Get More Information on Heat Resistant Coatings Market - Request Sample Report

The heat-resistant coatings market size was valued at USD 6.80 billion in 2023 and is expected to reach USD 10.60 billion by 2032 and grow at a CAGR of 5.06% over the forecast period 2024-2032. The heat-resistant coatings market report provides key statistical insights and trends on production capacity and utilization rates by country, highlighting leading manufacturing hubs and coating types. It analyzes raw material price fluctuations and supply chain disruptions affecting regional markets. The report examines regulatory compliance and environmental impact, focusing on VOC regulations and fire safety standards. Sustainability trends, including eco-friendly formulations and waste management practices, are explored. It delves into R&D investments and technological advancements, such as nano-coatings and high-temperature polymers. Additionally, the report assesses market adoption across industries, identifying key growth sectors like oil & gas, power generation, and metallurgy.

Drivers

Growing applications in heat-resistant coatings within the equipment of defense.

Heat-resistant coatings are more widely utilized for defense equipment due to their increase in applications for enhanced performance solutions under extreme operational conditions. Military vehicles, aircraft, naval vessels, and avionics systems undergo extreme temperature exposure, wear due to friction, and severe weather conditions that necessitate specialized coatings to maximize durability and performance. These coatings offer thermal stability, corrosion resistance, and fire protection artifacts to ensure essential components such as engine parts and exhaust systems or missile casings components during their life cycle. Rising Defence Budgets and Modernisation Programmes in countries such as the US, China, and India will push them to invest in heat-resistant coating to enhance the reliability and efficiency of their defense equipment. In addition, the defense sector is also opting for lightweight and better heat-dissipating coating formulations, such as nanotechnology-based and ceramic-based formulations, over solvent-based and water-based formulations.

Restraint

Stricter Regulations on VOC emissions may hamper the market growth.

High volatile organic compound (VOC) content in traditional coatings will hamper demand growth in the heat-resistant coatings market, as stricter indirect regulation over VOC emission will impede the growth of the coatings market in a contemporary environment. Due to regulations enacted by the U.S. (EPA regulations), Europe (REACH directives), and China environmental protection agencies, governments are enforcing extremely low VOC content limits to industrial coatings. This has pushed manufacturers to spend on reformulating, moving towards water-based, low VOC, or bio-based coatings, which typically are higher cost and have a performance trade-off. Furthermore, adherence to these ongoing regulations could result in delays in product approval and market visits for some coatings, particularly in sectors such as automotive, aerospace, and heavy machinery where high-temperature resistance is necessary. Although regulations intend to limit the environmental impact, they present financial and technical hurdles for coating manufacturers that might hinder the growth of those markets in the short run.

Opportunities

High investments and sustainability force growth in heat-resistant coatings creating the opportunity for the market.

There are growth opportunities in the heat-resistant coatings market as industries focus on efficient energy consumption, durability, and meeting environmental standards, along with high investments and sustainability initiatives. The coating industry is designing low-VOC, water-based, and bio-based coatings from advanced R&D work in the government and private sector to meet global sustainability goals. Increasing emphasis on green building certifications, lower carbon footprint, and circular economy is fuelling the demand for environment-friendly heat-resistant coatings in the construction, automotive, and aerospace industries. Moreover, there is a growing market for high-performance coatings for industries including power generation, oil & gas, and metallurgy for prolonging equipment lifecycle and minimizing maintenance expenditure. With the increasing applicability of nanotechnology and ceramic-based coatings due to their better heat resistance properties and less environmental pollution, companies undertaking sustainable innovations will be able to take advantage of emerging market opportunities and ever-changing regulatory requirements.

Challenges

Fluctuations in energy prices and raw materials are major challenges for heat resistant coatings and may challenge the market growth.

There are growth opportunities in the heat-resistant coatings market as industries focus on efficient energy consumption, durability and meeting environmental standards, along with high investments and sustainability initiatives. The coating industry is designing low-VOC, water-based, and bio-based coatings from advanced R&D work in the government and private sector to meet global sustainability goals. Increasing emphasis of green building certifications, lower carbon footprint, and circular economy is fuelling the demand for environment-friendly heat-resistant coatings in the construction, automotive, and aerospace industries. Moreover, there is a growing market for high-performance coatings for industries including power generation, oil & gas and metallurgy for prolonging equipment lifecycle and minimizing maintenance expenditure. With the increasing applicability of nanotechnology and ceramic-based coatings due to their better heat resistance properties and less environmental pollution, the companies undertaking sustainable innovations will be able to take advantage of emerging market opportunities and ever-changing regulatory requirements.

By Resin Type

The Epoxy resin type accounted for the highest revenue share of around 37% in 2023, in Heat Resistant Coatings market, as per the latest heat-resistant coatings market report. One such machine that makes extensive use of epoxy coating is, which have their unique place in heat resistant coating market. Epoxy coatings are very popular owing to their feature of impact and abrasion resistance. The term epoxy coatings means that it is an organic polymer from the reaction of an epoxide resin with a polyamine. They are also thermosets, meaning that once cured they cannot be melted and reshaped like one would with a vinyl or plastic. An applied thermal point of excess heat will break-down the chemical-bonds in a thermoset that will result in degradation, discoloration, ductility loss, and/or a brittle state. As we all know, epoxy resins have solar radiation degradation and chalking in sunlight. Such properties are expected to boost the epoxy coatings segment and hence, propelling the market through the forecast period.

By Technology

Liquid-based heat resistant coatings held the largest market share around 65% in 2023. It is due to its versatility which provides an ease of application over the different types of substrates. The benefits that a liquid-based type of coatings include good adhesion, flexibility, and the ability to cover a variety of complex shapes and surfaces relatively easy. This is why these coatings are utilized in the greater part of the businesses related with warmth protection for example, auto and aeronautics ventures and assembling modern gear. They provide extreme thermal insulation and corrosion protection properties that elevate strict performance criteria. In addition, advances in formulation technologies have aided the extension of their heat-resistance potential, resulting in sustained demand across a range of key applications where durability and reliability are essential.

By End-Use

The automotive and transportation segment accounted for the largest market share of approximately 35% in 2023 and is expected to grow exponentially in the forecast period. This is a result of increasing demand for high-performance coatings, which is exhibiting as high temperature and environmental resistance that is generally needed in the automotive and aerospace industries. Which isn't just to protect against high temperatures (that's a given), but also to save fuel and reduce pernicious emissions from the engine, exhaust system, and other ancillary components. All these factors contribute and facilitate growth in the heat-resistant coatings market.

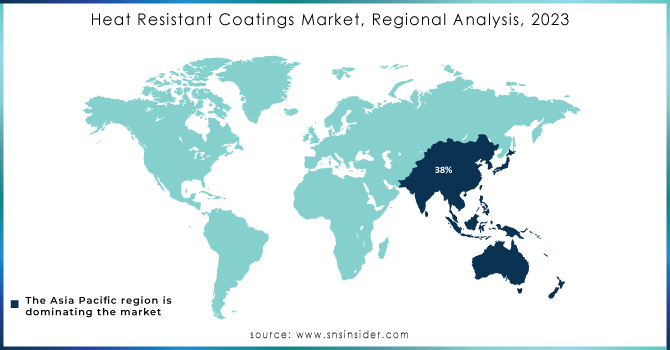

Asia Pacific led the heat-resistant coating in revenue share at 38% owing to the enormous and rising population, and therefore fantastic demand throughout all types of products and services including automotive and construction and several other industrial goods. Since there is always a requirement for high-performance coating types capable of enduring high temperatures and rigorous environments, the regional segment will witness evergreen demand for heat resistant coatings that are applied in a variety of industrial applications. In addition, positive trends regarding industrial development and construction activities like China and India is also expected to drive the growth of heat-resistant coatings market over the forecast period. Given the growing solicitations from the automotive sector, the solicitation for heat-safe coatings may get a lift as the automobile division will request something similar for coatings on their engine parts, exhausts, and parts that are presented to elevated temperatures. Coatings World referred to the coming summer months to have temperatures virtually close to 50°C, that will make cooling out of the question in South and Southeast Asia in April 2024. AkzoNobel has had the Keep Cool Technology, previously named Sun Reflect technology, in its Dulux Weathershield paints and basecoats since 2010, to help keep the interior cooler.

Need any customization research on Heat-Resistant Coating Market - Enquiry Now

Tikkurila OYJ (Temalac ML 90, Fontecryl SC 50)

AkzoNobel N.V. (Intertherm 50, Intertherm 228HS)

Sherwin Williams Company (Heat-Flex 650, Hi-Temp 1027)

KCC Corporation (Silicone HT Coating, Heat Resistant Enamel)

PPG Industries Inc. (PPG HI-TEMP 1027, PPG SIGMATHERM 540)

Jotun A/S (Jotatemp 540 Zinc, Jotun Solvalitt)

Hempel A/S (Hempel's Silicone 56914, Hempadur 85671)

Axalta Coating Systems (Tufcote 5400, Alesta HR)

Kansai Paints Co., Ltd. (Kansai Heat Shield, Thermo Guard)

RPM International Inc. (Carboline Thermaline 450, Tremclad High Heat)

Nippon Paints Holdings Co., Ltd. (Heat Barrier Paint, Thermal Insulating Coating)

Weilburger Coatings GmbH (Greblon D101, Greblon H511)

Hentzen Coatings Inc. (Heat-Resistant Powder Coating, Siloxane Coating)

BASF SE (Cathoguard 800, Sicopal Heat Management Pigments)

Benjamin Moore & Co. (Corotech High Heat Coating, Industrial High Heat)

Axalta Coating Systems Ltd. (Alesta HR, ThermoTec)

Teknos Group (Teknodur 0290, Teknocomp 2480)

Wacker Chemie AG (Silres HK 46, Silres WH 101)

Valspar Corporation (Flame Control High Heat Paint, WeatherXL Silicone Polyester)

Lord Corporation (Chemglaze Z-440, Autoseal 3507)

Recent Development:

2024: NanoTech Materials introduced Wildfire Shield, featuring Insulative Ceramic Particle (ICP) technology to improve fire resistance and minimize heat penetration in buildings. This innovative solution has been adopted by organizations such as SpaceX and the State of California for wildfire protection initiatives.

2024, AkzoNobel N.V., introduced a new line of high-heat-resistant powder coatings designed for the automotive and aerospace industries, offering improved durability and environmental compliance.

May 2023: AkzoNobel launched a bisphenol-free internal coating for the ends of beverage cans. This product will help in catering to the surge in demand for alternative coatings due to a foreseen surge following the opinion by EFSA about BPA restrictions in metal packaging of food and beverage products. Bisphenols are part of so many industries today—a growing urgency for change, following the published opinion of EFSA.

April 2023: AkzoNobel to acquire Chinese Decorative Paints business from Sherwin-Williams AkzoNobel is to further strengthen its China position after reaching an agreement with Sherwin-Williams to acquire its Chinese Decorative Paints business*. Completion, which is subject to regulatory approvals, is expected in the second half of 2023.

April 2023: Indicus Paint launched a new Heatseal heat reflective coating that makes buildings relaxed and efficient. It's a next-generation coating with excellent properties related to reflection for heat insulation.

February 2023: Wacker launched two heat-resistant silicone resin binders for the creation of industrial coatings that would tolerate very high temperatures.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.80 billion |

| Market Size by 2032 | US$ 10.60 Billion |

| CAGR | CAGR of 5.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Silicone, Epoxy, Acrylic, Polyester, Modified Resins), •By Technology (Powder based, Liquid based), •By End-use (Automotive & Transportation, Consumer Goods, Building & Construction, Oil & Gas, Woodworking & Furniture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tikkurila OYJ, AkzoNobel N.V., Sherwin Williams Company, KCC Corporation, PPG Industries Inc., Jotun A/S, Hempel A/S, Axalta Coating Systems, Kansai Paints Co., Ltd., RPM International Inc., Nippon Paints Holdings Co., Ltd., Weilburger Coatings GmbH, Hentzen Coatings Inc., BASF SE, Benjamin Moore & Co., Axalta Coating Systems Ltd., Teknos Group, Wacker Chemie AG, Valspar Corporation |

Ans: Asia Pacific region holds the largest market share in the Heat Resistant Coatings Market during the forecast period.

Ans: Price volatility for raw materials and High Price are the restraints for Heat Resistant Coatings Market.

Ans: Fluctuations in energy prices and raw materials are major challenges for Heat Resistant Coatings.

Ans: Heat Resistant Coatings Market size was USD 6.8 billion in 2023 and is expected to Reach USD 10.60 billion by 2032.

Ans: The Heat Resistant Coatings Market is expected to grow at a CAGR of 5.06%.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Heat Resistant Coatings Market Segmentation, by Resin Type

7.1 Chapter Overview

7.2 Silicone

7.2.1 Silicone Market Trends Analysis (2020-2032)

7.2.2 Silicone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Epoxy

7.3.1 Epoxy Market Trends Analysis (2020-2032)

7.3.2 Epoxy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Acrylic

7.4.1 Acrylic Market Trends Analysis (2020-2032)

7.4.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyester

7.5.1 Polyester Market Trends Analysis (2020-2032)

7.5.2 Polyester Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Modified Resins

7.6.1 Modified Resins Market Trends Analysis (2020-2032)

7.6.2 Modified Resins Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Heat Resistant Coatings Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Powder-based

8.2.1 Powder-based Market Trends Analysis (2020-2032)

8.2.2 Powder-based Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Liquid-based

8.3.1 Liquid-based Market Trends Analysis (2020-2032)

8.3.2 Liquid-based Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Heat Resistant Coatings Market Segmentation, by End-Use Industry

9.1 Chapter Overview

9.2 Automotive & Transportation

9.2.1 Automotive & Transportation Market Trends Analysis (2020-2032)

9.2.2 Automotive & Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Consumer Goods

9.3.1 Consumer Goods Market Trends Analysis (2020-2032)

9.3.2 Consumer Goods Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Building & Construction

9.4.1 Building & Construction Market Trends Analysis (2020-2032)

9.4.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Oil & Gas

9.5.1 Oil & Gas Market Trends Analysis (2020-2032)

9.5.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Woodworking & Furniture

9.6.1 Woodworking & Furniture Market Trends Analysis (2020-2032)

9.6.2 Woodworking & Furniture Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.4 North America Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.6.2 USA Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.7.2 Canada Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.7.2 France Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.6.2 China Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.7.2 India Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.8.2 Japan Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.12.2 Australia Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.4 Africa Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Heat Resistant Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.4 Latin America Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Heat Resistant Coatings Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Heat Resistant Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Heat Resistant Coatings Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Tikkurila OYJ

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 AkzoNobel N.V.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 Sherwin Williams Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 KCC Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 PPG Industries Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 Jotun A/S

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 Hempel A/S

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Axalta Coating Systems

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 Kansai Paints Co., Ltd

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 RPM International Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin Type

Silicone

Epoxy

Acrylic

Polyester

Modified Resins

Others

By Technology

Powder-based

Liquid-based

By End Use Industry

Automotive & Transportation

Consumer Goods

Building & Construction

Oil & Gas

Woodworking & Furniture

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Bio-Based Chemicals Market was valued at USD 70.5 Billion in 2023 and is anticipated to touch USD 167.6 Billion by 2032, at a CAGR of 10.1% from 2024 to 2032.

The Dyes and Pigments Market Size was valued at USD 40.19 billion in 2023 and is expected to reach USD 63.42 billion by 2032, and grow at a CAGR of 5.20% over the forecast period 2024-2032.

The Coating Equipment Market Size was USD 18.5 billion in 2023 and is expected to reach USD 30.4 billion by 2032 and grow at a CAGR of 5.7% by 2024-2032.

The Slip Additives Market size was USD 276.94 million in 2023 and is expected to reach USD 402.20 million by 2032 and grow at a CAGR of 4.23% over the forecast period of 2024-2032.

The Digital Textile Printing Inks Market size was USD 1.7 billion in 2023 and is expected to reach USD 4.1 billion by 2032 and grow at a CAGR of 9.6% over the forecast period of 2024-2032.

Thermoplastic Polyurethane Adhesive Market Size is expected to reach USD 2.43 Billion by 2032, growing at a CAGR of 7.07% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone