Get more information on Healthcare Workforce Management Systems Market - Request Sample Report

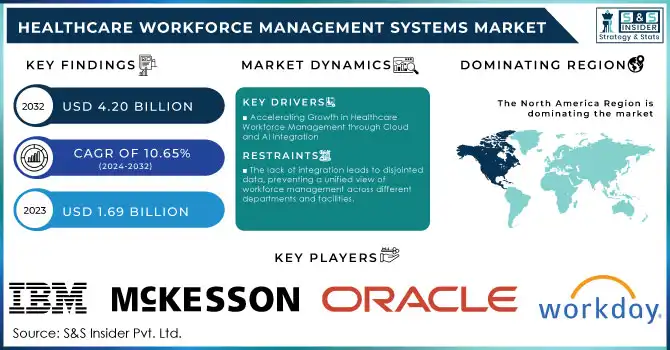

The Healthcare Workforce Management Systems Market Size was valued at USD 1.69 billion in 2023 and is expected to reach USD 4.20 billion by 2032 and grow at a CAGR of 10.65% over the forecast period 2024-2032.

The healthcare workforce management system market is growing at a robust rate, driven by multiple key factors: the shift toward value-based reimbursements, the adoption of telehealth technologies, and the utilization of AI-driven analytics. Dealing with an ongoing labor shortage, healthcare organizations are emphasizing more on maximization of staffing and workforce cost management as high priorities. To address all these challenges, more and more providers adopt workforce management systems that contain the latest scheduling, recruiting, retention strategies, and overall staffing efficiency. They all merge data and functions into a unified interface that allows administrators to better manage their staffing needs, reduce employee turnover, and optimize human resources for long-term benefits.

In addition, advancement in cloud computing and artificial intelligence propels the market further. These innovations help health facilities manage large, multi-care hospitals with relative ease through automated processes. Among recent market developments, Strata Decision Technology launched its real-time workforce management solution in June 2023. This platform enhances nursing leadership/staff communication by providing real-time, actionable data for operational and financial decision-making. Additionally, in October 2023, Empeon announced its digital-first Scheduling solution, part of a full human capital management platform that was designed to simplify workforce management in healthcare.

One of the biggest consolidation activities taking place in the market is being done by market leaders such as Ultimate Kronos Group, Workday Inc., and Oracle Corporation. Such firms are making strategic acquisitions to strengthen their market presence. For example, Ultimate Kronos Group acquired Immedis, a global payroll provider, in June 2023, which indicated the efforts of the firm to strengthen its offerings through international payroll and workforce management solutions. While the influence of government policies like HIPAA on the market is moderate, favorable government policies that are targeted toward ensuring the safety and efficacy of workforce management systems will help enhance further growth in the market. Regional expansion is moderate and depends on the specific regulatory frameworks and demands of a particular market. For example, UKG's launch of its products in New Zealand and Australia in 2023 represents its broader strategic campaigns for increasing market penetration in these regions.

Drivers

Accelerating Growth in Healthcare Workforce Management through Cloud and AI Integration

Many benefits are associated with the cloud-based healthcare workforce management solutions that are rapidly gaining major adoption. IP traffic within global clouds will grow by 30% year over year from 2015 to 2020, reaching 14.1 ZB by 2020, according to the Cisco Global Cloud Index Forecast. Several advantages are associated with cloud deployment, such as cost-cutting benefits along with quick implementation and easier increase in operational agility. This way, cloud support supports geographically distributed healthcare organizations through a unified platform that streamlines their workforce management. This led to many healthcare service providers changing their services from on-premises systems to cloud-based services to utilize the aspects of the above feature.

The growing demand for effective human resource management is further propelling the growth of the healthcare workforce management market. Advanced technologies are driving modern HR strategies to change hiring, employee records, and performance monitoring functions in healthcare organizations. Workforce management solutions in the cloud seem to be key enablers for change, making operations more fluid. The growth of the economy also spurred the penetration of low-cost mobile technologies by smaller healthcare organizations, thus continuing the market extension further.

Recently, important steps in that direction were taken with the launch of EY.ai Workforce-the new AI-based HR solution built in collaboration between EY and IBM. Such collaboration will eventually enable organizations to bring in artificial intelligence for embedding AI in all critical HR processes, thus making a significant milestone in the use of AI to drive productivity improvements in HR functions. Such innovative solutions introduce further accelerations in the process of transformation of workforce management, further increasing both efficiencies and responses to evolving healthcare sector demands.

Restraints

Challenges in interoperability between healthcare workforce management systems and other healthcare applications hinder seamless data sharing and integration.

The lack of integration leads to disjointed data, preventing a unified view of workforce management across different departments and facilities.

Meeting regulatory standards with workforce management systems creates significant complexities, requiring considerable time and effort for implementation.

By Solution

The software segment dominated the healthcare workforce management system market in 2023, with more than 68% revenue share, and is likely to exhibit the highest growth during the forecast period. The segment is segmented into standalone and integrated software solutions. Within standalone software, the revenue segment of time and attendance management retained the largest share in 2023. This is because this part would play a decisive role in workforce management, where healthcare organizations could efficiently track and monitor their employees' attendance and schedules. It is seen that an increase in demand for cost optimization and improved productivity would lead to a multifold hike in the adoption of time and attendance management solutions in the healthcare sector.

Reporting and analytics segment to grow at the highest compound annual growth rate during the forecast period: Increased adoption of cloud computing and SaaS solutions has led to increased integration of advanced reporting and analytics capabilities into workforce management systems, thereby contributing to faster growth in the reporting and analytics segment. The latest advancements in cloud-based software, mobile applications, and AI analytics will also be part of this synergy which would further enhance the growth of this segment.

By Mode of Delivery

In 2023, the web and cloud-based segment led the market, capturing over 62% of the revenue share. The healthcare industry favors cloud deployment for its flexibility, cost-effectiveness, and operational simplicity. Cloud-based solutions facilitate efficient collaboration and communication among various workforce members, including frontline nursing managers, healthcare authorities, and staff, enabling them to manage large-scale staffing operations and make informed decisions. Additionally, cloud-based workforce management platforms can be seamlessly integrated with other healthcare systems, such as Electronic Health Records (EHRs), to create a unified management system. This integration enhances activity tracking and boosts operational efficiency within healthcare organizations.

The on-premises segment is anticipated to experience significant growth during the forecast period. New on-premises software offerings provide healthcare organizations with improved offline access, compliance support, customization options, and better control over data. These benefits empower organizations to have greater oversight of system updates, long-term cost management, and seamless integration with existing infrastructure. These advantages are driving the increasing adoption of on-premises software solutions in the healthcare industry.

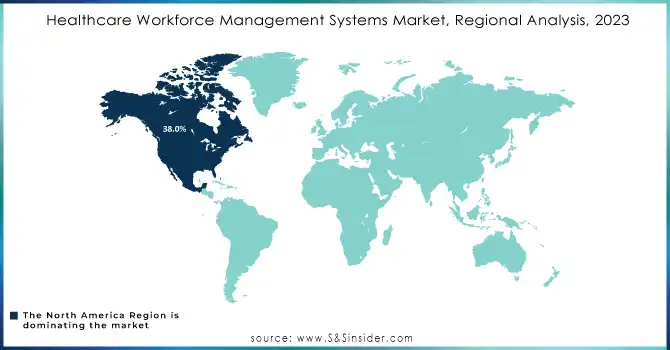

North America accounted for more than 38.0% of the market share in 2023 for the healthcare workforce management system market. Growth was mainly fueled by growing healthcare expenditure, awareness of effective personnel management, increasing adoption of technology in healthcare settings, and stringent regulatory frameworks in countries like the U.S. and Canada. In the U.S., the market for healthcare workforce management systems would rise significantly as the number of surgeries has been on the increase, with America conducting 40 to 50 million surgeries annually and thus having a huge need for efficient workforce management.

Europe is also developing at a robust speed, as stringent labor laws force healthcare organizations to employ versatile workforce management systems to remain in line with guidelines about working hours, breaks, and vacations. The UK market is likely to rise because of growing demand for management solutions and cost-cutting measures along with a high adoption rate in the health domain. Germany is also on a growth trajectory due to increasing healthcare institutions adopting workforce management systems.

Asia Pacific will be leading growth in the coming years, based on rising demands for healthcare and increasing needs for effective workforce management. Among the important markets are Japan, which is already a very significant market, and China, where an increasingly large number of companies have started using cloud-based solutions.

Need any customization research on Healthcare Workforce Management Systems Market - Enquiry Now

IBM Corporation - IBM Watson Talent

McKesson Corporation - McKesson Workforce Management

Ultimate Kronos Group (UKG) - UKG Workforce Central

Cornerstone OnDemand Inc. - Cornerstone Learning

Oracle Corporation - Oracle HCM Cloud

Atoss Software - Atoss Workforce Management

Workday Inc. - Workday Human Capital Management (HCM)

NICE - NICE Workforce Management

Infor - Infor Workforce Management

RLDatix - RLDatix Workforce Management

Hexagon AB - Hexagon Workforce Management

SAP AG - SAP SuccessFactors

ADP, Inc. - ADP Workforce Now

Strata Decision Technology - Strata Workforce Management

GE Healthcare (Api Healthcare) - API Healthcare Workforce Management

QGenda, LLC - QGenda Scheduling

Symplr - Symplr Workforce Management

Kronos, Inc. - Kronos Workforce Management

OSP Labs - OSP Healthcare Workforce Solutions

In May 2024, Cornerstone (US) introduced Cornerstone Galaxy, an AI-driven workforce agility platform designed to address the workforce readiness gap. This gap is driven by the rapid pace of innovation, market shifts, and other factors that are out of sync with employees' ability to adapt. The Workforce Readiness Gap Report, created in collaboration with Lighthouse Research, highlighted that this gap is growing, with 63% of enterprise leaders expressing concerns that their workforce lacks adaptability to change, and 60% citing that AI has accelerated the pace of workplace transformation.

In February 2024, Workday, Inc. (US) entered into a partnership with Insperity, Inc. (US) (NYSE: NSP) to co-develop, brand, market, and sell a comprehensive HR solution targeted at small and midsize businesses. This collaboration offers customers the combined advantage of Insperity’s Workforce Optimization premium services, including dedicated HR specialists, payroll and benefits, risk management, and compliance support, alongside Workday Human Capital Management (HCM).

In November 2023, Intelliworx, a provider of workflow and process automation software, unveiled a new workforce management solution tailored specifically for rural hospitals. This innovative software is expected to help smaller healthcare facilities lower recruitment costs, streamline the hiring process, and enhance the experience for both hospitals and job candidates. With the introduction of this tool, rural hospitals will be able to fill vacancies more quickly, ultimately enhancing their capacity to deliver high-quality healthcare services to patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.69 billion |

| Market Size by 2032 | US$ 4.20 billion |

| CAGR | CAGR of 10.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution [Software (Standalone Software {Time and Attendance, HR and Payroll, Scheduling, Talent Management, Reporting & Analytics, Others}, Integrated Software), Services] • By Mode of Delivery (Web & Cloud Based, On-Premise) • By End-Use (Hospitals, Long-term Care Centers, Nursing Homes Centers, Assisted Living Centers, Other Healthcare Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, McKesson Corporation, Ultimate Kronos Group (UKG), Cornerstone OnDemand Inc., Oracle Corporation, Atoss Software, Workday Inc., NICE, Infor, RLDatix, Hexagon AB, SAP AG, ADP, Inc., Strata Decision Technology, GE Healthcare (Api Healthcare), QGenda, LLC, Symplr, Kronos, Inc., OSP Labs. |

| Key Drivers | • Accelerating Growth in Healthcare Workforce Management through Cloud and AI Integration |

| Restraints | • Challenges in interoperability between healthcare workforce management systems and other healthcare applications hinder seamless data sharing and integration. • The lack of integration leads to disjointed data, preventing a unified view of workforce management across different departments and facilities. • Meeting regulatory standards with workforce management systems creates significant complexities, requiring considerable time and effort for implementation. |

Ans: The Healthcare Workforce Management Systems Market Size was valued at US$ 1.69 billion in 2023.

Ans: The Healthcare Workforce Management Systems Market is growing at a CAGR of 10.65% over the forecast period 2024-2032.

IBM Corporation, Atoss Software, Workday Inc., Hexagon AB, Strata Decision Technology, NICE, RLDatix, Cornerstone Ondemand Inc., McKesson Corporation, Ultimate Kronos Group, Infor, GE Healthcare (Api Healthcare), Oracle Corporation, ADP, Inc., SAP AG are the key players of Healthcare Workforce Management Systems market

North America is anticipated to dominate the global market for healthcare workforce management systems.

The United States market for healthcare workforce management systems will grow as a result of healthcare industry consolidation, and Increasing Need for Workforce Management Systems to Manage Regulatory Compliance are the key drivers of the Healthcare Workforce Management Systems market

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Market Adoption and Growth (2023-2032)

5.2 Healthcare Workforce Trends by Region (2023)

5.3 Key Workforce Trends by End User (2023)

5.4 Healthcare Spending on Labor and Technology (2023)

5.5 Technology Adoption and Workforce Management Solutions (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare Workforce Management Systems Market Segmentation, by Solution

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Standalone Software

7.2.3.1 Standalone Software Market Trends Analysis (2020-2032)

7.2.3.2 Standalone Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3 Time and Attendance

7.2.3.3.1 Time and Attendance Market Trends Analysis (2020-2032)

7.2.3.3.2 Time and Attendance Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.4 HR and Payroll

7.2.3.4.1 HR and Payroll Market Trends Analysis (2020-2032)

7.2.3.4.2 HR and Payroll Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.5 Scheduling

7.2.3.5.1 Scheduling Market Trends Analysis (2020-2032)

7.2.3.5.2 Scheduling Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.6 Talent Management

7.2.3.6.1 Talent Management Market Trends Analysis (2020-2032)

7.2.3.6.2 Talent Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.7 Reporting & Analytics

7.2.3.7.1 Reporting & Analytics Market Trends Analysis (2020-2032)

7.2.3.7.2 Reporting & Analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.8 Others

7.2.3.8.1 Others Market Trends Analysis (2020-2032)

7.2.3.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Integrated Software

7.2.4.1 Integrated Software Market Trends Analysis (2020-2032)

7.2.4.2 Integrated Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare Workforce Management Systems Market Segmentation, by Mode of Delivery

8.1 Chapter Overview

8.2 Web & Cloud Based

8.2.1 Web & Cloud-Based Market Trends Analysis (2020-2032)

8.2.2 Web & Cloud-Based Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 On-Premise

8.3.1 On-Premise Market Trends Analysis (2020-2032)

8.3.2 On-Premise Market Size Estimates and Forecasts to 2032 (USD Million)

9. Healthcare Workforce Management Systems Market Segmentation, by End-Use

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Long-term Care Centers

9.3.1 Long-term Care Centers Market Trends Analysis (2020-2032)

9.3.2 Long-term Care Centers Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Nursing Homes Centers

9.4.1 Nursing Homes Centers Market Trends Analysis (2020-2032)

9.4.2 Nursing Homes Centers Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Assisted Living Centers

9.5.1 Assisted Living Centers Market Trends Analysis (2020-2032)

9.5.2 Assisted Living Centers Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Other Healthcare Institutions

9.6.1 Other Healthcare Institutions Market Trends Analysis (2020-2032)

9.6.2 Other Healthcare Institutions Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.2.4 North America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.2.5 North America Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.2.6.2 USA Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.2.6.3 USA Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.2.7.2 Canada Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.2.7.3 Canada Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.2.8.2 Mexico Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.2.8.3 Mexico Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use(2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.1.6.2 Poland Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.1.6.3 Poland Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.1.7.2 Romania Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.1.7.3 Romania Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.1.8.2 Hungary Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.1.8.3 Hungary Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.9 turkey

10.3.1.9.1 Turkey Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.1.9.2 Turkey Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.1.9.3 Turkey Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.4 Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.5 Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.6.2 Germany Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.6.3 Germany Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.7.2 France Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.7.3 France Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.8.2 UK Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.8.3 UK Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.9.2 Italy Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.9.3 Italy Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.10.2 Spain Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.10.3 Spain Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.13.2 Austria Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.13.3 Austria Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.4 Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.5 Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.6.2 China Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.6.3 China Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.7.2 India Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.7.3 India Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.8.2 Japan Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.8.3 Japan Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.9.2 South Korea Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.9.3 South Korea Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.10.2 Vietnam Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.10.3 Vietnam Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.11.2 Singapore Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.11.3 Singapore Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.12.2 Australia Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.12.3 Australia Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.1.4 Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.1.5 Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.1.6.2 UAE Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.1.6.3 UAE Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.1.7.2 Egypt Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.1.7.3 Egypt Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.1.9.2 Qatar Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.1.9.3 Qatar Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.2.4 Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.2.5 Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.2.6.2 South Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.2.6.3 South Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.6.4 Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.6.5 Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.6.6.2 Brazil Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.6.6.3 Brazil Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.6.7.2 Argentina Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.6.7.3 Argentina Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.6.8.2 Colombia Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.6.8.3 Colombia Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use(2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Solution (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by Mode of Delivery (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Healthcare Workforce Management Systems Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

11. Company Profiles

11.1 IBM Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 McKesson Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Ultimate Kronos Group (UKG)

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Cornerstone OnDemand Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Oracle Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Atoss Software

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Workday Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Strata Decision Technology

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 GE Healthcare (Api Healthcare)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 OSP Labs

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Solution

Software

Standalone Software

Time and Attendance

HR and Payroll

Scheduling

Talent Management

Reporting & Analytics

Others

Integrated Software

Services

By Mode of Delivery

Web & Cloud Based

On-Premise

By End-Use

Hospitals

Long-term Care Centers

Nursing Homes Centers

Assisted Living Centers

Other Healthcare Institutions

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Molecular Diagnostics Market Size was USD 15.35 Billion in 2023, and expected to reach USD 32.37 Billion by 2032, and grow at a CAGR of 9.07%.

The Medical Spa Market was valued at USD 18.33 billion in 2023 and is expected to reach USD 61.85 billion by 2032, growing at a CAGR of 14.50% from 2024-2032.

The Antiperspirants and Deodorants Market Size was valued at USD 62,889 million in 2023 and is expected to reach USD 81,920.89 million by 2031, and grow at a CAGR of 3.36% over the forecast period 2024-2031.

The Healthcare Waste Management Market Size was valued at USD 34.08 Billion in 2023, and is expected to reach USD 68.03 Billion by 2032, and grow at a CAGR of 8.36% Over the Forecast Period of 2024-2032.

The NGS based RNA Sequencing Market Size was USD 2.9 Billion in 2023 and will reach USD 12.1 Billion by 2032 and grow at a CAGR of 17.1% Over the Forecast Period of 2024-2032.

The Lymphoma Treatment market size was USD 7.01 billion in 2023 and is expected to reach USD 14.66 billion by 2032 and grow at a CAGR of 8.54% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone