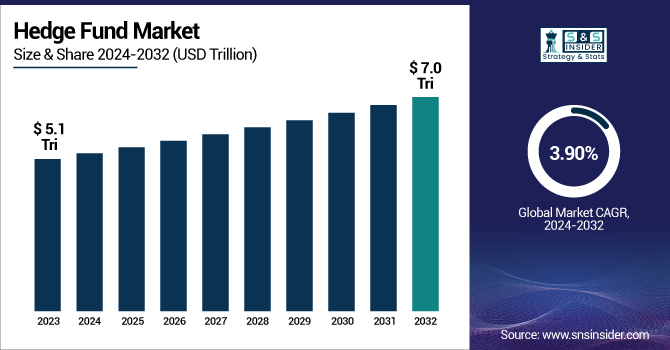

The Hedge Fund Market was valued at USD 5.1 trillion in 2024 and is expected to reach USD 7.0 trillion by 2032, growing at a CAGR of 3.90% from 2025-2032.

To Get more information on Hedge Fund Market - Request Free Sample Report

Strong Growth is observed in the Hedge Fund Market, with increasing demand for alternative investments, portfolio diversification, and new trading strategies. Hedge funds are becoming increasingly popular among institutional and high-net-worth investors looking to use them as tools to gain stable returns, but with much lower correlation with traditional asset classes due to the increased volatility and uncertainty recently witnessed in global financial markets. With the use of AI, machine learning, and big data analytics, decision-making, risk management, and execution in hedge fund strategies are being made even more efficient. Moreover, the market is anticipated to grow due to the liberalization of investment norms in emerging markets and increasing participation from sovereign wealth funds and pension funds.

In 2024, according to a report, 60% of global institutional investors have allocated part of their portfolios to hedge funds, reflecting strong institutional trust in this asset class

In 2024, the U.S. hedge fund market is valued at approximately USD 0.7 trillion and is projected to grow to USD 1.0 trillion by 2032, reflecting a CAGR of 3.78% during the forecast period. This growth is driven by increased institutional participation, advancements in AI-driven trading strategies, and a heightened demand for alternative investments amid market volatility. The market is expected to continue expanding steadily through 2032, supported by ongoing innovation, regulatory evolution, and a growing appetite for diversified investment approaches.

Driver

Increasing institutional investments are fueling demand for hedge funds due to diversification and higher return prospects.

Hedge funds are gaining traction among institutional investors as an attractive source of alpha generation and portfolio diversification, with pension funds, endowments, and sovereign wealth funds continuing to deploy capital to hedge funds in 2024. Hedge funds are seen as a strategic path to decrease risks while generating performance as traditional markets enter a new era of volatility and lower returns. To this effect, more than 64% of global institutional investors held allocations to hedge funds in 2024, a vote of confidence if there ever was one. That new institutional capital expands the market, and it also encourages the development of new hedge fund strategies, including the application of machine learning and alternative data to make investment decisions.

In 2024, Beacon Platform Inc. indicates that 93% of institutional investors expect hedge fund fundraising to rise by at least 10% over the next three years, with 14% anticipating growth exceeding 20%.

Restraint

Regulatory complexities and compliance burdens are limiting hedge fund flexibility and profitability.

Despite their growth, hedge funds operate in a complex and evolving regulatory landscape that varies across jurisdictions. Increased scrutiny from financial watchdogs like the SEC and ESMA, aimed at enhancing transparency and reducing systemic risk, has led to higher compliance costs. These regulatory pressures can limit the entry of new firms, restrict risk-taking strategies, and lead to operational inefficiencies. Additionally, proposed reforms targeting fee structures and reporting obligations can reduce profit margins. As global regulations evolve, hedge fund managers must constantly adapt, diverting resources toward legal counsel and compliance infrastructure instead of focusing on investment innovation.

Opportunity

Technological advancements like AI and quantitative strategies are enhancing hedge fund performance and scalability.

The integration of AI, machine learning, and big data analytics is reshaping the hedge fund landscape, offering managers advanced tools for predictive modeling, trade execution, and risk management. Firms leveraging algorithmic trading, natural language processing, and real-time sentiment analysis gain a competitive edge in market forecasting. As these technologies become more accessible and cost-effective, even smaller hedge funds can deploy sophisticated quantitative strategies that were once exclusive to large institutions. This digital transformation presents vast opportunities to enhance returns, lower operational costs, and attract tech-savvy investors, further expanding the appeal and capabilities of modern hedge funds.

Challenge

Talent shortages and operational complexities are hindering hedge fund efficiency and sustainable growth.

Running a hedge fund demands a unique combination of quantitative expertise, financial acumen, and technological proficiency. However, the market is currently facing a shortage of skilled professionals capable of navigating complex algorithmic systems and regulatory nuances. Additionally, high turnover rates among fund managers and analysts disrupt continuity and affect long-term strategy execution. Operational complexity—ranging from real-time data processing to risk management systems and compliance tracking—adds to the burden. Smaller funds, in particular, struggle to scale due to limited resources. Addressing this talent gap while managing intricate operations remains a persistent challenge in sustaining growth and competitiveness.

By Type

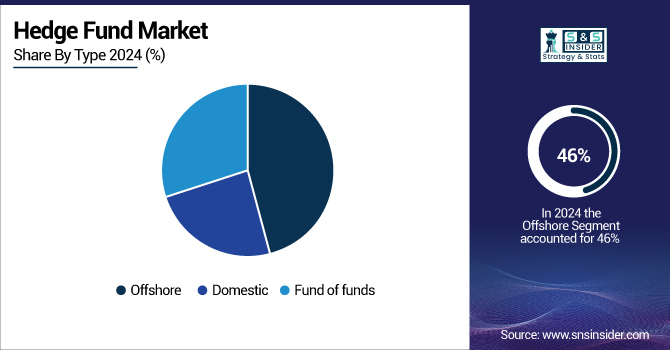

In 2024, the offshore hedge fund segment dominated the market and accounted for 46% of revenue share, due to tax efficiency, access to global investors, and regulatory advantages. The appeal of jurisdictions with favorable tax policies, such as the Cayman Islands and Luxembourg, makes them attractive for hedge fund managers seeking to minimize operational costs. The increasing demand from global investors for diversified portfolios further boosts the growth of offshore funds.

For Instance, In 2024, Hong Kong proposed tax exemptions on gains from cryptocurrencies, private credit investments, and other assets for hedge funds and investment vehicles of the super-rich. This initiative aims to establish Hong Kong as a leading offshore finance hub, competing with Singapore and Luxembourg.

The fund of funds segment is expected to witness the fastest CAGR due to its diversified nature, offering lower risk by investing in multiple hedge funds. Investors increasingly prefer these vehicles for enhanced portfolio diversification, which helps mitigate the risks associated with investing in a single fund. As institutional and high-net-worth individuals look for more balanced risk profiles, the fund of funds segment is likely to see significant growth.

By Strategy

The long/short segment dominated the market in 2024 and accounted for a significant revenue share, delivering irrespective of market direction. This approach combines long positions in undervalued stocks with short positions in overvalued stocks and provides asymmetric upside and downside risk. This has secured its position as the most stable resource as it winds up appealing to institutional investors chasing after risk-adjusted returns.

The macro strategy is projected to grow at the fastest CAGR during the forecast period as it focuses on exploiting the opportunities from large-scale economic and geopolitical events. Macro-focused hedge funds that follow this strategy capitalize on broad-based moves in the yield curve, currencies, and commodity markets while establishing a macroeconomic bias. As uncertainty in the global economy rises, so will the need for flexible, adaptable investment strategies in global macro.

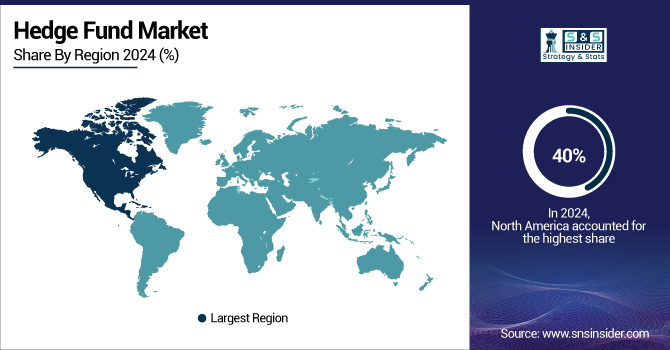

North America dominated the hedge fund market in 2024 and accounted for 40% revenue share, owing to multiple strategic advantages. Along with this, there is a large institutional investor base in the region, including pension funds, endowments, and sovereign wealth funds that provide steady demand for hedge fund investment. An enabling environment helps innovate, manage risk, and permits complex and diversified investment strategies. Some of the globe's biggest hedge fund managers in quantitative, macroeconomic, and long/short equity call the U.S. home.

In April 2025, Elliott Management increased its stake in BP to over 5%, becoming its second-largest shareholder. The hedge fund is pushing BP to boost free cash flow by cutting spending and scaling back renewable investments, aiming to improve shareholder returns.

The Asia-Pacific region is expected to register the fastest CAGR during the forecast period, driven by strong performance and strategic innovation. In 2024, hedge funds across the region delivered their best returns in over a decade, with the HFRI Asia with Japan Index climbing 12.1%. Increased volatility, rising AI-related investment opportunities, and targeted exposure to China's recovering economy. Funds like Keywise Capital gained 51% by tapping into Gen Z consumption trends and AI, while First Beijing rose 42% through smart plays on tech and logistics firms benefiting from Chinese government stimulus. With an average return of 14.1% for fundamental long-short strategies, Asia-Pacific hedge funds outperformed their counterparts in the U.S. and Europe, signaling sustained investor confidence and growth momentum.

In 2024, Asian hedge funds saw a strong rebound with double-digit gains, driven by China’s market recovery and Japan’s tech-fueled equity rally. AI and Gen Z consumption trends played a key role in boosting performance.

India is the fastest-growing hedge fund market in the Asia-Pacific region. After surpassing China as the world’s most populous nation in 2023, India is set to grow by 6.3% in 2025, contributing 15% to global economic growth, a figure expected to rise to 18% over the next five years, according to the IMF. Favorable government policies, economic transparency, and a booming stock market have drawn interest from global financial giants such as JP Morgan, Goldman Sachs, and Morgan Stanley. The National Stock Exchange’s rapid rise positions India as a dynamic and increasingly influential hub for hedge fund investments

Europe holds a substantial share in the global hedge fund market, anchored by the United Kingdom, which serves as a leading hub due to London’s deep financial expertise, advanced infrastructure, and favorable regulatory environment. Switzerland enhances the region’s strength with its global reputation in private wealth management and hedge fund services, while Luxembourg has become a preferred jurisdiction for fund domiciliation thanks to its investor-friendly policies. The growing integration of Environmental, Social, and Governance factors into investment strategies is fueling demand, particularly among institutional investors across Germany, France, and the Nordic countries.

The United Kingdom, with London at its core, stands out as a leading global hub for hedge funds. The city’s advanced financial infrastructure, supportive regulatory environment, and access to top-tier investment talent drive its prominence. Major hedge funds operate significant offices there, drawing international capital. London's strategic position also enhances its global investment reach.

For Instance, In January 2025, London remained the top global hub for hedge funds, hosting over half of the international investing talent for major U.S. multimanagers. Despite rising hubs like Dubai and Singapore, London’s scale and infrastructure keep it dominant.

Get Customized Report as per Your Business Requirement - Enquiry Now

The major Hedge Fund Companies are Bridgewater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliott Investment Management, Citadel LLC, BlackRock, DE Shaw & Co., Baupost Group, Pershing Square Capital, and others in report

In April 2025, Elliott Management increased its stake in BP to over 5%, becoming the company's second-largest investor. The activist hedge fund is pressuring BP to implement deeper spending cuts, aiming to boost annual free cash flow by 40% to USD 20 billion by 2027. Elliott also advocates for BP to divest its renewable energy ventures, emphasizing a focus on core oil and gas operations.

In June 2024, Bill Ackman's Pershing Square Capital announced plans to raise USD 25 billion for a new closed-end fund, Pershing Square USA Ltd., targeting U.S. retail investors. The fund aims to list on the New York Stock Exchange, significantly increasing the firm's fee-paying assets and revenue ahead of a potential IPO.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.1 Trillion |

| Market Size by 2032 | US$ 7.0 Trillion |

| CAGR | CAGR of 3.90 % From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Offshore, Domestic, Fund of funds) • By Strategy (Long/short equity, Global macro, Event driven, Multi strategy, Long/short credit, Managed futures/CTA, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bridgewater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliott Investment Management, Citadel LLC, BlackRock, DE Shaw & Co., Baupost Group, Pershing Square Capital, Viking Global Investors, Point72 Asset Management, Third Point LLC and others in report |

Ans - The Hedge Fund Market was valued at USD 5.1 trillion in 2024 and is expected to reach USD 7.0 trillion by 2032.

Ans- The CAGR of the Hedge Fund Market during the forecast period is 3.90% from 2025-2032.

Ans- Asia-Pacific is expected to register the fastest CAGR during the forecast period.

Ans Increasing institutional investments are fueling demand for hedge funds due to diversification and higher return prospects.

Ans- Talent shortages and operational complexities are hindering hedge fund efficiency and sustainable growth.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Global Hedge Fund Asset Under Management (AUM), by Region (2020–2024)

5.2 Hedge Fund Strategy Allocation Breakdown (2024)

5.3 Institutional vs. Retail Investor Participation in Hedge Funds (2019–2024)

5.4 Hedge Fund Performance Benchmark (Average Net Returns), by Strategy (2020–2024)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hedge Fund Market Segmentation, by Type

7.1 Chapter Overview

7.2 Offshore

7.2.1 Offshore Market Trends Analysis (2020-2032)

7.2.2 Offshore Market Size Estimates and Forecasts to 2032 (USD Trillion)

7.3 Domestic

7.3.1 Domestic Market Trends Analysis (2020-2032)

7.3.2 Domestic Market Size Estimates and Forecasts to 2032 (USD Trillion)

7.4 Fund of funds

7.4.1 Fund of funds and Above Market Trends Analysis (2020-2032)

7.4.2 Fund of funds and Above Market Size Estimates and Forecasts to 2032 (USD Trillion)

8. Hedge Fund Market Segmentation, by Strategy

8.1 Chapter Overview

8.2 Long/short equity

8.2.1 Long/short equity Market Trends Analysis (2020-2032)

8.2.2 Long/short equity Market Size Estimates and Forecasts to 2032 (USD Trillion)

8.3 Global Macro

8.3.1Global Macro Market Trends Analysis (2020-2032)

8.3.2 Global Macro Market Size Estimates and Forecasts to 2032 (USD Trillion)

8.4 Event driven

8.4.1Event driven Market Trends Analysis (2020-2032)

8.4.2 Event driven Market Size Estimates and Forecasts to 2032 (USD Trillion)

8.5 Multi strategy

8.5.1Multi strategy Market Trends Analysis (2020-2032)

8.5.2 Multi strategy Market Size Estimates and Forecasts to 2032 (USD Trillion)

8.5 Long/short credit

8.5.1Long/short credit Market Trends Analysis (2020-2032)

8.5.2 Long/short credit Market Size Estimates and Forecasts to 2032 (USD Trillion)

8.5 Managed futures/CTA

8.5.1Managed futures/CTA Market Trends Analysis (2020-2032)

8.5.2 Managed futures/CTA Market Size Estimates and Forecasts to 2032 (USD Trillion)

8.5 Others

8.5.1Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Trillion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Hedge Fund Market Estimates and Forecasts, by Country (2020-2032) (USD Trillion)

9.2.3 North America Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.2.4 North America Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.2.5 USA

9.2.5.1 USA Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.2.5.2 USA Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.2.6 Canada

9.2.6.1 Canada Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.2.6.2 Canada Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.2.7 Mexico

9.2.7.1 Mexico Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.2.7.2 Mexico Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3 Europe

9.3.1 Trends Analysis

9.3.2 Europe Hedge Fund Market Estimates and Forecasts, by Country (2020-2032) (USD Trillion)

9.3.3 Europe Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.4 Europe Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.5 Germany

9.3.5.1 Germany Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.5.2 Germany Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.6 France

9.3.6.1 France Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.6.2 France Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.7 UK

9.3.7.1 UK Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.7.2 UK Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.8 Italy

9.3.8.1 Italy Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.8.2 Italy Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.9 Spain

9.3.9.1 Spain Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.9.2 Spain Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.10 Poland

9.3.10.1 Poland Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.10.2 Poland Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.11 Turkey

9.3.11.1 France Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.11.2 France Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.3.12 Rest of Europe

9.3.12.1 UK Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.3.12.2 UK Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Hedge Fund Market Estimates and Forecasts, by Country (2020-2032) (USD Trillion)

9.4.3 Asia-Pacific Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.4 Asia-Pacific Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.5 China

9.4.5.1 China Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.5.2 China Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.6 India

9.4.5.1 India Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.5.2 India Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.5 Japan

9.4.5.1 Japan Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.5.2 Japan Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.6 South Korea

9.4.6.1 South Korea Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.6.2 South Korea Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.7 Singapore

9.4.7.1 Singapore Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.7.2 Singapore Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.8 Australia

9.4.8.1 Australia Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.8.2 Australia Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.9 Taiwan

9.4.9.1 Taiwan Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.9.2 Taiwan Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.4.10.2 Rest of Asia-Pacific Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.5 Middle East and Africa

9.5.1 Trends Analysis

9.5.2 Middle East Hedge Fund Market Estimates and Forecasts, by Country (2020-2032) (USD Trillion)

9.5.3 Middle East Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.5.4 Middle East Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.5.5 UAE

9.5.5.1 UAE Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.5.5.2 UAE Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.5.6 Saudi Arabia

9.5.6.1 Saudi Arabia Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.5.6.2 Saudi Arabia Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.5.7 Qatar

9.5.7.1 Qatar Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.5.7.2 Qatar Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.5.8 South Africa

9.5.8.1 South Africa Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.5.8.2 South Africa Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.5.9 Rest of Middle East

9.5.9.1 Rest of Middle East Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.5.9.2 Rest of Middle East Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Hedge Fund Market Estimates and Forecasts, by Country (2020-2032) (USD Trillion)

9.6.3 Latin America Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.6.4 Latin America Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.6.5 Brazil

9.6.5.1 Brazil Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.6.5.2 Brazil Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.6.6 Argentina

9.6.6.1 Argentina Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.6.6.2 Argentina Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Hedge Fund Market Estimates and Forecasts, by Type (2020-2032) (USD Trillion)

9.6.8.2 Rest of Latin America Hedge Fund Market Estimates and Forecasts, by Strategy (2020-2032) (USD Trillion)

10. Company Profiles

10.1 Bridgewater Associates

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Renaissance Technologies

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Man Group

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 AQR Capital Management

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Two Sigma Investments

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Millennium Management

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Elliott Investment Management

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 MTI Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Citadel LLC

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 BlackRock

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Offshore

Domestic

Fund of funds

By Strategy

Long/short equity

Global macro

Event driven

Multi strategy

Long/short credit

Managed futures/CTA

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Time and Attendance Software Market was valued at USD 3.1 Billion in 2023 and is expected to reach USD 8.9 Billion by 2032, growing at a CAGR of 12.29% from 2024-2032.

The Geospatial Solutions Market was valued at USD 410.1 Billion in 2023 and will reach USD 1434.6 Billion by 2032, growing at a CAGR of 14.94% by 2032.

The Learning Management System (LMS) Market Size was valued at USD 20.9 Bn in 2023 and will reach USD 95.4 Bn by 2032, growing at a CAGR of 18.4% by 2032.

The Online Banking Market Size was valued at USD 4.4 billion in 2023 and is expected to reach USD 6.0 billion by 2032 and grow at a CAGR of 3.6% by 2024-2032.

The Lottery Market was valued at USD 337.0 Billion in 2023 and is expected to reach USD 560.6 Billion by 2032, growing at a CAGR of 5.84% by 2032.

The Concierge Services Market size was valued at USD 856.4 Million in 2023 and is expected to reach USD 1548.1 Million by 2032 and grow at a CAGR of 6.8% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone