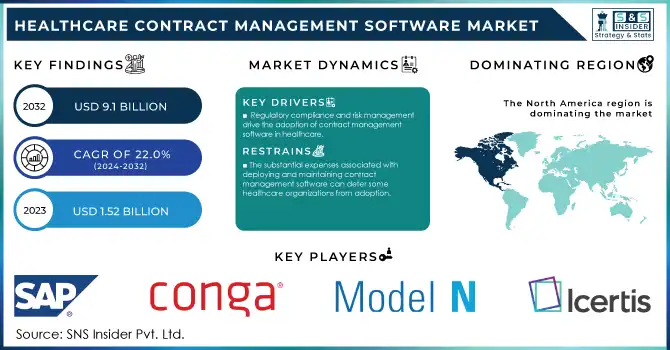

The Healthcare Contract Management Software Market Size was valued at USD 1.52 billion in 2023 and is expected to reach USD 9.1 billion by 2032, growing at a CAGR of 22.0% over the forecast period 2024-2032.

Get more information on Healthcare Contract Management Software Market - Request Free Sample Report

The Healthcare Contract Management Software Market is projected to increase at a remarkable pace, fuelled by growing regulatory complexity, operational efficiency demand among healthcare providers, hospitals, and life sciences companies, rising need for better quality assurance, and unprecedented demand for collaborative data. The U.S. Department of Health and Human Services (HHS) says virtually unprecedented contracts are leaving healthcare providers to manage more than 500 active contracts on average at any given time at one hospital. The spurt in the volume of contracts, along with ever-increasing compliance requirements, has led to the requirement of a solution for the automated management of contracts. CMS has used much stronger language regarding effective contract management as a means of lowering costs and improving care for patients. CMS provided new rules on value-based care contracts in 2024 requiring more rigorous contract oversight and performance tracking by providers. Such a regulatory push has driven the immediate market for contract management software in the healthcare sector.

In addition, many healthcare providers are reported to be adopting digital health technologies according to the Office of the National Coordinator for Health Information Technology (ONC), demonstrating a move toward digital transformation in healthcare administration. This change has already begun to shift before the pandemic and the numbers have risen more and more with the COVID-19 pandemic making them do so, with the Centers for Disease Control and Prevention (CDC) reporting that 95% of healthcare facilities used new digital tools to keep operations running remotely during the pandemic, including contract management solutions. With healthcare organizations looking to manage the complex regulatory landscape, manage resources more effectively, and increase operational efficiency, demand for robust contract management software is only expected to increase and keep the market poised for growth in the years to come. The additional advantages of software scalability, efficient workflows, remote work adaptability, and cost savings increased the software's attractiveness. The market posted robust growth in the form of increased e-signatures, contract requests, and documents created in its software for companies such as Contract Logix. This contract management software for healthcare seems set to continue growing, with a focus on efficiency, reduction of costs along with the capability to adapt to remote work.

Drivers

Healthcare organizations are increasingly transitioning from paper-based to digital processes, necessitating contract management solutions that streamline and automate complex workflows.

The need to adhere to regulatory requirements and manage risks effectively is propelling the adoption of contract management software in the healthcare sector.

As healthcare agreements become more intricate, there is a heightened demand for software that can efficiently manage and simplify contract lifecycles.

The healthcare industry is experiencing a new age of digital transformation due to the demand for operational efficiency and effective care outcomes for patients. This move away from manual and paper-based systems has greatly driven the adoption of contract management software as organizations now seek out more efficient, automated solutions. A survey done by HealthTech Magazine in 2023 found that 87% of healthcare organizations in developed areas are allocating their resources towards digital tools that emphasize workflow optimization, including contract management systems. With multiple stakeholders such as suppliers and insurers involved with a single contract, contract management software helps healthcare providers manage this complexity. One example could be large hospital networks such as the Mayo Clinic and Cleveland Clinic that have deployed sophisticated contract management software to ensure compliance, mitigate mistakes, and accelerate contract approvals.

Furthermore, digital solutions help address regulatory compliance, a critical requirement in healthcare. By having tools with functionality such as real-time tracking, automated alerts, and audit trails, organizations can effectively comply with complicated regulations such as the Health Insurance Portability and Accountability Act (HIPAA). However, combining contract management software with other healthcare IT systems like electronic health records (EHRs) has improved data visibility and collaboration. Telemedicine is one of those businesses that heavily depend on contracts with technology providers as well as consultants for their business to operate making that trend especially noteworthy. This push toward digitalization underscores the growing reliance on contract management software as a fundamental component of modern healthcare administration.

Restraints:

The substantial expenses associated with deploying and maintaining contract management software can deter some healthcare organizations from adoption.

Data Security and Privacy Concerns: Handling sensitive patient and organizational data raises concerns about security and privacy, potentially hindering the adoption of digital contract management solutions.

A lack of awareness and understanding of the benefits of contract management software in certain regions results in continued reliance on traditional methods, slowing market growth.

Healthcare contract management software is typically very expensive to implement and maintain, which presents a major obstacle to adoption, particularly for small and mid-sized healthcare organizations. Software licensing fees, customization to suit specific organizational requirements, integration with the existing systems, and staff training, are just a few of these costs. Alongside this, the ongoing costs of maintenance updates, technical support, and scalability, all contribute to making the financial burden heavier.

Most healthcare providers are budget-constrained and do not see the value of spending a large amount of money on administrative tools, focusing instead on immediate clinical needs. In companies where the necessary technical infrastructure is absent for supporting sophisticated software, this restraint becomes all the more pronounced. However, the lack of resources only complicates this digital transformation process, and naturally, the adoption rate is slowed down. Overcoming this limitation would entail cost-effective, scalable, and user-friendly solutions for smaller healthcare providers.

By Pricing Model

The subscription-based segment held a significant share in 2023 due to its flexibility, cost-effectiveness, and scalability. According to the U.S. Small Business Administration (SBA), healthcare organizations (especially smaller to medium-sized practices) prefer a subscription-based model as it not only helps them to effectively budget for the solution (fixed monthly fee for many software solutions), but also has no large up-front costs. In a recent report, the National Center for Health Statistics (NCHS) found that costs contributed to 72 percent of provider decisions to take technological risk versus return. This concern is mitigated by subscription-based models that allow businesses to have predictable monthly expenses, instead of large capital outlays. Additionally, the Centers for Medicare & Medicaid Services (CMS) has proposed to promote organizational flexibility in IT solutions that will support value-based initiatives, indirectly increasing interest in subscription-based software.

In addition, the Office of the National Coordinator for Health Information Technology (ONC) in 2022 reported that the reliance on subscription-based IT solutions was enabling healthcare organizations to keep up with software updates and security patches 28% of the time, which was vital for ensuring that agility is present in compliance with emerging healthcare regulations. The shift from traditional license-based pricing models towards subscription-based pricing models for healthcare IT solutions mirrors an emerging trend in the broader healthcare technology landscape towards a more agile and flexible technology infrastructure in healthcare. This shift aligns with the industry's need for scalable solutions that can grow with organizational needs and adapt to changing regulatory requirements.

By Deployment

In 2023, cloud-based contract management software accounted for more than a 69% share on account of better accessibility, scalability, and cost-effectiveness. According to the U.S. Department of Health and Human Services (HHS), organizations using cloud-based solutions saved around 30% in IT infrastructure costs. Cloud-based systems can provide better data security and data recovery and, in this regard, NIST mentioned that these cloud-based systems are important for sensitive healthcare information. Cloud Computing Benefits Cloud-based solutions drive collaboration and remote access with 85% of healthcare providers citing these as key advantages, according to the Office of the National Coordinator for Health Information Technology (ONC). In addition, the Federal Risk and Authorization Management Program (FedRAMP) has created an expedited security assessment process for cloud services that correspond easily to the needs of healthcare organizations. Healthcare contract management software is largely cloud-based, showing that the industry is recognizing how the cloud allows for faster scalability, better data accessibility, and less IT management. This trend is going to continue to grow with healthcare organizations looking for more agile and resilient IT infrastructure.

By End Use

In 2023, healthcare providers accounted for the largest revenue share of 49% due to the complexities and growing requirements for management systems driven by needing to manage multiple contracts in healthcare. U.S. hospitals had an average of 1,200 contracts per facility in 2022, a 15% increase over 2020, according to the American Hospital Association (AHA). Over 25% more healthcare providers had entered into value-based care programs, according to the Centers for Medicare & Medicaid Services (CMS), between 2020 and 2023, creating a need for more advanced contract management tools. The OIG noted that managing contracts properly could have provided relief from compliance headaches to many healthcare providers, especially since in 2022, 30% of the healthcare fraud cases related to contracts. Moreover, the National Center for Health Statistics (NCHS) showed that hospitals that were benefiting from sophisticated contracting management application were experiencing 20% lower administrative costs associated with contracting oversight.

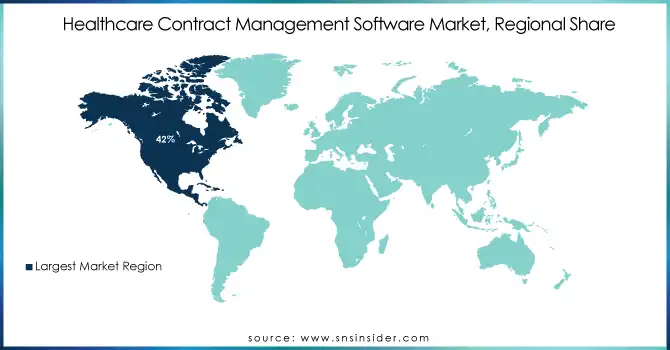

In 2023, the Healthcare Contract Management Software Market was led by North America, accounting for 42% of the market. This can primarily be attributed to North America owing to the presence of the established healthcare infrastructure and early adoption of digital health technologies in the past few years. In 2023, the U.S. Department of Health and Human Services stated that 96 percent of hospitals and 78 percent of physician practices in the United States had adopted certified health IT. The Canadian Institute for Health Information reported a 35% increase in digital health investments Canada-wide between 2020 and 2023. The rigorous regulatory atmosphere of the region has played as a critical factor for the adoption of advanced contract management solutions, such as HIPAA compliance requirements.

Asia Pacific is expected to witness the highest growth rate over the forecast period due to a growing focus on health sector spending and several initiatives taken by the government to encourage the adoption of digital health in the region. According to China's National Health Commission, institutional expenditures for hospital IT systems increased by 150 percent from 2020 through 2023, with new administrative software such as contract management solutions responsible for a large share of the growth. Accelerated by the establishment of the National Digital Health Mission by the Ministry of Health and Family Welfare of India in 2020, which aims to digitize all aspects of health administration, the demand for contract management software is rising. Amidst these challenges, the Asia Pacific is expected to be one of the lucrative markets for healthcare contract management software with the region's immense aging population along with evolving healthcare coverage further augmenting the growth of healthcare IT in the region.

Need any customization research on Healthcare Contract Management Software Market - Enquiry Now

Recent developments

In March 2024, Icertis signed a contract with the U.S. Department of Veterans Affairs to roll out its AI-driven contract management application at sites across VA healthcare facilities and to provide greater visibility and compliance to thousands of contracts.

CobbleStone Software Built a New Healthcare-Specific Contract Management Platform in January 2025, Approved by the American Hospital Association for Compliance-Focused Features and EHR Integration with Major Systems.

Key Service Providers/Manufacturers

Icertis (Icertis Contract Intelligence, ICI Healthcare Suite)

SAP SE (SAP Ariba Contracts, SAP S/4HANA for Contract Management)

Conga (Conga CLM, Conga Composer)

Model N, Inc. (Revenue Cloud, Model N CLM)

CobbleStone Software (Contract Insight, Healthcare Contract Lifecycle Management)

Symplr (Cactus Provider Management, symplr Contract Management)

Apttus (Thoma Bravo) (Apttus Contract Management, Intelligent Contract Lifecycle Management)

ContractWorks (Contract Management Software, Contract Repository)

DocuSign (DocuSign CLM, eSignature Integration)

Exari (a part of Coupa Software) (Exari Contracts Hub, Coupa CLM)

Key Users

Mayo Clinic

Cleveland Clinic

Kaiser Permanente

UnitedHealth Group

HCA Healthcare

Anthem, Inc.

CVS Health

Baylor Scott & White Health

Novartis International AG

Pfizer Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.52 Billion |

| Market Size by 2032 | USD 9.1 Billion |

| CAGR | CAGR of 22.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software {Contract Lifecycle Management Software, Contract Document Management Software}, Services {Support and Maintenance Services, Implementation and Integration Services, Training and Education Services}) • By Deployment Model (Cloud-based, On-Premises) • By Pricing Model (Subscription Based, Others) • By End Use (Healthcare Providers, Hospitals, Physicians, Payers, Medical Device Manufacturers, Pharma, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Icertis, SAP SE, Conga, Model N, Inc., CobbleStone Software, Symplr, Apttus (Thoma Bravo), ContractWorks, DocuSign, Exari (a part of Coupa Software) |

| Key Drivers | • Healthcare organizations are increasingly transitioning from paper-based to digital processes, necessitating contract management solutions that streamline and automate complex workflows. • The need to adhere to regulatory requirements and manage risks effectively is propelling the adoption of contract management software in the healthcare sector. |

| Restraints | • The substantial expenses associated with deploying and maintaining contract management software can deter some healthcare organizations from adoption. • Handling sensitive patient and organizational data raises concerns about security and privacy, potentially hindering the adoption of digital contract management solutions. |

Ans. The projected market size for the Healthcare Contract Management Software Market is USD 9.1 Billion by 2032.

Ans: The North American region dominated the Healthcare Contract Management Software Market in 2023.

Ans: The Cloud-based deployment segment dominated the Healthcare Contract Management Software Market

Ans: The increased usage of cloud computing, remote work, the desire to limit risk through greater compliance, and the demand for cost reduction and operational efficiency are key drivers driving the healthcare contract management software market's growth.

Ans: Yes, you may request customization based on your company's needs.

Table of contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Software

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare Contract Management Software Market Segmentation, By Component

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Contract Lifecycle Management Software

7.2.3.1 Contract Lifecycle Management Software Market Trends Analysis (2020-2032)

7.2.3.2 Contract Lifecycle Management Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Contract Document Management Software

7.2.4.1 Contract Document Management Software Market Trends Analysis (2020-2032)

7.2.4.2 Contract Document Management Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Support and Maintenance Services

7.3.3.1 Support and Maintenance Services Market Trends Analysis (2020-2032)

7.3.3.2 Support and Maintenance Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Implementation and Integration Services

7.3.4.1 Implementation and Integration Services Market Trends Analysis (2020-2032)

7.3.4.2 Implementation and Integration Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Training and Education Services

7.3.5.1 Training and Education Services Market Trends Analysis (2020-2032)

7.3.5.2 Training and Education Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare Contract Management Software Market Segmentation, By Deployment Model

8.1 Chapter Overview

8.2 Cloud-based

8.2.1 Cloud-based Market Trends Analysis (2020-2032)

8.2.2 Cloud-based Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 On-Premises

8.3.1 On-Premises Market Trends Analysis (2020-2032)

8.3.2 On-Premises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Healthcare Contract Management Software Market Segmentation, By Pricing Model

9.1 Chapter Overview

9.2 Subscription Based

9.2.1 Subscription Based Market Trends Analysis (2020-2032)

9.2.2 Subscription Based Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Others

9.3.1 Others Market Trends Analysis (2020-2032)

9.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Healthcare Contract Management Software Market Segmentation, By End Use

10.1 Chapter Overview

10.2 Healthcare Providers

10.2.1 Healthcare Providers Market Trends Analysis (2020-2032)

10.2.2 Healthcare Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Hospitals

10.3.1 Hospitals Market Trends Analysis (2020-2032)

10.3.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Physicians

10.4.1 Physicians Market Trends Analysis (2020-2032)

10.4.2 Physicians Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Payers

10.5.1 Payers Market Trends Analysis (2020-2032)

10.5.2 Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Medical Device Manufacturers

10.6.1 Medical Device Manufacturers Market Trends Analysis (2020-2032)

10.6.2 Medical Device Manufacturers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Pharma

10.7.1 Pharma Market Trends Analysis (2020-2032)

10.7.2 Pharma Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Others

10.8.1 Others Market Trends Analysis (2020-2032)

10.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.2.5 North America Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.2.6 North America Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.2.7.3 USA Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.2.7.4 USA Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.7 Canada

11.2.7.1 Canada Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 Canada Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.2.7.3 Canada Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.2.7.3 Canada Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.8 Mexico

11.2.8.1 Mexico Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Mexico Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.2.8.3 Mexico Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.2.8.3 Mexico Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.6 Poland

11.3.1.6.1 Poland Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.6.2 Poland Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.1.6.3 Poland Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.1.6.3 Poland Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.7 Romania

11.3.1.7.1 Romania Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Romania Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.1.7.3 Romania Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.1.7.3 Romania Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Hungary Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Turkey Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.5 Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.5 Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.6 Germany

11.3.2.6.1 Germany Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.6.2 Germany Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.6.3 Germany Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.6.3 Germany Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.7 France

11.3.2.7.1 France Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 France Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.7.3 France Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.7.3 France Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.8 UK

11.3.2.8.1 UK Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 UK Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.8.3 UK Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.8.3 UK Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.9 Italy

11.3.2.9.1 Italy Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 Italy Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.9.3 Italy Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.9.3 Italy Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.11.3 Spain Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.11.3 Spain Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Netherlands Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.12 Switzerland

11.3.2.12.1 Switzerland Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Switzerland Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.13 Austria

11.3.2.13.1 Austria Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Austria Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.13.3 Austria Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.13.3 Austria Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Rest of Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.5 Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.5 Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.6 China

11.4.6.1 China Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.6.2 China Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.6.3 China Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.6.3 China Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.7 India

11.4.7.1 India Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 India Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.7.3 India Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.7.3 India Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.8 Japan

11.4.8.1 Japan Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 Japan Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.8.3 Japan Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.8.3 Japan Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.9 South Korea

11.4.9.1 South Korea Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 South Korea Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.9.3 South Korea Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.9.3 South Korea Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.11.3 Vietnam Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.11.3 Vietnam Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.11 Singapore

11.4.11.1 Singapore Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Singapore Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.11.3 Singapore Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.11.3 Singapore Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.12 Australia

11.4.12.1 Australia Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Australia Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.12.3 Australia Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.12.3 Australia Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Rest of Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.1.5 Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.1.5 Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.6 UAE

11.5.1.6.1 UAE Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.6.2 UAE Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.1.6.3 UAE Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.1.6.3 UAE Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 Egypt Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Saudi Arabia Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Qatar Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.2.5 Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.2.8.3 Africa Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.6.2 South Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.2.6.3 South Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.2.8.3 South Africa Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 Nigeria Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.2.7.3 Nigeria Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Rest of Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Healthcare Contract Management Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.6.5 Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.6.5 Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.6 Brazil

11.6.6.1 Brazil Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.6.2 Brazil Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.6.6.3 Brazil Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.6.6.3 Brazil Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.7 Argentina

11.6.7.1 Argentina Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Argentina Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.6.7.3 Argentina Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.6.7.3 Argentina Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.8 Colombia

11.6.8.1 Colombia Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Colombia Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.6.8.3 Colombia Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.6.8.3 Colombia Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Rest of Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By Deployment Model (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By Pricing Model (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Healthcare Contract Management Software Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Icertis

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 SAP SE

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Conga

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Model N, Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 CobbleStone Software

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Symplr

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Apttus (Thoma Bravo)

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 ContractWorks

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 DocuSign

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Exari (a part of Coupa Software)

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Software

Contract Lifecycle Management Software

Contract Document Management Software

Services

Support and Maintenance Services

Implementation and Integration Services

Training and Education Services

By Deployment Model

Cloud-based

On-Premises

By Pricing Model

Subscription Based

Others

By End Use

Healthcare Providers

Hospitals

Physicians

Payers

Medical Device Manufacturers

Pharma

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Vitrification Market Size, valued at USD 8.23 billion in 2023, is projected to reach USD 33.04 billion by 2032, growing at a CAGR of 16.75%.

The Online Pharmacy Market size was valued at USD 112.88 billion in 2023 and is estimated to reach USD 399.10 Billion by 2031 and grow at a CAGR of 17.1% over the forecast period of 2024-2031.

The Dermal Fillers Market size was valued at USD 5.05 billion in 2023 and is expected to reach USD 10.26 billion by 2032 and grow at a CAGR of 8.2% by 2024-2032.

The Burn Care Market size was valued at USD 3.10 Billion in 2023. It is estimated to reach USD 5.70 Billion by 2032, growing at a CAGR of 7.02% during 2024-2032.

The Legionella Testing Market size was valued at USD 283.52 Million in 2023 & is estimated to reach USD 581.08 Million by 2032 and increase at a CAGR of 8.3% between 2024 and 2032.

Synthetic Biology Market Size was valued at USD 12.5 billion in 2023 and is expected to reach USD 60.4 billion by 2032, growing at a CAGR of 19.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone