Healthcare Technology Management Market Report Scope & Overview:

To Get More Information on Healthcare Technology Managemen Market - Request Sample Report

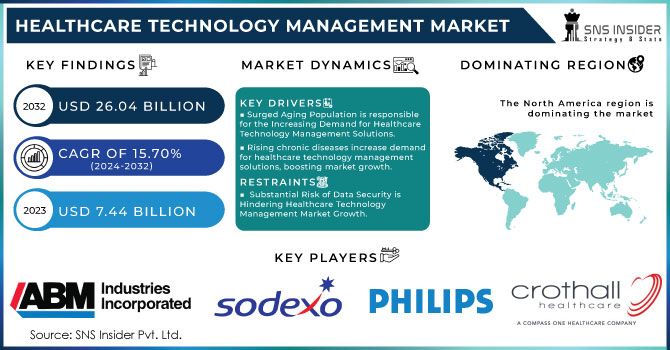

The Healthcare Technology Management Market Size was valued at USD 29.77 billion in 2024 and is expected to reach USD 94.28 billion by 2032 and grow at a CAGR of 15.56% over the forecast period 2025-2032.

Key Drivers in the healthcare technology management market are the growing penetration of cloud technology and related Human-Computer Interaction (HCI) services along with mounting requests for telehealth & mHealth solutions. Accelerated adoption of different healthcare reforms like PPACA (Patient Protection and Affordable Care Act), spreads a positive impact on the market growth. Furthermore, the rising elderly population and rising incidence of numerous chronic disorders are supporting exponential expansion in the healthcare technology management market.

This has increased the number of elderly people in society so that, according to official projections by the U.S. Census Bureau if current trends continue, we will see all baby boomers reach 65 years old and over around or shortly after 2030. While, approximately 20%, According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults have a chronic disease, while four in ten live with two or more-making it all too obvious why there is such urgency when it comes to finding effective health solutions.

Healthcare organizations, which mainly include hospitals and clinics are underperformance pressure to create as well as design effective information systems by using healthcare IT. Healthcare technology management impacts healthcare in numerous ways, contributing to improvements in clinical outcomes with current technologies and increased patient safety consequent the reduction of error rates due not only to personal "human factor" but also empowered practice efficiency that precedes streamlined care coordination resulting from accurate data collected over time.

In health research, countries like Japan, France, and Spain have a strong presence in this field of study with the United States. For example, medical research in the U. S. costs over $42 billion a year with funding from places like the National Institute of Health (NIH) In the UK, on the other hand, they are concentrating on growing research and development (R&D) in these regions and exporting technology to other countries which is encouraged by large government financing for healthcare innovation.

MARKET DYNAMICS:

KEY DRIVERS:

-

Surged Aging Population is responsible for the Increasing Demand for Healthcare Technology Management Solutions.

-

The Raising Chronic Diseases Led to Increased Demand for Healthcare Technology Management Solutions Which is Boosting the Market Growth.

RESTRAINTS:

-

Substantial Risk of Data Security is Hindering Healthcare Technology Management Market Growth.

-

The Higher Implementation Costs of Healthcare Technology Management Solutions can Limit the Adoption of Healthcare Technology Management.

OPPORTUNITY:

-

Technological Advancements are Offering a Lucrative Growth Opportunity for Healthcare Technology Management Systems.

-

Rising Telehealth, As Well As Remote Monitoring Systems, are Responsible for the Market Growth During Upcoming Years.

KEY MARKET SEGMENTATION:

By Services Type

Maintenance & Repair is the most important category within healthcare technology management holding 28% of the market share. Healthcare devices and equipment maintenance & repair are critical for maintaining the reliability, functioning as well as safety of medical devices throughout healthcare settings. This is a critical area as it takes in numerous medical devices and systems found throughout clinical settings-from diagnostic imaging equipment to patient monitoring to surgical instruments. Preventing equipment from failing or breaking down, could place patient care and safety at risk as well as eat into potentially the lifespan of expensive medical machines. However, the growing complexity and technology level of healthcare devices further highlight how crucial expert maintenance as well as repair service is. For healthcare providers, this means preemptive investment in discipline-specific service and prevention compliance with agency regulations (e.g., those from the FDA or CMS) requiring adherence to quality of safe practices narrowing their infrastructure. As a result, the need for full-service maintenance and repair solutions is as strong as it ever has been to keep healthcare delivery systems running efficiently around the world.

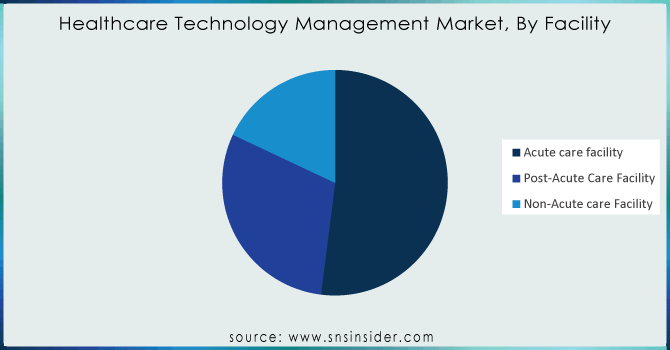

By Facility

The acute care facilities accounted for 42% in 2023. These sites encompass everything from healthcare facilities that provide critical medical services and treat severe illnesses or injuries of a temporary nature (hospitals). The medical equipment used in acute care settings are important and extensive machines that assist with critical life support, surgical interventions as well intensive monitoring. Many of these deployers operate on a large scale due to their advanced infrastructure and high numbers of patients, which in turn will require comprehensive healthcare technology management services ranging from planned maintenance and repairs through cybersecurity: all necessary for efficient operations as well as meeting regulatory compliance needs. Therefore, the demand from acute care facilities for healthcare technology management services is higher than post-acute care entities involved in rehabilitation and long-term stay or non-acute entities such as outpatient clinics, diagnostic centers, etc. which generally have low-end point needs of technology use with lower patient footfall turnover.

Do You Need any Customization Research on Healthcare Technology Managemen Market - Enquire Now

REGIONAL ANALYSIS:

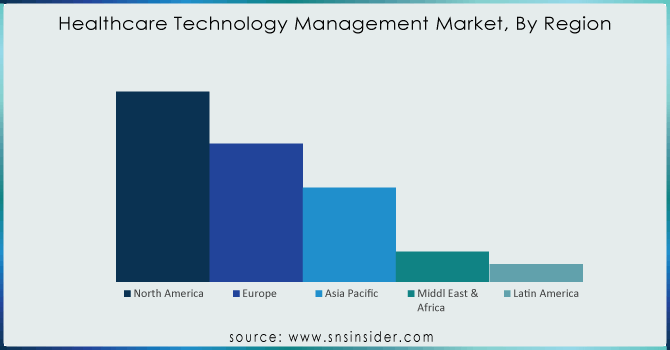

In 2023, North America holds the major share of the market globally which is 40%. The market is being propelled by its state-of-the-art healthcare infrastructure, increasing implementation of digital health technologies, and strict regulatory guidelines. The area's positive attitude is further reinforced by substantial investment in cybersecurity measures and expertise, due to the amount of data breaches indicating that healthcare systems are being preyed upon. HIPAA compliance requirements also prioritize security for protecting patient data from being accessible and preventing unauthorized copies. North American leadership in secure healthcare IT practices is supported by leading cybersecurity firms, and research institutions and remains a pivotal epicenter for global innovation and implementation of onsite-healthcare-specific cybersecurity solutions.

The European healthcare technology management market accounted for a considerable share in the global revenue shares, due to high R&D investment, increasing technological innovation acceptance, and the presence of large players with an efficient focus on developing newer patents. The market in Europe is expected to offer lucrative opportunities because of improved healthcare infrastructure hubs in countries like Germany and the U.K.

KEY PLAYERS:

The key market players include JANNX Medical Systems, Inc., ABM Industries, Inc., Crothall Healthcare, Inc., Koninklijke Philips N.V., Sodexo S.A., Agility, Inc., TriMedx, LLC, Siemens Healthineers AG, Renovo Solutions, General Electric (GE) Co. & other players.

RECENT DEVELOPMENTS

-

In April 2022, GE Healthcare collaborated with Medtronic, an American registered medical device company in which both companies would focus on Addressing unique needs and demand for care at Ambulatory Surgery Centers along with Office Labs.

-

In Mar-2022, Sodexo partnered with University Hospitals to deploy an innovative model for comprehensive primary and community-based care. Sodexo sought to provide a broad range of services including inpatient meal and retail food, housekeeping and construction management, as well as managing healthcare technology through the alliance.

-

In January 2022, GE Healthcare landed a 10-year partnership agreement with private healthcare provider Circle Health Group Connectivity: This deal would effectively permit Circle’s clinicians to better target their decisions for patients in care, monitoring & diagnosis.

| Report Attributes | Details |

| Market Size in 2024 | US$ 29.77 Billion |

| Market Size by 2032 | US$ 94.28 Billion |

| CAGR | CAGR of 15.56% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Services Type (Maintenance & Repair, Integrated Software Platform, Cyber Security, Capital Planning, Quality & Regulatory Compliance, Labor Management, Supply Chain (Procurement) •By Facility (Acute care facility, Post-Acute Care Facility, and Non-Acute care Facility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | JANNX Medical Systems, Inc., ABM Industries, Inc., Crothall Healthcare, Inc., Koninklijke Philips N.V., Sodexo S.A., Agility, Inc., TriMedx, LLC, Siemens Healthineers AG, Renovo Solutions, General Electric (GE) Co. & other players |

| Key Drivers | •Surged Aging Population is responsible for the Increasing Demand for Healthcare Technology Management Solutions. •The Raising Chronic Diseases Led to Increased Demand for Healthcare Technology Management Solutions Which is Boosting the Market Growth. |

| RESTRAINTS | •Substantial Risk of Data Security is Hindering Healthcare Technology Management Market Growth. •The Higher Implementation Costs of Healthcare Technology Management Solutions can Limit the Adoption of Healthcare Technology Management. |