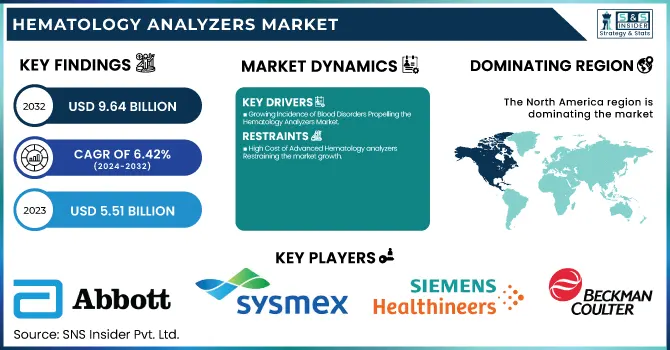

The Hematology Analyzers Market was valued at USD 5.51 billion in 2023 and is expected to reach USD 9.64 billion by 2032, growing at a CAGR of 6.42% from 2024-2032.

To Get more information on Hematology Analyzers Market - Request Free Sample Report

In this report, we conduct an in-depth analysis of the Hematology Analyzers Market with distinctive insights on the incidence and prevalence of hematological disorders, more particularly targeting diseases like anemia and blood cancers, that have a direct impact on hematology testing demand. We further examine regional trends in prescriptions, highlighting changes in diagnostic practices region-wise and automated hematology analyzers adoption. The device volume by geography underscores the growth in sales of hematology analyzers, particularly in North America, Europe, and Asia Pacific. We also discuss healthcare expenditure trends by geography, including government, commercial, private, and out-of-pocket expenditures, giving an overall insight into market trends.

Drivers

Growing Incidence of Blood Disorders Propelling the Hematology Analyzers Market

The growing incidence of blood disorders like anemia, leukemia, and other blood-related diseases is a major growth driver for the hematology analyzers market. Anemia, as reported by the World Health Organization (WHO), preys on about 24.8% of the world's population, with a high prevalence seen in low- and middle-income nations. The increasing incidence of blood diseases is fueling demand for precise diagnostic devices like hematology analyzers. The requirement for early detection, effective diagnosis, and treatment monitoring keeps driving the demand for sophisticated hematology analyzers in hospitals and diagnostic facilities. Such recent advancements as FDA clearance of Abbott's Alinity h-series hematology system further enhance this growth by providing more accurate and quicker diagnostic powers.

Hematology Analyzer Technological Upgrades accelerating the Market growth.

Continued advancements in hematology analyzers, including the incorporation of artificial intelligence (AI) and automation, are driving market growth. These technologies improve accuracy, speed, and efficiency in the diagnosis of blood disorders. For example, Siemens Healthineers introduced the Atellica HEMA 570 Analyzer in May 2023, which offers faster results with fewer workflow barriers. Also, the availability of next-gen analyzers that can conduct a range of tests like CBC and platelet counts enhances the clinical value of such devices. These technological advancements enhance diagnosis, but also minimize human error, thereby contributing to better patient outcomes. This has enhanced the attractiveness of hematology analyzers to healthcare institutions and laboratories around the world.

Restraint

High Cost of Advanced Hematology analyzers Restraining the market growth

The prohibitive cost of sophisticated hematology analyzers is a major limitation to market expansion, especially in low- and middle-income nations. Such analyzers, which are furnished with high-end technologies like automation and artificial intelligence, may be limited by their price tag to acquire, install, and maintain. Smaller hospitals and clinical centers with limited financial resources find it unaffordable to make the initial investment and cover the operational costs of such machinery. The average cost of high-end hematology analyzers can be anywhere from USD 10,000 to USD 150,000. This financial barrier hinders the universal adoption of sophisticated hematology analyzers, especially in areas with limited healthcare budgets.

Opportunities

The increasing demand for point-of-care (POC) hematology analyzers presents a significant opportunity for market growth.

As healthcare systems concentrate on providing quicker results, particularly in emergency and remote locations, demand for easy-to-use, portable analyzers has increased. The devices provide rapid diagnostic results, enhancing the care of patients and decreasing wait times. Based on recent developments, the usage of POC devices is poised to increase based on their potential to deliver results outside the standard laboratory environment. With healthcare practitioners looking to make their operations more efficient and to ease the load on centralized labs, POC hematology analyzers are picking up steam, offering plenty of room for growth and innovation. The growth of telemedicine and home healthcare services also fuels this demand further, with patients increasingly opting for in-home diagnostic equipment due to convenience and accessibility.

Challenges

The hematology analyzers market faces significant challenges related to regulatory compliance and approvals.

The hematology analyzers market is subject to major regulatory hurdles and approvals. Due to the complexity and accuracy involved in hematology testing, manufacturers have to comply with rigorous regulatory standards, including those provided by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Regulatory clearance is a time-consuming and expensive process, particularly for new product innovations and developments. Delays or issues in securing approval can slow down the product launch and market entry, and hence, it is a serious challenge for manufacturers. Compliance with ever-changing regulations also contributes to the operational complexity. The growing emphasis on patient confidentiality and data security also necessitates ongoing product revisions, complicating the regulatory environment for manufacturers and healthcare organizations.

By Product Type

The Reagents segment dominated the hematology analyzers market with a 48.23% market share in 2023 because of their pivotal role in conducting blood tests and their accuracy in delivering results. Reagents play a key part in the operation of diagnostic tests on hematology analyzers, such as complete blood count (CBC) tests, which are the most frequent ones conducted in clinical and laboratory environments. Their ongoing requirement for replenishment and the extensive application of hematology analyzers in hospitals and diagnostic centers played a major role in the dominance of this segment. In addition, the growing incidence of blood disorders, including anemia, leukemia, and hemophilia, has increased demand for reagents, which are an essential component of hematology diagnostic kits.

In addition, technological developments in reagent formulations, including the creation of more stable and accurate reagents, have also played a part in their market dominance. These developments enable enhanced accuracy, speed, and efficiency in blood tests, promoting their uptake in developed and emerging economies. As the emphasis on early and personalized diagnostics increases, demand for high-quality reagents also increases, further cementing their position in the hematology analyzers market. In addition, the strong reagent consumption rate, together with their relatively lower initial investment compared to instruments, has propelled the growth and continued dominance of the reagents segment.

By Price Range

The Mid-range Hematology Analyzers segment dominated the Hematology Analyzers Market with 46.25% market share in 2023 because they are affordable, versatile, and have the best features-per-dollar combination. They provide fundamental capabilities needed for every day diagnostics, including complete blood count (CBC), making them well-liked in hospitals, clinical laboratories, and other small healthcare institutions. Their affordability, coupled with consistent performance, enables healthcare professionals to perform necessary tests without the cost burden of high-end machines. In addition, mid-range hematology analyzers are simpler to maintain and give fast results, fulfilling the demands of healthcare professionals for efficient and cost-effective solutions. These, along with rising demand for diagnostic tests in developing economies, have established mid-range analyzers as the go-to for a broad spectrum of healthcare centers, particularly those with tight budgets.

The High-end Hematology Analyzers segment is expected to grow at the fastest rate with 8.70% CAGR during the forecast period due to the growing demand for sophisticated, high-accuracy diagnostic tools. These analyzers come with the latest technologies, which provide higher throughput, better accuracy, and the capacity to conduct more varied specialized tests such as uncommon blood disorders, cancer markers, and genetic studies. High-end hematology analyzers are finding wide acceptance among big hospitals, research centers, and high-volume laboratories where accurate, fast, and detailed results are of great importance. The high-end automation, integration with laboratory information systems (LIS), and ability to perform complex tests render high-end analyzers critical to contemporary healthcare use. The continuous shift towards personalized medicine, necessitating advanced diagnostics for improved patient care, is driving the need for these high-end devices.

By End-Use

The Hospitals segment dominated the hematology analyzers market in 2023 owing to the indispensable position that hospitals have in the provision of integral healthcare services, such as diagnostic testing. The largest buyers of hematology analyzers are normally hospitals because they provide various services, such as emergency, inpatient, and outpatient clinics. Hematology analysis, including complete blood counts (CBC), plays a critical role in the diagnosis of many diseases, including infections, anemia, and malignancies of the blood, and therefore forms a bedrock of day-to-day hospital diagnostics. High patient flow within hospitals and the necessity of getting quick and reliable results contribute to the need for hematology analyzers in these institutions. Also, hospitals enjoy better access to resources, allowing them to spend on better technology to enhance the efficiency of diagnostics and patient care. The existence of specialized units such as oncology, hematology, and internal medicine adds to the prevalence of the hospital segment in the market.

North America dominated the hematology analyzers market with 37.46% of the market share in 2023 on account of some major factors such as superior healthcare infrastructure, elevated healthcare spending, and strong regulatory environments. The U.S. specifically has a high concentration of diagnostic labs and hospitals that require leading-edge hematology analyzers. Moreover, the regulatory landscape in North America, especially the FDA's clearance procedures, offers an open and effective system for the development and distribution of these devices. This, coupled with robust investments in healthcare research and technology, has enabled the region to continue its dominance in the hematology analyzers market. Also, the growing rate of blood diseases and disorders like anemia and leukemia raises the demand for hematology tests in the region.

The Asia Pacific region is expected to exhibit the fastest growth with 8.36% CAGR throughout the forecast period because of the accelerating demand for healthcare services, enhanced healthcare infrastructure, and an increasing population. Economies such as China, India, and Japan are also seeing major leaps in diagnostic technology, leading to more use of hematology analyzers in hospitals as well as clinical laboratories. Further, rising awareness of healthcare issues, combined with increasing healthcare spending, is also driving the need for advanced and precise diagnostic tools. As healthcare facilities in developing economies such as China and India are modernizing at a fast pace, the demand for cost-efficient, effective hematology analyzers is increasing manifold. With increased chronic diseases and more emphasis on preventive care, Asia Pacific will witness high growth in the market in the next few years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Abbott Laboratories (Architect Hematology Analyzer, Cell-Dyn Ruby)

Sysmex Corporation (XS-500i Hematology Analyzer, XN-9000 Series)

Siemens Healthineers (ADVIA 2120i Hematology System, Atellica COAG 360)

Beckman Coulter, Inc. (DxH 800 Hematology Analyzer, UniCel DxC 600i Chemistry Analyzer)

Horiba Medical (Pentra 60C, Pentra 80X)

Mindray (BC-5300 Hematology Analyzer, BC-6800 Hematology Analyzer)

Vermed, Inc. (Hematology Analyzer 9800, HumaCount 500)

Diatron (A3 Hematology Analyzer, NEO Hematology Analyzer)

Dendreon Corporation (PROVENGE, Provenge Immunotherapy)

Roche Diagnostics (Cobas 6000, Cobas 8000)

Schiller AG (Cardiovit AT-102 G2, Hematology Analyser 601)

Tosoh Corporation (Hematology Analyzer G-900, G-600)

Bio-Rad Laboratories (Eidias Hematology Analyzer, BioPlex 2200)

Boule Diagnostics (Pentra 120, Penta 400)

Alifax (ALIFAX Hematology Analyzer, ALIFAX iM8)

STAGO (STA-R Evolution, STA Compact Max)

Labcorp (Cobas 8000, Cobra Analysis)

Becton Dickinson (BD FACSCalibur, BD Hematology Analyzer)

Wako Pure Chemical Industries (Wako Hematology Analyzer, Wako Instruments)

Cell-Dynamics (CELLAnalyzer 200, Hematology Analyzer H-4000)

In May 2024, HORIBA, Ltd. announced that it had obtained US FDA 510(k) clearance for its Yumizen H2500 high-throughput hematology analyzer. This clearance allows the company to provide a cutting-edge solution that improves the efficiency and accuracy of hematology testing in laboratories.

In August 2023, Abbott announced that it had obtained U.S. Food and Drug Administration (FDA) clearance for its next-generation Alinity h-series hematology system. The clearance allows laboratories throughout the United States to perform complete blood counts (CBC) as part of Abbott's Alinity family of diagnostic solutions, providing improved efficiency and accuracy in hematology testing.

In May 2023, Siemens Healthineers launched two new high-volume hematology analyzers, the Atellica HEMA 570 Analyzer and the Atellica HEMA 580 Analyzer. These innovative solutions are designed to eliminate workflow obstacles and deliver quicker results to patients. CBC tests, essential for diagnosing numerous conditions, are among the most commonly performed in laboratories, and these new analyzers will enable physicians to get accurate hematology information more quickly.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.51 Billion |

| Market Size by 2032 | US$ 9.64 Billion |

| CAGR | CAGR of 6.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Instruments, Reagents, Services) • By Price Range (Low-end Hematology Analyzers, Mid-range Hematology Analyzers, High-end Hematology Analyzers) • By End-Use (Hospitals, Clinical Laboratories, Research Institutes, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Sysmex Corporation, Siemens Healthineers, Beckman Coulter, Inc., Horiba Medical, Mindray, Vermed, Inc., Diatron, Dendreon Corporation, Roche Diagnostics, Schiller AG, Tosoh Corporation, Bio-Rad Laboratories, Boule Diagnostics, Alifax, STAGO, Labcorp, Becton Dickinson, Wako Pure Chemical Industries, Cell-Dynamics, and other players. |

Ans: The Hematology Analyzers Market is expected to grow at a CAGR of 6.42% during 2024-2032.

Ans: The Hematology Analyzers Market was USD 5.51 billion in 2023 and is expected to Reach USD 9.64 billion by 2032.

Ans: Hematology Analyzer Technological Upgrades accelerating the Market growth.

Ans: The “Mid-range Hematology Analyzers” segment dominated the Hematology Analyzers Market.

Ans: North America dominated the Hematology Analyzers Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023) by Region

5.3 Prescription Trends (2023), by Region

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hematology Analyzers Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Instruments

7.2.1 Instruments Market Trends Analysis (2020-2032)

7.2.2 Instruments Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Reagents

7.3.1 Reagents Market Trends Analysis (2020-2032)

7.3.2 Reagents Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Hematology Analyzers Market Segmentation, by Price Range

8.1 Chapter Overview

8.2 Low-end Hematology Analyzers

8.2.1 Low-end Hematology Analyzers Market Trends Analysis (2020-2032)

8.2.2 Low-end Hematology Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Mid-range Hematology Analyzers

8.3.1 Mid-range Hematology Analyzers Market Trends Analysis (2020-2032)

8.3.2 Mid-range Hematology Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 High-end Hematology Analyzers

8.4.1 High-end Hematology Analyzers Market Trends Analysis (2020-2032)

8.4.2 High-end Hematology Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Hematology Analyzers Market Segmentation, by End User

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Clinical Laboratories

9.3.1 Clinical Laboratories Market Trends Analysis (2020-2032)

9.3.2 Clinical Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Research Institutes

9.4.1 Research Institutes Market Trends Analysis (2020-2032)

9.4.2 Research Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Other

9.5.1 Other Market Trends Analysis (2020-2032)

9.5.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.4 North America Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.2.5 North America Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.6.2 USA Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.2.6.3 USA Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.2.7.3 Canada Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.2.8.3 Mexico Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.1.6.3 Poland Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.1.7.3 Romania Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.5 Western Europe Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.6.3 Germany Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.7.3 France Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.8.3 UK Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.9.3 Italy Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.10.3 Spain Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.13.3 Austria Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.5 Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.6.2 China Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.6.3 China Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.7.2 India Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.7.3 India Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.8.3 Japan Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.9.3 South Korea Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.10.3 Vietnam Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.11.3 Singapore Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.12.3 Australia Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.1.5 Middle East Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.1.6.3 UAE Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.2.5 Africa Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Hematology Analyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.4 Latin America Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.6.5 Latin America Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.6.6.3 Brazil Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.6.7.3 Argentina Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.6.8.3 Colombia Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Hematology Analyzers Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Hematology Analyzers Market Estimates and Forecasts, by Price Range (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Hematology Analyzers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Abbott Laboratories

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Sysmex Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Siemens Healthineers

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Beckman Coulter, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Horiba Medical

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Mindray

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Vermed, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Diatron

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Dendreon Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Roche Diagnostics

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product Type

Instruments

Reagents

Services

By Price Range

Low-end Hematology Analyzers

Mid-range Hematology Analyzers

High-end Hematology Analyzers

By End-Use

Hospitals

Clinical Laboratories

Research Institutes

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g., Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Wearable Medical Devices Market size was valued at USD 40.9 Billion in 2023 and is expected to reach USD 102.5 Billion by 2032 and grow at a CAGR of 11.3% over the forecast period 2024-2032.

The Medical Foam Market size was valued at USD 32.9 billion in 2023, and is expected to reach USD 54.18 billion by 2032, and grow at a CAGR of 5.7% over the forecast period 2024-2032.

The Healthcare Waste Management Market Size was valued at USD 34.08 Billion in 2023, and is expected to reach USD 68.03 Billion by 2032, and grow at a CAGR of 8.36% Over the Forecast Period of 2024-2032.

The High Throughput Screening Market Size was valued at USD 25.80 billion in 2023 and is witnessed to reach USD 69.46 Billion by 2032 and grow at a CAGR of 12.18% over the forecast period 2024-2032.

The Monoclonal Antibody Therapy Market size was valued at USD 87.8 Bn in 2023 and is expected to reach USD 230.38 Bn by 2031 with a growing CAGR of 12.8% Over the Forecast Period of 2024-2031.

The Echocardiography Market was estimated at US$ 2.01 billion in 2023 and is expected to reach US$ 3.54 billion by 2031 and is anticipated to increase at a CAGR of 7.21% predicted for the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone