Hearables Market Size:

Get E-PDF Sample Report on Hearables Market - Request Sample Report

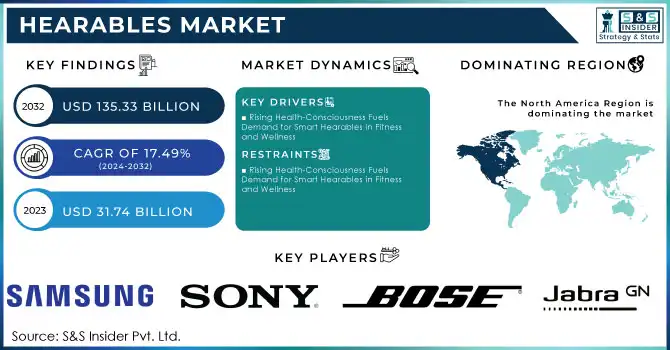

The Hearables Market Size was valued at USD 31.74 billion in 2023 and is expected to grow to USD 135.33 billion by 2032 and grow at a CAGR of 17.49 % over the forecast period of 2024-2032.

Hearing loss is rapidly becoming a global epidemic, with approximately 1 in 7 American adults experiencing some degree of hearing difficulty. Alarmingly, around 80% of individuals who could benefit from hearing aids do not seek assistance, leaving a significant portion of the population without proper care. However, a new wave of hearable devices is emerging as a potential solution for many who have yet to address their hearing challenges. Hearables not only provide the functionality of traditional hearing aids but also integrate advanced features like active noise cancellation, AI-driven customization, and fitness tracking.

In the broader context of technological evolution, the last two decades have seen a profound shift. For example, in 2000, only 50% of Americans had broadband access at home. More than 90% of Americans are online, and similar trends are evident globally. While just 7% of the global population was online in 2000, over 50% of the world is now connected, highlighting the rapid expansion of digital access. Mobile technology has similarly evolved, with global cellphone subscriptions surpassing 8 billion today, far exceeding the world’s population.

These technological advancements directly correlate with the rising demand for hearables. As more people globally gain access to the internet and smartphones, the need for innovative personal audio solutions becomes more critical. Hearables, which combine high-quality audio with connectivity features, are well positioned to cater to an ever-growing market. With the increasing adoption of wireless devices and infotainment solutions, the hearables market is poised for significant growth, meeting the needs of both those with hearing impairments and tech-savvy consumers looking for advanced audio solutions.

Hearables Market Dynamics

Drivers

-

Rising Health-Consciousness Fuels Demand for Smart Hearables in Fitness and Wellness

The growing health-conscious trend is significantly shaping the hearables market, with consumers seeking devices that enhance both their audio experience and health tracking capabilities. Hearables, once focused solely on audio, are now integrated with health-tracking features such as heart rate monitoring, fitness tracking, and mental wellness support. For example, devices like the Jabra Elite Active 75t and Bose SoundSport Free allow users to monitor heart rates during workouts while enjoying motivating music. Additionally, wearables like Aftershokz Open Move provide access to sound therapy and mindfulness apps to help users reduce stress and improve sleep. This aligns with research that shows while 80% of individuals at risk for cardiovascular disease are open to sharing health data from wearables with healthcare providers, age, education, and income disparities still hinder usage. Among individuals with cardiovascular disease, only 18% use wearables, compared to 29% of the general adult population. Specifically, usage drops to 12% for those over 65 with cardiovascular conditions, highlighting the barriers posed by age and income. Furthermore, the fitness industry is seeing increased engagement, with 68.9 million U.S. consumers being gym members in 2022, marking a 3.7% increase. This trend suggests that as more people embrace fitness and health monitoring, the demand for hearables and wearable health devices will likely continue to rise, driven by the desire to track physical and mental well-being in real-time. by improving access and reducing usage barriers, there’s a clear opportunity to reach underserved populations and leverage wearables to bridge health gaps.

Restraints

-

High Price of Advanced Features as a Barrier to Widespread Adoption in the Hearables Market

The high price of hearables with advanced features, like health monitoring tools (heart rate tracking, fitness assessments, sleep analysis), remains a significant barrier in the market. These devices integrate additional hardware, advanced sensors, and powerful processors, which significantly increase their retail price. Premium models with these features typically cost between USD 200 and USD 350, with some reaching even higher prices. While this appeals to tech-savvy consumers, especially athletes or health-conscious users, the cost can be prohibitive for many others, particularly in price-sensitive markets. Consumers who are primarily interested in audio performance might hesitate to invest in hearables with extra health-monitoring functionalities, as they often see them as less of a necessity. Although hearables like the Jabra Elite Active 75t and Bose SoundSport Free offer integrated health tracking, the high price of these models may not justify the return on investment for the average consumer. In comparison, fitness bands or smartwatches with similar functionalities are often more affordable. As the market for hearables expands, manufacturers face the challenge of finding a balance between advanced features and pricing to attract a broader audience, including consumers who are not focused on fitness. Ultimately, the premium pricing of hearables could limit the market's growth potential by restricting these devices to a niche audience, rather than appealing to a wider mass market looking for cost-effective audio solutions.

Hearables Market Segment Analysis

by Product Type

In 2023, earbuds dominated the hearables market with a significant share of approximately 46% of the total revenue. This dominance can be attributed to their compact design, versatility, and ease of use, making them a preferred choice for consumers. Earbuds offer a combination of portability, advanced features, and high-quality sound, appealing to a broad range of users, from casual listeners to fitness enthusiasts and tech-savvy individuals. They are equipped with features like noise cancellation, touch controls, and wireless connectivity, further enhancing their appeal. Major brands like Apple (AirPods), Samsung (Galaxy Buds), and Sony have contributed to the growing popularity of earbuds by offering models that cater to different user needs, including health monitoring, fitness tracking, and seamless integration with smartphones and other devices. With continuous advancements in battery life, sound quality, and connectivity, earbuds are expected to maintain their market dominance moving forward.

by Type

In 2023, Incar hearables led the market, capturing around 39% of the total revenue. This dominance is primarily driven by the increasing integration of audio technologies in vehicles, enhancing the in-car experience for consumers. In-car hearables, such as Bluetooth headsets and smart headphones, are designed to offer hands-free communication and seamless connectivity with in-car systems like infotainment and navigation. With rising demand for safer, more convenient driving experiences, these devices have become essential for communication, entertainment, and even health monitoring while on the road. Major automotive companies are also incorporating these technologies into their vehicles, driving further adoption of in-car hearables. As smart features like voice assistants, advanced noise cancellation, and seamless integration with mobile devices continue to evolve, in-car hearables are expected to see sustained growth. This sector's success is attributed to its ability to combine convenience, safety, and entertainment, making it a key player in the broader hearables market.

Hearables Market Regional Outlook

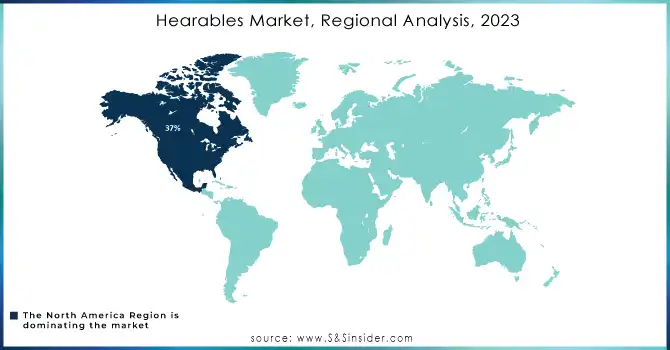

In 2023, North America held the largest share of the hearables market, accounting for approximately 37% of global revenue. This dominance is driven by the region's advanced technological infrastructure, high consumer adoption, and a culture of innovation. The United States, in particular, has seen strong demand for hearables, fueled by a tech-savvy population, the growing popularity of wireless audio devices, and the widespread use of smartphones and connected technologies. The rise in fitness and wellness trends has further spurred interest in hearables with health-monitoring features like heart rate tracking and sleep analysis. Additionally, the seamless integration of hearables with ecosystems such as Apple’s iOS and Google’s Android has contributed to their widespread appeal. Major North American companies like Apple, Bose, and Jabra continue to lead in product development, driving growth in the hearables market. As demand for advanced, feature-rich devices rises, North America is expected to maintain its market leadership.

In 2023, the Asia-Pacific region led the fastest growth in the global hearables market, driven by rapid technological advancements and a rise in consumer demand. Countries like China, India, and Japan have witnessed a surge in digital lifestyles, with growing interest in fitness and health, leading to increased demand for hearables featuring advanced functions like fitness tracking, heart rate monitoring, and sleep analysis. The popularity of wireless and Bluetooth-enabled devices aligns with the region's shift toward portable and convenient technology. Local manufacturers are thriving in markets like China and India, contributing to regional expansion. Additionally, the increasing use of mobile gaming, streaming, and smart devices has amplified the need for hearables with enhanced audio quality and smart capabilities. This momentum positions Asia-Pacific as a critical player in the hearables market's ongoing growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in Hearables Market with their product:

-

Apple Inc. - (AirPods, AirPods Pro, AirPods Max)

-

Samsung Electronics - (Galaxy Buds, Galaxy Buds Pro, Galaxy Buds Live)

-

Sony Corporation - (WF-1000XM5, WH-1000XM5, WH-CH710N)

-

Bose Corporation - (QuietComfort Earbuds, Bose Noise Cancelling 700)

-

Jabra (GN Group) - (Elite 75t, Elite Active 75t, Jabra Evolve 65)

-

Sennheiser - (Momentum True Wireless, HD 450BT, CX 400BT)

-

Beats by Dre (Apple) - (Beats Fit Pro, Powerbeats Pro, Beats Studio3)

-

Xiaomi Corporation - (Redmi Buds 3, Xiaomi AirDots Pro 2)

-

Google LLC - (Pixel Buds Pro, Pixel Buds A-Series)

-

Amazon - (Echo Buds 2nd Gen, Echo Frames)

-

Plantronics (Poly) - (Voyager 5200, BackBeat Pro 2)

-

Shure Incorporated - (Aonic 215, Aonic Free, SE215)

-

Anker Innovations - (Soundcore Liberty 2 Pro, Soundcore Life P3)

-

Logitech - (Logitech G Pro X, Logitech Zone Wireless)

-

Skullcandy - (Crusher Evo, Push Active, Indy Fuel)

-

B&O (Bang & Olufsen) - (Beoplay EX, Beoplay HX, Beoplay E8)

-

Realme - (Realme Buds Air 3, Realme Buds Q2)

-

Huawei - (FreeBuds Pro, FreeBuds 4i, FreeBuds 3)

-

Philips - (Philips T8505, Philips TAT5506)

-

OnePlus - (OnePlus Buds Pro, OnePlus Nord Buds)

List key suppliers of raw materials and components for the hearables market:

-

Knowles Corporation

-

STMicroelectronics

-

Qualcomm

-

NXP Semiconductors

-

Broadcom Inc.

-

Texas Instruments

-

Cirrus Logic

-

AAC Technologies

-

Vishay Intertechnology

-

Murata Manufacturing Co.

Recent Development

-

November 15, 2024 - Apple released the AirPods 4, which feature improved sound quality, a smaller design, and the addition of the H2 chip. The step-up model offers Active Noise Cancellation (ANC), making them a game-changer in the open-earbuds category, where ANC has traditionally been less effective. The AirPods 4 are available in two versions: a USD 129 entry-level model and a USD 179 model with ANC

-

July 10, 2024 - Samsung Electronics unveiled its latest iteration in the Galaxy Buds series, the Galaxy Buds 2 Pro. These new earbuds build on the legacy of their predecessors by offering enhanced noise-canceling capabilities, a more ergonomic design, and upgraded sound quality with 24-bit Hi-Fi audio support, compatible with the latest Galaxy S24 series and foldable devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 31.74 Billion |

| Market Size by 2032 | USD 135.33 Billion |

| CAGR | CAGR of 17.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Earbuds, Hearing Aids, Headsets) • By Type (Incar, Over Ear, OnEar) • By Connectivity Technology (Wired, Wireless) • By End User (Consumer, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics, Sony Corporation, Bose Corporation, Jabra (GN Group), Sennheiser, Beats by Dre (Apple), Xiaomi Corporation, Google LLC, Amazon, Plantronics (Poly), Shure Incorporated, Anker Innovations, Logitech, Skullcandy, B&O (Bang & Olufsen), Realme, Huawei, Philips, and OnePlus are key players in the hearables market. |

| Key Drivers | • Rising Health-Consciousness Fuels Demand for Smart Hearables in Fitness and Wellness. |

| Restraints | • High Price of Advanced Features as a Barrier to Widespread Adoption in the Hearables Market. |