Healthcare Cloud Computing Market Report Scope & Overview:

To Get More Information on Healthcare Cloud Computing Market - Request Sample Report

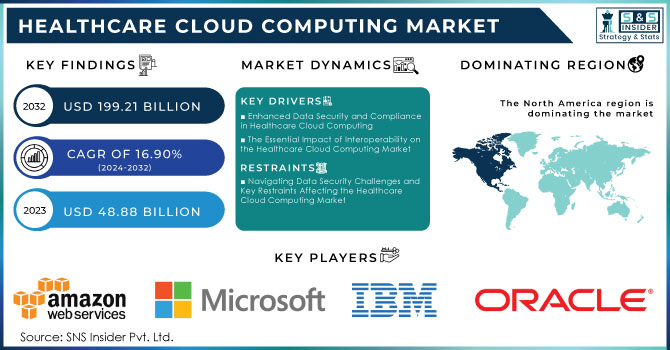

The Healthcare Cloud Computing Market size was valued at USD 48.88 Billion in 2023 and it is expected to reach USD 199.21 Billion by 2032 with a growing CAGR of 16.90% over the forecast period 2024-2032.

The Healthcare Cloud Computing Market is undergoing significant transformation due to the rapid digitization of healthcare services, leading to a heightened demand for cloud-based solutions that improve data storage, analytics, and accessibility across various healthcare systems. As healthcare organizations strive to enhance efficiency and patient outcomes, they are increasingly adopting cloud computing to meet their operational requirements. Key factors driving this market growth include the need for interoperability, scalability, and cost-effectiveness in managing health data.

A primary driver is the demand for seamless data exchange and interoperability among healthcare providers. Challenges in health tech interoperability highlight the necessity for robust cloud solutions that can bridge gaps between different systems, facilitating better communication and data sharing. Cloud platforms empower healthcare organizations to provide coordinated and effective patient care.

Confidence in cloud adoption has grown, with organizations recognizing the benefits of reduced IT infrastructure costs and increased agility, allowing them to focus on essential healthcare services while utilizing advanced technologies. With cloud computing, healthcare providers can securely store vast amounts of patient data, employ advanced analytics for informed decision-making, and ensure compliance with strict regulations governing data protection and privacy.

The importance of analytics in cloud computing is supported by numerous industry reports, which show that organizations can use cloud analytics tools to derive actionable insights from patient data, resulting in improved clinical outcomes and operational efficiencies. Moreover, the integration of artificial intelligence and machine learning into cloud platforms is transforming healthcare delivery, enabling predictive analytics that enhance patient management and treatment personalization.

As cloud, computing becomes more prevalent, organizations are investing in the infrastructure needed to support these technologies. Companies like Equinix play a crucial role by providing data centers that facilitate connectivity and data exchange for cloud applications. In the U.S., strategic investments in computing infrastructure are enhancing cloud services, driving more efficient data processing and storage tailored to healthcare providers' needs.

Globally, investments are also strengthening cloud capabilities. For example, Google's recent USD 1 billion investment in Thailand aims to advance AI and cloud services, reflecting the worldwide trend of integrating cutting-edge technologies into healthcare systems. This initiative aligns with the recognition of cloud computing as a vital enabler of digital transformation, enhancing access to essential services and improving patient engagement. The Healthcare Cloud Computing Market is poised for significant growth, driven by the need for digital solutions that enhance interoperability, analytics, and data management. As healthcare organizations increasingly adopt cloud technology, they can anticipate improved operational efficiency, better patient outcomes, and a more interconnected healthcare ecosystem. This transformation not only addresses current challenges but also lays the foundation for innovative solutions that redefine healthcare delivery in the future.

Increasing adoption of cloud solutions across healthcare organizations. As of 2023, 70% of health IT professionals reported that their organizations have already transitioned to cloud-based infrastructure, with another 20% planning to migrate within the next two years. This widespread adoption is fueled by the cloud’s ability to address longstanding healthcare challenges, provide scalable data storage, and introduce advanced technologies such as artificial intelligence (AI) and machine learning (ML) to the industry.

Cloud service providers (CSPs) are empowering healthcare institutions by making AI and ML tools more accessible. These technologies enable large-scale data analytics, improving outcomes for 5% of patients responsible for nearly half of the medical expenses in the U.S. Healthcare payers are leveraging ML models to identify at-risk patients, enabling proactive interventions such as reminders for medical screenings and therapies. On the provider side, AI is being utilized to detect diseases earlier, including recognizing early-stage breast cancer through CT scans and identifying patients at risk for Alzheimer’s disease, enabling earlier intervention to slow disease progression.

In addition to improving patient care, cloud computing is reducing the high costs of medical record storage. Healthcare generates vast amounts of unstructured data, such as lab reports, medical imaging, and patient notes, which require much larger storage capacities than structured data. The Health Information Portability and Accountability Act (HIPAA) mandates that medical data must be stored for a minimum of seven years, further complicating storage needs.

Despite the benefits, the healthcare industry is facing a cloud skills shortage, with 80% of companies reporting a lack of skilled professionals to support cloud initiatives. This shortage is creating delays in cloud migration projects and increasing costs due to inefficient architectures and security concerns.

Market Dynamics

Drivers

- Enhanced Data Security and Compliance in Healthcare Cloud Computing

In the rapidly evolving Healthcare Cloud Computing Market, enhanced data security and compliance are pivotal drivers of growth. As healthcare organizations increasingly migrate to cloud-based solutions, they confront the dual challenge of protecting sensitive patient information while adhering to stringent regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). Notably, the average cost of a healthcare data breach reached USD 10.1 million in 2022, underscoring the critical need for robust security measures. Cloud service providers address these challenges through comprehensive strategies, including data encryption, which safeguards information both at rest and in transit, and regular data backups to ensure continuity in patient care. Furthermore, with 83% of healthcare organizations now leveraging cloud solutions, the demand for secure cloud infrastructures continues to rise. Multi-factor authentication (MFA) and audit trails enhance access controls and monitoring, further mitigating risks associated with unauthorized access. By investing in security training, healthcare providers can reduce breach incidents by 45%, ultimately fostering trust in cloud technology and enhancing operational efficiencies. Enhanced data security and compliance will remain integral to the Healthcare Cloud Computing Market, propelling its expansion and innovation in the sector.

- The Essential Impact of Interoperability on the Healthcare Cloud Computing Market

Interoperability is a pivotal driver of growth in the healthcare cloud computing market, fundamentally enhancing communication and data sharing among various healthcare systems. As healthcare organizations increasingly adopt cloud-based solutions, the ability to achieve seamless data exchange among hospitals, clinics, laboratories, and insurance companies becomes essential. Interoperability facilitates real-time access to electronic health records (EHRs), lab results, and treatment plans, enabling healthcare providers to make informed decisions swiftly and reduce care delivery delays. Additionally, improved care coordination fosters collaboration among healthcare professionals, thereby minimizing the risk of medical errors and redundant testing, ultimately leading to better patient outcomes. Regulatory frameworks, such as the 21st Century Cures Act, emphasize the need for interoperability, encouraging organizations to leverage cloud solutions that ensure compliance while safeguarding patient privacy. Moreover, the use of standardized communication protocols like HL7 and FHIR within cloud platforms enhances the integration of various systems. By fostering interoperability, healthcare cloud computing not only empowers patients with access to their health information but also enables organizations to harness data analytics for effective population health management. This strategic focus on interoperability positions cloud computing as a transformative force in healthcare, driving the market's growth and adoption of advanced solutions.

Restraints

- Navigating Data Security Challenges and Key Restraints Affecting the Healthcare Cloud Computing Market

Data security concerns remain a significant restraint in the healthcare cloud computing market, primarily due to the sensitive nature of patient information. As healthcare organizations increasingly adopt cloud solutions, the risk of data breaches and cyberattacks has become a growing worry. The healthcare sector deals with highly confidential data, including personal identifiers, medical histories, and treatment plans. Unauthorized access to this information can lead to severe consequences, including identity theft and fraud, making organizations hesitant to fully embrace cloud technologies. The prevalence of sophisticated cyber threats, such as ransomware attacks, poses a serious challenge to data integrity and confidentiality. Compliance with strict regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), mandates that organizations implement stringent security measures, adding complexity to cloud adoption. The need to maintain patient trust is also paramount, as any breach could result in significant reputational damage and loss of patient confidence. Lastly, when migrating to the cloud, organizations often lose some control over their data security protocols, raising concerns about their third-party vendors' capabilities. Consequently, these data security challenges significantly restrain the healthcare cloud computing market, prompting organizations to proceed cautiously in their cloud adoption strategies.

Segment Analysis

By Service

In the healthcare cloud computing market, Software as a Service (SaaS) has emerged as the leading segment, accounting for approximately 58% of total revenue in 2023. This dominance reflects the growing adoption of cloud-based software solutions that enhance operational efficiency, data management, and patient care. Key factors driving SaaS adoption include cost efficiency, as it eliminates hefty upfront IT infrastructure investments; scalability, allowing healthcare providers to adjust usage based on demand; and ease of implementation, facilitating rapid deployment and updates. Notable product developments include the launch of new healthcare management platforms by companies like Epic Systems and Cerner, which focus on improving patient engagement and interoperability. Additionally, Athenahealth introduced updated SaaS solutions designed to streamline billing and enhance telehealth services. SaaS also fosters collaboration through real-time data sharing and aids compliance with regulations like HIPAA, ensuring secure management of sensitive information.

By Cloud deployment Model

In the healthcare cloud computing market, the public cloud deployment model has emerged as the dominant segment, capturing approximately 69% of total revenue in 2023. This significant share underscores the broad acceptance of public cloud solutions, driven by factors such as cost-effectiveness, scalability, and enhanced accessibility. Public cloud services operate on a pay-as-you-go model, reducing upfront capital expenditures, which is especially advantageous for smaller healthcare providers looking to adopt advanced technologies without significant financial burden. The scalability of public cloud solutions allows organizations to swiftly adapt to changing patient volumes and service demands, ensuring optimal performance and efficiency. Additionally, public clouds facilitate secure remote access to patient data, enhancing collaboration among multidisciplinary teams for improved care coordination. Rapid deployment capabilities enable healthcare organizations to implement new applications quickly, crucial in a fast-paced environment where timely information is vital for patient outcomes. Major providers have recently launched noteworthy products, such as Amazon Web Services' Amazon HealthLake for data aggregation, Microsoft Azure's Health Data Services for secure data management, Google Cloud's collaboration with Cleveland Clinic on AI-driven applications, and IBM's Watson Health Cloud for actionable insights through AI, further solidifying the public cloud's role in healthcare innovation.

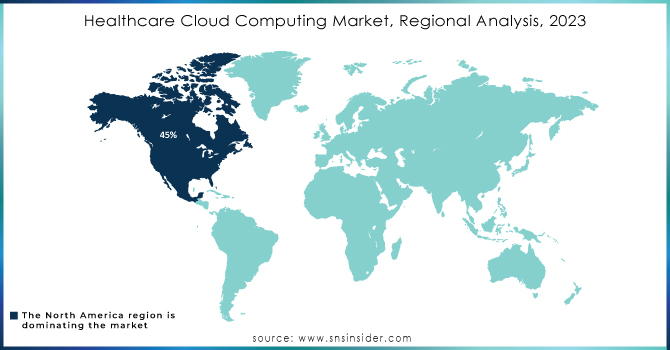

Regional Analysis

In 2023, North America commanded a significant portion of the healthcare cloud computing market, representing approximately 45% of total revenue. This dominance is driven by the region's advanced technological infrastructure, robust regulatory framework, and an increasing demand for innovative healthcare solutions. North America features a well-established IT ecosystem, with leading cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offering secure platforms specifically designed for healthcare applications. Stringent regulations, like the Health Insurance Portability and Accountability Act (HIPAA), further bolster cloud adoption, as providers ensure compliance and security for patient data. The COVID-19 pandemic has intensified the demand for telehealth and remote monitoring solutions, prompting healthcare organizations to seek scalable cloud services that support virtual care. Significant investments from both the public and private sectors are also enhancing health IT solutions, aided by government initiatives aimed at improving healthcare delivery and patient outcomes. Noteworthy advancements in the U.S. and Canada include major health systems adopting cloud solutions for better data sharing and the Canadian government promoting digital health strategies. Moreover, regional collaborations and the rise of startups focused on healthcare cloud solutions underscore the commitment to leveraging technology to improve patient care while emphasizing cybersecurity to protect sensitive information.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for healthcare cloud computing, driven by strong demand for innovative solutions and substantial investments in digital transformation. Key factors contributing to this growth include rising healthcare expenditures, an increasing population, and a growing need for efficient healthcare delivery systems. Rising healthcare spending in countries like China and India is facilitating the adoption of advanced technologies, including cloud computing, to enhance operational efficiencies and improve patient care. Government initiatives are also playing a significant role, with various programs promoting digital health and cloud adoption. For example, the Indian government launched the National Digital Health Mission to leverage technology for better healthcare delivery. There is a growing emphasis on telehealth services, which has led to a surge in the use of cloud-based platforms for remote consultations and patient monitoring. The focus on interoperability among healthcare providers is further driving cloud adoption, as it enables seamless data exchange and improves care coordination. Several companies have made notable advancements in this space, including Alibaba Cloud, which launched a suite of healthcare-specific cloud solutions, and IBM Watson Health, which partnered with Japanese hospitals to implement AI-driven cloud solutions. Microsoft Azure also introduced Azure Health Data Services to assist healthcare organizations in securely managing health data. Meanwhile, Cure Metrix expanded into the Asia-Pacific market with its cloud-based AI solutions for mammography analysis, partnering with providers in Australia and Singapore.

Do You Need any Customization Research on Healthcare Cloud Computing Market - Inquire Now

Key Players

Some of the major key players in the Healthcare Cloud Computing Market who provide products and services:

-

Amazon Web Services, Inc. (AWS HealthLake, Amazon Comprehend Medical)

-

Microsoft Corporation (Azure Health Data Services, Microsoft Cloud for Healthcare)

-

International Business Machines Corporation (IBM Watson Health, IBM Cloud for Healthcare)

-

athenahealth, Inc. (athenaOne EHR, athenaTelehealth)

-

CareCloud, Inc. (CareCloud Central, CareCloud Telehealth)

-

Siemens Healthineers AG (Siemens Digital Ecosystem, Teamplay)

-

Koninklijke Philips N.V. (Philips HealthSuite, Philips IntelliSpace)

-

Allscripts Healthcare Solutions, Inc. (Allscripts Sunrise, Allscripts FollowMyHealth)

-

NTT DATA Corporation (NTT DATA Healthcare Cloud Solutions)

-

Cerner Corporation (Cerner Millennium, Cerner Cloud Services)

-

Epic Systems Corporation (Epic Cloud, MyChart)

-

McKesson Corporation (McKesson Cloud Solutions)

-

Oracle Corporation (Oracle Cloud for Healthcare, Oracle Health Sciences)

-

GE Healthcare (GE Health Cloud, Edison AI)

-

Dell Technologies (Dell EMC Cloud for Healthcare)

-

Infor (Infor CloudSuite Healthcare, Infor Cloud ERP)

-

Zebra Technologies (Zebra Medical Vision, Zebra Cloud Services)

-

eClinicalWorks (eClinicalWorks Cloud, Healow)

-

Salesforce.com, Inc. (Salesforce Health Cloud, Salesforce for Patient 360)

-

Veeva Systems Inc. (Veeva Vault, Veeva CRM for Life Sciences)

List of Suppliers:

-

Amazon Web Services, Inc.

-

Microsoft Corporation

-

International Business Machines Corporation (IBM)

-

athenahealth, Inc.

-

Cerner Corporation

-

Epic Systems Corporation

-

Oracle Corporation

-

Allscripts Healthcare Solutions, Inc.

-

Siemens Healthineers AG

-

GE Healthcare

Recent Developments

-

In May 2024: Athenahealth launched specialty EHR solutions tailored to the needs of women's health and urgent care organizations.

-

In March 2024: Genesys partnered with Epic to enhance the consistency and connectivity of patient experiences, facilitating the recording of clinical data across various systems and departments.

-

In March 2024: Microsoft teamed up with NVIDIA to drive innovation in life sciences and healthcare through advanced cloud capabilities, accelerated computing, and AI technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 48.88 Billion |

| Market Size by 2032 | USD 199.21 Billion |

| CAGR | CAGR of 16.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), and Others) • By Technology(Thermoforming Technology, Film-based Technology, Tray-based Technology) • By Application (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy, Ready-to-eat Meals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., Microsoft Corporation, International Business Machines Corporation, athenahealth, Inc., CareCloud, Inc., Siemens Healthineers AG, Koninklijke Philips N.V., Allscripts Healthcare Solutions, Inc., NTT DATA Corporation, Cerner Corporation, Epic Systems Corporation, McKesson Corporation, Oracle Corporation, GE Healthcare, Dell Technologies, Infor, Zebra Technologies, eClinicalWorks, Salesforce.com, Inc., and Veeva Systems Inc. |

| Key Drivers | • Enhanced Data Security and Compliance in Healthcare Cloud Computing • The Essential Impact of Interoperability on the Healthcare Cloud Computing Market |

| RESTRAINTS | • Navigating Data Security Challenges and Key Restraints Affecting the Healthcare Cloud Computing Market |