Get more information on Healthcare IT Outsourcing Market - Request Sample Report

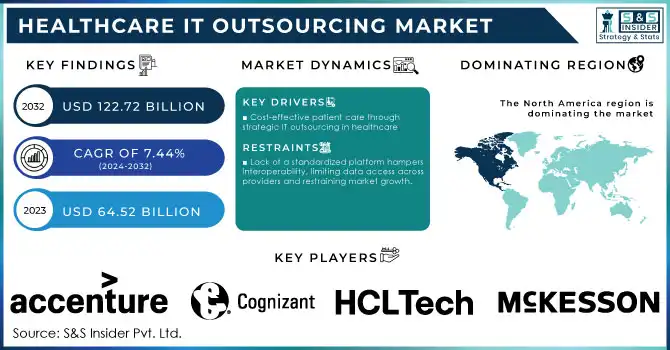

The Healthcare IT Outsourcing Market Size was valued at USD 64.52 billion in 2023 and is expected to reach USD 122.72 billion by 2032 and grow at a CAGR of 7.44% over the forecast period 2024-2032.

The healthcare industry is increasingly adopting IT outsourcing as part of its digital transformation to improve operational efficiency and reduce costs. Healthcare organizations are outsourcing critical functions such as pharmacy information management, revenue cycle management, electronic health records (EHR), inventory management, and laboratory information systems to specialized service providers. This shift allows healthcare providers to focus on patient care while ensuring that their IT systems are secure, scalable, and up-to-date. The growth of healthcare IT outsourcing is driven by the need for advanced technology solutions, compliance with regulatory requirements, and the growing complexity of healthcare systems. Benefits include cost reduction, improved service quality, and access to specialized expertise, positioning IT outsourcing as a key enabler for the future of healthcare.

Healthcare IT outsourcing companies are well-positioned to meet these emerging requirements by offering EHR management, cybersecurity, telemedicine platforms, and analytics expertise. By outsourcing, healthcare providers can focus on core medical functions but harness cutting-edge technology, scalability, and flexibility in meeting ever-changing and shifting market demand. IT outsourcing is a strategic step toward the final objective of optimum digital transformation in healthcare operations when improving patient outcomes and releasing operational tensions become objectives for healthcare organizations.

Outsourcing healthcare IT to industry leaders enables the migration of operations to digital platforms, where efficient data management becomes essential. This shift allows healthcare providers to focus on patient care while ensuring secure, scalable, and compliant management of critical information. However, the sector is facing higher cybersecurity risks: the hacking within an organization and also around some of these high-profile cases that occurred, including the ransomware attack on Cognizant last year that carried enormous recovery costs. Data are continuously produced by healthcare providers about patient records and payment systems, and such a demand calls for robust data processing and storage infrastructure that help facilitate smooth and efficient handling of its operations.

Cost pressures and efforts toward better cash flow in the back-office administration and IT systems together with encouraging government initiatives in general around the world are drivers fueling growth in the healthcare IT outsourcing market. For example, the USD 1.5 billion investment by Microsoft in Italy is targeting digital infrastructure and cybersecurity. It depicts the global shift towards digitizing health services. Another step of digitizing medical records can be seen in the Indian National Digital Health Mission, through which people even from the remotest corners can access proper health services easily. However, a few issues continue to persist therein, such as the security of data an inadequate standardized IT platform, or poor performance. Nevertheless, with general government support and the growing focus on healthcare digital solutions, government health IT outsourcing will enjoy a solid growth trend in the future.

| Trend | Impact on the Market |

|---|---|

| Cloud-based healthcare solutions | Reduces infrastructure costs, and enhances scalability. |

| Artificial Intelligence (AI) | Enhances data analysis, decision support systems |

| Blockchain technology | Improves data security and patient data management |

| Telemedicine integration | Expands patient care reach, especially in remote areas |

| Big data analytics | Optimizes operations, improves decision-making |

Drivers

One of the primary drivers for healthcare IT outsourcing is increased pressure to reduce healthcare costs without compromising levels of patient care. Therefore, cost-effective solutions that will provide quality service are what healthcare systems look for; and what has emerged in this respect is that the outsourcing of IT functions can be an effective way of managing operational costs. Delegating IT responsibilities allows health care providers to focus more on their core work—ensure excellent levels of patient care—while the technical complexity could be dealt with by the outsourcing partners.

Some of the advantages of outsourcing by healthcare organizations in providing state-of-the-art technologies with specialized know-how to handle diverse needs include bringing down capital expenditures to build in-house IT infrastructure and placing IT systems within the hands of experts who best know how to use them. On operations, this also reorganizes, allowing providers to quickly respond to new regulations and ensure full compliance with changing healthcare standards. This would help organizations flex their muscles according to changes in government policies, and the advantage of exploiting the best advancements in technology they can offer.

Restraints

Lack of a standardized platform hampers interoperability, limiting data access across providers and restraining market growth.

Rising data breaches and confidentiality risks, with 47% of 2022 breaches exposing sensitive information, hinder market expansion.

By Application

In 2023, the Provider IT Outsourcing segment led the market, capturing approximately 42.0% of the total market share. This is because there has been an increasing trend among most health providers, including hospitals and clinics, to outsource their IT functions to other specialized providers for full attention to their core clinical responsibilities. Beyond rising healthcare spending, more provider organizations are outsourcing services such as Electronic Health Records, cybersecurity, and telemedicine platforms. This will arm providers with the means to advance high-end technological offers combined with IT experience as this will create the possibility of security for patient data but with optimal operational efficiency—both of which are paramount in the digital health frontier. IT Infrastructure Outsourcing is the fastest-growing application, as healthcare organizations require scalable, secure, and cost-effective IT infrastructures. More and more, healthcare providers adopt cloud solutions, data centers, and IT security services to deal with huge volumes of sensitive patient data and ensure the reliability of the system. This is further complemented by the swift uptake of health digital tools, and seamless integration of data across healthcare networks two significant factors supporting strong growth in this segment.

By End User

The Hospital Information Systems (HIS) segment held the largest market share in 2023, accounting for approximately 47.0%. The strong demand for streamlined and integrated systems within hospitals, offering easy access to data, improvement of patient management, and increased operational efficiency is responsible for this level of dominance. Increasing demand from the side of hospitals to outsource IT for functions such as EHR, laboratory information systems, and revenue cycle management improves coordination, reduces administrative burdens, and upgrades the quality of patient care. The HIS segment will further be assisted by the government initiatives related to compulsory digital recording of health records, especially in North America and Europe. Pharmaceutical and Life Science Research will be the fastest-growing over the next few years. Presently, outsourcing for pharmaceutical and life sciences research is driven largely by the growing demand for advanced data analytics, AI-driven research tools, and a robust IT infrastructure for managing clinical data and trials. Phasor Innovations's focus on innovation in drug development requires that pharmaceutical firms outsource IT functions to manage large datasets, have enhanced research efficiencies, and reduce the time and costs associated with new products. More importantly, enhanced regulatory requirements for greater transparency of data, make it more important to have secure and compliant IT solutions, hence driving the market forward.

North America held the largest share of the healthcare IT outsourcing market in 2023. Driven by high levels of digital healthcare adoption, substantial healthcare IT spending, and supportive government policies for IT solutions in healthcare. For example, in July 2020, Allscripts and Microsoft Corp. strengthened their long-standing partnership to enhance the development and deployment of cloud-based healthcare IT solutions. These solutions, integrated with advanced analytics, aim to improve patient outcomes in hospitals globally.

The Asia Pacific region is also projected to experience significant growth in the healthcare IT outsourcing market, fueled by the rising adoption of healthcare IT solutions and supportive government initiatives. A notable development in the region occurred in July 2022, when GE Healthcare launched India’s first 5G Innovation Lab. The lab underscores the transformative potential of 5G in healthcare, offering high bandwidth, fast data speeds, low latency, and reliable connectivity. This technology is expected to advance patient care by reshaping diagnostics, therapy, and prognostics, further supporting the growth of healthcare IT outsourcing in the region.

Need any customization research on Healthcare IT Outsourcing Market - Enquiry Now

Tata Consultancy Services Limited (TCS) - iON Healthcare Solutions

Accenture PLC - myHealth Assistant, Synapse

Wipro Limited - HealthPlan, Wipro Healthcare Cloud

Cognizant Technology Solutions - Cognizant Healthcare Solutions

Hewlett-Packard Company (HP) - HP Healthcare IT Solutions

HCL Technologies - HCL Health and Life Sciences Solutions

McKesson Corporation - McKesson Enterprise Information Solutions

Allscripts Healthcare Solutions Inc. - Sunrise EHR, Allscripts CareInMotion

Dell Technologies Inc. - Dell Healthcare Cloud Solutions

Infosys Limited - Infosys Healthcare Solutions

International Business Machines (IBM) - IBM Watson Health

Koninklijke Philips N.V. - Philips HealthSuite

Optum Inc. (UnitedHealth Group Incorporated) - Optum360, OptumRx

Siemens Healthineers AG - Siemens Healthineers Digital Health Solutions

In Aug 2024, Sonata Software secured an IT Outsourcing Contract with a US Premier Healthcare and Wellness Company.

In September 2023, Accenture acquired Nautilus Consulting, a prominent UK-based digital healthcare consultancy known for its expertise in electronic patient record (EPR) solutions.

In February 2023, Allscripts Healthcare Solutions Inc. partnered with HealthVerity to enhance real-world evidence and improve care for patients with cardiovascular disease and diabetes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 64.52 billion |

| Market Size by 2032 | US$ 122.72 billion |

| CAGR | CAGR of 7.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Provider IT Outsourcing, Payer IT Outsourcing, IT Infrastructure Outsourcing, Life Science IT Outsourcing, Operation IT Outsourcing) •By End User (Hospital Information Systems, Pharmaceutical, and Life Science Research) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Consultancy Services Limited (TCS), Accenture PLC, Wipro Limited, Cognizant Technology Solutions, Hewlett-Packard Company (HP), HCL Technologies, McKesson Corporation, Allscripts Healthcare Solutions Inc., Dell Technologies Inc., Infosys Limited, International Business Machines (IBM), Koninklijke Philips N.V., Optum Inc. (UnitedHealth Group Incorporated), Siemens Healthineers AG |

| Key Drivers | • Cost-effective patient care through strategic IT outsourcing in healthcare |

| Restraints | • Lack of a standardized platform hampers interoperability, limiting data access across providers and restraining market growth. • Rising data breaches and confidentiality risks, with 47% of 2022 breaches exposing sensitive information, hinder market expansion. |

Ans. The Health Insurance Exchange Market Size was valued at USD 64.52 Billion in 2023.

Ans: The key drivers are Organizations providing accountable care, Costs of Operations Are Reduced and Increasing Demand for Healthcare IT Integration.

Ans. Due to its developed healthcare system, rising prevalence of chronic conditions, and increasingly informed customer base, North America is predicted to have the market's strongest growth.

Ans. exaware – Allscripts Healthcare, LLC, Carestream Health, eClinicalWorks, Agfa-Gevaert Group, GENERAL ELECTRIC, Cerner Corporation, athenahealth are the key players of Health Insurance Exchange market.

Ans: The Healthcare IT Outsourcing Market is to grow at a CAGR of 7.44% over the forecast period 2024-2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Software

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare IT Outsourcing Market Segmentation, by Application

7.2 Provider IT Outsourcing

7.2.1 Provider IT Outsourcing Market Trends Analysis (2020-2032)

7.2.2 Provider IT Outsourcing Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Payer IT Outsourcing

7.3.1 Payer IT Outsourcing Market Trends Analysis (2020-2032)

7.3.2 Payer IT Outsourcing Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 IT Infrastructure Outsourcing

7.4.1 IT Infrastructure Outsourcing Market Trends Analysis (2020-2032)

7.4.2 IT Infrastructure Outsourcing Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Life Science IT Outsourcing

7.5.1 Life Science IT Outsourcing Market Trends Analysis (2020-2032)

7.5.2 Life Science IT Outsourcing Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Operation IT Outsourcing

7.6.1 Operation IT Outsourcing Market Trends Analysis (2020-2032)

7.6.2 Operation IT Outsourcing Market Size Estimates and Forecasts to 2032 (USD Million)

8. Healthcare IT Outsourcing Market Segmentation, by End User

8.2 Hospital Information Systems

8.2.1 Hospital Information Systems Market Trends Analysis (2020-2032)

8.2.2 Hospital Information Systems Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Pharmaceutical and Life Science Research

8.3.1 Pharmaceutical and Life Science Research Market Trends Analysis (2020-2032)

8.3.2 Pharmaceutical and Life Science Research Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.4 North America Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5.2 USA Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6.2 Canada Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7.2 Mexico Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5.2 Poland Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6.2 Romania Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7.2 Hungary Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8.2 Turkey Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.4 Western Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5.2 Germany Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6.2 France Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7.2 UK Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8.2 Italy Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9.2 Spain Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12.2 Austria Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.4 Asia Pacific Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5.2 China Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5.2 India Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5.2 Japan Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6.2 South Korea Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7.2 Vietnam Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8.2 Singapore Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9.2 Australia Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.4 Middle East Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5.2 UAE Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6.2 Egypt Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8.2 Qatar Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.4 Africa Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Healthcare IT Outsourcing Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5.2.5.2 South Africa Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Healthcare IT Outsourcing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.4 Latin America Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5.2 Brazil Healthcare IT Outsourcing Market Estimates and Forecasts, by End User(2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6.2 Argentina Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7.2 Colombia Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Healthcare IT Outsourcing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Healthcare IT Outsourcing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10. Company Profiles

10.1 Tata Consultancy Services Limited (TCS)

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Accenture PLC

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Wipro Limited

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Cognizant Technology Solutions

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Hewlett-Packard Company (HP)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 HCL Technologies

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 McKesson Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Allscripts Healthcare Solutions Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Dell Technologies Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Optum Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Application

Provider IT Outsourcing

Payer IT Outsourcing

IT Infrastructure Outsourcing

Life Science IT Outsourcing

Operation IT Outsourcing

By End User

Hospital Information Systems

Pharmaceutical and Life Science Research

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Pharmacovigilance market valued USD 7.20 billion in 2023, and estimated to reach USD 18.52 billion by 2032 with CAGR 11.09% over the forecast period 2024-2032.

The D-dimer Testing Market was valued at USD 1.83 billion in 2023 and is expected to reach USD 2.74 billion by 2032, growing at a CAGR of 4.59% over the forecast period 2024-2032.

Downstream Processing Market was valued at USD 29.35 billion in 2023 and is expected to reach USD 99.64 billion by 2032, growing at a CAGR of 14.60%.

The Hyaluronidase Market was valued at USD 963.40 million in 2023 and is expected to reach USD 2032.10 million by 2032, growing at a CAGR of 8.69% from 2024 to 2032.

The Prostate Health Market Size was valued at USD 37.73 billion in 2023, and is expected to reach USD 82.62 billion by 2032 and grow at a CAGR of 9.1% over the forecast period 2024-2032.

The Pancreatic Cancer Treatment Market size was valued at USD 2.8 billion in 2023 and is expected to reach USD 10.53 billion by 2032 and grow at a CAGR of 15.85%.

Hi! Click one of our member below to chat on Phone