The Healthcare CRM Market Size was valued at USD 16.84 billion in 2023 and is expected to reach USD 37.09 billion by 2032 and grow at a CAGR of 9.19% over the forecast period 2024-2032.

Get more information on Healthcare CRM Market - Request Sample Report

The Healthcare CRM (Customer Relationship Management) market is expanding rapidly due to the increasing need for healthcare organizations to improve patient engagement, streamline operations, and deliver personalized care. According to a report, healthcare organizations that have adopted CRM systems have seen a notable improvement in patient retention and satisfaction, with some reporting a 20% increase in patient engagement through more personalized communication strategies. This growth is fueled by the industry's digital transformation, where CRM systems are centralizing patient data, enhancing coordination, and enabling better decision-making for healthcare providers.

For example, hospitals and clinics using CRM platforms can integrate various patient touchpoints such as appointment histories, treatment plans, and patient preferences into a single, cohesive system. This data integration enables healthcare professionals to deliver personalized care plans, improving outcomes and satisfaction. The Cleveland Clinic has successfully implemented CRM solutions to improve patient communications, resulting in more efficient management of appointments and follow-ups, significantly reducing missed appointments and enhancing overall operational efficiency.

The demand for better patient outcomes is also a significant driver. CRM systems automate essential processes like appointment reminders, billing notifications, and follow-ups, which are particularly beneficial for reducing administrative costs. As reported, healthcare organizations using CRM tools have experienced a 30% reduction in administrative costs through automation, which allows staff to focus more on patient care rather than routine paperwork.

Moreover, CRM systems provide tools for patient segmentation, enabling healthcare providers to target specific groups with tailored communications and services. For example, Mount Sinai Health System in New York implemented a CRM system that allowed them to track and engage high-risk patients with targeted care messages. This led to improved health outcomes for these patients and a reduction in hospital readmissions by 15%.

The regulatory environment further pushes the adoption of CRM systems, as solutions are built to comply with standards like HIPAA, ensuring patient data security and privacy. CRM platforms are designed with built-in encryption and data protection features, which are critical for healthcare providers aiming to avoid costly compliance violations.

Drivers

The growing emphasis on patient-centered care is a major driver of the Healthcare CRM market.

Modern patients expect personalized and seamless healthcare experiences, similar to other service industries. Healthcare CRM systems help providers centralize patient data, including medical history, preferences, and past interactions, allowing for more tailored communication and treatment approaches. These systems enable automated appointment scheduling, follow-up reminders, and targeted outreach, ensuring patients remain engaged in their care journey. Additionally, CRM solutions support proactive patient management, particularly for chronic disease patients, by tracking symptoms and sending timely alerts. This increased engagement not only improves patient satisfaction but also leads to better adherence to treatment plans, reducing hospital readmissions. As competition among healthcare providers grows, organizations are adopting CRM technology to enhance patient relationships, improve service delivery, and foster long-term patient loyalty, ultimately driving the market’s expansion.

The rapid adoption of digital health technologies is fueling the demand for advanced Healthcare CRM solutions.

Innovations such as AI-driven analytics, chatbots, telemedicine, and mobile health applications are transforming patient engagement strategies. CRM systems integrated with artificial intelligence can analyze patient data, predict health risks, and provide personalized recommendations, improving overall healthcare outcomes. Additionally, automation in CRM platforms helps reduce administrative burdens by streamlining appointment management, billing, and patient communication, allowing healthcare professionals to focus more on direct patient care. The integration of telemedicine with CRM solutions has further strengthened the market, enabling remote consultations and follow-ups, which became essential during the COVID-19 pandemic. As healthcare providers continue their digital transformation journey, the need for efficient CRM systems to manage large volumes of patient data and optimize service delivery remains a key driver of market growth.

Regulatory Compliance and Data Security Needs

Stringent healthcare regulations and increasing concerns over patient data security are pushing organizations to adopt CRM solutions that comply with standards such as HIPAA, GDPR, and other data protection laws. Healthcare CRM platforms are designed to securely store and manage patient information, ensuring compliance with legal requirements while improving operational efficiency. With cyber threats and data breaches on the rise, healthcare organizations are prioritizing CRM systems with advanced encryption, access controls, and audit trails to safeguard sensitive information. These platforms also facilitate better documentation and reporting, ensuring transparency and accountability in patient interactions. Regulatory requirements for interoperability and data sharing further drive the adoption of CRM systems that can seamlessly integrate with electronic health records and other healthcare IT infrastructure. As the industry moves toward more interconnected and digital healthcare solutions, the demand for secure and compliant CRM platforms continues to grow.

Restraints

A significant challenge in the Healthcare CRM market is the substantial cost associated with implementation and system integration.

Deploying an advanced CRM solution requires considerable investment in software acquisition, infrastructure upgrades, employee training, and ongoing maintenance. For smaller healthcare providers and clinics, these expenses can be prohibitive, limiting adoption. Additionally, integrating CRM platforms with existing healthcare IT systems, such as electronic health records and hospital management software, presents technical challenges. Compatibility issues, data migration difficulties, and potential disruptions in daily operations make the transition complex and time-consuming. Moreover, adherence to stringent regulatory requirements like HIPAA and GDPR adds another layer of complexity, as organizations must implement robust security measures to protect patient data. These factors collectively create barriers to widespread adoption, particularly for healthcare facilities with limited financial and technical resources, thereby restraining market growth.

By Component

The software segment led the Healthcare CRM market in 2023, accounting for 53.4% of total revenue. This dominance was fueled by the growing adoption of digital solutions to enhance patient engagement, optimize workflows, and improve data-driven decision-making. Hospitals, clinics, and pharmaceutical companies increasingly rely on CRM software to streamline operations, automate administrative tasks, and facilitate real-time communication. Cloud-based solutions, in particular, have gained significant traction due to their flexibility, cost-effectiveness, and ability to integrate with existing healthcare IT systems. The demand for AI-powered CRM platforms with predictive analytics and automated marketing features further strengthened this segment's leadership in 2023.

The service segment is expected to be the fastest-growing component in the Healthcare CRM market during the forecast period. The increasing complexity of CRM implementation and integration is driving demand for professional services, including consulting, training, and ongoing technical support. Healthcare organizations are increasingly relying on managed services to ensure seamless system functionality, data security compliance, and workflow optimization. Additionally, as CRM platforms evolve, healthcare providers require specialized training and customization services to maximize their operational benefits, contributing to the rapid growth of this segment.

By Functionality

The sales segment emerged as the dominant functionality in the Healthcare CRM market in 2023, capturing 31.2% of the total market share. This leadership was driven by the growing need for healthcare providers, pharmaceutical firms, and medical device manufacturers to optimize sales strategies, manage leads efficiently, and enhance customer relationship management. Advanced CRM solutions equipped with sales automation tools helped organizations streamline outreach efforts, improve customer tracking, and boost revenue generation. The integration of AI-powered analytics further enabled businesses to forecast sales trends, personalize interactions, and enhance engagement with healthcare professionals and patients.

The sales segment is also projected to be the fastest-growing functionality in the Healthcare CRM market throughout the forecast period. The increasing emphasis on data-driven sales strategies and customer engagement is driving demand for CRM tools that facilitate lead generation, pipeline management, and sales forecasting.

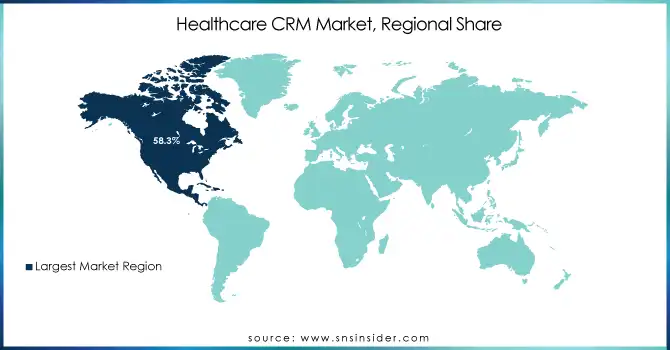

North America dominated the market in 2023 with a 58.3% share, with the United States leading the way. The region’s advanced healthcare infrastructure and strict data protection laws, such as HIPAA, have driven the widespread adoption of CRM solutions for secure patient data management and improved engagement. Companies like Oracle continue to develop hospital management software and integrate electronic health records into CRM systems, further strengthening market growth.

Europe showed substantial adoption of healthcare CRM, supported by the region’s focus on digital healthcare transformation. Countries such as Germany, the UK, and France are heavily investing in e-health solutions to improve patient care and operational efficiency. Government policies promoting digital health initiatives have also accelerated the implementation of CRM software across hospitals and healthcare organizations.

Asia-Pacific is expected to be the fastest-growing region in the coming years, driven by increasing healthcare digitization, a growing elderly population, and rising cases of chronic diseases. The demand for CRM solutions in hospitals and virtual care platforms is increasing rapidly. A key example is Salesforce’s launch of “Starter” CRM software in July 2023, aimed at Micro, Small, and Medium Enterprises (MSMEs) in India, reflecting the region’s expanding market potential.

Need any customization research on Healthcare CRM Market - Enquiry Now

Microsoft (Redmond, Washington, USA)

Oracle (Cerner Corporation) (Austin, Texas, USA)

IBM (Armonk, New York, USA)

SAP (Walldorf, Germany)

Accenture (Dublin, Ireland)

Zoho Corporation (Chennai, India)

hc1 (Indianapolis, Indiana, USA)

LeadSquared (Bengaluru, India)

Salesforce (San Francisco, California, USA)

Veeva Systems (Pleasanton, California, USA)

Talisma (Bengaluru, India)

Alvaria (Westford, Massachusetts, USA)

NICE (Ra’anana, Israel)

Verint Systems Inc. (Melville, New York, USA)

Creatio (Boston, Massachusetts, USA)

Cured (Acquired by Innovaccer Inc.) (San Francisco, California, USA)

Actium Health (Palo Alto, California, USA)

Keona Health (Chapel Hill, North Carolina, USA)

MediCRM.ai (Denver, Colorado, USA)

Recent Developments

In Dec 2024, Veeva Systems introduced two AI-powered innovations, Vault CRM Bot, and Vault CRM Voice Control, to enhance productivity in the life sciences sector. These features, which integrate with Vault CRM, assist with tasks like pre-call planning and personalized learning. Set to be available by late 2025 at no extra cost, the capabilities leverage advanced technologies, including a large language model and Apple Intelligence for voice command operation.

In Nov 2024, DKSH Healthcare and Euris launched "ConnectPlus," a comprehensive CRM and Multi-Channel Engagement (MCE) platform designed to enhance healthcare distribution across APAC. The platform, introduced in January 2025, aims to improve engagement with clients, customers, and patients in Thailand, offering data-driven solutions to optimize omnichannel strategies and commercial efficiency.

In Aug 2024, Keiron expanded its healthcare CRM platform to Colombia, adapting it to the local market. The Chilean startup focused on enhancing the patient experience through omnichannel solutions and integration with existing clinical systems.

| Report Attributes | Details |

| Market Size in 2023 | USD 16.84 Billion |

| Market Size by 2032 | USD 37.09 Billion |

| CAGR | CAGR of 9.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component [Software, Solutions] • By Functionality [Customer Service and Support, Digital Commerce, Marketing, Sales, Cross -CRM] • By Deployment mode [On-premise Model, Cloud/Web-based Model] • By End Use [Healthcare Providers, Healthcare Payers, Life Sciences Industry] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Oracle (Cerner Corporation), IBM, SAP, Accenture, Zoho Corporation, hc1, LeadSquared, Salesforce, Veeva Systems, Talisma, Alvaria, NICE, Verint Systems Inc., Creatio, Cured (Acquired by Innovaccer Inc.), Actium Health, Keona Health, MediCRM.ai. |

| Key Drivers | • The growing emphasis on patient-centered care is a major driver of the Healthcare CRM market. • The rapid adoption of digital health technologies is fueling the demand for advanced Healthcare CRM solutions. • Regulatory Compliance and Data Security Needs |

| Restraints | • A significant challenge in the Healthcare CRM market is the substantial cost associated with implementation and system integration. |

Healthcare CRM Market Size was valued at USD 16.84 billion in 2023.

Ans: The Healthcare CRM Market is to grow at a CAGR of 9.19% during the forecast period 2024-2032.

Cerner Corporation, Microsoft Corporation, Sage Group Plc, Oracle Corporation, Keona Health., SAP SE are the key players of Healthcare CRM market

North America dominated the market in 2023.

Gains from CRM Software, Increasing Attention to Patient Engagement are the key drivers of the Healthcare CRM market

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Trends and Growth (2023)

5.2 Technology Adoption and Device Integration (2023-2032)

5.3 Healthcare CRM Spending and Financial Trends (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and Promotional Activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare CRM Market Segmentation, by Component

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Solutions

7.3.1 Solutions Market Trends Analysis (2020-2032)

7.3.2 Solutions Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare CRM Market Segmentation, By Functionality

8.1 Chapter Overview

8.2 Customer Service and Support

8.2.1 Customer Service and Support Market Trends Analysis (2020-2032)

8.2.2 Customer Service and Support Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Digital Commerce

8.3.1 Digital Commerce Market Trends Analysis (2020-2032)

8.3.2 Digital Commerce Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Marketing

8.4.1 Marketing Market Trends Analysis (2020-2032)

8.4.2 Marketing Market Size Estimates And Forecasts To 2032 (USD Billion)

8.5 Sales

8.5.1 Sales Market Trends Analysis (2020-2032)

8.5.2 Sales Market Size Estimates And Forecasts To 2032 (USD Billion)

8.6 Cross -CRM

8.6.1 Cross -CRM Market Trends Analysis (2020-2032)

8.6.2 Cross -CRM Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Healthcare CRM Market Segmentation, by Deployment Mode

9.1 Chapter Overview

9.2 On-premise Model

9.2.1 On-premise Model Market Trends Analysis (2020-2032)

9.2.2 On-premise Model Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Cloud/Web-based Model

9.3.1 Cloud/Web-based Model Market Trends Analysis (2020-2032)

9.3.2 Cloud/Web-based Model Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Healthcare CRM Market Segmentation, By End Use

10.1 Chapter Overview

10.2 Healthcare Providers

10.2.1 Healthcare Providers Market Trends Analysis (2020-2032)

10.2.2 Healthcare Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Healthcare Payers

10.3.1 Healthcare Payers Market Trends Analysis (2020-2032)

10.3.2 Healthcare Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Life Sciences Industry

10.4.1 Life Sciences Industry Market Trends Analysis (2020-2032)

10.4.2 Life Sciences Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.4 North America Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.2.5 North America Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.2.6 North America Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.7.2 USA Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.2.7.3 USA Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.2.7.4 USA Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.8.2 Canada Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.2.8.3 Canada Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.2.8.4 Canada Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.2.9.3 Mexico Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.2.9.4 Mexico Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.1.7.3 Poland Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.1.7.4 Poland Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.1.8.3 Romania Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.1.8.4 Romania Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.5 Western Europe Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.6 Western Europe Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.7.3 Germany Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.7.4 Germany Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.8.2 France Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.8.3 France Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.8.4 France Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.9.3 UK Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.9.4 UK Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.10.3 Italy Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.10.4 Italy Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.11.3 Spain Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.11.4 Spain Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.14.3 Austria Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.14.4 Austria Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.5 Asia Pacific Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.6 Asia Pacific Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.7.2 China Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.7.3 China Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.7.4 China Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.8.2 India Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.8.3 India Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.8.4 India Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.9.2 Japan Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.9.3 Japan Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.9.4 Japan Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.10.3 South Korea Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.10.4 South Korea Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.11.3 Vietnam Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.11.4 Vietnam Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.12.3 Singapore Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.12.4 Singapore Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.13.2 Australia Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.13.3 Australia Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.13.4 Australia Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.1.5 Middle East Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.1.6 Middle East Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.1.7.3 UAE Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.1.7.4 UAE Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.4 Africa Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.2.5 Africa Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.2.6 Africa Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Healthcare CRM Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.4 Latin America Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.6.5 Latin America Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.6.6 Latin America Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.6.7.3 Brazil Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.6.7.4 Brazil Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.6.8.3 Argentina Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.6.8.4 Argentina Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.6.9.3 Colombia Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.6.9.4 Colombia Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Healthcare CRM Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Healthcare CRM Market Estimates and Forecasts, By Functionality (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Healthcare CRM Market Estimates and Forecasts, by Deployment Mode (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Healthcare CRM Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Microsoft

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Oracle (Cerner Corporation)

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 IBM

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Accenture

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 Zoho Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 LeadSquared

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Veeva Systems

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Cured (Acquired by Innovaccer Inc.)

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Actium Health

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Keona Health

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product / Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Software

Solutions

By Functionality

Customer Service and Support

Digital Commerce

Marketing

Sales

Cross -CRM

By Deployment mode

On-premise Model

Cloud/Web-based Model

By End Use

Healthcare Providers

Healthcare Payers

Life Sciences Industry

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The epithelioma treatment market size was valued at USD 4.75 billion in 2024 and is expected to reach USD 10.71 billion by 2032, growing at a CAGR of 9.49% over the forecast period of 2025-2032.

The Positron Emission Tomography (PET) Market to grow from USD 2.63 billion in 2023 to USD 4.69 billion by 2032, at 6.65%. CAGR

3D Printing Medical Device Software Market Size was valued at USD 1.2 Billion in 2023 and is expected to reach USD 4.81 Billion by 2032, growing at a CAGR of 16.7% over the forecast period 2024-2032.

The Wireless Health Market Size was valued at USD 198.7 Billion in 2023 and is expected to reach USD 896.3 Billion by 2032, growing at a CAGR of 18.2% over the forecast period 2024-2032.

The Nucleic acid-based therapeutics market size was USD 5.01 Billion in 2023 and is expected to reach USD 14.98 Billion by 2032 and grow at a CAGR of 12.93 % over the forecast period of 2024-2032.

The Patient Portal Market Size was valued at USD 3.35 billion in 2023 and is expected to reach USD 16.71 billion by 2032 and grow at a CAGR of 19.55% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone