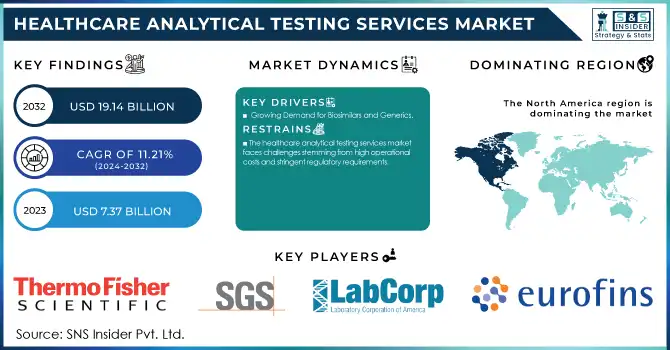

Healthcare Analytical Testing Services Market Size and Overview:

The Healthcare Analytical Testing Services Market Size was valued at USD 7.37 billion in 2023 and is expected to reach USD 19.14 billion by 2032 and grow at a CAGR of 11.21% over the forecast period 2024-2032.

Get more information on Healthcare Analytical Testing Services Market - Request Sample Report

The global healthcare analytical testing services market is witnessing robust growth due to the increasing complexity of pharmaceutical products and the need for rigorous testing to meet stringent regulatory requirements. For instance, according to recent studies, over 40% of new drug approvals by the U.S. FDA in 2022 were biologics, requiring advanced analytical techniques for characterization and stability testing. Biologics’ sensitivity to environmental factors has intensified the demand for sophisticated testing solutions, including high-resolution mass spectrometry and nuclear magnetic resonance spectroscopy, which enable precise analysis of molecular structures.

Another significant driver is the adoption of personalized medicine. Pharmacogenetic testing, for example, has gained traction as healthcare shifts toward individualized treatments. A report from the Personalized Medicine Coalition highlights that over 20% of FDA-approved drugs in 2022 included biomarkers in their labels, underscoring the growing reliance on biomarker-based testing. Analytical service providers are developing specialized assays to support these needs, facilitating targeted therapies with improved outcomes.

Technological advancements have also streamlined analytical workflows. Automated liquid chromatography systems and AI-driven predictive analytics are improving efficiency and accuracy in testing processes. A notable example is the integration of AI by companies such as Thermo Fisher Scientific, which enhances data analysis in bioanalytical laboratories, reducing error rates by over 30% and accelerating turnaround times.

Emerging trends in pharmaceutical outsourcing further bolster market growth. According to a survey by Pharmaceutical Outsourcing, approximately 70% of pharmaceutical companies now outsource some or all of their analytical testing. Companies like Charles River Laboratories and Labcorp have expanded their service portfolios to include comprehensive testing solutions, from raw material analysis to post-market surveillance.

The increasing prevalence of chronic diseases, such as cancer and diabetes, has also escalated clinical trial activities. For instance, oncology drugs accounted for nearly 30% of all clinical trials 2023, requiring extensive analytical testing to assess safety and efficacy.

Healthcare Analytical Testing Services Market Dynamics

Drivers

-

Growing Demand for Biosimilars and Generics

The expiration of patents for several blockbuster drugs has fueled the demand for biosimilars and generic medications. These products undergo stringent regulatory scrutiny, requiring comprehensive analytical testing for bioequivalence, impurity profiling, and stability assessments. For instance, biosimilars must demonstrate a high degree of similarity to reference biologics in terms of safety, efficacy, and quality. The rise in biosimilar approvals across major markets, including the U.S. and Europe, has prompted pharmaceutical companies to rely on analytical service providers for robust testing protocols. This trend ensures adherence to regulatory guidelines while expediting time-to-market, creating consistent demand for specialized testing solutions.

-

Advancements in Cell and Gene Therapies

The rapid development of cell and gene therapies has introduced unique analytical challenges, driving the need for specialized testing services. These therapies involve complex biomolecular compositions that require precise characterization of vectors, transgenes, and cellular components. The growing number of clinical trials, particularly in oncology and rare diseases, highlights the demand for quality assurance in manufacturing and testing. Service providers are investing in cutting-edge techniques like flow cytometry, next-generation sequencing, and vector quantification assays to meet these requirements. As regulatory frameworks for these therapies evolve, the role of analytical testing in ensuring product safety and efficacy continues to expand, reinforcing its importance in the healthcare ecosystem.

-

Emergence of Decentralized and Point-of-Care Testing

The increasing adoption of decentralized and point-of-care testing devices has broadened the scope of analytical testing services. These devices, critical for rapid diagnostics in remote and resource-limited settings, require rigorous quality assurance to maintain accuracy and reliability. Analytical testing ensures compliance with international standards, enhancing the credibility of POCT devices in addressing public health challenges. Moreover, with the rise in demand for home-based diagnostic solutions, companies are partnering with analytical service providers to validate device performance under diverse conditions. This shift aligns with the global emphasis on improving accessibility to healthcare diagnostics, further driving the demand for innovative testing solutions.

Restraint

-

The healthcare analytical testing services market faces challenges stemming from high operational costs and stringent regulatory requirements.

Advanced analytical techniques, such as high-performance liquid chromatography and mass spectrometry, involve significant investment in equipment, skilled personnel, and maintenance, which can strain smaller service providers. Additionally, compliance with diverse regulatory frameworks across regions, including the U.S. FDA, EMA, and other global authorities, adds complexity to operations. These regulations mandate extensive documentation, quality audits, and validation procedures, which are time-consuming and costly. Furthermore, evolving standards for novel therapies, such as cell and gene treatments, require continuous adaptation, increasing financial and logistical burdens. For pharmaceutical companies, the reliance on third-party testing providers may delay drug development timelines, adding to overall costs. These factors collectively act as restraints, limiting the scalability of analytical testing services, especially for emerging markets and smaller enterprises.

Healthcare Analytical Testing Services Market Segment Analysis

By Type

The pharmaceutical analytical testing services segment dominated the market in 2023, accounting for 60% of the total market share. This dominance stems from the increasing demand for stringent analytical testing across the pharmaceutical industry, particularly for biologics, biosimilars, and generic drug development. Regulatory mandates for quality control, stability testing, and impurity profiling have bolstered the segment's growth. Moreover, the outsourcing of analytical testing services by pharmaceutical companies has gained momentum, allowing them to focus on core competencies such as R&D and product innovation. With an ever-expanding pipeline of drugs in clinical development, the pharmaceutical sector continues to drive the need for comprehensive and reliable analytical testing solutions.

The medical device analytical testing services segment is anticipated to grow substantially over the forecast period, driven by technological advancements and increasing regulatory scrutiny. The development of complex medical devices, such as combination products and implantable technologies, requires robust analytical testing to meet safety and efficacy standards. The growing adoption of wearable health monitoring devices and home-based diagnostic tools has further elevated the demand for specialized testing services. Additionally, regulations surrounding biocompatibility and material integrity continue to evolve, prompting medical device manufacturers to collaborate with analytical testing providers. This upward trajectory reflects the critical role of testing services in ensuring the quality and performance of innovative medical devices.

Regional Outlook

North America emerged as the leading region in the healthcare analytical testing services market in 2023, driven by robust investments in pharmaceutical and biotechnology R&D. The presence of established pharmaceutical companies and a strong regulatory framework, including the U.S. FDA, has accelerated the adoption of analytical testing services in the region. The growing demand for biologics, biosimilars, and advanced medical devices has further fueled market growth, alongside an increasing trend of outsourcing analytical services to optimize operational efficiency.

Europe held a significant share of the market, supported by stringent quality standards and a thriving pharmaceutical manufacturing sector. Countries such as Germany, the UK, and Switzerland are major contributors, leveraging their advanced healthcare infrastructure and research capabilities. The increasing focus on precision medicine and personalized healthcare in the region is also boosting demand for analytical testing.

The Asia-Pacific region is anticipated to witness the fastest growth over the forecast period. Factors such as the expanding pharmaceutical industry, favorable government initiatives, and cost advantages associated with outsourcing analytical testing services are driving the market. Countries like China, India, and South Korea are becoming key hubs for clinical trials and drug manufacturing, further amplifying the need for advanced testing solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Products in Healthcare Analytical Testing Services

-

Eurofins Scientific – Microbial Testing, Pharmaceutical Testing, Biotech Services, Analytical Chemistry, Environmental Testing, Stability Testing

-

Laboratory Corporation of America Holdings – Drug Development Services, Clinical Trial Services, Bioanalytical Testing, Stability Studies, Compounding & Analytical Testing, Genomic Services

-

SGS S.A. – Analytical Chemistry, Stability Testing, Biocompatibility Testing, Microbial Testing, Method Validation, Regulatory Compliance Services

-

Charles River Laboratories – Safety Assessment, Biologics Testing Solutions, Microbial Testing, Product Development Services, Bioanalytical Services, In-Vitro Testing

-

WuXi AppTec Co. Ltd. – Drug Discovery and Development Services, Biologics Testing, Cell-Based Assays, Analytical Chemistry, Stability Testing, Preclinical Testing

-

Element Materials Technology – Analytical Testing Services, Chemical Testing, Microbial Testing, Biocompatibility Testing, Environmental Testing, Validation Services

-

Thermo Fisher Scientific, Inc. – Analytical Instruments, Clinical Testing, Genomic Analysis, Bioanalytical Services, Stability Studies, Method Development

-

Pace Analytical Services LLC – Pharmaceutical Analytical Testing, Environmental Testing, Stability Testing, Bioanalytical Services, Chemical Analysis

-

Intertek Group plc – Analytical Chemistry, Bioanalytical Testing, Stability Studies, Regulatory Compliance Services, Safety Testing, Environmental Testing

-

IQVIA Inc. – Pharmaceutical Analytics, Clinical Research Services, Drug Development Testing, Market Research Analytics, Data Analytics Solutions

-

Merck KGaA – Laboratory Equipment, Bioanalytical Services, Stability Studies, Chemical Analysis, Microbial Testing, Process Validation

-

Source BioScience – DNA/RNA Testing, Pathology Services, Stability Testing, Microbial Testing, Pharmaceutical Analytical Services

-

Almac Group – Clinical Trial Services, Analytical Testing, Stability Studies, Bioanalytical Services, Drug Development

-

ICON Plc – Clinical Research Services, Bioanalytical Testing, Stability Testing, Clinical Trial Management Services

-

Frontage Laboratories, Inc. – Bioanalytical Services, Preclinical Testing, Analytical Chemistry, Stability Testing, Formulation Development

-

STERIS Plc – Sterility Testing, Biocompatibility Testing, Microbial Testing, Analytical Chemistry, Validation Services

-

Sartorius AG – Bioanalytical Testing, Process Development Services, Stability Studies, Quality Control Services, Cell & Gene Therapy Services

-

ALS Life Science – Pharmaceutical Analytical Services, Stability Testing, Biotech & Biopharma Testing, Environmental & Chemical Testing

-

Syneos Health, INC – Clinical Trial Testing, Analytical Testing Services, Biopharmaceutical Testing, Regulatory Compliance, Drug Development Services

Recent Developments

In Jan 2025, Canyon Labs announced the strategic acquisition of iuvo BioScience's lab services and consulting businesses, enhancing its end-to-end development solutions. This transaction strengthens both companies' positions, with iuvo BioScience poised for continued growth in ophthalmic clinical research.

In Oct 2024, Eurofins Scientific announced an agreement to acquire SYNLAB's clinical diagnostics operations in Spain. The deal, subject to regulatory approvals, is expected to be finalized in 2025, further expanding Eurofins' footprint in specialized molecular clinical diagnostics and in-vitro testing.

In March 2024, LGM Pharma announced a 50% expansion of its Analytical Testing Services (ATS) capabilities, backed by an investment of over USD 2 million. Additionally, the company has introduced new suppository manufacturing capabilities to its CDMO portfolio, offering enhanced flexibility and efficiency for customers’ manufacturing needs.

In Dec 2023, Sterling Accuris Diagnostics acquired Vaibhav Analytical Services, an Ahmedabad-based company that operates an NABL-accredited laboratory, adhering to international pharmaceutical testing standards. Additionally, Vaibhav Analytical Services holds approval from the Nigerian Government (NAFDAC) as a CRIA-authorized laboratory, serving clients across India.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.37 Billion |

| Market Size by 2032 | USD 19.14 Billion |

| CAGR | CAGR of 11.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Medical Device Analytical Testing Services (Extractable and Leachable, Material Characterization, Physical Testing, Bioburden Testing, Sterility Testing, Other Tests), Pharmaceutical Analytical Testing Services (Bioanalytical Testing, Method Development and Validation, Stability Testing, Other Testing Services)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eurofins Scientific, Laboratory Corporation of America Holdings, SGS S.A., Charles River Laboratories, WuXi AppTec Co. Ltd., Element Materials Technology, Thermo Fisher Scientific, Inc., Pace Analytical Services LLC, Intertek Group plc, IQVIA Inc., Merck KGaA, Source BioScience, Almac Group, ICON Plc, Frontage Laboratories, Inc., STERIS Plc, Sartorius AG, ALS Life Science, Syneos Health, INC. |

| Key Drivers | • Growing Demand for Biosimilars and Generics • Advancements in Cell and Gene Therapies • Emergence of Decentralized and Point-of-Care Testing |

| Restraints | • The healthcare analytical testing services market faces challenges stemming from high operational costs and stringent regulatory requirements. |