Healthcare Predictive Analytics Market Size:

Get More Information on Healthcare Predictive Analytics Market - Request Sample Report

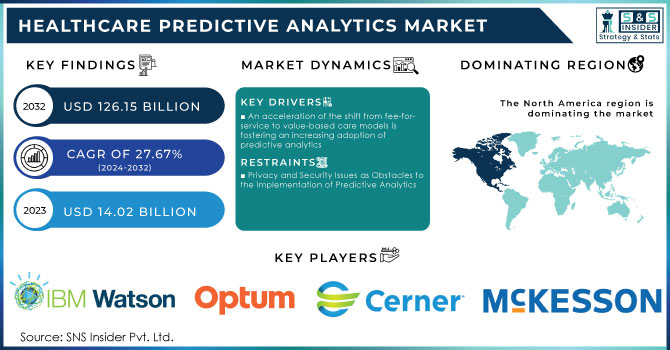

The Healthcare Predictive Analytics Market was valued at USD 14.02 billion in 2023 and is expected to reach USD 126.15 billion by 2032, growing at a CAGR of 27.67% from 2024-2032.

The healthcare predictive analytics market has emerged as a transformative force within the healthcare sector, harnessing data analysis and predictive modeling to improve patient care, streamline operations, and reduce costs. By leveraging historical data, statistical algorithms, and machine learning techniques, predictive analytics enables healthcare providers to identify potential outcomes, assess risks, and discover opportunities, empowering them to make informed decisions. As the complexities of healthcare continue to evolve, predictive analytics plays a vital role in addressing some of the industry's most significant challenges.

Rapidly evolving, the healthcare predictive analytics market is becoming an essential component of modern healthcare. It utilizes advanced data analysis and predictive modeling to enhance patient care, streamline operations, and effectively manage costs. By employing historical data and sophisticated algorithms, predictive analytics allows healthcare providers to forecast potential outcomes, evaluate risks, and identify areas for improvement. 66% of healthcare organizations in the US have embraced predictive analytics. As the healthcare landscape grows increasingly intricate, predictive analytics proves crucial in tackling key industry challenges.

The transition to electronic health records (EHRs) has led to a tremendous increase in healthcare data, which can be analyzed to gain insights that inform clinical decisions and improve patient outcomes. As of 2023, 70% of healthcare organizations reported that they possess the necessary data infrastructure to support predictive analytics initiatives. One significant application of predictive analytics is in forecasting patient outcomes. Predictive models can analyze patient data to determine the most likely outcome for specific treatment options. This capability is invaluable for physicians in deciding each patient's best course of action.

Additionally, there has been a shift toward outcome- and value-based payment initiatives in healthcare, driving the need to leverage health data and predictive analytics to enhance patient care and optimize information processing. Health information technology has revolutionized healthcare management, offering benefits ranging from cost savings to improved risk management.

Integrating artificial intelligence (AI) and machine learning into predictive analytics tools has significantly enhanced their accuracy and effectiveness. As of 2023, 65% of healthcare organizations indicated plans to invest in AI-driven analytics solutions within the next two years. Furthermore, predictive analytics is crucial in improving patient engagement by facilitating personalized care plans. Research indicates that organizations employing predictive analytics have experienced a 30% increase in patient adherence to treatment protocols, highlighting the positive impact of data-driven strategies on patient outcomes.

Market Dynamics

Drivers

Healthcare Cost Inflation and the Pressure for Operating Efficiency

An acceleration of the shift from fee-for-service to value-based care models is fostering an increasing adoption of predictive analytics

Rising healthcare delivery costs have become an imperative push for healthcare organizations to increase operational efficiency and decrease costs. In 2023, healthcare spending in the U.S. was at around USD 4.8 trillion, which is expected to be at USD 7.7 trillion by the end of 2032. Predictive analytics can help providers pinpoint areas of inefficiency, resource optimization, and better patient care management. Predictive analytics, with such technology, helps such organizations minimize waste and keep costs under control; hence it is an essential tool for reaching financial sustainability in this increasingly complex healthcare environment.

The paradigm shift from fee-for-service to value-based care models underlines the necessity of results for the patients and cost-effectiveness.

More than 90 % of healthcare executives have visions for value-based care as the future of healthcare delivery. Predictive analytics allows healthcare providers to measure risk factors and identify high-risk populations to be targeted with interventions. It lends itself to proactive care management, improves the quality of care delivered, and aligns well with the payment structures being developed under value-based care. With a slant toward more value than volume in healthcare systems, further demand for predictive analytics solutions may come to the fore to be shaped into investments in the area.

Restraints

Privacy and Security Issues as Obstacles to the Implementation of Predictive Analytics

Legacy systems and problems of integration are hindering the market's expansion

Exposure and Privacy/Security Issues In healthcare, the industry is highly regulated, and therefore, more prone to patient information. This calls for the highest level of patient privacy, especially in the United States under the Health Insurance Portability and Accountability Act, which regulates some aspects of data exposure based on unauthorized entry, breaches, and other vulnerability issues that could lead to the misuse of a patient's information, hence further arresting the adoption of predictive analytics solutions in healthcare. All this may hinder the growth of the market since organizations would be reluctant to introduce these tools for fear of hurting the privacy of their patients or facing the law.

Most healthcare organizations remain primarily using legacy systems that are not easily compatible with advanced predictive analytics. The integration process of new analytic solutions into already established EHRs, billing software, and other aspects of healthcare information technology infrastructure is very difficult. The amount of money and time required to have complete integration can be the biggest inhibition for the deployment of predictive analytics for many organizations, hence restraining further growth of this market and negating all the promised benefits.

Segment Analysis

By Application

The financial application segment accounted for the largest revenue share in the market in 2023 at 35.50%. Financial applications revolve around managing revenue cycles, fraud risk assessment, and reduction in fraudulent claims. For example, an estimated 1 billion is lost by healthcare fraud every year, according to an approximate figure by the U.S. Department of Justice. Applications of artificial intelligence include creating predictive models for fraud detection and analyzing large amounts of data derived from patient records and provider payments. Its applications are significant to private organizations as well as public ones and hence contribute to the growth of the market.

Population health management is expected to be the highest-growing market with a CAGR of 33.81% during the period 2024-2032. Predictive analytics can be used to identify outbreaks of diseases. With this ample amount of data about patients, healthcare services will also be able to increase patient survivability through the tracking of people through telehealth, web-based, and other connected devices to monitor a patient and get risky people treated early in the course.

By End-Use

Providers constitute the biggest share 50% of the healthcare predictive analytics market, as these organizations use predictive analytics to improve clinical outcomes, optimize resources, and ensure better patient care. Predictive models may enable healthcare organizations to reduce rehospitalizations and identify high-risk patients; in doing so, they make it easier to streamline operations. Fueling their growing adoption, EHRs and patient-centered care further fuel the use of these tools by providers to ensure better care is administered but lost not at the cost of losing operational efficiency. The imperative to enhance outcomes while controlling costs makes predictive analytics a necessity in modern healthcare.

The most rapidly growing end-use segment for predictive analytics is in the life sciences industry, which includes pharmaceutical and biotechnology, and contributed 20% in 2023 to the market. This segment employs predictive models in drug discovery, clinical trials, and personalized medicine that can predict very accurately the responses of patients to treatments, which can, in turn, be used to optimize the design of subsequent clinical trials and accelerate the development of new drugs. The pharmaceutical industry will spend more than USD 2 billion annually on AI-based predictive analytics for drug discovery and personalized medicines by 2025. The most important drivers of growth for this segment are the advances in genomics, AI-enabled research, and the increasing relevance of personalized medicine. Predictive analytics is going to be the biggest influencer of fast acceleration in drug development and the improvement of personalized healthcare solutions going forward in innovation. By July 2024, Cleveland Clinic collaborated with Masimo to roll out a tele-ICU and remote patient monitoring program focused on the development of advanced predictive analytics through AI for cardiology.

Regional Analysis

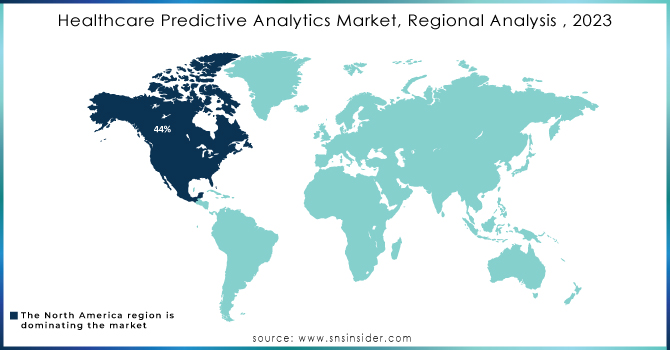

North America, at present, leads the market by 44% in 2023, primarily because of the tremendous investments in healthcare IT that include advances in applied technologies. The market here is benefitting by having a high prevalence for diseases that should be properly managed; besides, it is also gorged with corporate giants like IBM and Cerner, which continuously innovate and refine predictive analytics solutions. The projected cuts in healthcare costs amounting to USD 2.6 trillion are expected to fall on the U.S. over the next decade with the advent of value-based care.

The Asia Pacific region is acknowledged as one of the fastest-growing markets in the health predictive analytics industry. The growth is driven by the rapid adoption of electronic health records coupled with an ever-increasing volume of healthcare data that is generated by a large and highly heterogeneous population. Countries such as China and India are also now beginning to make e-health measures to manage the data efficiently. Governmental support for efficient and more effective health systems also propels the implementation of predictive analytics.

The region will witness a compound annual growth rate of approximately 31.79% from 2024 to 2032, reflecting the growing demand for healthcare services in data-driven products.

Moreover, the growing interest in personalized medicine as well as value-based care has raised the bar of health care organizations to embrace predictive analytics tools. Predictive analytics tools are powerful as well as efficient because they facilitate healthcare providers in analyzing patient data more effectively, allowing them to enhance decision-making processes and overall quality of patient outcomes. Technological advancement, increasingly high volumes of healthcare data, and the need for efficient as well as cost-effective healthcare solutions will fuel the expansive growth of the healthcare predictive analytics market.

Need Any Customization Research On Healthcare Predictive Analytics Market- Inquiry Now

Key Players

IBM Watson Health (IBM Watson for Oncology, IBM Watson Health Population Health Insights)

Optum (UnitedHealth Group) (OptumIQ, Optum Care Coordination)

Cerner Corporation (Cerner HealtheIntent, Cerner PowerChart)

SAS Institute (SAS Visual Analytics, SAS Health Outcomes Analytics)

Epic Systems Corporation (Epic Health Planet, Epic Cogito)

McKesson Corporation (McKesson Analytics Explorer, InterQual)

Oracle Health Sciences (Oracle Health Analytics, Oracle Healthcare Foundation)

Cognizant Technology Solutions (TriZetto Facets Analytics, Cognizant Health Insights)

Allscripts Healthcare Solutions (Allscripts Analytics,dbMotion)

Health Catalyst (Health Catalyst Data Operating System, Population Health Suite)

GE Healthcare (GE Health Cloud, Edison AI)

Philips Healthcare (Philips IntelliVue Guardian,Philips HealthSuite)

Siemens Healthineers (AI-Rad Companion, teamplay Insights)

Truven Health Analytics (Truven Micromedex, Truven MarketScan)

MEDai (a LexisNexis company) (Pinpoint Review,Pinpoint Care Management )

Flatiron Health (OncoEMR, Flatiron Clinico-Genomic Database)

Inovalon (Inovalon ONE Platform,Risk Score Analytics)

Ayasdi (SymphonyAI) (Ayasdi Care,SymphonyAI Eureka)

Zebra Medical Vision (Zebra Medical Insights,Textray)

Lumiata (Lumiata Risk Matrix, Lumiata Clinical AI)

Key Market Suppliers

Intel Corporation

Microsoft Azure

Amazon Web Services (AWS)

NVIDIA Corporation

Red Hat (IBM subsidiary)

SAP SE

Cloudera

Snowflake

VMware

Hewlett Packard Enterprise (HPE)

Recent Developments

In May 2024, mPulse introduced a new predictive analytics and engagement solution, which reported robust growth in the first quarter of 2024. This growth is primarily driven by improvements in automation and efficiency across its various business units such as omnichannel engagement and health portals.

In Feb 2023, Researchers at Corewell Health recently demonstrated how their predictive analytics tool has proven to be highly successful in the identification of patients at risk of readmission. This initiative saved over 200 patient readmissions for the organization and has been instrumental in saving costs of about USD 5 million to the organization.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.02 Billion |

| Market Size by 2032 | US$ 126.15 Billion |

| CAGR | CAGR of 27.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Operations Management, Financial, Population Health, Clinical) •by End-Use (Payers, providers, Life Science Industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Celonis GmbH, SAP SE, Software AG, UiPath, IBM Corporation, ABBYY, Microsoft Corporation, Apromore, Fluxion, QPR Software, Signavio, ProcessGold, Lana Labs, Process Street, Icaro Tech, Epicor. |

| Key Drivers | •Healthcare Cost Inflation and the Pressure for Operating Efficiency •An acceleration of the shift from fee-for-service to value-based care models is fostering an increasing adoption of predictive analytics |

| Restraints | •Privacy and Security Issues as Obstacles to the Implementation of Predictive Analytics •Legacy systems and problems of integration are hindering the market's expansion |

Ans- The Healthcare Predictive Analytics Market was valued at USD 14.02 billion in 2023 and is expected to reach USD 126.15 billion by 2032.

Ans – The CAGR rate of the Healthcare Predictive Analytics Market during 2024-2032 is 27.67%.

Ans- The financial segment dominated the market by 35.50%

Ans- North America held the largest revenue share by 44.94%.

Ans-Asia Pacific is the fastest-growing region in the Healthcare Predictive Analytics Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Software

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare Predictive Analytics Market Segmentation, by Application

7.1 Chapter Overview

7.2 Operations Management

7.2.1 Operations Management Market Trends Analysis (2020-2032)

7.2.2 Operations Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Demand Forecasting

7.2.3.1 Demand Forecasting Market Trends Analysis (2020-2032)

7.2.3.2 Demand Forecasting Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Workforce Planning and Scheduling

7.2.4.1 Workforce Planning and Scheduling Market Trends Analysis (2020-2032)

7.2.4.2 Workforce Planning and Scheduling Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Inpatient Scheduling

7.2.5.1 Inpatient Scheduling Market Trends Analysis (2020-2032)

7.2.5.2 Inpatient Scheduling Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Outpatient Scheduling

7.2.6.1 Outpatient Scheduling Market Trends Analysis (2020-2032)

7.2.6.2 Outpatient Scheduling Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Financial

7.3.1 Financial Market Trends Analysis (2020-2032)

7.3.2 Financial Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Revenue Cycle Management

7.3.3.1 Revenue Cycle Management Market Trends Analysis (2020-2032)

7.3.3.2 Revenue Cycle Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Fraud Detection

7.3.4.1 Fraud Detection Market Trends Analysis (2020-2032)

7.3.4.2 Fraud Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Other Financial Applications

7.3.5.1 Other Financial Applications Market Trends Analysis (2020-2032)

7.3.5.2 Other Financial Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Population Health Market

7.4.1 Population Health Market Trends Analysis (2020-2032)

7.4.2 Population Health Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 Population Risk Management Market

7.4.3.1 Population Risk Management Market Trends Analysis (2020-2032)

7.4.3.2 Population Risk Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Patient Engagement Market

7.4.4.1 Patient Engagement Market Trends Analysis (2020-2032)

7.4.4.2 Patient Engagement Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Population Therapy Management Market

7.4.5.1 Population Therapy Management Market Trends Analysis (2020-2032)

7.4.5.2 Population Therapy Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.6 Other Application Market

7.4.6.1 Other Application Market Trends Analysis (2020-2032)

7.4.6.2 Other Application Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Clinical

7.5.1 Clinical Market Trends Analysis (2020-2032)

7.5.2 Clinical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5.3 Quality Benchmarking

7.5.3.1 Quality Benchmarking Market Trends Analysis (2020-2032)

7.5.3.2 Quality Benchmarking Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5.4 Patient Care Enhancement

7.5.4.1 Patient Care Enhancement Market Trends Analysis (2020-2032)

7.5.4.2 Patient Care Enhancement Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5.5 Clinical Outcome Analysis and Management

7.5.5.1 Clinical Outcome Analysis and Management Market Trends Analysis (2020-2032)

7.5.5.2 Clinical Outcome Analysis and Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare Predictive Analytics Market Segmentation, by End User

8.1 Chapter Overview

8.2 Payers

8.2.1 Payers Market Trends Analysis (2020-2032)

8.2.2 Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Providers

8.3.1 Providers Market Trends Analysis (2020-2032)

8.3.2 Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Life Science Industry

8.4.1 Life Science Industry Market Trends Analysis (2020-2032)

8.4.2 Life Science Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.4 North America Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5.2 USA Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6.2 Canada Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Mexico Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5.2 Poland Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6.2 Romania Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.4 Western Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5.2 Germany Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6.2 France Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7.2 UK Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8.2 Italy Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9.2 Spain Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Healthcare Predictive Analytic Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12.2 Austria Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.4 Asia Pacific Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 China Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 India Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 Japan Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6.2 South Korea Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Vietnam Healthcare Predictive Analytic Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8.2 Singapore Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9.2 Australia Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.4 Middle East Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5.2 UAE Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.4 Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Healthcare Predictive Analytics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.4 Latin America Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5.2 Brazil Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6.2 Argentina Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7.2 Colombia Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Healthcare Predictive Analytics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Healthcare Predictive Analytics Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10. Company Profiles

10.1 IBM Watson Health

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Optum

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Cerner Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 SAS Institute

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Oracle Health Sciences

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Cognizant Technology Solutions

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Allscripts Healthcare Solutions

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Health Catalyst

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 GE Healthcare

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Philips Healthcare

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Healthcare Predictive Analytics Market, By Application

Operations Management

Demand Forecasting

Workforce Planning and Scheduling

Inpatient Scheduling

Outpatient Scheduling

Financial

Revenue Cycle Management

Fraud Detection

Other Financial Applications

Population health

Population Risk Management

Patient Engagement

Population Therapy Management

Other Applications

Clinical

Quality Benchmarking

Patient Care Enhancement

Clinical Outcome Analysis and Management

Healthcare Predictive Analytics by End-Use

Payers

Providers

Life Science Industry

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Healthcare EDI Market Size was valued at USD 4.5 Billion in 2023 and is expected to reach USD 10.2 Billion by 2032, growing at a CAGR of 9.6% over the forecast period 2024-2032.

Oxidative Stress Assay Market was valued at USD 1.09 billion in 2023 and is expected to reach USD 2.49 billion by 2032, growing at a CAGR of 9.53% from 2024-2032.

The HbA1c Testing Devices Market was valued at USD 1.72 billion in 2023, projected to grow to USD 3.18 billion by 2032 at a 7.10% CAGR.

Sepsis Diagnostics Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.5 billion by 2032, growing at a CAGR of 8.6% from 2024 to 2032.

The Monoclonal Antibody Therapy Market size was valued at USD 87.8 Bn in 2023 and is expected to reach USD 230.38 Bn by 2031 with a growing CAGR of 12.8% Over the Forecast Period of 2024-2031.

The Pet Dental Health Market was valued at USD 7.46 billion in 2023 and is expected to reach USD 14.2 billion by 2032, growing at a CAGR of 7.42% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone