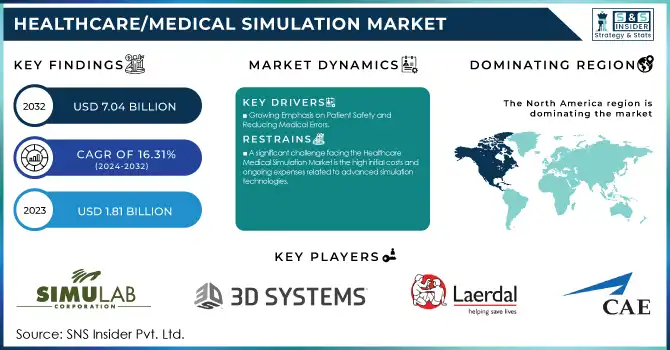

The Healthcare/Medical Simulation Market size was valued at USD 1.81 billion in 2023 and is projected to reach USD 7.04 billion by 2032, growing at a CAGR of 16.31% from 2024 to 2032.

Get more information on Healthcare/Medical Simulation Market - Request Sample Report

The healthcare/medical simulation market has seen remarkable growth due to the increasing complexity of medical procedures and the need for effective training solutions. According to the U.S. Department of Health and Human Services, the shortage of healthcare workers is expected to reach 3.2 million by 2026, particularly in areas like nursing and primary care, which underscores the need for scalable, efficient training methods. The medical simulation addresses this challenge by providing realistic, immersive training environments that help medical professionals refine their skills without the risk of harm to real patients.

For example, the use of virtual reality in healthcare simulations has proven highly effective. Studies show that VR-based simulations allow healthcare professionals to practice surgeries, such as complex spinal procedures, in a safe, controlled environment. A study published in the Journal of Surgical Education demonstrated that VR-based training significantly improved the proficiency of medical students in performing spinal surgeries, compared to traditional training methods. Additionally, the University of California, Los Angeles has integrated augmented reality into their medical curriculum to simulate patient scenarios, providing real-time feedback to students while enhancing their decision-making abilities.

In terms of reducing medical errors, simulation training has been shown to improve outcomes in critical care settings. The Agency for Healthcare Research and Quality highlights that simulation-based education, such as that used by the U.S. military’s "Combat Medic" training programs, has led to a 20-30% reduction in procedural errors. These error reductions are not limited to the military, with hospitals worldwide implementing similar programs, such as simulation-based training for emergency room staff to handle high-stress situations like cardiac arrests.

Moreover, the growing integration of e-learning platforms in medical simulations is enhancing accessibility. In a study by the National Center for Biotechnology Information, it was found that 82% of healthcare professionals reported that online medical simulation training significantly improved their clinical skills and knowledge retention, especially during the COVID-19 pandemic when remote learning became essential.

The U.S. National Institutes of Health also supports innovation in medical simulations. For instance, the NIH’s funded projects have focused on developing medical simulators for specific specialties, such as obstetrics, to better train healthcare workers on rare, life-threatening scenarios that may not be regularly encountered in clinical settings. This not only helps in skill enhancement but also ensures that healthcare professionals are better prepared for a wide array of emergencies.

Drivers

Growing Emphasis on Patient Safety and Reducing Medical Errors

With patient safety becoming a top priority in healthcare, the demand for solutions that can effectively mitigate medical errors is increasing. Medical simulation plays a pivotal role in enhancing patient safety by offering healthcare professionals the opportunity to practice complex procedures in a risk-free environment. By simulating real-life scenarios, medical simulation allows doctors, nurses, and technicians to make critical decisions, hone their skills, and perform procedures without risking harm to actual patients. Studies have shown that healthcare professionals who undergo simulation-based training experience a significant reduction in medical errors, improving overall patient outcomes. The adoption of these simulations in healthcare facilities and medical schools is seen as an essential step toward ensuring that clinicians are well-prepared to handle high-risk situations. This focus on patient safety, combined with the reduced cost of training through simulation, is a major driver of the healthcare simulation market's growth.

Technological advancements in virtual reality, augmented reality, and artificial intelligence are transforming medical simulations into highly immersive and realistic training tools.

VR and AR technologies, in particular, enable medical professionals to experience lifelike scenarios and practice intricate procedures that are often too risky or costly to perform in real-life training. These innovations allow for more interactive and engaging learning experiences, where healthcare workers can practice surgeries, emergency responses, or diagnostic procedures multiple times without limitation. AI-powered simulations are also helping to create more personalized training experiences by adapting to the learner’s skill level and providing real-time feedback. The ongoing integration of these cutting-edge technologies not only enhances the efficacy of training but also ensures that healthcare workers are better prepared for the dynamic nature of patient care. As these technologies continue to evolve, they are becoming a key driver of growth in the healthcare simulation market.

Increased Demand for Healthcare Workers Amid Global Shortages:

The growing demand for healthcare services, driven by factors such as an aging global population, increasing rates of chronic diseases, and expanding access to healthcare, has led to significant pressure on the healthcare workforce. According to reports from the World Health Organization and other health bodies, the global shortage of healthcare professionals is projected to worsen in the coming years. This shortage is prompting the healthcare sector to seek innovative solutions for training and upskilling a larger workforce in less time. Medical simulation is proving to be an efficient and effective method for rapidly training healthcare professionals, ensuring that they acquire essential skills before working with patients. By allowing healthcare workers to practice and master critical procedures in a controlled environment, simulations help to reduce the time required for training while increasing workforce productivity. As the demand for healthcare workers continues to rise, the healthcare simulation market is expected to experience significant growth in response.

Restraints

A significant challenge facing the Healthcare/Medical Simulation Market is the high initial costs and ongoing expenses related to advanced simulation technologies.

While these tools offer considerable advantages in training efficiency and patient safety, the substantial investment required for high-quality simulators, virtual reality and augmented reality systems, and artificial intelligence-powered solutions can be a barrier, particularly for smaller healthcare institutions or educational providers. In addition, the ongoing costs for maintenance, software updates, and the need for specialized personnel to operate the equipment can further strain budgets. For healthcare organizations, especially in developing regions, these financial constraints limit the widespread adoption of simulation technologies. The expense of integrating these systems into existing training programs also poses a challenge. As a result, the high costs associated with medical simulations hinder their broader implementation, potentially slowing the market's growth in certain healthcare settings.

By Product & Services

In 2023, Healthcare Anatomical Models dominated the Healthcare/Medical Simulation Market with a 38.2% share. This segment has a strong presence due to the widespread use of physical models in medical schools, hospitals, and training facilities for realistic practice. Anatomical models, which allow learners to study and manipulate human anatomy tangibly, have been integral to hands-on training for various medical disciplines, including surgery, emergency care, and more. They are especially prevalent in academic institutions and hospital training programs where practical learning is crucial.

The Healthcare Simulation Software segment emerged as the fastest-growing segment throughout the forecast period. This growth is primarily driven by the increasing demand for advanced, scalable, and cost-effective solutions to enhance medical training. Healthcare simulation software enables the creation of realistic virtual patient scenarios and procedural training, allowing healthcare professionals to practice and refine their skills in a safe, controlled environment. The segment has experienced significant adoption across medical schools, hospitals, and healthcare training institutions as it provides a versatile platform for training without the need for expensive physical equipment. Additionally, the software’s ability to integrate with virtual reality and augmented reality technologies is accelerating its growth.

By Technology

In 2023, 3D Printing technology dominated the healthcare simulation market with a 42.3% share. The ability to create customized, patient-specific anatomical models and surgical simulators using 3D printing has revolutionized medical training. This technology allows healthcare professionals to work with highly accurate, tangible models, making it easier to plan surgeries, practice procedures, and study complex anatomical structures. The use of 3D printing is particularly prominent in surgical training, where precision and personalization are crucial. It is also gaining traction for creating prosthetics and implants tailored to individual patient needs.

Virtual Patient Simulation technology is the fastest-growing segment within healthcare simulation. This technology allows for the creation of realistic, interactive virtual patient scenarios, where medical professionals can diagnose, treat, and manage complex cases in a simulated environment. It enables learners to experience a wide range of medical conditions and procedures without the risks associated with live patient care. The fast adoption of virtual patient simulations can be attributed to the increasing demand for immersive, scenario-based training in academic institutions and healthcare settings. It supports diverse training needs, including emergency care, surgery, and diagnostics.

Regional Outlook

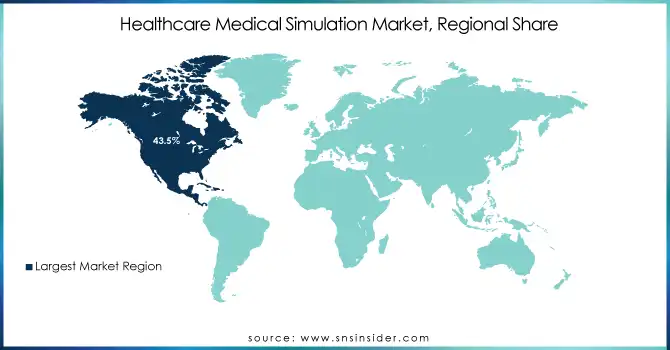

North America held a dominant position in the market in 2023, with a 43.5% share. The region benefits from a robust healthcare infrastructure, high adoption of simulation technologies, and significant investments in medical training. For example, the U.S. Department of Defense has heavily invested in simulation technologies for military medical personnel training, with virtual patient simulations and procedural rehearsal technologies becoming standard in both military and civilian medical settings. Additionally, the rise of simulation-based training programs in hospitals, such as the Mayo Clinic's use of simulation for surgical education, further contributes to North America's leadership in the market.

Europe is another significant region, where countries like the UK, Germany, and France are investing in healthcare simulation technologies to enhance medical education and improve patient outcomes. The UK’s National Health Service (NHS) has been incorporating medical simulation to train healthcare professionals in a range of disciplines, from emergency care to surgery. In Germany, universities and medical institutions are increasingly adopting 3D printing for creating anatomical models and training simulators. As Europe continues to emphasize patient safety and healthcare workforce development, it remains a critical market.

The Asia-Pacific region is the fastest-growing, with countries like China, India, and Japan leading the expansion. For instance, China’s government is investing in simulation-based medical education programs as part of its effort to modernize healthcare and improve healthcare worker competency. In India, institutions such as the All India Institute of Medical Sciences (AIIMS) have integrated medical simulation to address the shortage of hands-on clinical training opportunities. The APAC region is expected to see rapid growth in simulation technologies due to rising healthcare demands and the need for a skilled workforce.

Need any customization research on Healthcare/Medical Simulation Market - Enquiry Now

Key Players

CAE, Inc. (Canada)

Laerdal Medical (Norway)

3D Systems, Inc. (United States)

Simulab Corporation (United States)

Limbs & Things Ltd (United Kingdom)

Simulaids (United Kingdom)

Kyoto Kagaku Co., Ltd (Japan)

Gaumard Scientific (United States)

Mentice (Sweden)

Surgical Science Sweden AB (Sweden)

Intelligent Ultrasound (United Kingdom)

Operative Experience, Inc. (United States)

Cardionics, Inc. (United States)

VirtaMed AG (Switzerland)

SYNBONE AG (Switzerland)

IngMar Medical (United States)

TruCorp (Ireland)

Recent Development

In Oct 2024, The Orlando VA Healthcare System (OVAHCS) introduced an advanced chaplaincy simulation training program, enhancing the integration of spiritual care within clinical practice through immersive, hands-on experiences.

In Aug 2024, HCA Healthcare pledged USD 500,000 to Nova Southeastern University (NSU) to support the creation of a clinical simulation lab for its nurse anesthesiology program. This donation is part of HCA Healthcare’s broader USD 10 million commitment over three years to HBCUs and Hispanic-serving institutions.

In Jan 2024, GigXR, Inc. partnered with CAE Healthcare to enhance clinical training through multimodal simulation, integrating analog, immersive, and digital techniques for medical and nursing schools, hospitals, and first responders. The collaboration aims to streamline simulation management and implementation, with its potential showcased at IMSH 2024.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.81 Billion |

| Market Size by 2032 | USD 7.04 Billion |

| CAGR | CAGR of 16.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Services [Healthcare Anatomical Models (Type 1, Patient Simulators {Adult, Pediatrics and Baby Care}, Task Trainers, Fidelity (Low-fidelity, Medium-fidelity, High-fidelity), Type 2 (Interventional/Surgical Simulators {Laparoscopic Surgical Simulators, Gynecology Simulators, Cardiovascular Simulators, Arthroscopic Surgical Simulators, Spine Surgical Simulators, Other Interventional/Surgical Simulators}, Endovascular Simulators, Ultrasound Simulators, Dental Simulators, Eye Simulators), Healthcare Simulation Software, Simulation Training Services] • By Technology [Virtual Patient Simulation, 3D Printing, Procedure Rehearsal Technology] • By End Use [Academic Institutes, Hospitals, Military Organizations, Research (Medical Device Companies, Others)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CAE, Inc., Laerdal Medical, 3D Systems, Inc., Simulab Corporation, Limbs & Things Ltd, Simulaids, Kyoto Kagaku Co., Ltd, Gaumard Scientific, Mentice, Surgical Science Sweden AB, Intelligent Ultrasound, Operative Experience, Inc., Cardionics, Inc., VirtaMed AG, SYNBONE AG, IngMar Medical, TruCorp, KaVo Dental, Simendo, Haag-Streit, Symgery, HRV Simulation, Synaptive Medical, Inovus Limited. |

| Key Drivers | • Growing Emphasis on Patient Safety and Reducing Medical Errors • Technological advancements in virtual reality, augmented reality, and artificial intelligence are transforming medical simulations into highly immersive and realistic training tools. • Increased Demand for Healthcare Workers Amid Global Shortages |

| Restraints | • A significant challenge facing the Healthcare/Medical Simulation Market is the high initial costs and ongoing expenses related to advanced simulation technologies. |

Ans: The Healthcare/Medical Simulation market size was valued at USD 1.81 Bn in 2023.

Virtual Patient Simulation, 3D Printing, Procedure Rehearsal Technology are the sub segments of Healthcare/Medical Simulation market

Key drivers of the Healthcare/Medical Simulation Market is medical education is becoming more technologically advanced, the desire for minimally invasive treatments is increasing.

Healthcare/Medical Simulation is a teaching and review technique in which learners use tools and models like virtual reality to practice tasks and processes in realistic settings and scenarios.

Ans: The Healthcare/Medical Simulation Market is to grow at a CAGR of 16.31% over the forecast period 2024-2032.

Table of contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption Trends (2023-2032)

5.2 Regulatory Trends

5.3 Sustainability Trends (2023-2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and Promotional Activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare/Medical Simulation Market Segmentation, by Product & Services

7.1 Chapter Overview

7.2 Healthcare Anatomical Models

7.2.1 Healthcare Anatomical Models Market Trends Analysis (2020-2032)

7.2.2 Healthcare Anatomical Models Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Type 1

7.2.3.1 Type 1 Market Trends Analysis (2020-2032)

7.2.3.2 Type 1 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3 Patient Simulators

7.2.3.3.1 Patient Simulators Market Trends Analysis (2020-2032)

7.2.3.3.2 Patient Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3.3 Adult

7.2.3.3.3.1 Adult Market Trends Analysis (2020-2032)

7.2.3.3.3.2 Adult Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3.4 Pediatrics and Baby Care

7.2.3.3.4.1Pediatrics and Baby Care Market Trends Analysis (2020-2032)

7.2.3.3.4.2 Pediatrics and Baby Care Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Task Trainers

7.2.4.1 Task Trainers Market Trends Analysis (2020-2032)

7.2.4.2 Task Trainers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Fidelity

7.2.5.1 Fidelity Market Trends Analysis (2020-2032)

7.2.5.2 Fidelity Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5.3 Low-fidelity

7.2.5.3.1 Low-fidelity Market Trends Analysis (2020-2032)

7.2.5.3.2 Low-fidelity Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5.4 Medium-fidelity

7.2.5.4.1 Medium-fidelity Market Trends Analysis (2020-2032)

7.2.5.4.2 Medium-fidelity Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5.5 High-fidelity

7.2.5.5.1 High-fidelity Market Trends Analysis (2020-2032)

7.2.5.5.2 High-fidelity Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Type 2

7.2.6.1 Type 2 Market Trends Analysis (2020-2032)

7.2.6.2 Type 2 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3 Interventional/Surgical Simulators

7.2.6.3.1 Interventional/Surgical Simulators Market Trends Analysis (2020-2032)

7.2.6.3.2 Interventional/Surgical Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3.3 Laparoscopic Surgical Simulators

7.2.6.3.3.1 Laparoscopic Surgical Simulators Market Trends Analysis (2020-2032)

7.2.6.3.3.2 Laparoscopic Surgical Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3.4 Gynecology Simulators

7.2.6.3.4.1 Gynecology Simulators Market Trends Analysis (2020-2032)

7.2.6.3.4.2 Gynecology Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3.5 Cardiovascular Simulators

7.2.6.3.5.1 Cardiovascular Simulators Market Trends Analysis (2020-2032)

7.2.6.3.5.2 Cardiovascular Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3.6 Arthroscopic Surgical Simulators

7.2.6.3.6.1 Arthroscopic Surgical Simulators Market Trends Analysis (2020-2032)

7.2.6.3.6.2 Arthroscopic Surgical Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3.7 Spine Surgical Simulators

7.2.6.3.7.1 Spine Surgical Simulators Market Trends Analysis (2020-2032)

7.2.6.3.7.2 Spine Surgical Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6.3.8 Other Interventional/Surgical Simulators

7.2.6.3.8.1 Other Interventional/Surgical Simulators Market Trends Analysis (2020-2032)

7.2.6.3.8.2 Other Interventional/Surgical Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Endovascular Simulators

7.2.7.1 Endovascular Simulators Market Trends Analysis (2020-2032)

7.2.7.2 Endovascular Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.8 Ultrasound Simulators

7.2.8.1 Ultrasound Simulators Market Trends Analysis (2020-2032)

7.2.8.2 Ultrasound Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.9 Dental Simulators

7.2.9.1 Dental Simulators Market Trends Analysis (2020-2032)

7.2.9.2 Dental Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.10 Eye Simulators

7.2.10.1 Eye Simulators Market Trends Analysis (2020-2032)

7.2.10.2 Eye Simulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Healthcare Simulation Software

7.3.1 Healthcare Simulation Software Market Trends Analysis (2020-2032)

7.3.2 Healthcare Simulation Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Simulation Training Services

7.4.1 Simulation Training Services Market Trends Analysis (2020-2032)

7.4.2 Simulation Training Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare/Medical Simulation Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Virtual Patient Simulation

8.2.1 Virtual Patient Simulation Market Trends Analysis (2020-2032)

8.2.2 Virtual Patient Simulation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 3D Printing

8.3.1 3D Printing Market Trends Analysis (2020-2032)

8.3.2 3D Printing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Procedure Rehearsal Technology

8.4.1 Procedure Rehearsal Technology Market Trends Analysis (2020-2032)

8.4.2 Procedure Rehearsal Technology Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Healthcare/Medical Simulation Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Academic Institutes

9.2.1 Academic Institutes Market Trends Analysis (2020-2032)

9.2.2 Academic Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Hospitals

9.3.1 Hospitals Market Trends Analysis (2020-2032)

9.3.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Military Organizations

9.4.1 Military Organizations Market Trends Analysis (2020-2032)

9.4.2 Military Organizations Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Research

9.5.1 Research Market Trends Analysis (2020-2032)

9.5.2 Research Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.3 Medical Device Companies

9.5.3.1 Medical Device Companies Market Trends Analysis (2020-2032)

9.5.3.2 Medical Device Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.4 Others

9.5.4.1 Others Market Trends Analysis (2020-2032)

9.5.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.2.4 North America Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.2.6.2 USA Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.2.7.2 Canada Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.2.8.2 Mexico Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.1.6.2 Poland Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.1.7.2 Romania Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 turkey

10.3.1.9.1 Turkey Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.4 Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.6.2 Germany Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.7.2 France Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.8.2 UK Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.9.2 Italy Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.10.2 Spain Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.13.2 Austria Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.4 Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.6.2 China Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.7.2 India Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.8.2 Japan Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.9.2 South Korea Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.10.2 Vietnam Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.11.2 Singapore Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.12.2 Australia Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.1.4 Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.1.6.2 UAE Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.2.4 Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.6.4 Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.6.6.2 Brazil Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.6.7.2 Argentina Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.6.8.2 Colombia Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by Product & Services (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Healthcare/Medical Simulation Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 CAE, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product / Services Offered

11.1.4 SWOT Analysis

11.2 Laerdal Medical

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product / Services Offered

11.2.4 SWOT Analysis

11.3 3D Systems, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product / Services Offered

11.3.4 SWOT Analysis

11.4 Simulab Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product / Services Offered

11.4.4 SWOT Analysis

11.5 Limbs & Things Ltd

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product / Services Offered

11.5.4 SWOT Analysis

11.6 Kyoto Kagaku Co., Ltd

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product / Services Offered

11.6.4 SWOT Analysis

11.7 Surgical Science Sweden AB

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product / Services Offered

11.7.4 SWOT Analysis

11.8 Intelligent Ultrasound

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product / Services Offered

11.8.4 SWOT Analysis

11.9 Cardionics, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product / Services Offered

11.9.4 SWOT Analysis

11.10 IngMar Medical

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product / Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product & Services

Healthcare Anatomical Models

Type 1

Patient Simulators

Adult

Pediatrics and Baby Care

Task Trainers

Fidelity

Low-fidelity

Medium-fidelity

High-fidelity

Type 2

Interventional/Surgical Simulators

Laparoscopic Surgical Simulators

Gynecology Simulators

Cardiovascular Simulators

Arthroscopic Surgical Simulators

Spine Surgical Simulators

Other Interventional/Surgical Simulators

Endovascular Simulators

Ultrasound Simulators

Dental Simulators

Eye Simulators

Healthcare Simulation Software

Simulation Training Services

By Technology

Virtual Patient Simulation

3D Printing

Procedure Rehearsal Technology

By End Use

Academic Institutes

Hospitals

Military Organizations

Research

Medical Device Companies

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Medication Management Market Size was valued at USD 7.08 Billion in 2023 and is expected to reach USD 13.37 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.

Toxicity Testing Outsourcing Market Size was valued at USD 3.76 Billion in 2023 and is expected to reach USD 8.28 Billion by 2032, growing at a CAGR of 9.2%.

Dermatology Devices Market Size was valued at USD 15.2 Billion in 2023 and is expected to reach USD 40.56 Billion by 2032, growing at a CAGR of 11.54% over the forecast period 2024-2032.

Immunoassay Analyzers Market was valued at USD 7.55 billion in 2023, expected to reach USD 10.16 billion by 2032, growing at a CAGR of 3.38% from 2024-2032.

The Oncology Companion Diagnostic Market, valued at USD 4.12 billion in 2023, projected to grow to USD 10.60 billion by 2032 at an 11.09% CAGR.

The Consumer Genomics Market Size was valued at USD 1.5 Billion in 2023, projected to grow at at a CAGR of 24.6% to reach USD 10.8 Billion by 2032.

Hi! Click one of our member below to chat on Phone