and underdeveloped areas. The growing use of liquid biopsy in hematology diagnosis, especially for cancer identification, is broadening the market space. The hematology tests based on biomarkers are picking up momentum, paving the way for targeted treatment approaches in hematological malignancies. Strategic collaborations between pharmaceutical companies and diagnostic firms for the development of hematology-based companion diagnostics are fueling innovation. The emerging economies, specifically in Asia and Latin America, present attractive opportunities owing to developing healthcare infrastructure and rising investments in diagnostic services. Government-initiated screening programs for anemia, hemophilia, and leukemia are also driving the demand for hematology diagnostics further. Moreover, the transition towards telehematology and cloud-based diagnostic platforms is opening up new growth opportunities, enabling remote analysis and diagnosis through digitalized hematology imaging solutions.

Challenges

-

The hematology diagnostics market faces multiple challenges, including data standardization and interoperability issues in hematology analyzers across different healthcare systems.

The inconsistency in hematology testing parameters and methods across various diagnostic platforms causes test results to be inconsistent, which affects the accuracy of diagnosis. Moreover, contamination of the sample and pre-analytical errors in hematology diagnostics are always a concern and need to be checked with stringent quality controls. Regulatory inconsistency across geographies, with respective countries adopting different approval processes and compliance mechanisms, poses another major challenge for manufacturers who want to expand internationally. The heavy dependence on expert professionals for the interpretation of hematology tests is another challenge, as even computerized analyzers need human expertise to make complicated blood disorder diagnoses. Fake diagnostic products and inconsistent test kits in low-regulated markets are also market credibility and growth impediments. Furthermore, the growing threat of cybersecurity threats in computer-based hematology diagnostics is a concern about patient data privacy and security. Another significant challenge is the high expense of implementing automated hematology diagnostic systems across established laboratory infrastructures which render it challenging for mid-size and small healthcare providers to implement sophisticated hematology solutions. Solving these challenges through innovation, regulatory consistency, and workforce development will be essential to long-term market growth.

Hematology Diagnostics Market Segmentation Analysis

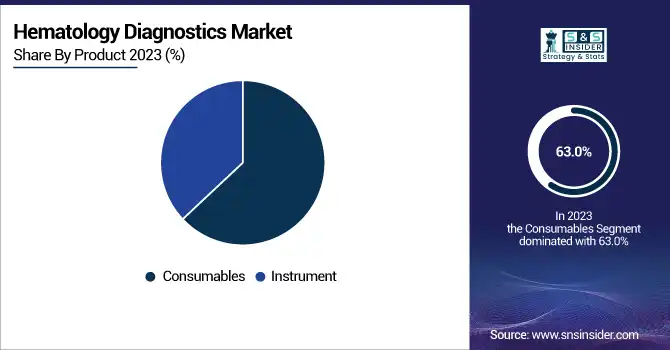

By Product

In 2023, the consumables segment held the largest share of the hematology diagnostics market at 63.0% due to the high and periodic demand for reagents, test kits, and other disposable elements utilized in diagnostic tests. The increasing number of hematology tests, as well as the requirement for precise diagnostic consumables, helped to propel its strong market presence.

The instruments segment is set to experience significant growth in the future driven by technological improvement in automated hematology analyzers, high demand for high-throughput diagnostics, and adoption of AI-based diagnostic technology. The move towards automation in laboratories and hospitals further fuels the growth of this segment.

By Test Type

The blood count segment accounted for the highest revenue share of 42.0% in 2023 due to the extensive application of Complete Blood Count (CBC) tests for the diagnosis of numerous hematological and systemic diseases. The rising incidence of anemia, infections, and blood disorders, along with regular health screening, made it the most dominant test type in the market.

Platelet function segment is expected to record the highest growth rate during the forecast period. This is because of the increase in incidence rates of bleeding disorders, thrombocytopenia, and cardiovascular conditions that require sophisticated platelet function tests. Furthermore, growing awareness and technological innovations in coagulation analyzers are driving the growth of this segment.

By End-Use

In 2023, the hospital segment contributed the highest revenue share of 37.0% due to the large patient flow, sophisticated laboratory facilities, and growing need for in-house hematology testing. The convenience of having full-fledged diagnostic services on hospital premises and the presence of specialist hematologists also contributed to its market dominance.

The diagnostic lab segment is likely to expand at the highest growth rate, driven by the rising hospital outsourcing of hematology testing, cost-effective testing options, and growth in independent diagnostic chains. The increased use of automated and high-throughput analyzers in laboratories and the increased demand for specialized hematology tests are driving the growth of the segment.

Hematology Diagnostics Market Regional Insights

North America led the hematology diagnostics market in 2023 with the highest revenue share of the region attributable to the presence of established healthcare infrastructure, high healthcare spending, and extensive use of sophisticated diagnostic technologies. The region is supported by a robust network of diagnostic laboratories and hospitals that are well-equipped with cutting-edge hematology analyzers. The rising incidence of blood diseases like leukemia, anemia, and thrombocytopenia, coupled with encouraging government programs promoting early detection of diseases, also supported the growth of the market. The U.S. region was especially responsible for the largest share of regional revenue due to high volumes of hematology tests and substantial research and development investments.

Asia-Pacific is estimated to be the highest-growing area in the market for hematology diagnostics, powered by an increasing population of older adults, heightened healthcare awareness, and speedy technology advances in diagnosis. The area is experiencing growing diagnostic laboratories and hospitals, most notably in up-and-coming economies like China and India, where demand for hematology testing is on the rise because there is a higher rate of anemia and other blood diseases. Moreover, the government programs supporting healthcare infrastructure development and diagnostic service access are fueling market growth. The Asia-Pacific region is likely to experience high growth in hematology diagnostic test volumes and serve as a critical growth driver during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Hematology Diagnostics Products

-

Abbott – Alinity h-series, CELL-DYN Series

-

Beckman Coulter, Inc. – DxH 900, DxH 520, DxH 690T

-

Sysmex Corporation – XN-Series, XP-Series, XN-L Series, SP-50

-

Horiba – Yumizen H500, Yumizen H550, Yumizen H1500/H2500

-

Bio-Rad Laboratories – Variant II, D-10 Hemoglobin Testing System

-

Siemens Healthineers AG – ADVIA 360, ADVIA 560/560 AL, ADVIA 2120i

-

F. Hoffmann-La Roche Ltd – Cobas m 511, Cobas Integra 400 Plus

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. – BC-6000 Series, BC-700 Series, CAL 8000

-

NIHON KOHDEN CORPORATION – MEK-9100, MEK-7300, MEK-6500K

-

EKF Diagnostics – Hemo Control, DiaSpect Tm

Recent Developments

In Sept 2024, Beckman Coulter and Scopio Labs expanded their long-term partnership with a global distribution agreement for Scopio’s Full-Field Bone Marrow Aspirate (FF-BMA) Application. The CE-marked X100/X100HT with FF-BMA enhances digital bone marrow imaging and analysis, advancing hematology diagnostics.

In Sept 2024, Zoetis Inc. introduced Vetscan OptiCell, the first cartridge-based, AI-powered hematology analyzer, designed for advanced Complete Blood Count (CBC) analysis. Launched in the U.S., the innovative analyzer enhances efficiency, reduces costs, and optimizes clinic workflow, improving veterinary patient outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.85 billion |

| Market Size by 2032 | USD 6.86 billion |

| CAGR | CAGR of 6.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Instrument (Analyzers, Flow cytometers, Others), Consumables (Reagent, Stains, Others)] • By Test Type [Blood count, Platelet function, Hemoglobin, Hematocrit] • By End-Use [Hospitals, Diagnostic labs, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, Beckman Coulter, Inc., Sysmex Corporation, Horiba, Bio-Rad Laboratories, Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., NIHON KOHDEN CORPORATION, EKF Diagnostics. |