Healthcare Testing, Inspection And Certification Outsourcing Market Size & Trends:

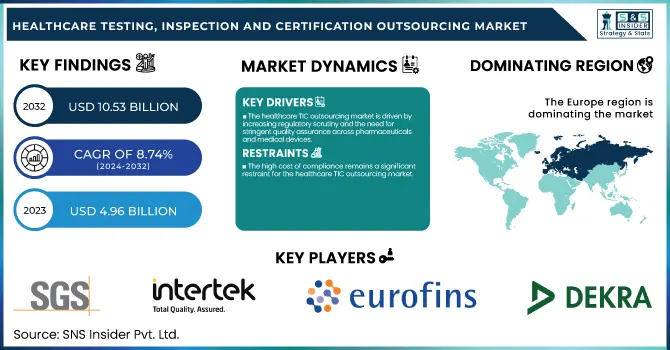

The Healthcare Testing, Inspection And Certification Outsourcing Market Size was valued at USD 4.96 billion in 2023 and is expected to reach USD 10.53 billion by 2032 and grow at a CAGR of 8.74% over the forecast period 2024-2032. This study focuses on shifting trends in regulatory compliance and certification, fueled by strict quality measures and patient safety demands. It investigates regional disparities in testing, inspection, and certification numbers in response to variances in healthcare regulation and infrastructure. It also delves into prominent industry sectors making use of TIC services, such as pharmaceuticals, medical devices, and biotechnology, where regulatory compliance and quality assurance are imperative. Additionally, the report identifies various types of healthcare TIC services and puts special emphasis on the rising necessity for specialty tests and computerized certification processes. The report further evaluates the impact of future breakthrough technologies in the outsourcing of TIC, i.e., artificial intelligence-powered automation and blockchain connectivity, that is transforming efficiency, traceability, and compliance levels in the medical sector.

To Get more information on Healthcare Testing, Inspection And Certification Outsourcing Market - Request Free Sample Report

Healthcare Testing, Inspection And Certification Outsourcing Market Dynamics

Drivers

-

The healthcare TIC outsourcing market is driven by increasing regulatory scrutiny and the need for stringent quality assurance across pharmaceuticals and medical devices.

Regulatory bodies like the FDA, EMA, and WHO have imposed stricter compliance regulations, involving extensive testing, inspection, and certification procedures. The increasing sophistication of biologics, personalized medicine, and networked medical devices has further fueled the need for third-party TIC services to meet international standards such as ISO 13485, CE Marking, and GMP (Good Manufacturing Practice). Also, the increase in clinical trials—more than 140,000 trials are registered worldwide in 2023—has stimulated demand for outsourced TIC services to validate drug efficacy and safety. Also, growth in digital health products, AI-based diagnostics, and telemedicine equipment requires stringent testing prior to market authorization. With pharmaceutical companies under pressure to ensure product integrity while speeding up time-to-market, TIC outsourcing became a strategic imperative for regulatory compliance and risk reduction.

Restraints

-

The high cost of compliance remains a significant restraint for the healthcare TIC outsourcing market.

Healthcare regulations are also complicated, usually resulting in costly and time-consuming compliance procedures. For example, it may require 12-24 months and hundreds of thousands of dollars to get CE marking for a European medical device, which is very burdensome to small and medium-sized manufacturers. Also, the cost of certification and inspections differs based on the regulatory environment of various nations, resulting in additional operational costs for cross-border healthcare companies. The extensive approval periods also slow down market access for new medicines and medical equipment, affecting revenue generation. The other problem is the continuous modification of global regulatory requirements, necessitating repeated testing and re-certifications by manufacturers, again adding to expenses and time pressures. The scarcity of accredited TIC service providers is also a contributor to delays since firms tend to face bottlenecks in acquiring regulatory approvals. Additionally, firms with internal compliance staff might consider outsourcing to be too expensive owing to third-party reliability issues, data security concerns, and integration complexities. The absence of standardization among regulatory agencies also makes it challenging for firms to effectively streamline TIC outsourcing processes.

Opportunities

-

The expansion of digital health, AI-driven diagnostics, and connected medical devices presents a significant opportunity for the healthcare TIC outsourcing market.

As Internet of Medical Things (IoMT), telemedicine, and artificial intelligence-based diagnostic devices gain prominence, there is a strong requirement for rigorous testing and certification to provide data protection, device reliability, and regulatory compliance. For instance, the international AI in healthcare market size is anticipated to grow more than 40% each year, resulting in greater demand for autonomous TIC services to verify machine-learning algorithms and medical AI applications. The growing use of wearable medical devices and remote monitoring equipment also calls for third-party testing to meet cybersecurity and performance requirements. On top of this, the emerging trend towards personalized medicine and biopharmaceuticals has prompted demand for bespoke TIC services to authenticate drug efficacy, safety, and conformance with developing industry standards. Another key area of opportunity involves the increased level of clinical trials taking place, with more than 400,000 ongoing trials worldwide, calling for significant TIC services for verification of compliance. Emerging markets are also developing as outsourcing centers for TIC services since companies need cost-effective means of regulatory compliance. Additionally, the development of blockchain technology to ensure secure certification and cloud-based TIC services is opening new avenues for efficient and streamlined healthcare compliance procedures.

Challenges

-

The shortage of skilled professionals capable of handling complex regulatory and compliance requirements.

The demand for TIC services has grown faster than the supply of skilled professionals, especially in niche fields like biopharmaceutical testing, cybersecurity compliance, and AI validation. For instance, the medical device cybersecurity talent gap is estimated to be 3.5 million unfilled jobs worldwide, impacting the industry's capacity to adapt to changing digital health regulations. Moreover, data privacy and cybersecurity issues are a major challenge, with healthcare organizations having to guarantee the safeguarding of sensitive patient and research information while outsourcing TIC services. Increased cyberattacks on healthcare databases, with more than 50 million patient records compromised in 2023 alone, have raised regulatory attention regarding data security compliance. Another significant challenge is the inconsistency in global regulatory standards, which makes it challenging for firms to implement a single TIC strategy. Geopolitical tensions and supply chain disruptions have also affected the capacity of TIC providers to carry out on-site audits and inspections, resulting in delays in compliance certification. Overcoming these challenges necessitates greater investment in training programs, more robust cybersecurity frameworks, and greater cooperation between regulators and TIC service providers.

Healthcare Testing, Inspection And Certification Outsourcing Market Segmentation Analysis

By Service

The testing services segment was the leading category in 2023, accounting for 61.2% of the overall revenue in the healthcare TIC outsourcing market. The demand for testing services is high due to stringent regulatory needs, growing product complexity, and heightened quality assurance demands across the healthcare industry. The increased number of medical device approvals, drug trials, and diagnostic advancements has also spurred the demand for comprehensive testing to meet global safety standards.

The certification services segment is expected to witness the most rapid growth during the forecast period. The increased emphasis on worldwide standardization, combined with the growing regulatory requirements in various healthcare industries, has spurred the demand for certification services. The increased demand for ISO certifications, CE markings, and FDA approvals for pharmaceuticals and medical devices is further driving this segment's growth.

By Type

Medical Devices commanded the highest revenue share in 2023, driven mainly by the rising regulatory oversight of device safety, performance, and effectiveness. The rise in medical device innovations, along with the increased focus on compliance with international standards like FDA and ISO certifications, has played a major role in driving the demand for third-party TIC services. Also, the growing use of connected and AI-based medical devices has further increased the demand for intense testing and examination.

The Pharmaceuticals category is anticipated to experience the largest growth rate during the coming years. Increasing numbers of drug approvals, mounting investment in research in biopharmaceuticals, and strict regulatory environments are the primary demand drivers for outsourcing TIC services. Furthermore, the pharmaceutical industry's globalizing supply chains as well as regulation compliance requirements per region have continued to support growth in certification and inspection services among this category.

Healthcare Testing, Inspection And Certification Outsourcing Market Regional Insights

Europe was the leading region in the healthcare testing, inspection, and certification (TIC) outsourcing market in 2023 with a revenue share of 40.2%. This is due to the fact that the region has a strong regulatory environment in place, such as the European Medicines Agency (EMA) and the Medical Device Regulation (MDR), which require extensive testing and certification procedures for drugs and medical devices. The growth in clinical trials, increased use of sophisticated medical technologies, and strong presence of major TIC service providers have further consolidated Europe's market leadership. Moreover, the region's emphasis on high standards of quality in healthcare products has fueled third-party TIC outsourcing demand.

Asia-Pacific is the fastest-growing healthcare TIC outsourcing market, fueled by the rapid growth in pharmaceutical production, medical device manufacturing, and regulatory evolution. The area is supported by affordable TIC services, a rise in foreign investment, and the establishment of more contract research organizations (CROs). China, India, and Japan are all experiencing a high demand for TICs because of changing compliance needs and the uptick in medical exports. The increasing healthcare infrastructure, increasing R&D activities, and government efforts to improve quality assurance standards are also fueling the growth of the TIC outsourcing market in Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Healthcare TIC Outsourcing Products

-

SGS SA – Medical Device Testing, Pharmaceutical Testing, Clinical Trial Services, GMP/GLP Audits, Biocompatibility Testing

-

Intertek Group plc – Medical Device Certification, Pharmaceutical Auditing, Good Clinical Practice (GCP) Compliance, Laboratory Testing, Regulatory Consulting

-

Eurofins Scientific SE – Pharmaceutical Quality Control, Biopharmaceutical Testing, Clinical Diagnostics, Microbiology Testing, Toxicology Studies

-

DEKRA CERTIFICATION B.V. – Medical Device Certification, Risk Assessment, Regulatory Compliance Testing, CE Marking, Quality Management Audits

-

UL Solutions Inc. – Medical Device Cybersecurity Testing, FDA Compliance Testing, Electrical Safety Certification, Performance Testing, ISO Certification

-

TÜV SÜD – Medical Device Testing & Certification, Biocompatibility Testing, EMC Testing, GMP Audits, Risk Management Services

-

ALS Limited – Pharmaceutical Stability Testing, Contaminant Analysis, Microbial Testing, Bioanalytical Services, Environmental Monitoring

-

CSA Group Testing & Certification Inc. – Medical Equipment Certification, Electromagnetic Compatibility Testing, Regulatory Compliance Audits, ISO Certification, Functional Safety Testing

-

Applus+ Technologies, Inc. – Clinical Laboratory Testing, Healthcare Facility Inspections, Product Conformity Assessments, Validation & Verification Services, Medical Audits

-

Element Materials Technology – Biopharmaceutical Testing, Sterilization Validation, Extractables & Leachables Testing, Material & Chemical Analysis, Mechanical Testing

Recent Developments

In March 2025, RadiusXR, Glaukos Corporation, and Topcon Healthcare, Inc. collaborated to launch Inspire, a next-generation wearable vision testing platform. This partnership combines RadiusXR’s innovative visual field technology, Topcon Healthcare’s expertise in robotic diagnostics, and Glaukos’ commitment to enhancing access to glaucoma diagnosis, aiming to expand visual field testing for all patients in need.

In Dec 2024, Metropolis Healthcare Limited announced the acquisition of Core Diagnostics, a Delhi-NCR-based company, to strengthen its capabilities in advanced cancer testing. This strategic move will expand Metropolis' presence in Northern and Eastern India, enhancing partnerships with leading hospitals and driving growth in the specialized diagnostics segment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.96 billion |

| Market Size by 2032 | USD 10.53 billion |

| CAGR | CAGR of 8.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service [Testing, Inspection, Certification] • By Type [Medical Devices, Pharmaceutical] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SGS SA, Intertek Group plc, Eurofins Scientific SE, DEKRA CERTIFICATION B.V., UL Solutions Inc., TÜV SÜD, ALS Limited, CSA Group Testing & Certification Inc., Applus+ Technologies, Inc., Element Materials Technology. |