Get more information on Healthcare Asset Management Market - Request Sample Report

The Healthcare Asset Management Market size was valued at USD 25.7 billion in 2023, and is expected to reach USD 166.82 billion by 2032 and grow at a CAGR of 23.1% over the forecast period 2024-2032.

The healthcare asset management market is growing at a significant growth rate with an increasing need for effective asset-tracking solutions in healthcare facilities. For 2023, the U.S. spent $4.9 trillion in healthcare, which accounted for 17.6% of the Gross Domestic Product of the country, according to the latest government data. Such a huge investment in health care emphasizes the need for optimum asset management to maximize resource utilization and improve operational efficiency. The emphasis on healthcare expenditure has always increased in India. National Health Account estimates for the financial years 2020-21 and 2021-22 suggest that there is a steady increase in government health expenditure. The large growth can be attributed to increases in demand for real-time location tracking of medical equipment, the use of RFID and RTLS technologies, and inventory management systems. The COVID-19 pandemic has also accentuated the need for asset management solutions, especially in healthcare facilities which were inundated by medical equipment needed to fight the pandemic and ensure their accessibility at the exact point of view of need.

Moreover, government programs targeting the enhancement of healthcare infrastructure and the minimization of operating costs have propelled the market forward. However, in the U.S., the Department of Health and Human Services encourages the use of asset management systems in hospitals and clinics, which have proven to advance patient outcomes and help with operational efficiency. Moreover, rising emphasis on patient safety along with stringent regulatory requirements are encouraging healthcare providers to adopt advanced asset management solutions. Technological advancements have also been fueling the market due to the ability of our asset management platforms to integrate Artificial Intelligence and machine learning algorithms and provide predictive maintenance functions and resource capacity optimization.

Drivers

Healthcare facilities are increasingly adopting asset management solutions to optimize resource use, reduce equipment search times, and achieve cost savings.

The integration of IoT devices and AI-driven platforms enhances real-time tracking and predictive maintenance, improving operational efficiency in healthcare settings.

One of the major drivers for the healthcare asset management market is efficient resource utilization, which helps hospitals and clinics improve their operational workflows while minimizing the cost of operation. With both medical devices and various equipment proliferating in our healthcare environments, being able to find and keep track of critical assets becomes a larger challenge. Studies reveal that healthcare staff spends an estimated 30-40 minutes per shift searching for misplaced equipment, highlighting a pressing need for effective asset-tracking solutions. Advanced asset management systems such as Real-Time Location Systems (RTLS), Radio Frequency Identification (RFID), and IoT-based technologies make it easy to track assets effortlessly in real-time. One example is that of Mount Sinai Hospital, where they implemented an IoT-enabled tracking system and were able to cut equipment search times in half this helped them to ensure that staff was able to provide patients with the very critical care they needed, and also, helped with an increase in productivity along with staff time.

Furthermore, resource optimization plays a pivotal role in preventing equipment downtime. Predictive maintenance enabled by AI-driven asset management tools identifies potential issues before they escalate, minimizing disruptions. In 2023, a healthcare facility in the UK leveraged AI-enabled asset tracking to reduce equipment failure rates by 25%, improving operational efficiency and enhancing patient outcomes. With the increasing adoption of these technologies, the ability to utilize existing resources efficiently is becoming critical in the modern healthcare environment.

Restraints:

The initial investment for deploying advanced asset management systems can be substantial, potentially deterring smaller healthcare facilities from adoption.

Inaccurate data collection methods can lead to incorrect assessments of resource needs, impacting the performance and decision-making processes within healthcare

The factor limiting the growth of the healthcare asset management market is the high cost of implementation of technologically advanced asset management systems. The first step towards maintaining advanced supply chain solutions involves a considerable investment of initial capital for acquiring and integrating modern technologies such as IoT devices, RFID tracking, and AI-powered platforms. This presents a challenge, particularly for smaller healthcare facilities or organizations that typically operate on a restricted budget. These systems not only require upfront costs for hardware and software but also demand ongoing maintenance, training, and system updates, further adding to the financial burden. Additionally, the complexity of deploying these technologies within existing healthcare IT infrastructures can incur hidden costs related to integration efforts, downtime, and resource allocation. The return on investment (ROI) from these systems may take time to materialize, making it difficult for smaller institutions to justify the initial outlay. As a result, many healthcare organizations may delay or forgo adopting asset management systems, hindering overall market growth.

By product

In 2023, the RFID segment led the market and accounted for over 64% of the share of global revenue. This dominance is due to the benefits of using RFID technology in healthcare asset management. Another advantage of RFID is that RFID enables real-time tracking and monitoring of medical equipment, supplies, and even patients, helping healthcare facilities gain greater operational efficiency and cost savings. The U.S. Food and Drug Administration (FDA) states that RFID technology has demonstrated considerable promise in assisting with enhancing patient safety and minimizing the dangers related to medication errors. The FDA has begun to promote RFID use for healthcare, especially for tracking drugs and medical devices. B) It also leads the market share because of government initiatives regarding RFID in the healthcare sector. For example, the Centers for Medicare & Medicaid Services (CMS) has developed initiatives that provide incentives for hospitals to utilize RFID technology for asset tracking and inventory management. From small clinics to large hospital networks, healthcare providers are showing a sharp interest in RFID solutions and it is mainly because of the cost-effectiveness and scalability features. Furthermore, the potential for RFID systems to integrate with current Hospital Information Systems and electronic medical records has also contributed to their growth in the healthcare industry.

By Application

The hospital asset management segment accounted for the highest market share in 2023. The large share of this segment can be ascribed to the growing complexity involved in hospital processes, as well as the high demand for effective management of medical equipment, supplies, and resources. There are more than 6,000 hospitals in America, according to the American Hospital Association, each with thousands of assets to manage daily. Hospitals have a huge number of equipment and supplies that need good asset management, to utilize them effectively and cut down the cost of operations. Furthermore, governments have compelled healthcare systems to function efficiently and productively, which has a huge impact on the acceptance of asset management systems in a hospital environment. For example, the Joint Commission, which accredits and certifies healthcare organizations in the United States, has established standards for equipment maintenance and management that hospitals must meet to maintain their accreditation. These standards have prompted hospitals to invest in comprehensive asset management solutions. Additionally, the U.S. Department of Health and Human Services is pursuing programs to encourage the use of asset management systems in hospitals as part of a broader push to improve quality and lower costs associated with care. Hospital asset management systems are becoming an integral part of modern healthcare hospitals as they help enhance patient care by ensuring the availability of critical equipment, reduced wait times, and overall operational efficiency.

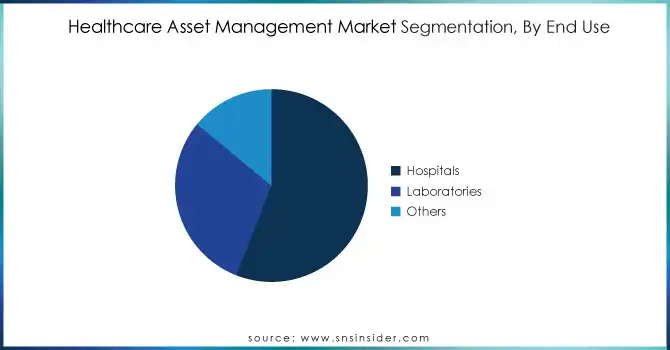

By End Use

The hospitals segment dominated the market with the largest market share of 58% In 2023. Several reasons contribute to this dominance, such as the magnitude and complexity of hospital operations, the high asset volume managed by hospitals, and the criticality of healthcare delivery in these institutions. According to historical data from the American Hospital Association, U.S. hospitals admitted over 36 million patients and performed over 108 million outpatient visits in 2019. This large patient volume requires the effective management of a wide range of medical equipment, supplies, and resources. The adoption of asset management systems in hospitals has also been fueled by government regulations and initiatives. One example is the Hospital Value-Based Purchasing Program, implemented by the Centers for Medicare & Medicaid Services (CMS), which links hospital payment to performance on quality measures, including resource use and efficiency. As a result, this program has incentivized hospitals to spend on advanced asset management solutions to utilize their resources effectively and optimize their operations. Additionally, the Office of the National Coordinator for Health Information Technology (ONC) has promoted the adoption of health IT systems, including asset management solutions, as part of its efforts to improve healthcare quality and reduce costs. The ability of asset management systems to enhance patient safety, reduce equipment downtime, and improve regulatory compliance has made them essential tools for hospitals seeking to maintain their competitive edge in an increasingly complex healthcare landscape.

In 2023, North America accounted for 43% share of the global healthcare asset management market. The region has a developed healthcare infrastructure, high adoption of innovative technologies, and beneficial government measures, these factors may contribute to the leadership position. With support for programs and incentives from the U.S. Department of Health and Human Services that focus on the importance of asset management systems for healthcare facilities, the movement to make the U.S. healthcare system more cost-effective and efficient is gaining attention. As an example, the Office of the National Coordinator for Health Information Technology (ONC) has incorporated asset management functionalities in its requirements for certified electronic health record technology to incentivize healthcare providers to adopt these solutions.

However, the Asia Pacific region is expected to witness the fastest growth, with a significant CAGR during the forecast period. Rapid growth is being fuelled by a developing healthcare infrastructure, rising adoption of digital technologies in the growing healthcare sector, and high growth potential in emerging economies. The market is being significantly augmented by government efforts in nations like China and India. Take for example the "Healthy China 2030" plan from China, aiming to reform the national health system and reform healthcare technology, infrastructure, and cost control strategy. India has also taken the lead with its National Digital Health Mission, which encourages digital health solutions, including asset management systems, in different parts of its healthcare landscape. An increase in affordability and improved knowledge of healthcare asset management benefits is also playing a vital role in the quick growth of the Asia Pacific market.

Need any customization research on Healthcare Asset Management Market - Enquiry Now

TRIMEDX, a clinical asset management company, released the healthcare-specific, real-time location system (RTLS) called GeoSense in April 2024. With this advanced system, medical facilities can enhance their asset management processes by providing accurate tracking for medical devices.

GE Healthcare launched ReadySee, a solution for asset management and network supervision, in April 2023. Specifically, ReadySee transforms device and infrastructure data into insights to enable healthcare professionals to find devices, reduce manual processes, and streamline cybersecurity management through device vulnerability identification.

Key Service Providers/Manufacturers

Zebra Technologies (Zebra MotionWorks, ZT600 Series)

GE Healthcare (AssetPlus, GE Healthcare’s Medical Equipment Management)

Siemens Healthineers (Real-Time Location Services, Asset Management Solutions)

Impinj (Impinj Speedway, Impinj xSpan)

Stanley Healthcare (Stanley Healthcare MobileView, AeroScout)

Oracle Corporation (Oracle Healthcare Cloud, Oracle Asset Tracking)

Savi Technology (Savi Mobile, Savi Asset Tracking)

Kipp & Zonen (Coriolis System, Smart Asset Tracker)

TAGSYS (Active RFID, RTLS Solution)

Honeywell (Honeywell RTLS, Vocollect)

Key Users

Johns Hopkins Medicine

Cleveland Clinic

Mayo Clinic

Kaiser Permanente

HCA Healthcare

Mount Sinai Health System

Medtronic

St. Jude Children's Research Hospital

NewYork-Presbyterian Hospital

Baylor Scott & White Health

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.7 Billion |

| Market Size by 2032 | USD 166.82 Billion |

| CAGR | CAGR of 23.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Radiofrequency Identification Devices (RFID) {Tag Passive Tags [Ultra-high frequency, Readers/Interrogators, Antennas] Accessories Hardware, Services, Software}, Real-Time Location Systems (RTLS) {Hardware [Tags/Badges, Readers/Interrogators], Software, Services}) • By Application (Pharmaceutical Asset Management {Drug Anti-counterfeiting, Supply Chain Management}, Hospital Asset Management {Equipment Tracking and Management, Patient Management, Temperature and Humidity Control, Staff Control, Infection Control and Hand Hygiene Compliance}) • By End Use (Hospitals, Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zebra Technologies, GE Healthcare, Siemens Healthineers, Impinj, Stanley Healthcare, Oracle Corporation, Savi Technology, Kipp & Zonen, TAGSYS, Honeywell. |

| Key Drivers | • Healthcare facilities are increasingly adopting asset management solutions to optimize resource use, reduce equipment search times, and achieve cost savings. • The integration of IoT devices and AI-driven platforms enhances real-time tracking and predictive maintenance, improving operational efficiency in healthcare settings. |

| Restraints | • The initial investment for deploying advanced asset management systems can be substantial, potentially deterring smaller healthcare facilities from adoption. • Inaccurate data collection methods can lead to incorrect assessments of resource needs, impacting the performance and decision-making processes within healthcare |

Ans: The Healthcare Asset Management Market size is expected to reach USD 166.82 billion by 2032.

Ans: The Healthcare Asset Management Market is to grow at a CAGR of 23.1% over the forecast period 2024-2032.

Ans: The North American region dominated the Healthcare Education Market in 2023.

Ans:

Ans: The hospitals end-use segment dominated the Healthcare Education Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Software

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare Asset Management Market Segmentation, By Product

7.1 Chapter Overview

7.2 Radiofrequency Identification Devices (RFID)

7.2.1 Radiofrequency Identification Devices (RFID) Market Trends Analysis (2020-2032)

7.2.2 Radiofrequency Identification Devices (RFID) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Tag

7.2.3.1 Tag Market Trends Analysis (2020-2032)

7.2.3.2 Tag Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3 Passive Tags

7.2.3.3.1 Passive Tags Market Trends Analysis (2020-2032)

7.2.3.3.2 Passive Tags Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3.3 High Frequency

7.2.3.3.3.1 High Frequency Market Trends Analysis (2020-2032)

7.2.3.3.3.2 High Frequency Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3.4 Low Frequency

7.2.3.3.4.1 Low Frequency Market Trends Analysis (2020-2032)

7.2.3.3.4.2 Low Frequency Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.4 Ultra-high frequency

7.2.3.4.1 Ultra-high frequency Market Trends Analysis (2020-2032)

7.2.3.4.2 Ultra-high frequency Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.5 Readers/Interrogators

7.2.3.5.1 Readers/Interrogators Market Trends Analysis (2020-2032)

7.2.3.5.2 Readers/Interrogators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.6 Antennas

7.2.3.6.1 Antennas Market Trends Analysis (2020-2032)

7.2.3.6.2 Antennas Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Accessories Hardware

7.2.4.1 Accessories Hardware Market Trends Analysis (2020-2032)

7.2.4.2 Accessories Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Services

7.2.5.1 Services Market Trends Analysis (2020-2032)

7.2.5.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Software

7.2.7.1 Software Market Trends Analysis (2020-2032)

7.2.7.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Real-Time Location Systems (RTLS)

7.3.1 Real-Time Location Systems (RTLS) Market Trends Analysis (2020-2032)

7.3.2 Real-Time Location Systems (RTLS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Hardware

7.3.3.1 Hardware Market Trends Analysis (2020-2032)

7.3.3.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.3 Tags/Badges

7.3.3.3.1 Tags/Badges Market Trends Analysis (2020-2032)

7.3.3.3.2 Tags/Badges Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.4 Readers/Interrogators

7.3.3.4.1 Readers/Interrogators Market Trends Analysis (2020-2032)

7.3.3.4.2 Readers/Interrogators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Software

7.3.4.1 Software Market Trends Analysis (2020-2032)

7.3.4.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Services

7.3.5.1 Services Market Trends Analysis (2020-2032)

7.3.5.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare Asset Management Market Segmentation, By Application

8.1 Chapter Overview

8.2 Pharmaceutical Asset Management

8.2.1 Pharmaceutical Asset Management Market Trends Analysis (2020-2032)

8.2.2 Pharmaceutical Asset Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Drug Anti-counterfeiting

8.2.3.1 Drug Anti-counterfeiting Market Trends Analysis (2020-2032)

8.2.3.2 Drug Anti-counterfeiting Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Supply Chain Management

8.2.4.1 Supply Chain Management Market Trends Analysis (2020-2032)

8.2.4.2 Supply Chain Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hospital Asset Management

8.3.1 Hospital Asset Management Market Trends Analysis (2020-2032)

8.3.2 Hospital Asset Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.3 Equipment Tracking and Management

8.3.3.1 Equipment Tracking and Management Market Trends Analysis (2020-2032)

8.3.3.2 Equipment Tracking and Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.4 Patient Management

8.3.4.1 Patient Management Market Trends Analysis (2020-2032)

8.3.4.2 Patient Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.5 Temperature and Humidity Control

8.3.5.1 Temperature and Humidity Control Market Trends Analysis (2020-2032)

8.3.5.2 Temperature and Humidity Control Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.6 Staff Control

8.3.6.1 Staff Control Market Trends Analysis (2020-2032)

8.3.6.2 Staff Control Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.7 Infection Control and Hand Hygiene Compliance

8.3.7.1 Infection Control and Hand Hygiene Compliance Market Trends Analysis (2020-2032)

8.3.7.2 Infection Control and Hand Hygiene Compliance Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Healthcare Asset Management Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Laboratories

9.3.1 Laboratories Market Trends Analysis (2020-2032)

9.3.2 Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2020-2032)

9.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.4 North America Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.6.2 USA Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.7.2 Canada Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.7.2 France Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.6.2 China Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.7.2 India Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.8.2 Japan Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.12.2 Australia Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.4 Africa Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Healthcare Asset Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.4 Latin America Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Healthcare Asset Management Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Healthcare Asset Management Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Healthcare Asset Management Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Zebra Technologies

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 GE Healthcare

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Siemens Healthineers

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Impinj

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Stanley Healthcare

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Oracle Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Savi Technology

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Kipp & Zonen.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 TAGSYS

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Honeywell.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Radiofrequency Identification Devices (RFID)

Tag

Passive Tags

High Frequency

Low Frequency

Ultra-high frequency

Readers/Interrogators

Antennas

Accessories Hardware

Services

Software

Real Time Location Systems (RTLS)

Hardware

Tags/Badges

Readers/Interrogators

Software

Services

By Application

Pharmaceutical Asset Management

Drug Anti-counterfeiting

Supply Chain Management

Hospital Asset Management

Equipment Tracking and Management

Patient Management

Temperature and Humidity Control

Staff Control

Infection Control and Hand Hygiene Compliance

By End Use

Hospitals

Laboratories

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The 7T Magnetic Resonance Imaging Systems Market size was valued at USD 2.01 billion in 2023, projected to grow to USD 3.78 billion by 2032 with a 7.26% CAGR.

Bariatric Medical Chairs Market Size was valued at USD 15 Billion in 2023 and is expected to reach USD 29.36 billion by 2032, growing at a CAGR of 7.75% over the forecast period 2024-2032.

The Psoriasis Treatment Market size was valued at USD 22.38 billion in 2023 and is projected to reach USD 54.40 billion by 2032, growing at a CAGR of 10.4%.

3D Printed Wearables Market was valued at USD 4.1 billion in 2023 and is expected to reach USD 7.97 billion by 2032, growing at a CAGR of 7.68% over the forecast period 2024-2032.

The Companion Animal Vaccines Market Size was valued at USD 3.39 billion in 2023 and is expected to reach USD 5.64 billion by 2032 and grow at a CAGR of 5.83% over the forecast period 2024-2032.

Practice Management System Market was valued at USD 12.4 billion in 2023 and is expected to reach USD 28.32 billion by 2032, growing at a CAGR of 9.62% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone