Get more information on Healthcare Consulting Services Market - Request Sample Report

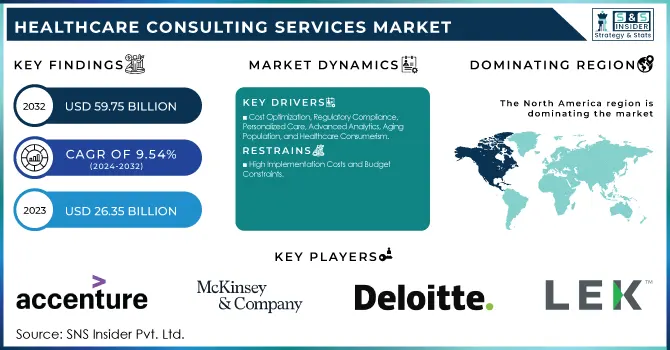

The Healthcare Consulting Services Market Size was valued at USD 26.35 billion in 2023 and is expected to reach USD 59.75 billion by 2032 and grow at a CAGR of 9.54% over the forecast period 2024-2032.

The Healthcare Consulting Services Market is undergoing significant growth, driven by the increasing complexity of the global healthcare ecosystem. With rising patient expectations, evolving regulatory requirements, and technological advancements, healthcare organizations are seeking expert guidance to navigate these challenges and enhance operational efficiency. Consulting services play a pivotal role in aiding providers, payers, and life sciences companies to achieve improved outcomes while optimizing costs.

Digital transformation is a primary driver of this market. Studies indicate that over 90% of healthcare executives view digital innovation as a strategic priority, with approximately USD 15 billion invested globally in healthcare IT solutions in 2023. The adoption of technologies like artificial intelligence (AI), telehealth, and blockchain in healthcare has created a demand for consultants skilled in technology integration and change management. Value-based care models have also emerged as a critical area, requiring organizations to shift focus from volume-based to outcome-based service delivery. Reports show that 60% of healthcare organizations in the U.S. have begun implementing value-based care frameworks, supported by consulting expertise.

Additionally, mergers, acquisitions, and partnerships in the healthcare sector have amplified the need for strategic consulting. In 2023, there were over 1,200 healthcare mergers and acquisitions globally, a significant increase from prior years, as providers aimed to consolidate and streamline operations. Workforce management, driven by the growing shortage of skilled professionals, has also become a focal point for consulting services. Estimates suggest that the global healthcare workforce faces a deficit of 15 million professionals by 2030, necessitating strategic workforce planning.

The market is further fueled by the expansion of healthcare systems in emerging economies. For instance, investments in healthcare infrastructure in Asia-Pacific have grown by 25% annually over the past five years, driven by rising demand for accessible healthcare. In developed markets, regulatory compliance remains a priority, with 80% of healthcare organizations reporting challenges in adhering to dynamic regulatory frameworks. As healthcare consumerism rises, patient engagement, personalization, and experience improvement are gaining prominence. Surveys reveal that 75% of patients prioritize digital engagement when choosing healthcare providers, underscoring the demand for innovative, consumer-focused strategies that consulting firms are well-positioned to deliver.

Overall, the Healthcare Consulting Services Market is poised for sustained growth as stakeholders across the ecosystem seek specialized expertise to navigate the dynamic healthcare landscape effectively.

Drivers

Cost Optimization, Regulatory Compliance, Personalized Care, Advanced Analytics, Aging Population, and Healthcare Consumerism

One significant driver is the growing focus on cost optimization and operational efficiency. For example, consultants help hospitals reduce administrative costs by implementing Lean management practices, such as Kaiser Permanente’s initiative to streamline workflows and enhance resource utilization, resulting in substantial savings. Regulatory compliance is another critical driver. The complexity of laws like the General Data Protection Regulation (GDPR) in Europe or the Affordable Care Act (ACA) in the U.S. prompts healthcare organizations to seek consulting services to ensure adherence. For instance, consulting firms have assisted organizations in adopting frameworks for GDPR compliance, and safeguarding patient data while maintaining operational continuity.

The rise of personalized care also fuels demand. Advances in precision medicine require tailored approaches, and consulting firms like IQVIA have supported healthcare providers in integrating genomic data into care pathways to deliver personalized treatments, particularly in oncology. The integration of advanced analytics and big data has become essential. For instance, Cleveland Clinic partnered with consulting experts to develop predictive analytics tools that enhance patient care by identifying high-risk patients and improving treatment outcomes. The aging population and increased prevalence of chronic diseases are driving demand for innovative care delivery models. For example, consulting firms have facilitated the adoption of value-based care approaches in managing diabetes and cardiovascular diseases, emphasizing improved outcomes over service volume.

Lastly, the rise of healthcare consumerism is reshaping the market. For instance, consulting firms have guided providers in implementing patient-friendly digital platforms, such as telehealth apps, to enhance transparency and engagement, aligning with modern patient expectations.

Restraints

High Implementation Costs and Budget Constraints

The adoption of healthcare consulting services often involves significant costs for technology integration, infrastructure upgrades, and workforce training. Smaller organizations and healthcare providers in developing regions may struggle to allocate budgets, limiting the market's growth potential.

Resistance to Change and Organizational Complexity

Many healthcare organizations face internal resistance to change when adopting new strategies or technologies. Complex organizational structures, coupled with the challenges of aligning diverse stakeholders, can hinder the effective implementation of consulting recommendations.

By Services

Strategic management consulting was the dominant segment in 2023, representing approximately 35.0% of the market. This dominance is driven by healthcare organizations’ need for expert guidance in navigating complex industry changes such as regulatory reforms, mergers and acquisitions, and shifting patient expectations. Consultants provide valuable services in optimizing business strategies, improving operational efficiency, and supporting long-term planning. The increased focus on sustainability and value-based care models has further fueled demand for strategic management consulting in hospitals, pharmaceutical companies, and other healthcare entities.

The fastest-growing segment over the forecast period was information technology (IT) consulting. This growth is primarily attributed to the rapid adoption of digital technologies in healthcare, including electronic health records (EHRs), telehealth solutions, and data analytics. The healthcare sector is increasingly relying on IT consulting services to optimize its infrastructure, enhance data security, and improve patient outcomes through technology integration. As healthcare organizations shift to more advanced, AI-driven systems and digital platforms, IT consulting is expected to continue expanding to meet the rising demand for digital solutions.

By End-use

Hospitals were the dominant end-use segment in 2023, accounting for the largest share of healthcare consulting services. The hospital sector continues to face mounting pressure to improve patient care, streamline operations, and manage increasing patient volumes. Healthcare consulting services assist hospitals in improving clinical outcomes, adopting value-based care models, implementing electronic health systems, and managing financial performance. The complexity of hospital operations and the growing need for strategic guidance have made hospitals the primary beneficiaries of healthcare consulting services.

The pharmaceutical industry is the fastest-growing end-use segment over the forecast period, driven by increasing regulatory complexities, research and development (R&D) challenges, and the rise of personalized medicine. Pharmaceutical companies are turning to healthcare consulting firms for strategic guidance in drug development, market access, regulatory compliance, and market expansion. As the industry faces significant transformation due to digital innovation, including data-driven drug discovery and digital health solutions, consulting services in this segment are poised to grow rapidly, helping pharmaceutical companies remain competitive and compliant.

In 2023, North America dominated the healthcare consulting services market, accounting for the largest share due to the region's advanced healthcare infrastructure, high healthcare spending, and the presence of major consulting firms. The U.S. particularly contributes to the market's growth, driven by the adoption of value-based care, regulatory complexities such as the Affordable Care Act, and the ongoing digital transformation in healthcare. Hospitals and pharmaceutical companies in North America increasingly rely on strategic management and IT consulting services to improve operational efficiency, reduce costs, and enhance patient care.

Europe is the second-largest market, with countries like Germany, the U.K., and France investing heavily in healthcare consulting to address challenges such as an aging population and rising healthcare costs. The shift towards personalized medicine and digital health solutions has boosted demand for IT consulting services. The European Union's strict regulatory environment also drives the need for compliance consulting.

The Asia-Pacific region is the fastest-growing market, fueled by the rapid expansion of healthcare infrastructure, rising healthcare awareness, and increasing demand for healthcare services in countries like China, India, and Japan. The growing adoption of digital health technologies, especially in India and China, has significantly increased the demand for IT consulting services. Furthermore, the region’s large pharmaceutical market is contributing to the demand for strategic and financial consulting services, as companies navigate expanding markets and complex regulatory environments.

Need any customization research on Healthcare Consulting Services Market - Enquiry Now

Products: Cloud solutions, AI-driven healthcare analytics

Services: Digital transformation, IT consulting, strategic management, EHR implementation

Services: Healthcare strategy, market entry analysis, operational efficiency, healthcare policy and regulation consulting, organizational restructuring

Products: Healthcare analytics, value-based care solutions

Services: IT strategy, digital transformation, financial management, regulatory compliance

L.E.K. Consulting

Services: Strategic consulting, market research, M&A advisory, R&D strategy, market access, business model optimization in healthcare

PwC (PricewaterhouseCoopers)

Products: Digital health solutions

Services: Financial consulting, risk management, regulatory compliance, value-based care transformation, M&A consulting

Huron Consulting Group Inc. and affiliates

Services: Healthcare operations, clinical transformation, strategic planning, revenue cycle management, healthcare IT consulting

Cognizant

Products: Data analytics, cloud computing, patient engagement tools

Services: Digital healthcare solutions, IT services, operational efficiency consulting

EY (Ernst & Young)

Services: Healthcare strategy, financial management, regulatory consulting, digital transformation, business transformation, cost optimization

Bain & Company, Inc.

Services: Strategic management, operational improvements, market growth strategy, cost reduction, healthcare technology integration

IQVIA Inc.

Products: Market insights, digital health solutions

Services: Data analytics, market access strategy, R&D consulting, regulatory compliance

Boston Consulting Group (BCG)

Services: Healthcare innovation strategy, organizational transformation, market entry and competitive analysis, digital health consulting

KPMG

Services: Financial management, regulatory consulting, IT services, digital transformation, value-based care models, healthcare efficiency consulting

In November 2024, JTS Health Partners appointed Kevin Smith as Senior Vice President of RCM Transformation, marking a significant step in the company's expansion and growth strategy. This move is aimed at strengthening their capabilities in revenue cycle management transformation.

In November 2024, Nsight Health formed a partnership with Physicians Choice Medical to deliver remote patient monitoring (RPM) and chronic care management (CCM) services. This collaboration aims to equip healthcare providers within Physicians Choice Medical’s network with the tools needed to improve patient care and manage chronic conditions effectively.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 26.35 billion |

| Market Size by 2032 | USD 59.75 Billion |

| CAGR | CAGR of 9.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Services (Strategic Management Consulting, Financial Management Consulting, Information Technology Consulting, Human Resource Consulting, Others) •By End-use (Pharmaceutical Companies, Hospitals, Insurance Companies, Government Organizations, Other Healthcare Providers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, McKinsey & Company, Deloitte Global, L.E.K. Consulting, PwC, Huron Consulting Group Inc., Cognizant, EY, Bain & Company, Inc., IQVIA Inc., Boston Consulting Group (BCG), and KPMG |

| Key Drivers | • Cost Optimization, Regulatory Compliance, Personalized Care, Advanced Analytics, Aging Population, and Healthcare Consumerism |

| Restraints | • High Implementation Costs and Budget Constraints • Resistance to Change and Organizational Complexity |

Ans: The Healthcare Consulting Services Market size was valued at US$ 26.35 Bn in 2023.

Ans: The Healthcare Consulting Services Market is growing at a CAGR of 9.54% during the forecast period 2024-2032.

Key drivers of the Healthcare Consulting Services Market is Cost Optimization, Regulatory Compliance, Personalized Care, Advanced Analytics, Aging Population, and Healthcare Consumerism.

Strategic Management Consulting, Financial Management Consulting, Information Technology Consulting, Human Resource Consulting are the sub segments of Healthcare Consulting Services.

North America overwhelmed the medical care counseling administrations market, trailed by Europe and the Row.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Consulting Services Adoption Trends, by Region (2023)

5.2 Key Trends in Healthcare Consulting by Industry

5.3 Technology Integration Trends in Healthcare Consulting

5.4 Growth of Value-Based Care Consulting Services (2023)

5.5 Healthcare Workforce Management Trends (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare Consulting Services Market Segmentation, by Services

7.2 Strategic Management Consulting

7.2.1 Strategic Management Consulting Market Trends Analysis (2020-2032)

7.2.2 Strategic Management Consulting Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Financial Management Consulting

7.3.1 Financial Management Consulting Market Trends Analysis (2020-2032)

7.3.2 Financial Management Consulting Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Information Technology Consulting

7.4.1 Information Technology Consulting Market Trends Analysis (2020-2032)

7.4.2 Information Technology Consulting Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Human Resource Consulting

7.5.1 Human Resource Consulting Market Trends Analysis (2020-2032)

7.5.2 Human Resource Consulting Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Healthcare Consulting Services Market Segmentation, by End-use

8.2 Pharmaceutical Companies

8.2.1 Pharmaceutical Companies Market Trends Analysis (2020-2032)

8.2.2 Pharmaceutical Companies Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Hospitals

8.3.1 Long-Term Care Facilities Market Trends Analysis (2020-2032)

8.3.2 Long-Term Care Facilities Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Insurance Companies

8.4.1 Insurance Companies Market Trends Analysis (2020-2032)

8.4.2 Insurance Companies Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Government Organizations

8.5.1 Government Organizations Market Trends Analysis (2020-2032)

8.5.2 Government Organizations Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Other Healthcare Providers

8.6.1 Other Healthcare Providers Market Trends Analysis (2020-2032)

8.6.2 Other Healthcare Providers Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.2.4 North America Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.2.5.2 USA Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.2.6.2 Canada Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.2.7.2 Mexico Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.1.5.2 Poland Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.1.6.2 Romania Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.1.7.2 Hungary Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.1.8.2 Turkey Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.4 Western Europe Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.5.2 Germany Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.6.2 France Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.7.2 UK Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.8.2 Italy Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.9.2 Spain Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.12.2 Austria Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.4 Asia Pacific Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.5.2 China Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.5.2 India Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.5.2 Japan Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.6.2 South Korea Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.2.7.2 Vietnam Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.8.2 Singapore Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.9.2 Australia Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.1.4 Middle East Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.1.5.2 UAE Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.1.6.2 Egypt Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.1.8.2 Qatar Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.2.4 Africa Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.2.5.2 South Africa Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Healthcare Consulting Services Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.6.4 Latin America Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.6.5.2 Brazil Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.6.6.2 Argentina Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.6.7.2 Colombia Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Healthcare Consulting Services Market Estimates and Forecasts, by Services (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Healthcare Consulting Services Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10. Company Profiles

10.1 Accenture

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 McKinsey & Company

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Deloitte Global

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 L.E.K. Consulting

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 PwC (PricewaterhouseCoopers)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Huron Consulting Group Inc. and affiliates

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Cognizant

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 EY (Ernst & Young)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Bain & Company, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 IQVIA Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Services

Strategic Management Consulting

Financial Management Consulting

Information Technology Consulting

Human Resource Consulting

Others

By End-use

Pharmaceutical Companies

Hospitals

Insurance Companies

Government Organizations

Other Healthcare Providers

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Fluoroscopy Imaging Systems Market Size was valued at USD 1.99 billion in 2023 and is expected to reach USD 2.45 billion by 2032 and grow at a CAGR of 2.37% over the forecast period 2024-2032.

The Hormonal Contraceptives Market size was valued at USD 17.58 Billion in 2023 and is expected to reach USD 25.39 Billion By 2031 with a growing CAGR of 4.70% over the forecast period of 2024-2031.

The On-Body Injectors Market was valued at USD 4.83 billion in 2023 and is expected to reach USD 16.89 billion by 2032, growing at a CAGR of 14.94% over the forecast period of 2024-2032.

The Neurorehabilitation Market was valued at USD 1.95 billion in 2023 and expected to reach USD 6.18 billion by 2032, at a CAGR of 13.68%.

The Muscle Stimulator Market size was valued at USD 783.8 million in 2023 and is expected to reach USD 1077.56 million by 2032 and grow at a CAGR of 3.6% over the forecast period 2024-2032.

Spay And Neuter Market Size was valued at USD 2.32 billion in 2023 and is expected to reach USD 3.43 billion by 2032, growing at a CAGR of 4.44% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone